Summary

Comment

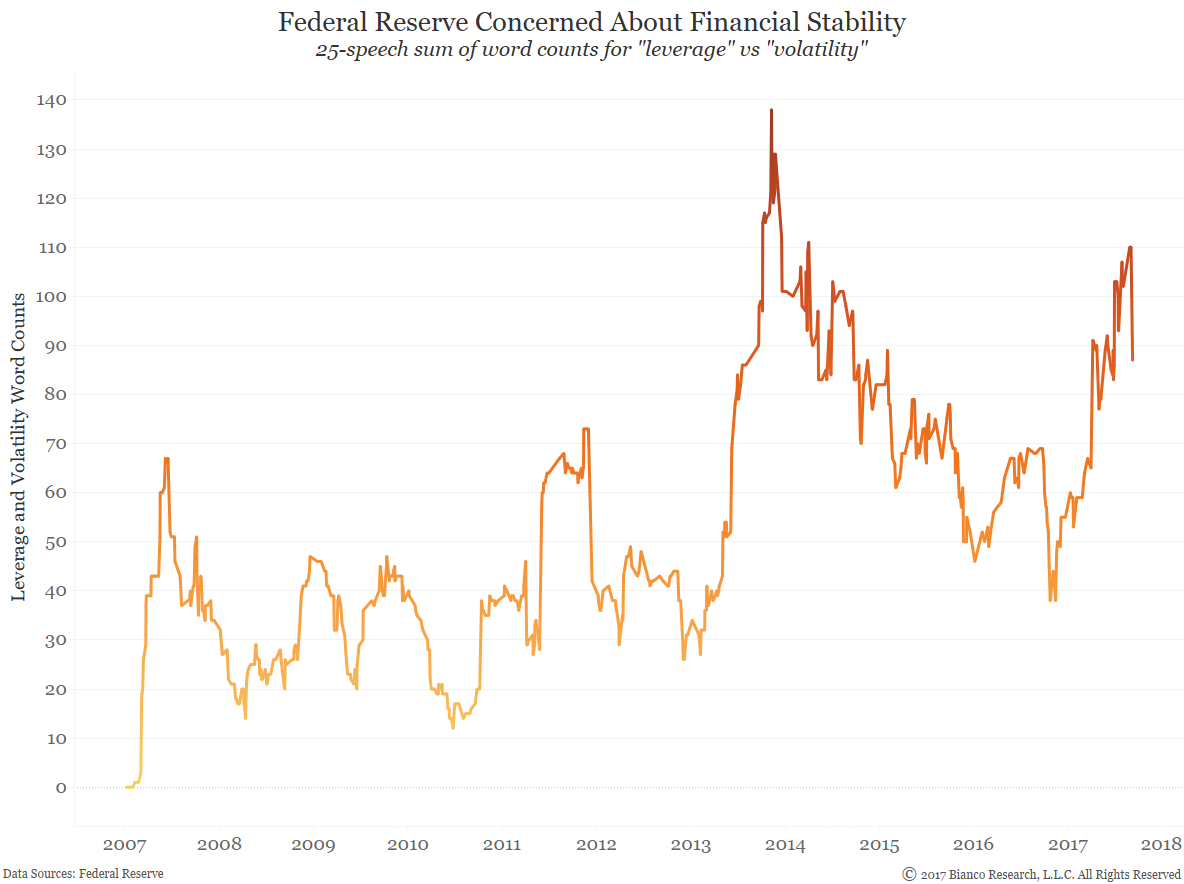

The Fed’s potentially hidden mandate of financial stability is again rearing its head. The next chart shows counts for ‘leverage’ or ‘volatility.’ Excessively easy financial conditions are likely heavily on their minds.

The likely slow trickle of balance sheet reduction will keep markets fixated on potential rate hikes. Low inflation has likely driven down the neutral rate to approximately 125-150 bps by our own calculations. Another hike (or more swift reduction in the balance sheet than expected) would cause the first tightening in financial conditions during this cycle. A contraction in deposits and lending growth shows a real potential to further flatten the U.S. Treasury yield curve, which is not favorable for the economy.

