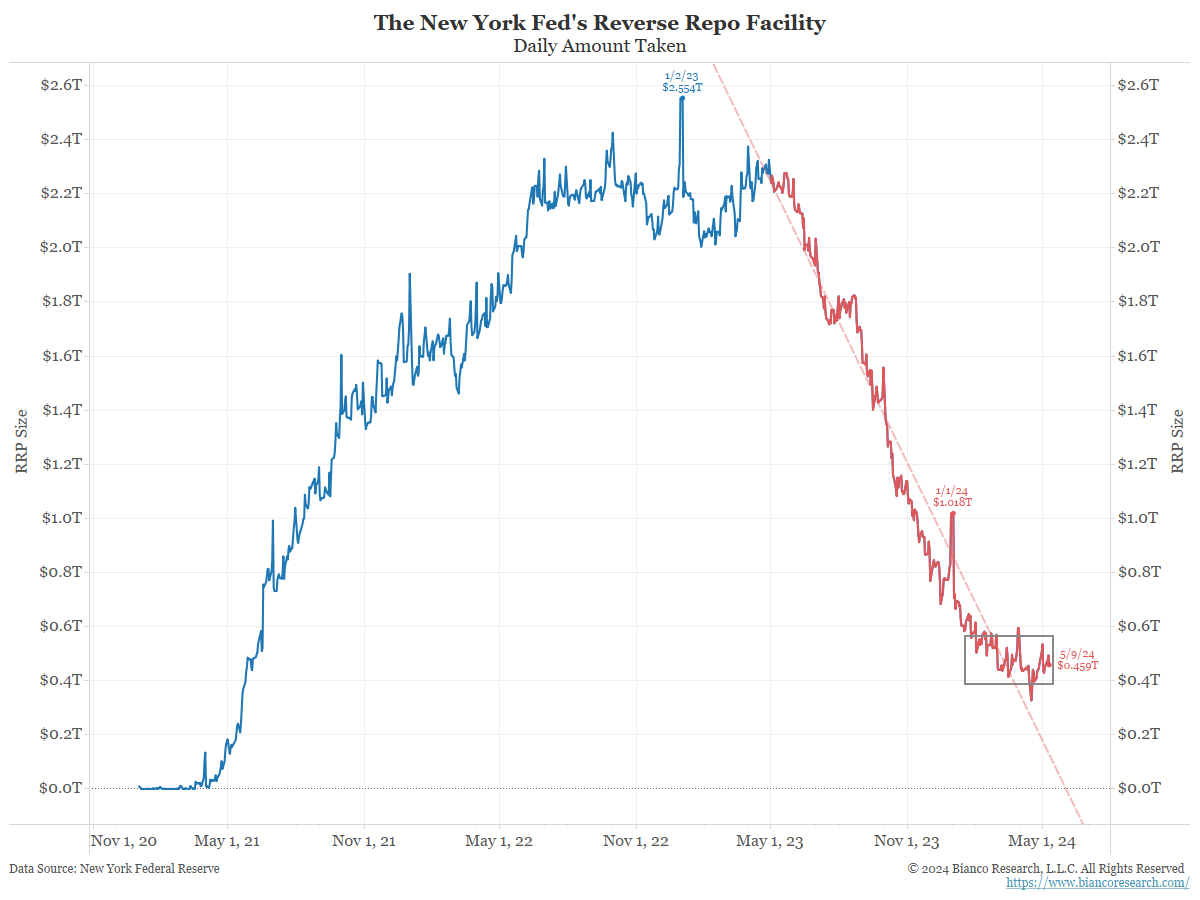

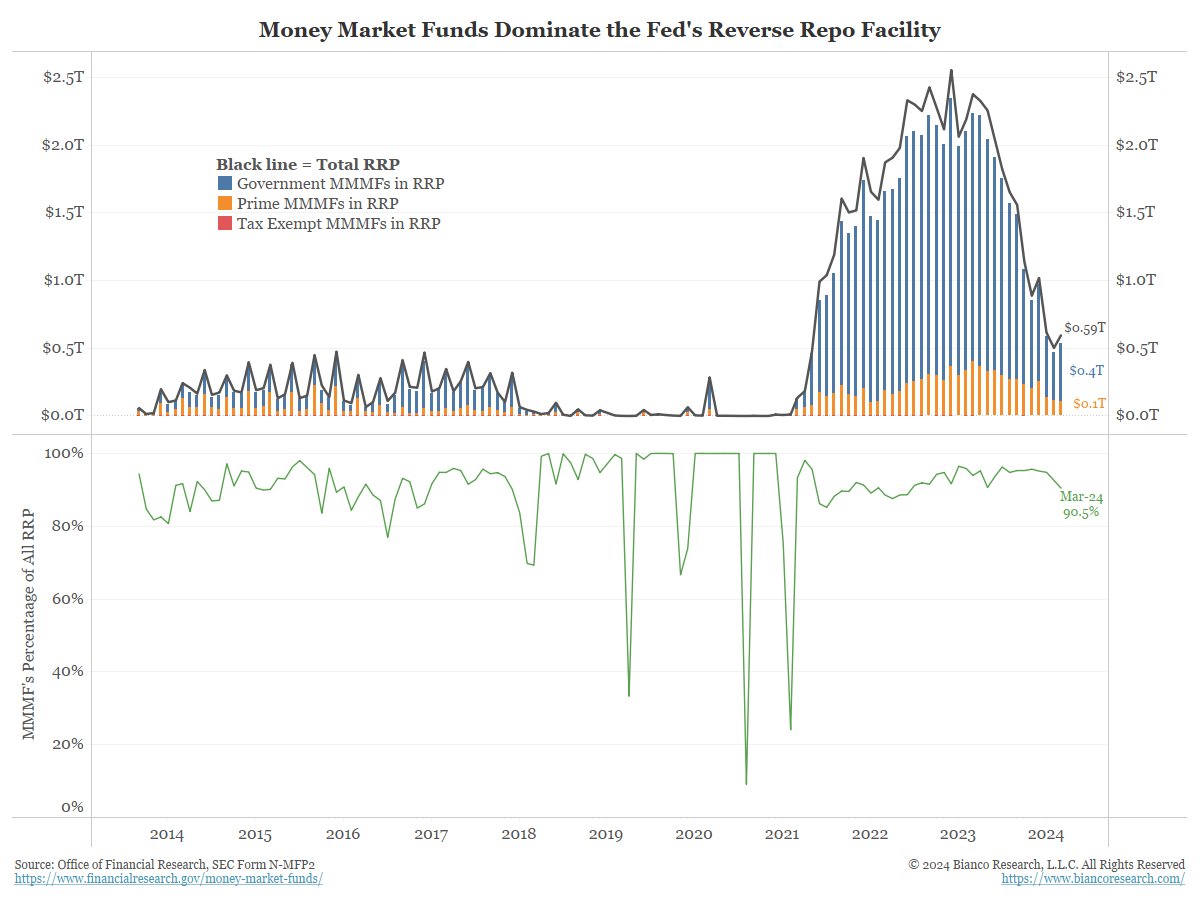

