A Look at Nearly 65 Years of Mutual Funds Flows

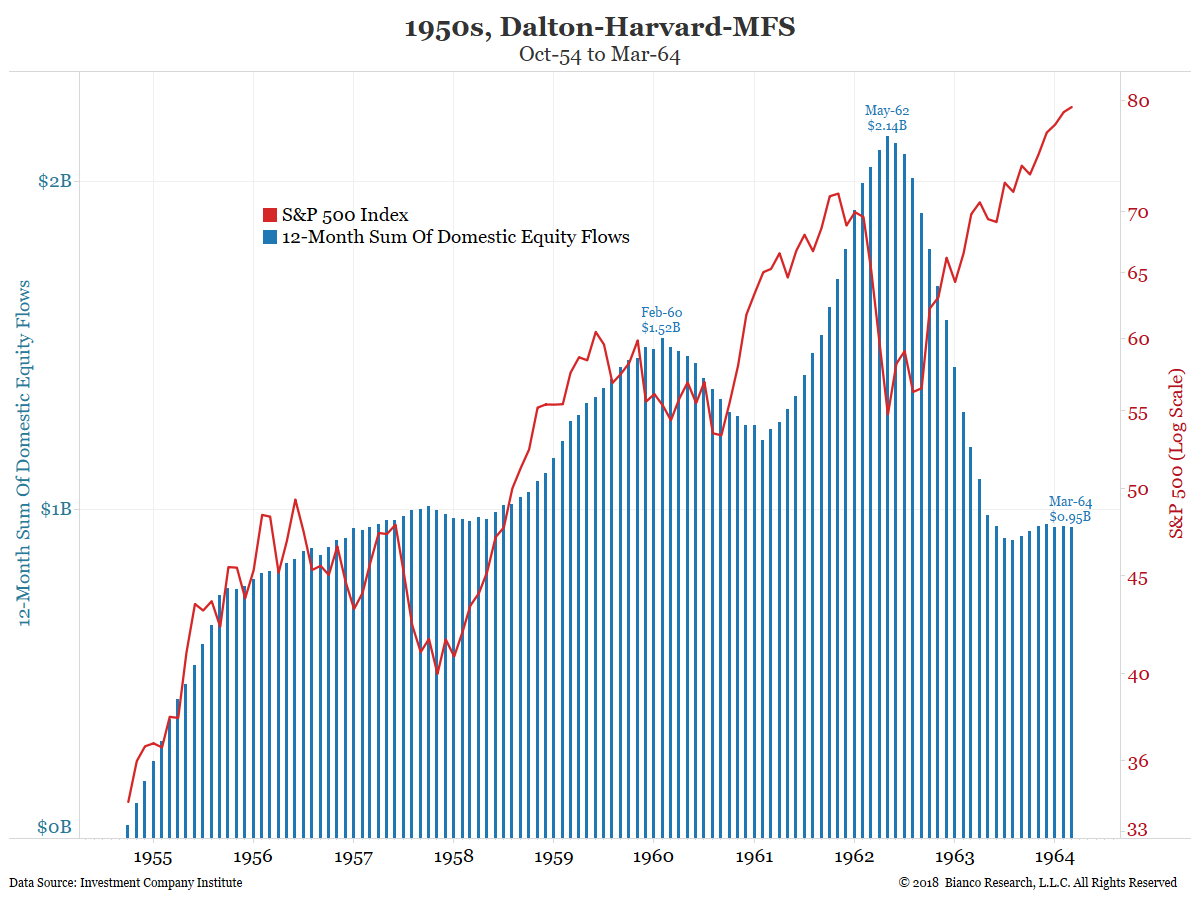

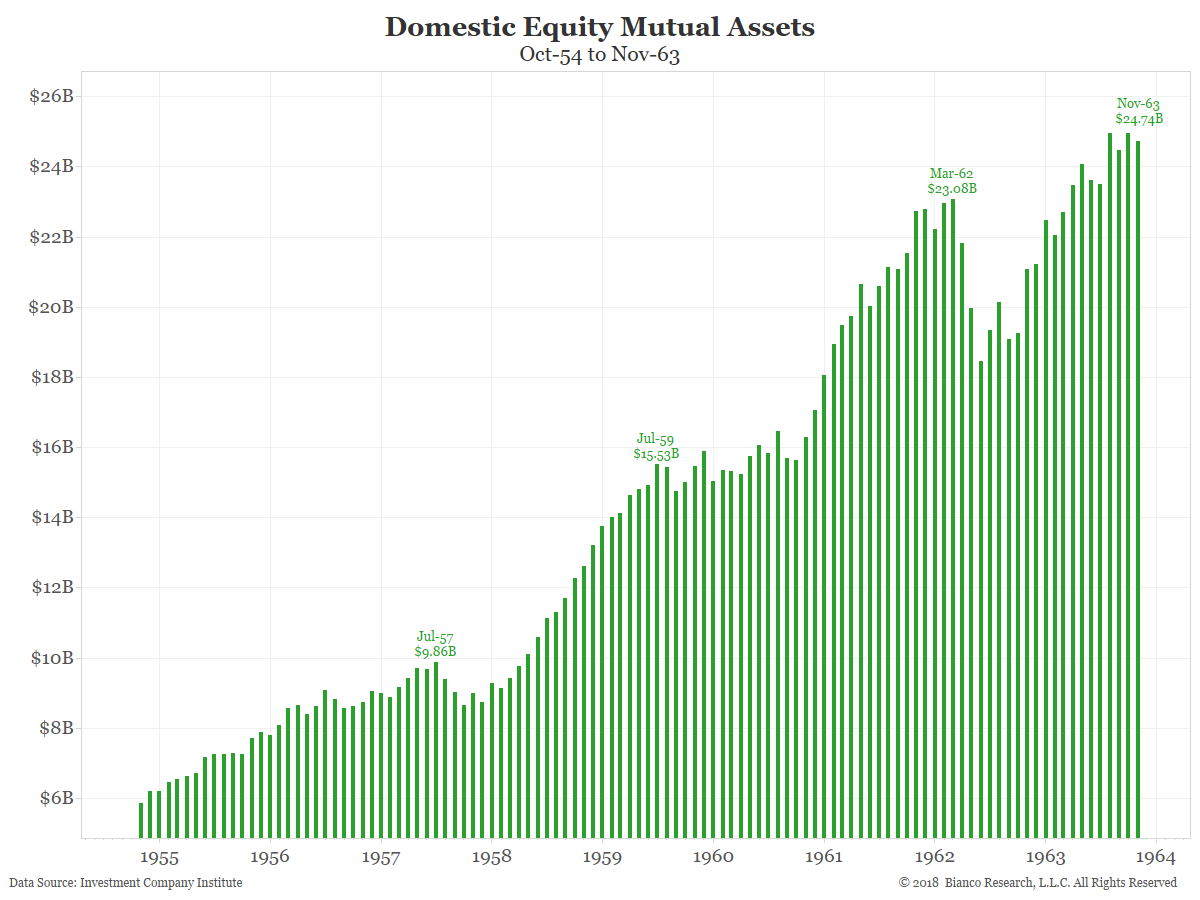

The 1950s: From Dalton, to Harvard, to MFS

The Arrival of the Modern Fund

The creation of the Massachusetts Investors’ Trust in Boston, heralded the arrival of the modern mutual fund in 1924. The fund was opened to investors in 1928, eventually spawning the mutual fund firm known today as MFS Investment Management. State Street Investors’ Trust was the custodian of the Massachusetts Investors’ Trust. Later, State Street started its own fund in 1924 with Richard Paine, Richard Saltonstall and Paul Cabot at the helm. Saltonstall was also affiliated with Scudder, Stevens and Clark, an outfit that would launch the first no-load fund in 1928. A momentous year in the history of the mutual fund, 1928 also saw the launch of the Wellington Fund, which was the first mutual fund to include stocks and bonds, as opposed to direct merchant-bank style of investments in business and trade.

