Summary

Average wage growth near 3.0% year-over-year masks a significant divergence between manufacturing and services labor. Their gap in growth currently nearing an extreme 2.0% has historically explained unfortunate waves of physical and mental stress felt by consumers.

Comment

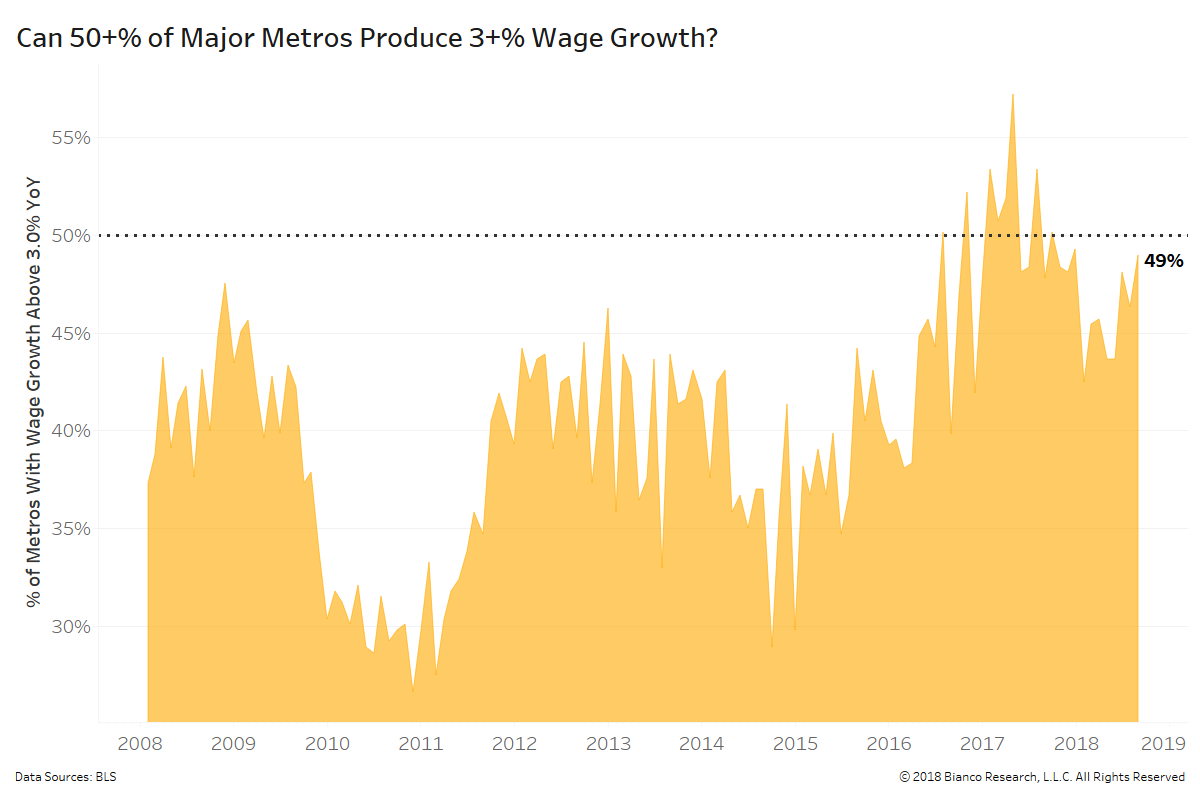

Inflation momentum has abruptly slowed heading into the fall of 2018. On the other hand, the percentage of major metros producing 3+% year-over-year wage growth is again on the rise at 49%.

