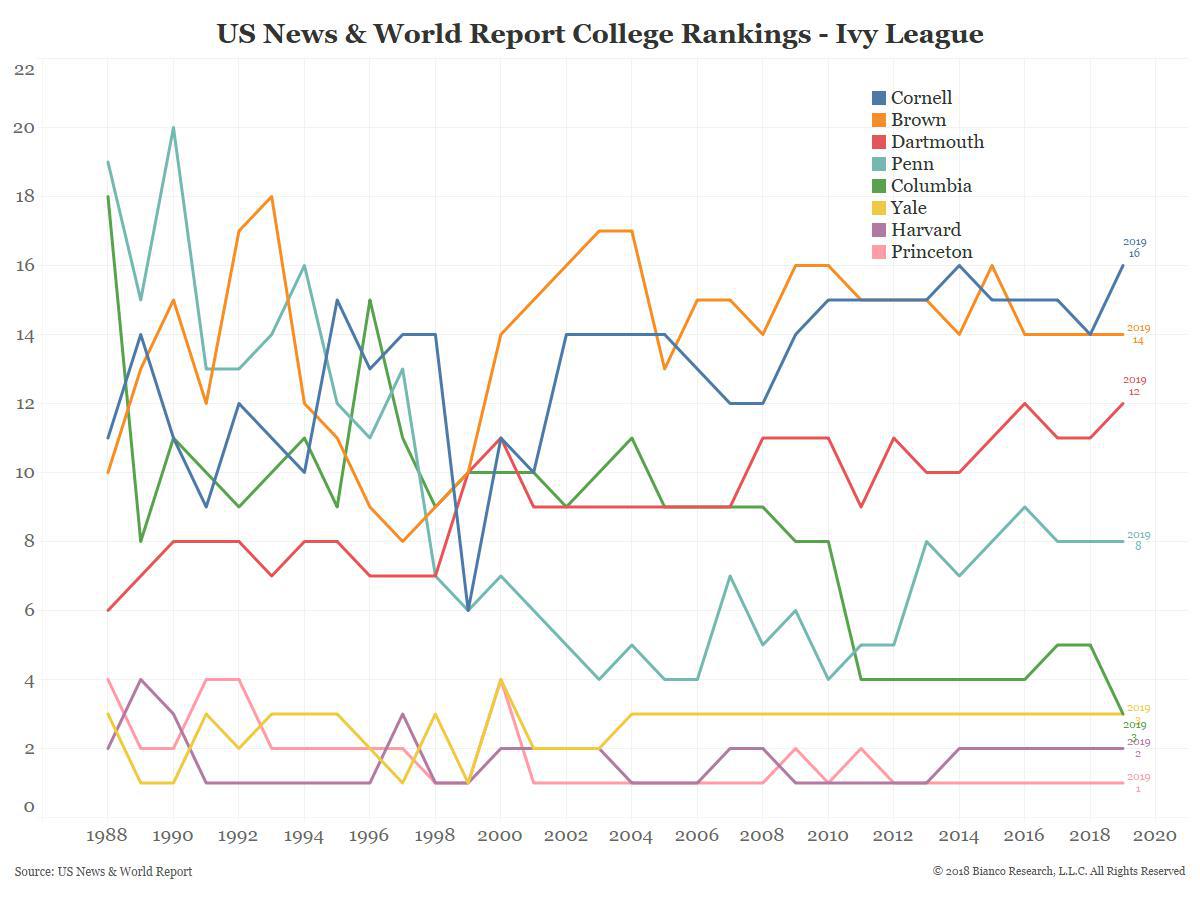

US News & World Report College Rankings

Posted By Jim Bianco

This week US News & World Report released their 2019 college rankings. This is the oldest such ranking, starting in 1983, and likely the most influential.... Read More