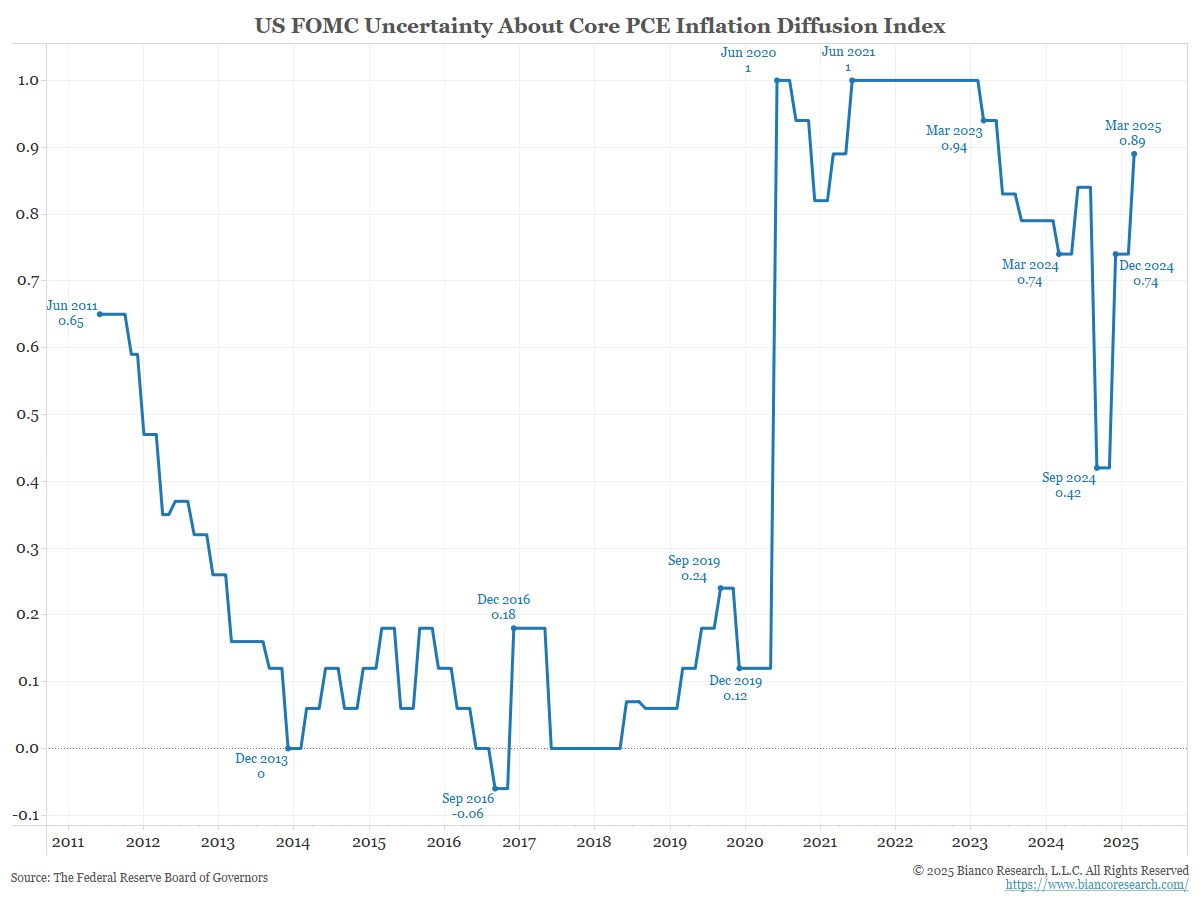

Uncertainty Reigns Supreme at the Fed

