Tag Archives: Markets

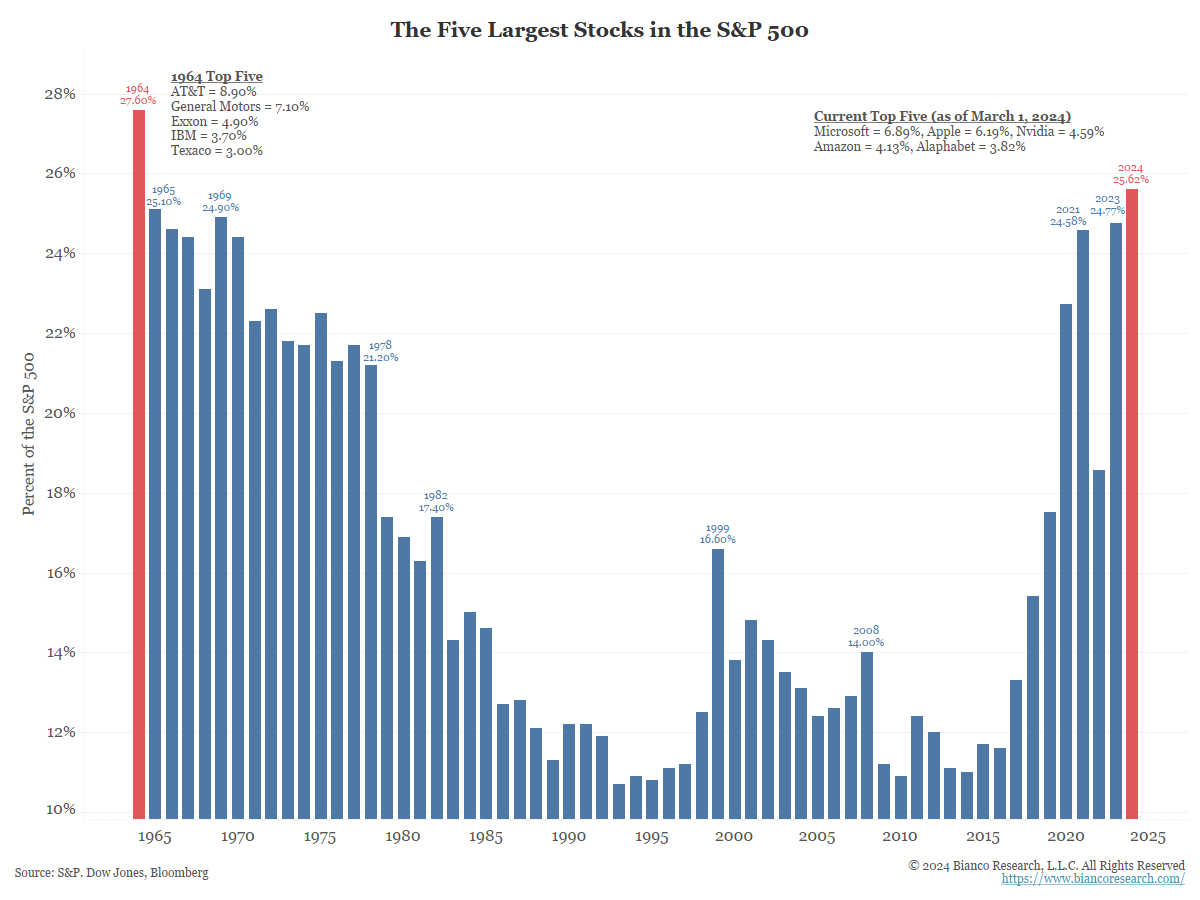

Characteristics of an Asset Bubble

Posted By Alex Malitas

Many argue about the formation of bubbles and the subsequent popping of bubbles. The truth is they are an extension of human psychology rather than a fixture of financial markets. ... Read More

