Comment

Comment

The Federal Reserve is heading into their September 26, 2018, FOMC meeting having a strong consumer, inflation that is near its target, and the global economy on the rebound away from emerging market weak spots. Trade policy uncertainty remains a potential roadblock, but an issue officials have yet to openly discuss.

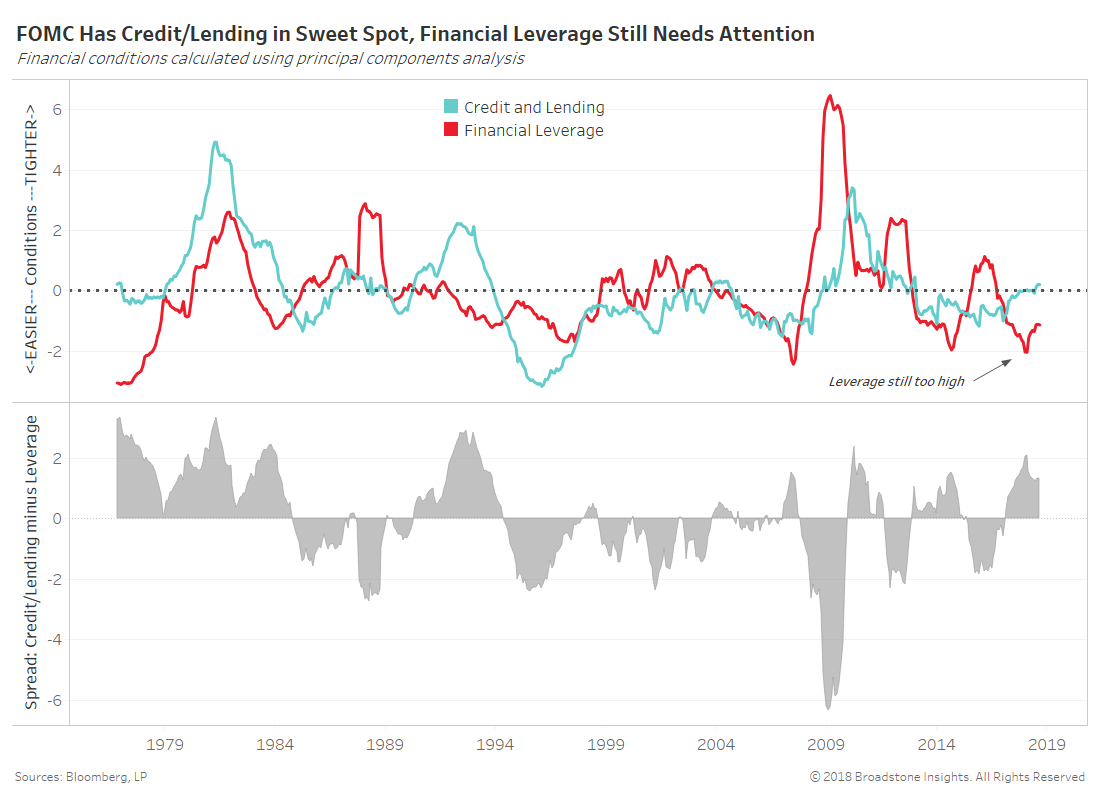

We continue to judge monetary policy by viewing U.S. credit and lending growth (blue) and financial leverage (red) relative to long-term averages. The chart below shows z-scores for each with higher values indicating tighter conditions and lower indicating easier conditions.

Credit and lending growth is nearly on top of its long-term average, meaning the neutral rate is not far away according to this metric alone. But, financial leverage remains quite elevated after an excessively long period of monetary stimulus from across the globe. Has the Federal Reserve allowed high leverage and unproductive companies to persist for too long before finally normalizing policy?

