-

- Bloomberg – US Adds 315,000 Jobs as Participation Jumps and Wages Rise

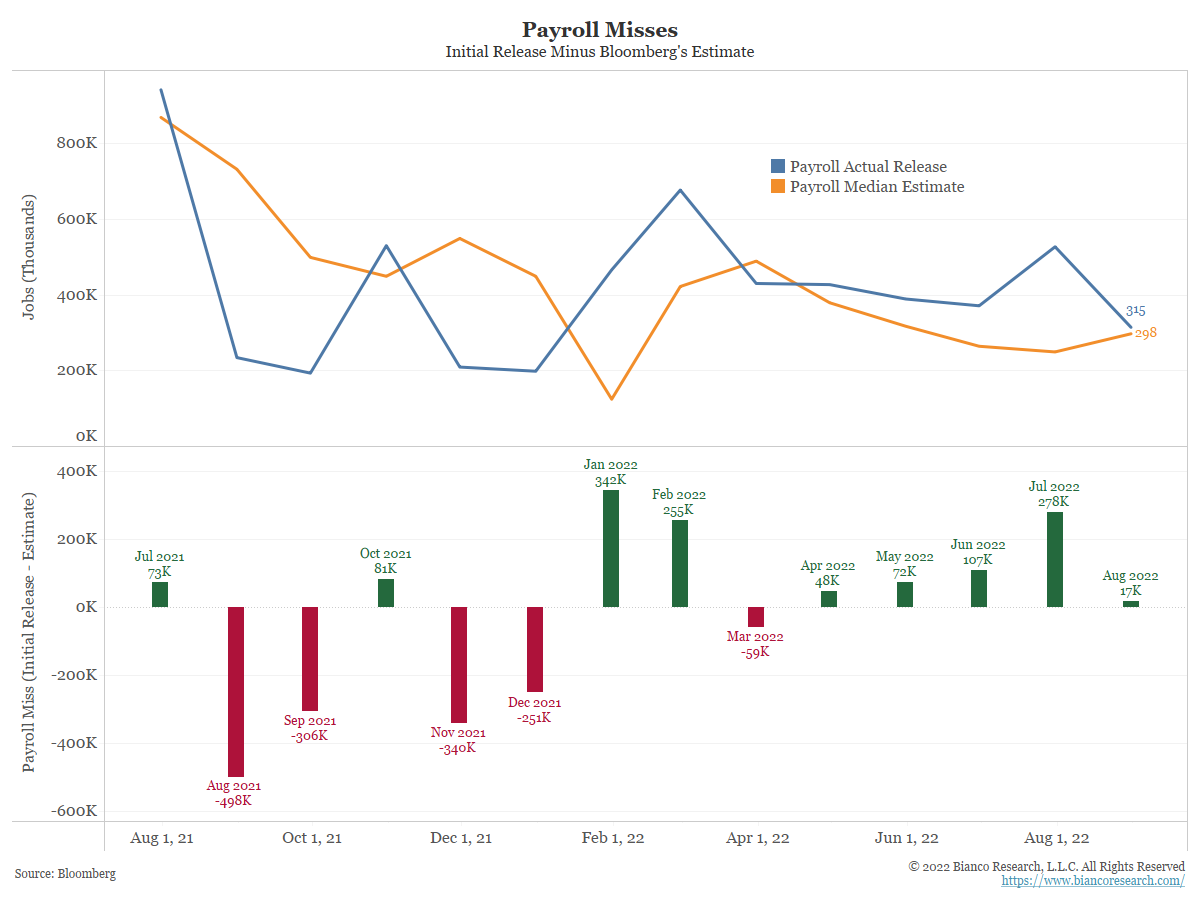

US employers added jobs at a healthy, yet more moderate pace in August, and participation posted a sizable increase, offering little evidence of any kind of definitive slowdown despite a jump in unemployment. Nonfarm payrolls increased 315,000 last month following a revised 526,000 advance in July, a Labor Department report showed Friday. The unemployment rate unexpectedly rose to 3.7% as the participation rate climbed. Economists projected an almost 300,000 gain in payrolls and a 3.5% jobless rate, based on the median estimates in a Bloomberg survey.