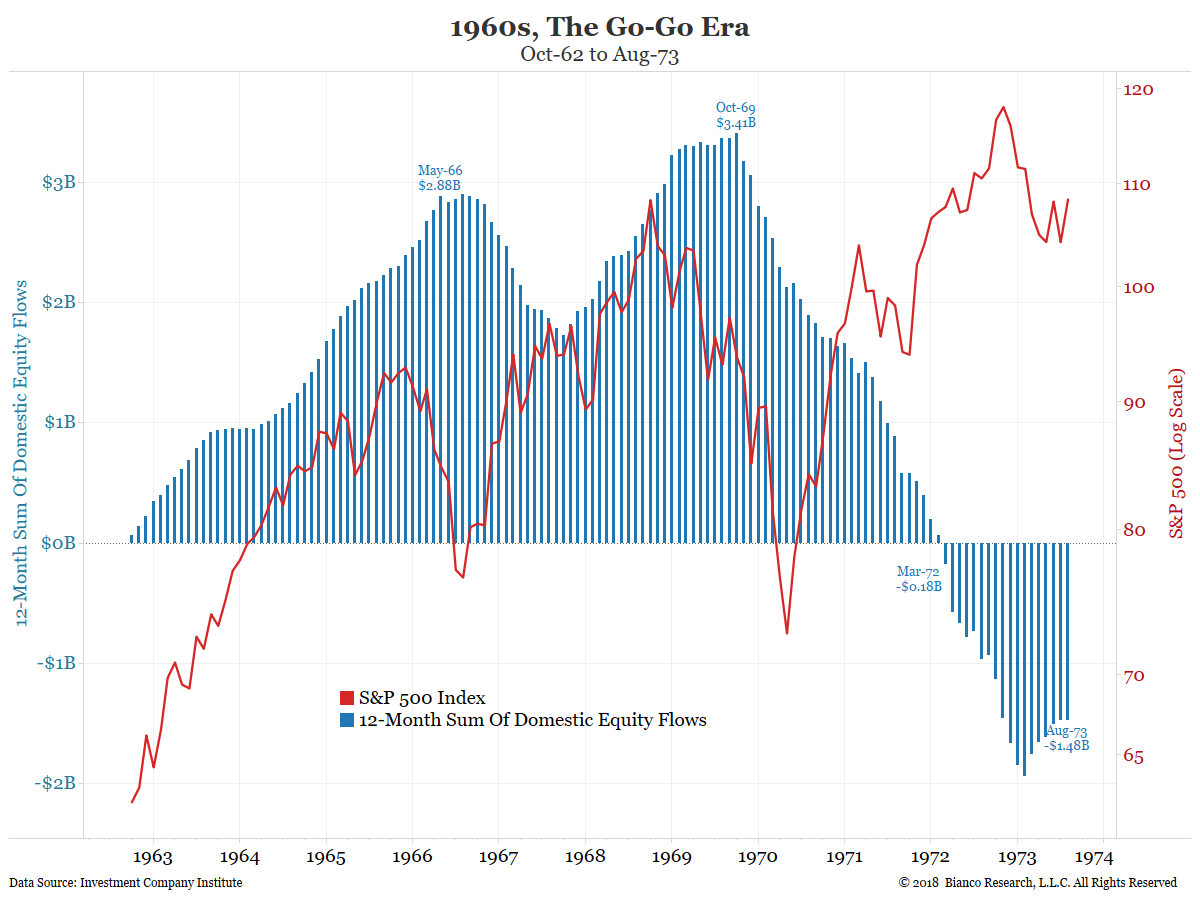

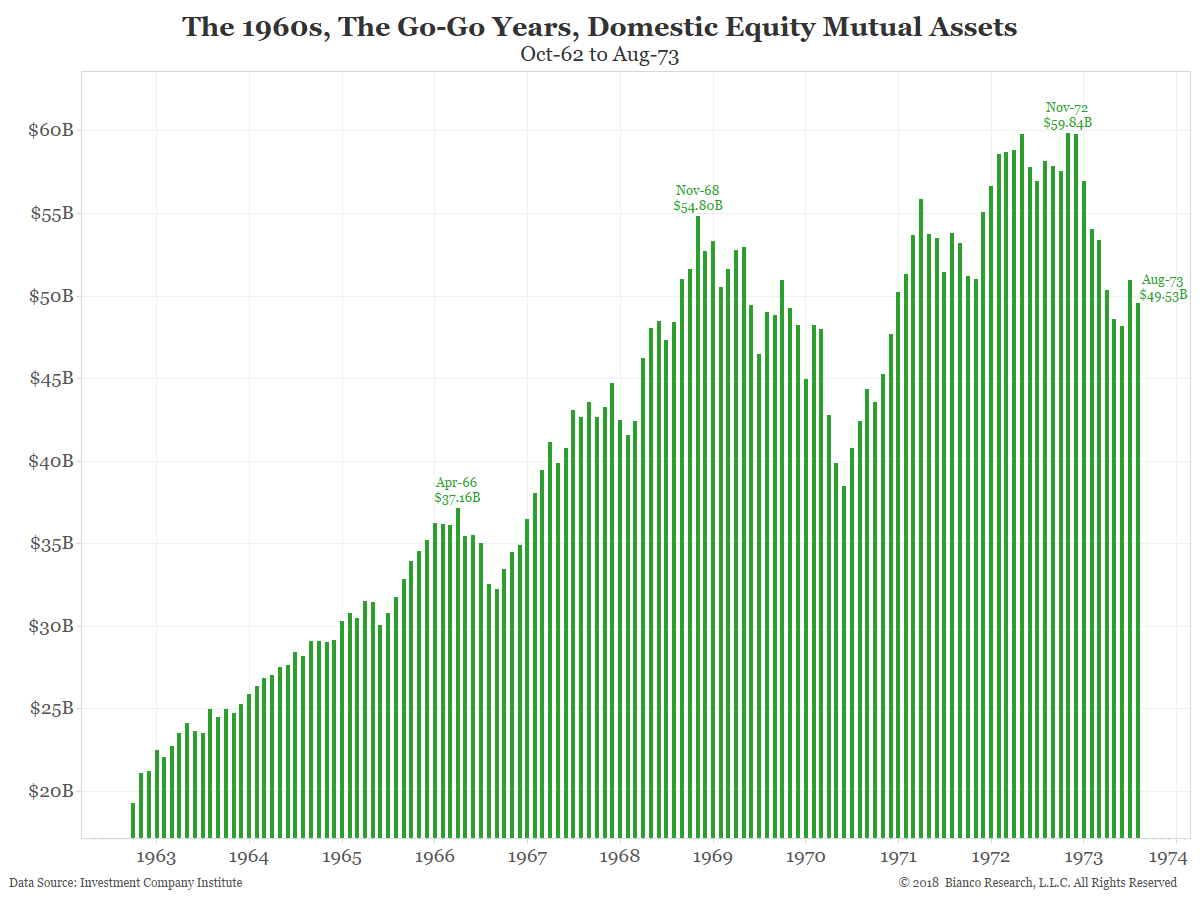

The 1960s Go-Go Era: Funds Go Mainstream

Managing a mutual fund before Bloomberg

Driving Deals, Flying High Gerald Tsai, standing, at the Manhattan fund, 1966.