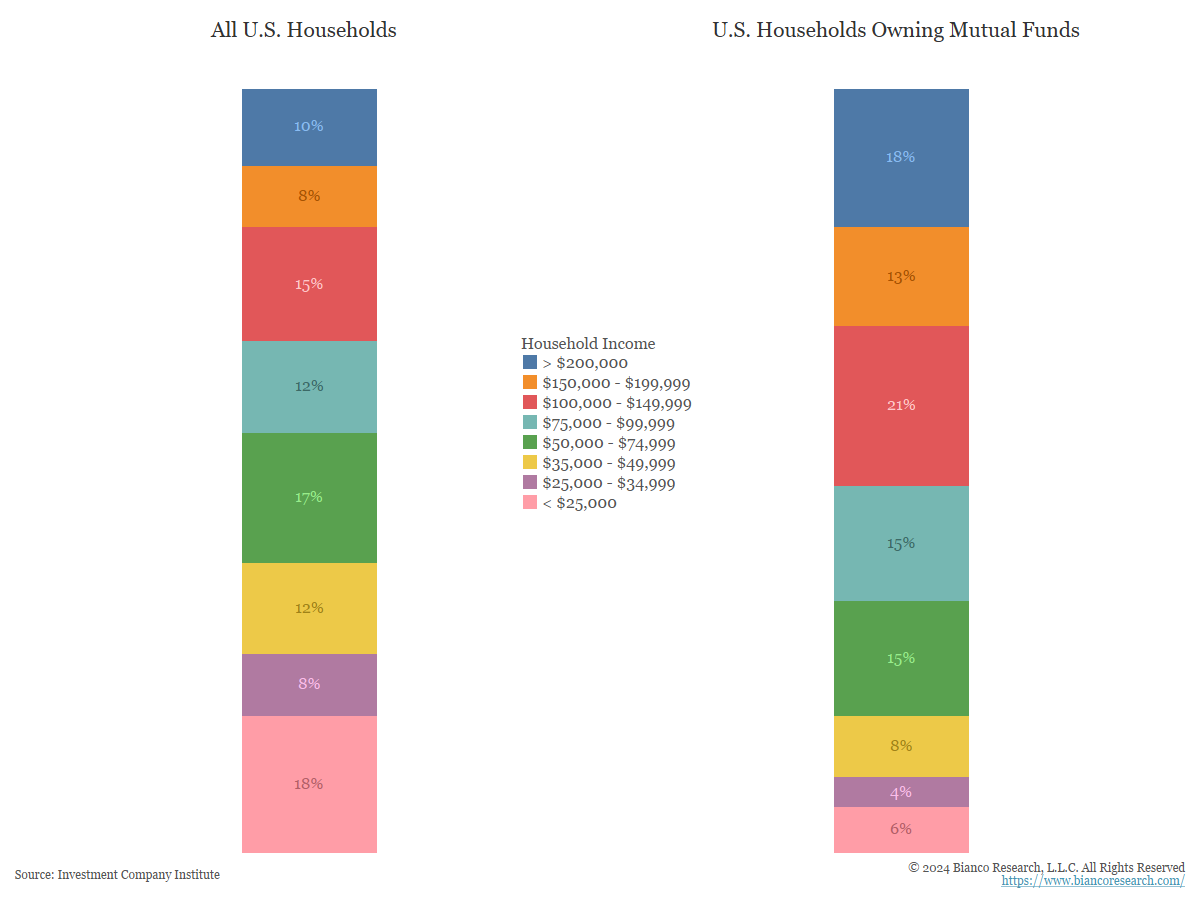

Profiling the Mutual Fund & ETF Universe

Posted By Greg Blaha

52% of households owning mutual funds make more than $100k per year.... Read More