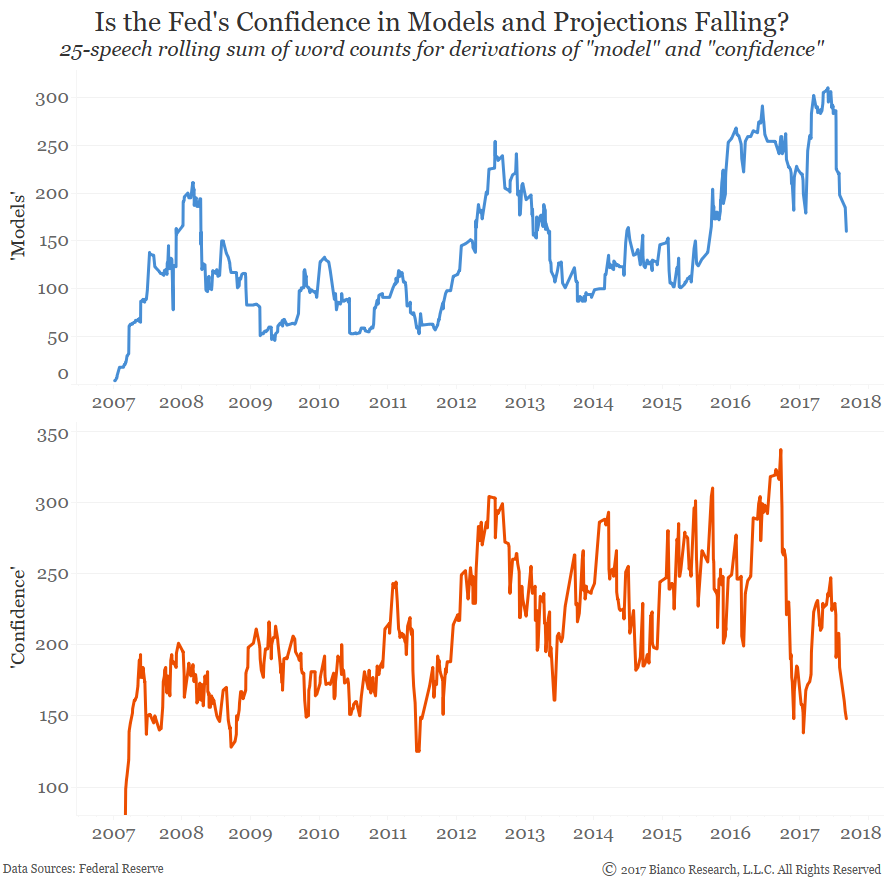

The Federal Reserve had never pushed their models and projections as much as they did during the spring of 2017. Lagging inflation relative to employment is seemingly not due to transitory forces. This conundrum is forcing economists and Fed officials to question the Phillips Curve and historical relationships between wages and the approach of full employment.

Not surprisingly, Fed officials have recently diminished the frequency of model and forecast comments (top panel). Notably, the uttering of ‘confidence’ has also tumbled (bottom panel).

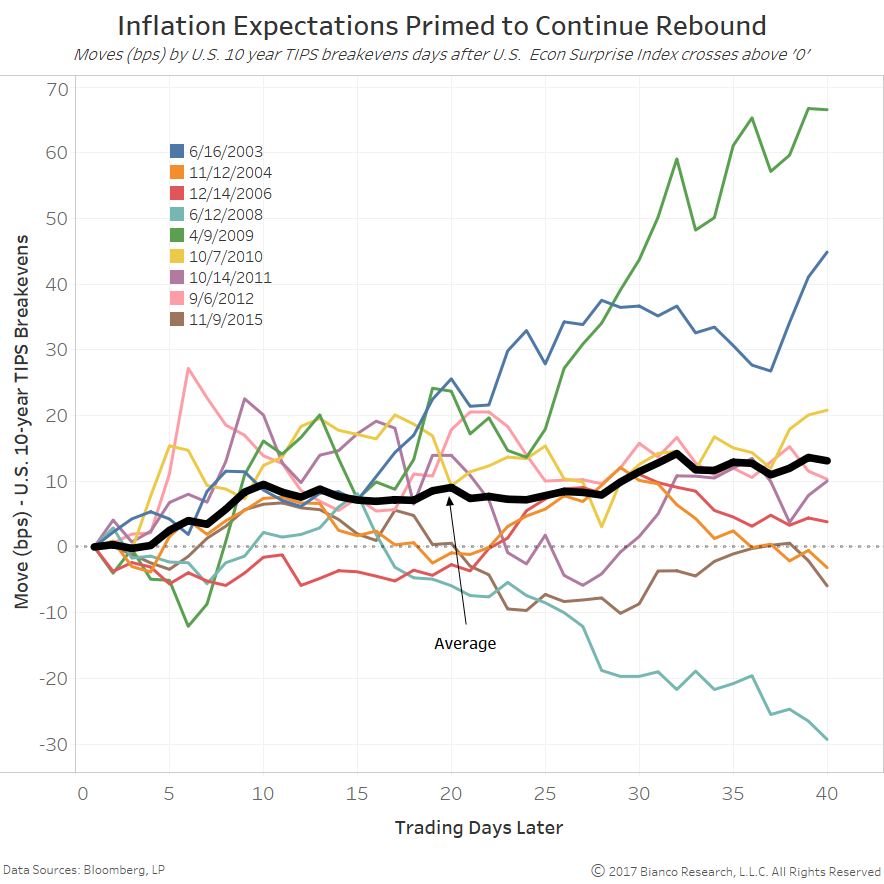

We now look to expected moves by inflation expectations in the event the surprise index continues its rebound above zero, meaning a return to concerted data beats. The chart below shows past moves in U.S. 10-year TIPS breakevens days after the surprise index recovers from below -60 and breaks above zero.

U.S. 10-year breakevens widened 30-trading days later 78% of past instances by an average of 11.5 bps.