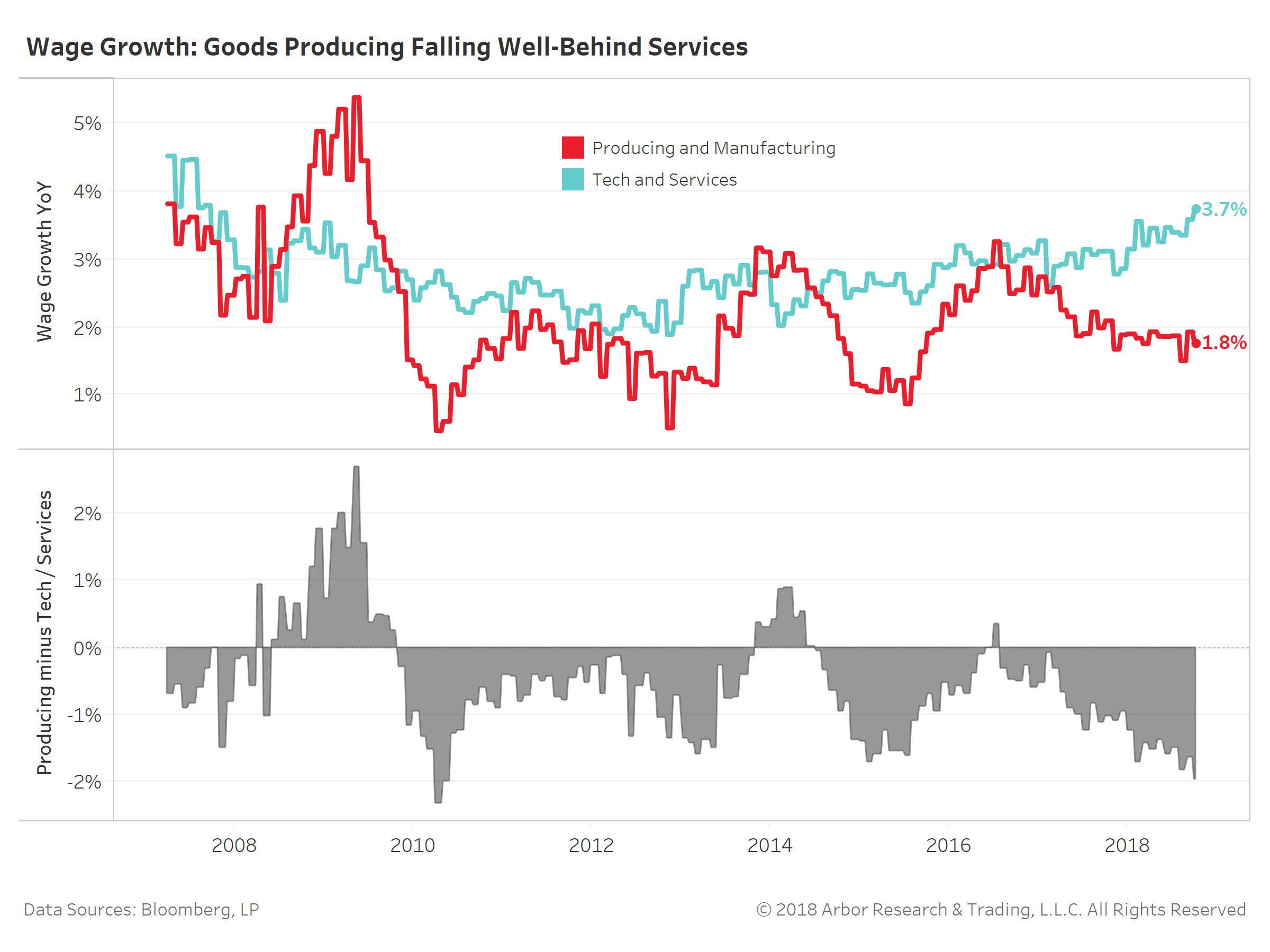

Financials, services, and technology labor (blue line) are enjoying robust 3.7% year-over-year wage growth, the highest post-crisis. Sadly, goods-producing and manufacturing labor (red line) have been stuck with sluggish 1.8% year-over-year wage growth. The gap has opened up to nearly the widest in a decade.

