Summary

Comment

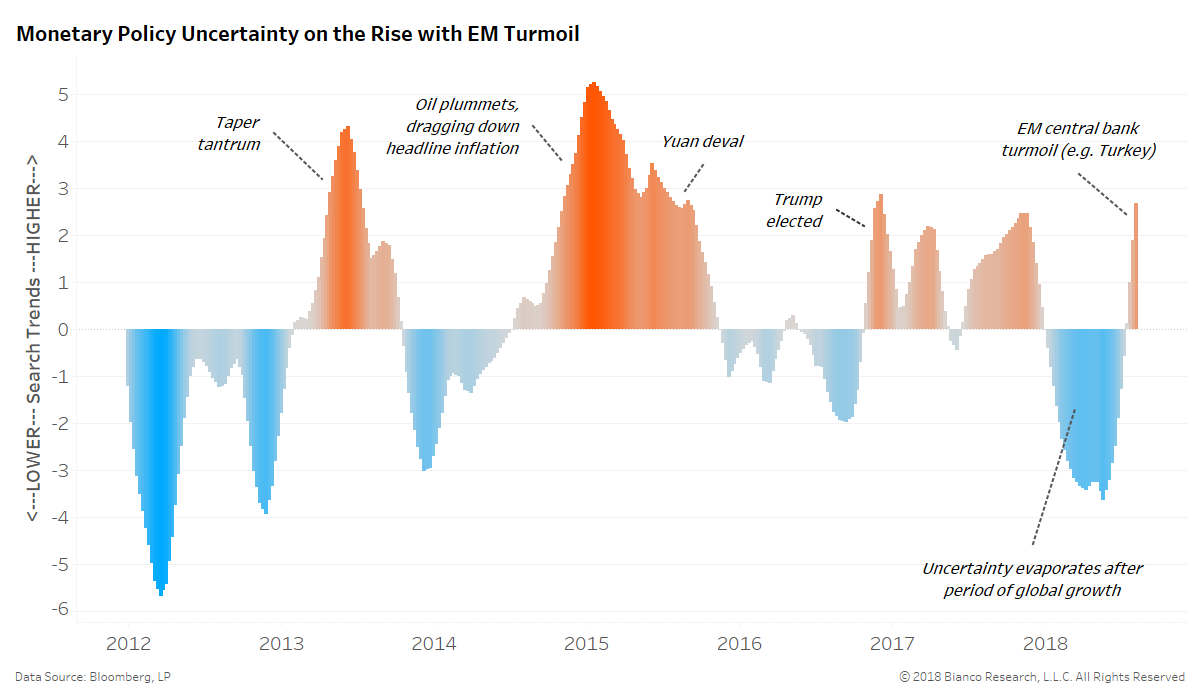

The chart below shows six-month changes in Google search trends concerning monetary policy across the globe.

Monetary policy uncertainty has awoken in recent weeks after a long slumber since the beginning of 2018. Turkey, Argentina, and more peripheral central banks are raising concerns about financial stability and contagion.

