Tag Archives: Markets

Jim Bianco on a “No Landing” Economy, Sticky Inflation and Powell Pivot

Jim Bianco, President of market and macroeconomic research firm Bianco Research, appears Jan. 11, 2024, with hosts Jeffrey Sherman and Samuel Lau to discuss among other issues his outlook for a ?no landing? U.S. economy in 2024, sticky inflation of 3% to 4% and his theory on Fed Chair Jerome H. Powell?s dovish turn on Dec. 13.... Read More

Jim Bianco on a “No Landing” Economy, Sticky Inflation and Powell Pivot

Jim Bianco, President of market and macroeconomic research firm Bianco Research, appears Jan. 11, 2024, with hosts Jeffrey Sherman and Samuel Lau to discuss among other issues his outlook for a ?no landing? U.S. economy in 2024, sticky inflation of 3% to 4% and his theory on Fed Chair Jerome H. Powell?s dovish turn on Dec. 13.... Read More

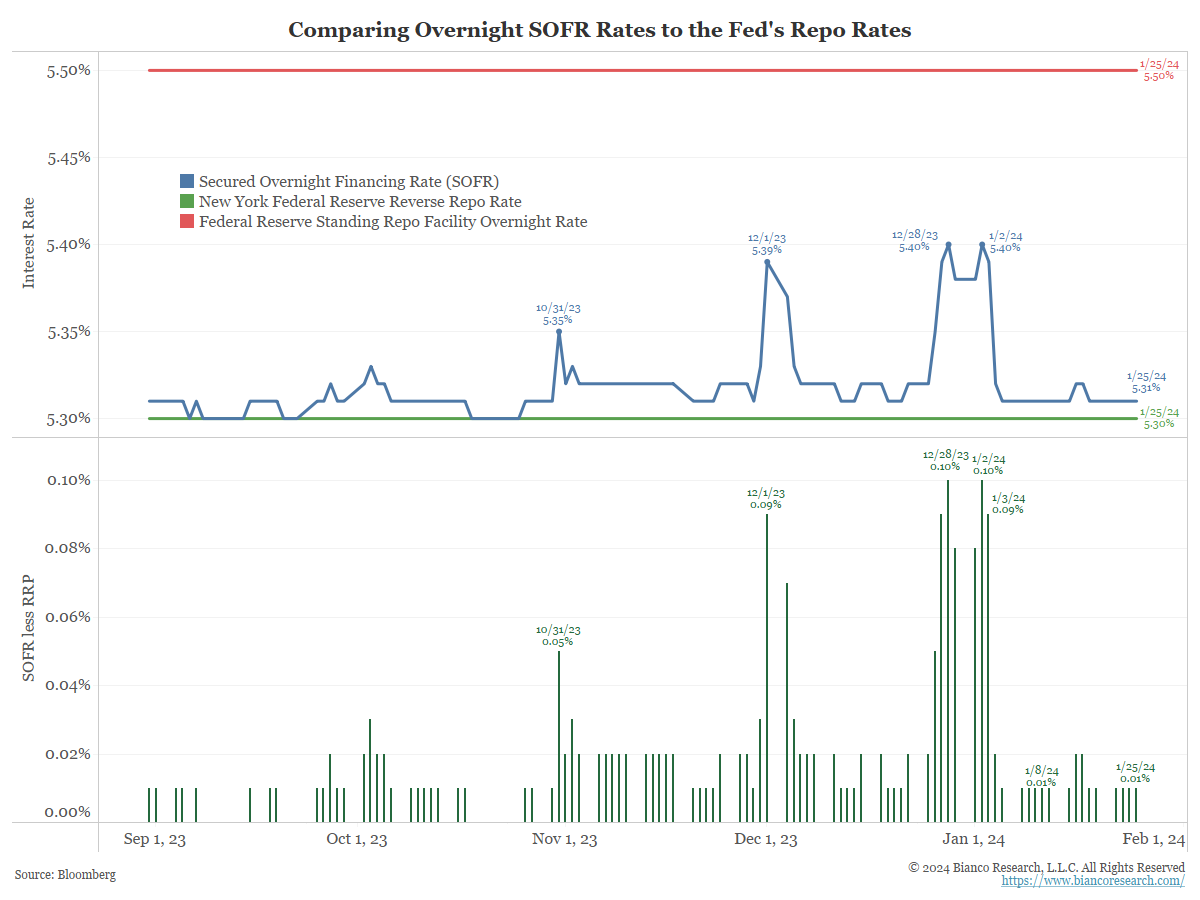

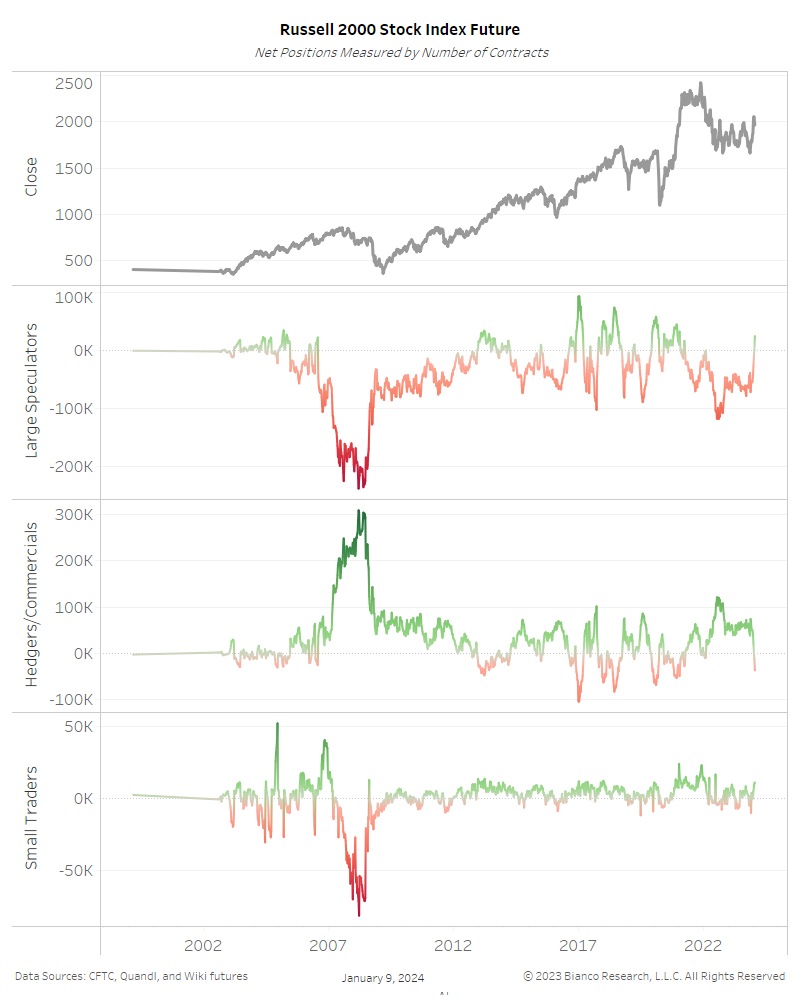

Liquidity Measures Worth Watching

Posted By Greg Blaha

Several liquidity charts worth watching as the Fed's reverse repo facility continues to be drained... Read More

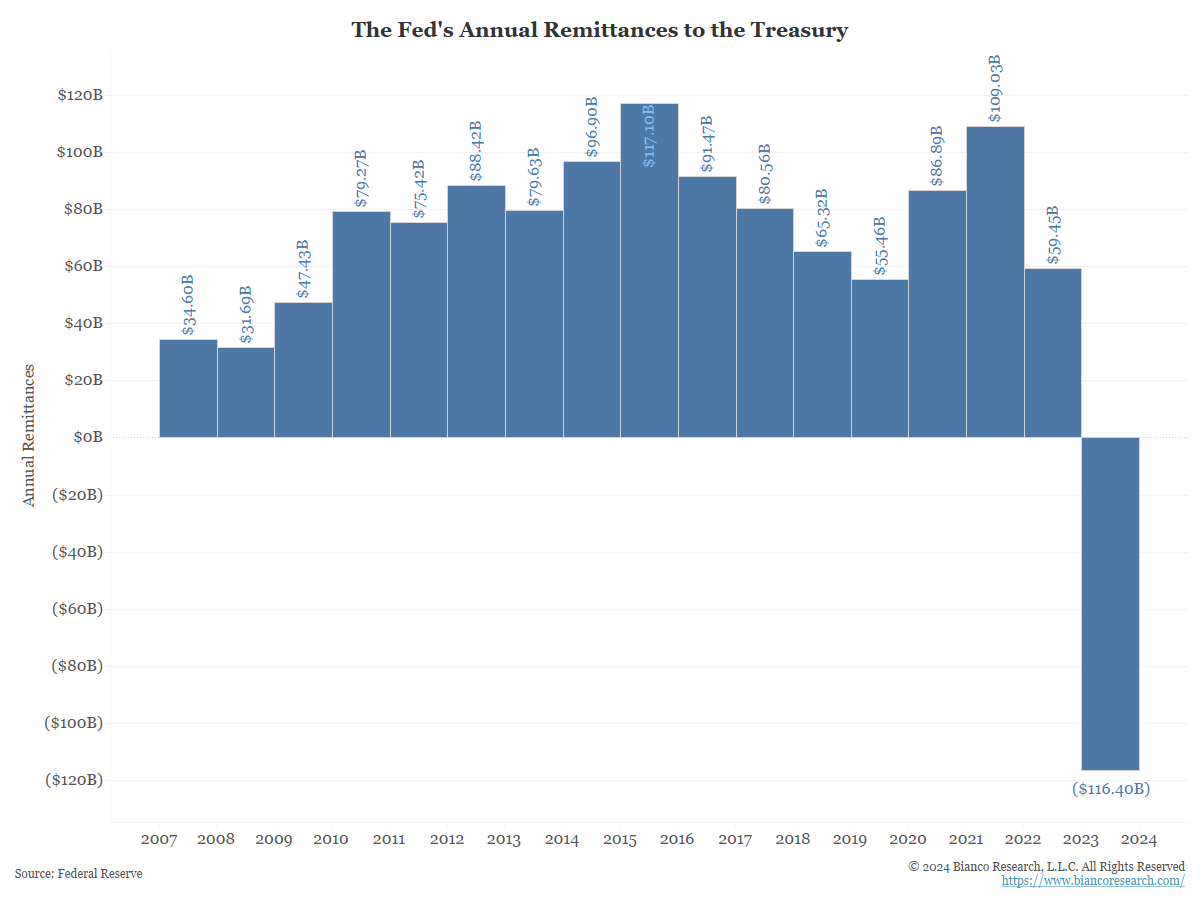

When Will the Fed Return to Profitability?

