Summary

Comment

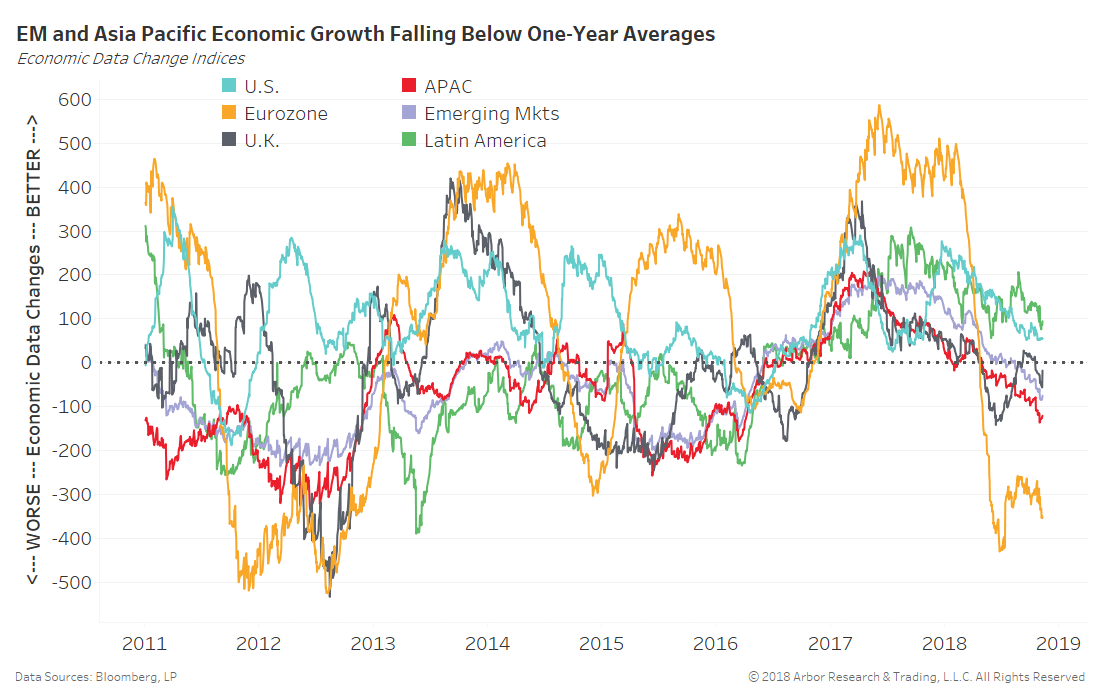

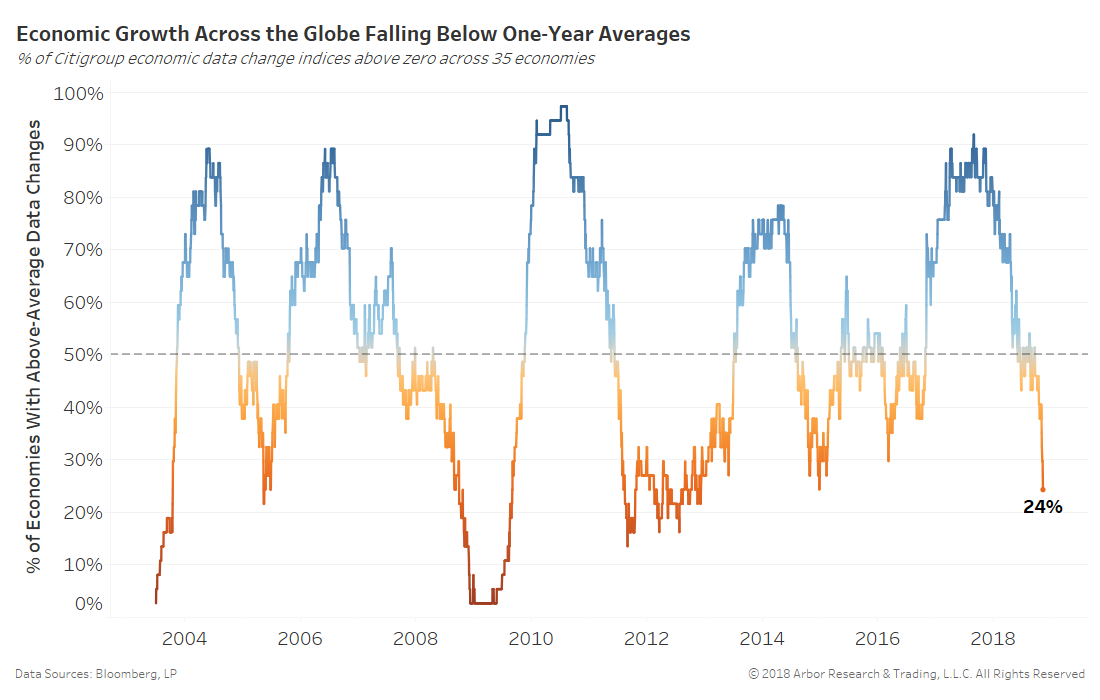

The Citigroup Economic Data Change indices shown below for each region measure incoming data releases relative to one-year averages. Below zero values indicate below-average growth.

