- Bloomberg.com – Hedge Funds Bet Oil Will Fall Further

Hedge funds boosted bearish wagers on oil to a four-year high as U.S. supplies grew the most since 2001. Money managers increased short positions in West Texas Intermediate crude to the highest level since September 2010 in the week ended Jan. 20, U.S. Commodity Futures Trading Commission data show. Net-long positions slipped for the first time in three weeks…“There’s been a rush to call a bottom,” John Kilduff, a partner at Again Capital LLC, a New York-based hedge fund that focuses on energy, said by phone Jan. 23. “The fundamentals are still stacked against a rebound.”…Short positions in WTI increased by 6,262 contracts to 94,203 futures and options in the week ended Jan. 20, CFTC data show. Long positions dropped 0.3 percent. Net-long positions fell 3.3 percent to 216,704. Producers increased net-short positions by 7,623 to 132,143 contracts, the most since December 2011.

Comment

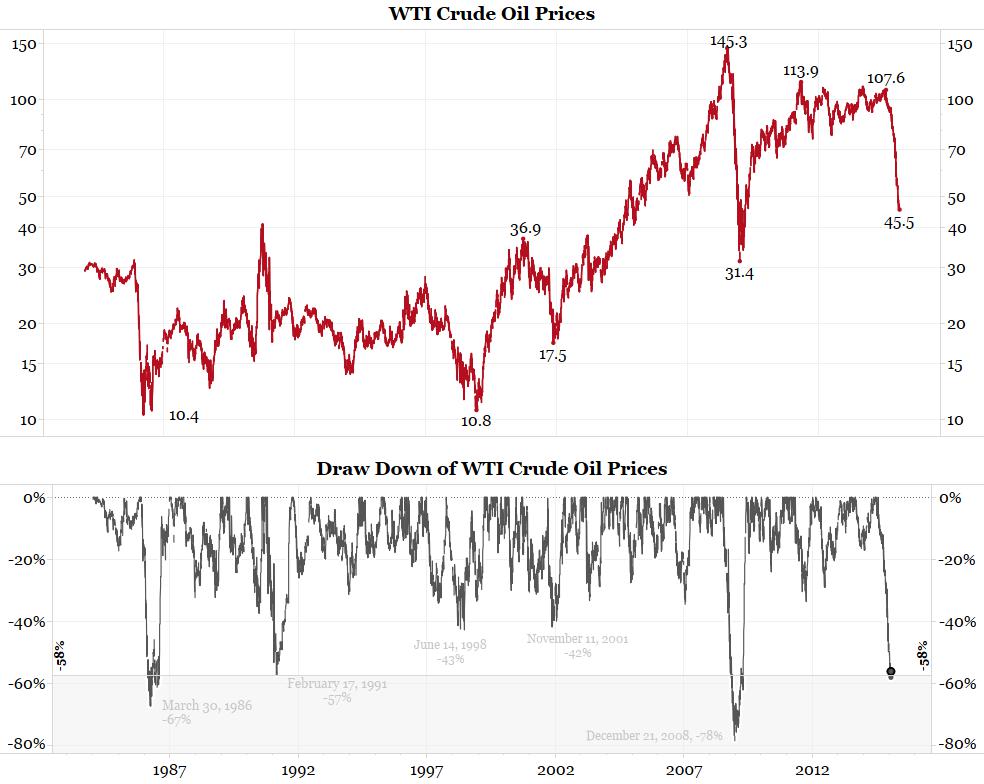

<Click on chart for larger image>

While money managers have increased their short positions near levels last seen in 2010, long positions have jumped considerably in the past couple weeks as well. The chart below highlights this spike in open interest (blue line).

<Click on chart for larger image>

This is why we always advocate using the net positions (longs- shorts) when interpreting COT data. Long and short positions can offer interesting insight during times of short or long squeezes, but to get a general feel for the way particular groups are betting, the net positions data proves most useful.

This data is actually a bit surprising given price trends. In the midst of one of the largest declines in crude oil history, no singular group is shifting their net position as they are completely confused. Positions are not being closed, only opened.

A trend typically stays in place until it forces a change in behavior. After a $60+ dollar downtrend in crude oil, little has changed among these players. This suggests we have not yet hit a bottom.

<Click on chart for larger image>

We have highlighted the COT data for NYMEX crude oil futures regularly in our weekly Commitments of Traders Update. Given crude prices have dropped roughly 60% since late July 2014, one might assume hedge funds have been riding this wave and boosting their bearish wagers. While the attention-grabbing headline above suggests as much, the blue line in the chart below shows net positions (longs – shorts) have actually held relatively steady since August of last year. None of the net positions in the chart shown below are near extremes.