Jim’s View: Investors Need To Look Forward, Not Backward

Posted By Jim Bianco

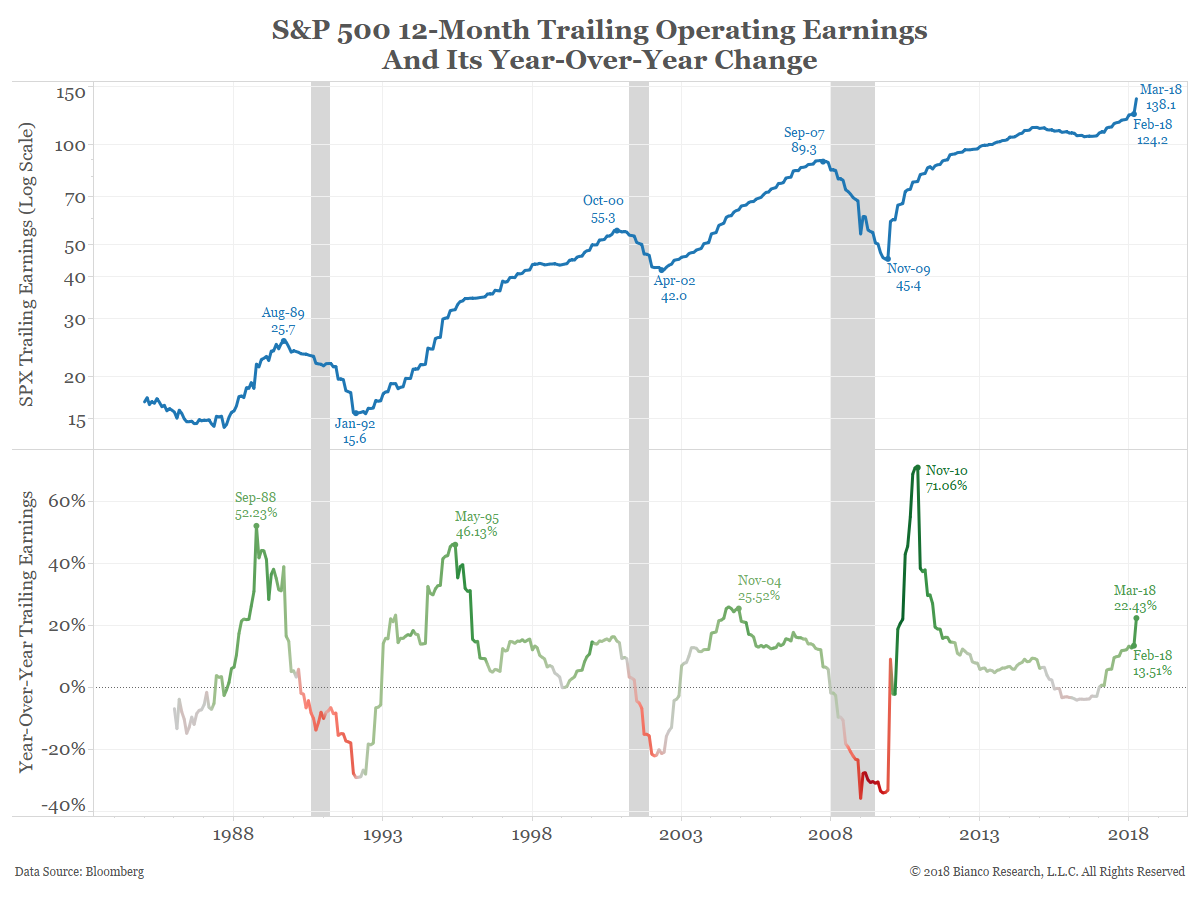