Between 1958, when he became the manager of Fidelity Capital Fund at age 29, and 1965, when he left Fidelity to strike out on his own, Tsai was a mutual-fund manager on an incredible hot streak. Not that anyone realized that’s what it was.

People were dazzled by his swashbuckling forays into the glamour stocks of the day, like Polaroid and LTV, which seemed only to go up and up, and his seeming ability to time the market’s every move. “It was a beautiful thing to watch his reactions,” Edward C. Johnson II, then the owner of Fidelity, said. “What grace, what timing — glorious!” Nobody had ever run a fund like that before, and the press, in particular, portrayed him as an investing genius. “Gerald Tsai Jr.,” wrote Newsweek at the height of his fame, “radiates total cool.” He was the first fund manager to receive celebrity treatment in the press.

Which, probably, made what happened next inevitable. After a dazzling 1965, Tsai set out on his own. Seeking to raise $25 million for his new Manhattan Fund, he wound up with 10 times that amount, as investors clamored to get into the fund. He had two middling years, and then the roof fell in. By July 1968, the Manhattan Fund was the sixth-worst-performing fund in the country. Tsai responded shrewdly — for himself at least — by selling the fund to an insurance company for $30 million. A year later it had lost 90 percent of its value.

1970s: The Dark Ages

Remembering the Past: Mutual Funds and the Lessons of the Wonder Years

Barry P. Barbash, Director Division of Investment Management, U.S. Securities and Exchange Commission, Washington, D.C., November 4, 1997

