- Financial Times – Resurgent dollar hits EM carry trade favourites

Currency’s index back above its 100-day moving average for first time this yearThe US dollar is attracting buyers after a long period of decline as higher bond yields finally shift the needle in favour of the reserve currency. While the dollar index — a basket of major rivals dominated by the euro — is now back above its 100-day moving average for the first time this year, emerging market currencies are also receiving a drubbing. The Bloomberg index of eight EM high-yield carry currencies has effectively erased its gains for the year with a decline of 2.3 per cent so far in April. The index — which includes Brazil, India, Mexico, Indonesia, South Africa, Hungary, Turkey and Poland — has now fallen more than 4 per cent from its January peak as US bond yields have climbed.

Summary

Dollar strength and rising Treasury yields are pressuring emerging market currencies tied to the carry trade. Economic growth is resilient in this group of emerging markets though, especially in Latin America. A unique advantage amid rising China / U.S. trade tensions and superior regional growth favor Brazil and Latin American over southeast Asian emerging markets.

Comment

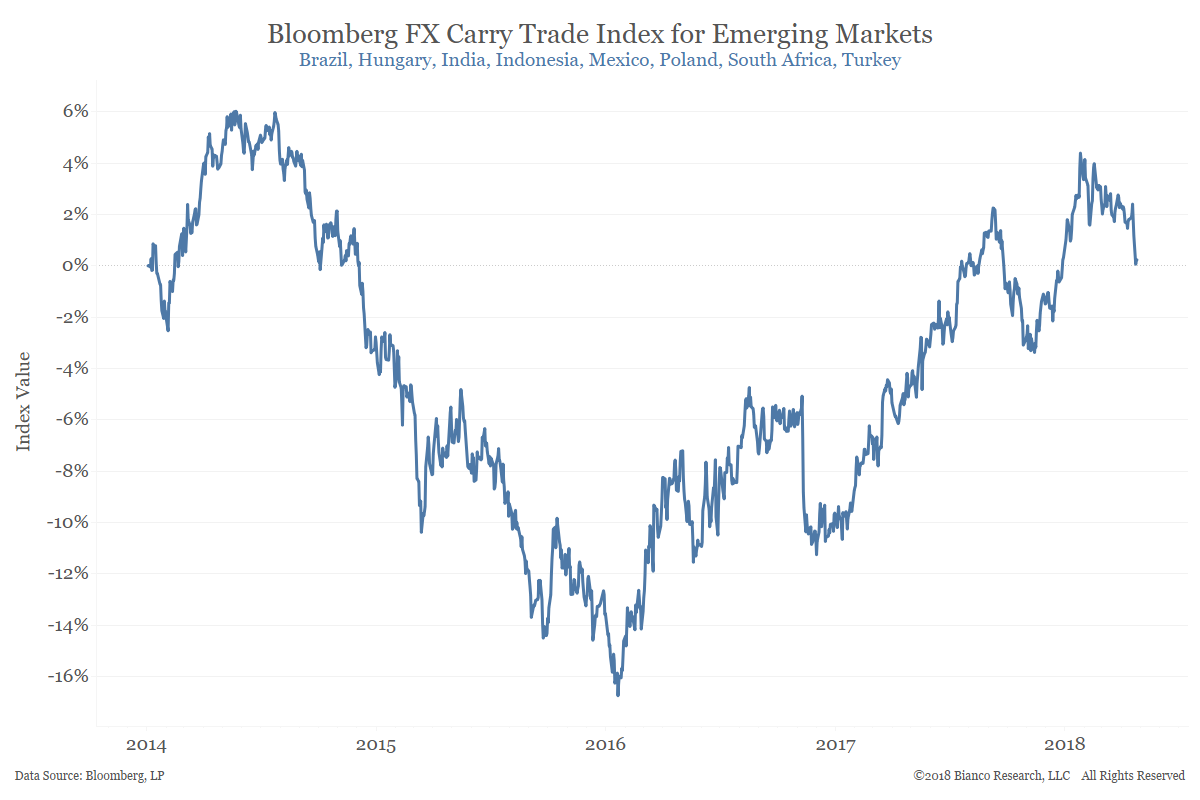

The chart at the top of the post shows the Bloomberg Cumulative FX Carry Trade index for 8 emerging market countries. The EM-8 Carry Trade Index measures the cumulative total return of a buy-and-hold carry trade position that is long eight emerging market currencies (Brazilan real, Mexican peso, Indian rupee, Indonesian rupiah, South African rand, Turkish lira, Hungarian forint, Polish zloty) that are fully funded with short positions in the U.S. dollar. Investments are assumed to be in 3-month securities.

The surge in the dollar and coincident rise in Treasury yields naturally dampened enthusiasm for emerging market exposure at lower yields. The chart below shows year-to-date returns for 2018 for the eight currencies in the index. The mid-April shift toward dollar strength (rising lines) erased significant gains for the South African rand and Mexican peso. The Brazilian real extended losses on the year to 7.3% (rising USDBRL, weakening real).

Brazil has been a chronic underperformer versus Bloomberg’s FX carry index since December. The chart below shows the difference between 65-day returns for each currency pair versus the FX carry index.

What’s interesting is the while economic growth in the developed world, and some emerging markets, is losing steam quickly, this group of emerging markets looks fairly resilient. The next chart shows Citigroup’s economic data change indices, which measure economic growth relative to one-year averages, for the eight countries in the index. The darker gray line shows the average. Indonesia and Mexico are the laggards, both near one-year averages. The rest of the pack continues to see economic growth outperform.

We discussed on April 11 how trade tensions and soybean tariffs from China may provide tailwinds for Brazil even as other emerging markets see disruptions. Superior regional economic performance might be another tailwind for Brazil. The chart below shows the economic data change indices for major emerging market economies in Latin America (top) and Southeast Asia (bottom). Among Latin American economies, only Peru has fallen below its one-year average. Four of five economies shown from the Asian region are seeing economic growth already below average, Malaysia and Korea have decelerated quickly.

Conclusion

We anticipated the dollar rally in a post on April 11. The rapid strengthening of the U.S. dollar and sudden rise in U.S. Treasury yields are at a potential inflection point. Brazil is uniquely positioned to benefit from rising trade tensions between the U.S. and China and will see tailwinds from superior regional growth versus its emerging market peers in Asia. Persistent dollar strength may pressure emerging markets broadly, but we think Brazil will is poised to outperform its peers.