- The Wall Street Journal – In a Dollarized World, a Rising Dollar Spells Pain

Even as U.S. economic influence shrinks, the dollar’s clout in global trade and borrowing is growing, magnifying impact of its rise in value

Economic ties between the U.S. and Argentina are modest, yet Federal Reserve policy is wreaking havoc on Argentina. It also threatens Turkey, Indonesia and others, for the same reason: their imports, exports and a lot of their debt is denominated in dollars. The latest emerging market tumult exposes a critical though dimly understood fault line in the global economy. Though the U.S. share of global output and trade has declined over the decades, the dollar has become even more dominant in global trade and finance. Dollarization, new research shows, means an appreciating dollar may hurt rather than help other economies by raising their import and debt costs. In fact, a rallying dollar may help explain why global growth has already faltered this year. The dollar’s dominance is also why the U.S. can isolate Iran simply by cutting off its access to the U.S. banking system.

Summary

Comment

Emerging markets have modestly underperformed developed equities year-to-date (-1.4% vs -0.3%). But, cracks are forming and headlines are being made by the likes of Argentine, Turkey, and India with the ascent of the U.S. dollar.

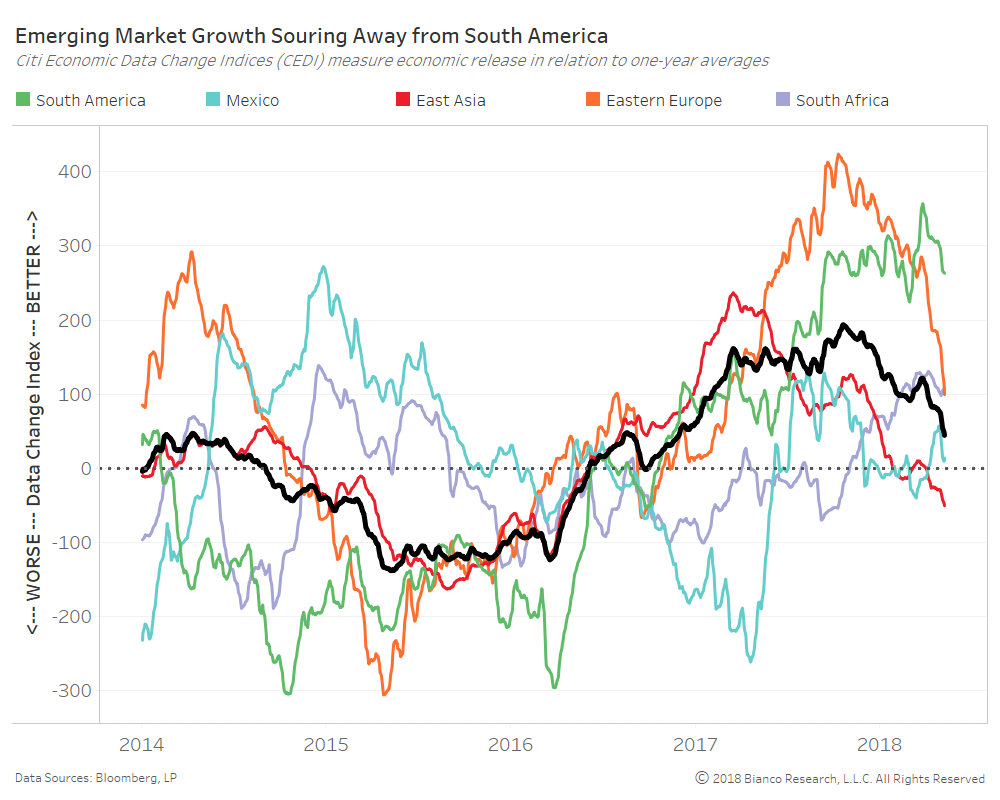

South America (green line) is thus far the lone survivor when it comes to positive economic data changes. The chart below show Citigroup Economic Data Change Indices by country or region. Breaks below zero indicates data releases are coming in below one-year averages.

