- Bloomberg – EU Plans Emergency Intervention to Stem Surging Power Prices

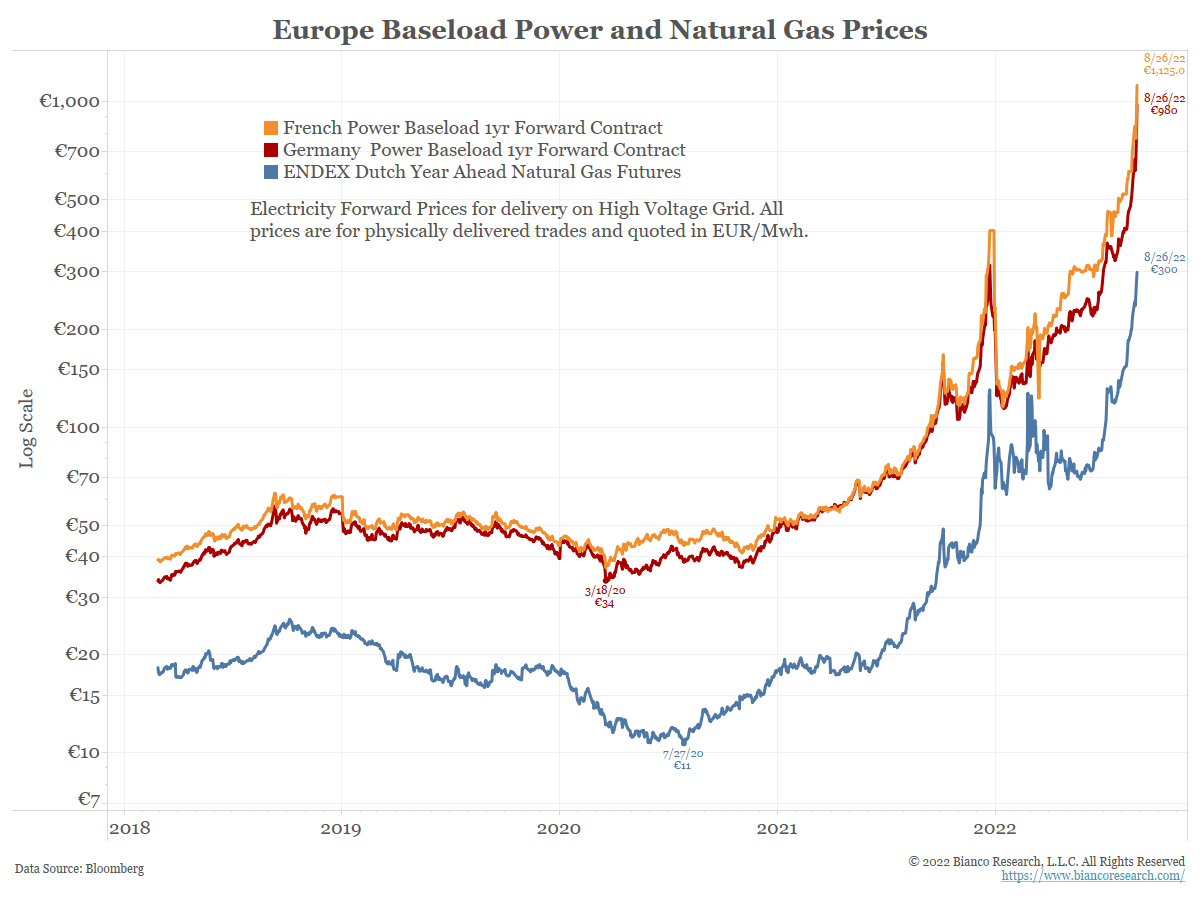

Electricity prices in Europe soared almost 10-fold in one year

EU’s von der Leyen says steps coming without offering detailsThe exact details of an EU intervention plan are still being developed, and EU diplomats said the EU’s executive arm could offer a detailed plan as soon as this week. With Russia squeezing gas deliveries and power-plant outages further sapping supply, the pressure is growing on EU leaders to act quickly or risk social unrest and political upheaval. Czech Prime Minister Petr Fiala is seeking backing for his price-cap plan and plans to discuss possible limits with German Chancellor Olaf Scholz. z

