Tag Archives: Markets

MacroVoices #380 Jim Bianco: FOMC to China to Dollar to AI

MacroVoices Erik Townsend and Patrick Ceresna welcome Bianco Research founder Jim Bianco to the show to discuss the FOMC statement, the Fed?s hawkish pause, where rates and stock prices are headed, and much more.... Read More

What’s Driving Fed Policy?

Jim Bianco, president of Bianco Research sits down with Maggie Lake to discuss the recent actions of the Federal Reserve, decipher the sentiment in the bond market, and provide a breakdown of yesterday's crucial inflation data. In the second half of today's show, Jim Bianco will explain to us the key drivers behind the current Fed policy. ... Read More

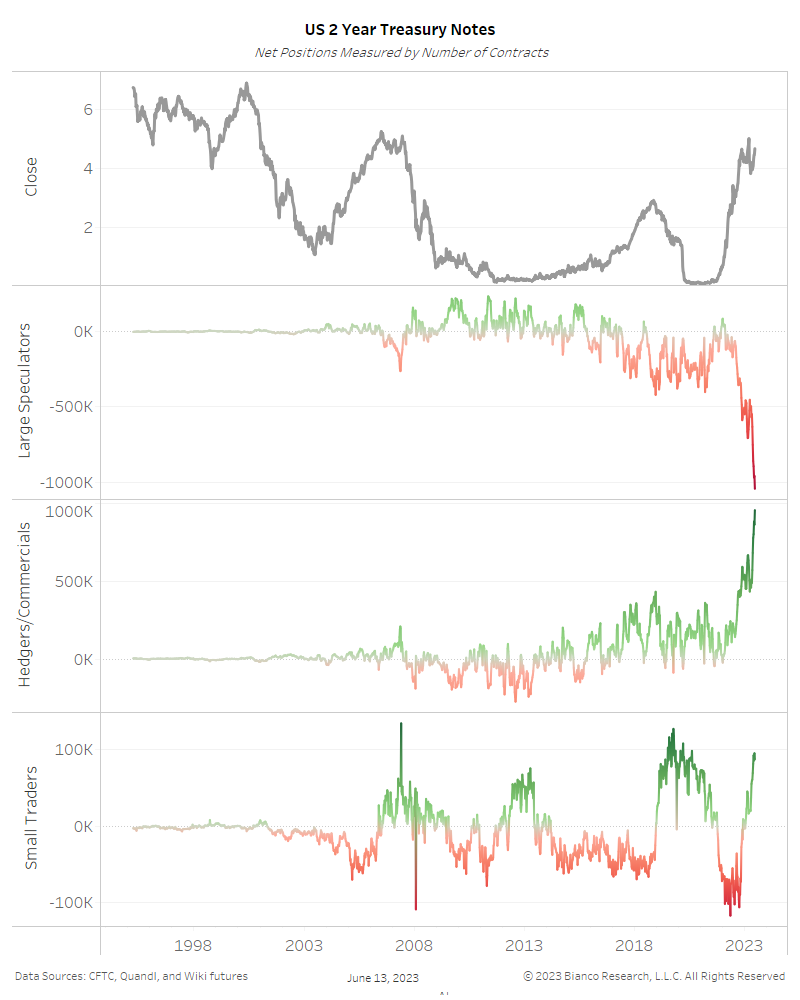

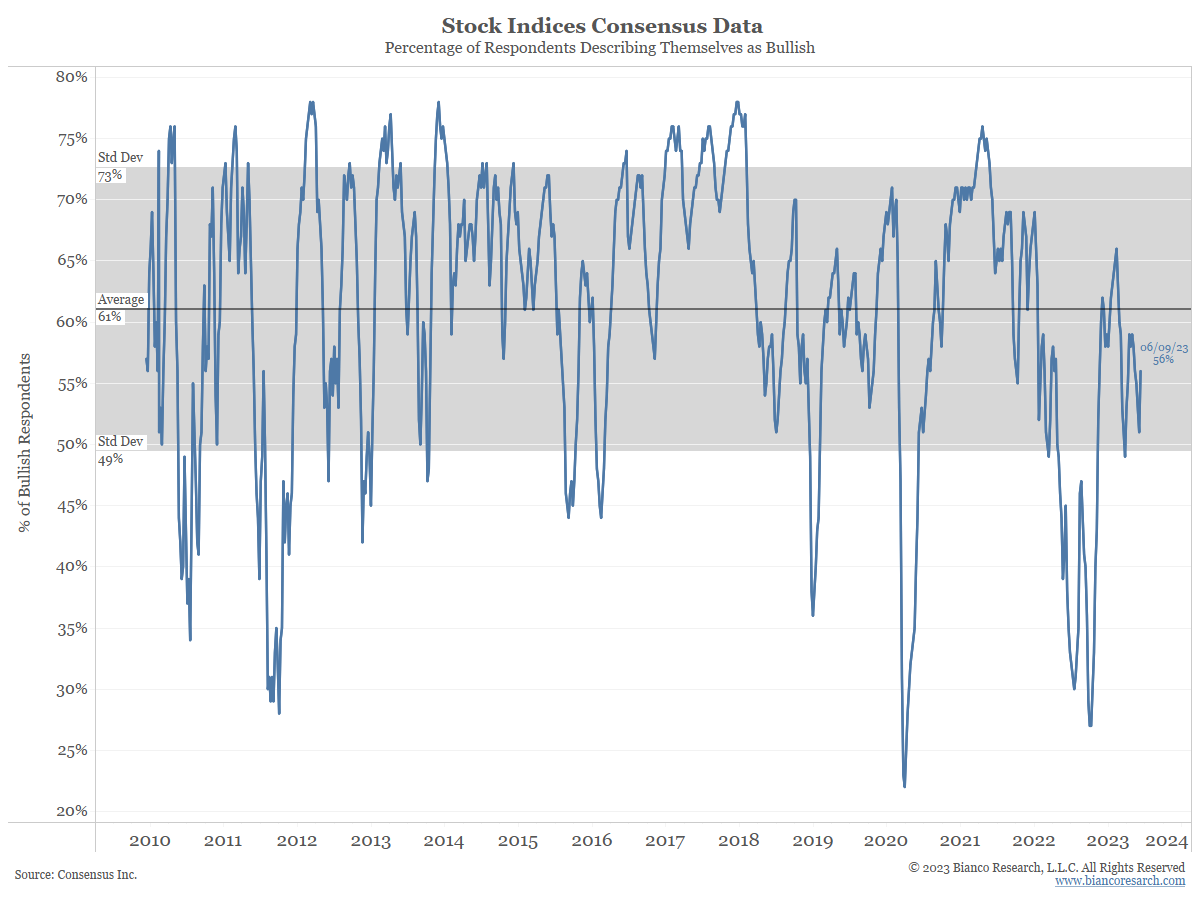

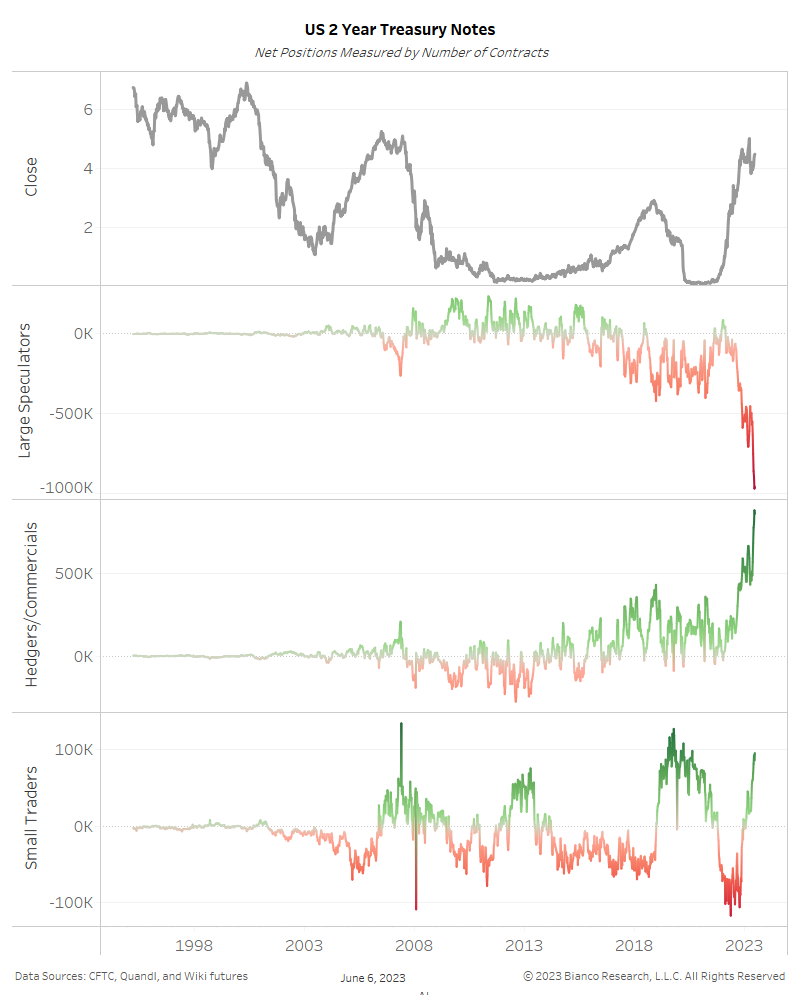

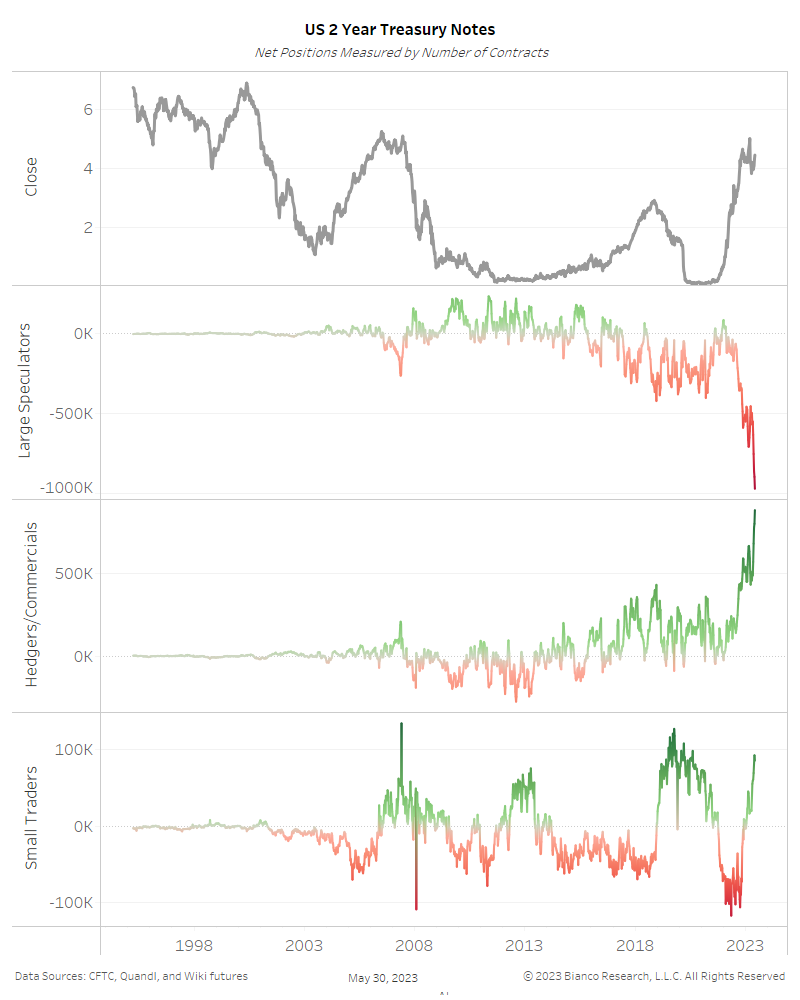

