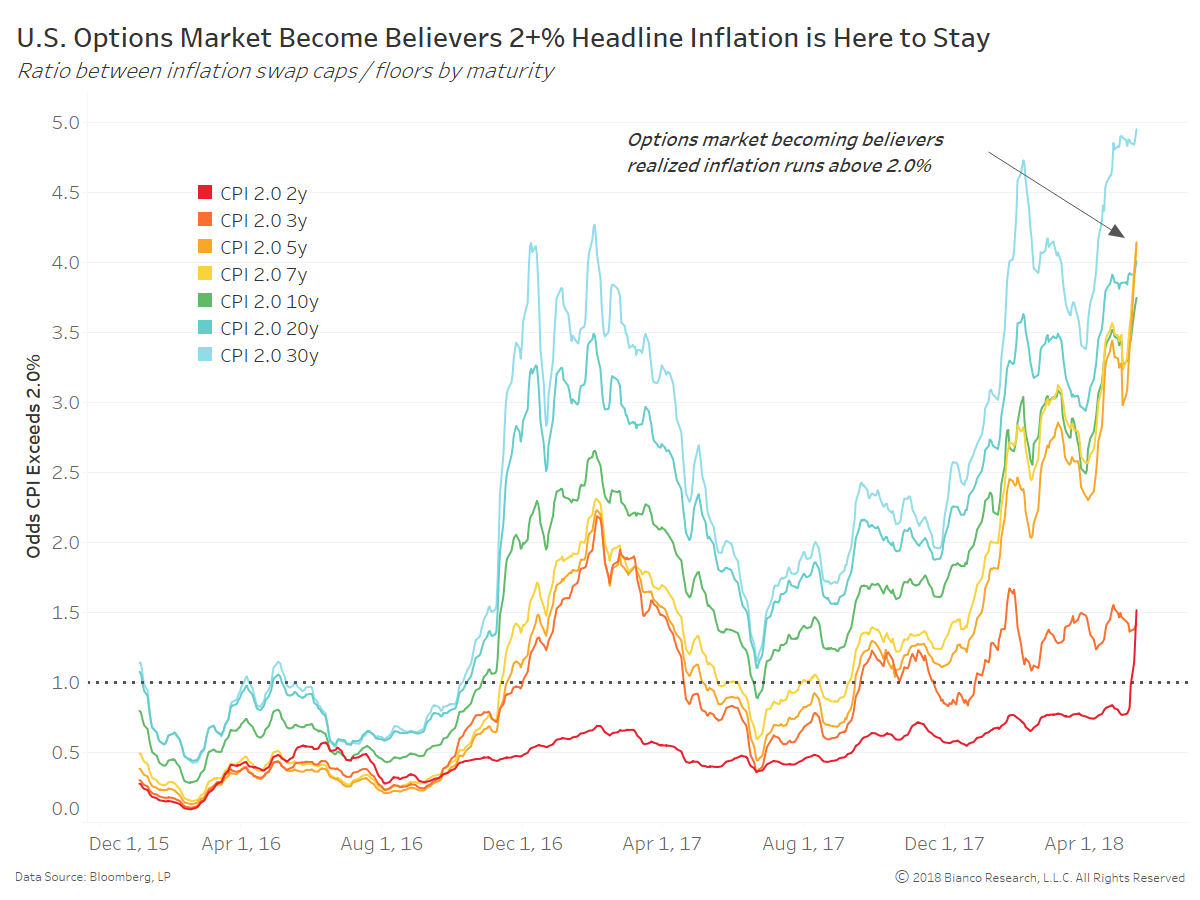

Investors Unexpectedly Commit to Higher U.S. Headline Inflation

Posted By Ben Breitholtz

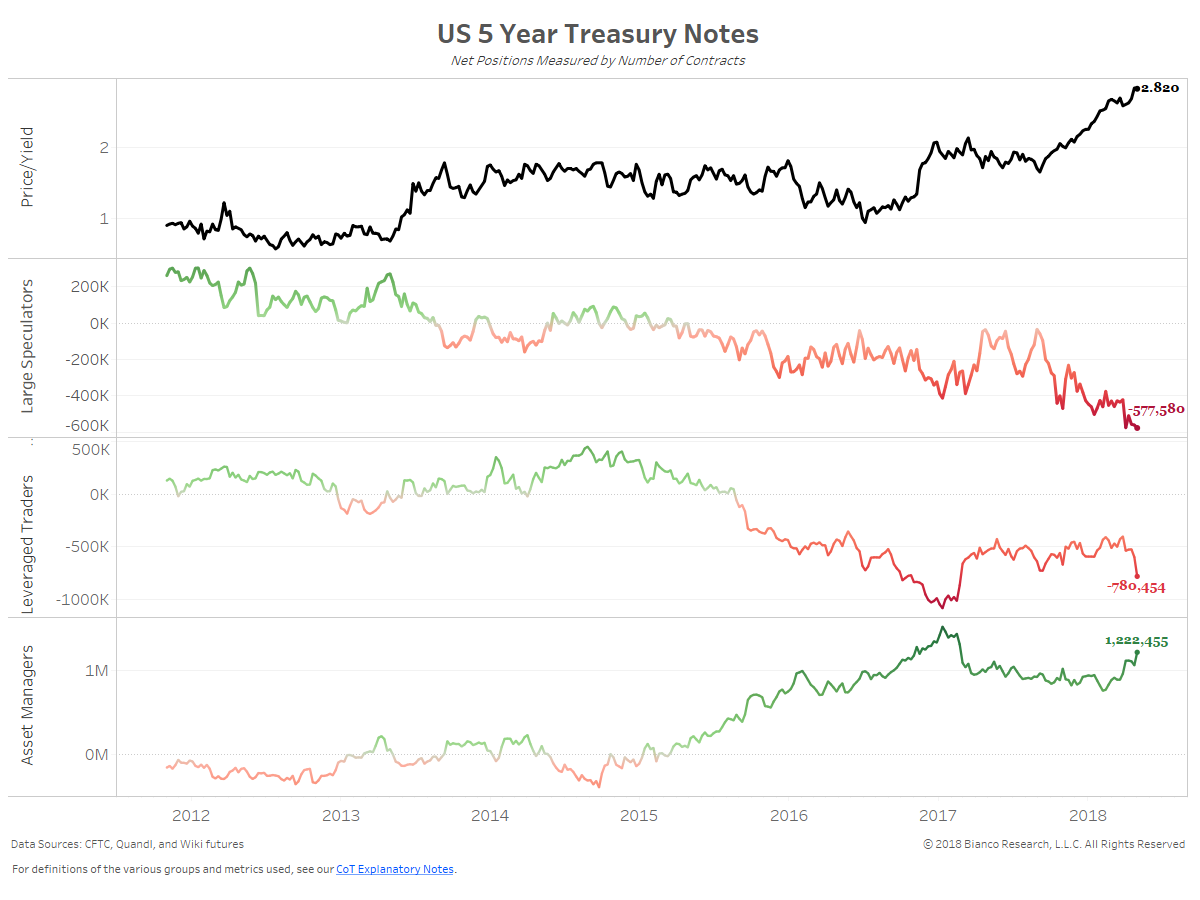

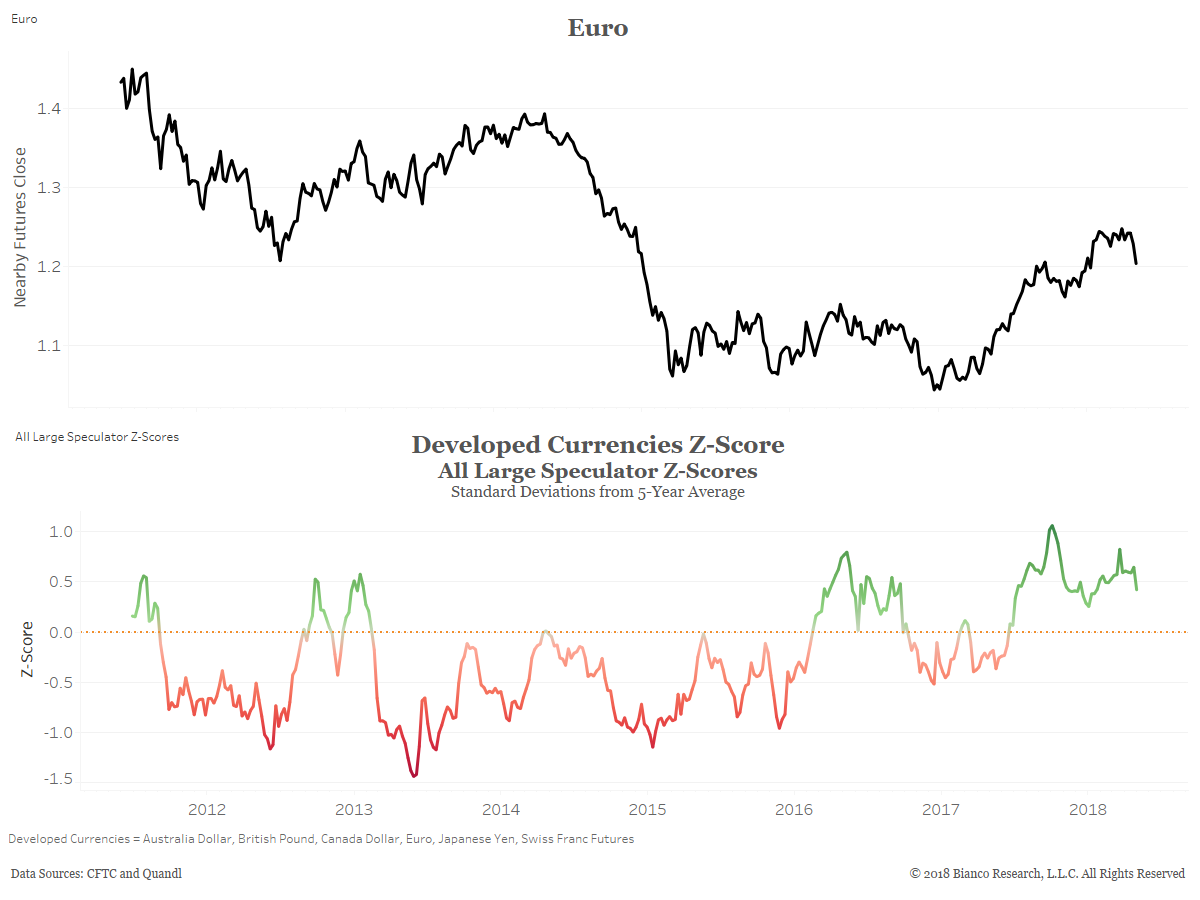

U.S. Treasury volatility may be ultra-low, but investors have finally committed to headline inflation running above 2.0% for the first time since 2014. U.S. 10-year yields are the highest across developed economies due to improving inflation momentum. But, investors must become believers in 2.5+% headline inflation to support a Fed hoping to hike another three to four times.... Read More