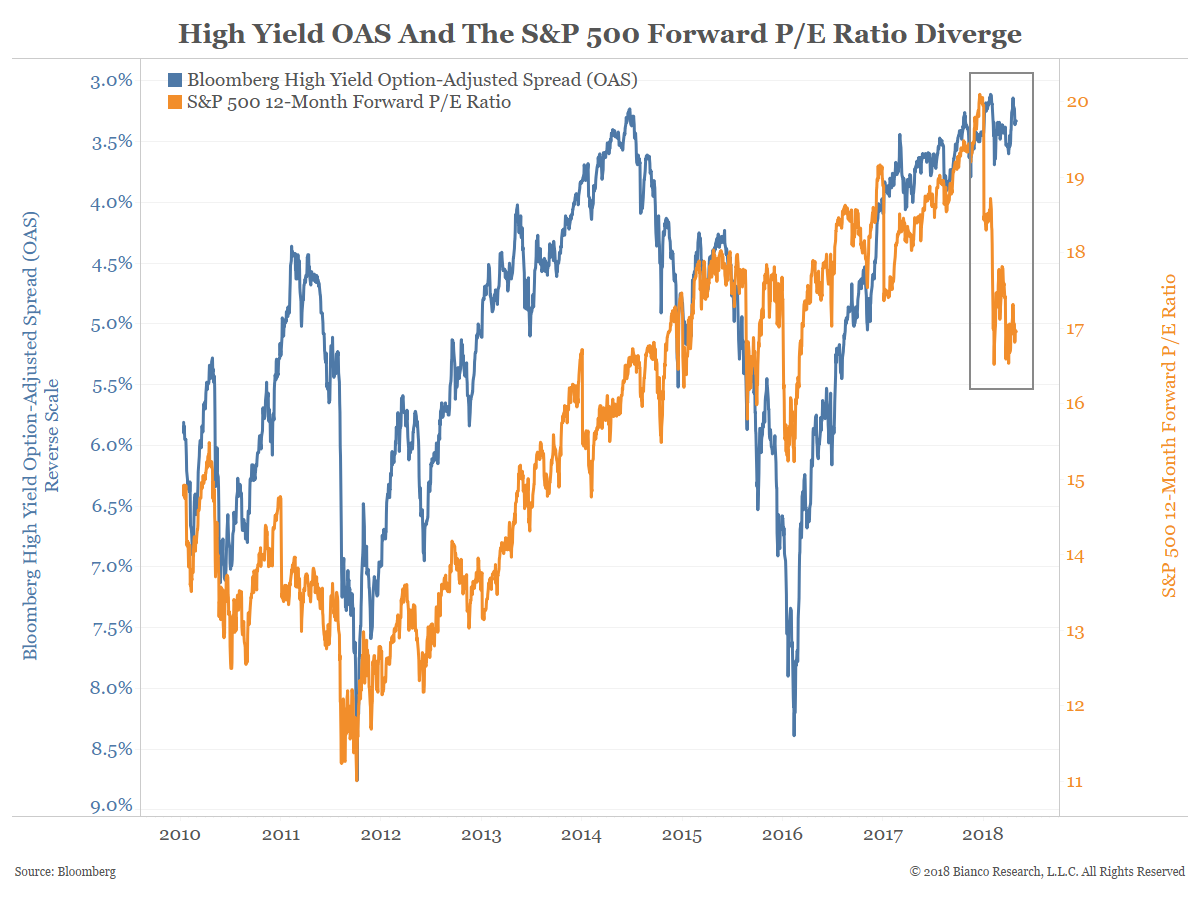

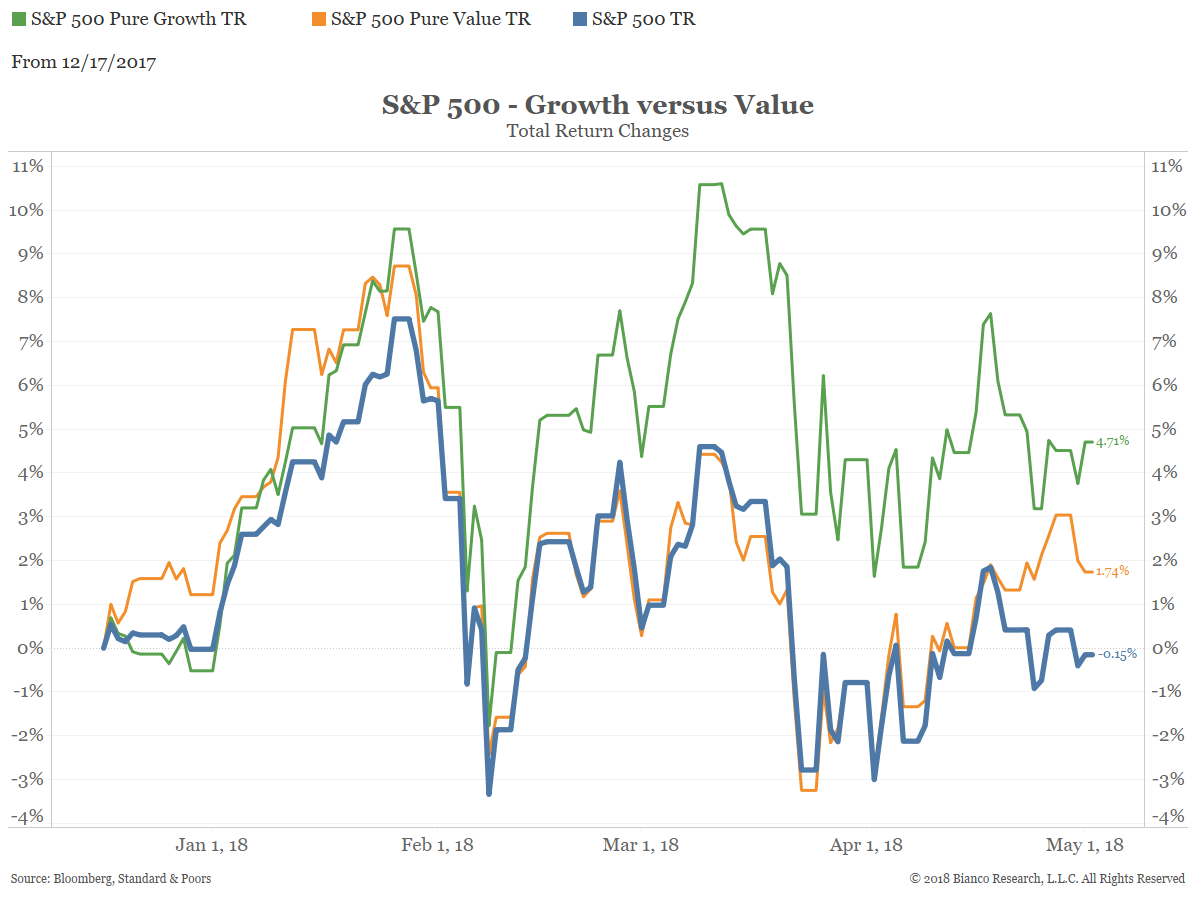

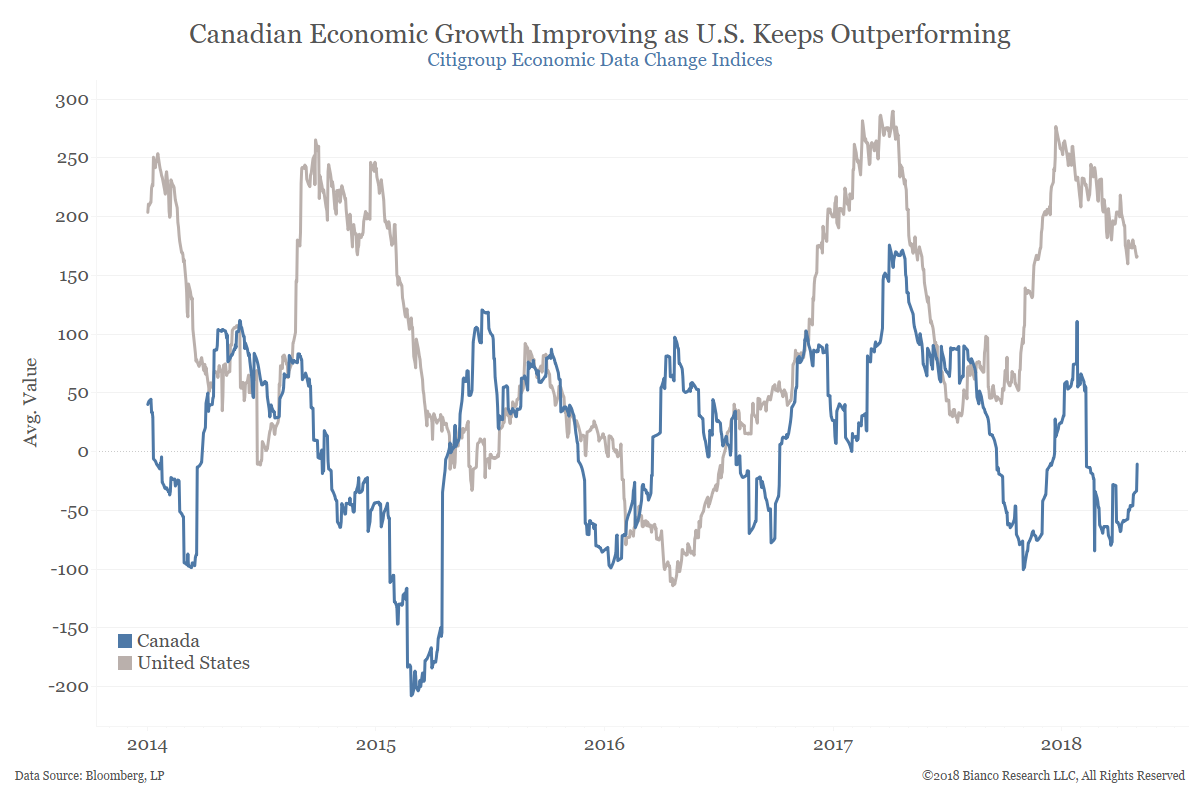