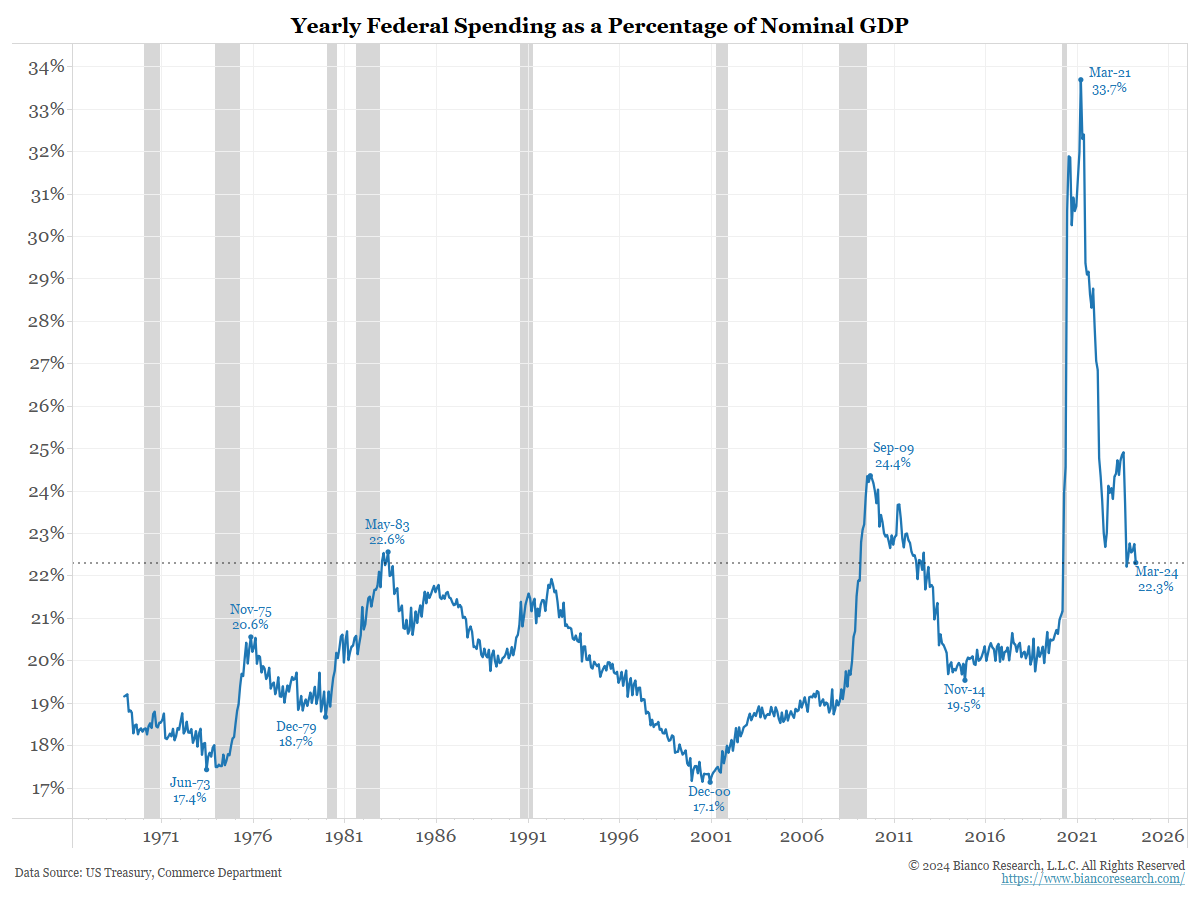

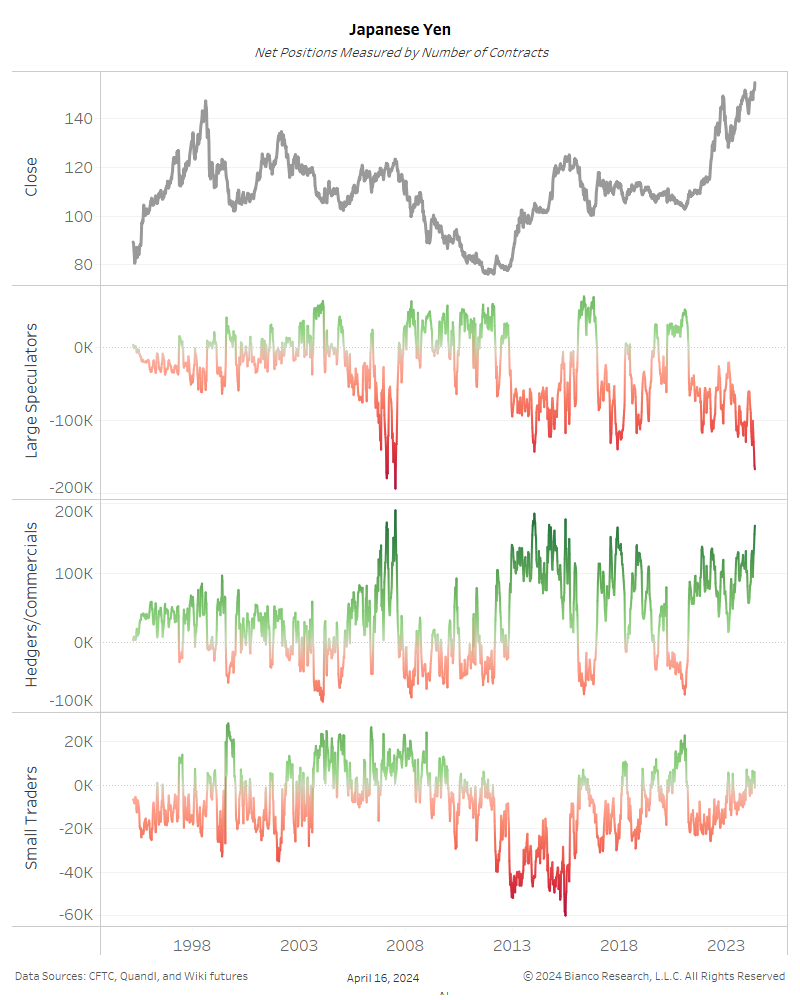

