Tag Archives: Markets

Jim Bianco joins Making Money with Charles Payne from MoneyShow’s 2024 Investment Masters Symposium

Jim Bianco discusses the Re-Thinking of Fed Cuts and the Path of Inflation, Geopolitical Concerns, the start of Earnings Season, Consumer Sentiment & Fed Speak with Charles Payne from MoneyShow's 2024 Investment Masters Symposium.... Read More

Jim Bianco joins the 2024 Hedgeye Investing Summit

Jim Bianco joins the 2024 Hedgeye Investing Summit hosted by Hedgeye Founder Keith McCullough.... Read More

Jim Bianco joins Fox Business to discuss Why Interest Rates Matter, No Landing & Higher Bond Yields

Jim Bianco joins Fox Business to discuss why interest rates matter, recent economic data supporting the "No Landing" scenario & the impact of higher bond yields on the stock market with Charles Payne.... Read More

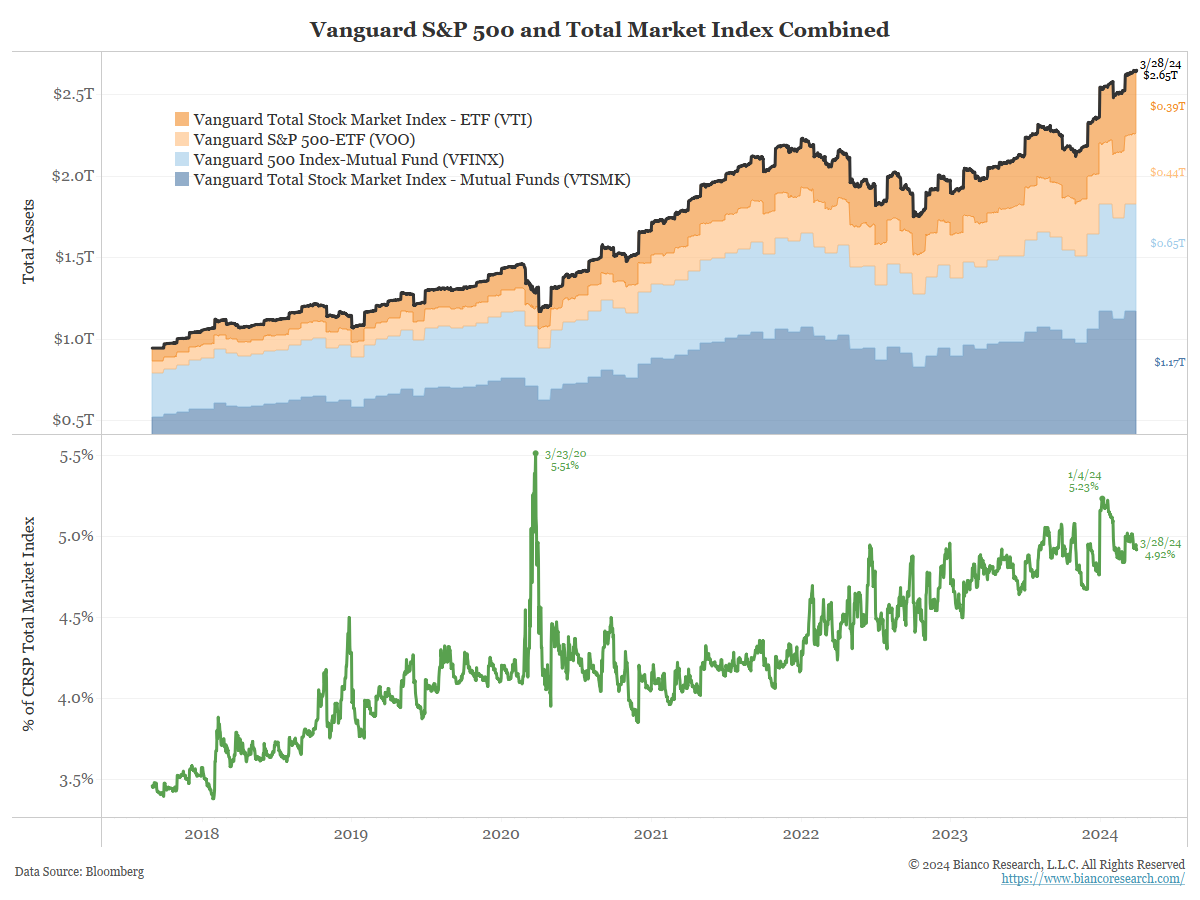

Vanguard, America’s Largest Funds

Posted By Jim Bianco

Vanguard's biggest funds tracking the S&P 500 and Total Stock Market Index collectively have $2.65 trillion in assets under management, or just shy of 5% of U.S. stocks.... Read More