Posted By Greg Blaha

The Fed's interest expenses exploded higher in 2023. They have been operating at a loss since September 2022 and might not return to profitability for several more years.... Read More

DoubleLine Capital Round Table Prime 2024

During the macroeconomic segment of its 2024 edition, participants in DoubleLine Round Table Prime among other issues debate the seeming failure of the most telegraphed recession in history to materialize in 2023, the intersection of Federal Reserve policy with a presidential election year and deep changes in the economy post-2020.... Read More

DoubleLine Capital Round Table Prime 2024

Coming together for Round Table Prime are DoubleLine CEO Jeffrey Gundlach and moderator DoubleLine Deputy Chief Investment Officer Jeffrey Sherman with their guests James Bianco, President and Macro Strategist at Bianco Research; Danielle DiMartino Booth, CEO of Quill Intelligence; Charles Payne, author and Fox Business Anchor; and David Rosenberg, President of economic consulting firm Rosenberg Research & Associates. Round Table Prime was held Jan. 11, 2024.... Read More

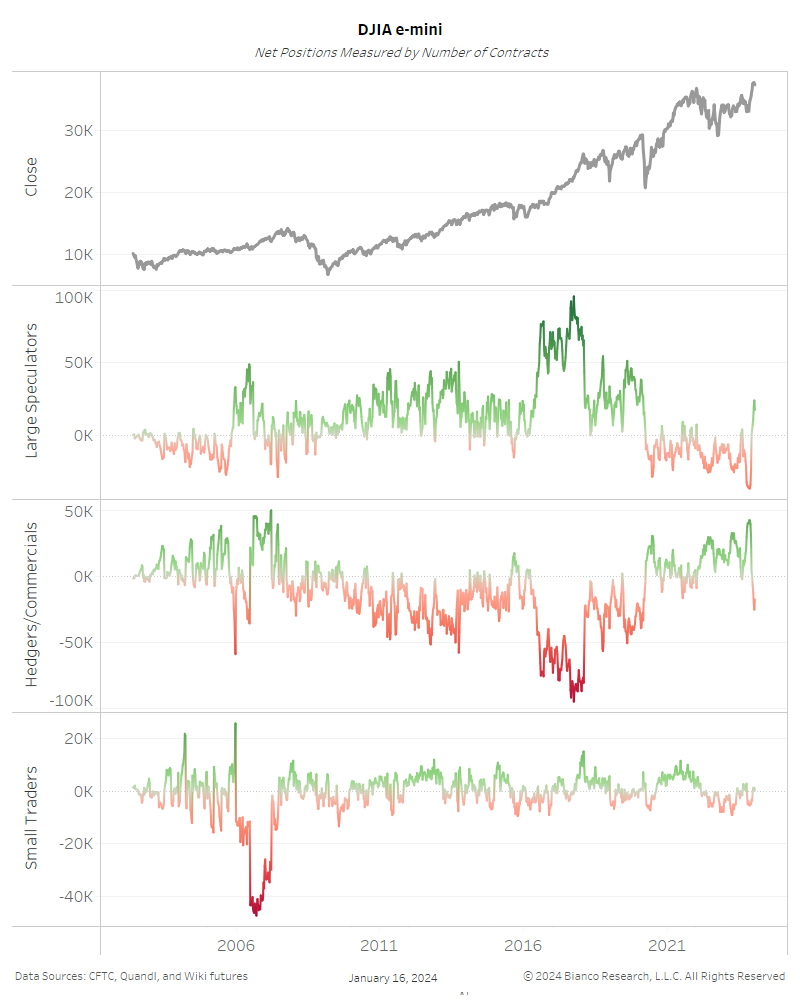

Will Inflation and Liquidity Remain Sticky Conference Call Replay & Notes

The outlook coming into 2024 is inflation has been defeated and will soon return to 2%. This would give the Fed room to cut rates and deal with potential liquidity concerns. Given this rosy outlook, the market has priced in as many as seven rate cuts for 2024.... Read More

Jim Bianco joins Fox Business to discuss Interest Rates, Geopolitical Conflicts & Economic Data

Jim Bianco joins Fox Business to discuss Soft Landings vs No Landing, Interest Rates, the Impact of Geopolitical Conflicts on Markets & Rethinking Economic Data with Charles Payne.... Read More

Jim Bianco joins Fox Business to discuss Interest Rates, Geopolitical Conflicts & Economic Data

Jim Bianco joins Fox Business to discuss Soft Landings vs No Landing, Interest Rates, the Impact of Geopolitical Conflicts on Markets & Rethinking Economic Data with Charles Payne.... Read More