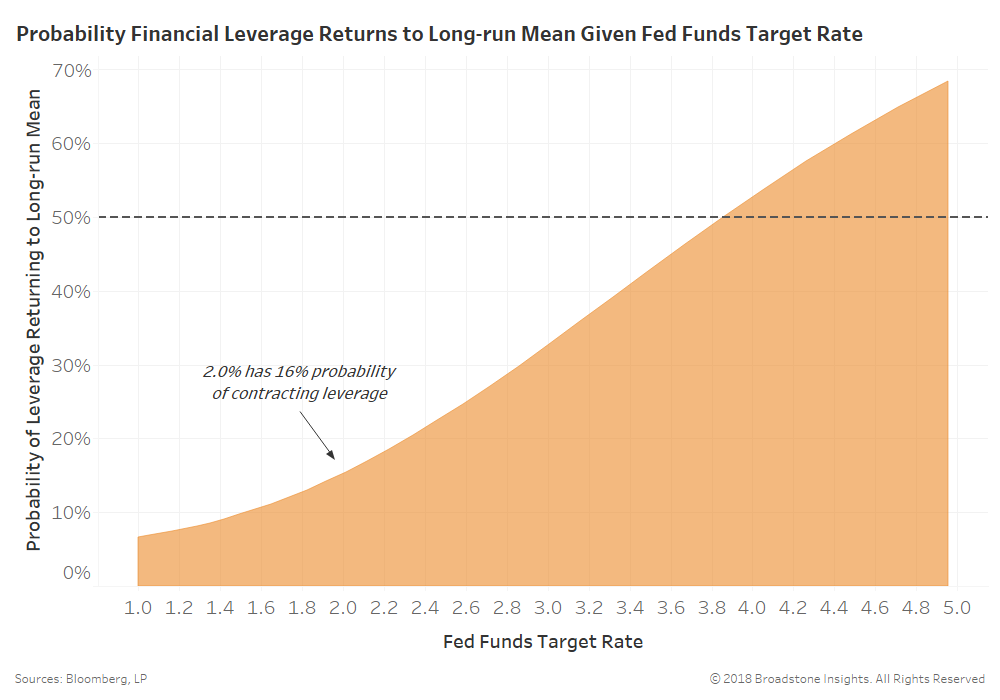

We perform stress tests financial leverage will return to its long-run average (zero in the chart above) within the next 12 months by varying the fed funds target rate. The model includes the fed funds rate, payrolls, headline inflation, wage growth, durable goods, and industrial production.

The current fed funds target rate of 2.0% shows a 16% probability leverage will shift tighter to its long-run mean. We do not see better than 50% probabilities until the fed funds target rate rises above 3.75%.

In other words, the Federal Reserve would need to raise rates well above the current long-term dot near 3.0% to reign in financial leverage.

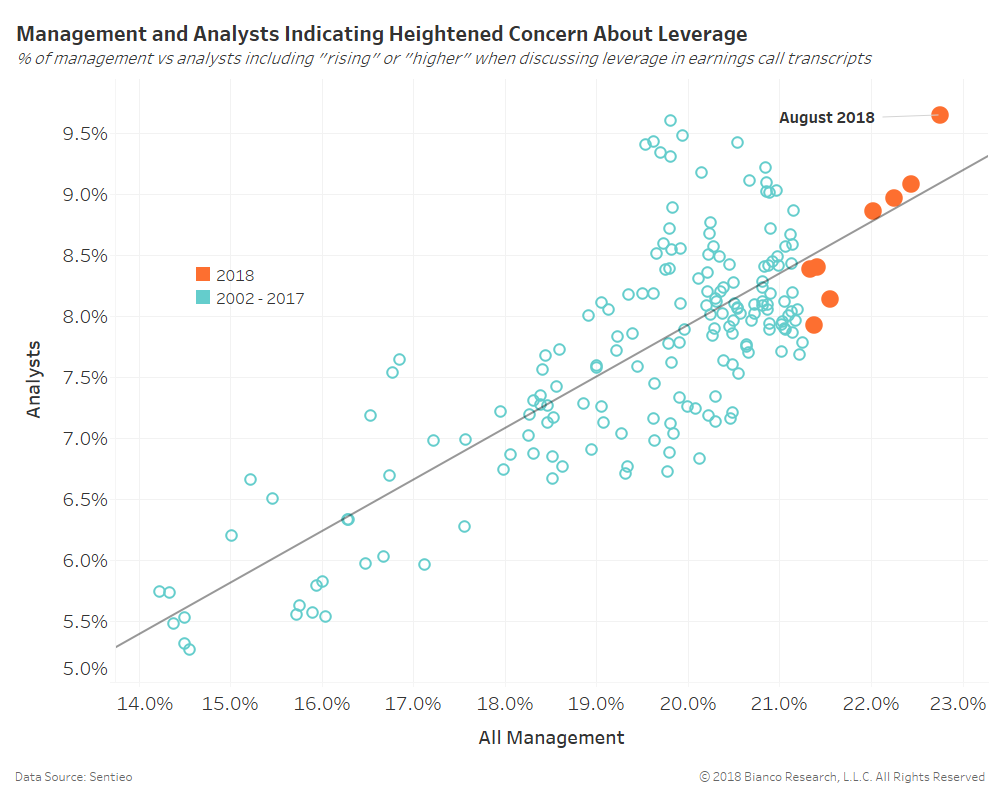

The chart below shows the percentage of management (x-axis) versus analysts (y-axis) including ‘rising’ or ‘higher’ when discussing leverage within earnings call transcripts and presentations. Earnings call transcripts show that both management (22.8%) and analysts (9.7%) are discussing rising leverage at their greatest rate in the history of our dataset back to 2002.