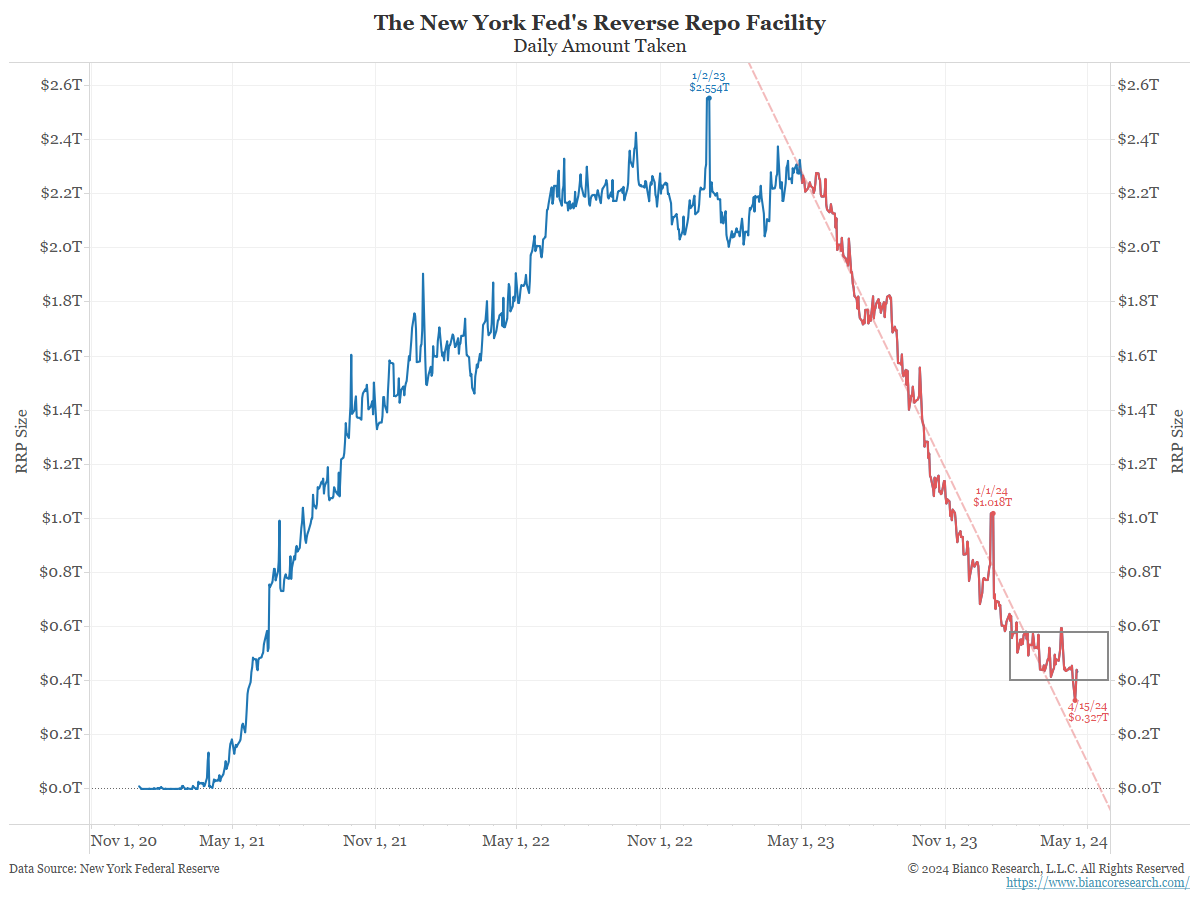

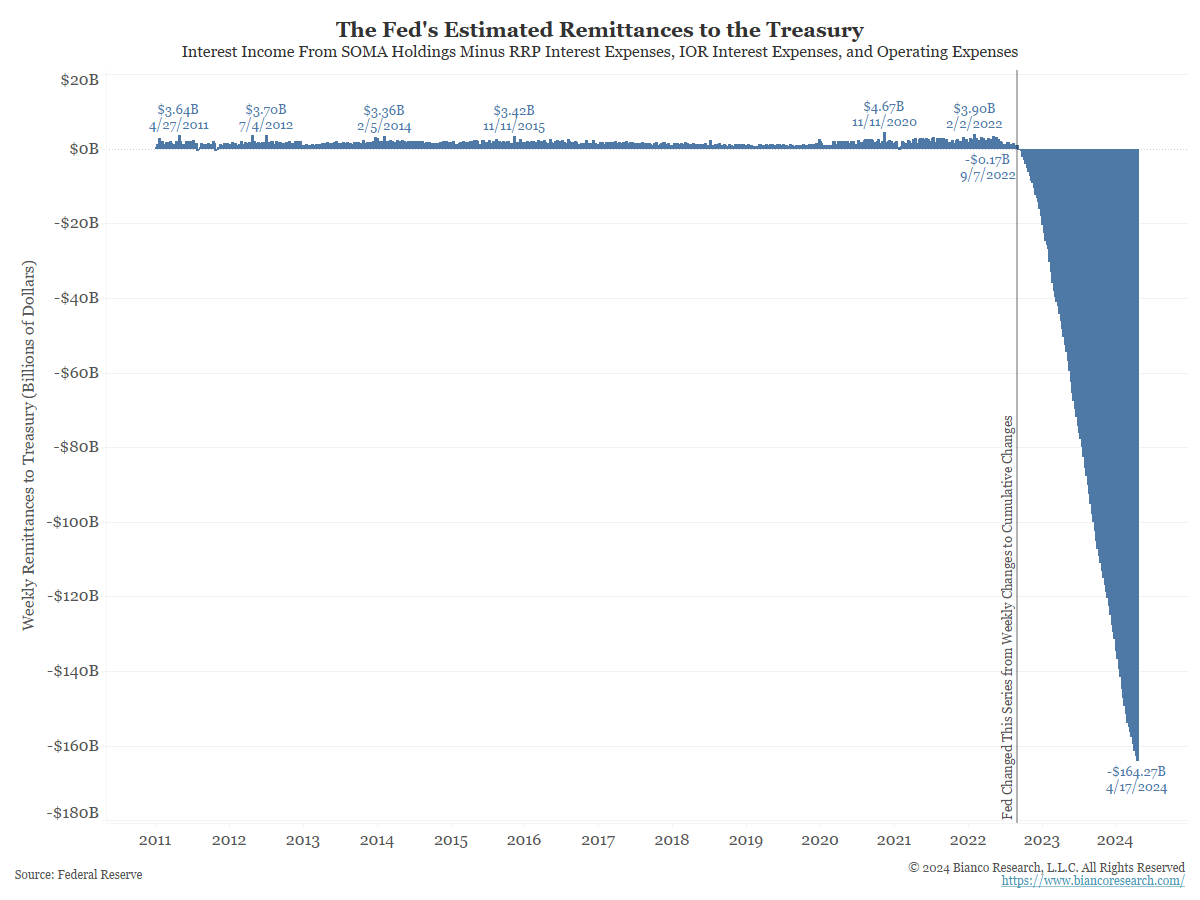