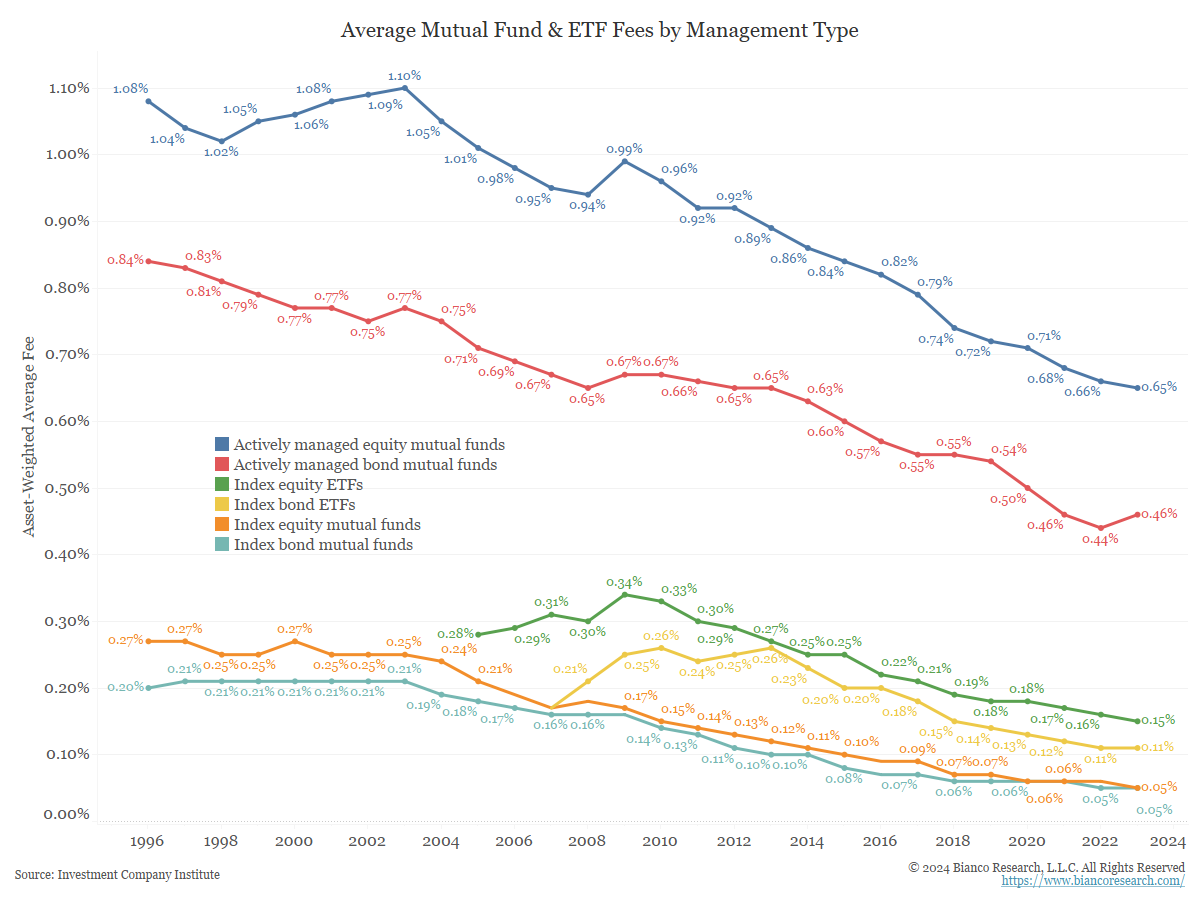

The Divide Between Active and Passive Fund Fees

Posted By Greg Blaha

Active equity mutual funds continue to charge more than 10x the fees of passive equity mutual funds.... Read More

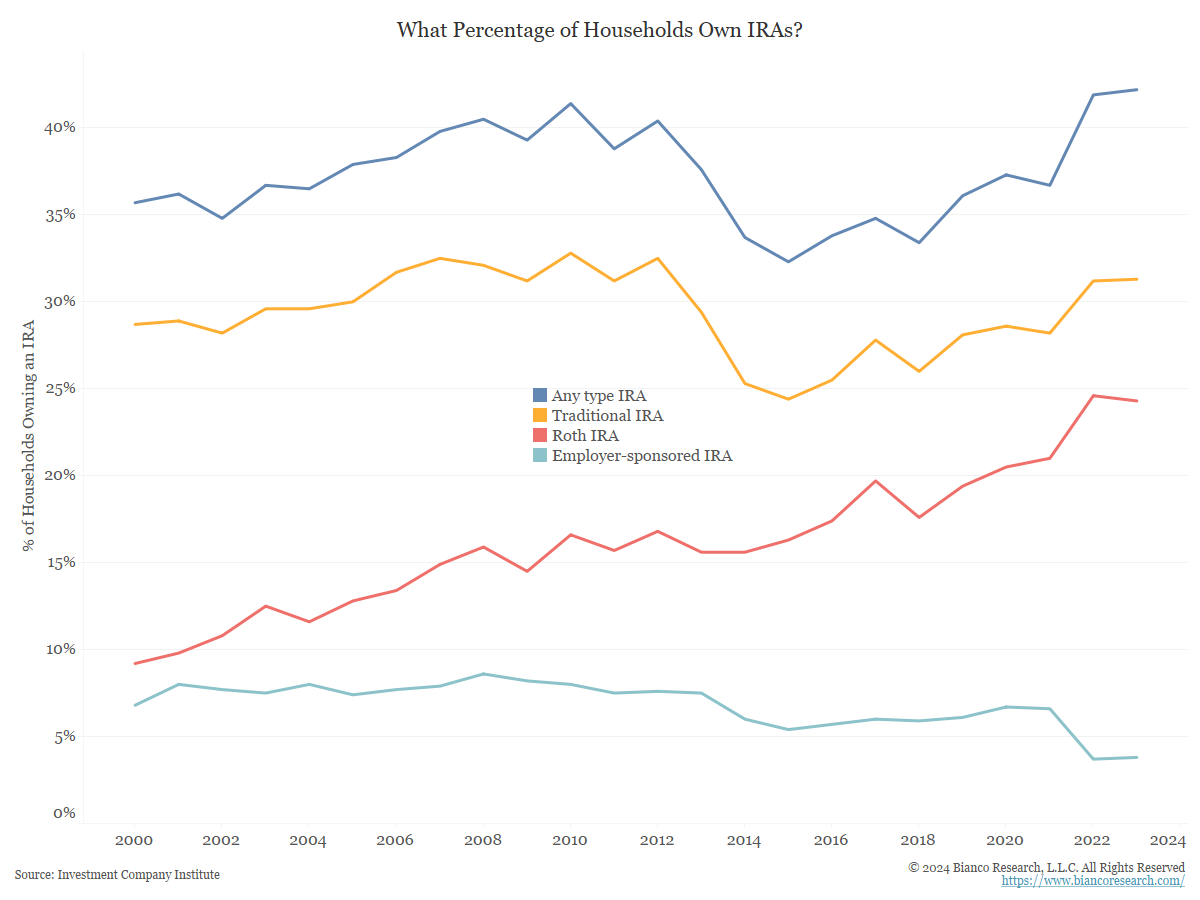

Breaking Down Retirement Assets

Posted By Greg Blaha

42% of U.S. households own an IRA. The difference in ownership between the highest and lowest income buckets is staggering.... Read More