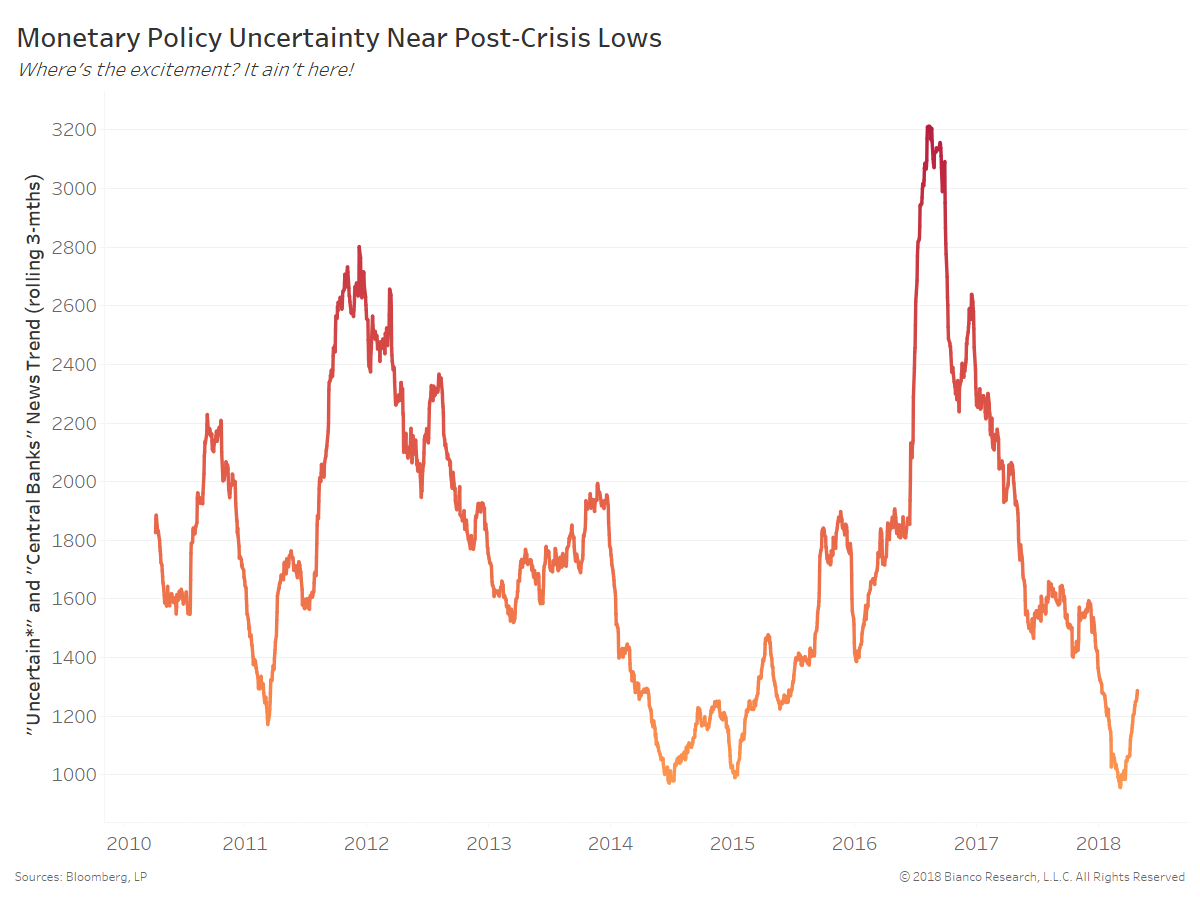

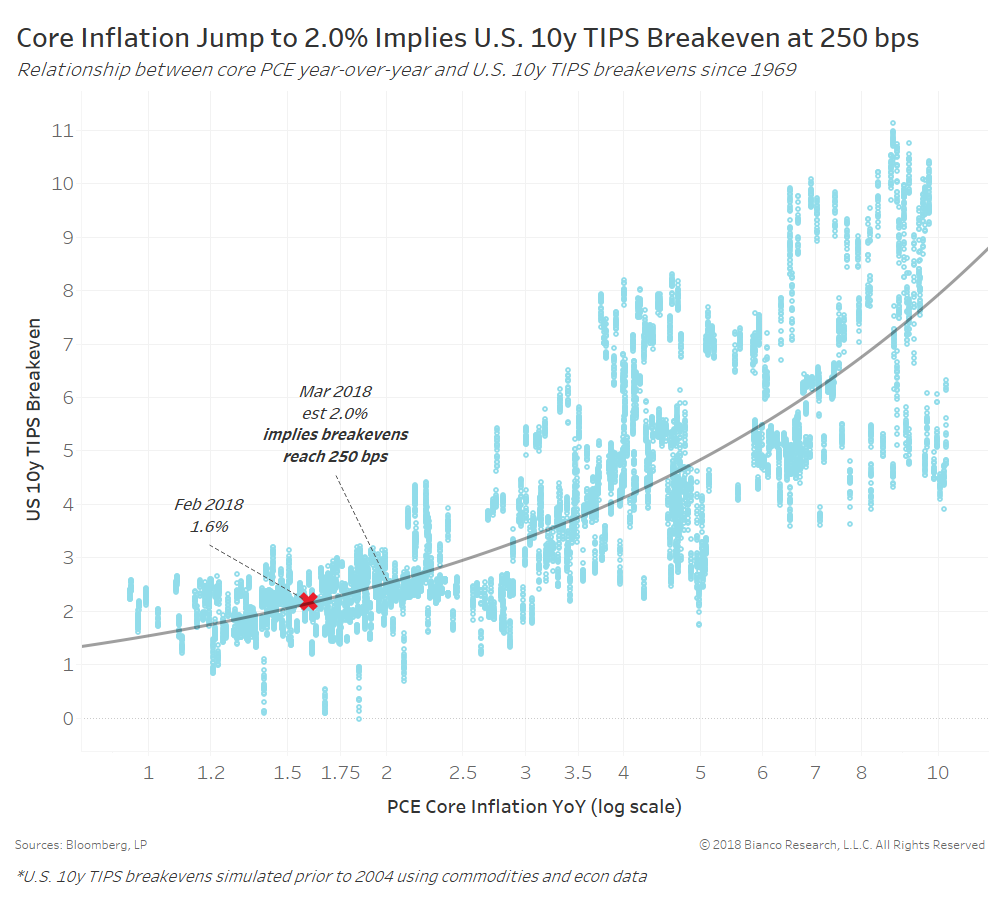

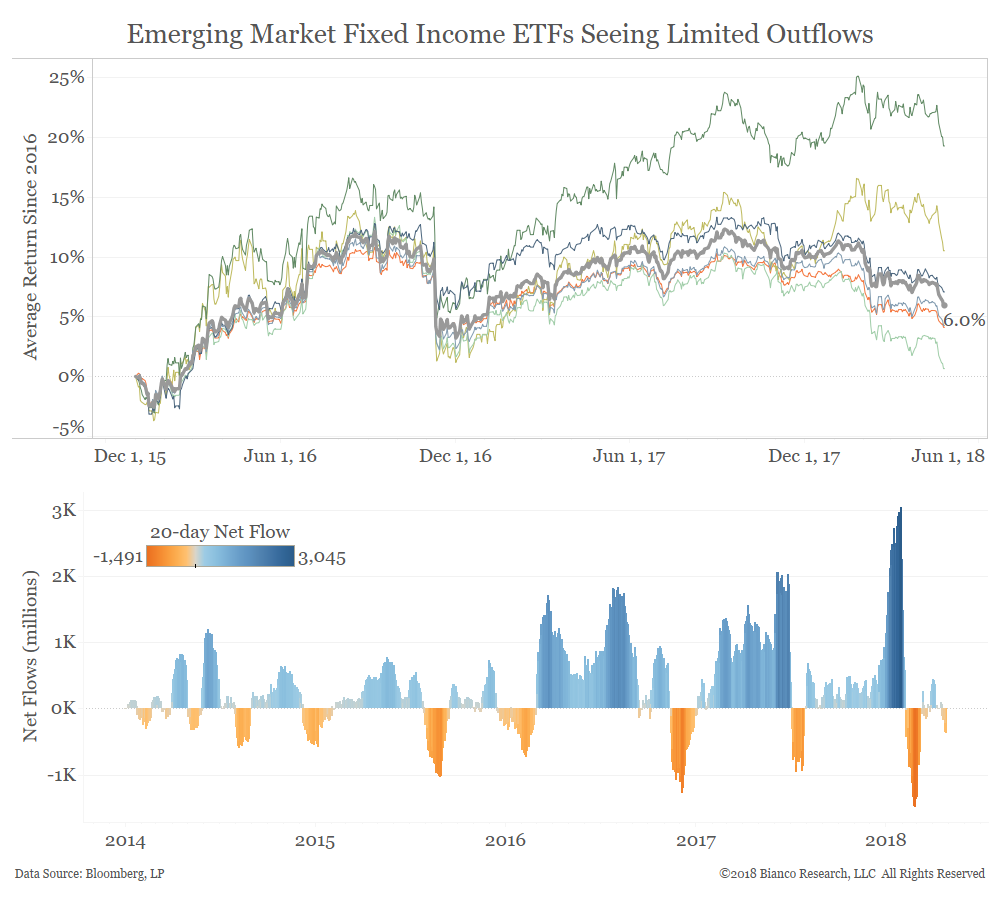