Just over 14% of S&P 1500 companies are so-called zombies with three-year average interest expense-to-EBIT ratios below one. We believe U.S. 10-year real yields (last: 0.92%) moving above 1.0% would begin to stress many of these zombies and highly leveraged companies.

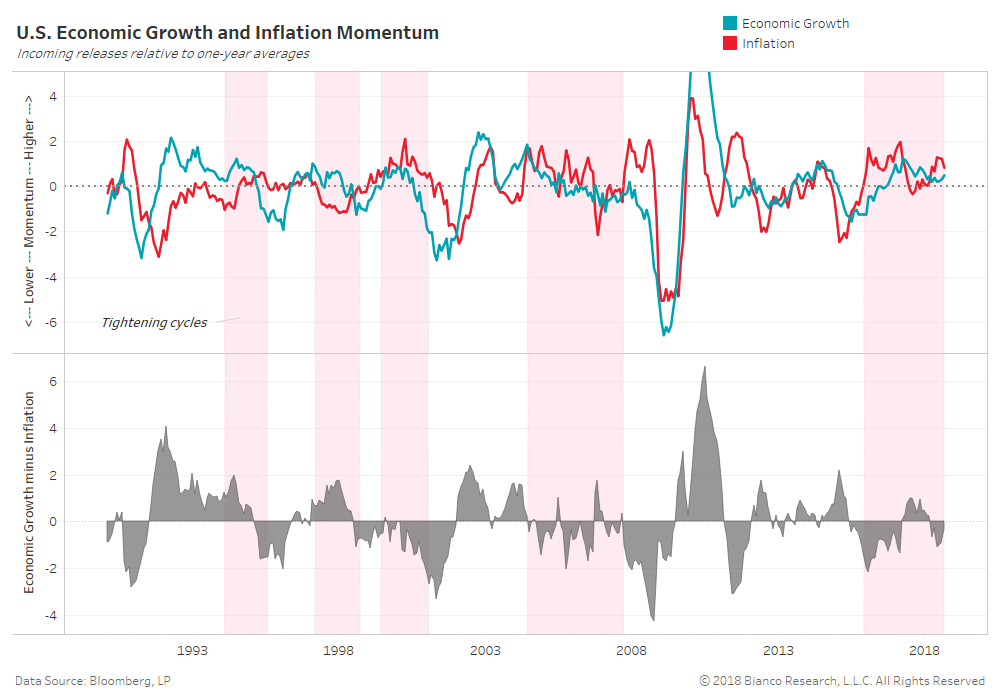

So why hasn’t U.S. high yield reflected the lurking zombie and leverage risk? U.S. economic growth and inflation are still growing above one-year averages. Additionally, inflation’s momentum is slowing.

The chart below shows economic growth (blue) and inflation (red) momentum by measuring incoming releases relative to one-year averages. Above zero values indicates above-average growth.

Inflation momentum has been running above economic since March 2018. However, inflation’s momentum is slowing the potential to fall back below economic growth momentum in the months ahead.