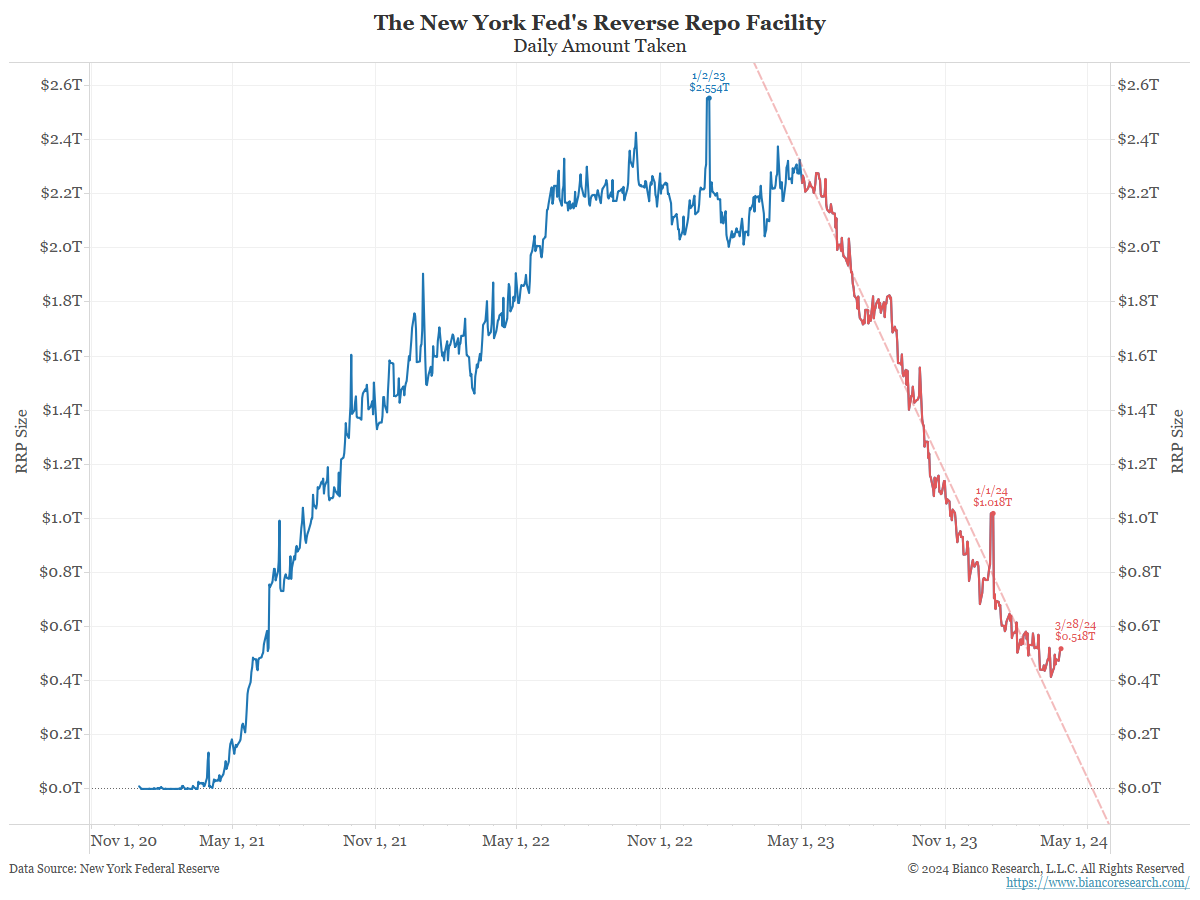

Liquidity Measures Worth Watching

Posted By Greg Blaha

Several liquidity charts worth watching as the Fed's reverse repo facility continues to be drained... Read More

Jim Bianco joins Fox Business to discuss “No Landing,” Post-Lockdown Economy & the Neutral Rate

Jim Bianco joins Fox Business to discuss "No Landing," Post-Lockdown Economy & the Neutral Rate with Charles Payne.... Read More

Quick Comments/What We’re Reading

Posted By Greg Blaha

Today's topics include economists are more hawkish than the Fed despite similar economic outlooks, persistent inflation, a new norm for spending?, renting vs. owning, breaking down household wealth gains, small caps vs. large caps, the yen, and more on AI's potential effect on productivity ... Read More