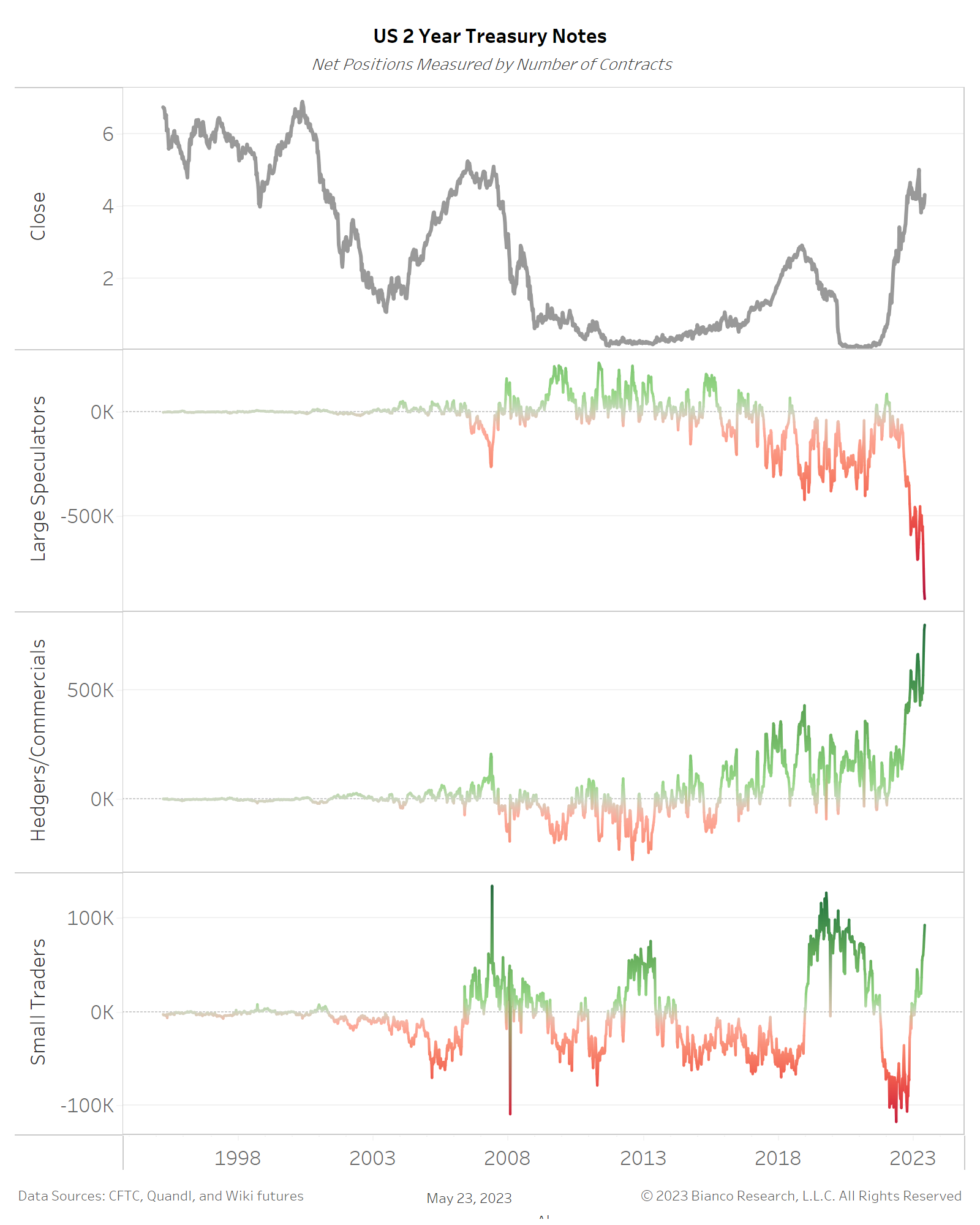

Sentiment and Positioning: A New Bull Market?

Posted By Alex Malitas

The S&P 500 has entered a new bull market after rallying 20% from its low last year. A lack of market breadth and uncertainty regarding the economic and inflation outlook in the U.S. has investors positioning for more trouble in the stock markets. Fixed income sentiment is mixed.... Read More