Liquidity Measures Worth Watching

Posted By Greg Blaha

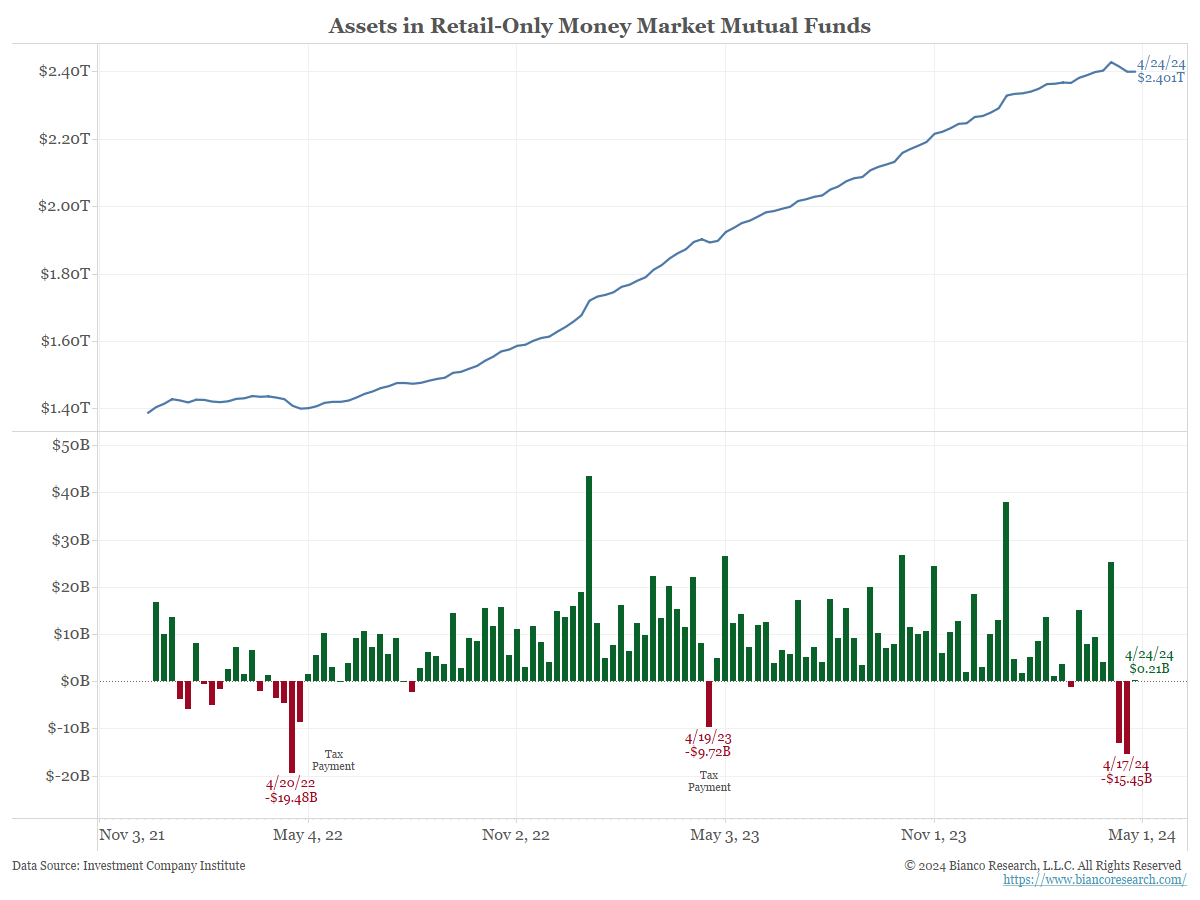