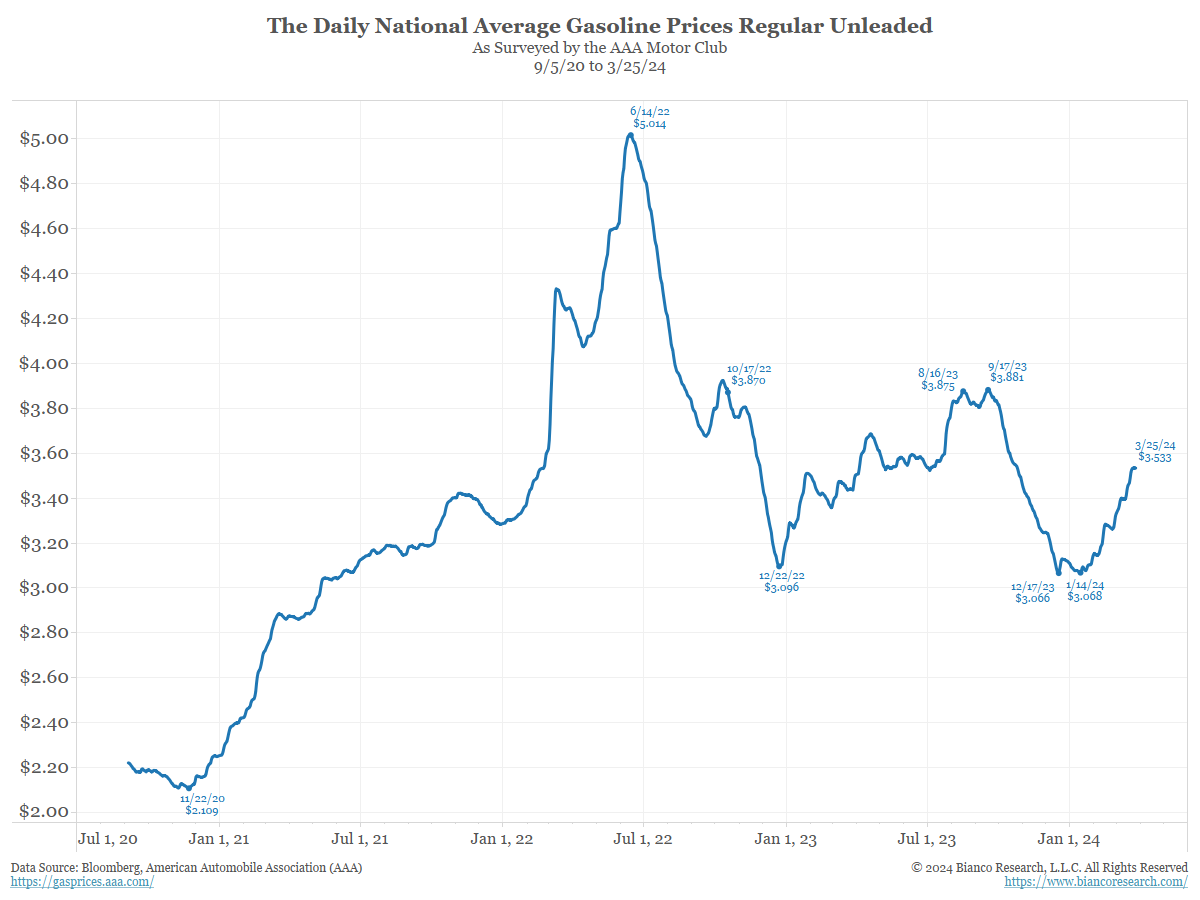

Quick Comments/What We’re Reading

Posted By Greg Blaha

Today's topics include detailing the reasons the neutral rate may now be higher, Fed officials' thoughts on inflation, El-Erian's thoughts on inflation targeting, the rising pile of debt, comparing valuations in the U.S. & EU, gas prices expected to rise, stocks to continue rallying?, office rents living in fantasyland, and SWIFT building CBDC platform... Read More