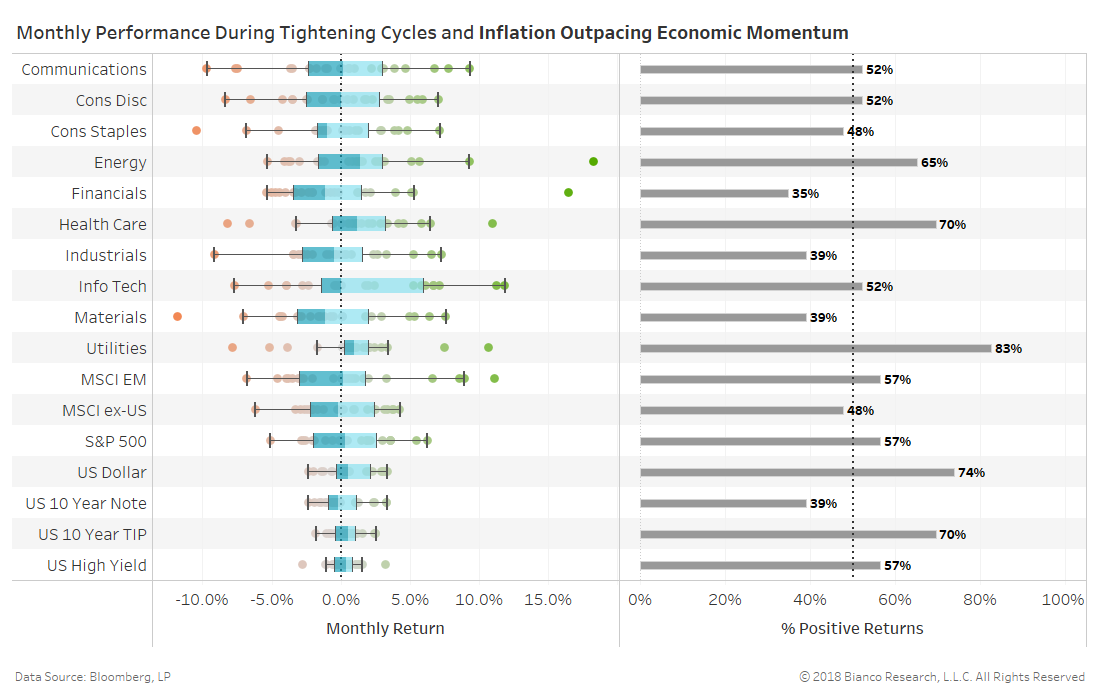

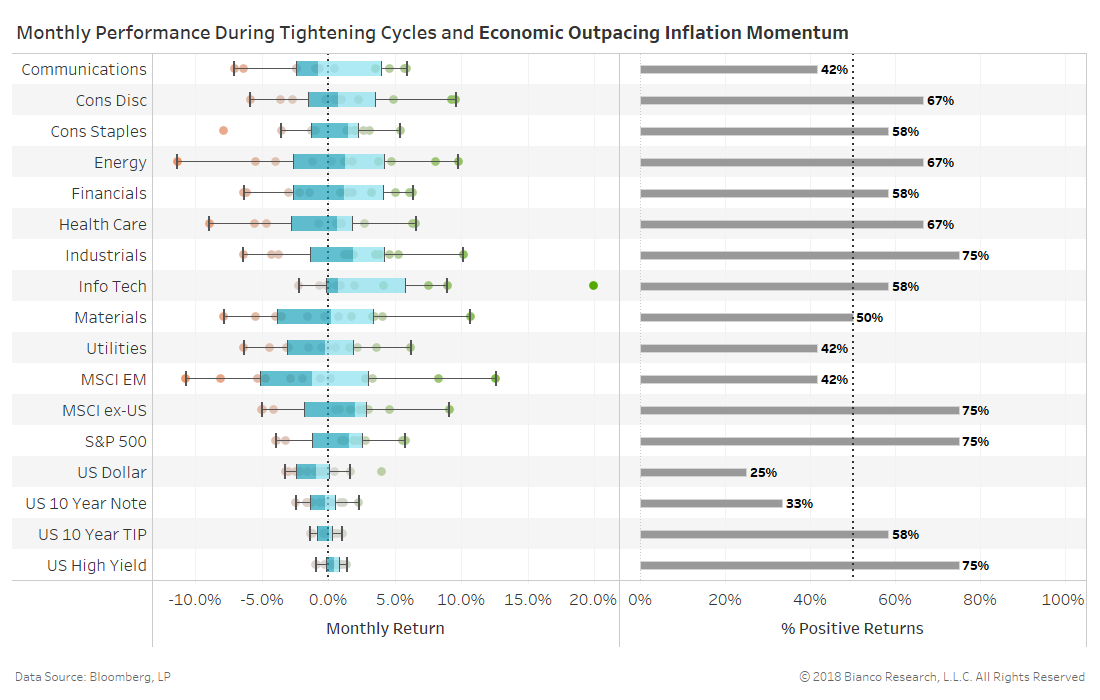

The next two tables show monthly performance by asset class and sector during similar conditions to today:

- Federal Reserve tightening cycle

- U.S. 2-year 10-year spread between 0 and 100 bps

- Economic growth above average

- Inflation momentum above average

The first table includes inflation outpacing economic momentum along with the conditions above.

Key takeaways:

- U.S. high yield and the S&P 500 offer ho-hum performance rising 57% of months

- U.S. dollar performs very well rising 74% of months by a median of 0.5%

- U.S. 10-year notes suffer losses during 61% of months

- U.S. 10-year TIP outperforms, producing gains during 70% of months by a median of 0.5%

It is no coincidence the U.S. dollar began to soar after inflation overtook economic momentum in March 2018.

The second table includes the potentially nearing condition of economic outpacing inflation momentum.

Key takeaways:

- U.S. high yield and the S&P 500 are star performers, producing gains during 75% of months

- U.S. dollar suffers losses during 75% of months, shedding a median of -0.9%

- U.S. 10-year notes suffer losses during 67% of months

- U.S. 10-year TIP performance muted, gaining 58% of months

We believe investors are front-running this potential for economic growth momentum to continue above average and, more importantly, outpace inflation. A lack of inflation momentum will likely prevent the Federal Reserve from tightening too quickly.

On the flip side, if economic growth momentum does not overtake inflation and real yields climb, then the U.S. high yield market is finally susceptible to losses. We will be watching very closely.