-

- CNBC – Dan Niles reveals why he prefers the ‘Fantastic Four’ and when the ‘AI bubble’ might pop

Hedge fund manager Dan Niles has named Nvidia, Meta, Microsoft and Amazon as his favorite stock picks thanks to their ability to boost earnings in 2024. … While shares of Apple, Tesla, and Alphabet have fallen this year on negative estimate revisions by analysts, Niles’ four picks continue to see analysts raise forecasts. Specifically, he called out estimate increases at Nvidia, Meta, Microsoft, and Amazon thanks to their booming AI businesses. “Those names are being driven by earnings,” Niles asserted.

- CNBC – Dan Niles reveals why he prefers the ‘Fantastic Four’ and when the ‘AI bubble’ might pop

Summary

Comment

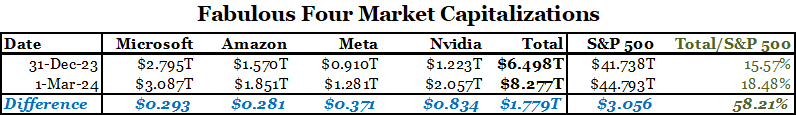

The Fabulous Four – Microsoft, Amazon, Meta, and Nvidia – have had an amazing run. The table below shows these four stocks have a market capitalization of $8.277 trillion as of March 1, or 18.48% of the S&P 500. They have accounted for 58.21% of the index’s change in market capitalization this year.