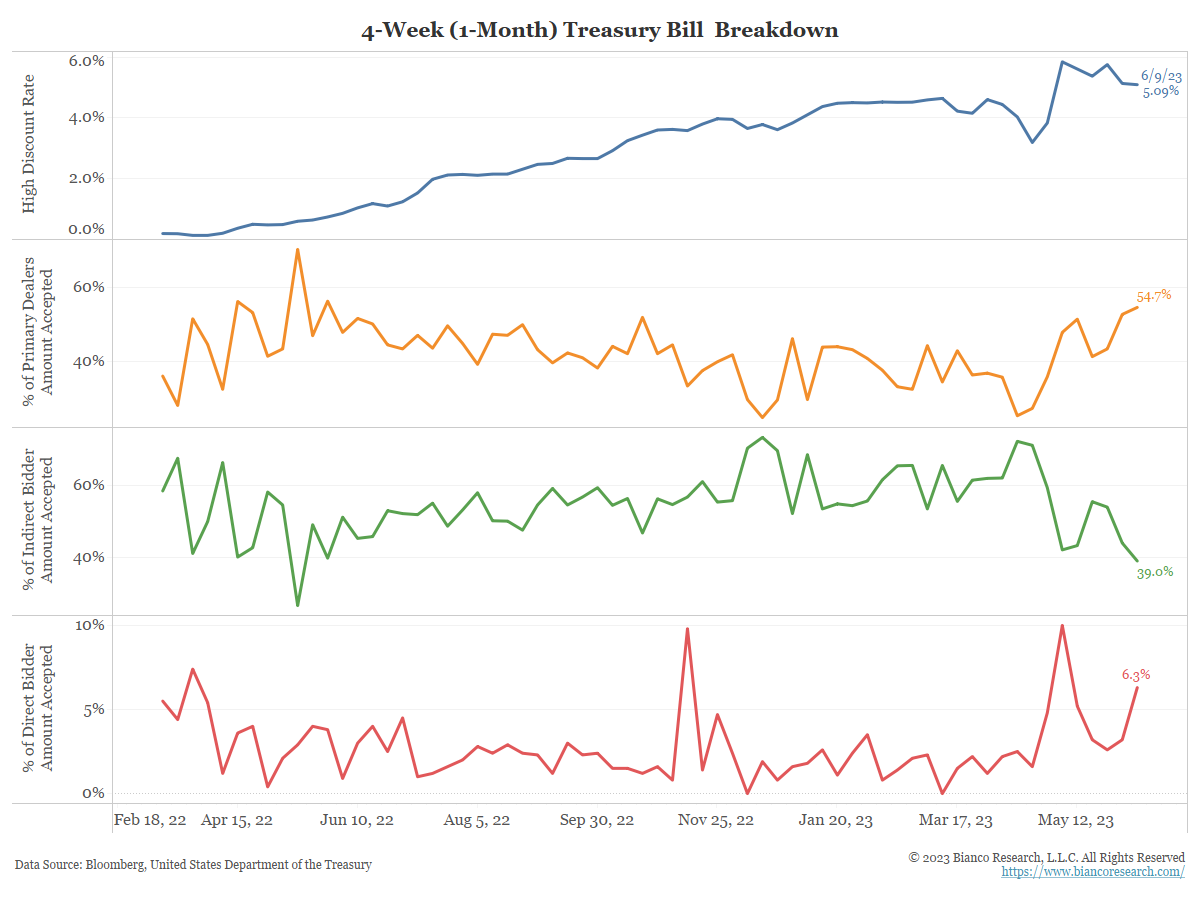

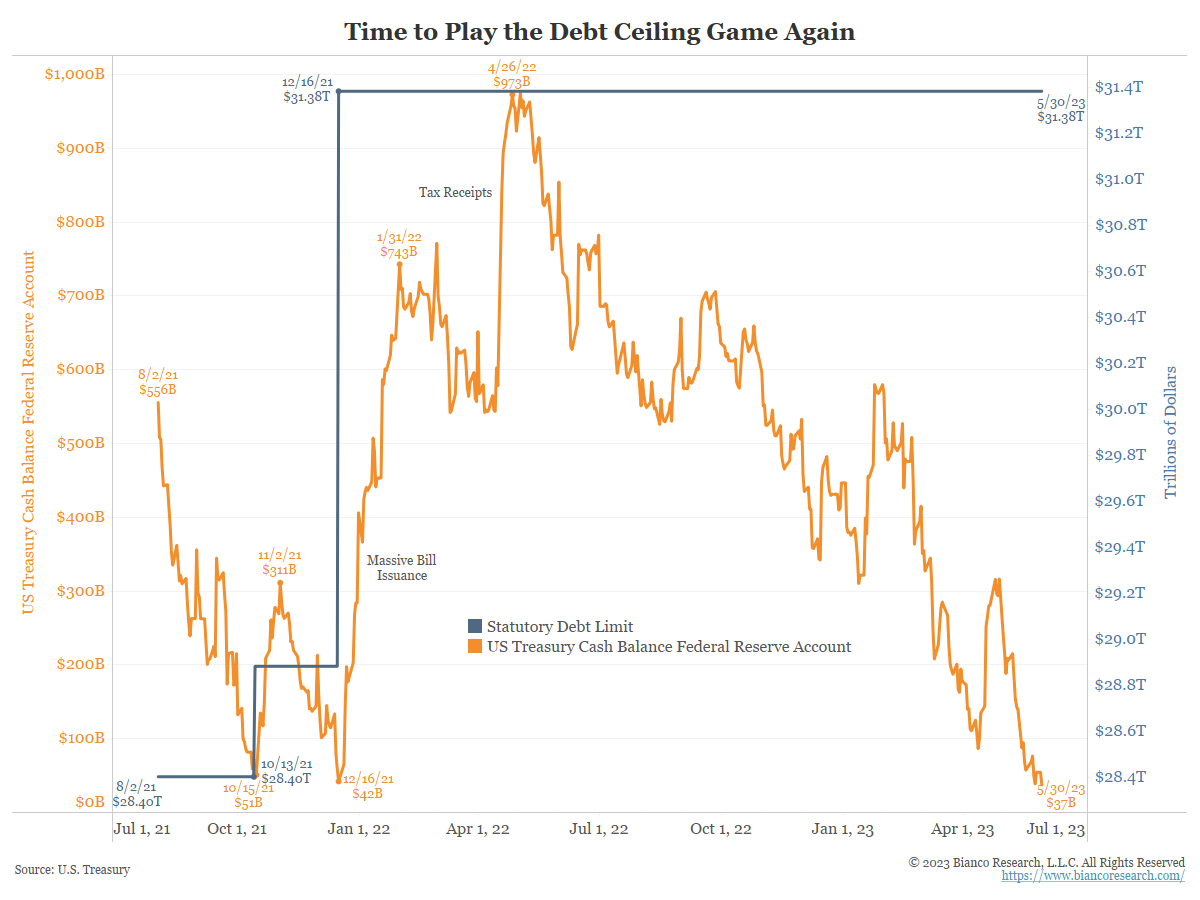

The Week Liquidity Gets Tested

Posted By Jim Bianco

In the next 48 hours, the Treasury will issue $290 billion of securities. This will tell us much about liquidity and the market impact of refilling the Treasury's General Account (TGA).... Read More

