Summary

Comment

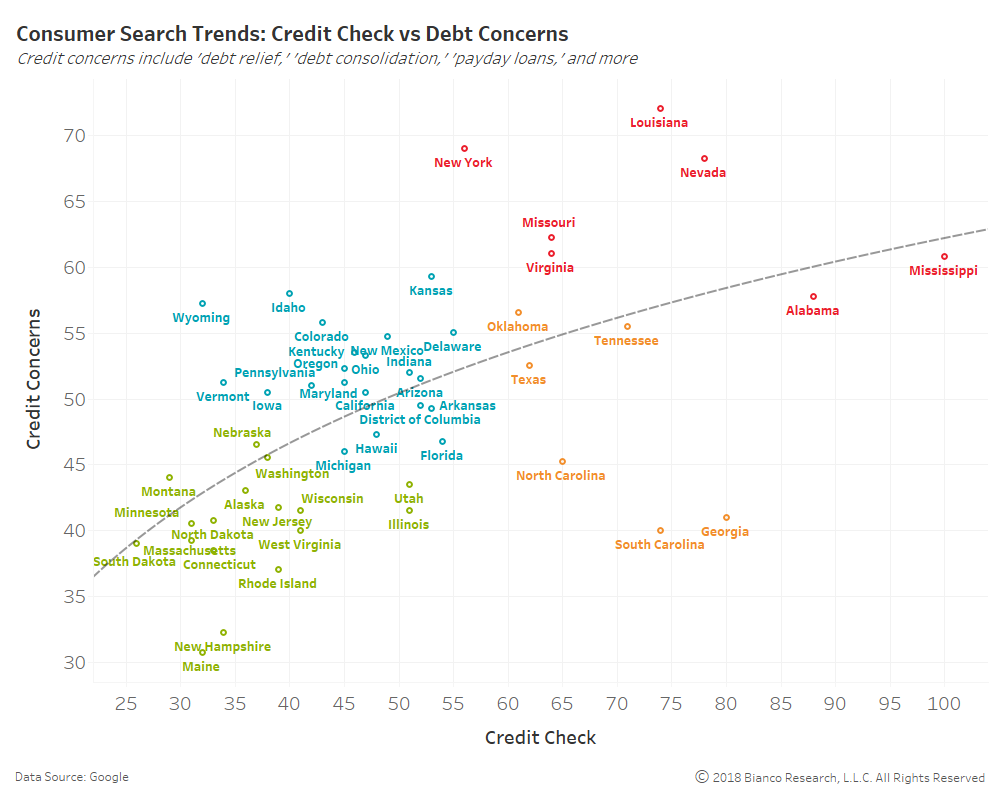

The scatterplot below indicates the frequency of consumer searches for ‘credit checks’ versus ‘credit concern.’ These concerns include debt relief, debt consolidation, payday loans, and more.

Louisiana, Nevada, Mississippi, Alabama, Missouri, Virginia, and New York stand out with consumers checking credit and heightened concern about an ability to pay down debt.

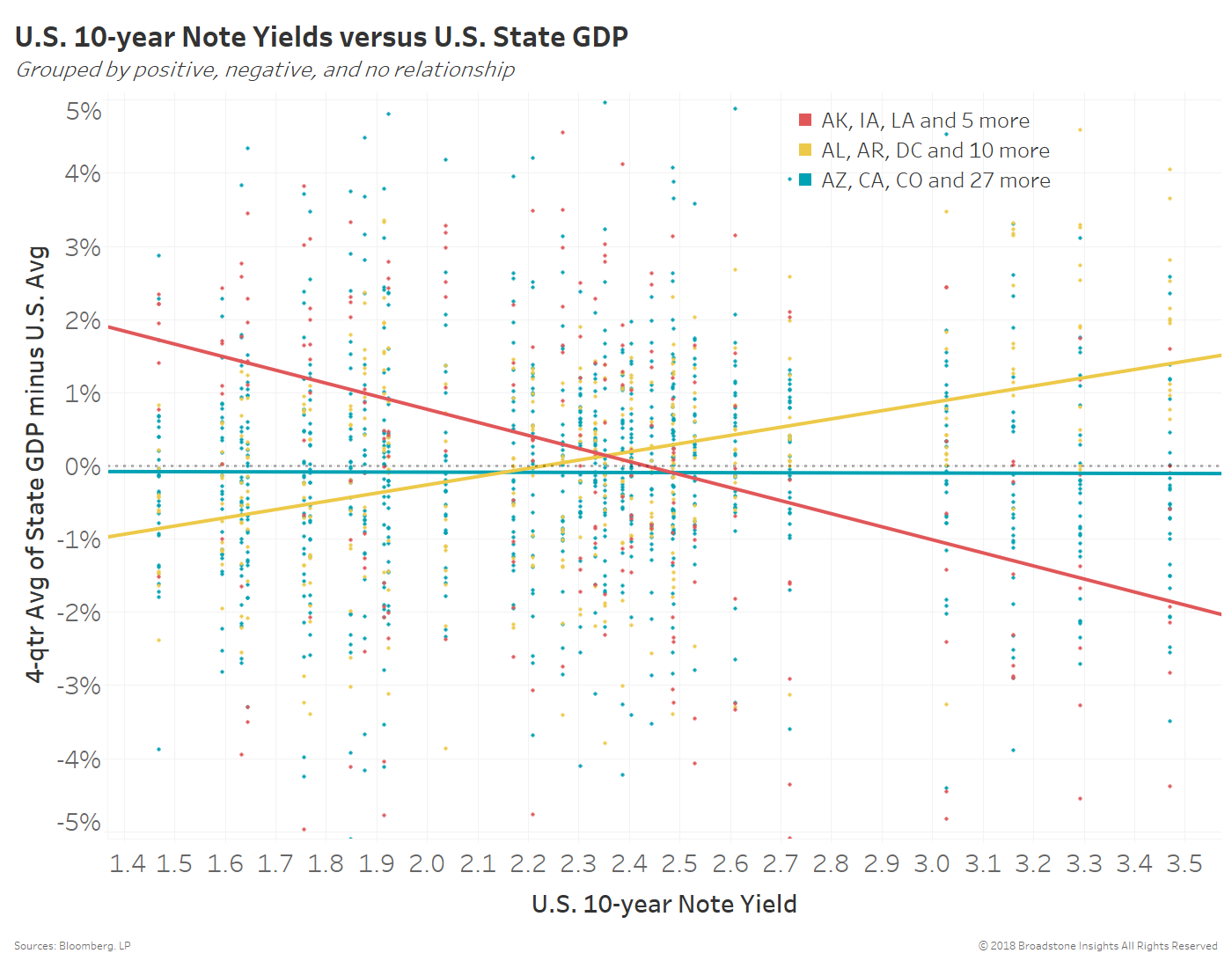

The next scatterplot shows how the level of U.S. 10-year note yields relate to state GDP (4-qtr average) since 2009. We grouped states by positive, negative, or no relationship to yields.

- Negative: AK, IA, LA, MS, ND, NM, WY

- Positive: AL, AR, DC, IN, KY, MD, MN, NV, OH, RI, UT, WA, WV

Mining and energy-focused states show a heightened (negative) sensitivity to rising yields.

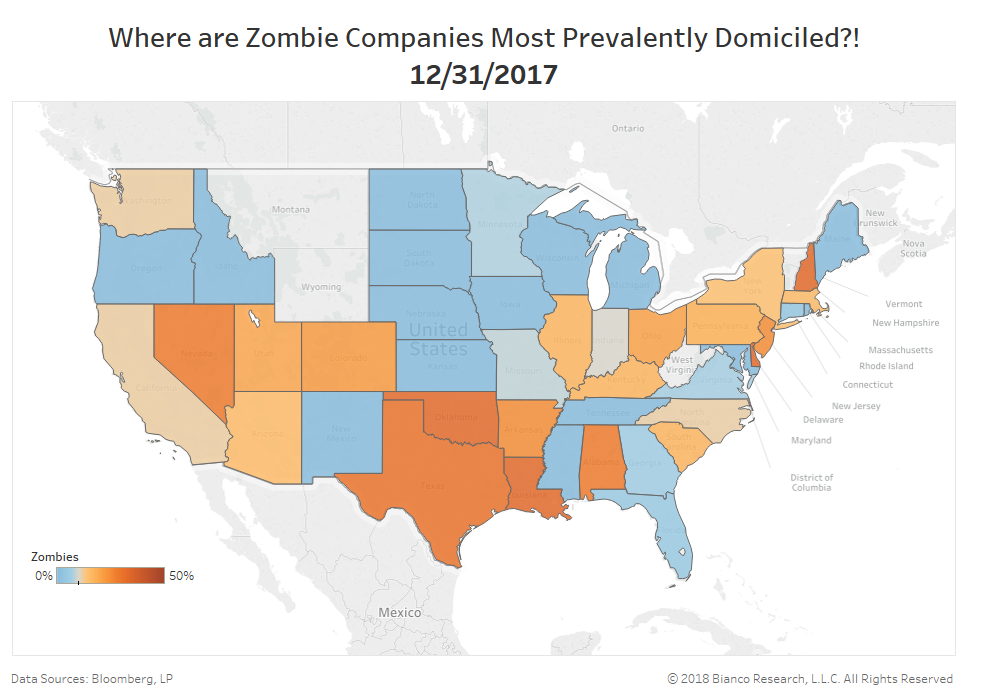

Another metric for determining sensitivity to rising yields would be the prevalence of zombie companies. These companies have three-year average EBIT-to-interest expense ratios below one.

Nevada, Texas, Oklahoma, Louisiana, Alabama, Delaware, and New Hampshire house the greatest percentages of these so-called zombie companies.