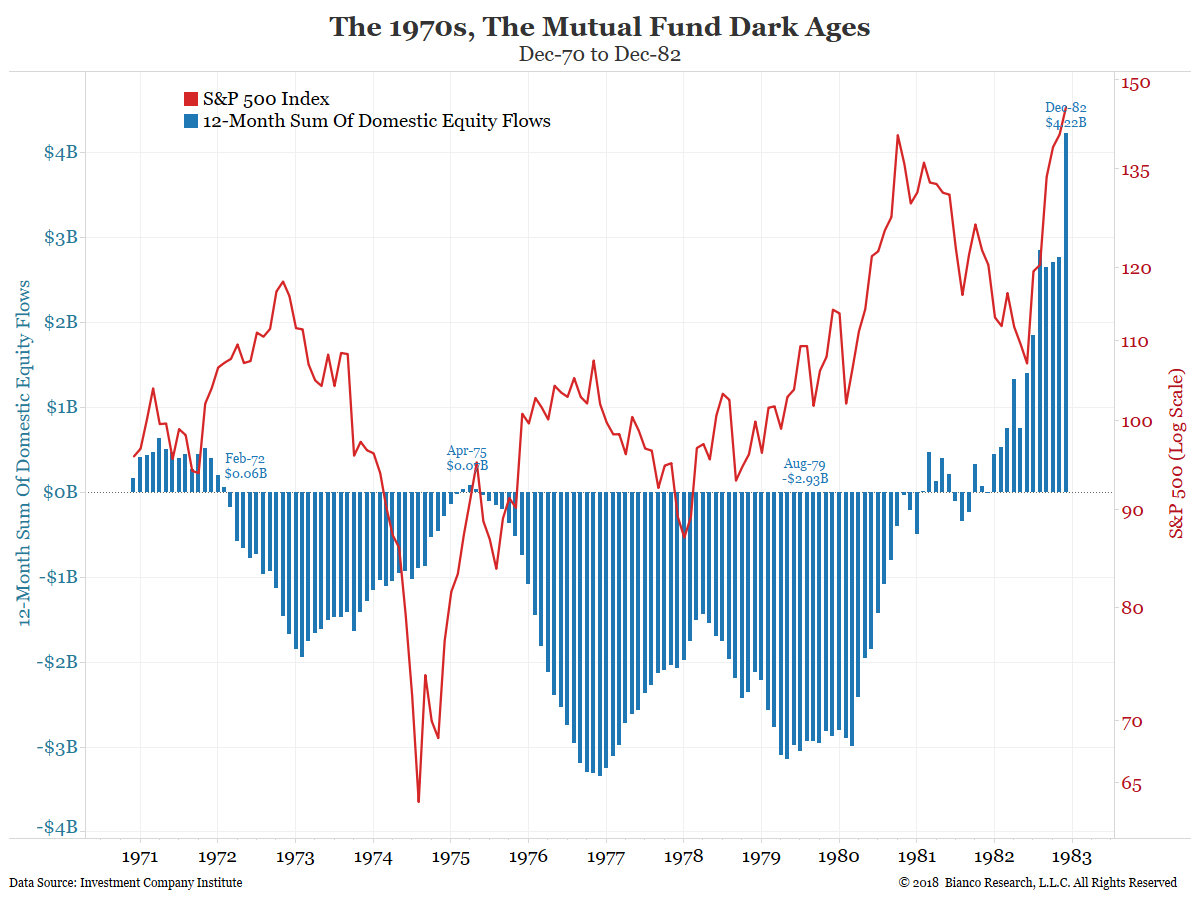

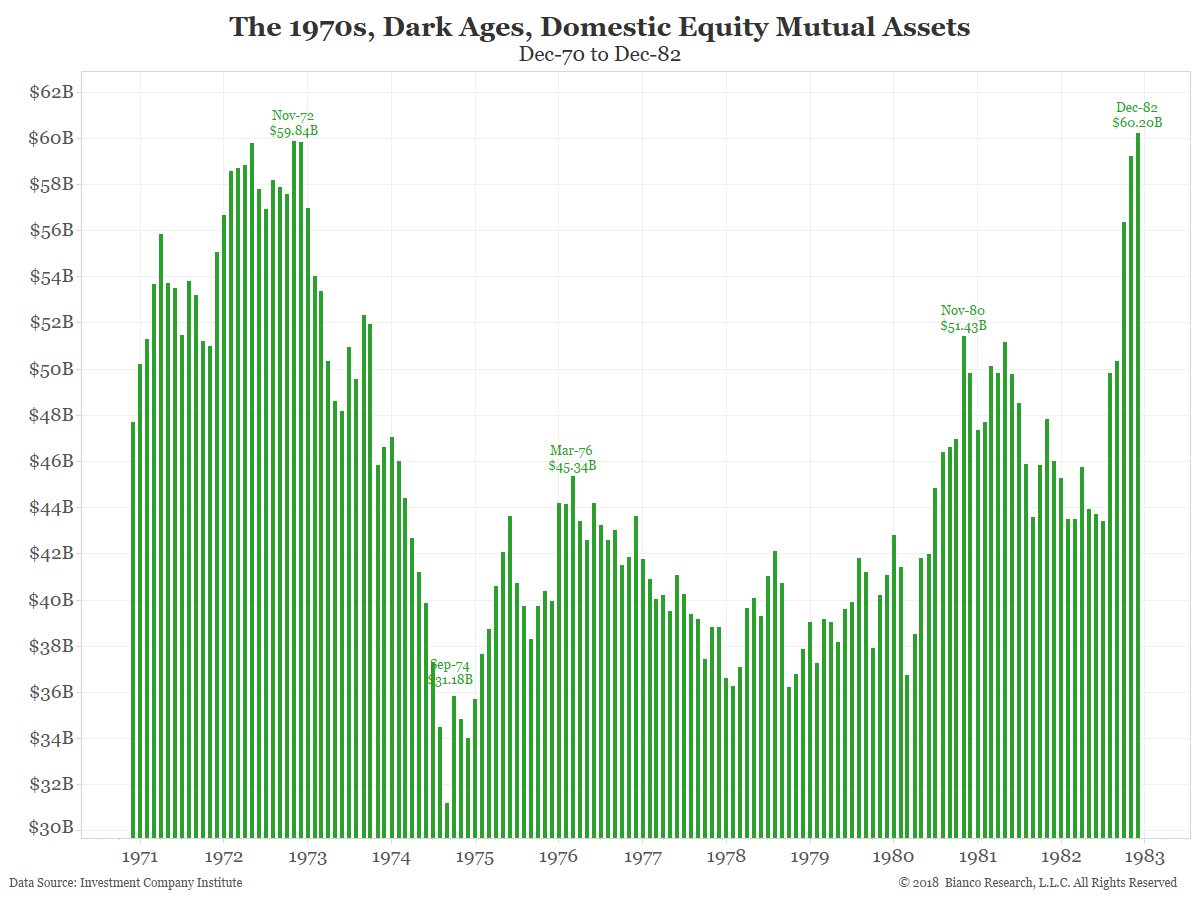

The Wonder Years of the 1960s for funds were followed by the Woeful Years of the 1970s. During 1973 and 1974, stock fund assets fell 44%. In the eight years between 1972 and 1979, fund redemptions exceeded sales in every year but one. During this period, assets did not leave mutual funds in a flood, but instead drained away slowly and relentlessly, year after year.

The power of hindsight allows us today to point to critical oversights made by the fund industry during the Wonder Years of the 1960s that contributed to the Woeful Years of the 1970s. This morning, I am going to follow Santayana’s advice and look to the 1960s and ’70s for guidance on some of the issues facing today’s industry.