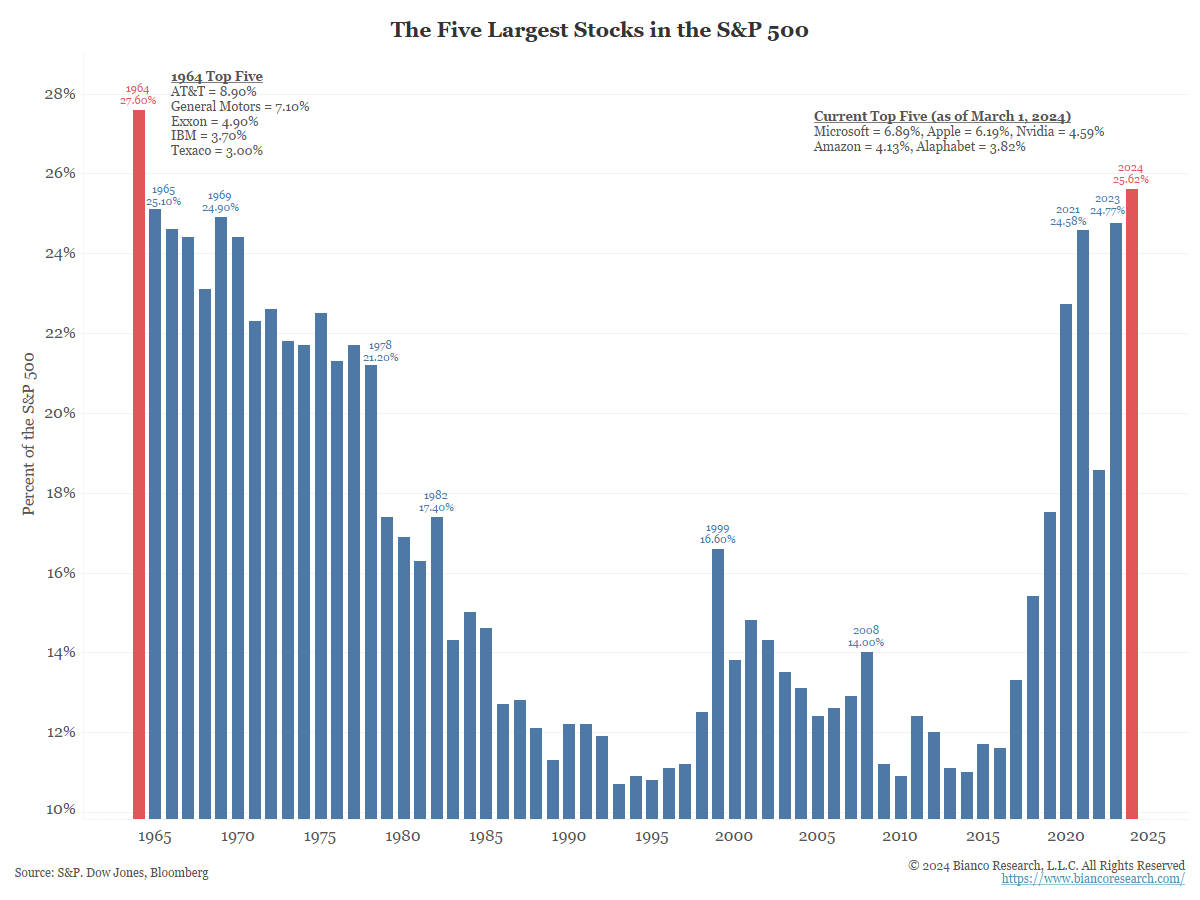

To put this level of stock market concentration into perspective, the next chart shows the five largest stocks as a percentage of the S&P 500. Three of the Fabulous Four are on this list (less Meta), along with Apple and Alphabet.

The red bars show that the current top five list accounts for 25.62% of the S&P 500’s market capitalization, the largest weighting since 1964. So, this is a 60-year extreme.