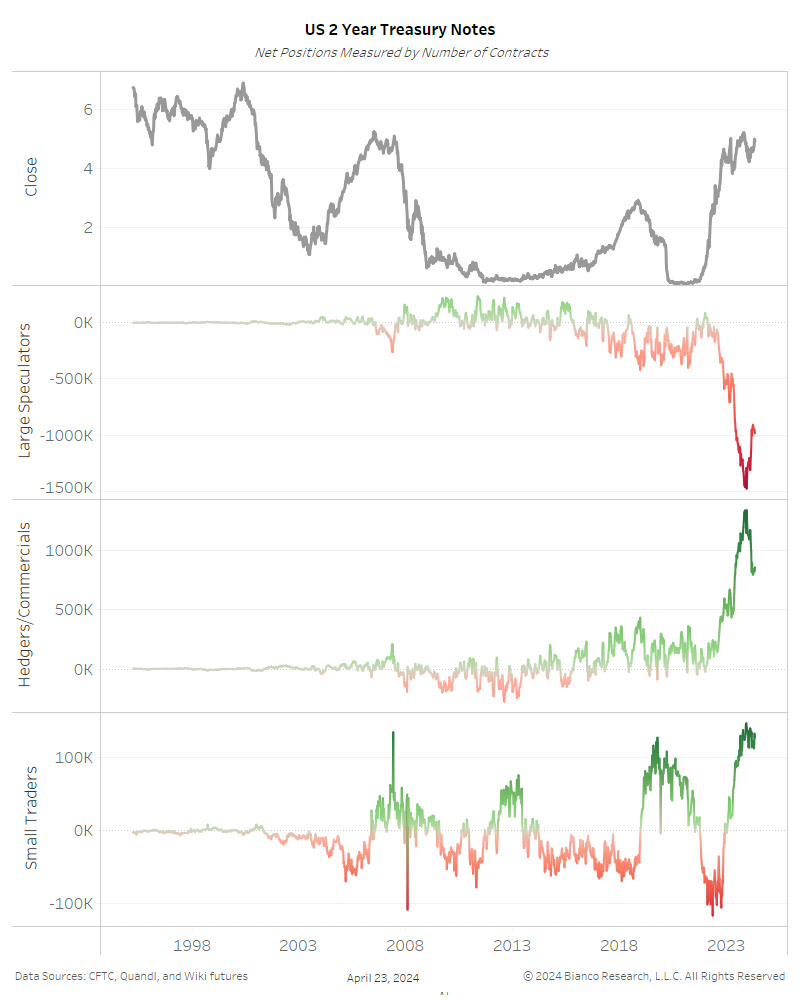

Several liquidity charts worth watching as the Fed's reverse repo facility continues to be drained... Read More