- Bloomberg – US Adds 315,000 Jobs as Participation Jumps and Wages Rise

Comment

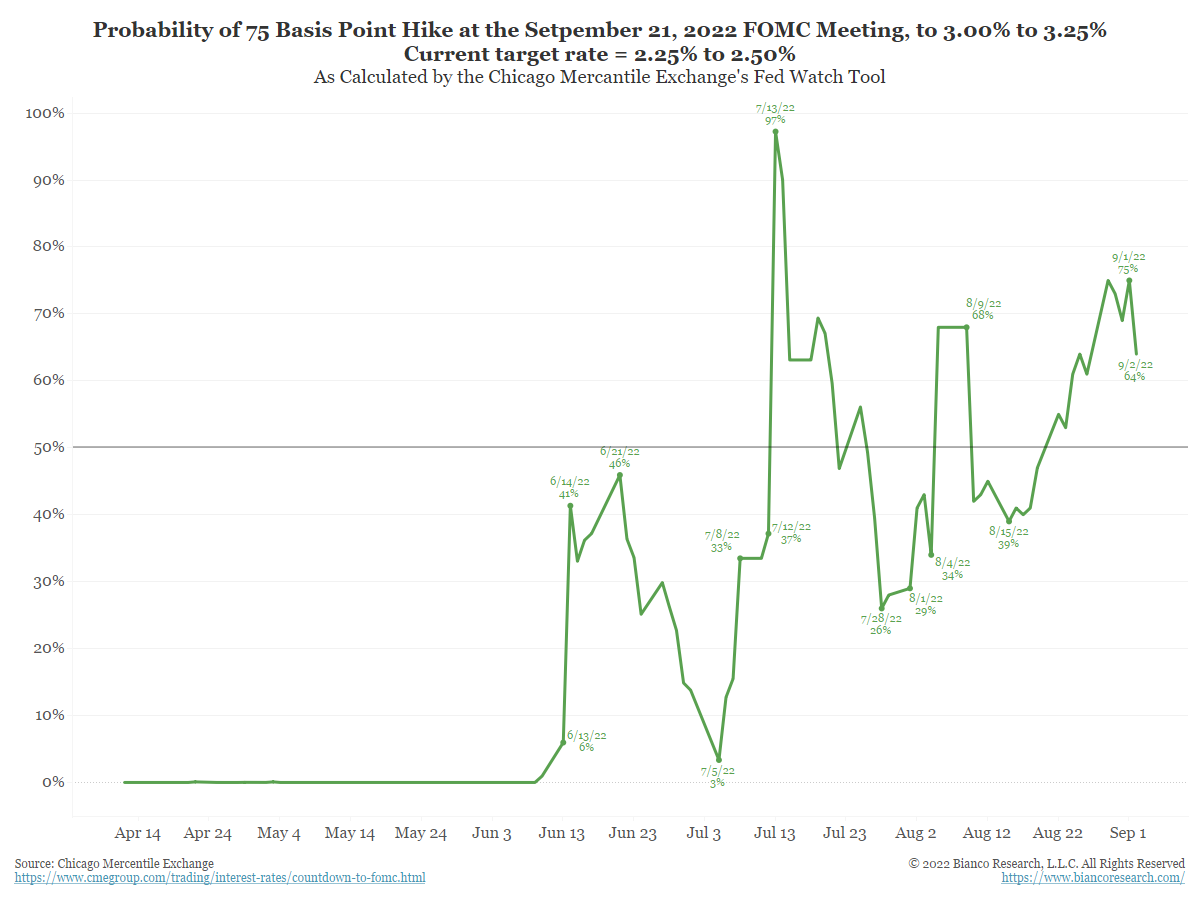

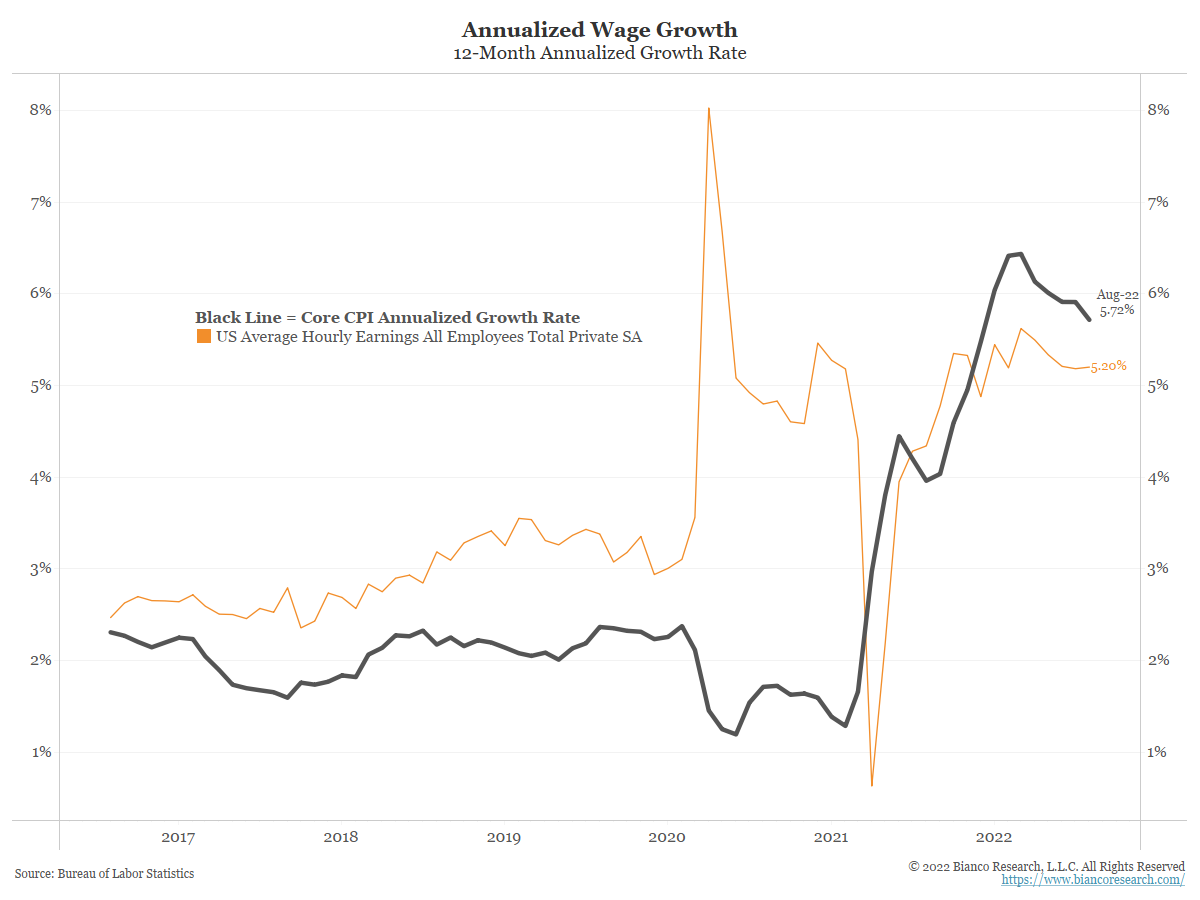

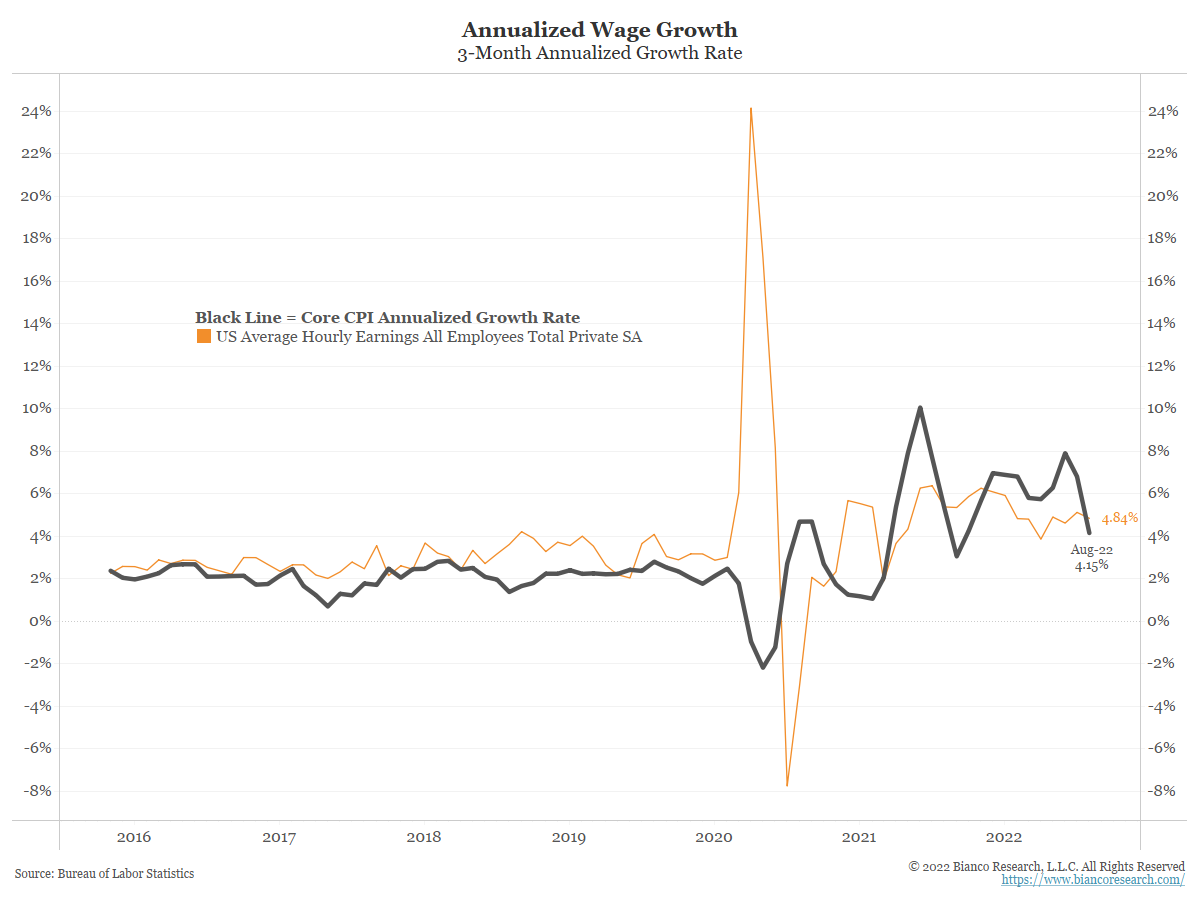

However, as we argued recently, the payrolls report may still play a role in determining just how aggressive the Fed may be in fighting inflation.

The markets are now in a strange place where good economic news may be bad news for financial conditions (and vice versa). Simply put, the strong labor market is giving the Fed cover to continue punishing the stock market. This morning’s release does little to change that.

Heading into this morning’s release, economists expected a median of 298k jobs added. The standard deviation of estimates was 61k, so the actual release of 315k was essentially right on the screws.

When the pandemic took hold and quarantines began in 2020, the payrolls report became one of the most important economic releases each month. With many people either getting sick or being laid off due to lockdowns, employment statistics offered a way to measure the severity of the pandemic and its effect on the economy. Now that the labor market has recovered all of the jobs lost during the pandemic, the focus has moved to monthly inflation releases.