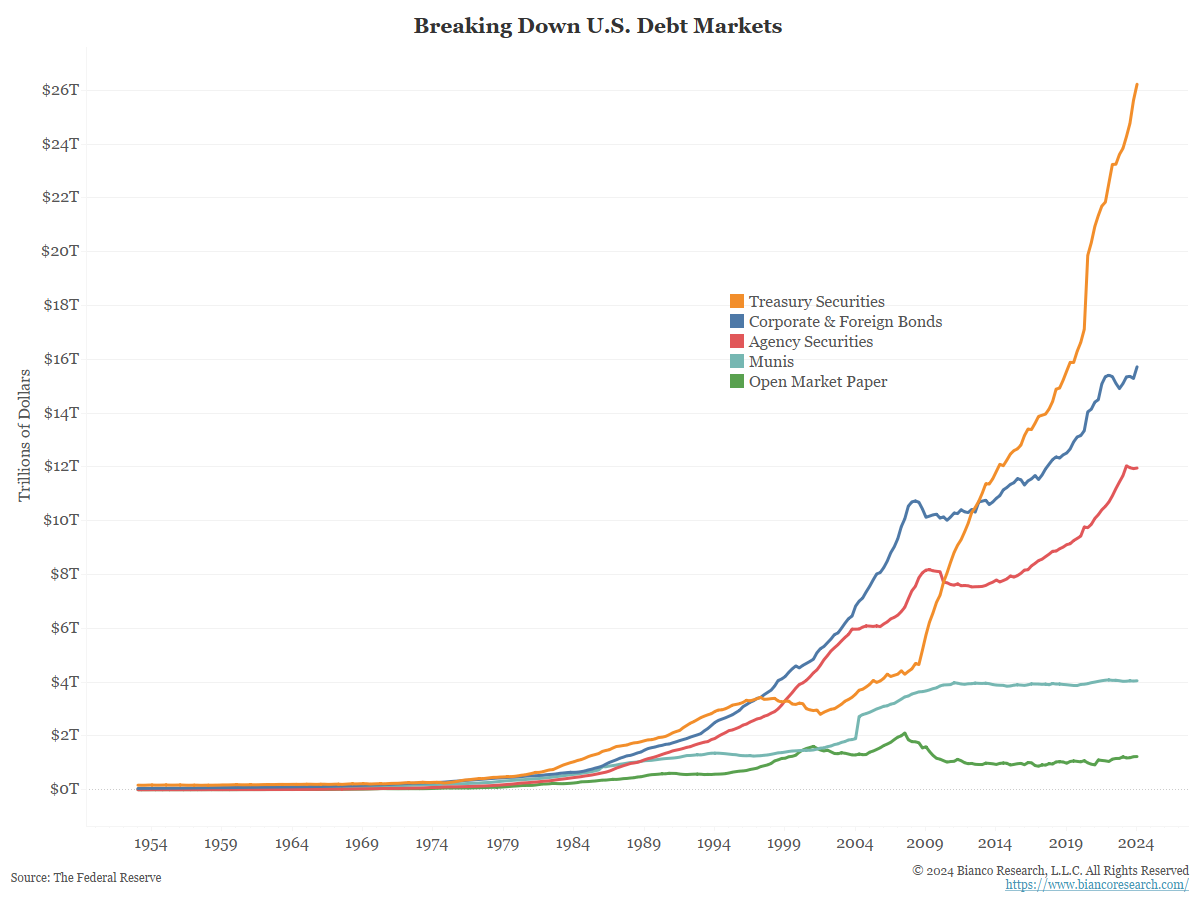

Breaking Down Debt in the U.S.