Posted By Greg Blaha

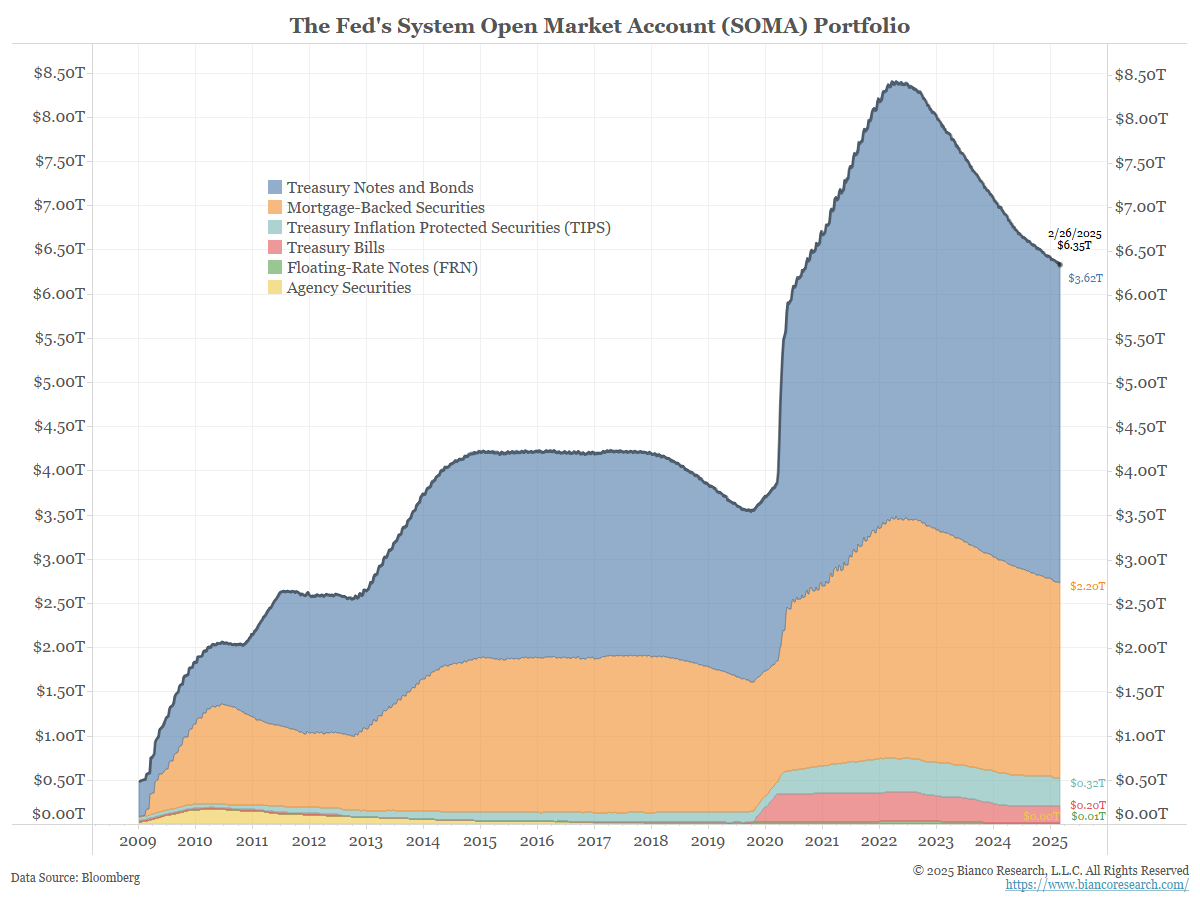