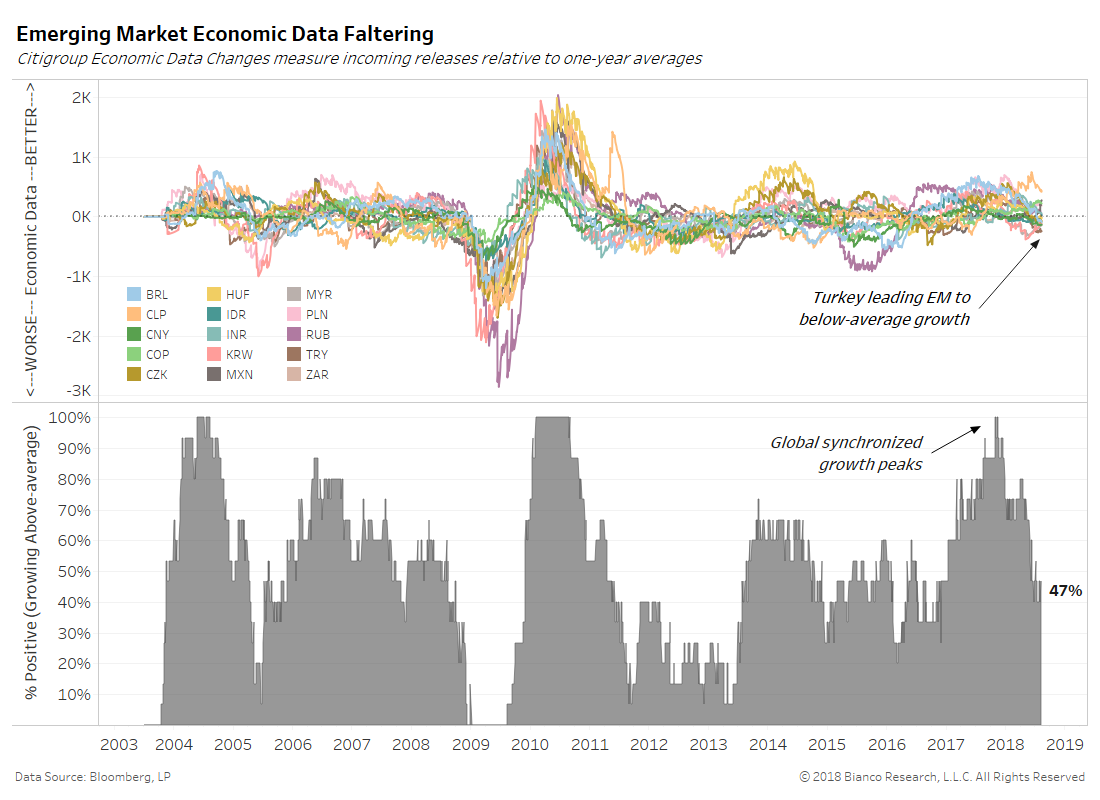

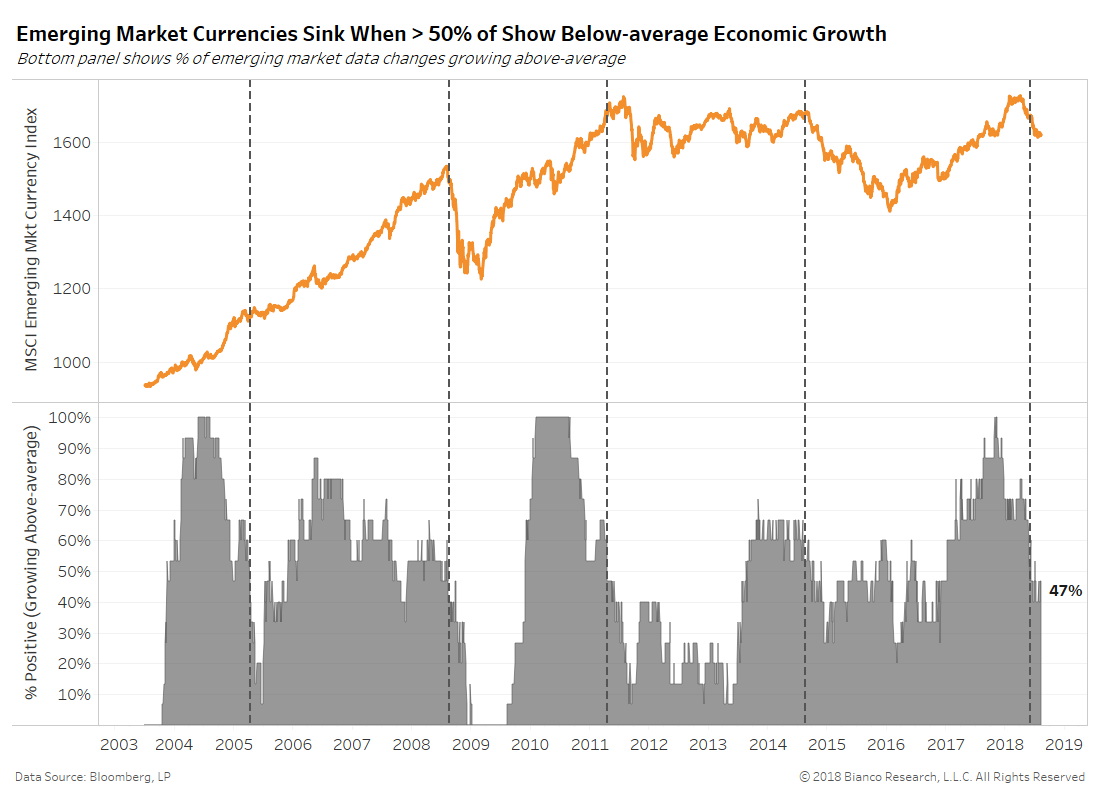

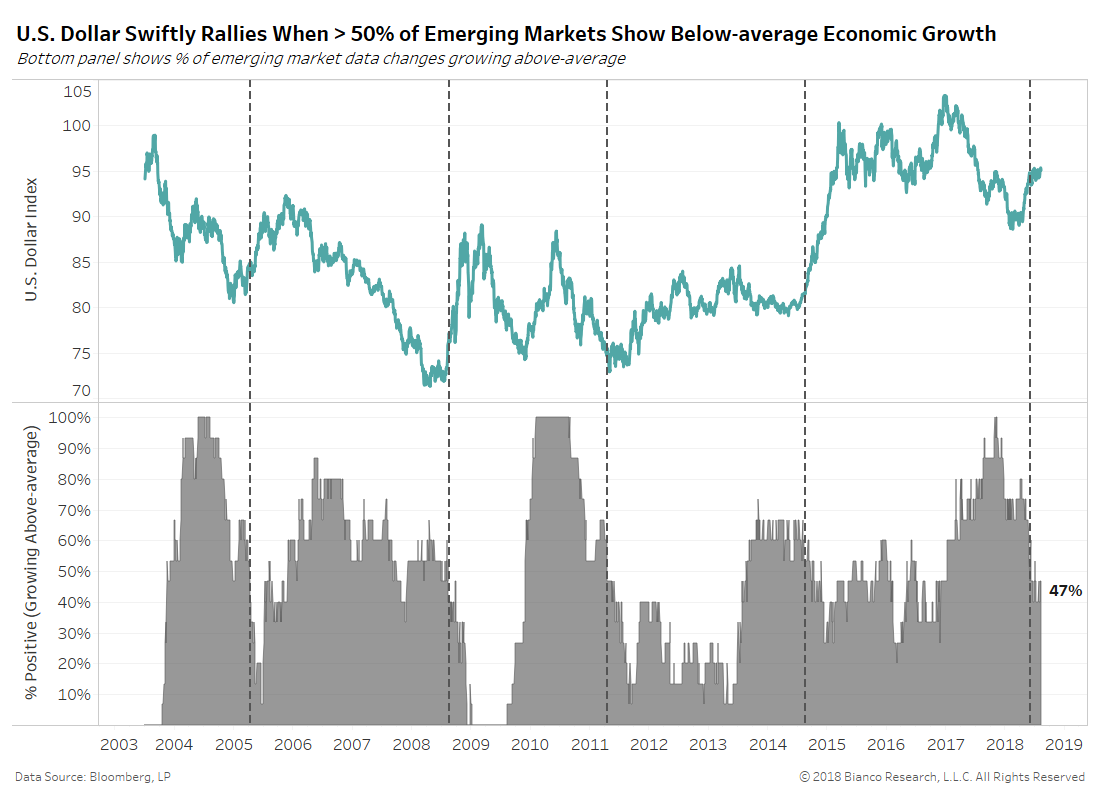

Risks may be isolated to the likes of Turkey, but emerging markets as a whole are seeing slowing economic growth. The top panel in the chart below shows Citigroup economic data change indices for major emerging markets, which measure incoming releases relative to one-year averages. Above zero index values indicate above-average growth and vice versa.