- Bloomberg – German Finance Chief Sounds Alarm on Soaring Power Prices

Lindner says government needs to act ‘with the utmost urgency’

Leading economist warns of gigantic macroeconomic shock

According to a “conservative” estimate by the Dusseldorf-based institute, companies, households and the state will have to shoulder an extra burden of more than 200 billion euros next year, or about 5% of gross domestic product, Dullien said Friday in a series of tweets. - Reuters – U.S. says had constructive talks with India on Russian oil price cap plan

The Group of Seven richest economies aims to have a price-capping mechanism on Russian oil exports in place by Dec. 5, when European Union sanctions banning seaborne imports of Russian crude come into force. The proposal to cap prices of Russian oil is aimed at curbing the oil revenue that Moscow uses to finance its invasion of Ukraine, while ensuring sufficient global supply at affordable prices, Adeyemo said. “We are very concerned that come December 5 … we will be in a place where access to Russian crude will diminish for the world and would potentially lead to higher prices,” he said. “It would allow European, American services from around the world and Western countries to continue to be used for the purchase and transportation of Russian crude.”

Summary

Comment

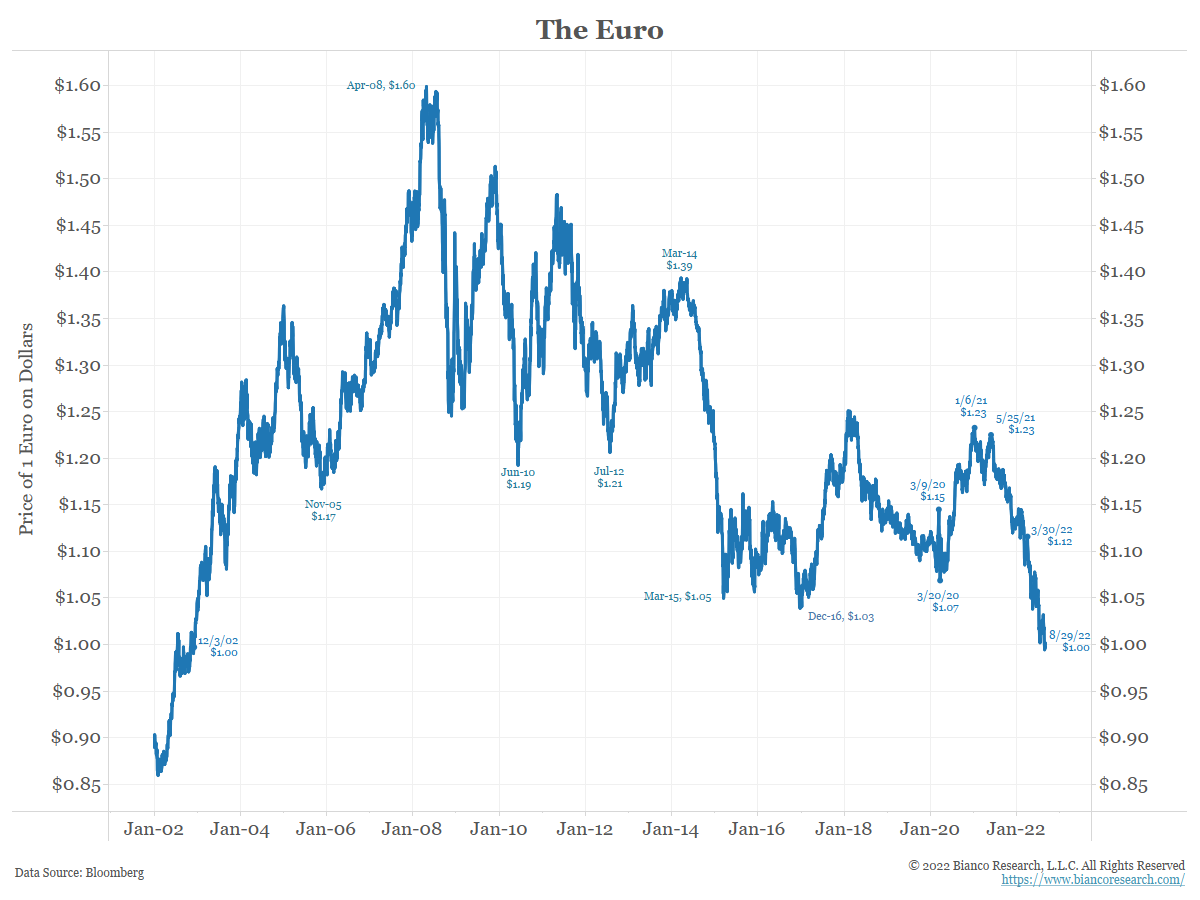

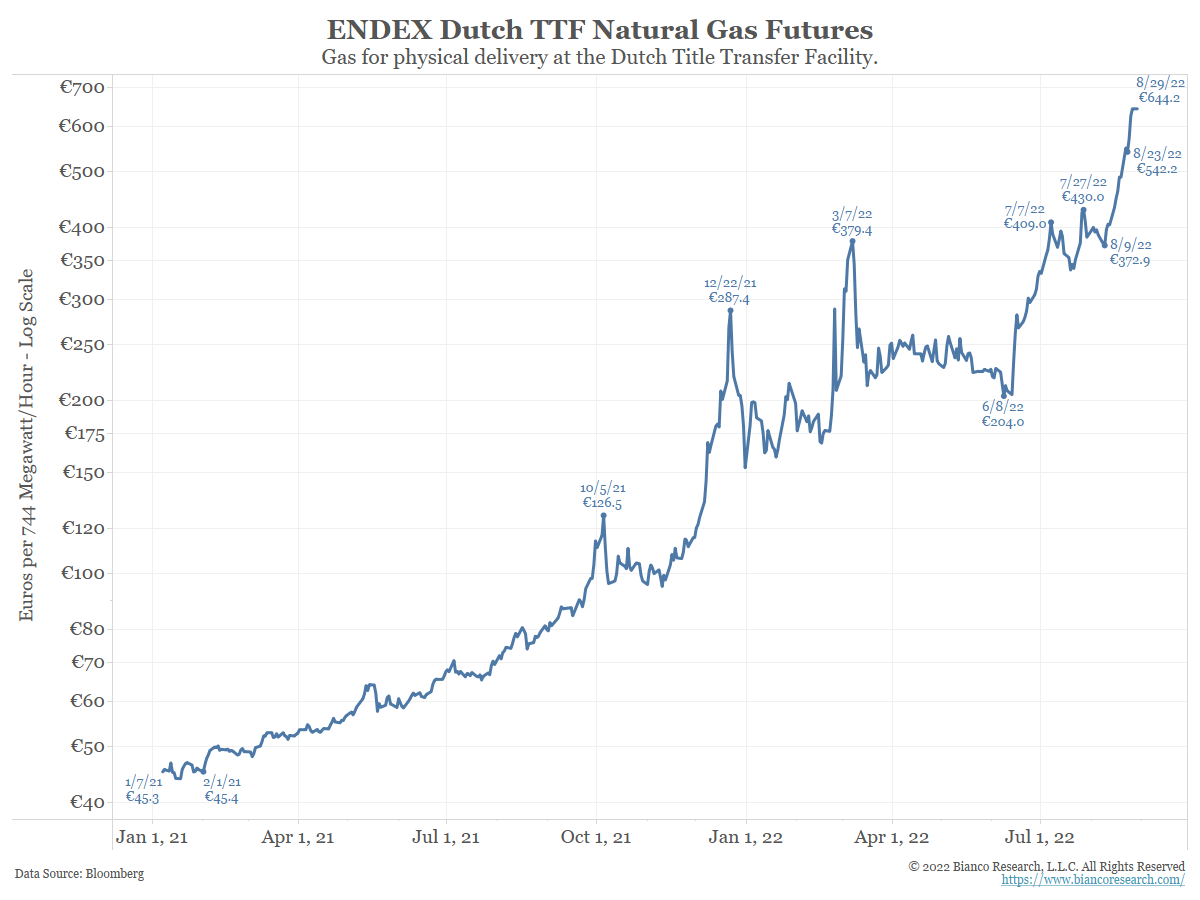

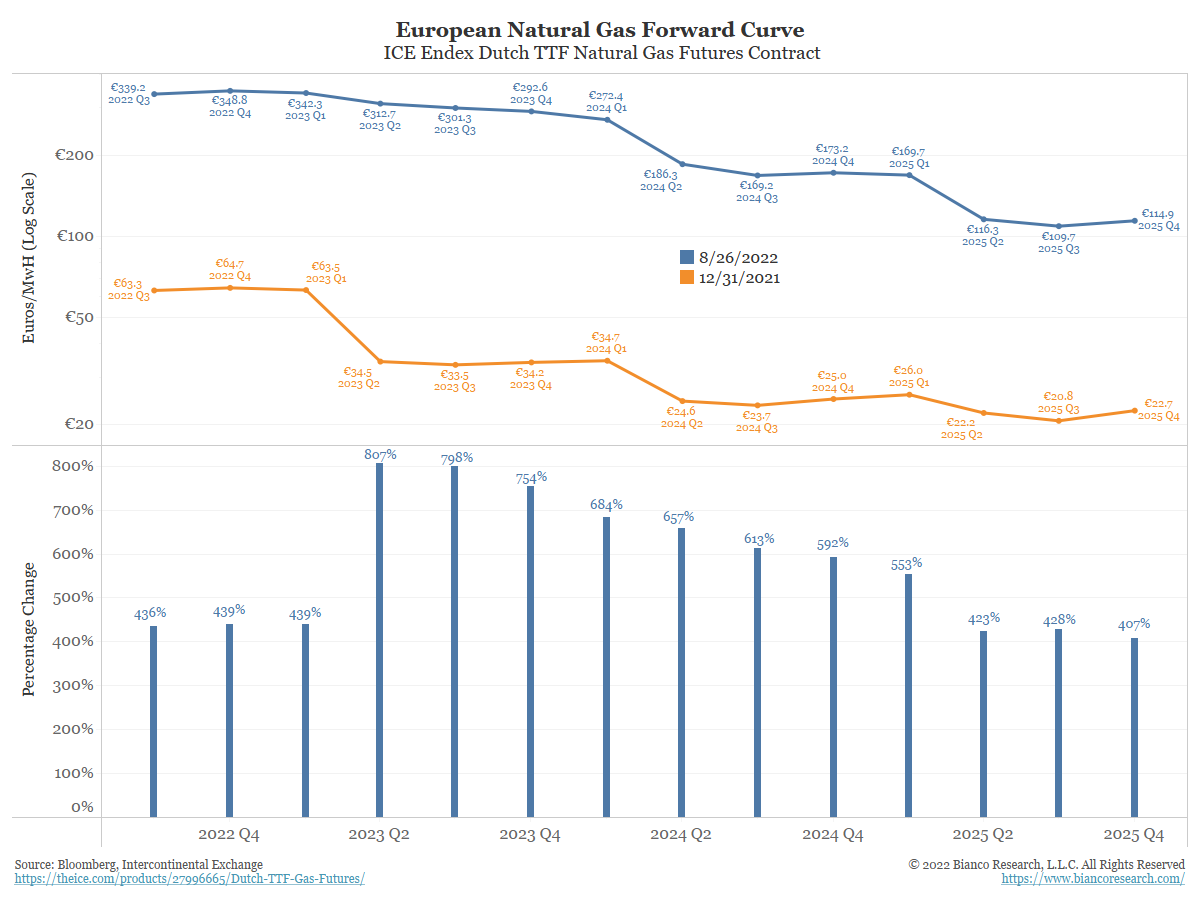

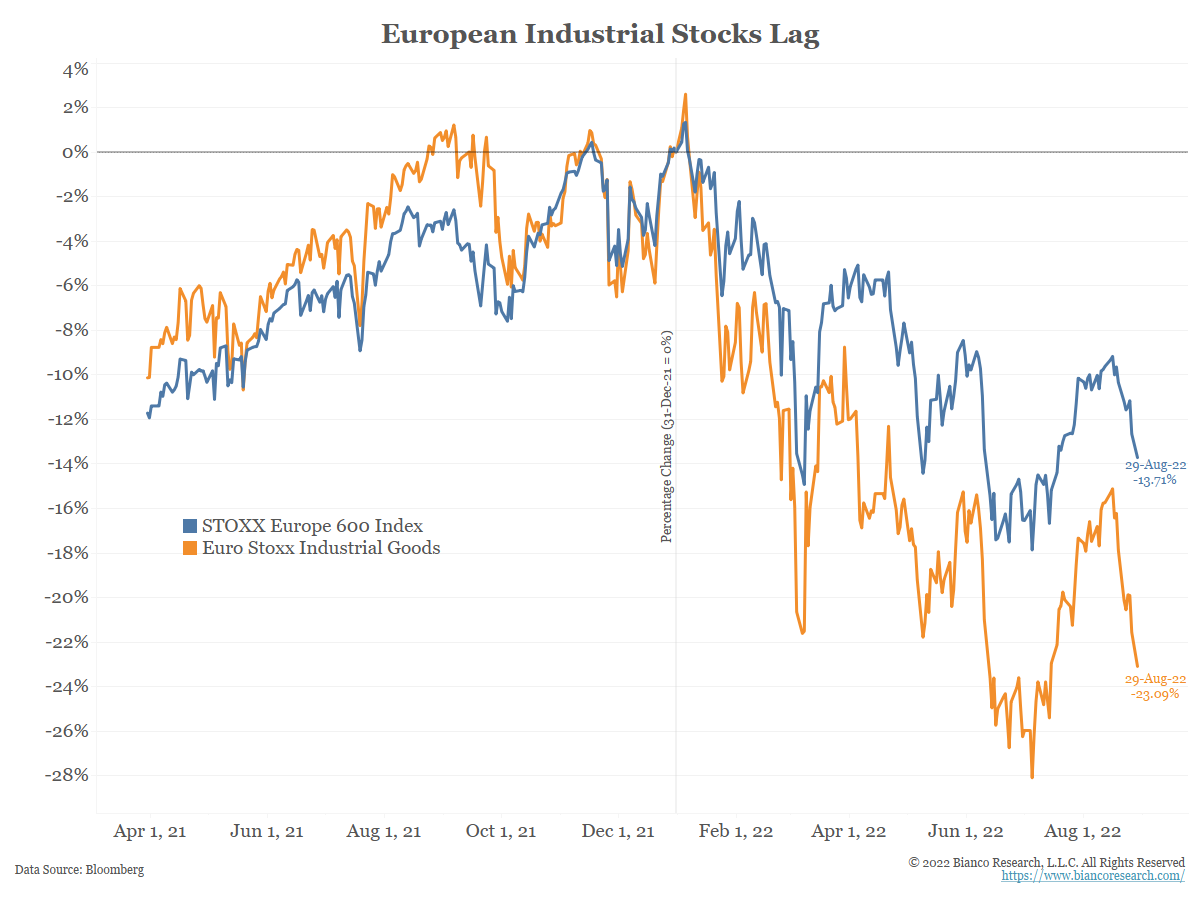

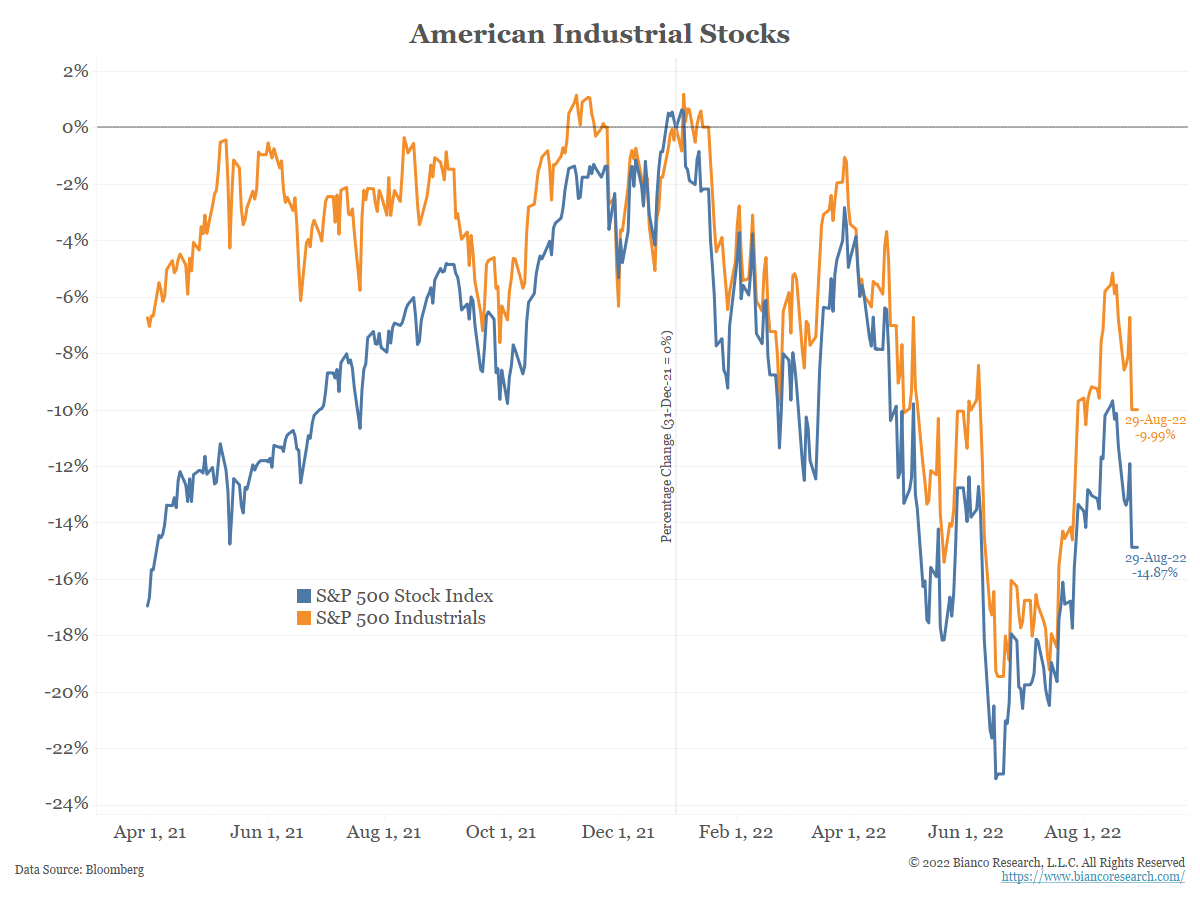

The following set of charts show the intolerable position Europe is in.