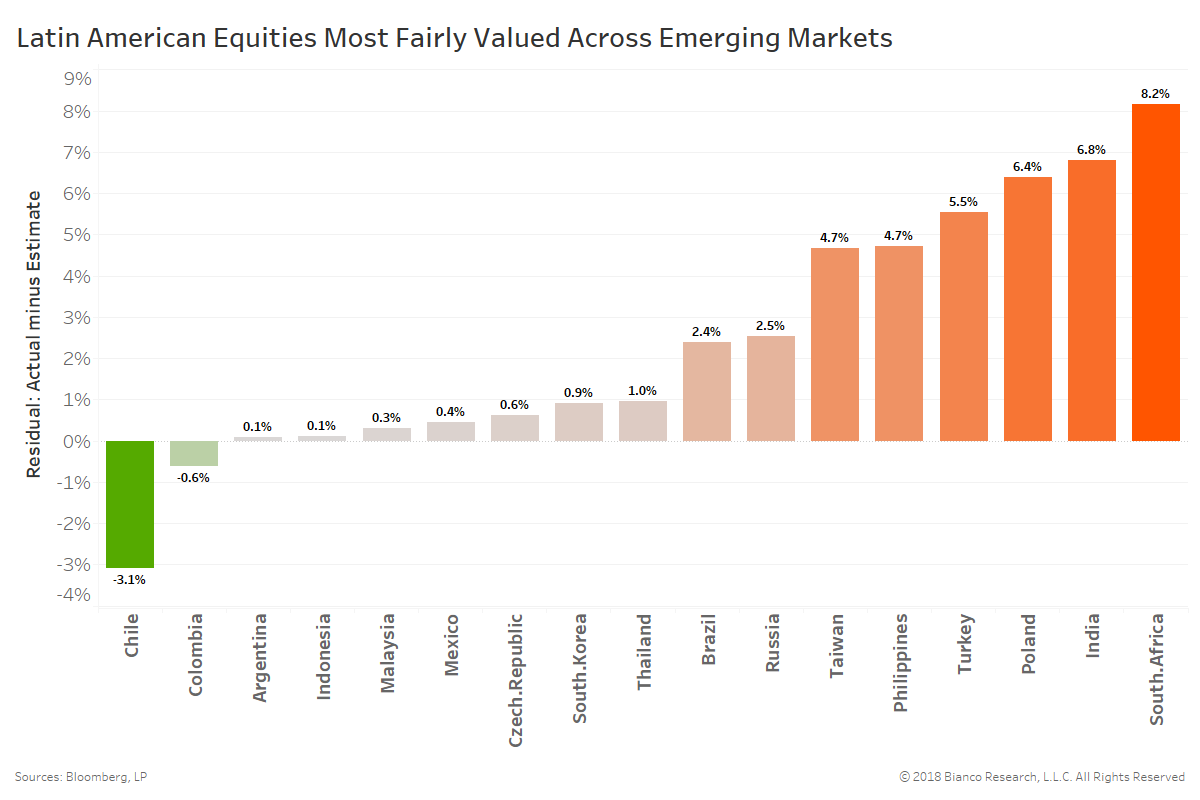

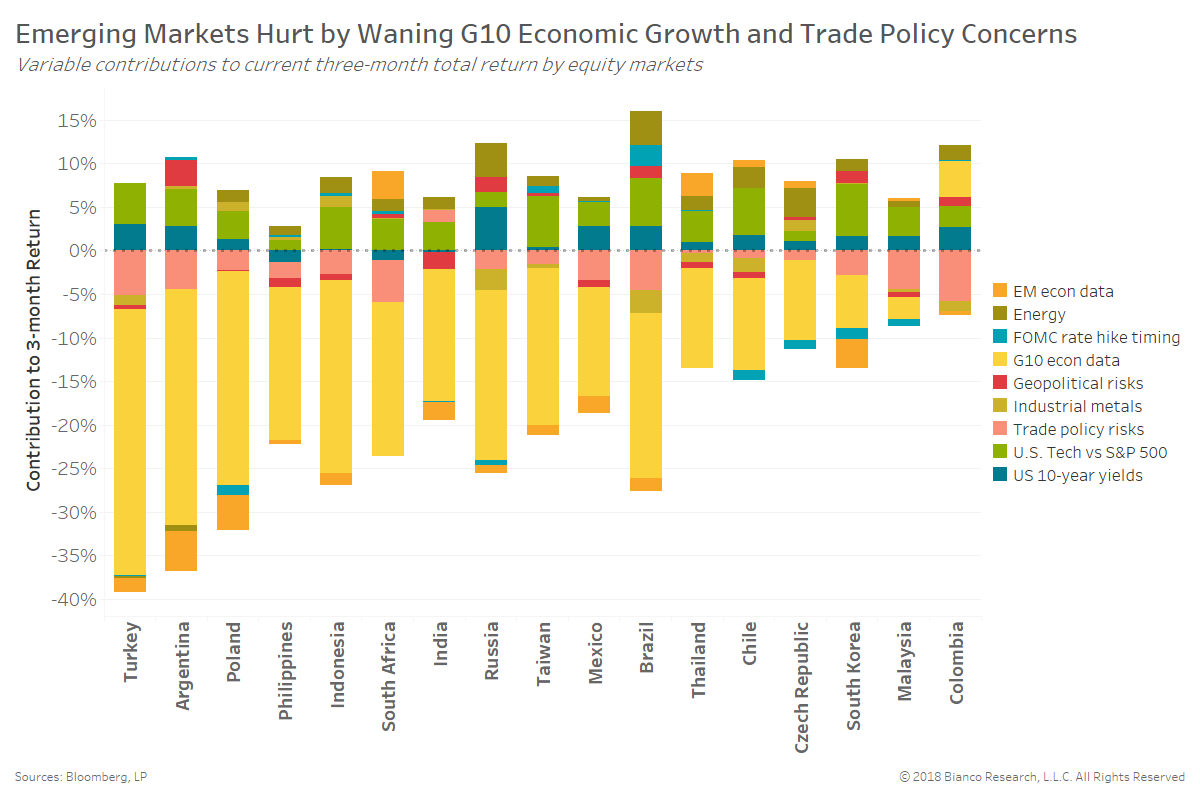

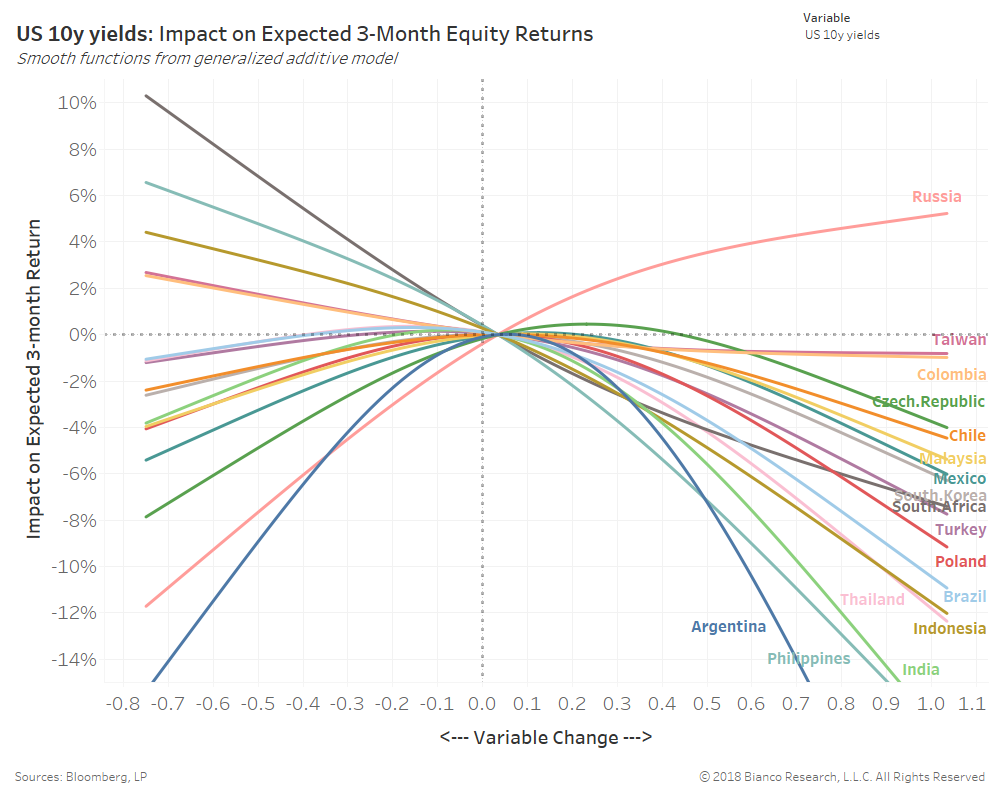

The chart below shows the difference (residual) between current equity index levels and our fair value estimates for each emerging market. Estimates are generated using changes in U.S. 10-year note yields, FOMC rate hike timing, G10 economic data, EM economic data, technology vs S&P 500 returns, energy, and industrial metals. Models explain approximately 70 to 80% of the variation in returns since 2012.