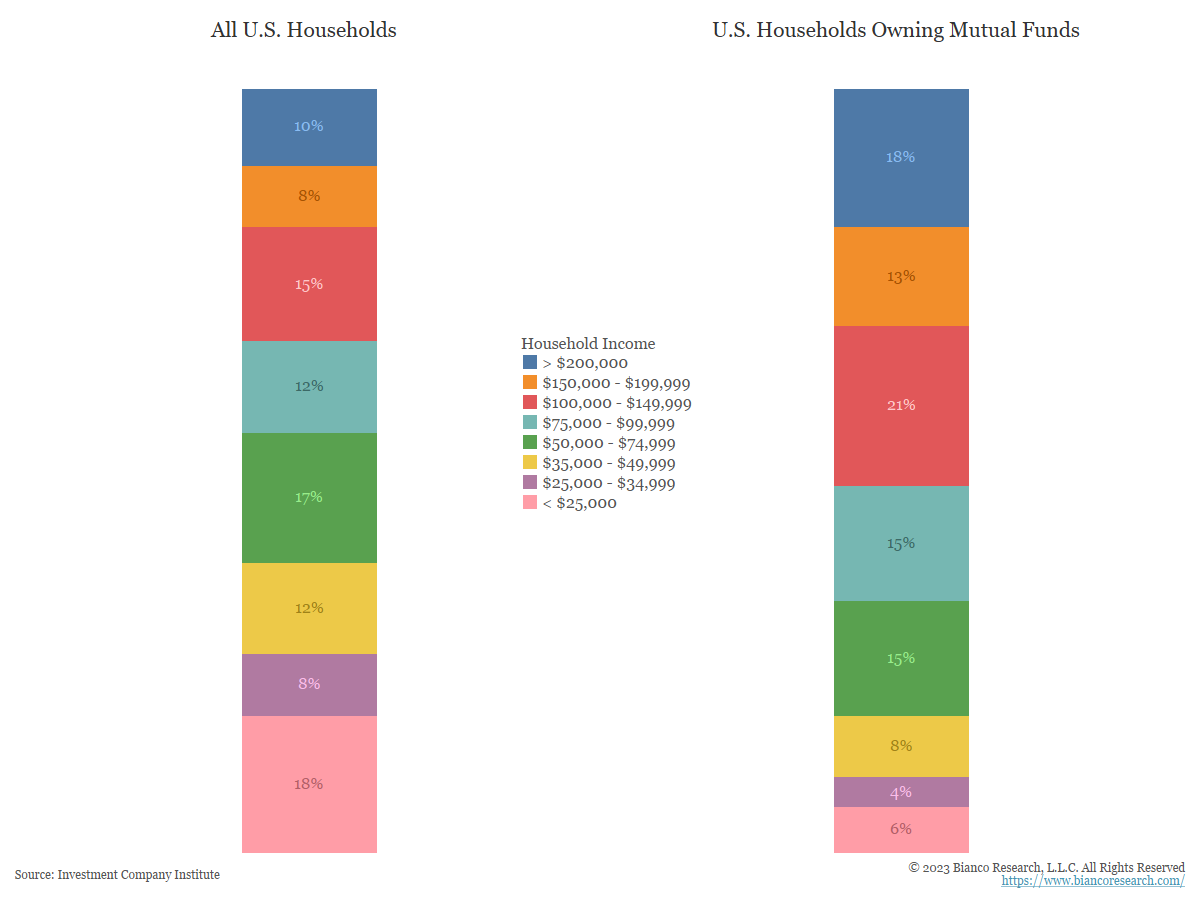

Profiling the Mutual Fund & ETF Universe

Posted By Greg Blaha

52% of households owning mutual funds make more than $100k per year.... Read More