S&P 496

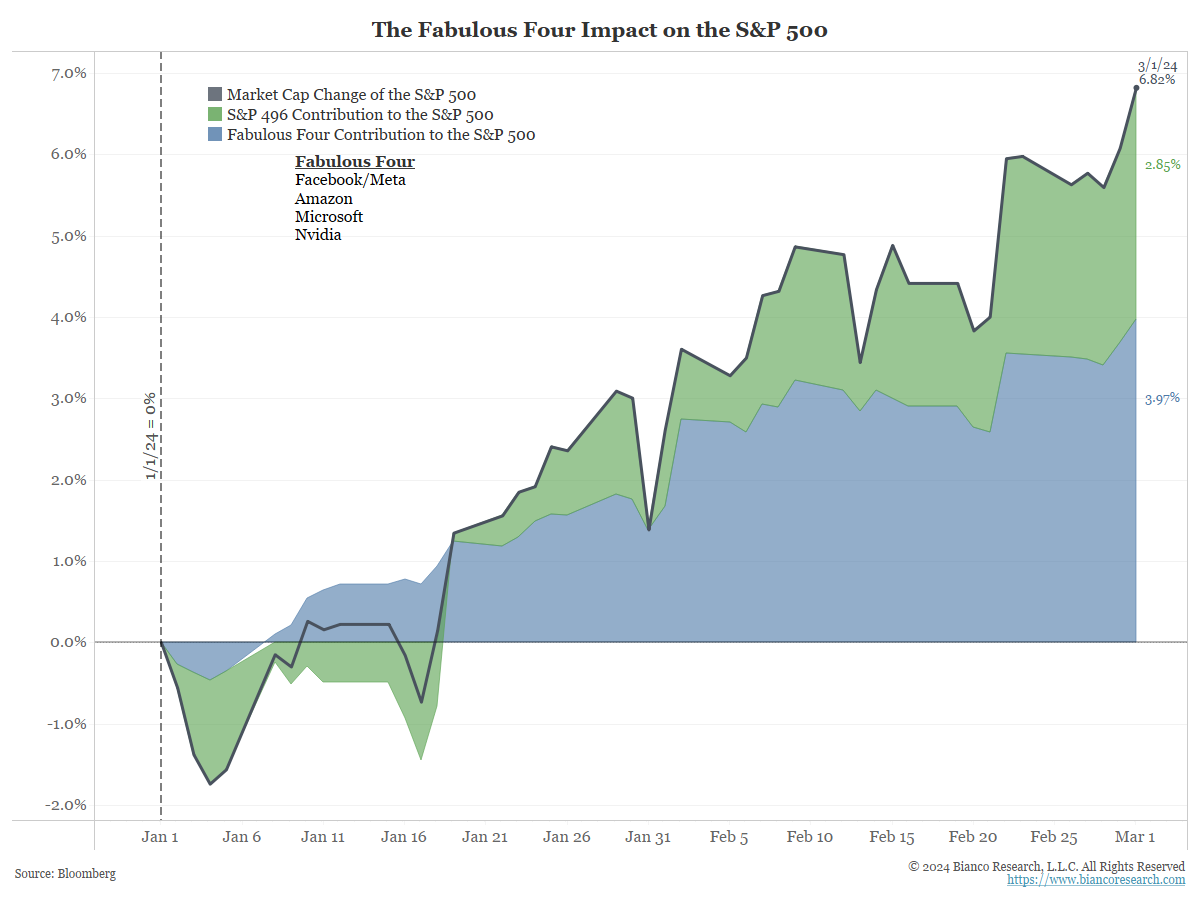

The next chart looks at the Fabulous Four’s impact on market returns on the S&P 500.

For this metric we use the change in market capitalization. This differs slightly from the S&P’s “modified market capitalization” measure in calculating its index. Nevertheless, this measure effectively produces the same results.

The S&P 500 (black line), the Fabulous Four (blue area), and the “S&P 496” (green area) are shown.

Note that the “S&P 496” contributed just 2.85% of the 6.82% change in the market capitalization of the overall S&P 500 year-to-date.