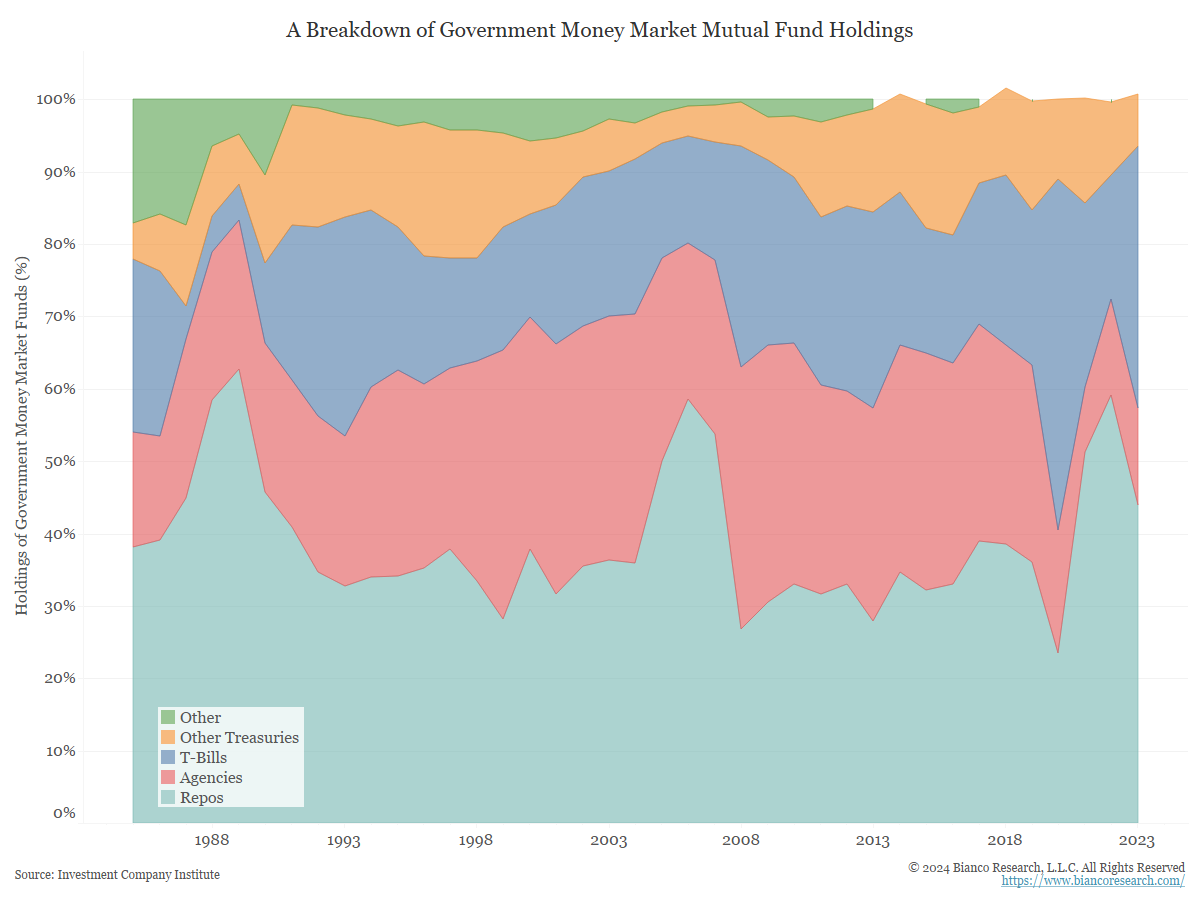

Government vs. Prime Money Market Funds

Posted By Greg Blaha

A look at the holdings of government-only money market funds versus prime money market funds... Read More

The Economy, the Deficit & Momentum Stocks Replay & Notes

Is the economy slowing? When will the deficit matter? How dominant are momentum stocks?... Read More