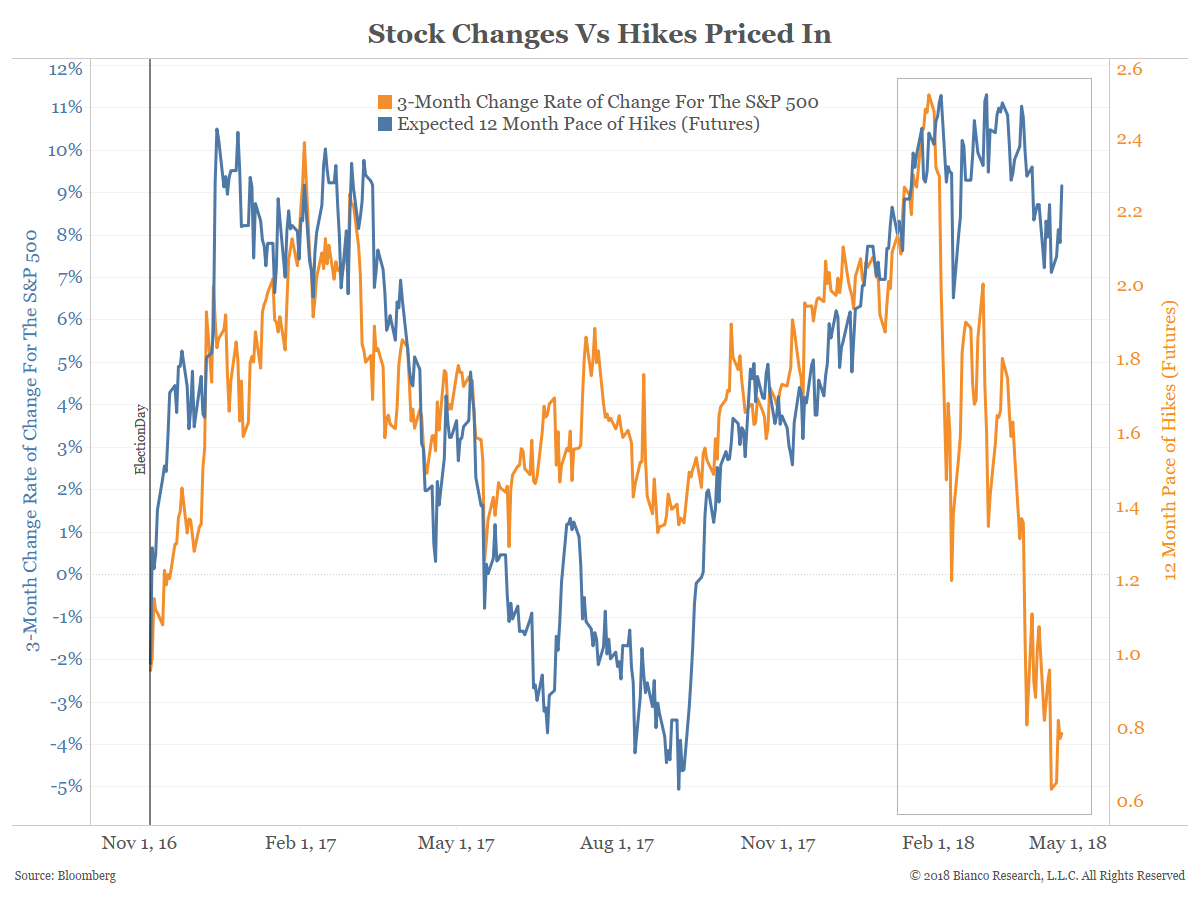

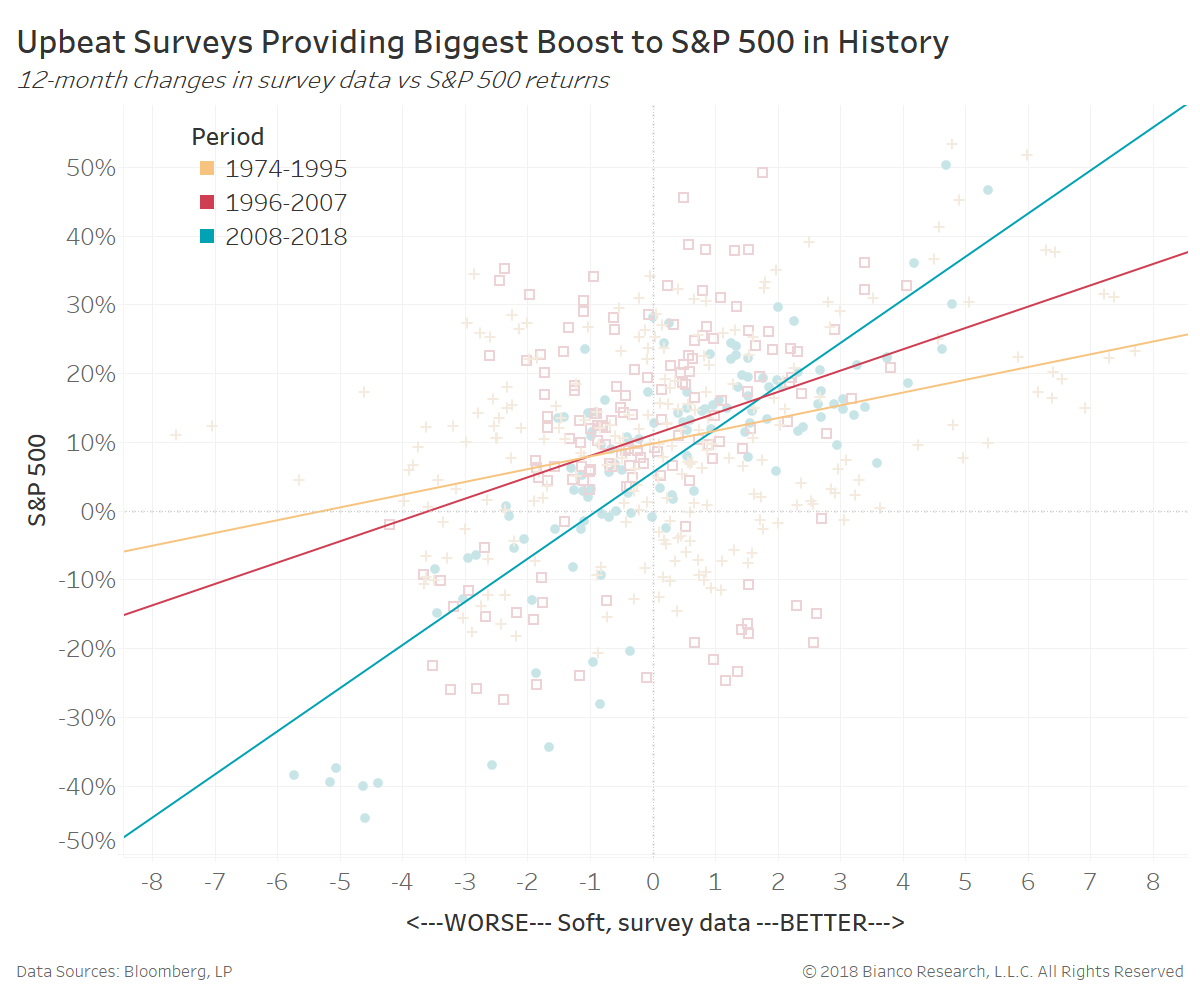

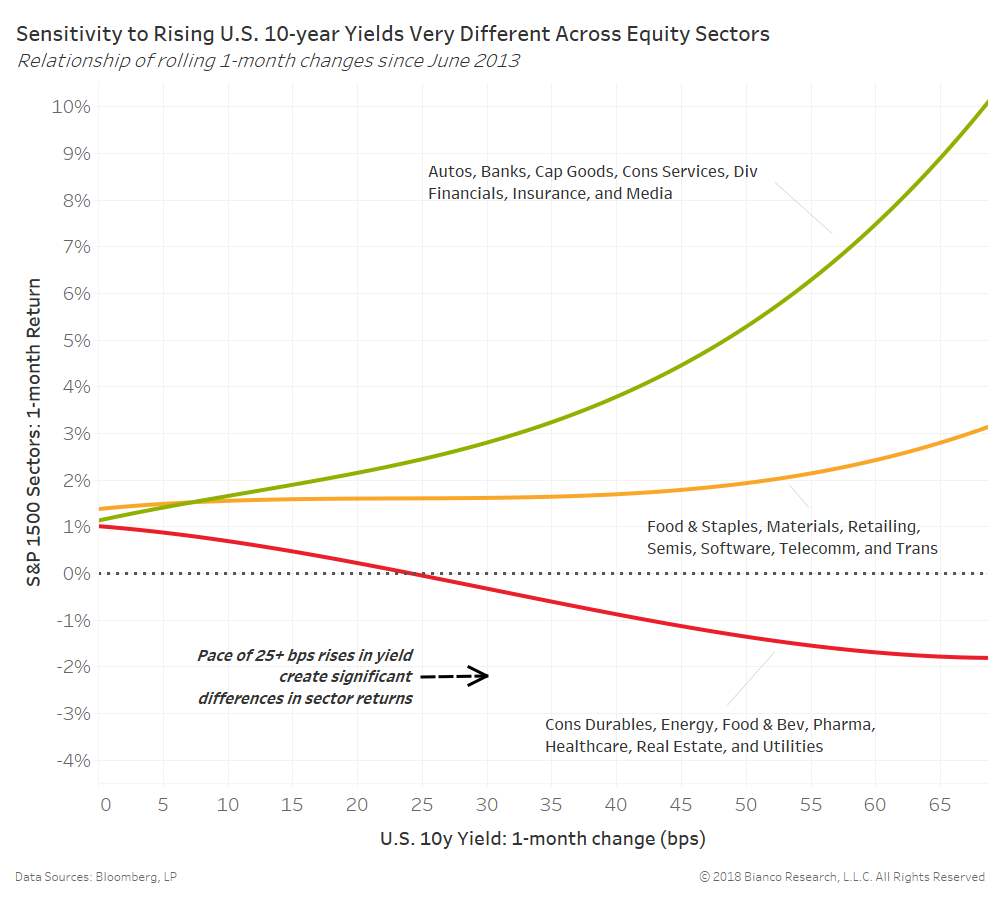