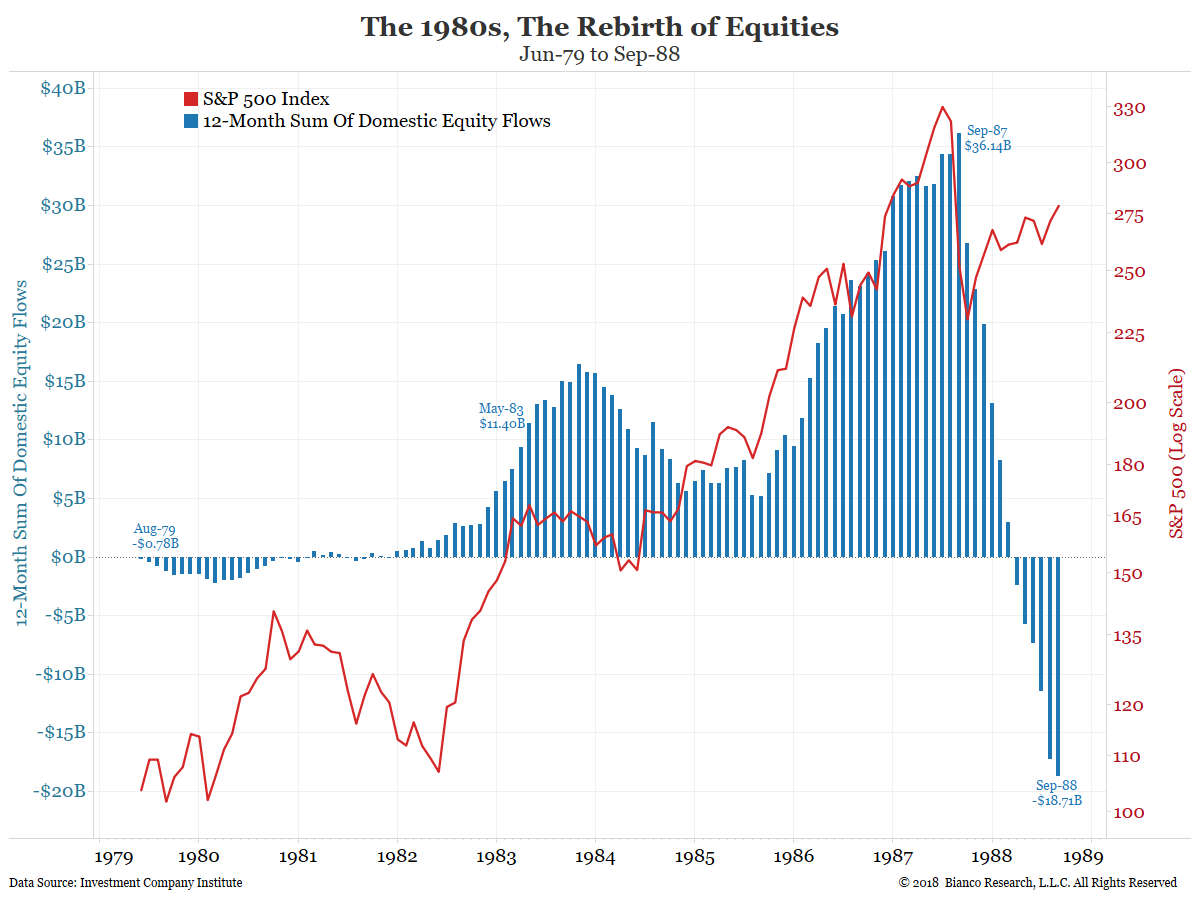

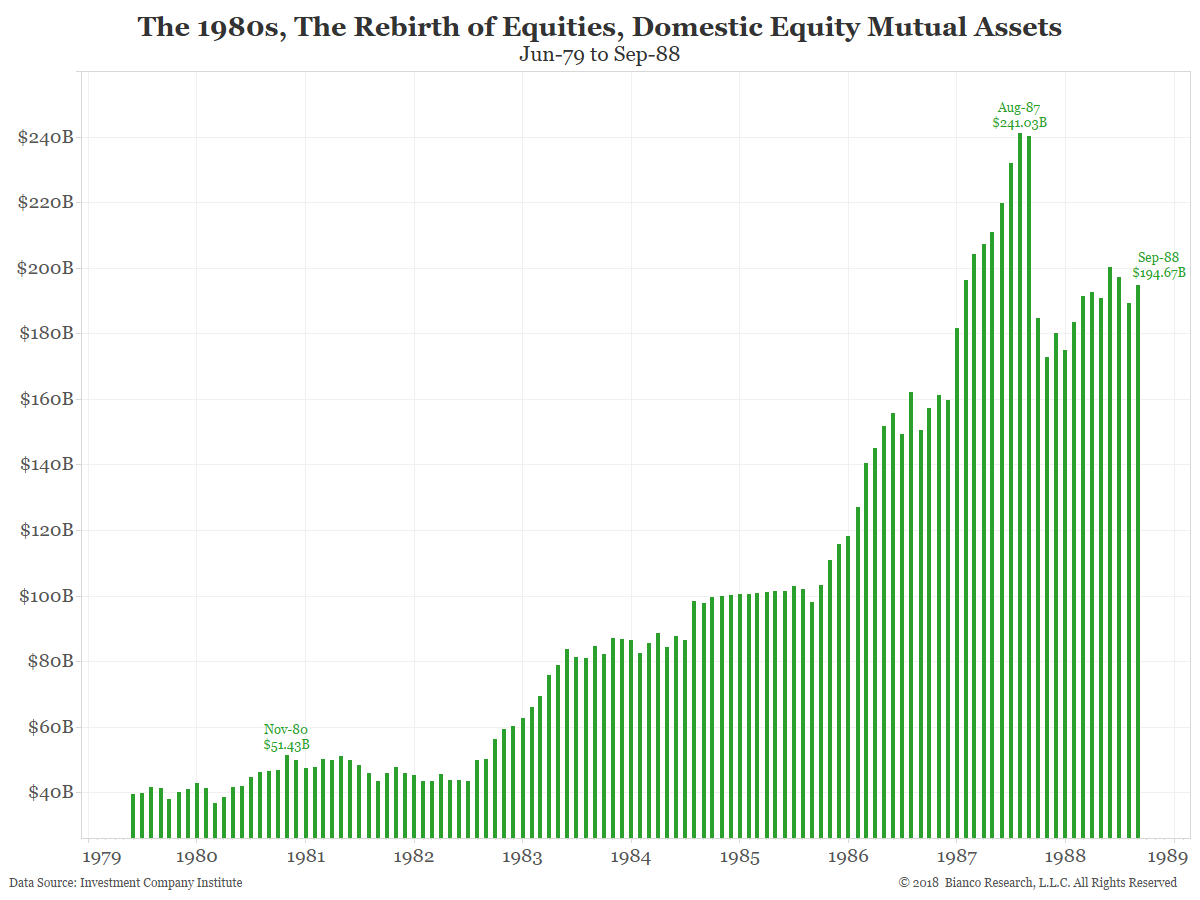

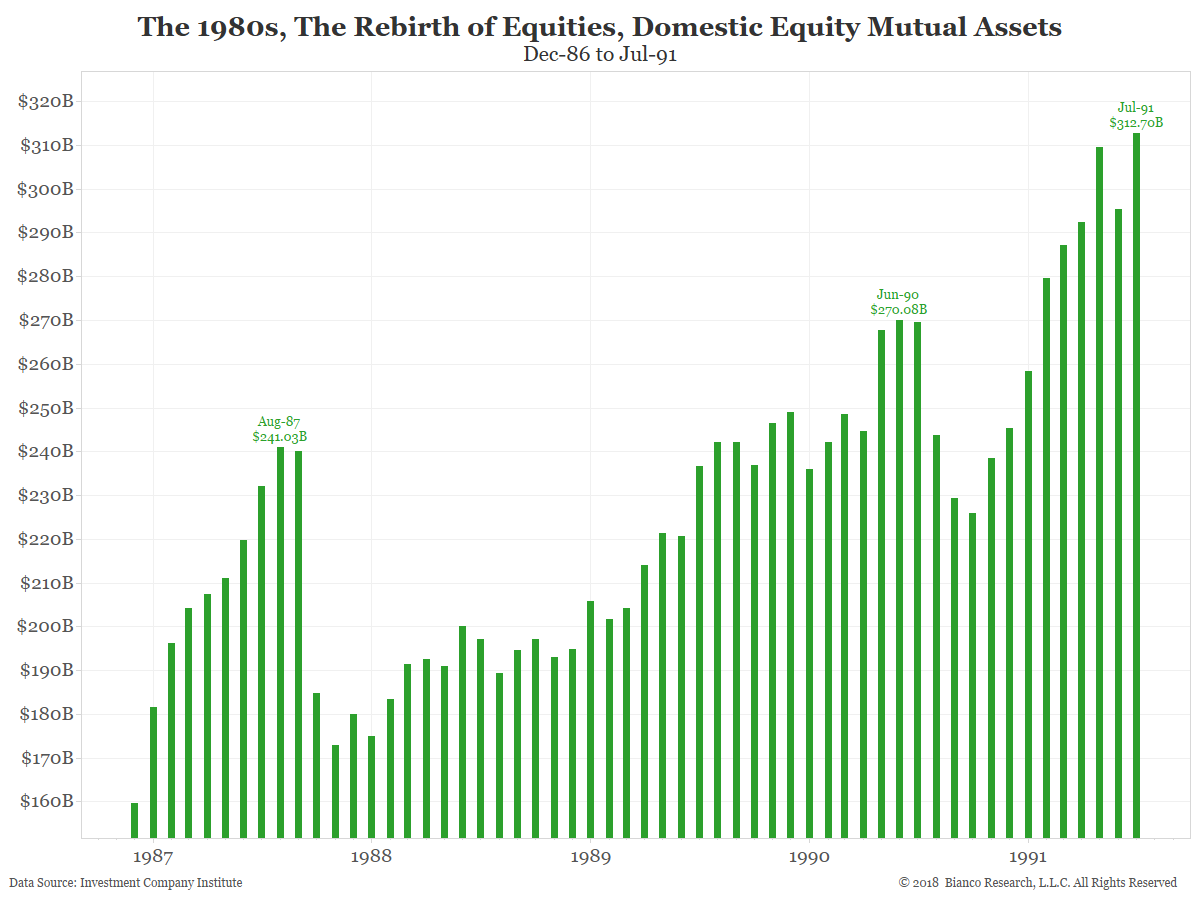

Rebirth of Equities in the 1980s: The Era of Peter Lynch

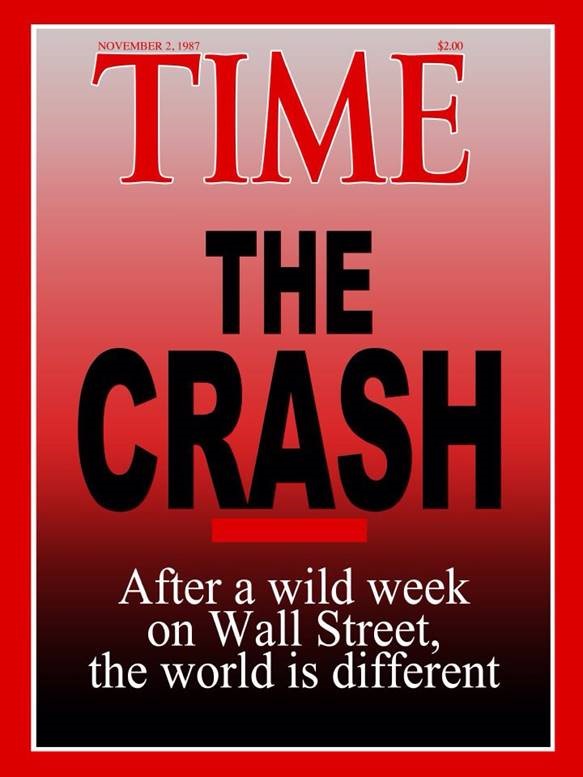

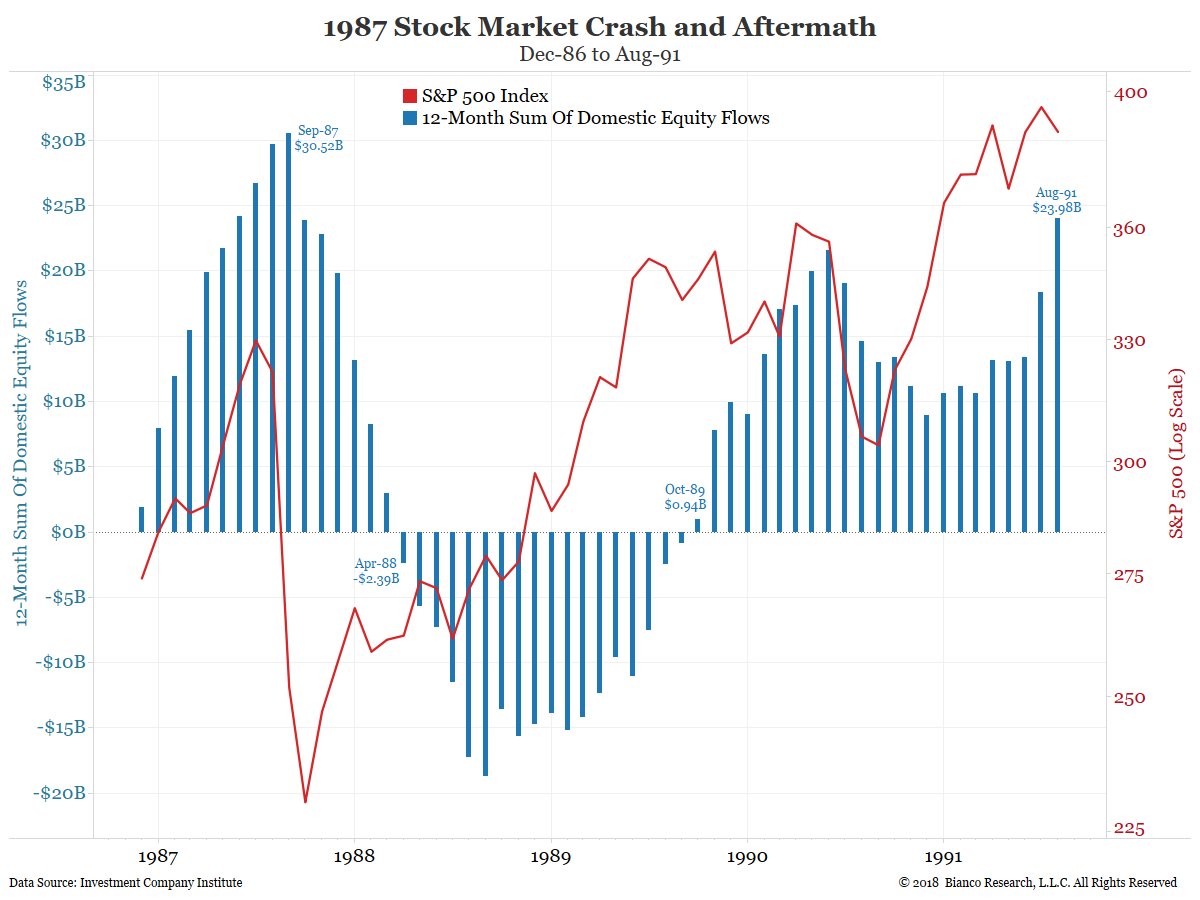

1987: Stock Market Crash

November 2, 1987

The 1990s Tech Boom

July 1997

- Wired Magazine (July 1997) The Long Boom: A History of the Future, 1980 – 2020

We’re facing 25 years of prosperity, freedom, and a better environment for the whole world. You got a problem with that?

By about 2005, high-bandwidth connections that can easily move video have become common in developed countries, and videophones finally catch on.By about 2005, animals are used for developing organs that can be donated to humans. Superproductive animals and ultrahardy, high-yielding plants bring another veritable green revolution to countries sustaining large populations.

Then comes the fourth technology wave – nanotechnology. Once the realm of science fiction, this microscopic method of construction becomes a reality in 2015.

By 2018, these micromachines are able to do basic cell repair.

By about 2015, nanotech techniques begin to be applied to the development of computing at the atomic level.

Around 2010, all new books come out in electronic form. By 2015, relatively complete virtual libraries are up and running.

In 2020, humans arrive on Mars.

In 2020, information technologies have spread to every corner of the planet. Real-time language translation is reliable.