The Eurozone, APAC, and emerging markets are leading a period of global synchronized slowing. The U.S. and Latin America remain standouts with above average growth, but have also been moderating throughout 2018.

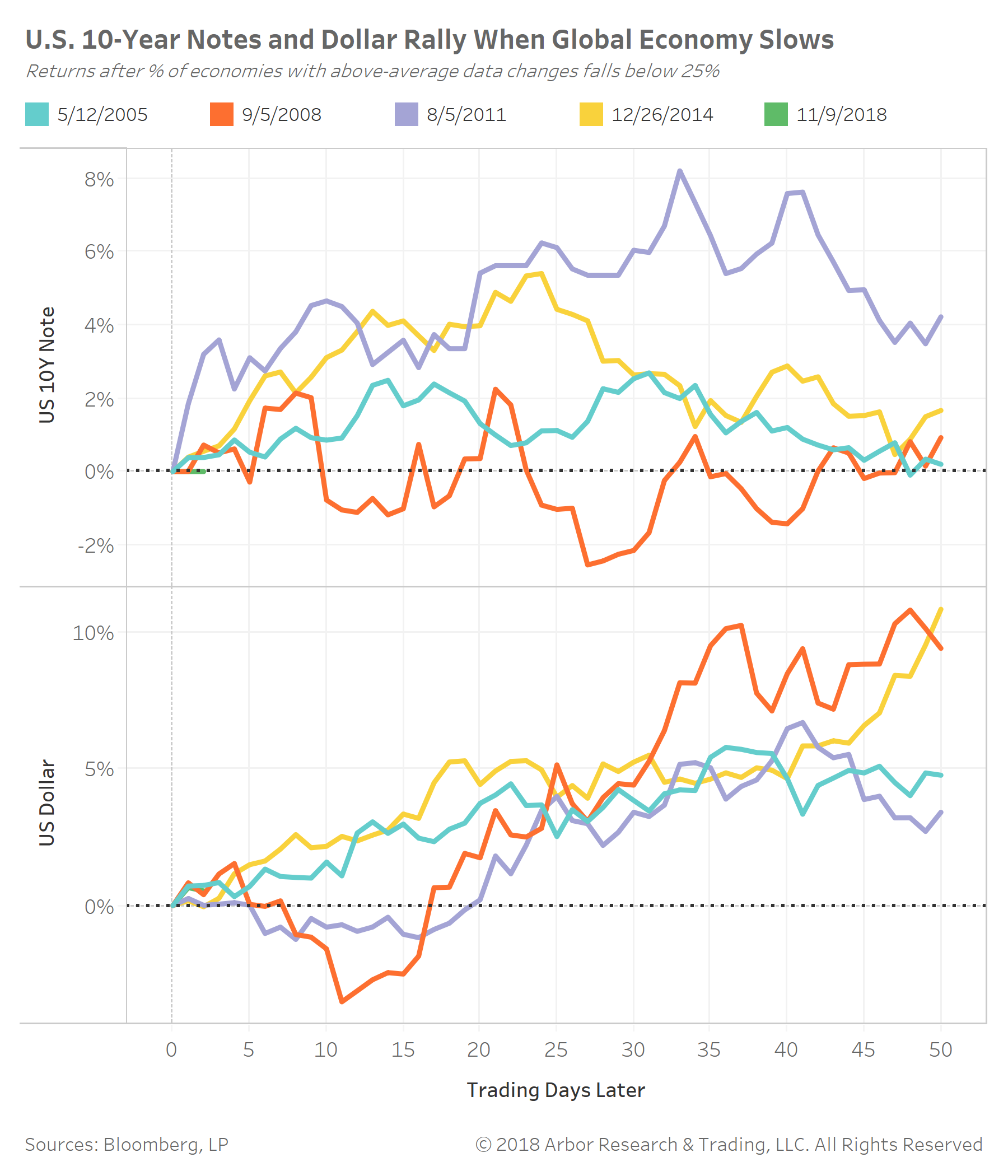

The next chart shows the reaction by U.S. 10-year notes and U.S. dollar after the percentage of economies producing above-average economic growth falls below 25%.