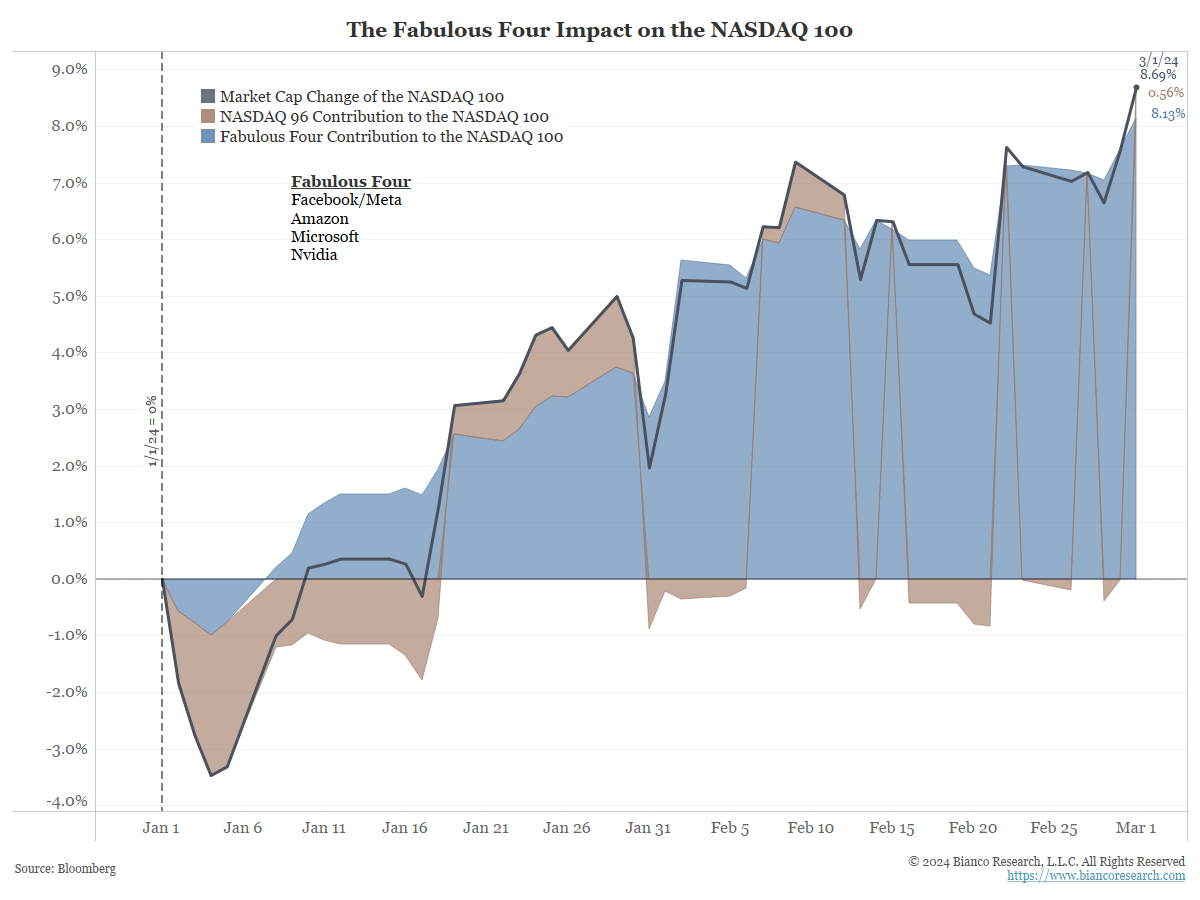

NASDAQ 96

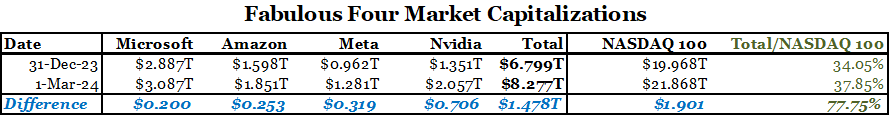

The next table is the same as above, but it compares the Fabulous Four against the NASDAQ 100, the underlying index for the popular QQQ ETF.

This year, 77.75% of the NASDAQ 100’s change in market capitalization comes from four stocks.

Likewise, the next chart shows the change in market capitalization of the NASDAQ 100 (black line), the “Fabulous Four” (blue area), and the “NASDAQ 96” (brown area).

Note that the “NASDAQ 96” contributed just 0.56%% of the 8.69% change in the market capitalization of the overall NASDAQ 100 year-to-date.