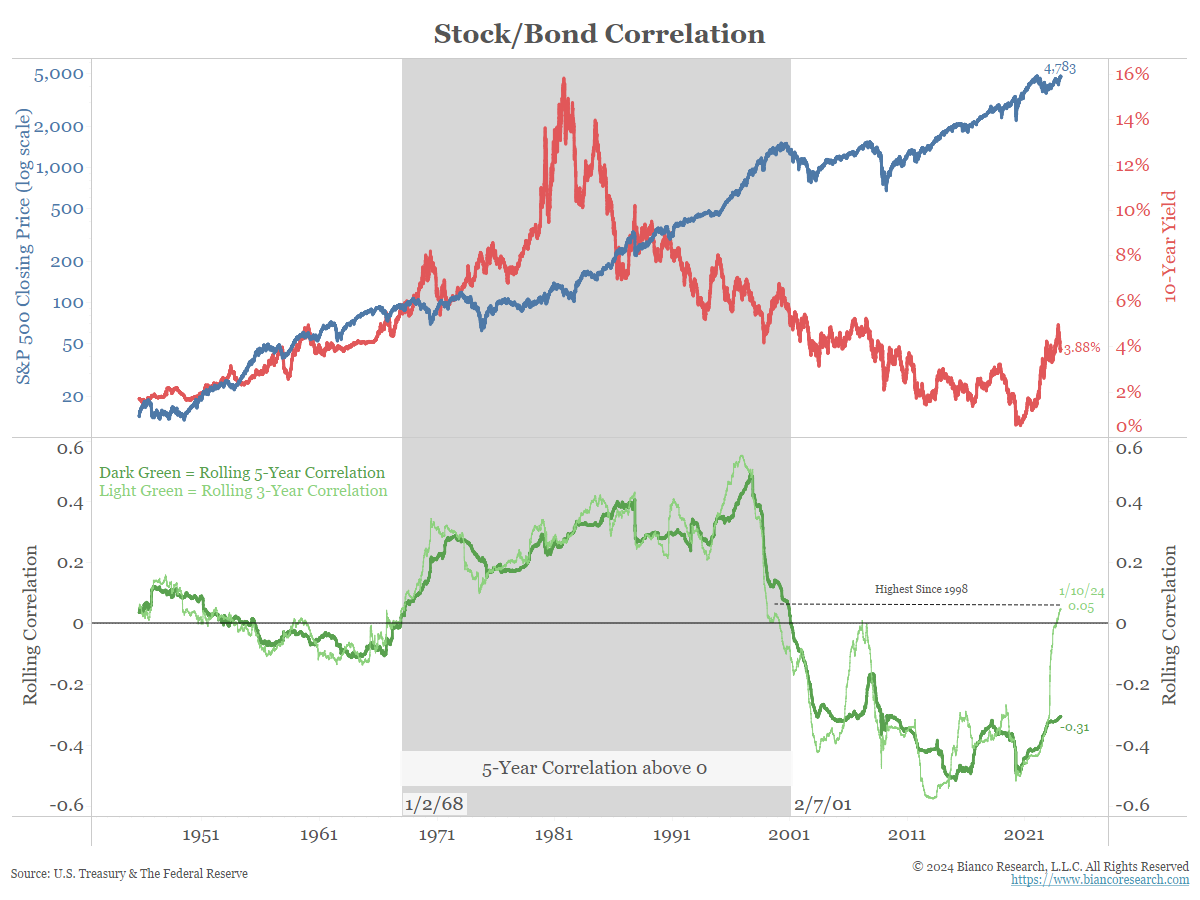

Cross-Asset Correlations Are Driven by Perception

Posted By Alex Malitas

Over the past couple decades stock and bond prices have moved in opposite directions, thus increasing diversification benefits and offsetting tail risk. A positive stock-bond correlation is often a bad scenario for investors. What drives this correlation and how will it impact returns in 2024?... Read More