The bottom panel shows the percentage of the top panel that is positive. The recent deceleration went from 100% in November 2017 to 47% in August 2018.

On the flip side, the Federal Reserve remains ultra-calm given strong job gains and rising inflation. In fact, utterances of words like ‘uncertainty’ or ‘concern’ in official Federal Reserve speeches are at the lowest since 2006. Even Charles Evans (Chicago), a long-time dove, has put on his hawk talons.

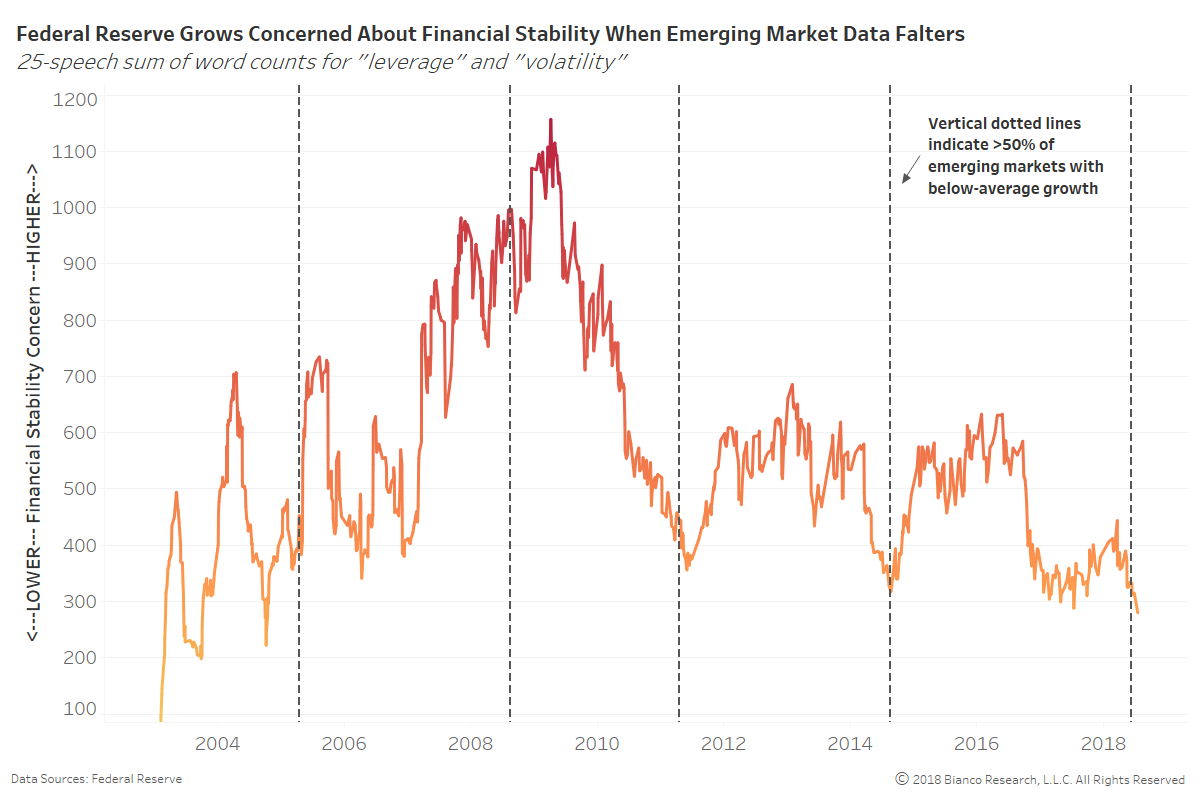

The next chart shows the rolling 25-speech count of words spoken by Federal Reserve officials about financial stability like ‘leverage,’ ‘volatility,’ or ‘equities.’ The dashed vertical lines indicate when emerging market economies slowed (i.e. <50% posting above-average growth). The Federal Reserve has tended to acknowledge rising financial and global risks after past instances. We expect continued slowing in emerging market growth would put financial stability back on the Federal Reserve’s radar. We would need to see the percentage of emerging markets with above-average growth fall below 35% to really cause concern and risk of contagion.