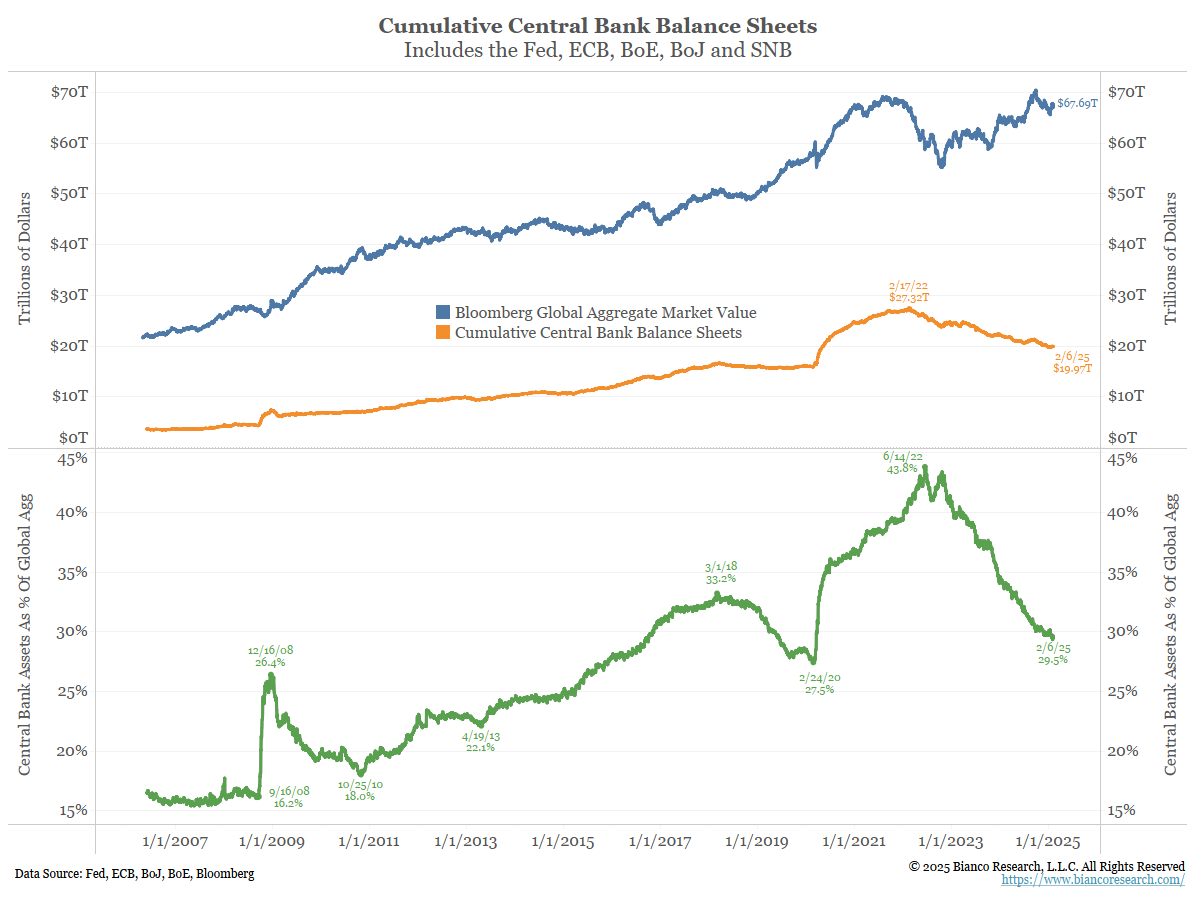

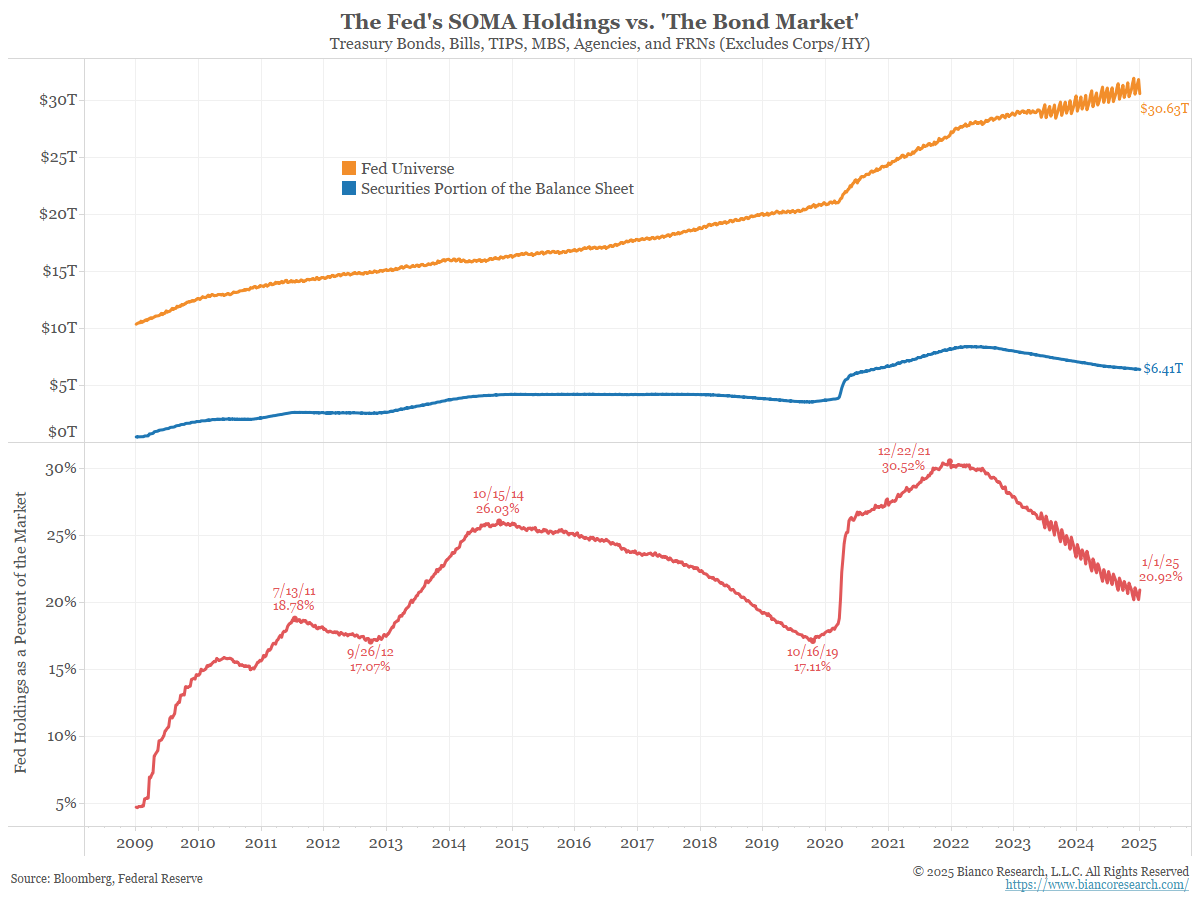