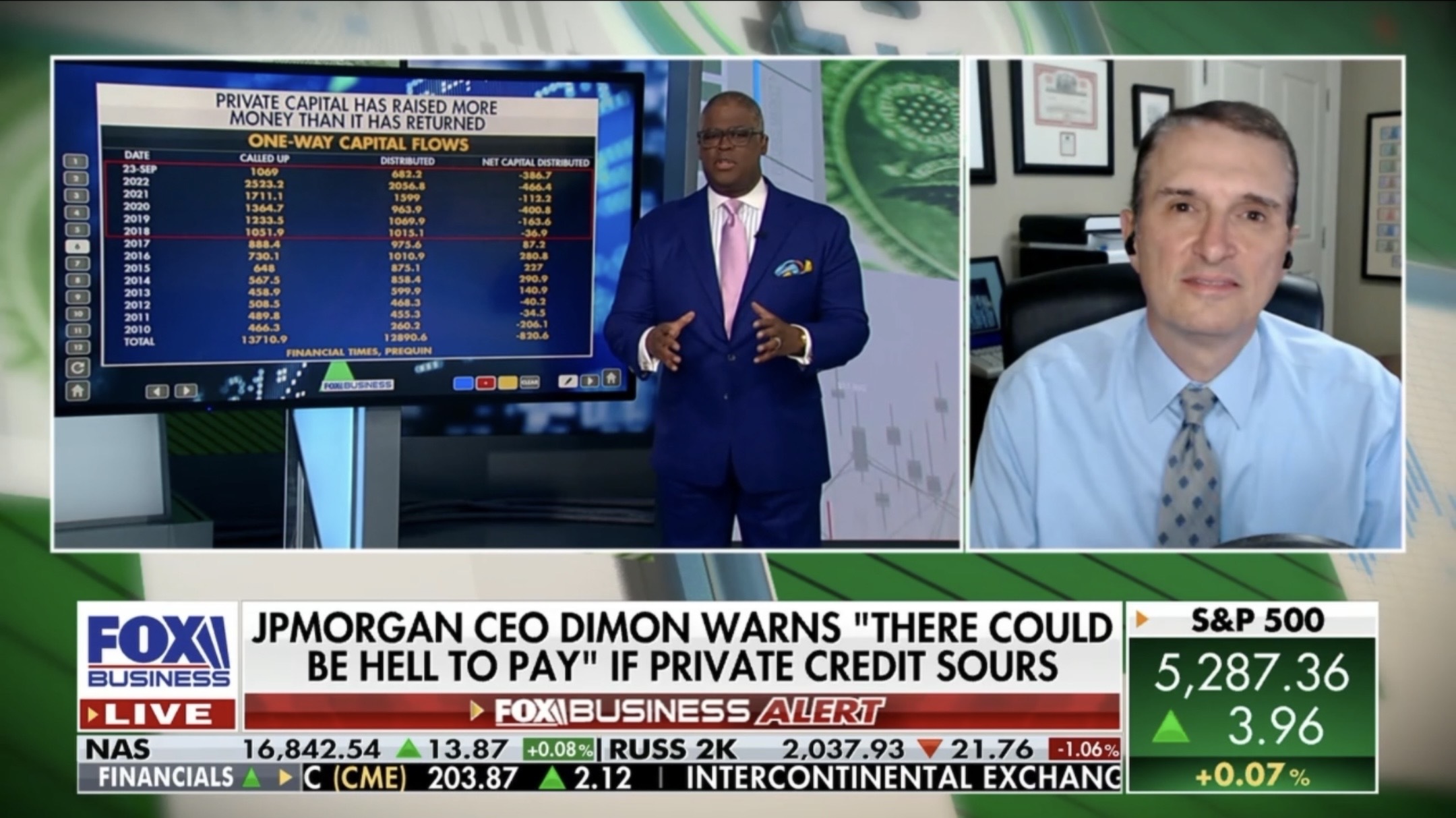

Jim Bianco on Private Credit, Market Concentration, Yield-Stock Relationship & Corporate Buybacks

Jim Bianco joins Fox Business to discuss Private Credit, Stock Market Concentration, Bond Yield-Stock Relationship & Corporate Buybacks with Charles Payne.... Read More