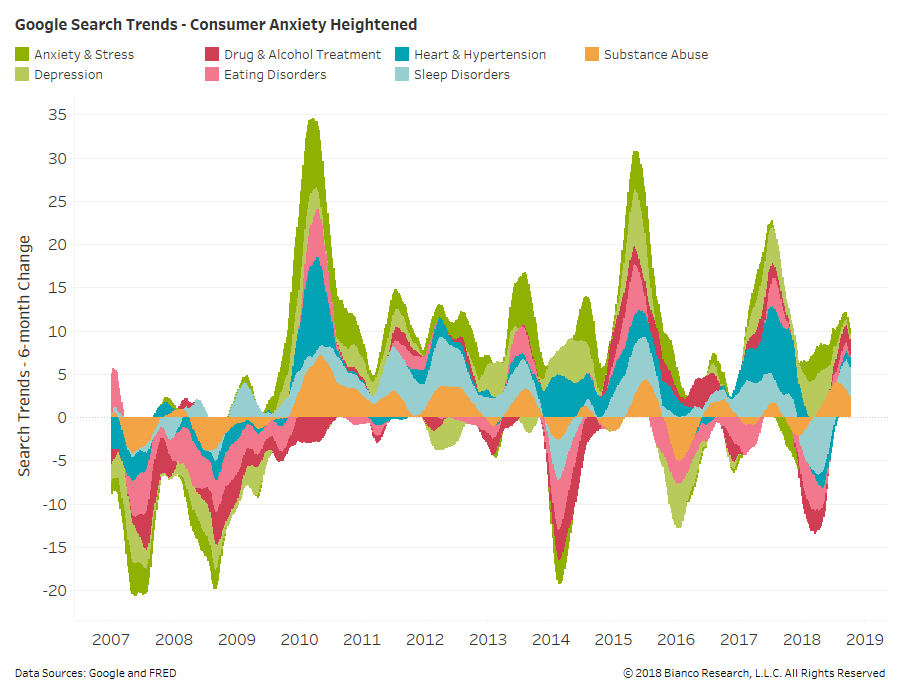

We have been concerned about continued waves of consumer anxiety and stress. The next chart shows six-month changes in seasonally-adjusted Google search trends for physical and mental stress. All search trends are on the rise led by substance abuse (orange) and sleep disorders (light blue).

The U.S. has become a tale of two economies: 1) rural, goods-producing and 2) urban, tech-heavy. We have often discussed the divergence in productivity and profit margins between industries and companies with heavier tech-focus.

