Summary

U.S. inflation expectations have become too pessimistic and a forgotten concern to degrees favoring widening in the weeks ahead.

Comment

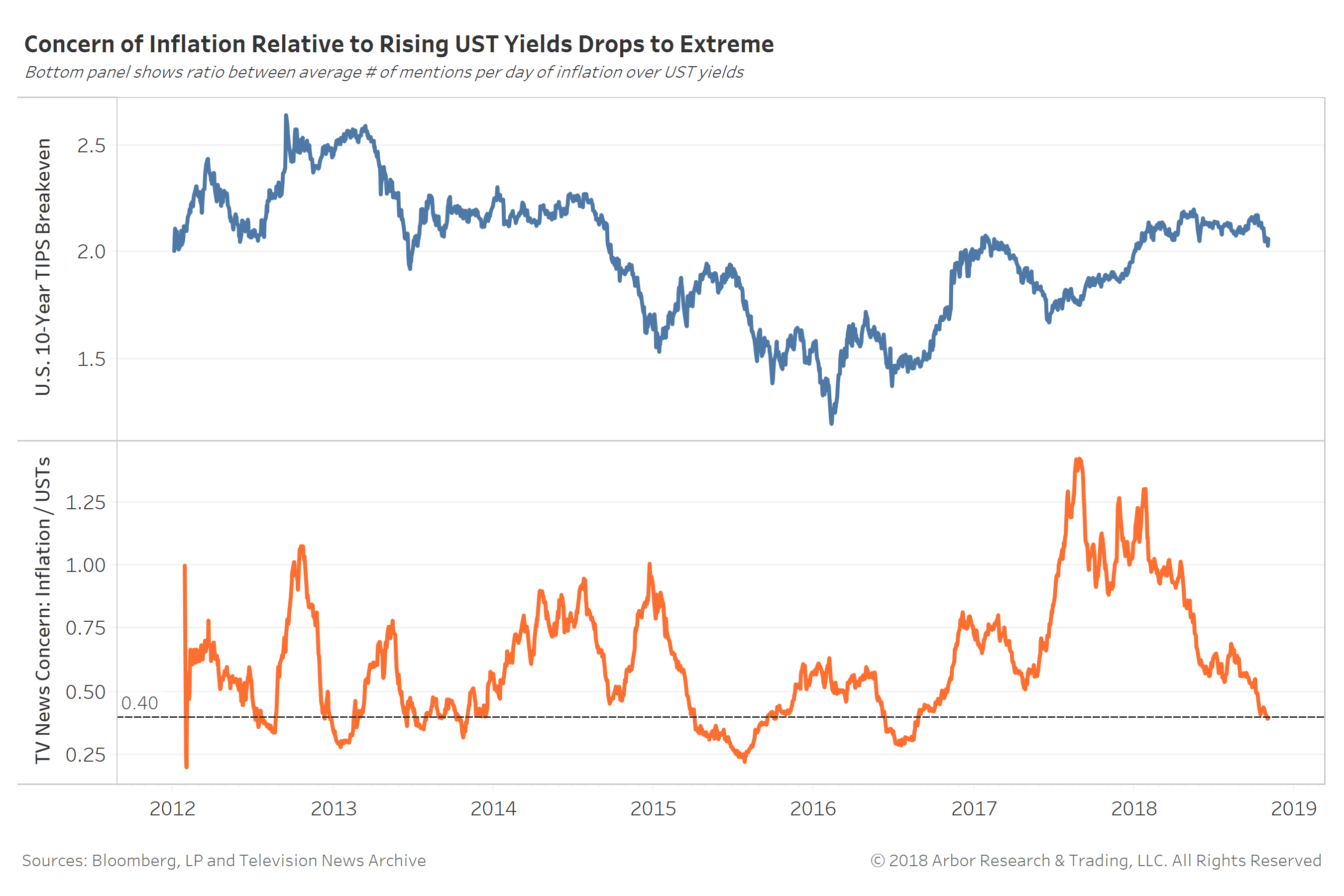

Earlier this week we showed the share of major topics across financial T.V. news includes a drop in concern over inflation. The bottom panel in the chart below offers the ratio between concerns of inflation over rising U.S. Treasury yields. It measures how much inflation is to blame for higher yields.

The ratio has plummeted since early 2018 to extremely low levels, implying inflation has NOT been viewed a problem or driver of higher yields.