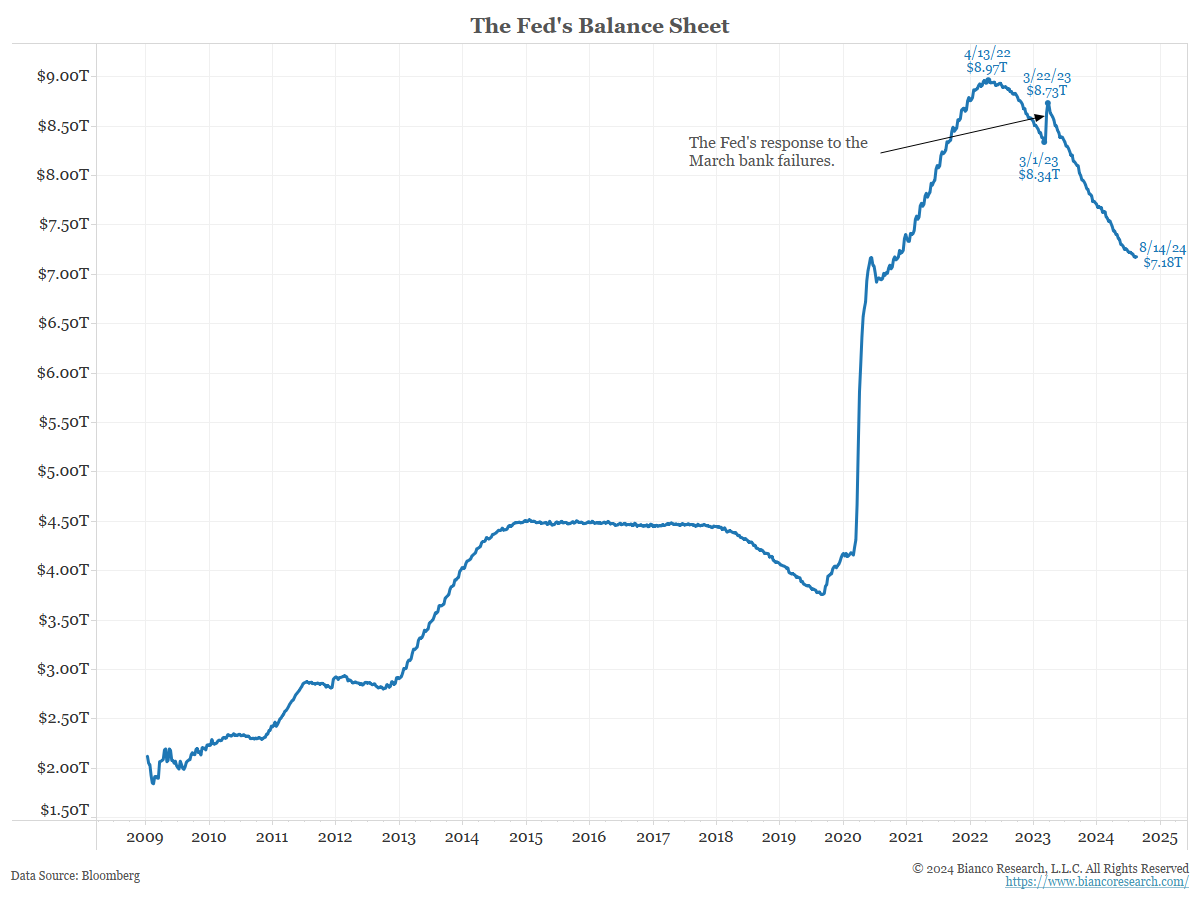

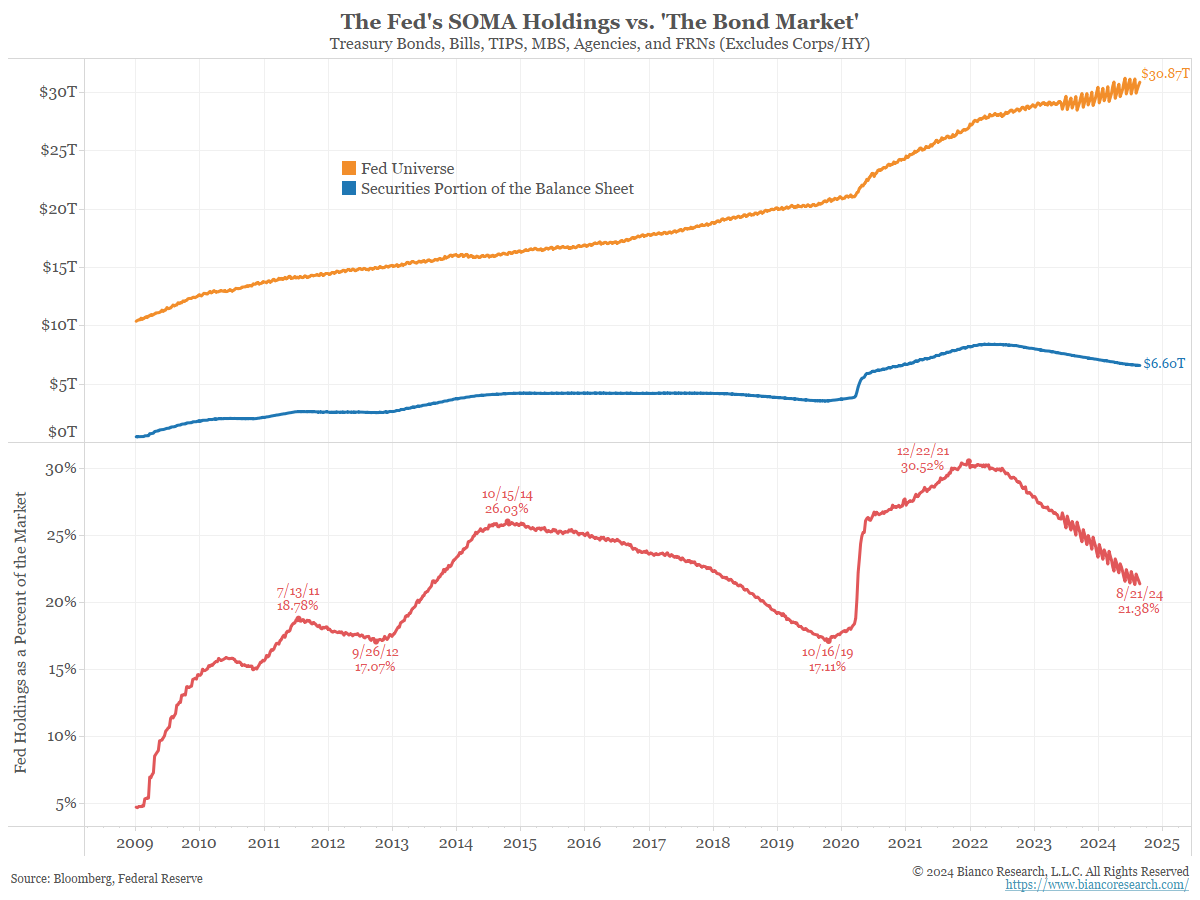