U.S. 10-year notes tend to perform quite well. But, remember risk-off flows have been heavily concentrated into shorter duration safe assets this time around. Heavy positioning for steepening (ETFs and futures) may finally allow longer-end U.S. Treasuries to again rally. We detail the impact of risk-off flows and positioning in a post today and our Weekly Roundup.

The U.S. dollar has been a steady performer during global angst.

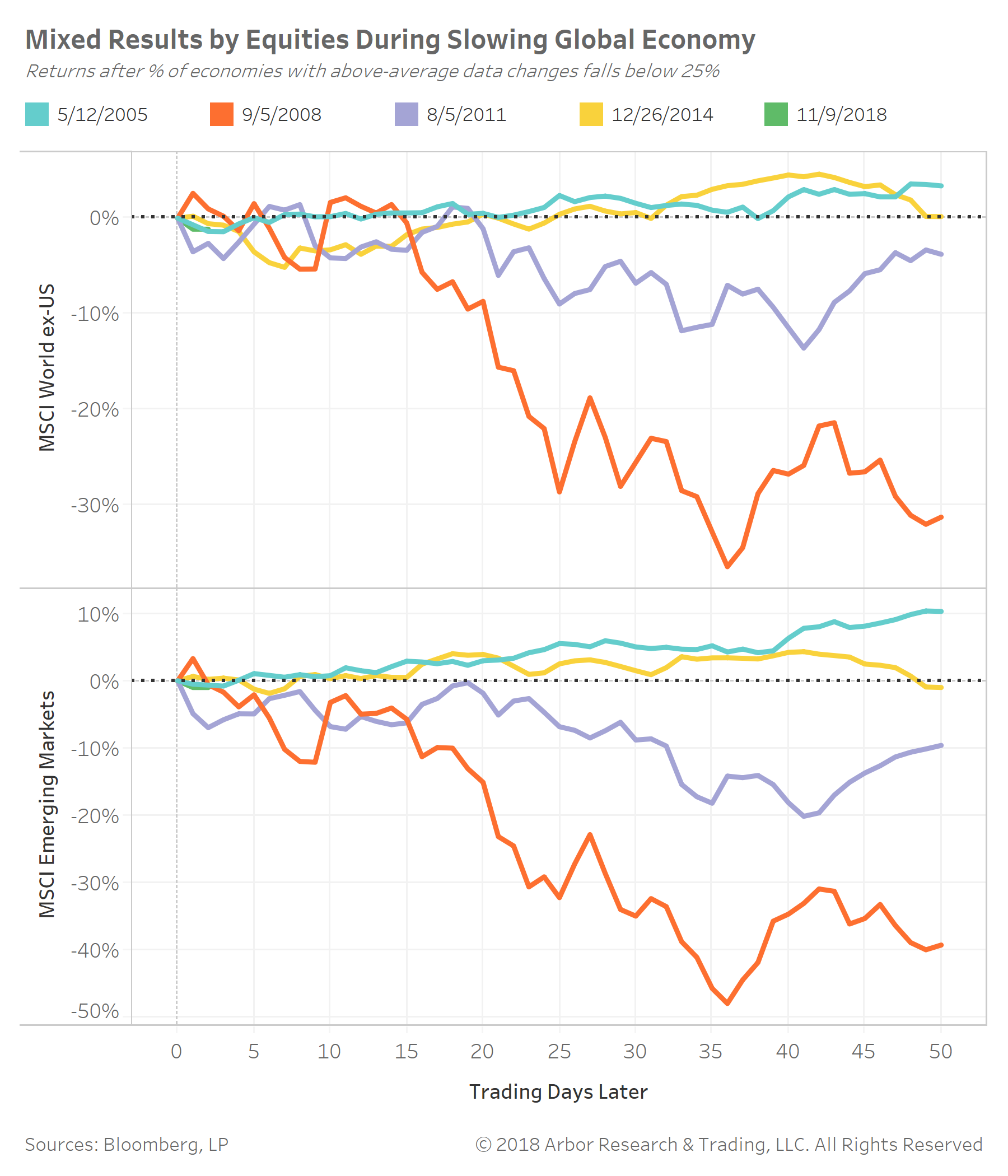

The last chart shows the reactions by the MSCI World ex-US and Emerging Markets equity indices. The outlook is much less clear, but both produce sideways-to-negative returns over the ensuing month.

We left out the U.S. (e.g. S&P 500) since its data changes continue to outperform much of the globe. U.S. equities will sour if U.S. economic data converges with the more global economy.