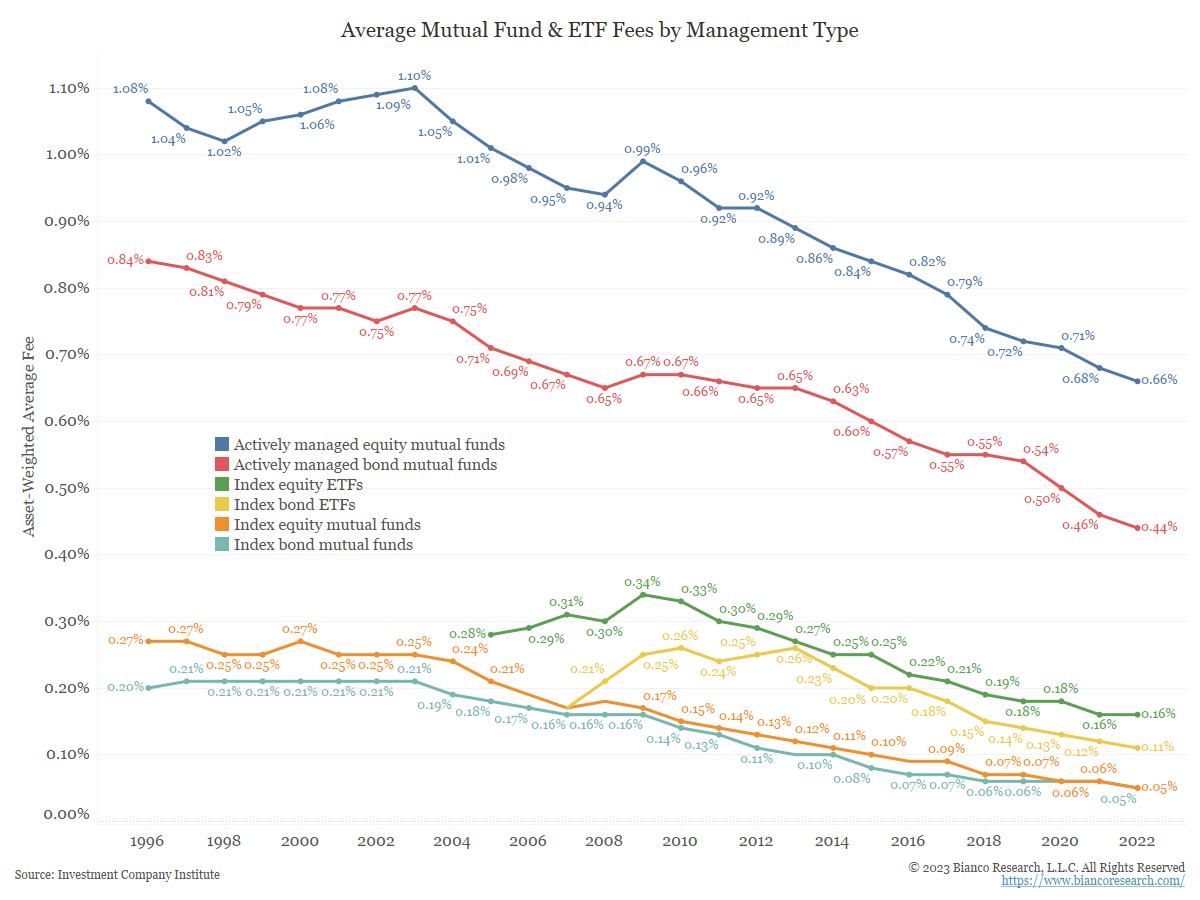

The Divide Between Active and Passive Fund Fees

Posted By Greg Blaha

Active equity funds continue to charge 10x the fees of passive equity funds.... Read More

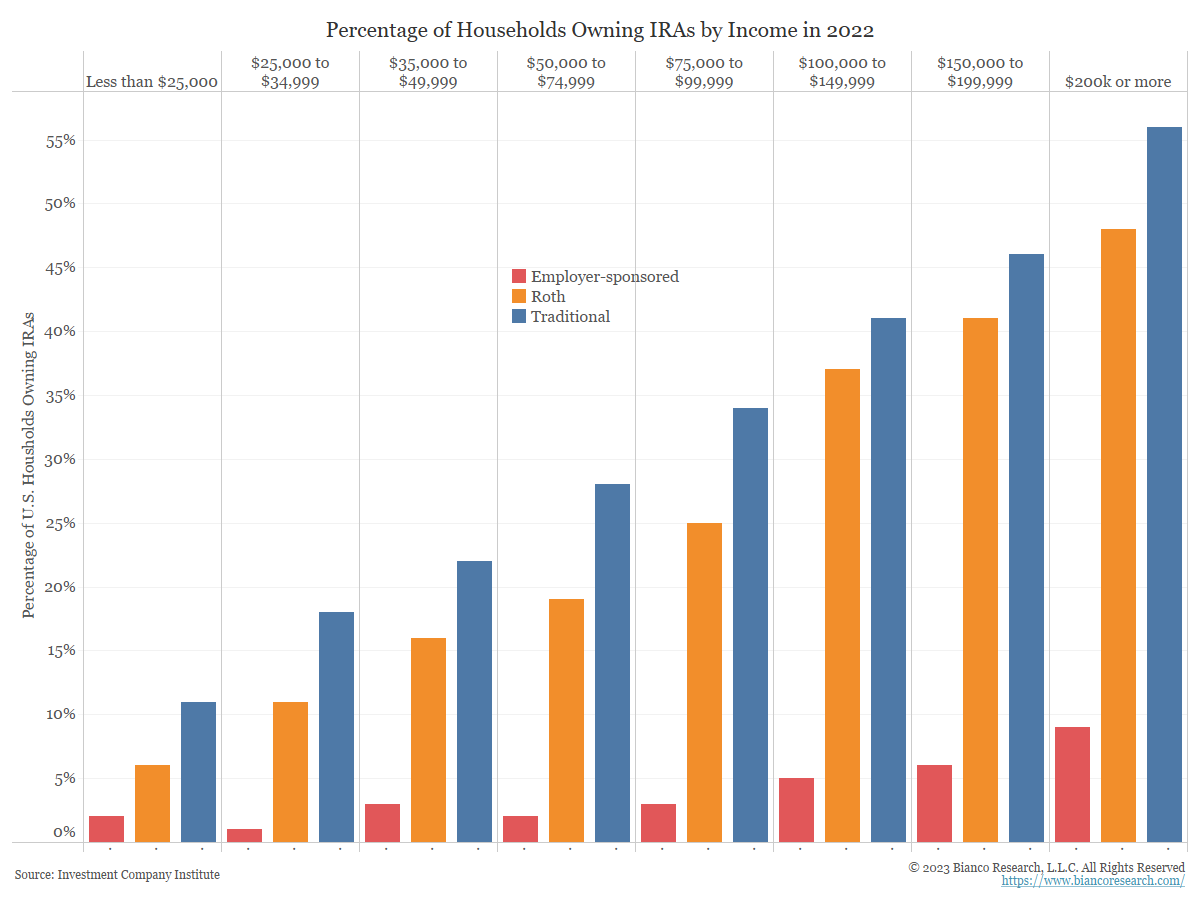

Breaking Down Retirement Assets

Posted By Greg Blaha

42% of U.S. households own an IRA. The difference in ownership between the highest and lowest income buckets is staggering.... Read More