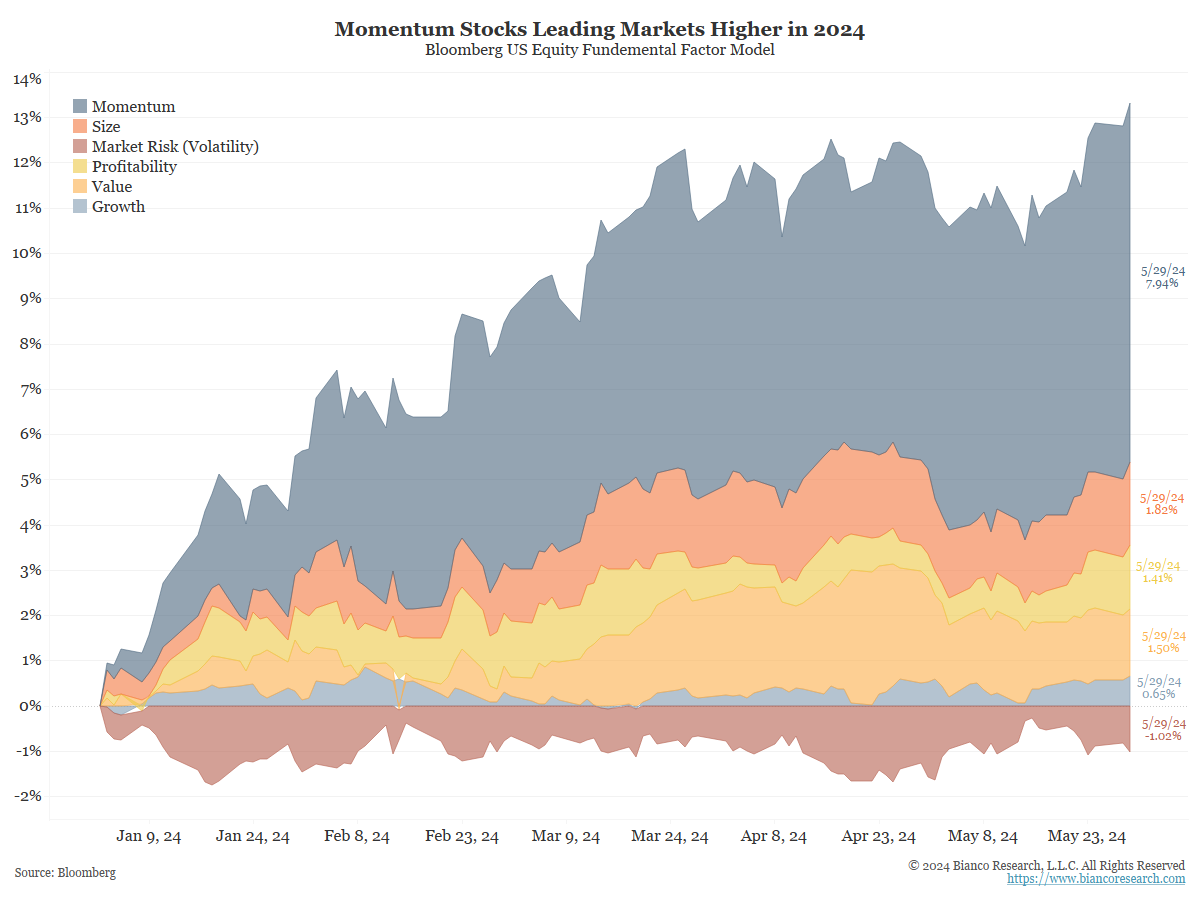

Momentum Driving Equity Returns in 2024

Posted By Alex Malitas

Factor models are widely used by active asset managers to dial in portfolio exposures. It is known that certain factors have an outsized impact on market returns during certain periods. In 2024, momentum stocks have driven equity returns. ... Read More

Jim Bianco on Economic Data Sentiment, Market Reaction After the First Rate Cut & the Bond Market

Jim Bianco joins Fox Business to discuss Economic Data Sentiment, Market Reaction After the First Rate Cut & the Bond Market with Charles Payne.... Read More

Is Lowering Rates the Answer?

Posted By Jim Bianco

The idea that lower rates will reduce interest income and rein in spending is classic Modern Monetary Theory thinking. Its basis is the wealth effect. But if cutting rates produces booming stocks, it can supercharge spending and increase inflation.... Read More