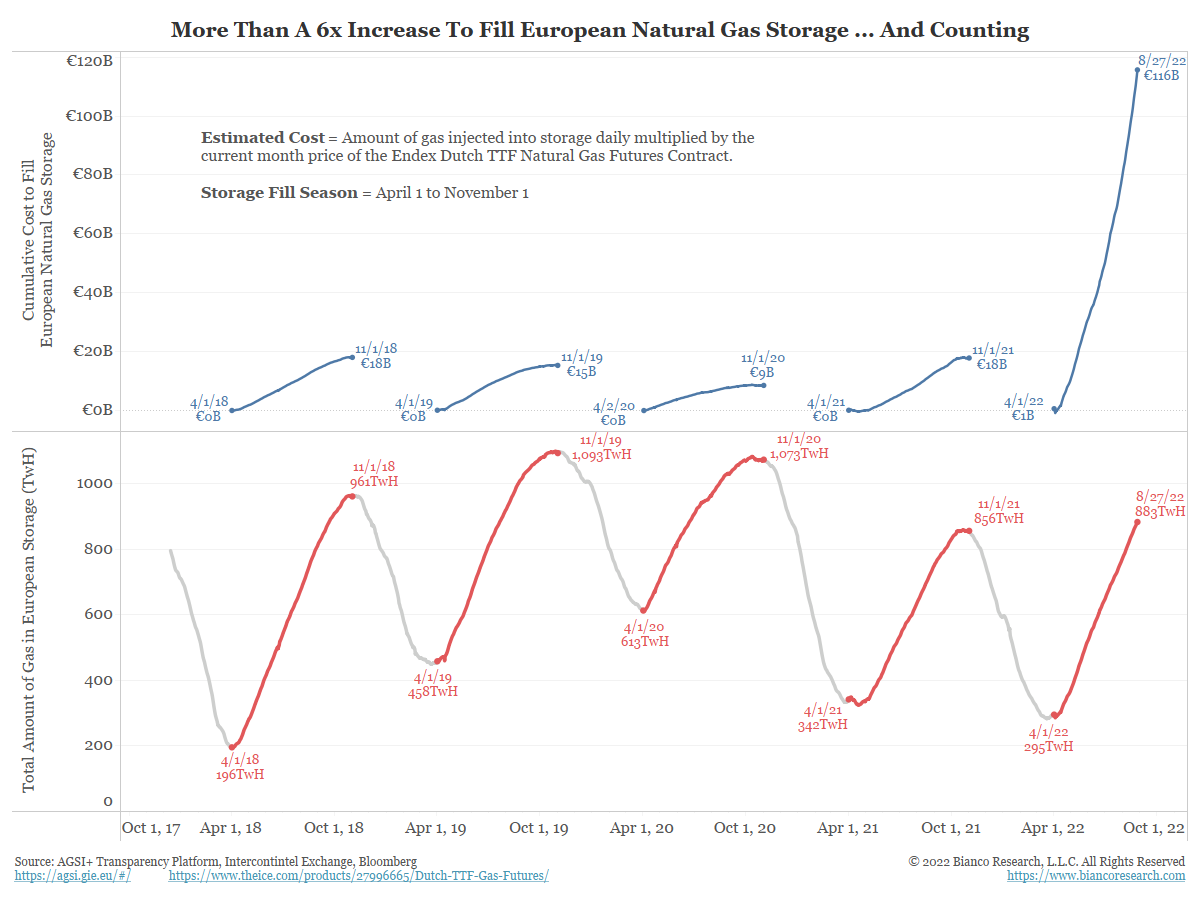

Natural gas is used for power (electricity) generation and space heating, so its usage is highly seasonal. As the chart below shows, storage facilities are filled in the summer and run down in the winter for space heating.

Currently, European storage facilities are 79% full, about the middle of the range seen over the last 5 years.

And this price rise is not just a squeeze on the nearby contract. As the following chart shows, the forward curve for natural gas prices is up orders of magnitude through 2026.

Restated, you cannot hedge this away. You have to pay up.

Natural gas storage only covers about 25% to 30% of winter natural gas needs, maybe more this year given the reductions in usage already implemented and proposed.