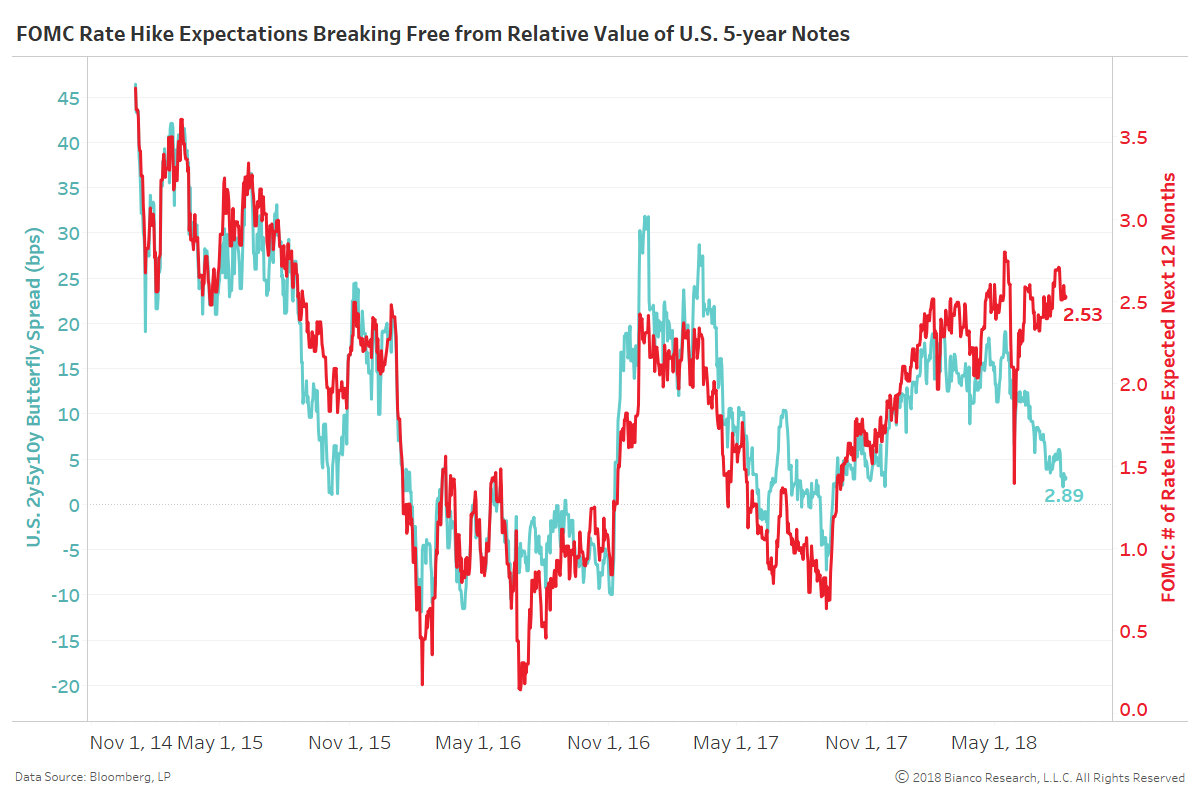

The U.S. 5-year note’s relative value to 2 and 10-years (blue) tracked very well with rate hike expectations (red) until 2018.

Bond investors are still refusing to price in continued inflation, hence a flatter yield curve. Growing risks from emerging markets are driving 5-year notes stronger with the 2-year 5-year 10-year butterfly again nearing zero. Either 5-year notes need to significant cheapen on the curve or the Federal Reserve’s hope for three hikes over the next 12 months should abate.