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper... Read More

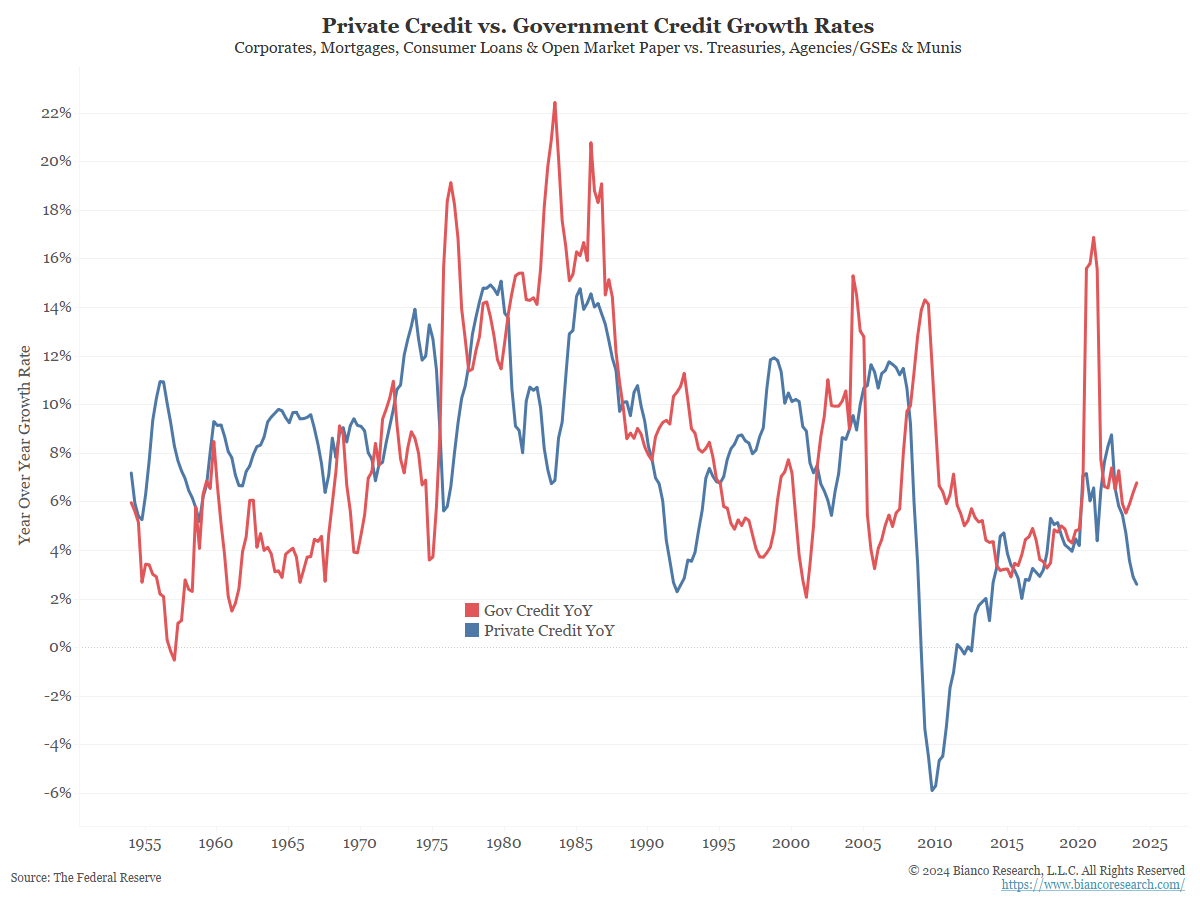

Comparing the Value of Credit in the U.S. to GDP

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period.... Read More

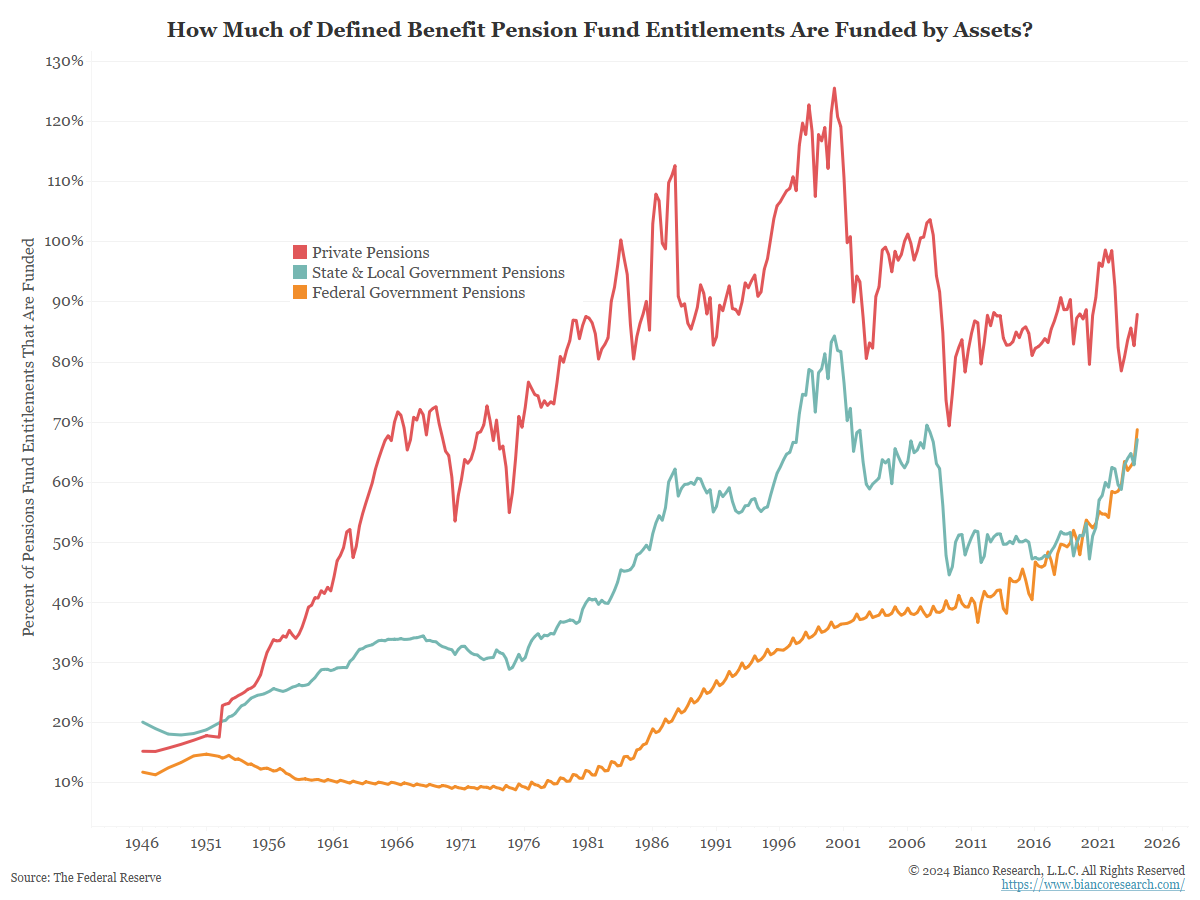

Funding Gaps at Public and Private Pensions

Private pension funds typically have much smaller funding gaps than their government counterparts.... Read More