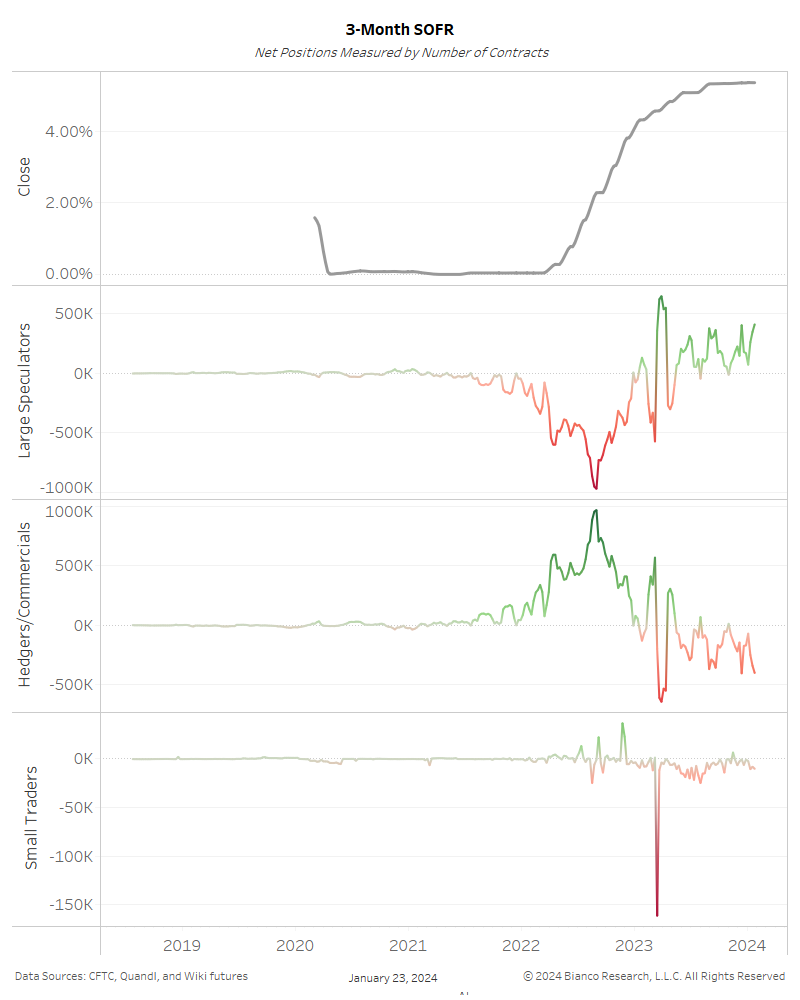

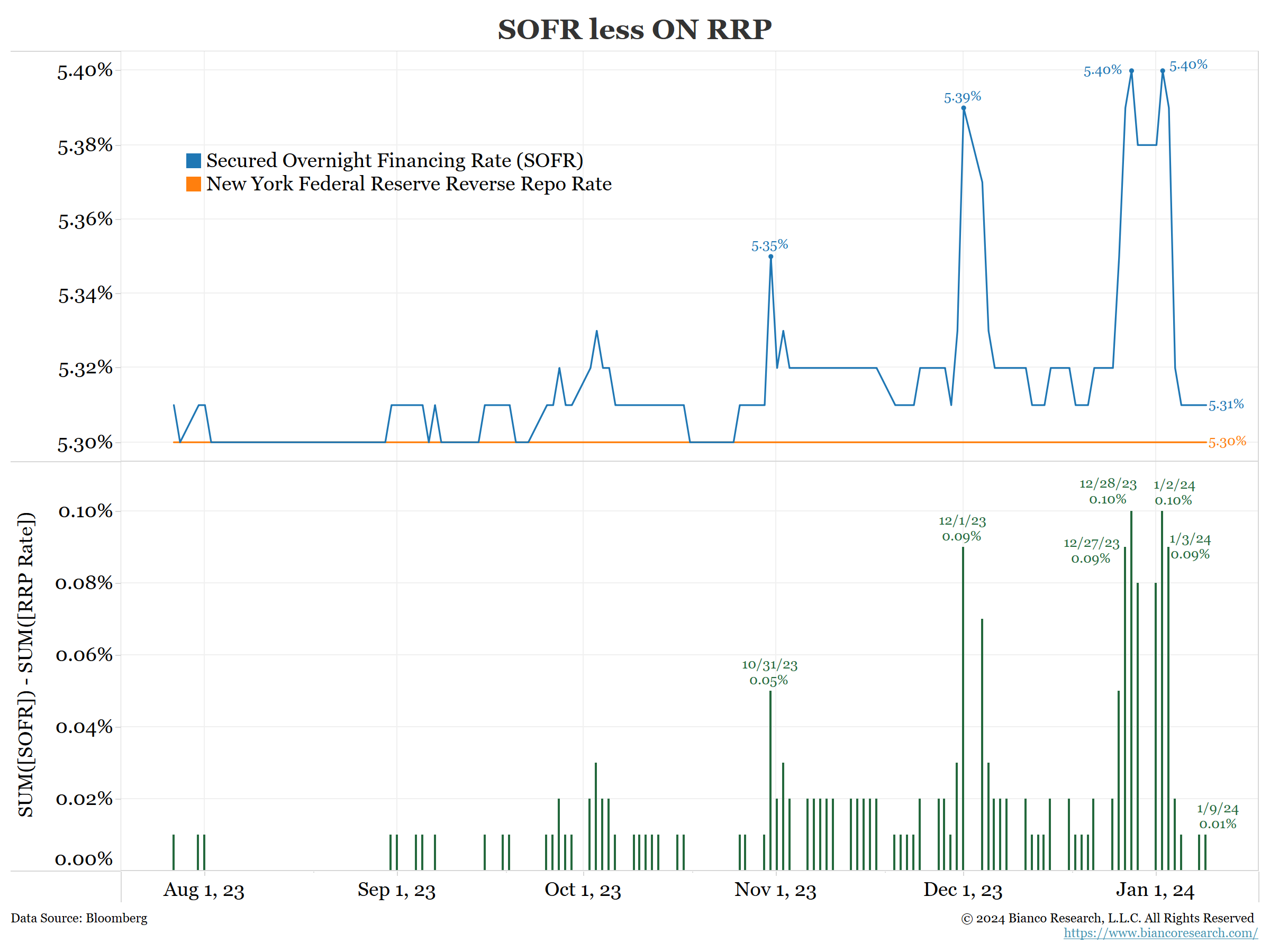

Is a Liquidity Problem Coming?