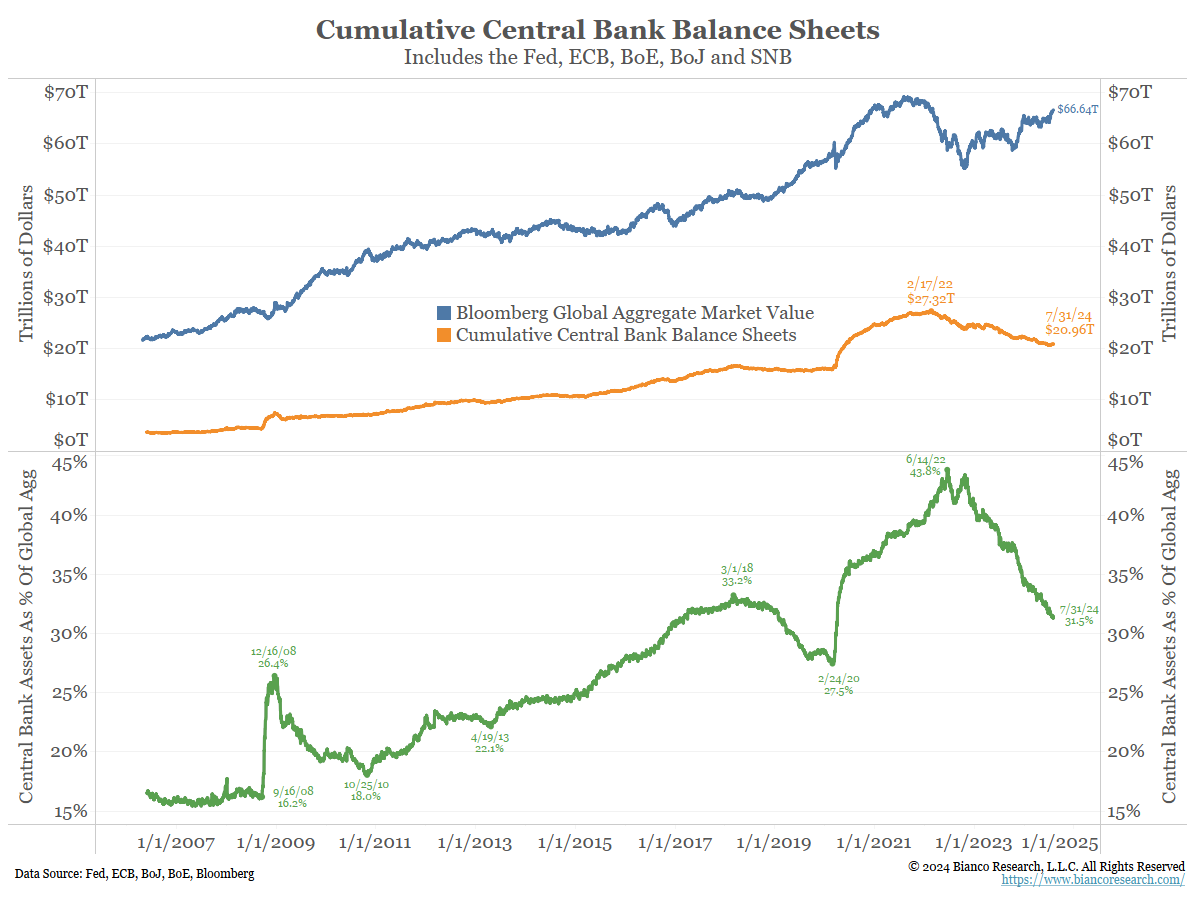

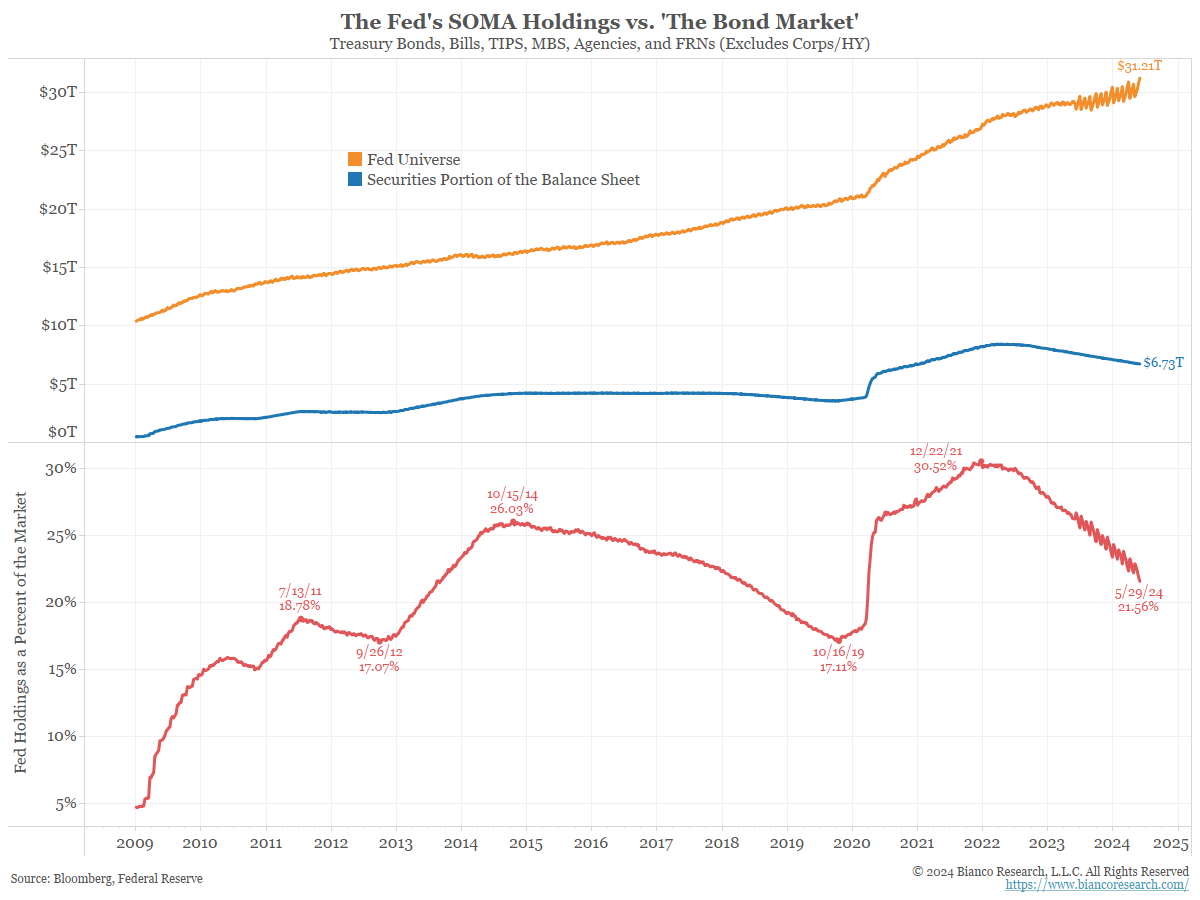

The Trump administration has made the Federal Reserve's job all the more difficult, creating uncertainty on several different fronts.... Read More