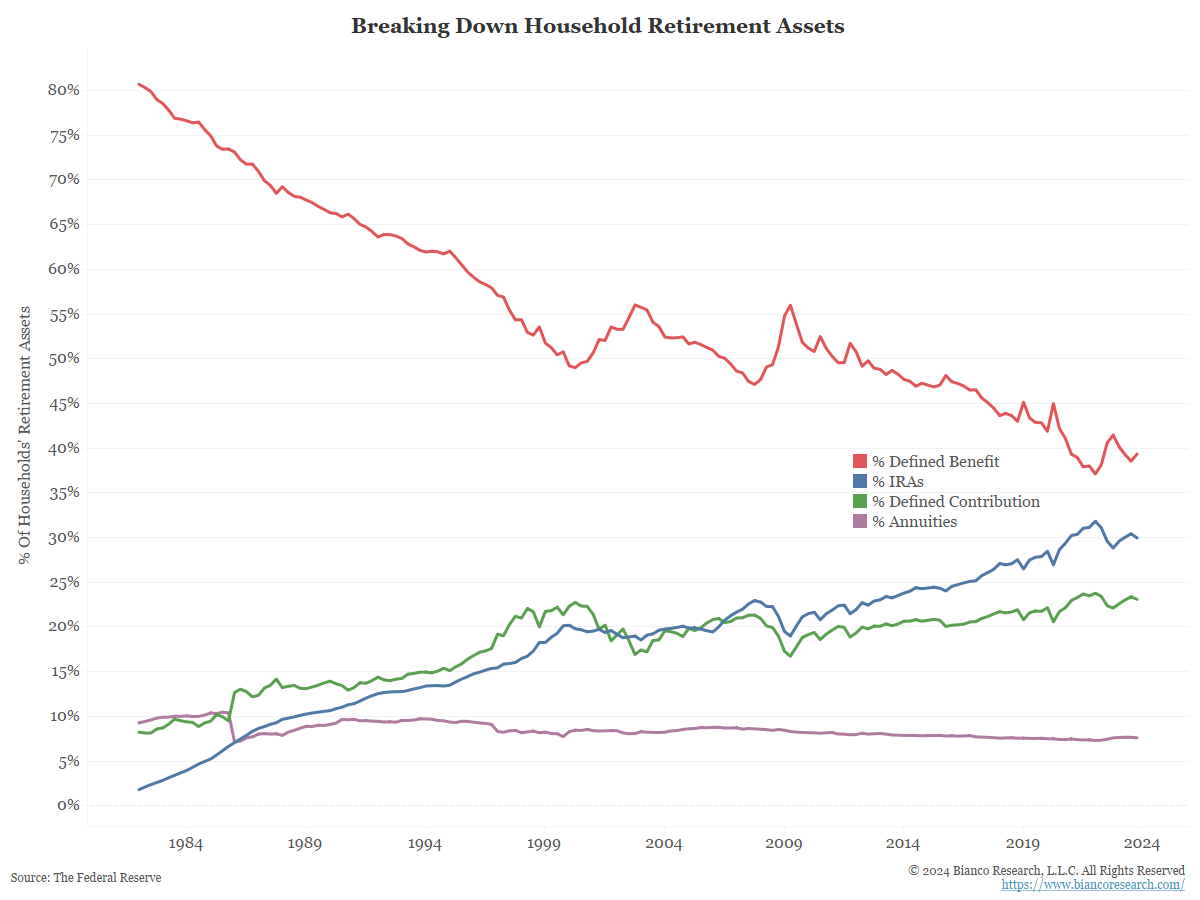

Defined Benefit Plans vs. IRAs

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More

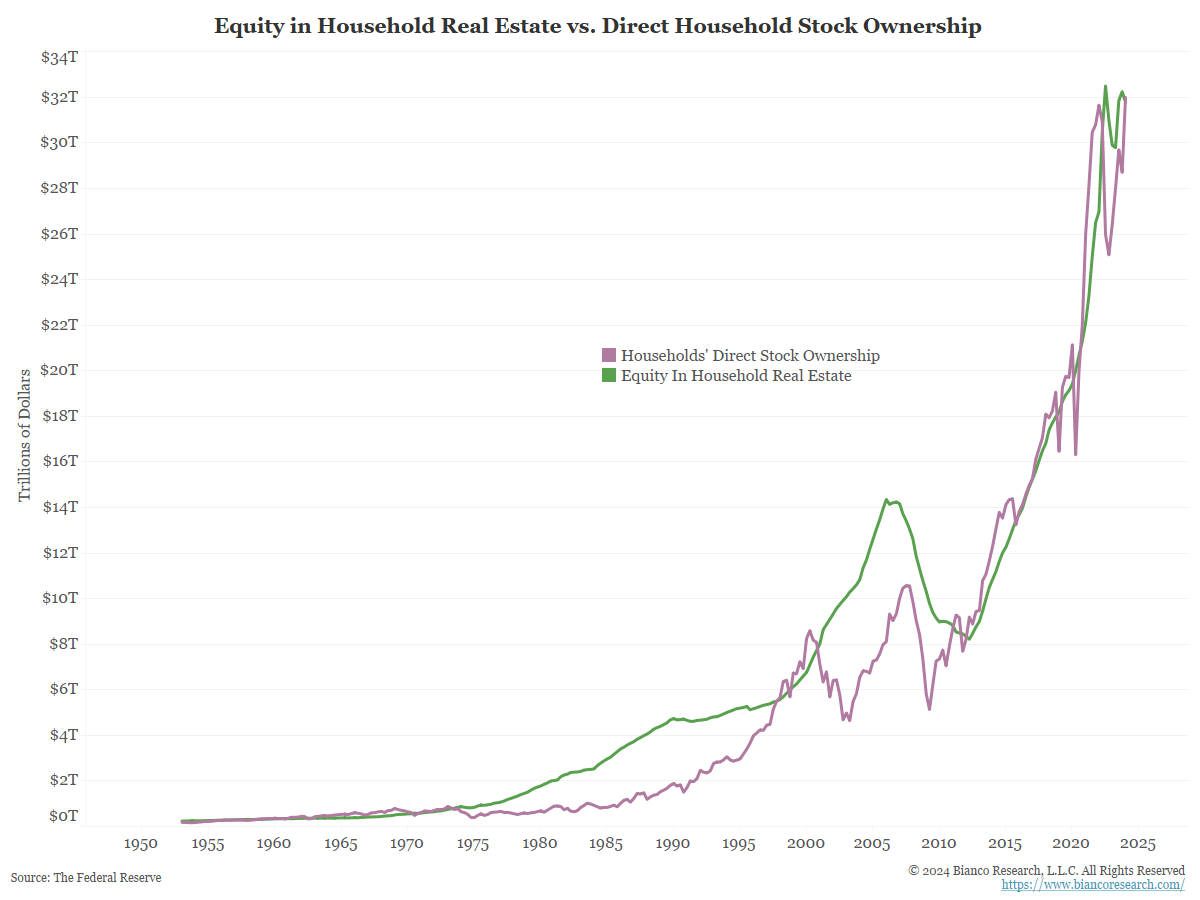

Comparing Real Estate to GDP and Stock Ownership

Over the past couple decades, households' real estate equity and direct stock ownership have moved in lockstep.... Read More