Posted By Jim Bianco

With the Fed's Reverse Repo Facility balance continuing its linear decline, the recent liquidity pump is nearing its end. How will this impact bank reserves and the Fed's ongoing Quantitative Tightening (QT) campaign?... Read More

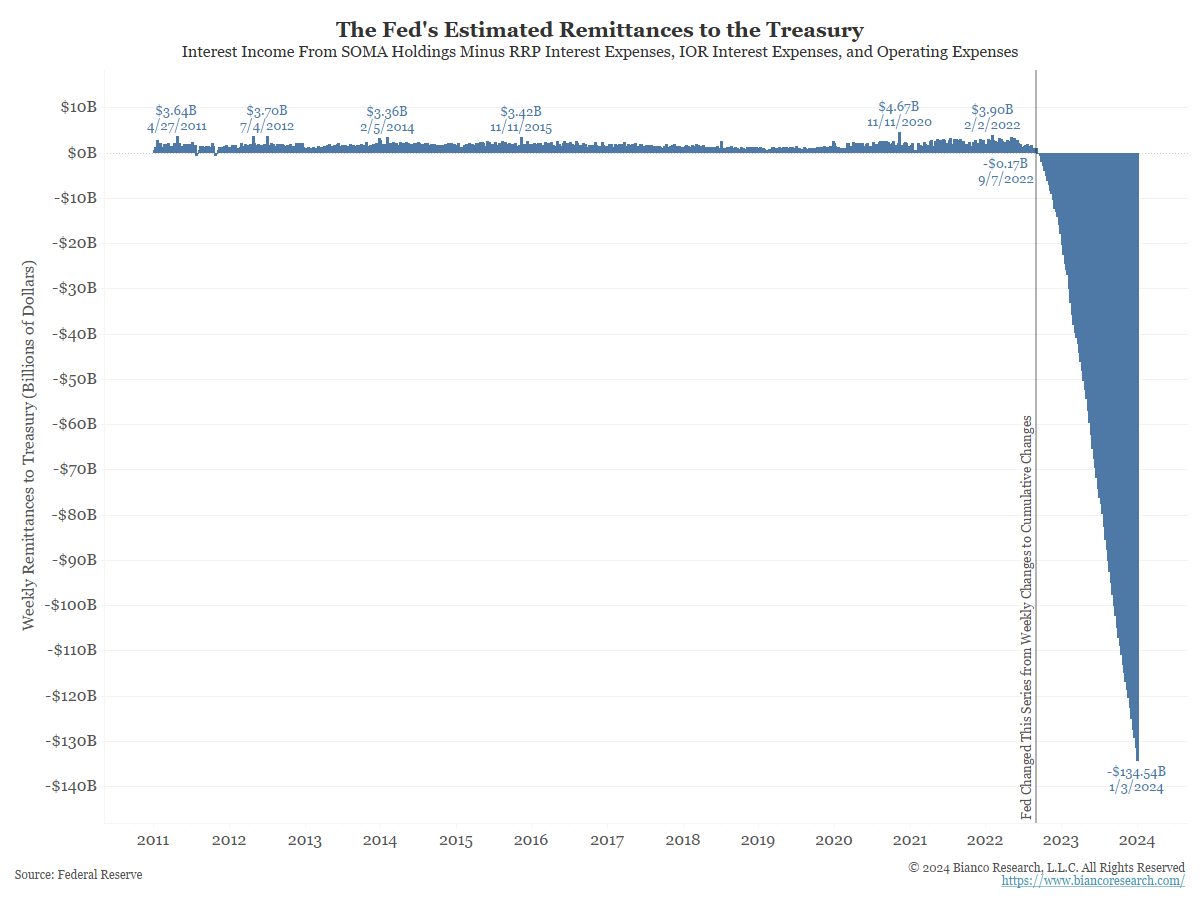

Updating the Fed’s “Deferred Assets”

Posted By Greg Blaha

The Fed's cumulative losses since September 7, 2022 now total roughly $135 billion.... Read More