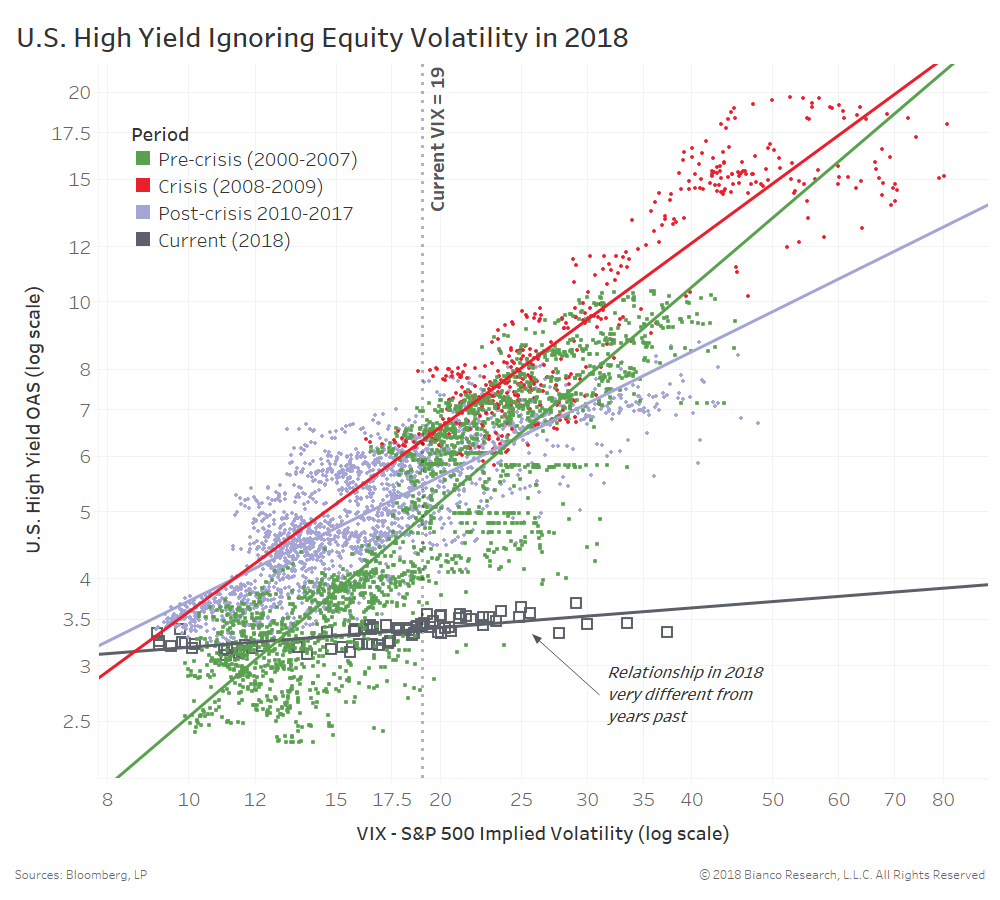

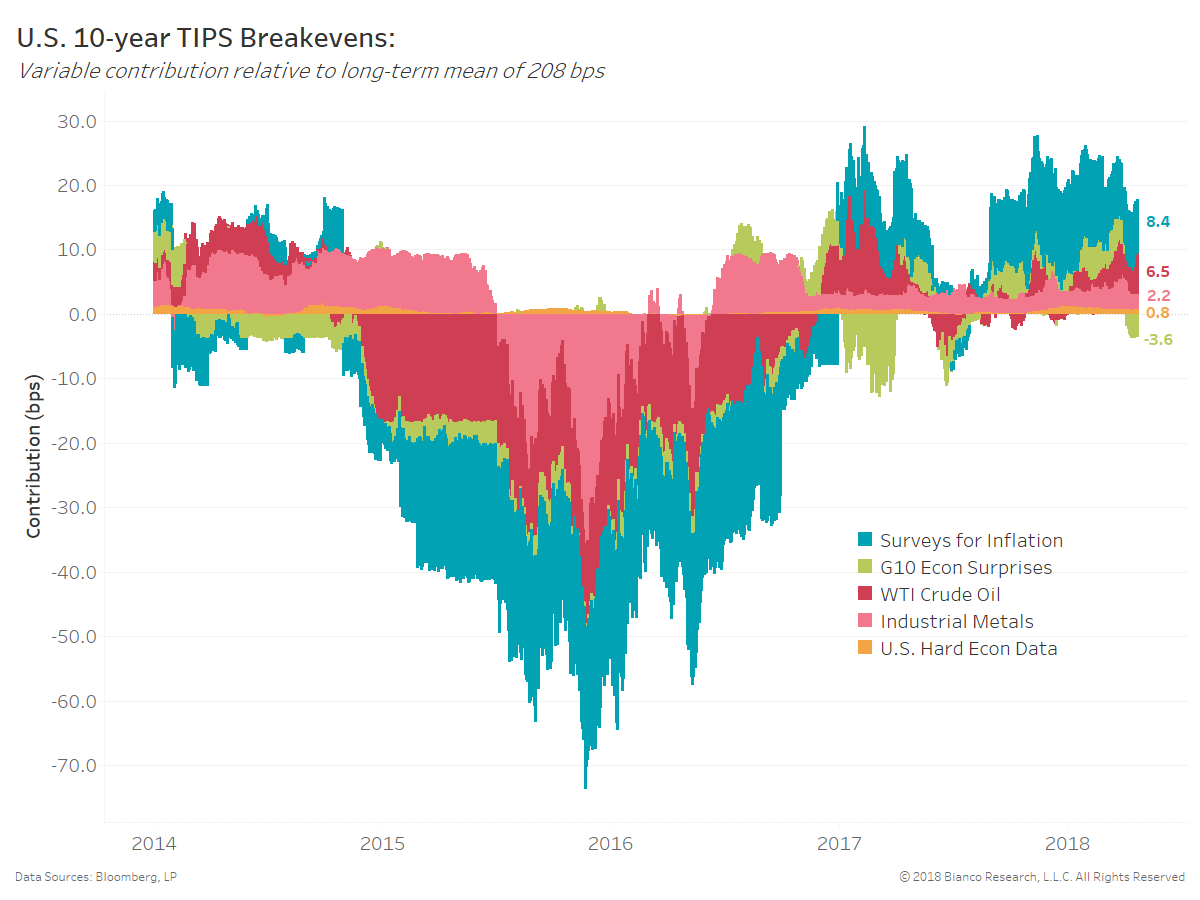

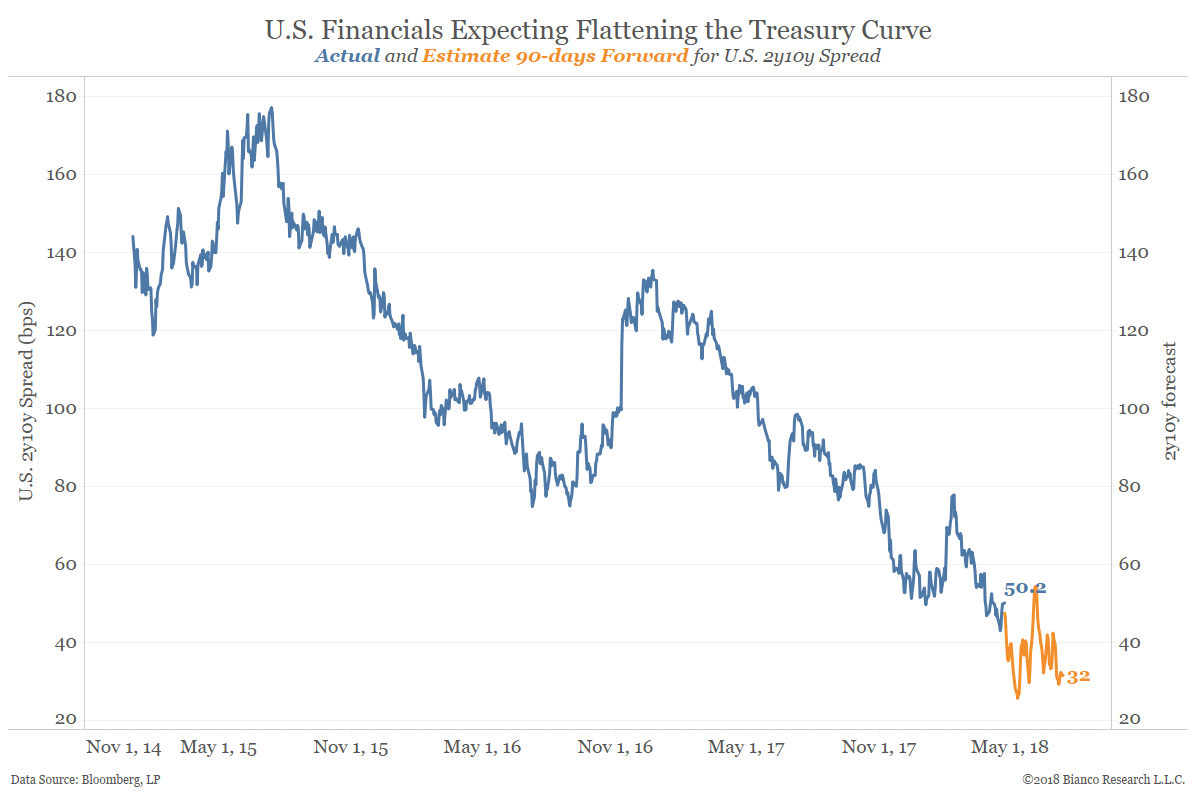