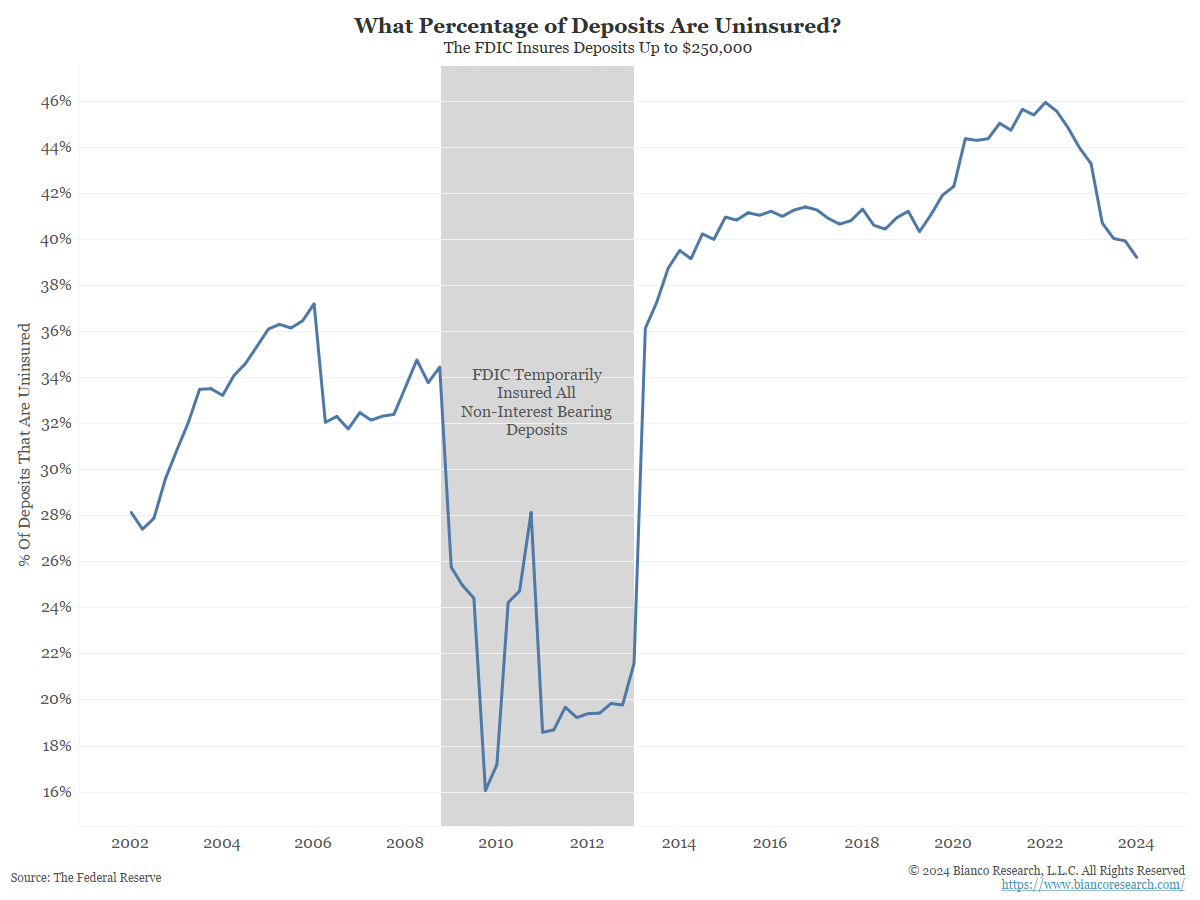

39% of FDIC Deposits Are Uninsured

Roughly 39% of FDIC deposits in the U.S. are uninsured.... Read More

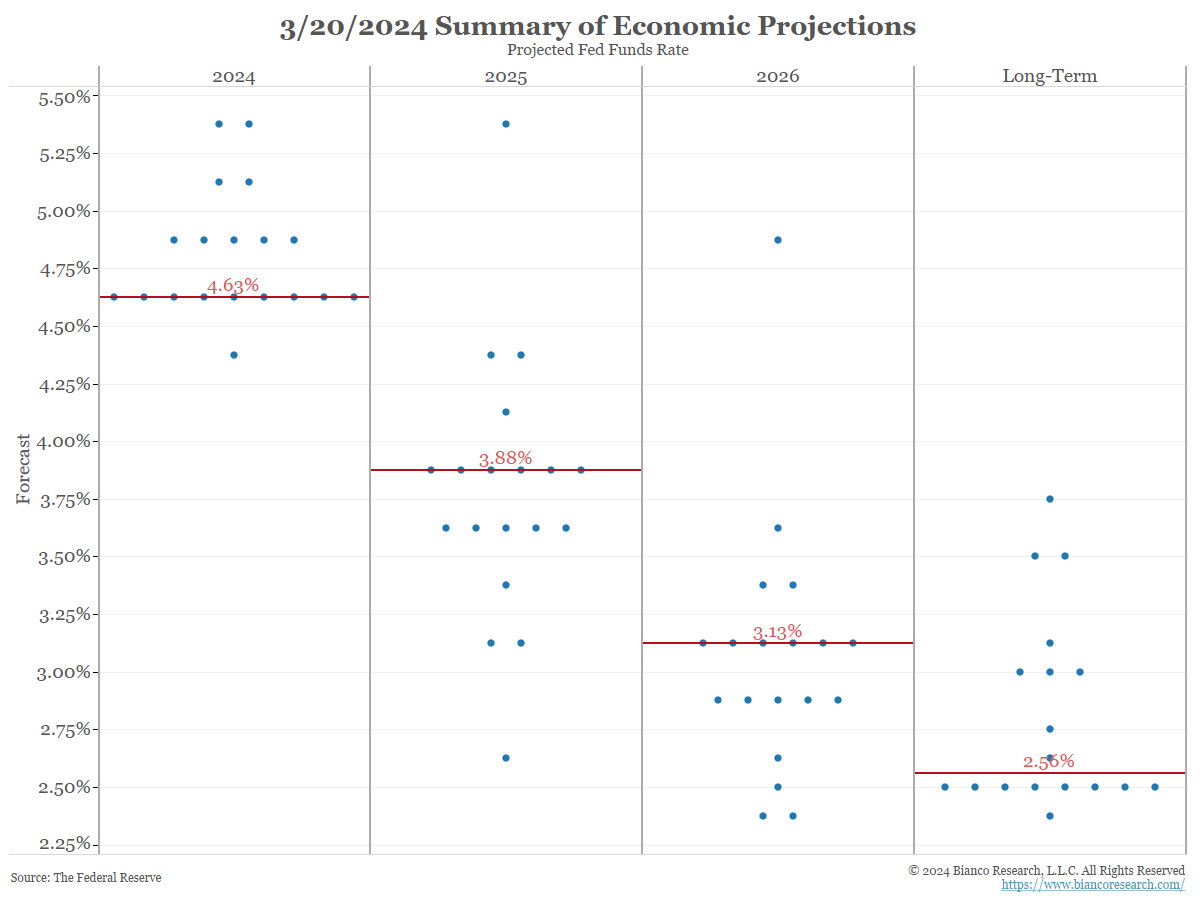

What Is Neutral?

Posted By Jim Bianco

The Fed said the economy is improving and inflation is higher than expected, yet they still want to cut three times this year. Why? They think the federal funds rate is very restrictive. The market is reacting to potential rate cuts as "cheaper money coming" and launching into record territory. We fear this easy money will produce more inflation down the road.... Read More

Jim Bianco joins Fox Business to discuss today’s FOMC Meeting, No Landing & the Bond Market

Jim Bianco joins Fox Business to discuss today's FOMC Meeting, No Landing & the Bond Market with Charles Payne.... Read More