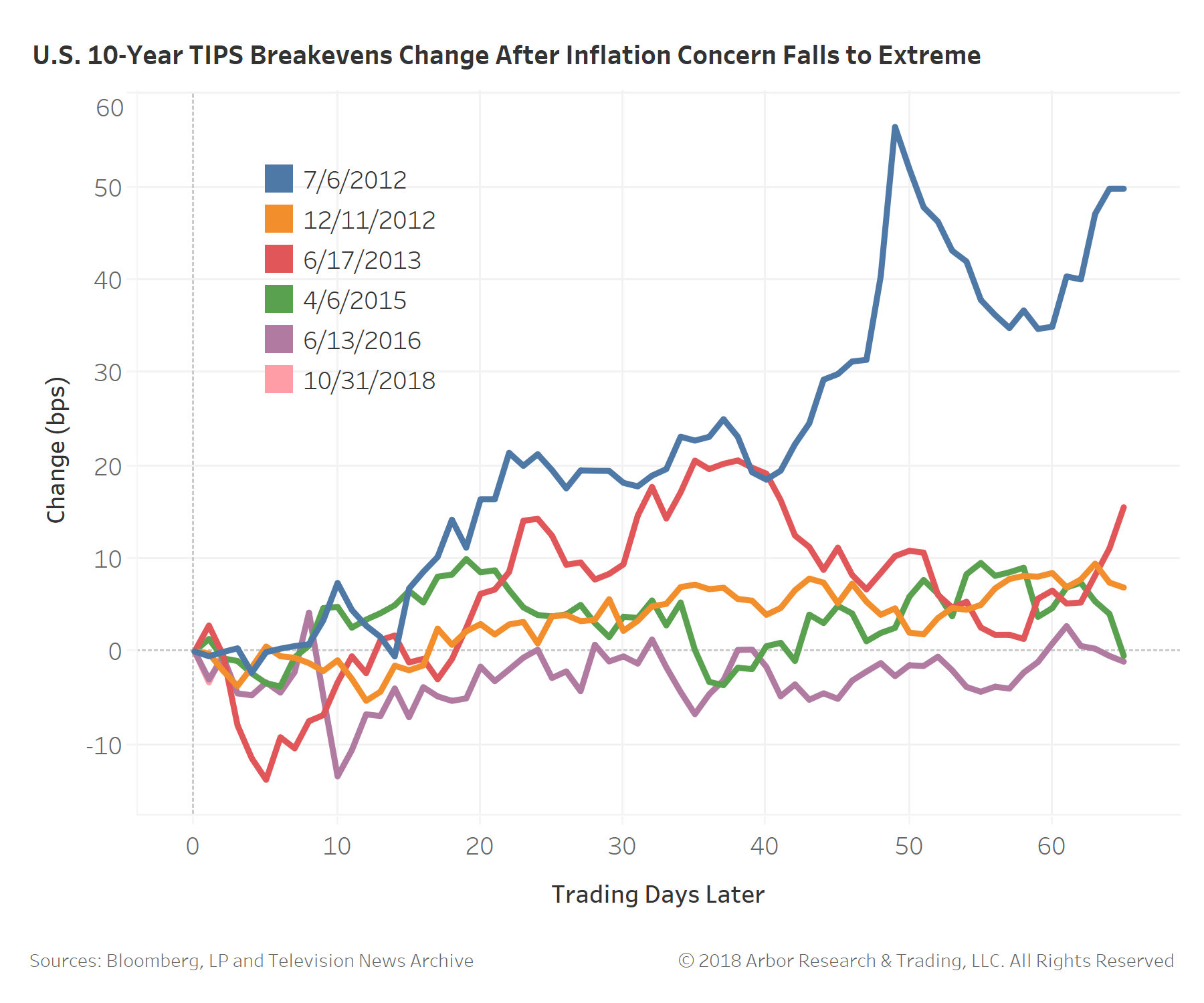

The lines below shows the moves by U.S. 10-year TIPS breakevens after similar drops in the ratio between inflation and yield concerns (<0.4). Inflation expectations are stable-to-wider over the course of the next month.

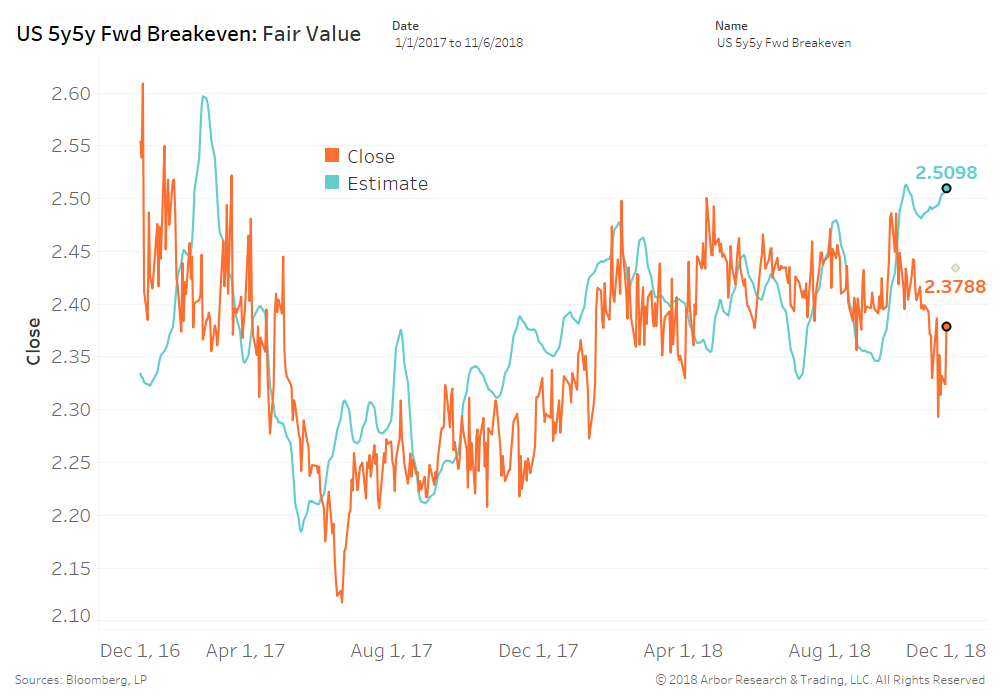

The U.S. 5-year 5-year forward breakeven at 238 bps (orange) resides 13 bps below fair value at 251 bps (blue). Breakevens’ slump on the heels of WTI crude oil’s 18.9% tumble appears to have run its course.