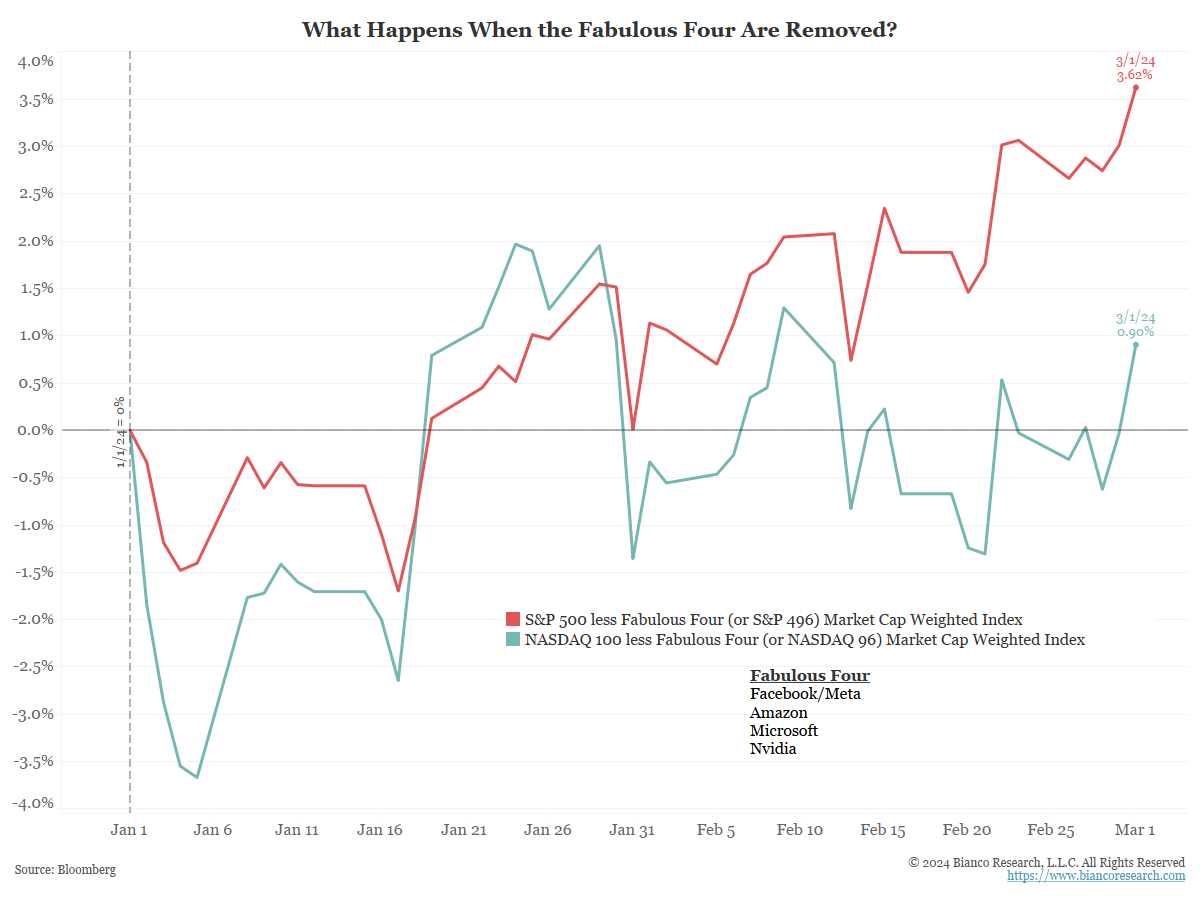

The two charts above show how much the Fabulous Four and the “other stocks” contributed to overall returns. Below, the Fabulous Four are shown as if they were an index by themselves.

The S&P 496 (red line) is up 3.62% year-to-date. The S&P 500 is up 7.70% year-to-date.

The NASDAQ 96 (green line) is up just 0.90% year-to-date. Note that all year-to-date gains came in the last two trading days. The NASDAQ 100 is up 8.78% year-to-date.

Why Concentration Matters

What does it mean that index returns are concentrated in a narrow group of stocks? Simply put, there is not enough money to go around.