Latin America is a standout as cheap to fairly valued, while Turkey, India, and South Africa are rich to estimates.

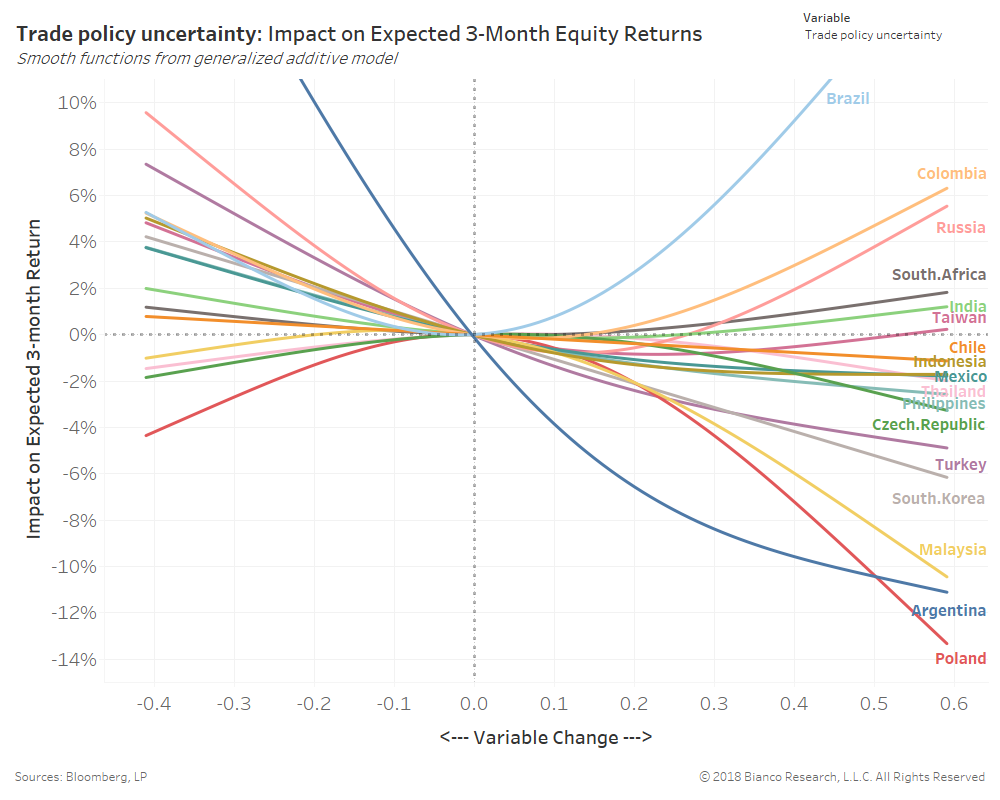

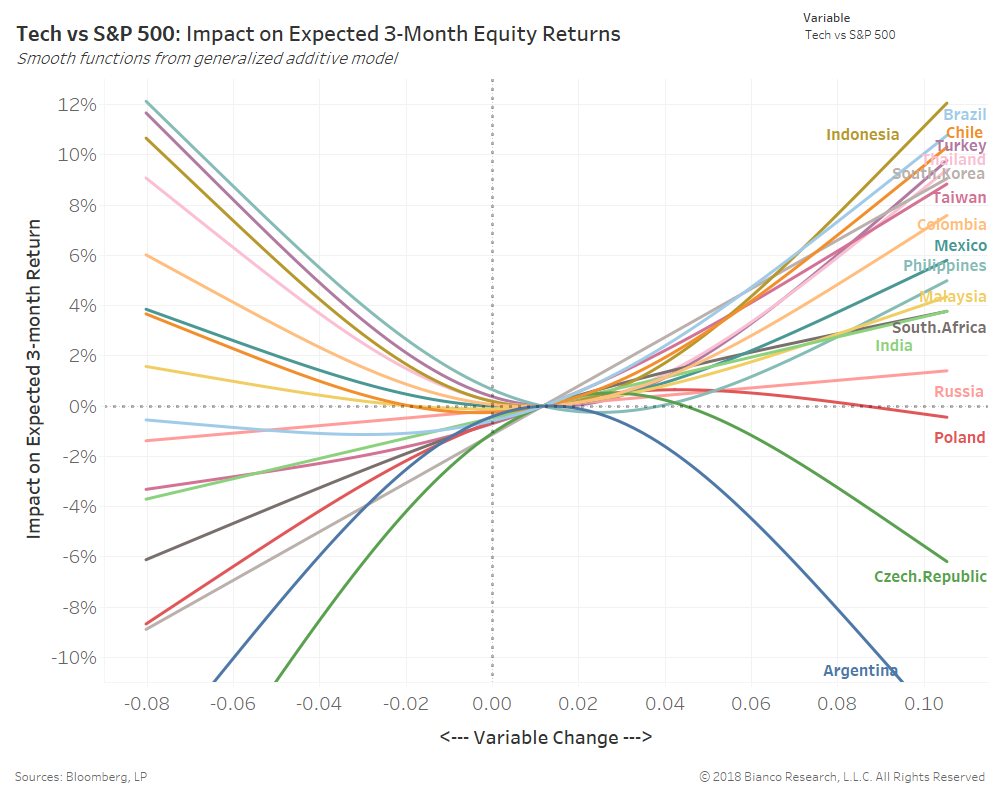

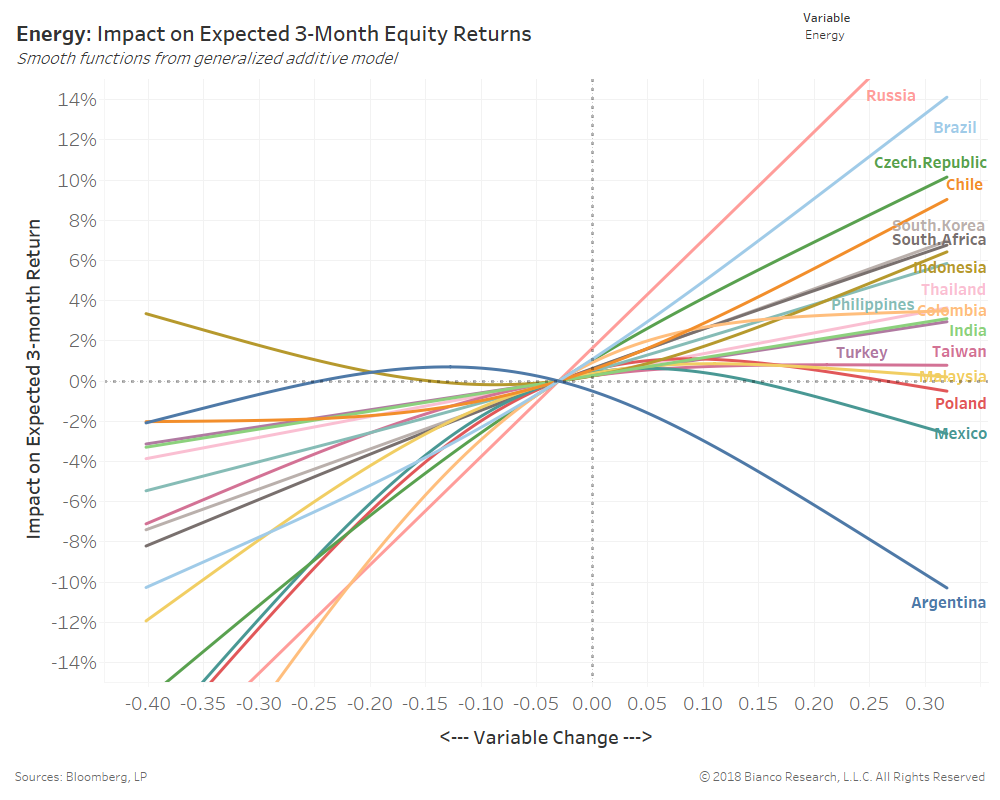

The next set of charts show the relationship between each variable (x-axis) and three-month equity returns by country (y-axis). The slope of each line represents how important each variable like trade policy, technology, and energy markets are for each country’s equity performance.

Rising trade policy uncertainty has major negative consequences for Argentina, Poland, Malaysia, South Korea, and Turkey. Conversely, Brazil, Columbia, and Russia appear mostly immune.