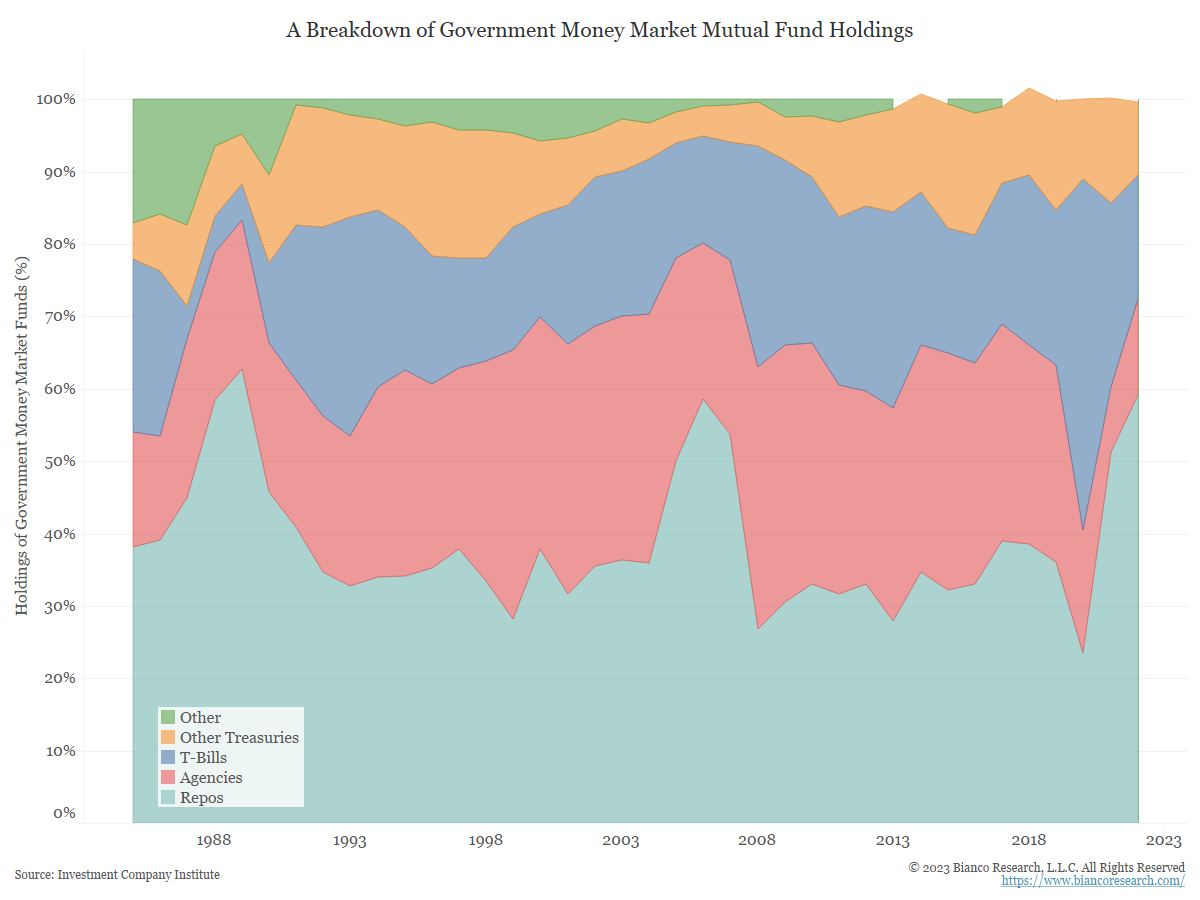

Government vs. Prime Money Market Funds

Posted By Greg Blaha

A look at the holdings of government-only money market funds versus prime money market funds... Read More