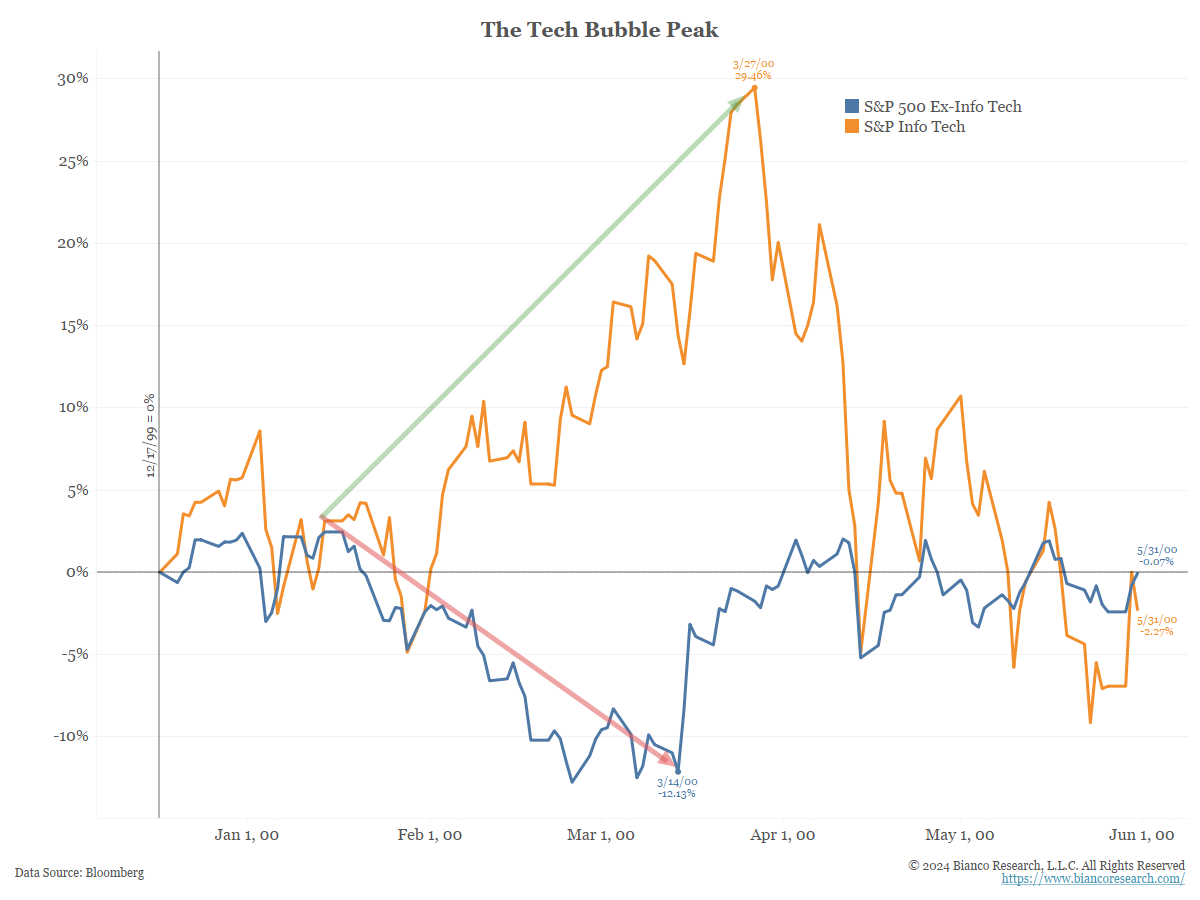

This is not dissimilar to what happened in early 2000 when the tech bubble burst. The orange line below shows that tech stocks rocketed to a 29.46% return year-to-date through March 27, 2000. At the same time, everything else, or the non-technology index (blue line), fell hard. Through March 14, 2000, the non-tech index was down over 12% for the year.

Think of it like an electric engine that requires so much power that it shuts down everything else in the grid (sparks flying and transformers blowing) to keep itself running.