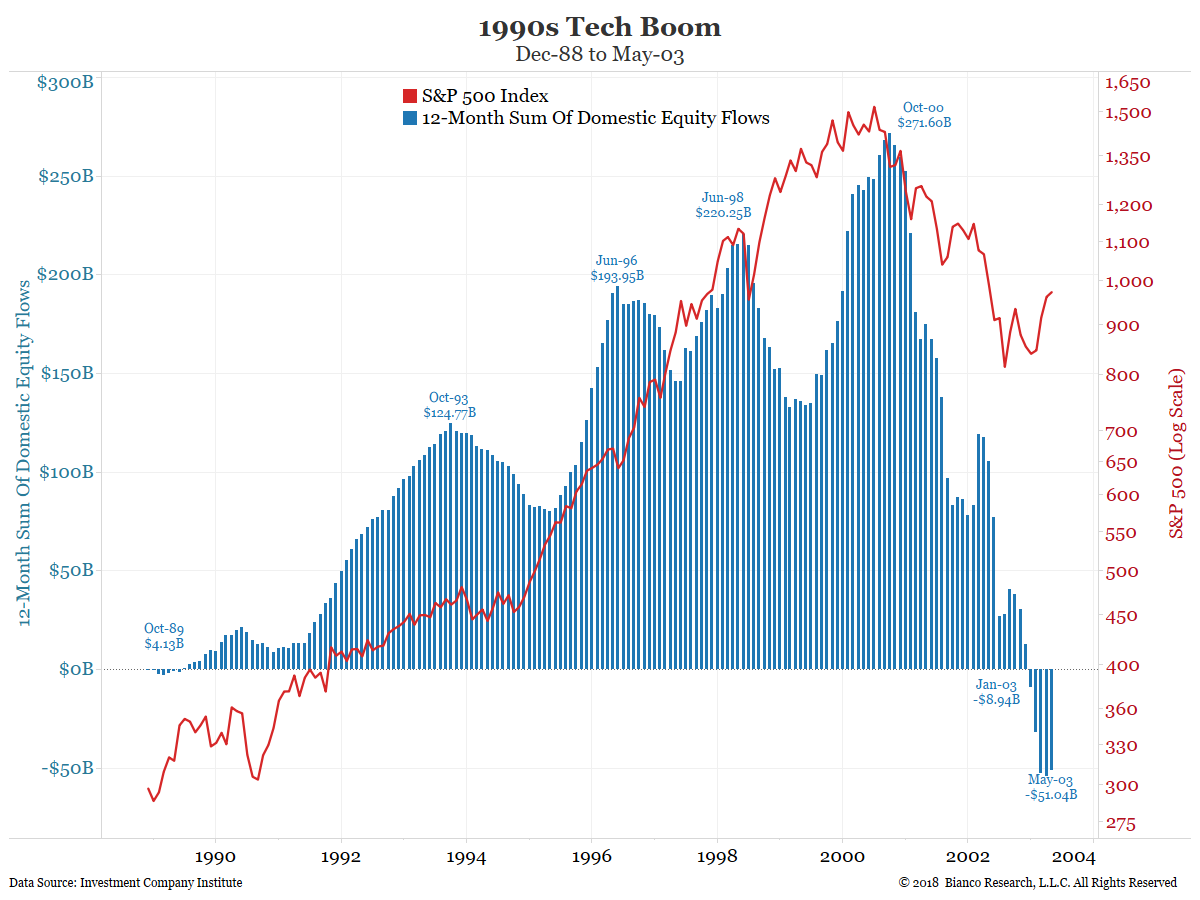

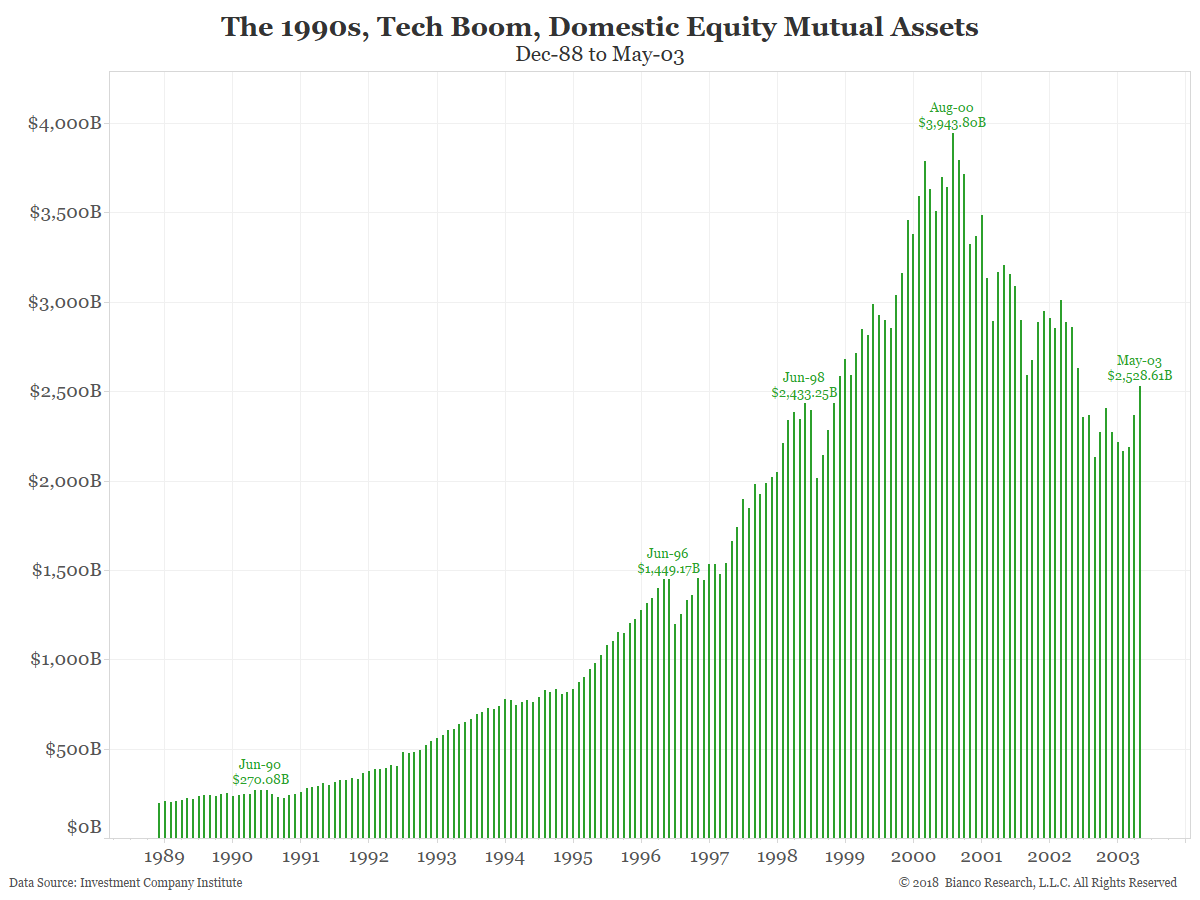

The 1990s were the greatest period in the history of mutual funds. Between October 1989 and January 2003 the industry experienced no outflow on a 12-month basis.

The tech boom, epitomized by the Wired cover above, drove flows during this period.