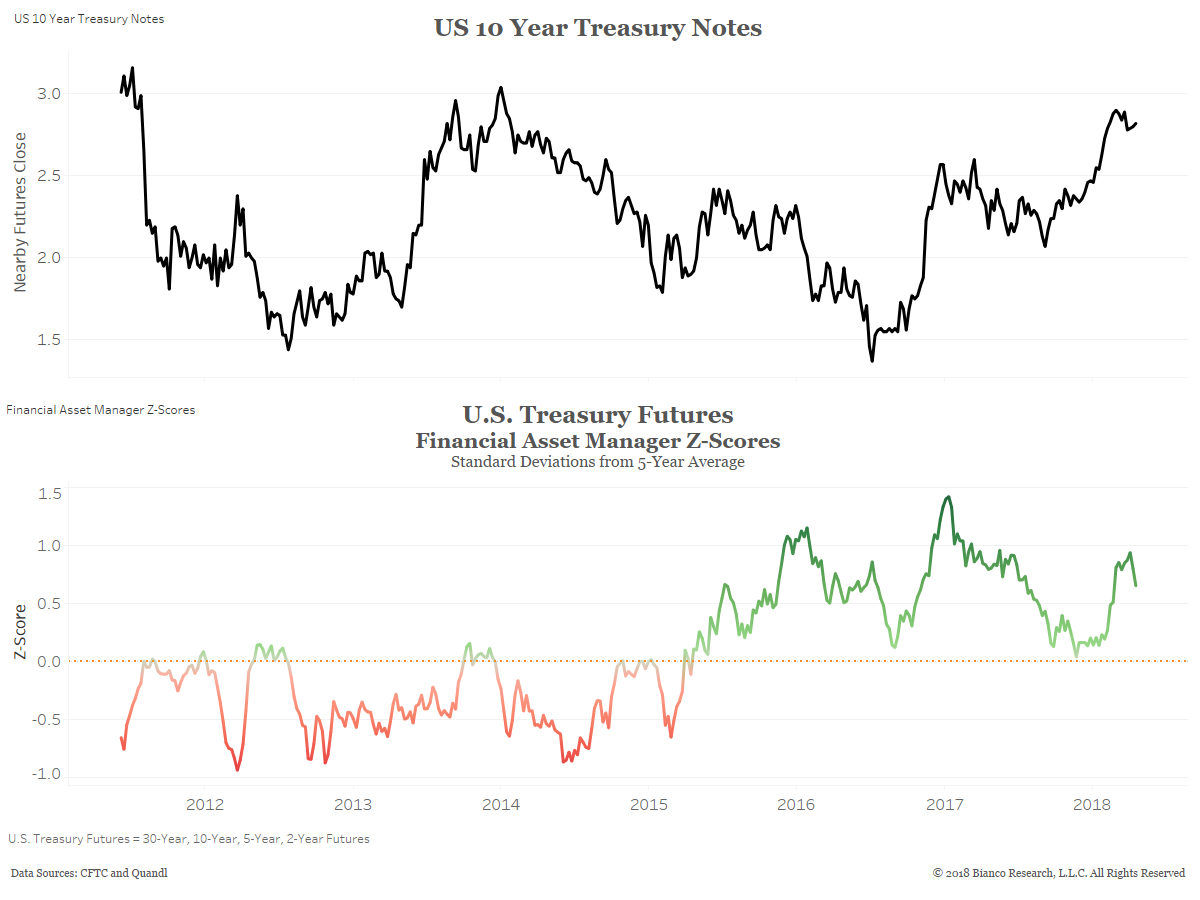

As risk markets struggle in 2018, we need to again remind ourselves they look forward and not backward. Booming earnings, deregulation, tax cuts and synchronized global growth propelled stocks earlier this year, but those themes have recently taken a back seat to peak earnings fears, rate hikes, quantitative tightening and a slowdown in Europe.... Read More