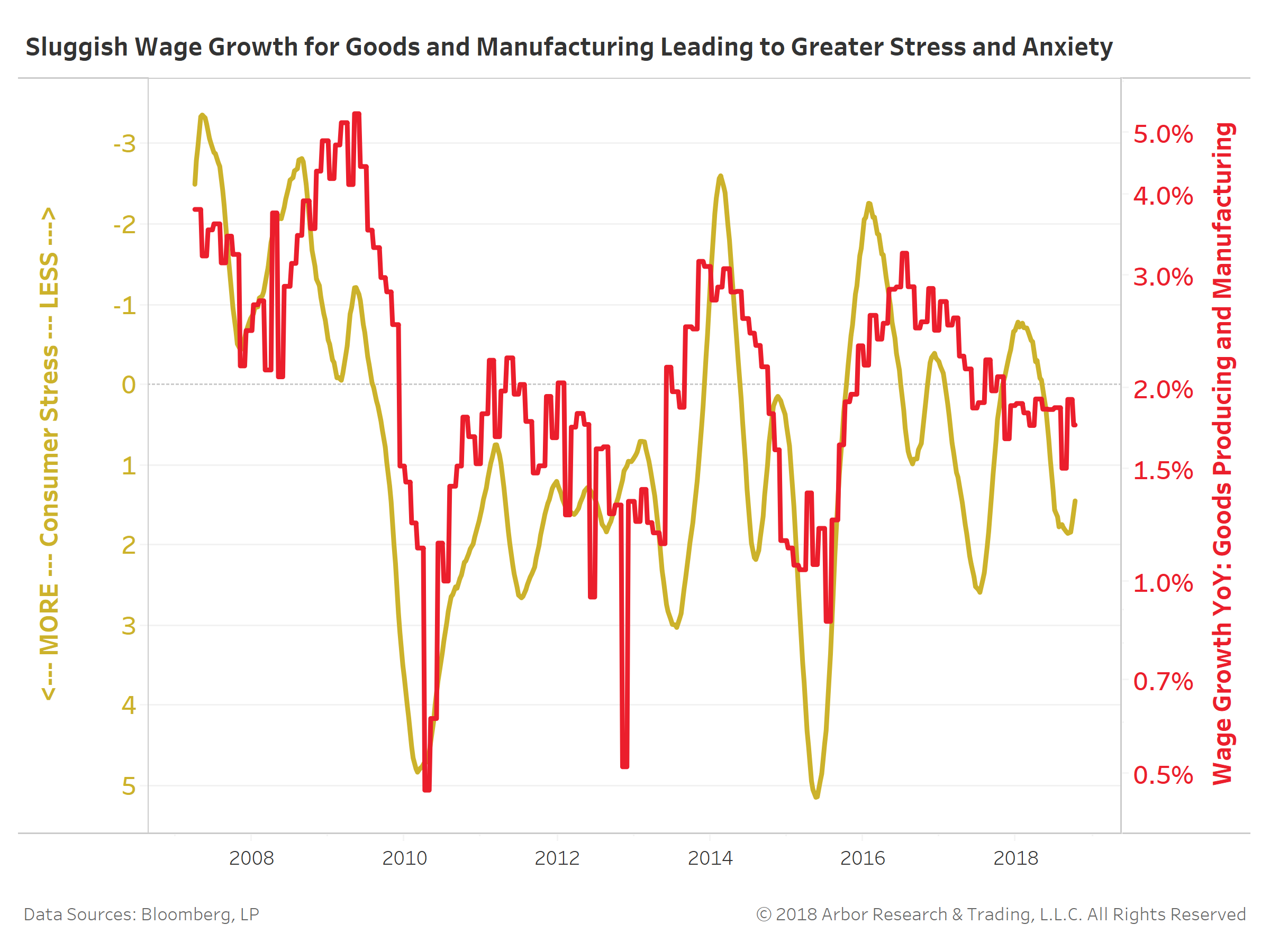

Surges in consumers’ physical and mental stress (left axis, reversed) have tracked wage growth for goods producing and manufacturing labor (right axis). In other words, blue collar labor is likely battling amplified stress when their wages fail to rebound with technology and services industries.

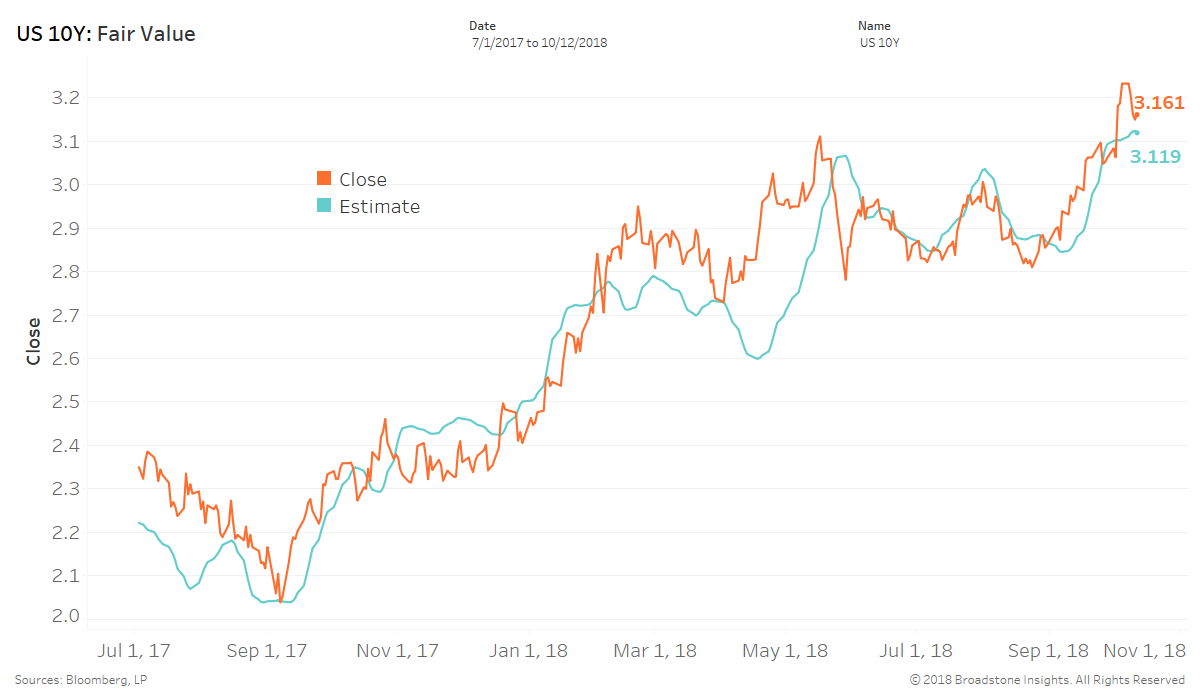

Economic growth still running near one-year averages coupled with core inflation near target have helped long-end Treasury yields finally bearishly breakout. Our own fair value estimates are mostly keeping pace, suggesting the blend of traditional and alternative data are still in favor of rising yields.