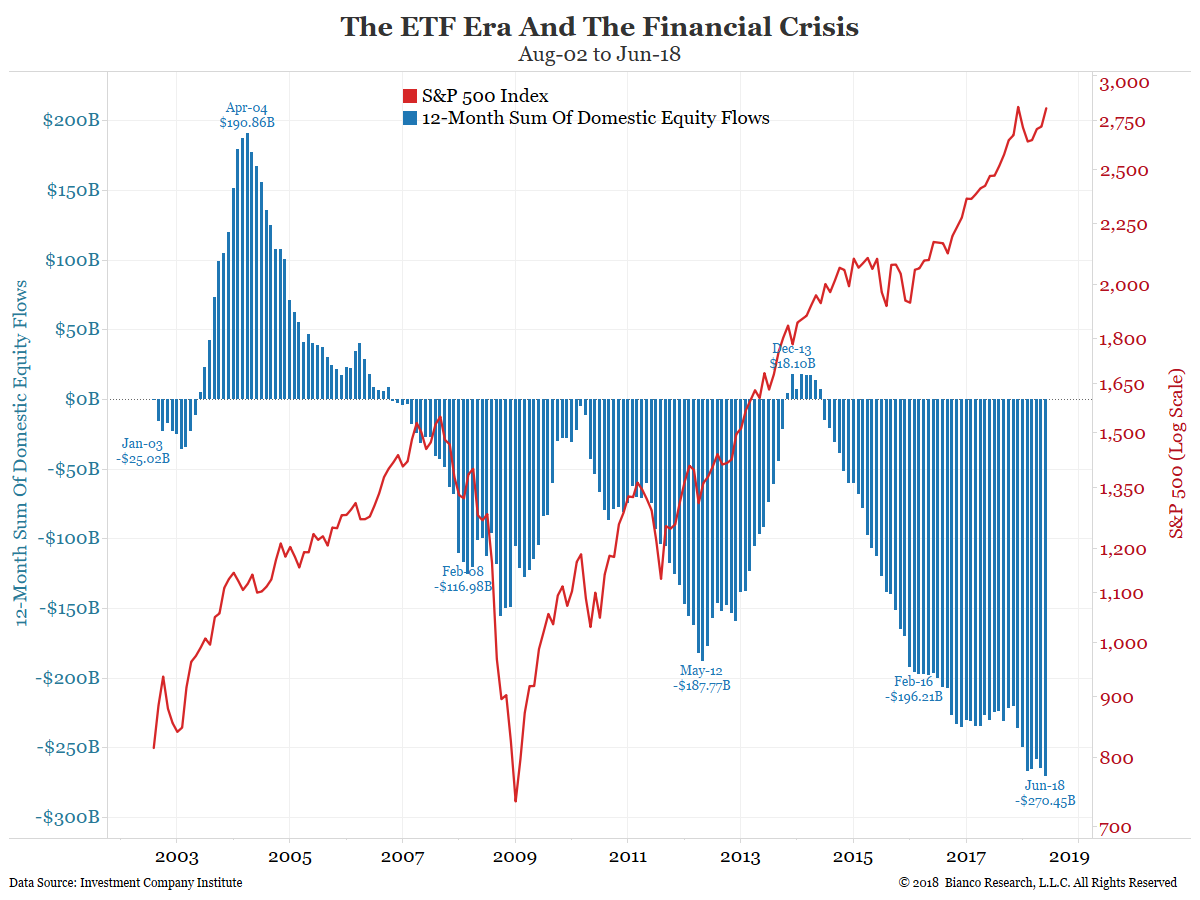

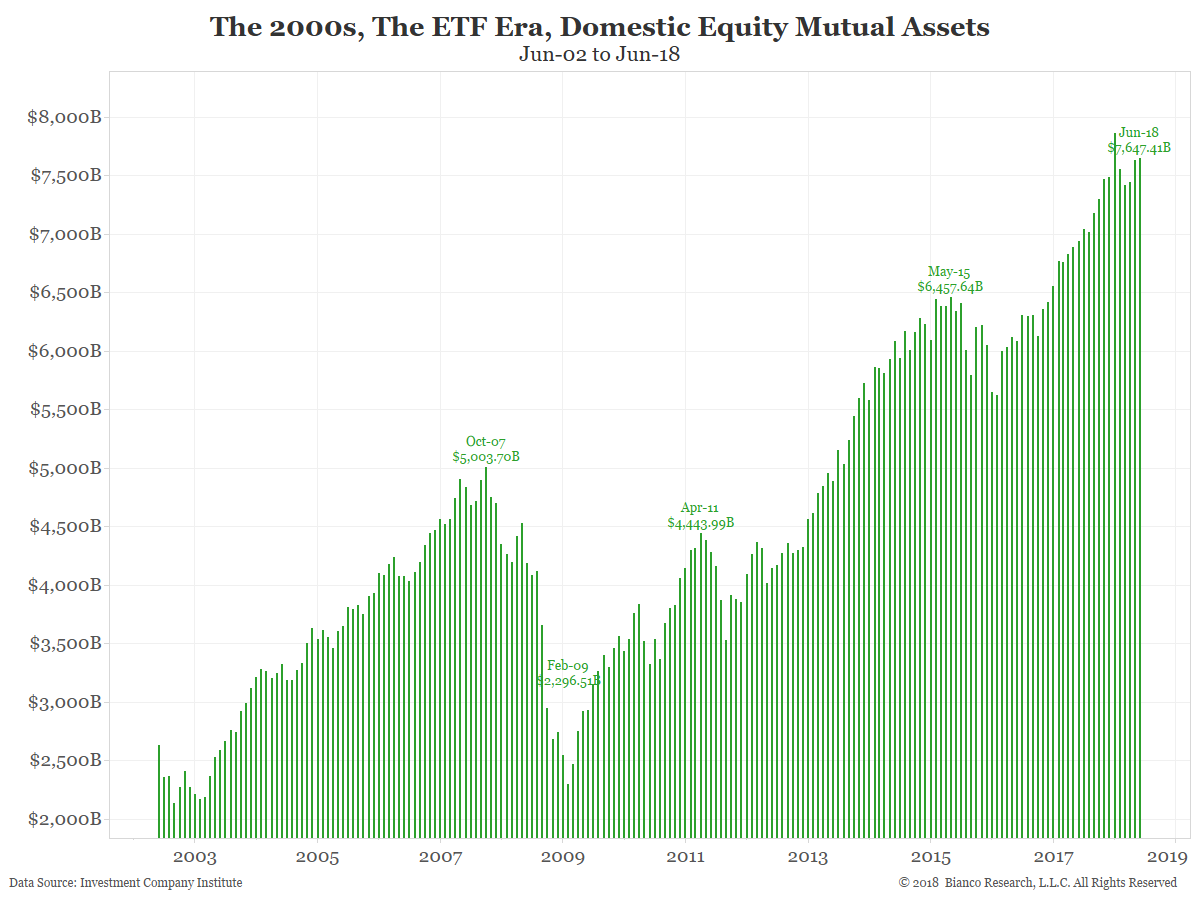

The ETF Era and Financial Crisis

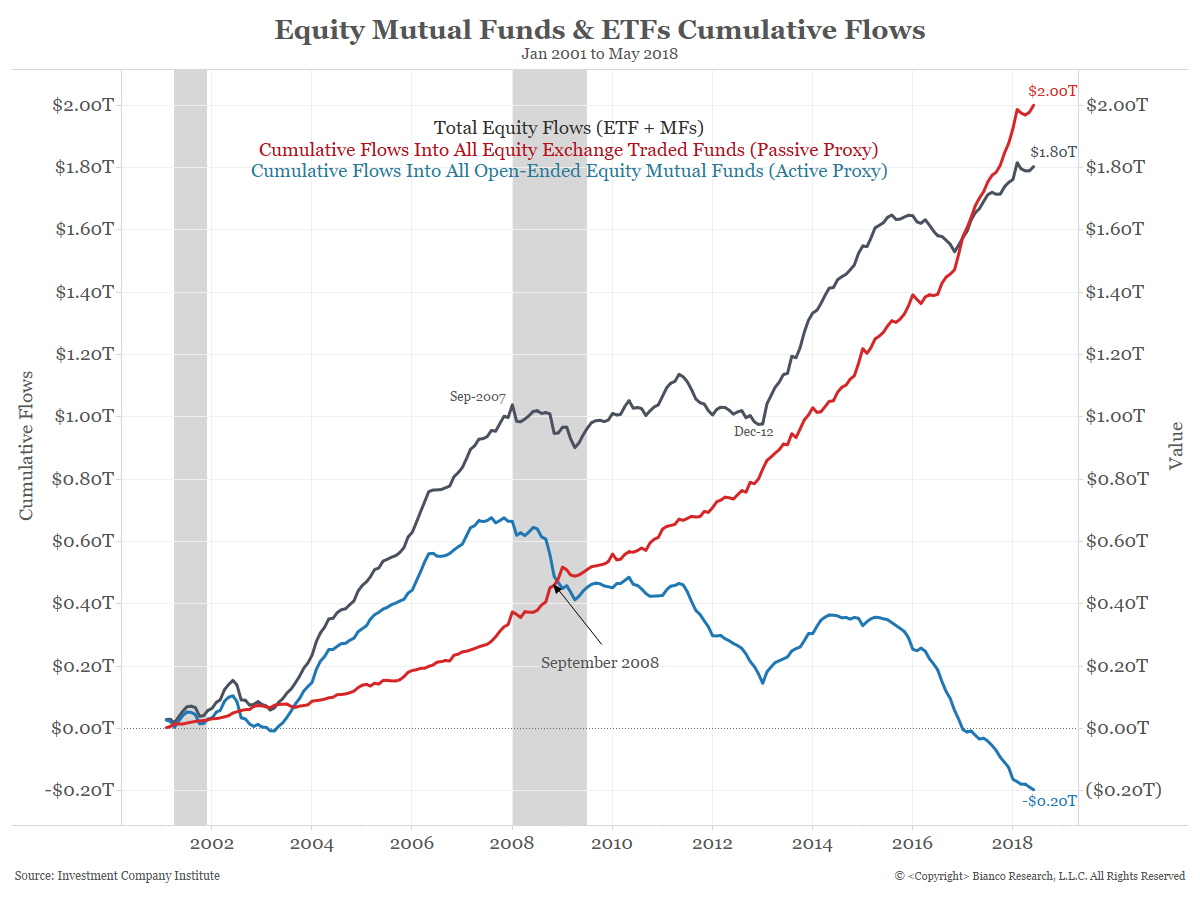

In the chart above note that the financial crisis did not produce a massive outflow from equities (gray line). Instead, it was a catalyst for investors to move from active (blue) to passive (red).

So, the 2007/2008 decline was a catalyst for fence sitters to act on something they probably wanted to do all along. In this case, they moved out of open-ended mutual funds and into ETFs.

Following a burst of inflows into mutual funds coming off the 2002 bear low/end of the 2001 recession/Iraq War, the industry turned to outflows and has never looked up since. The public is still interested in funds/the stock market. It is just focused on ETFs now instead of mutual funds.

/GettyImages-544377756-5a8c9a6ca9d4f900368f9603.jpg)

All the charts below show the following series: