Summary

Comment

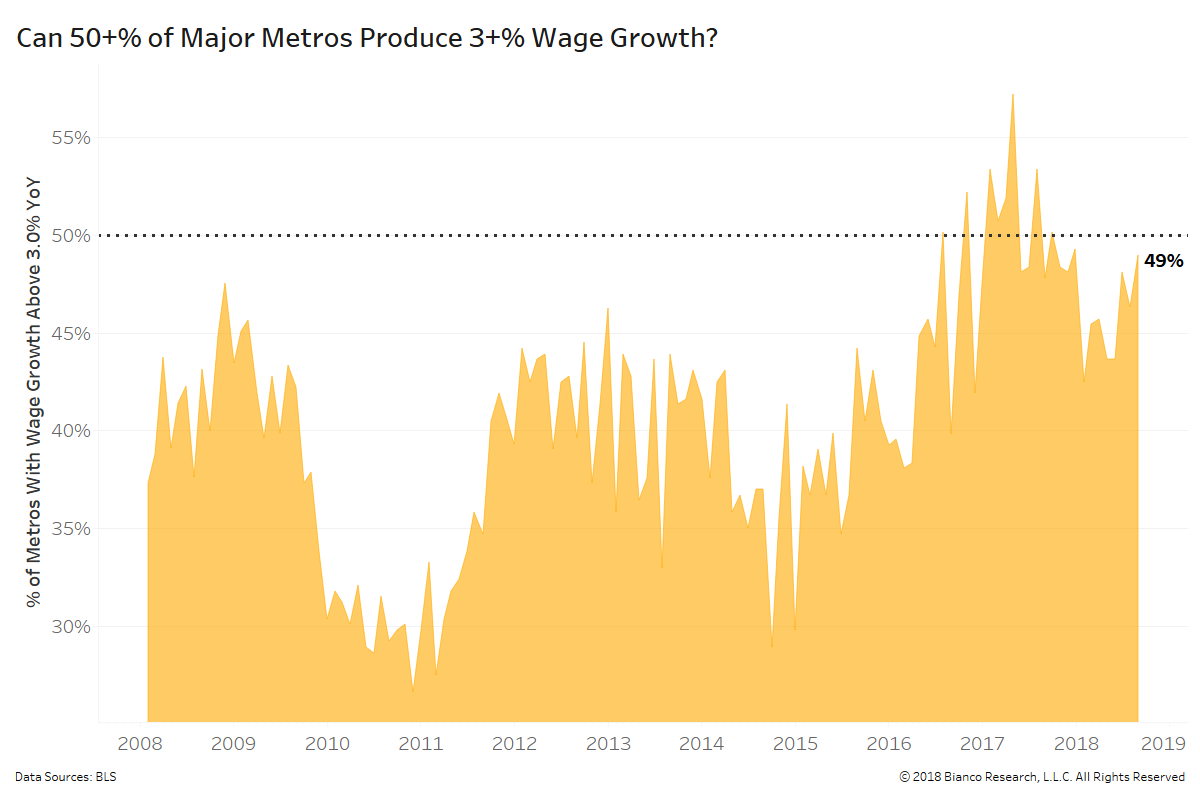

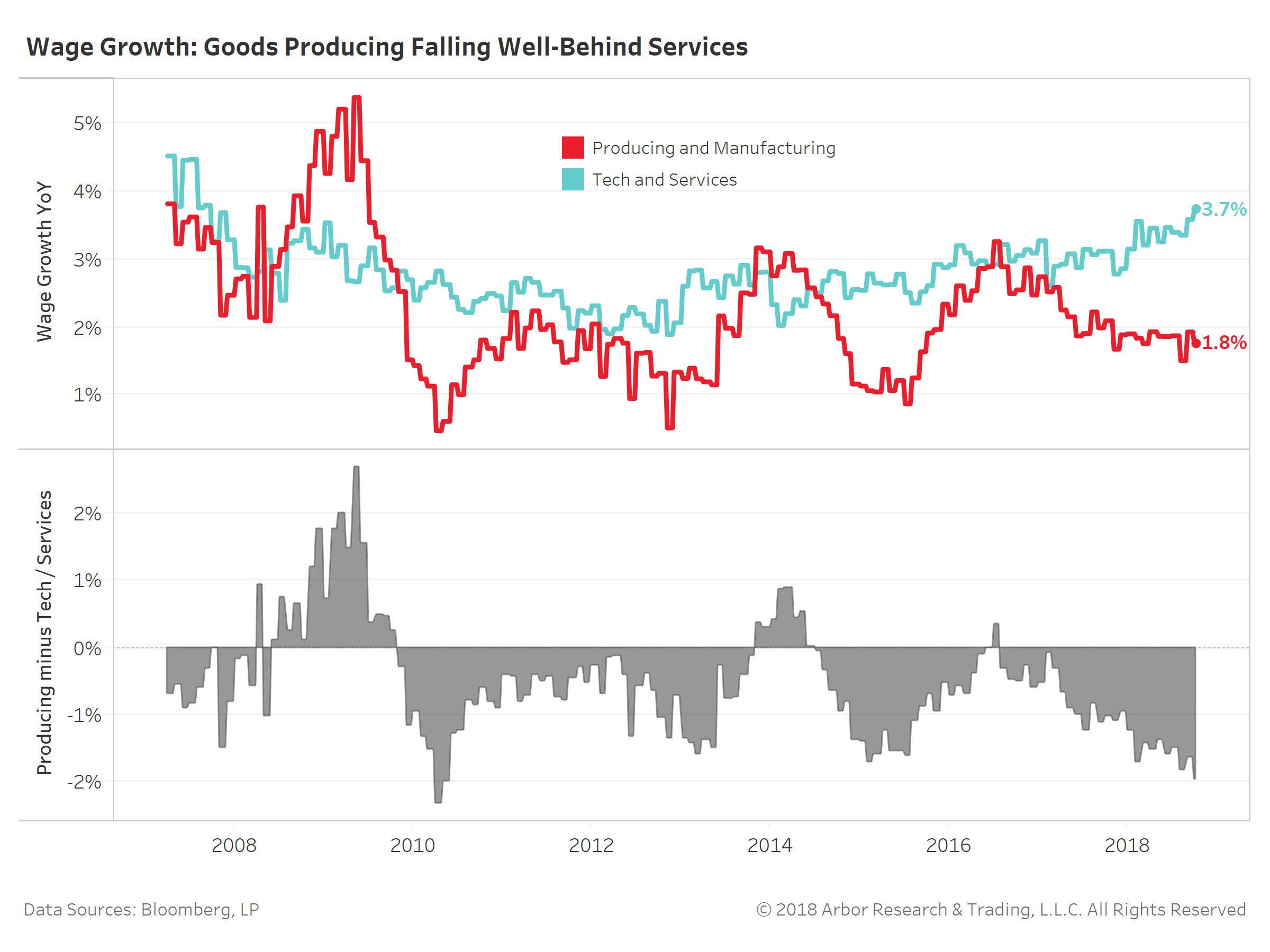

The U.S. has become a tale of two economies: 1) rural, goods-producing and 2) urban, tech-heavy. We have often discussed the divergence in productivity and profit margins between industries and companies with heavier tech-focus.

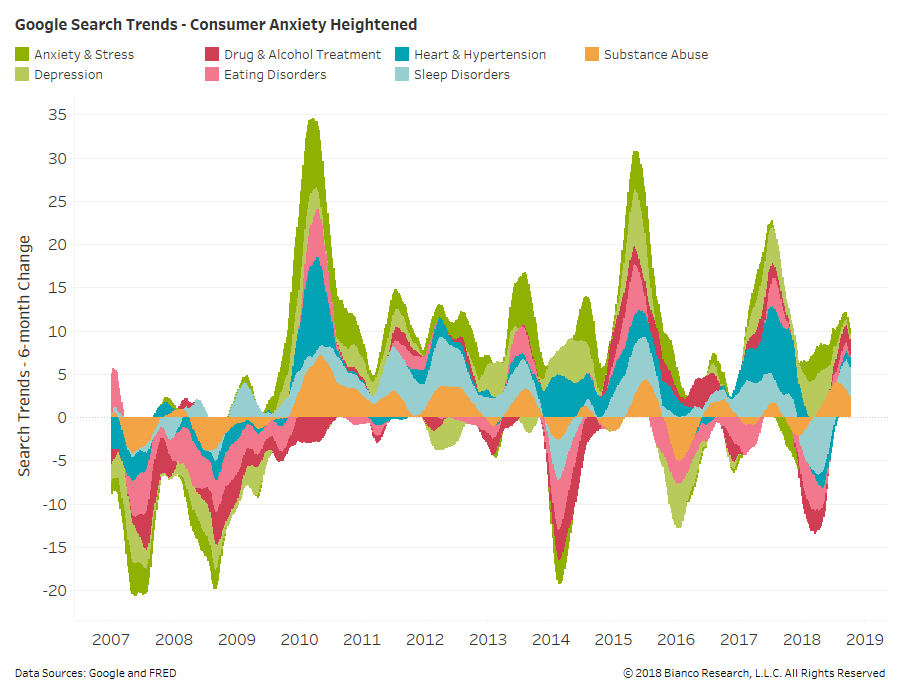

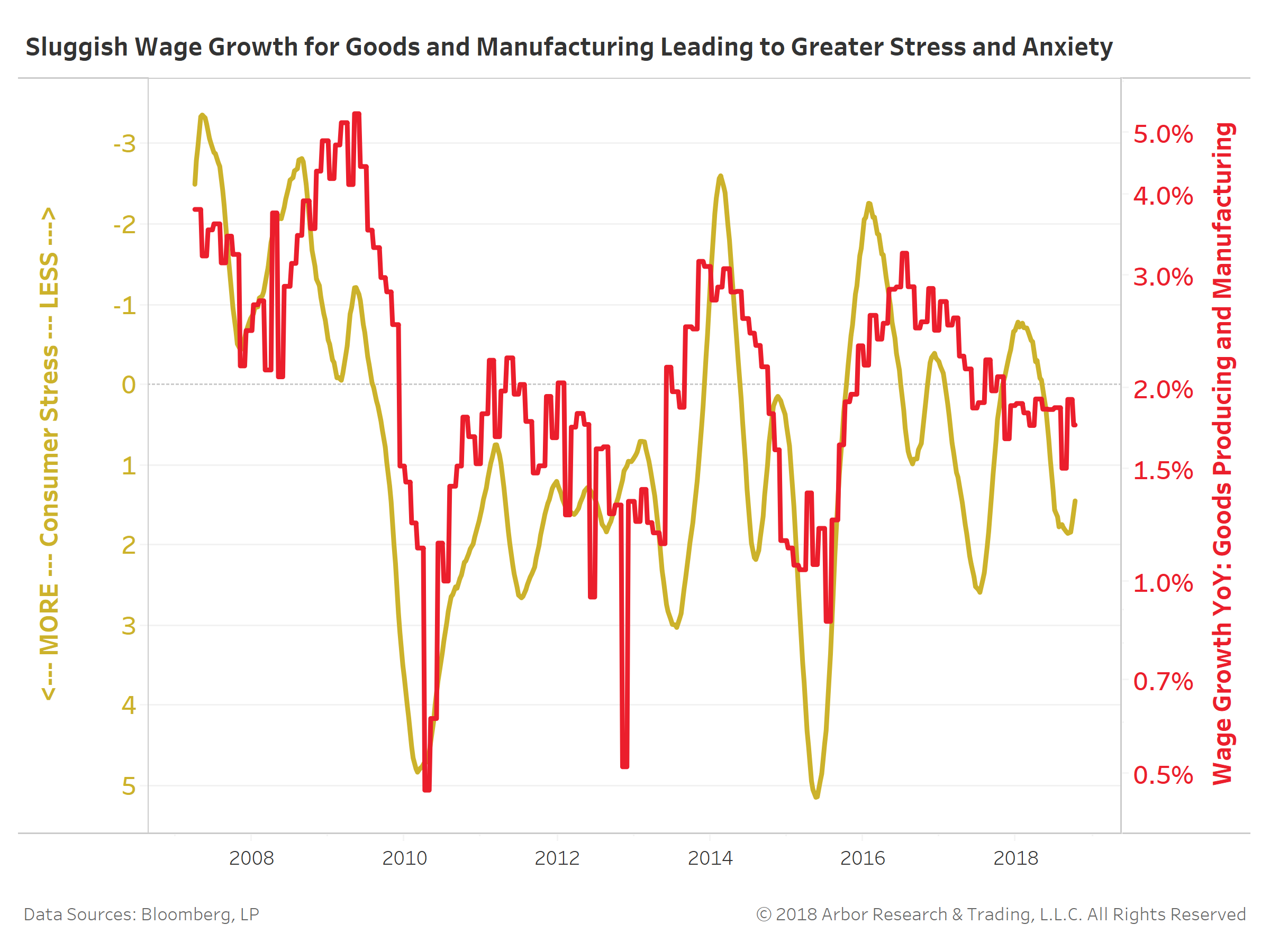

Surges in consumers’ physical and mental stress (left axis, reversed) have tracked wage growth for goods producing and manufacturing labor (right axis). In other words, blue collar labor is likely battling amplified stress when their wages fail to rebound with technology and services industries.