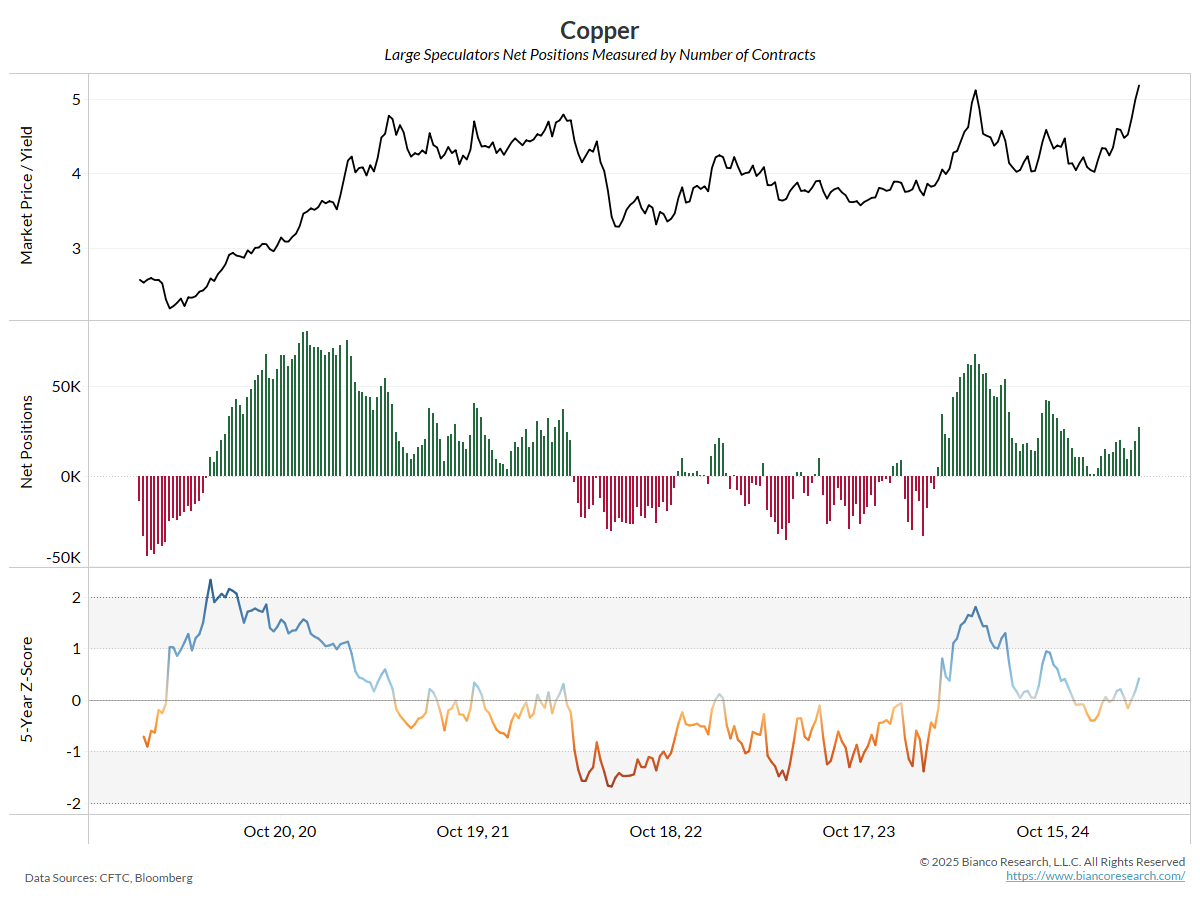

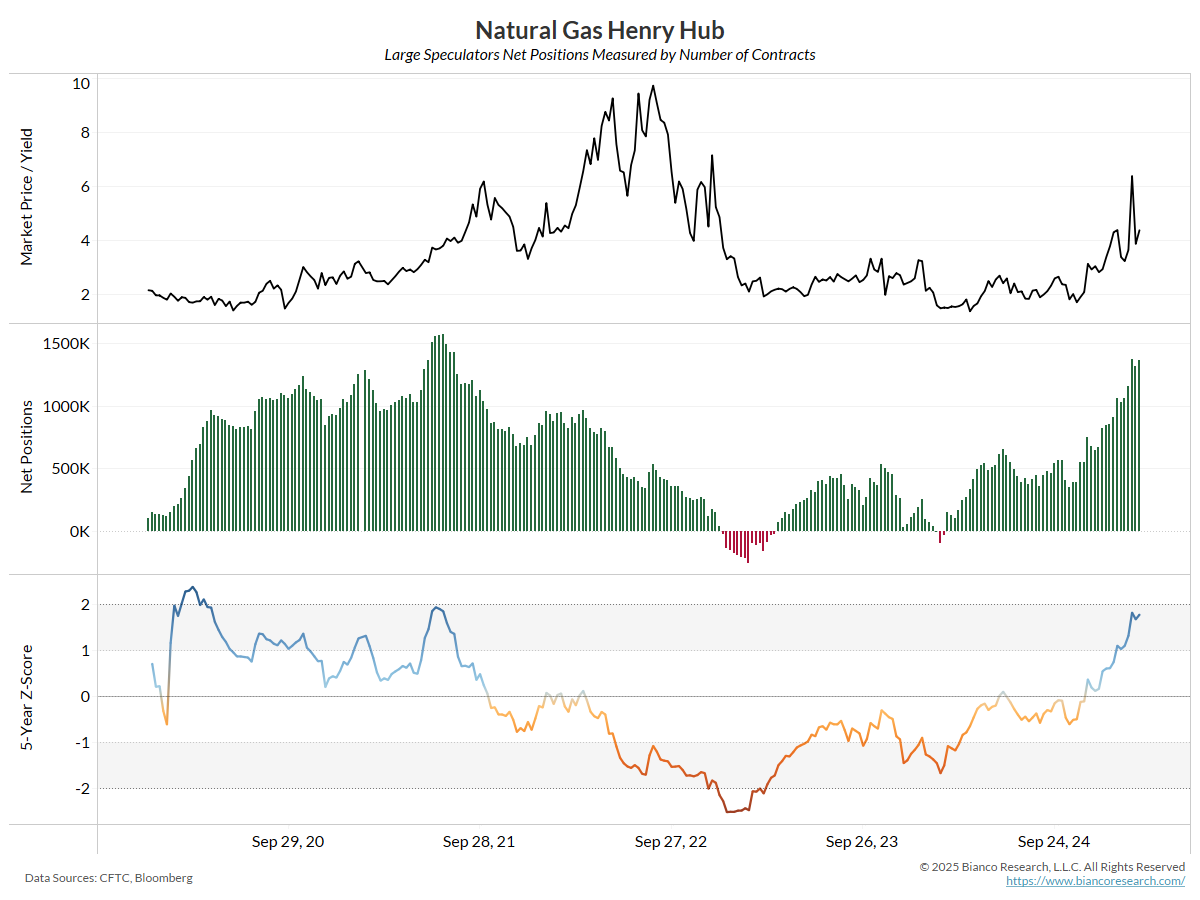

CoT Commentary: Eyes on Dr. Copper

Posted By Alex Malitas

The Commitments of Traders report gauges position changes among different types of market participants. ... Read More