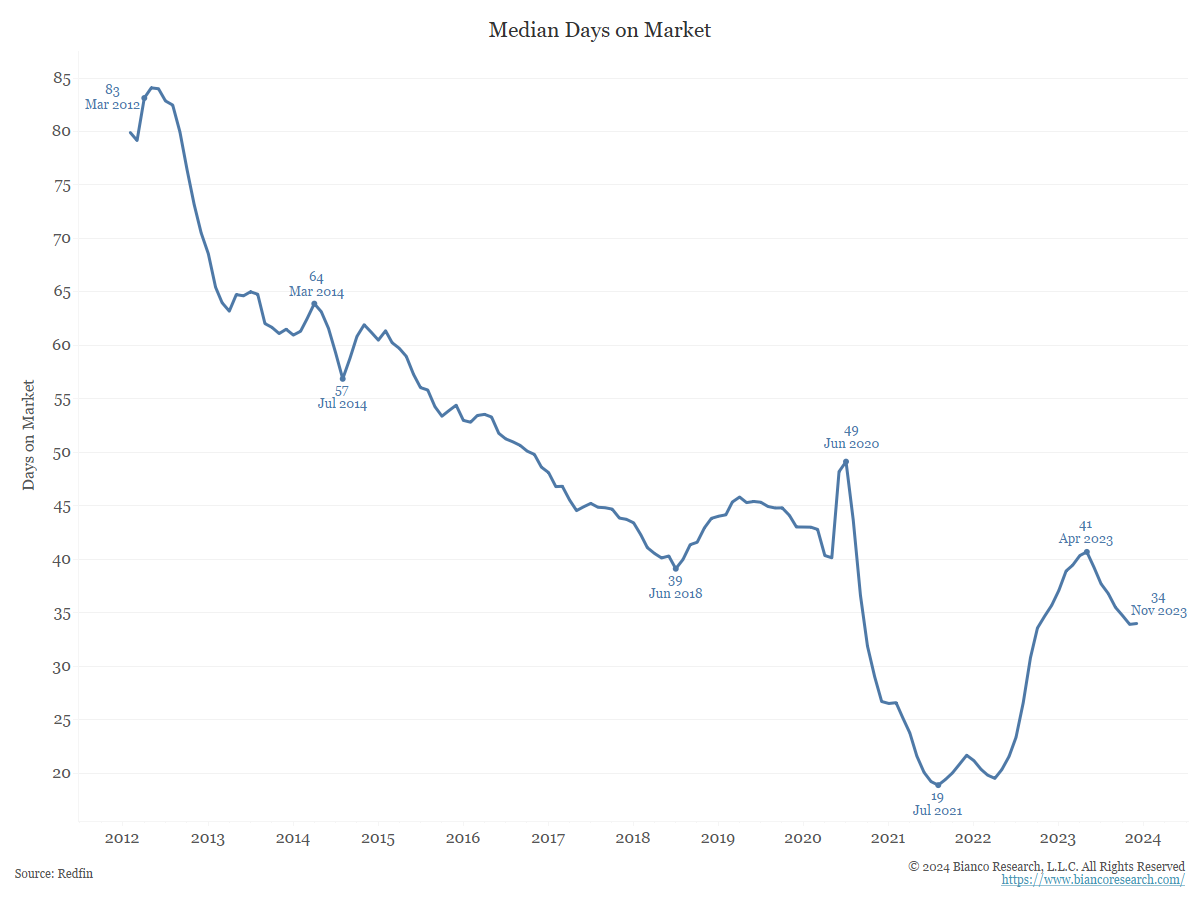

Alternative Measures of the Housing Market

Posted By Greg Blaha

The 34 days it takes to sell a house is still low when compared to the past decade, but it is markedly higher than the frenzy seen from mid-2021 to early-2022.... Read More

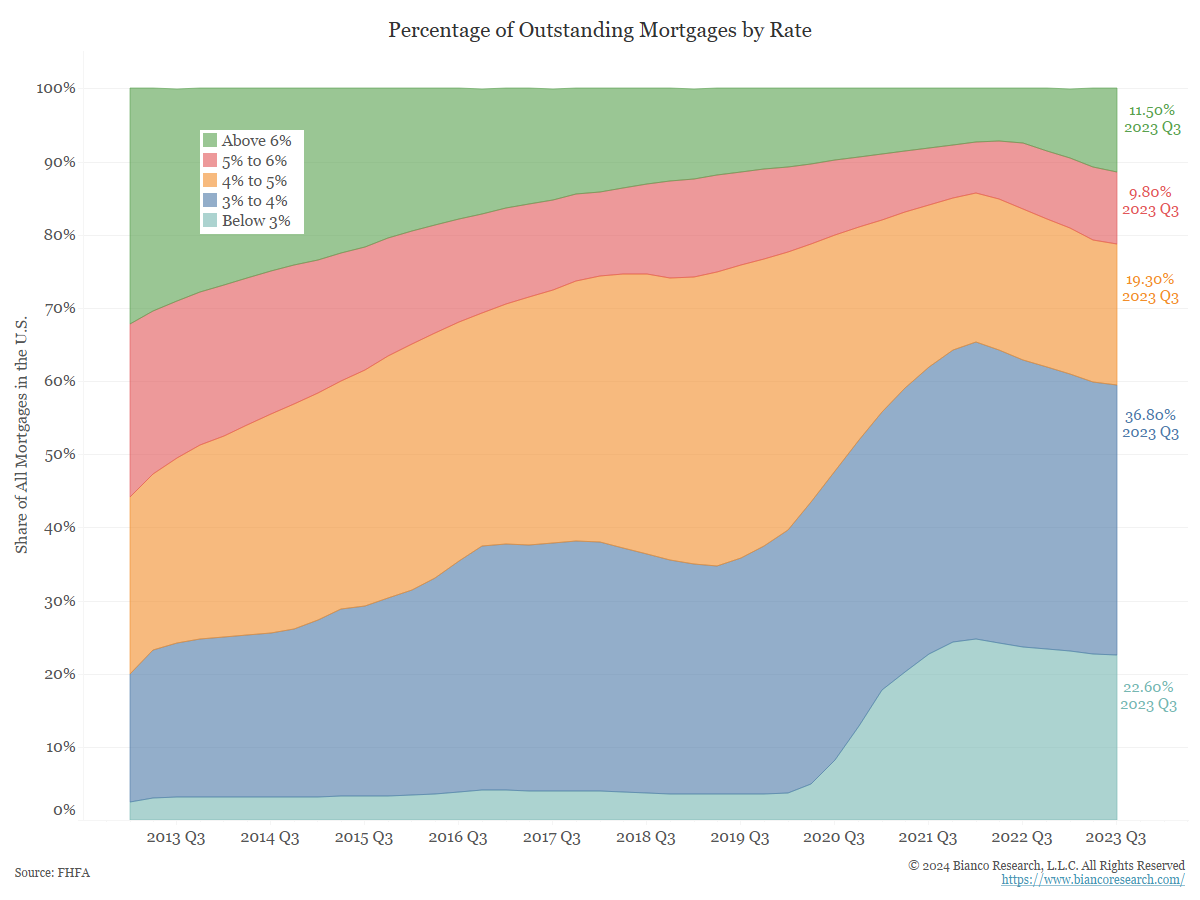

Homeowners Won’t Give Up Their Low Mortgage Rates

Posted By Greg Blaha

As of Q3 2023, almost 60% of homeowners with a mortgage had locked in a rate under 4%.... Read More