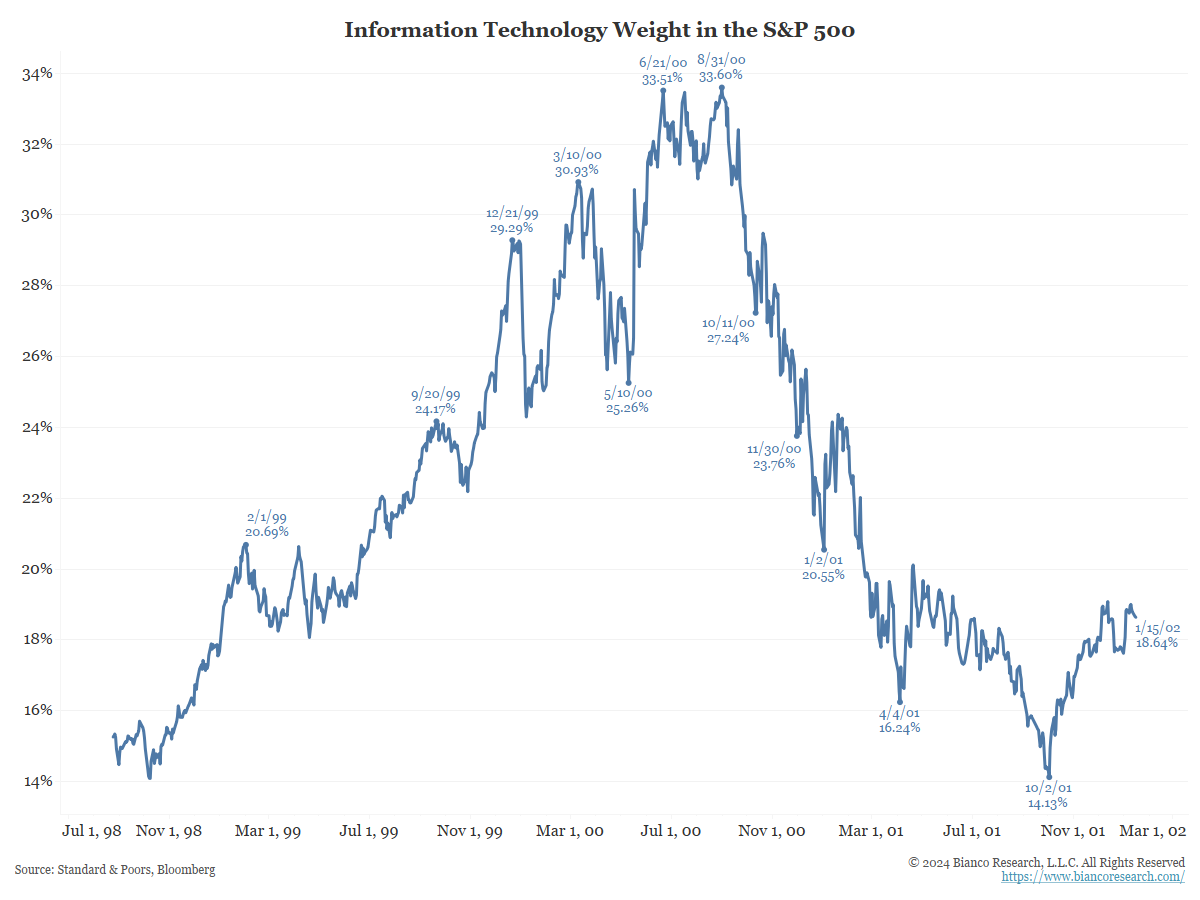

The tech frenzy drove the sector’s concentration in the S&P 500 to 33.60% by the summer of 2000. This remains the record peak for any sector’s weighting in the S&P500 (current sectors began in 1989).

Above, we suggested there was not enough money to go around. Could it have alternatively meant that technology stocks 25 years ago were getting higher valuations as non-technology companies were simultaneously becoming less valuable? We believe that argument would have merit if the weight of technology stocks in the S&P 500 did not subsequently collapse, along with prices, from 33.60% in August 2000 to 14.13% on October 2, 2001.

A concentrated run-up with everything else falling and the subsequent reversal is the very definition of a bubble peak.

Today, the information technology sector is approaching these concentration peaks at 29.84%.

But note that only Apple, Microsoft, and Nvidia are in the Information Technology Sector Index. Alphabet and Meta are in the Communications Services Sector Index. Amazon and Tesla are in the Consumer Discretionary Sector Index.

Dimming Lights

The current stock market concentration and the source of its year-to-date gains, the Fabulous Four, is as extreme as any historical period. Maybe the 2000 tech bubble peak might have been more concentrated.

Sticking with our electric engine metaphor from above, transformers are not blowing right now. But the lights are dimming everywhere to feed anything associated with AI.

What keeps this trend going? More money (more power to the grid), like the Fed ending Quantitative Tightening (QT) and cutting rates.

Wall Street often forecasts what it wants, not necessarily what it thinks will happen. Right now, Wall Street wants/needs more money (power). So, everywhere it looks, it sees a soft landing and no inflation. Given this outlook, economists demand the Fed cuts rates and ends QT.

Moody Analytics Chief Economist Mark Zandi offered an example of this yesterday. His number one concern is the Fed does not make money cheaper.

I’ve never thought recession, and still don’t. But the biggest threat to my optimism isn’t geopolitical risks or CRE, it is the Fed makes a mistake – it waits too long to recognize it has achieved its full-employment and inflation objectives – and begins to lower rates too late.

— Mark Zandi (@Markzandi) March 3, 2024

Desperate for Cuts

Most of Wall Street is singing a similar tune. While the first rate cut has been pushed out to June, Wall Street is not worried as they believe cuts and more money are coming.

We have held a different opinion. The economy is doing better than believed and we are in the “no-landing” camp. Additionally, we think inflation will stay stickier than expected. This will lead to higher interest rates (borrowing costs) and frustrate those looking for rate cuts.