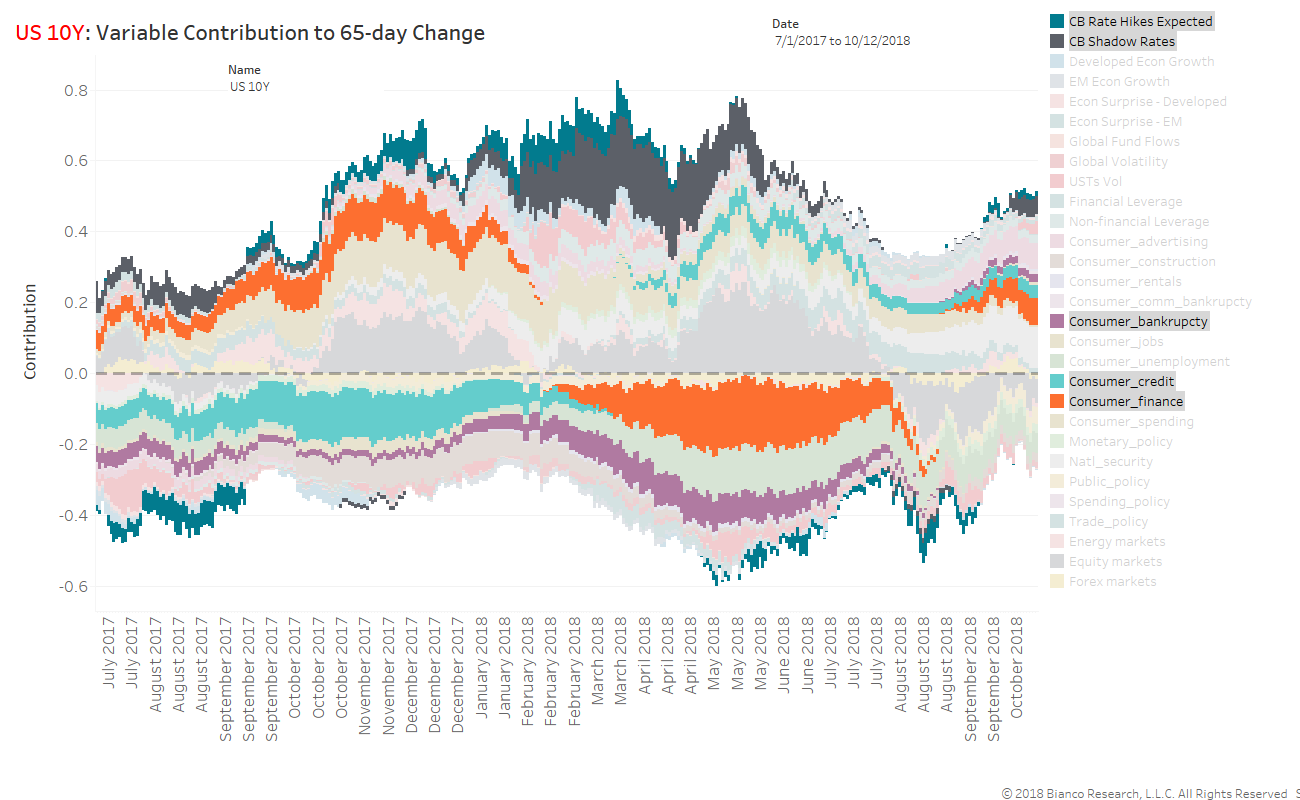

The last chart shows variable contributions to 65-trading day changes in U.S. 10-year note yields. We have highlighted key contributors pushing for higher yields. Namely, consumer search trends for bankruptcy, credit, and finance have added ~14 bps to yield. We are watching these search trends very, very closely as any indication of struggle or concern would take wind of the sails for higher yields.