Summary

Comment

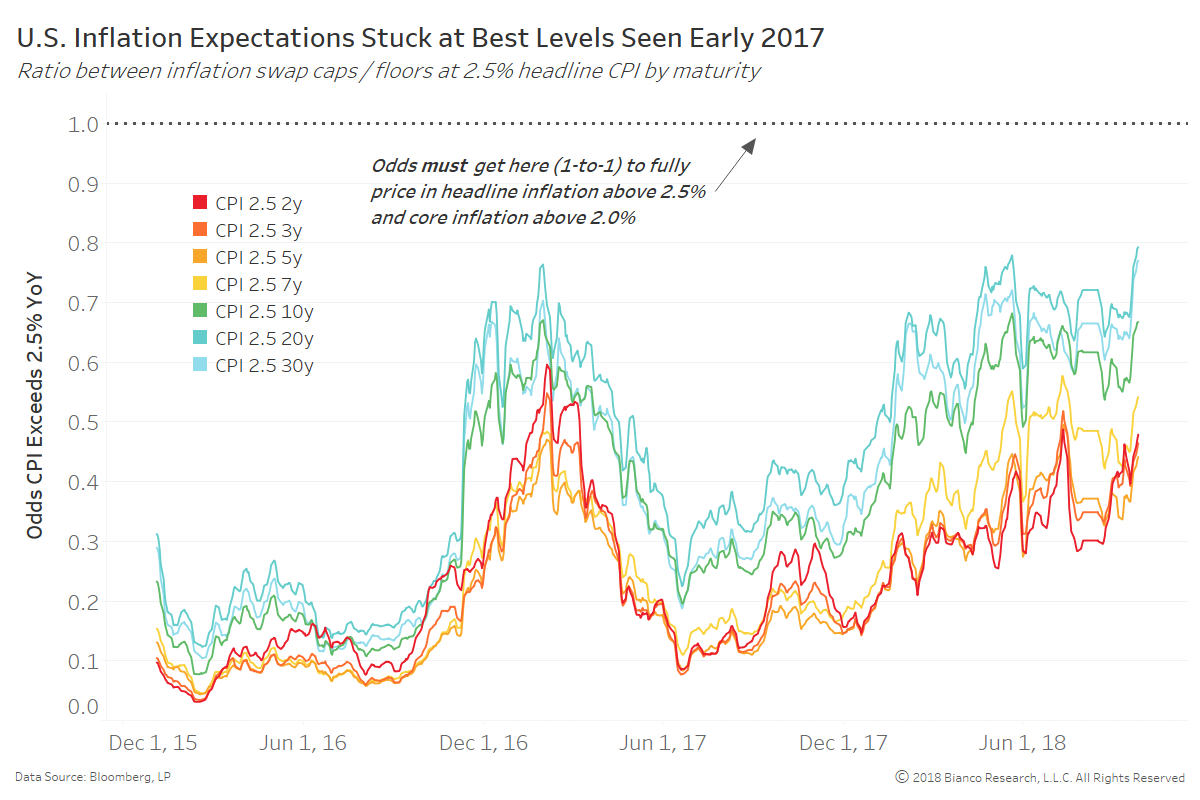

The clincher remains investors fully pricing in headline CPI running above the 2.5% year-over-year needed to produce core inflation above 2.0% year-over-year. The ratios between inflation swap caps and floors with a strike of 2.5% are attempting to break above their recent highs in early 2017.

A decisive breakout and approach of 1-to-1 odds is needed to signal a closing gap between anchored market-based rate hike timing (2.5 hikes next 12 months) relative to the Federal Reserve. We believe the chart below is one of the most important to nearly all asset classes heading towards the next hike in December 2018.