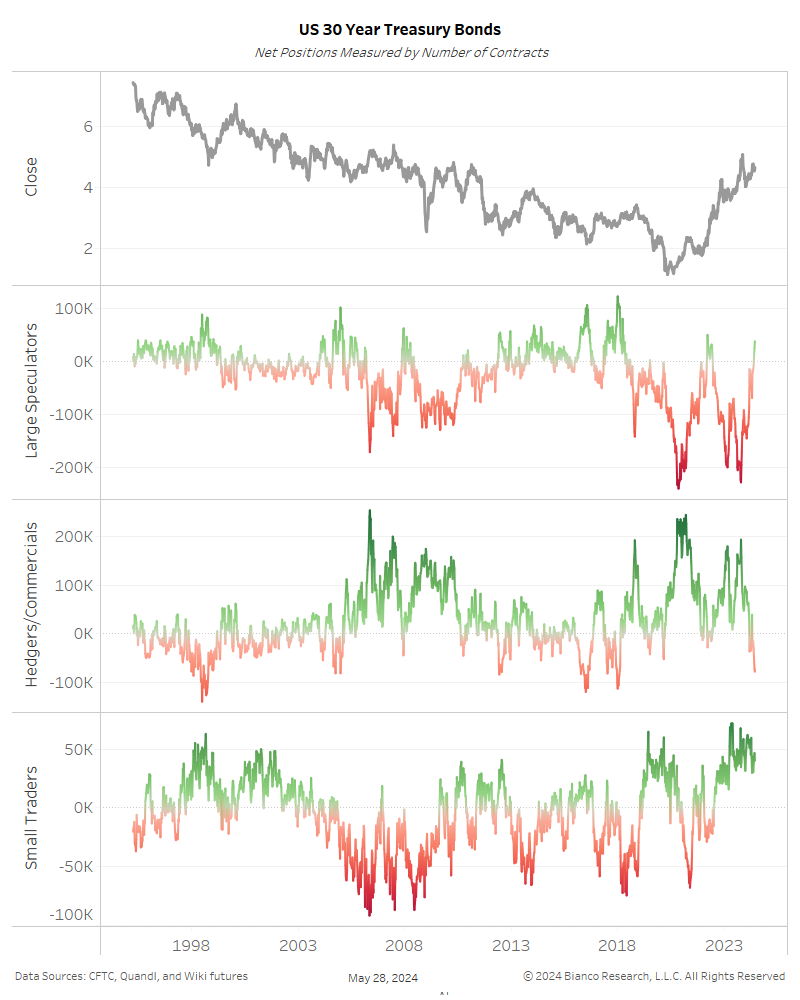

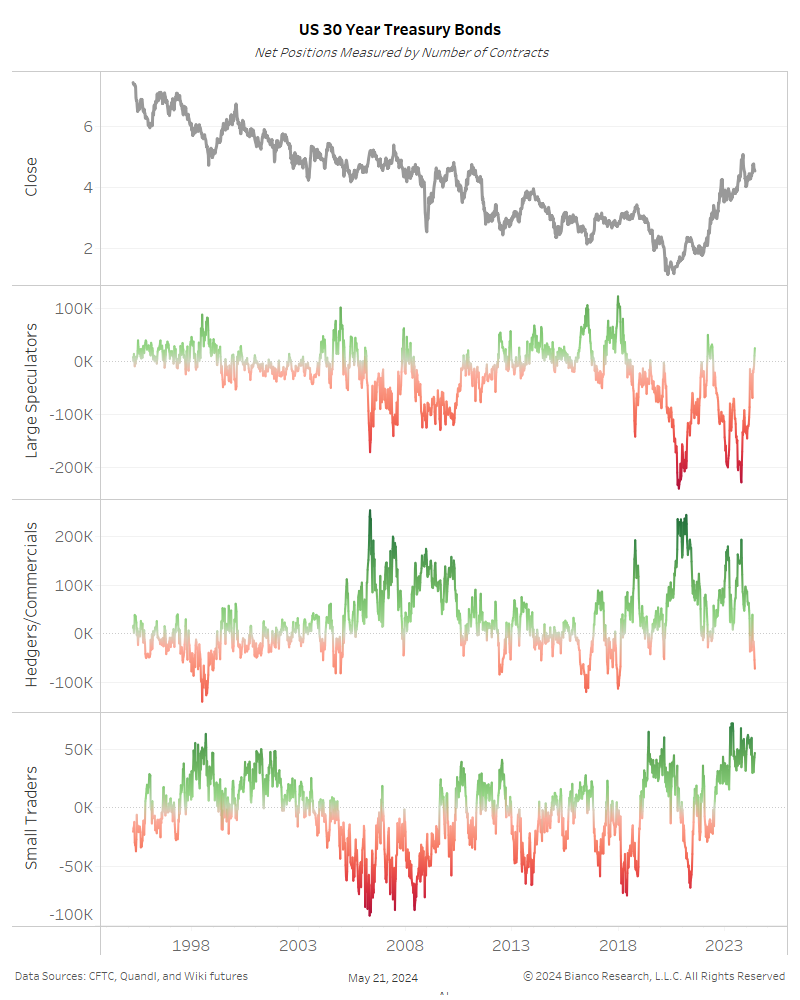

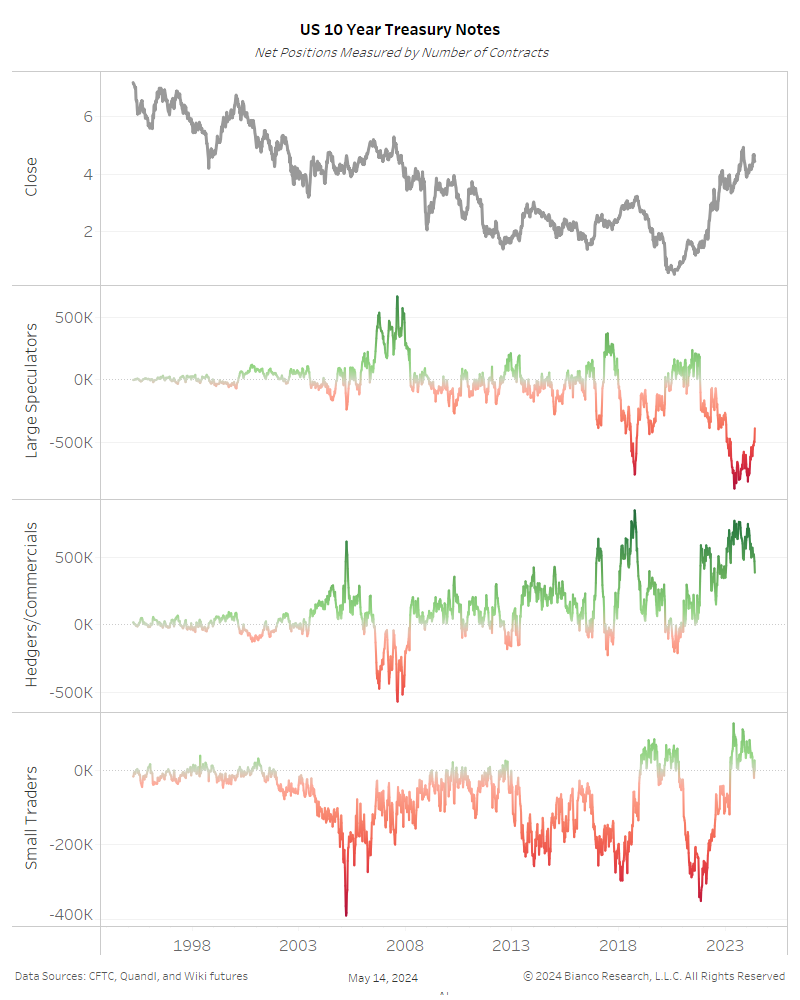

Bianco Research Conference Call Replay & Notes – Updating the Economic Landscape

The economic data since January has been strong. As a result, 10-year yields rose about 80 basis points, hopes for Fed rate cuts were dashed, and stocks rallied. But in recent weeks, the payroll report came in below expectations and initial claims unexpectedly jumped higher. CPI did not produce a number that is likely to move the needle much.... Read More