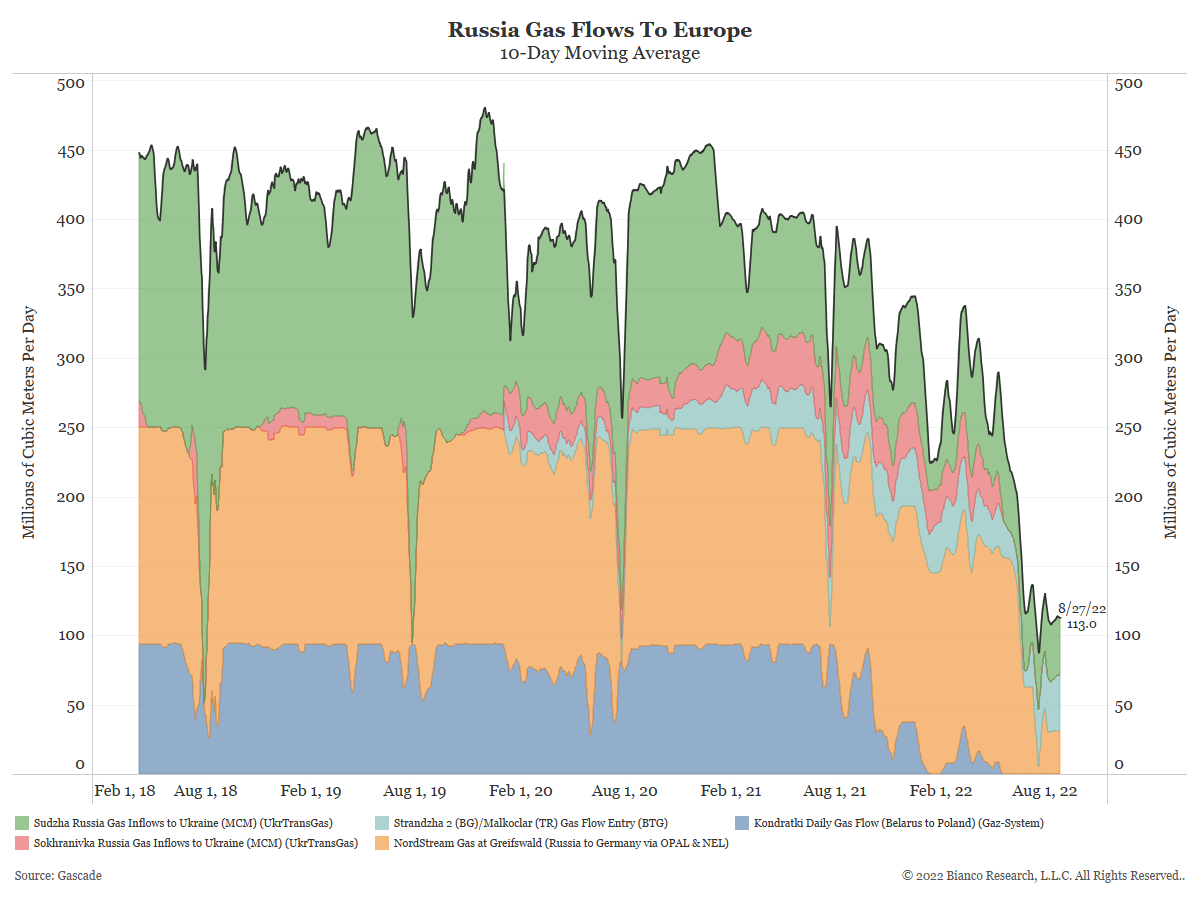

In other words, Europe still needs flows from Russia this winter. Before the Ukraine war, Germany got about about 55% of its gas needs from Russia. This has been lowered somewhat in recent months.

As the chart below shows, flows from Russia to Europe are down are down about 75%.

Conclusion

The fix for Europe’s energy crisis is a much lower price of natural gas. But since Russia is the second largest world producer (after the United States), prices will remain at astrinomical levels as long as supply is limited. The world does not have enough excess capacity to cover Russia’s shortfall.

Finally, Europe has the ability to pay up for natural gas, but it is also driving worldwide prices higher. Poorer countries do not the resources to pay up, and the consequences are being felt.

Pakistan: Infuriated citizens protest against inflated energy bills and long load-sheddings #Pakistan https://t.co/knFtVBbhHx

— Organiser Weekly (@eOrganiser) August 26, 2022

Europe’s energy crisis is becoming intolerable and politicians are promising action, but reduced supply from Russia limits possible solutions.