Market Cap to GDP

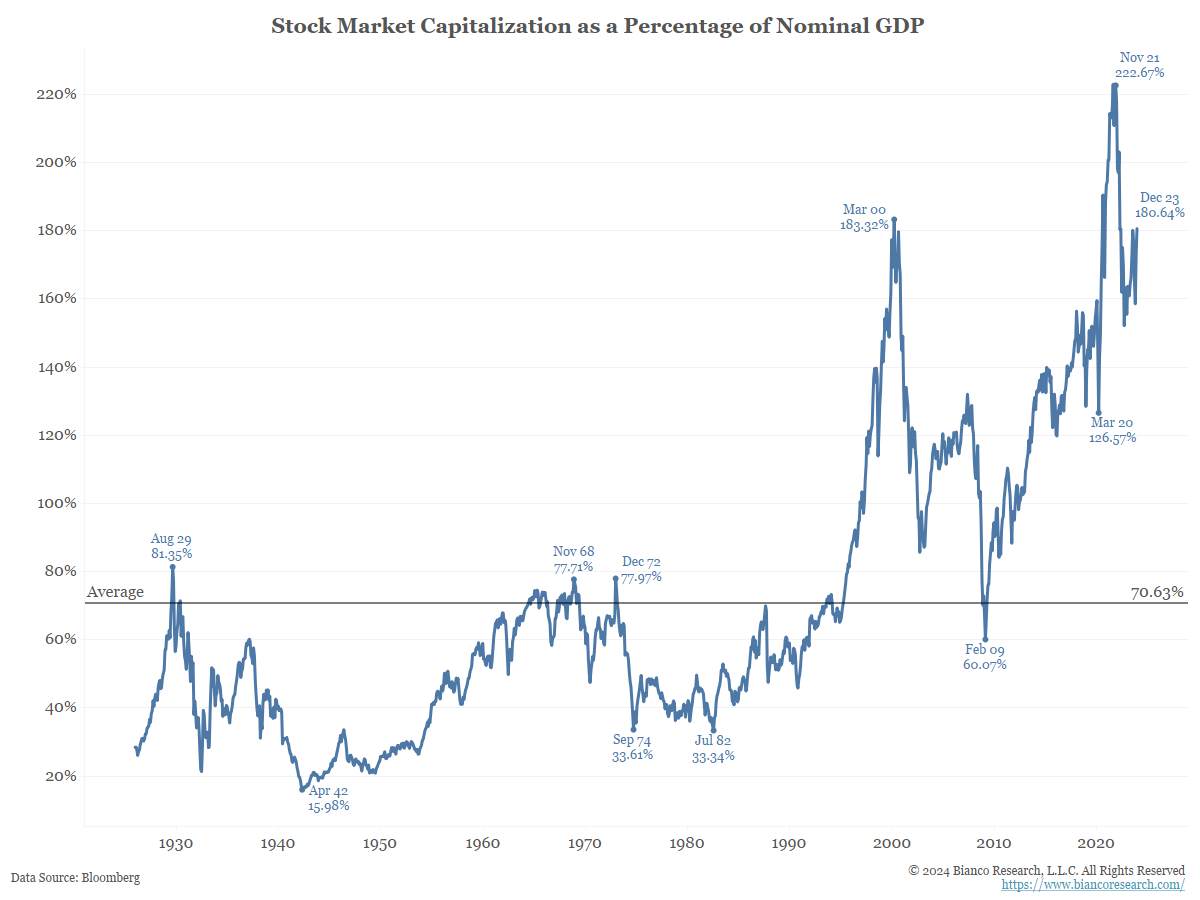

If our outlook becomes reality, the $53 trillion stock market (the latest market capitalization of the Russell 3000 Index), housed within a $28 trillion economy (latest nominal GDP) means the market cap to GDP ratio is around 185%. This is why some tough choices need to be made with existing capital. There just isn’t enough economic activity to support the market at current levels.

As the chart below shows, when market capitalization hit 180% of GDP in March 2000, stocks were enjoying cheap money via the Fed’s 1999 Special Liquidity Facility to combat the fear that Y2K would shut all computers down (this was essentially QE before the word was coined). This program ended in April 2000 when the computer world survived. Further, when Greenspan signaled the hikes he began in 1999 would continue into 2000 (the Fed hiked six times, from 4.75% to 6.50%, between 1999 and 2000), that concentrated stock market fell hard. It did not have enough money to sustain those levels.

In November 2021, the market cap to GDP ratio soared to 223%. This was fueled by 0% interest rates, a massive Fed balance sheet, and fiscal stimulus pouring into the economy during the pandemic. It was so much money that it had a part in the meme stocks’ boom (Gamestop), and bitcoin hitting $69,000.

Then in November 2021 Chairman Powell distanced himself from the idea that inflation would prove transitory (Powell: should stop calling it ‘transitory’), signaling hikes and QT were coming.

2022 saw the S&P 500 fall 25%, the NASDAQ 100 dive 38%, bitcoin collapse 77% and the bond market had it worst year since the Civil War.

The market cap to GDP ratio is now back to levels where a concentrated rally signals a lack of ammo to keep the rally going. This means more and cheaper money is needed.

Wall Street forecasts what it wants. And it wants more and cheaper money. We don’t think it will get it.