Jim Bianco joins CNBC to recap the CPI Report, the Stock Market’s Reaction & the 2% Inflation Target

Jim Bianco recaps the CPI Report, the Equity Market's Reaction & the 2% Inflation Target on CNBC's "The Bond Report" with Rick Santelli.... Read More

Jim Bianco joins Bloomberg Surveillance & Bloomberg Radio

Jim Bianco joins Bloomberg Surveillance & Bloomberg Radio to discuss the Bond Market, the Last Mile of Inflation, Fed Rate Cut Timing & the Post-Lockdown Economy.... Read More

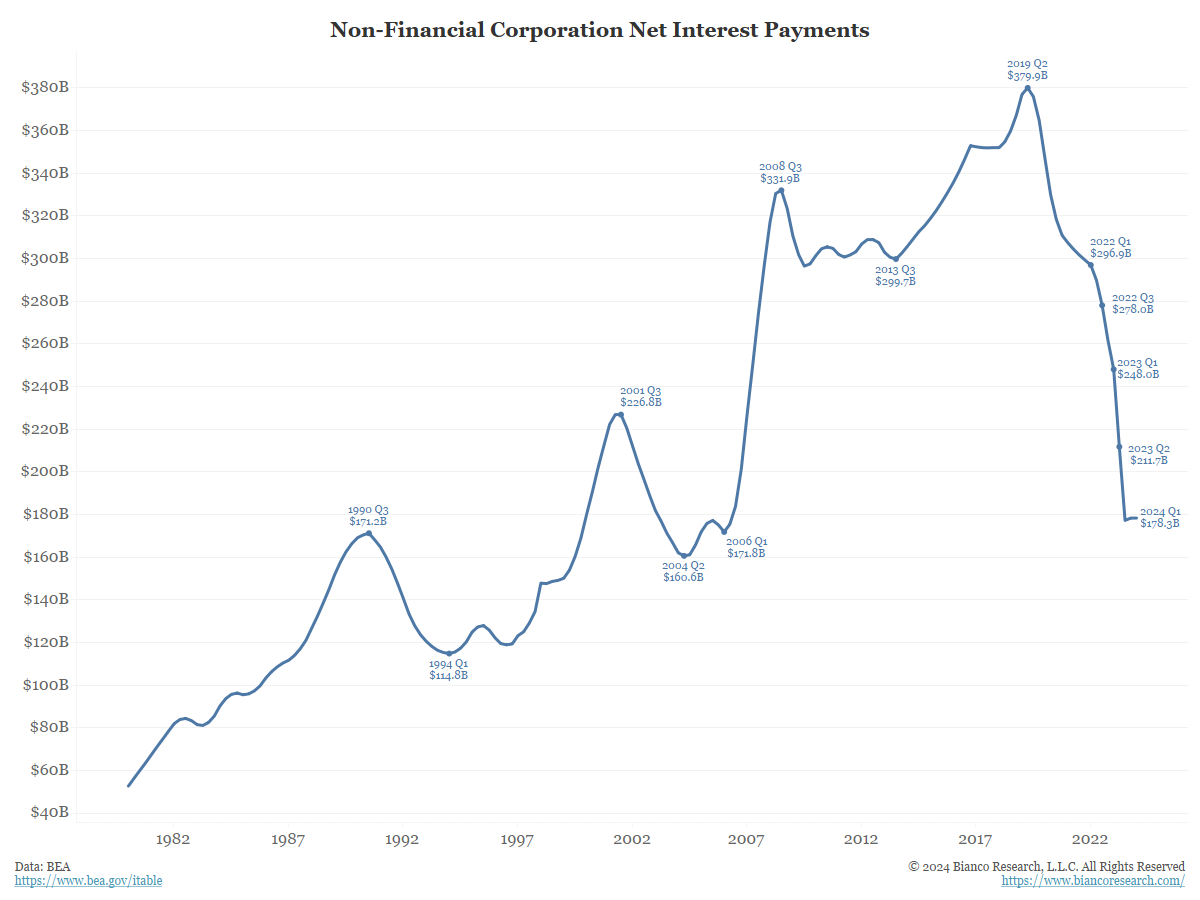

The Government Could Learn Something From Corporations

Posted By Greg Blaha

Non-financial corporations are getting a bigger benefit from higher interest income than the drag from higher interest expenses. Consequently, their financial position is improving. This may be why higher rates are not hurting the economy.... Read More