Jim Bianco joins Bloomberg to discuss Interest Rates, Inflation & the Change in the Nature of Work

Jim Bianco joins Bloomberg Surveillance to discuss Interest Rates, Inflation & the Change in the Nature of Work with Jonathan Ferro, Tom Keene & Lisa Abramowicz.... Read More

Jim Bianco joins Bloomberg to discuss Interest Rates, Inflation & the Change in the Nature of Work

Jim Bianco joins Bloomberg Surveillance to discuss Interest Rates, Inflation & the Change in the Nature of Work with Jonathan Ferro, Tom Keene & Lisa Abramowicz.... Read More

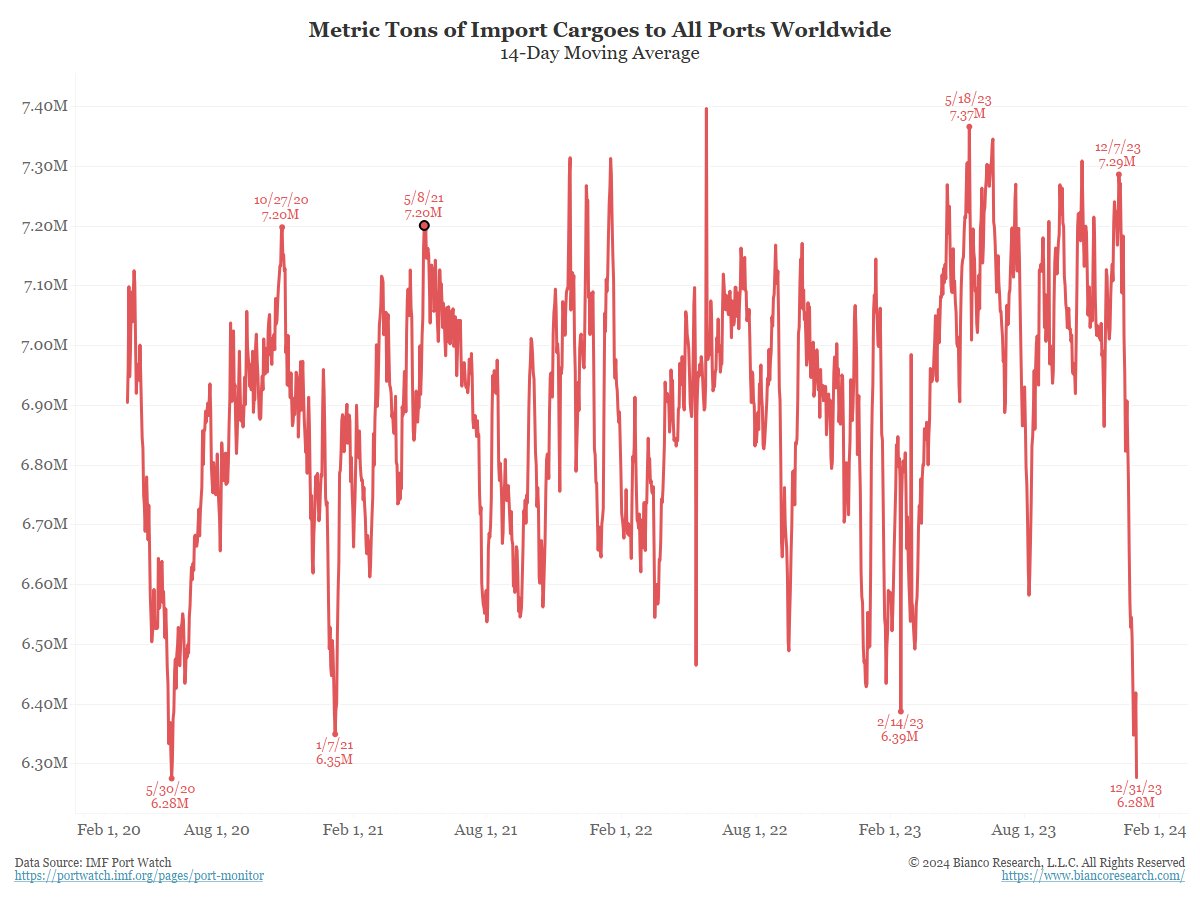

Is Goods Inflation About to Make a Return?

Posted By Jim Bianco

The spike in goods inflation in 2021/2022 occurred in part because of shipping problems. Consumers had to pay premiums to get what was available. The current shipping disruption is creating another round of products not reaching the end user. The longer it lasts, the more problems it creates.... Read More