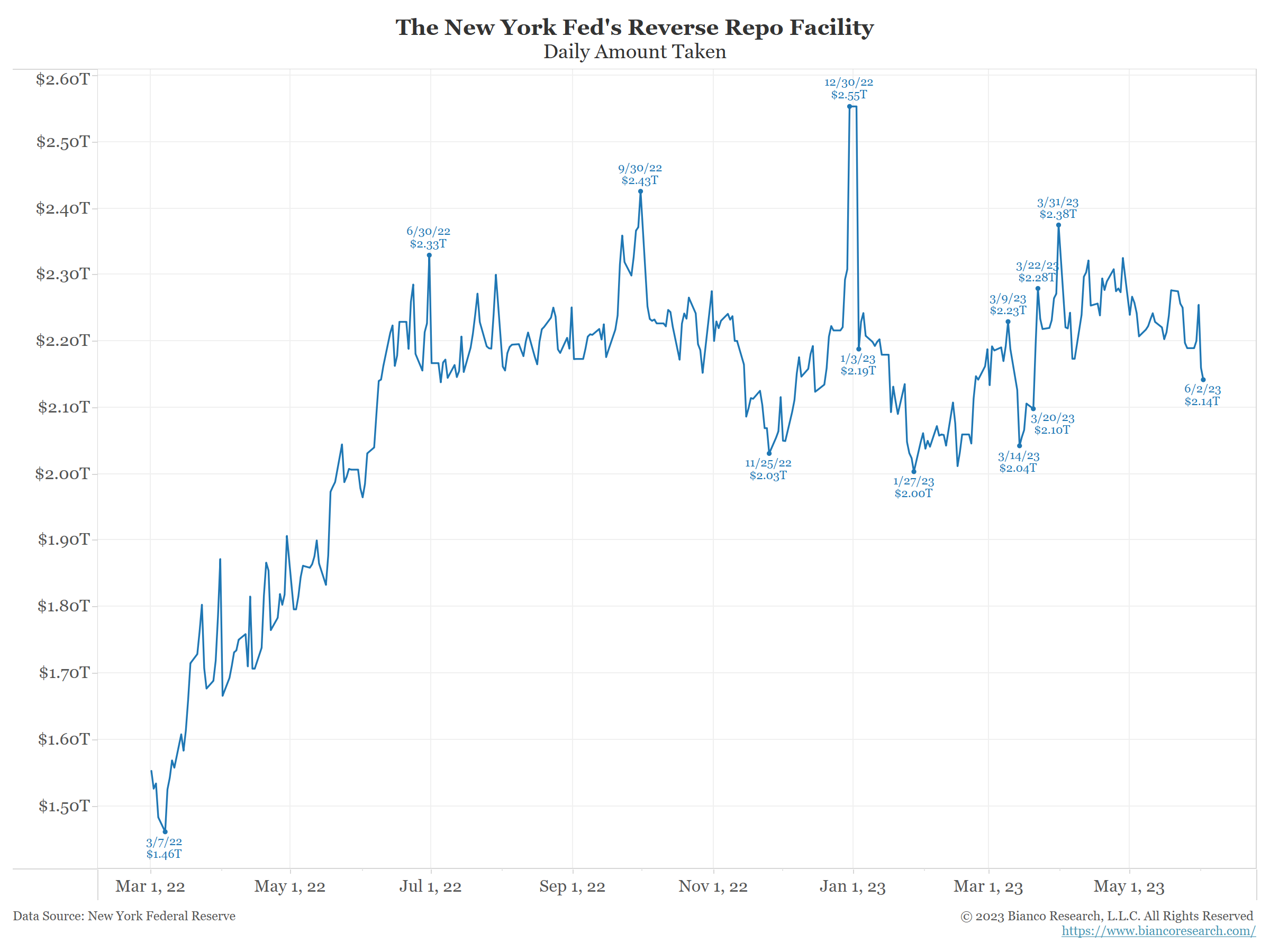

What’s Next for Bill Yields?

Posted By Jim Bianco

Today alone, the U.S. Treasury will issue over $170 billion of bills. This is the beginning of a total wave of issuance over the next few months expected to top one trillion dollars. What it means depends on how much of the funds for these new issues come from the Fed's Reverse Repo Facility (RRP). Predicting moves in the RRP is difficult. So, over the next few days, we will watch the daily take from the RRP.... Read More

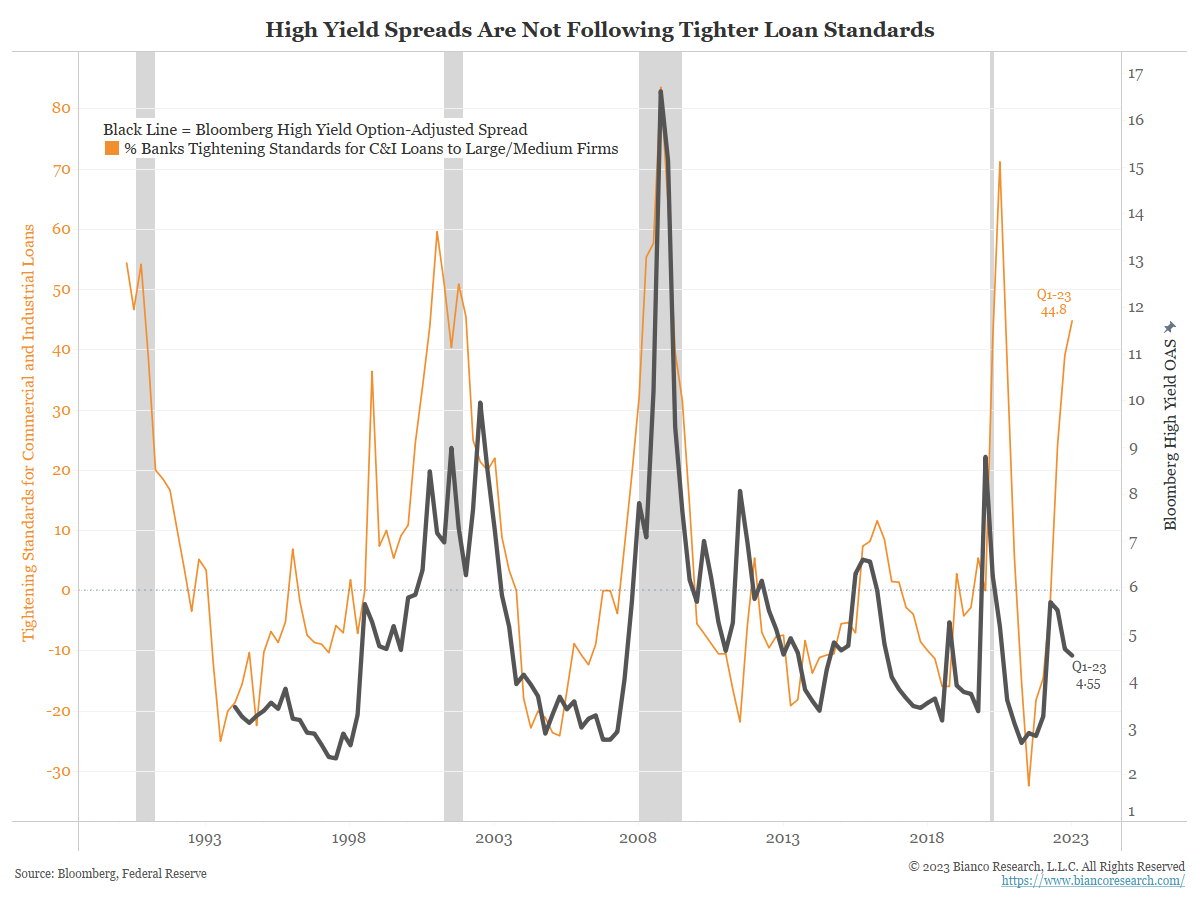

High Yield Spreads Not Following Tighter Loan Standards

Posted By Greg Blaha

Worsening loan conditions have yet to send high-yield spreads wider. It is worth noting the index contains higher quality bonds than in past crises.... Read More

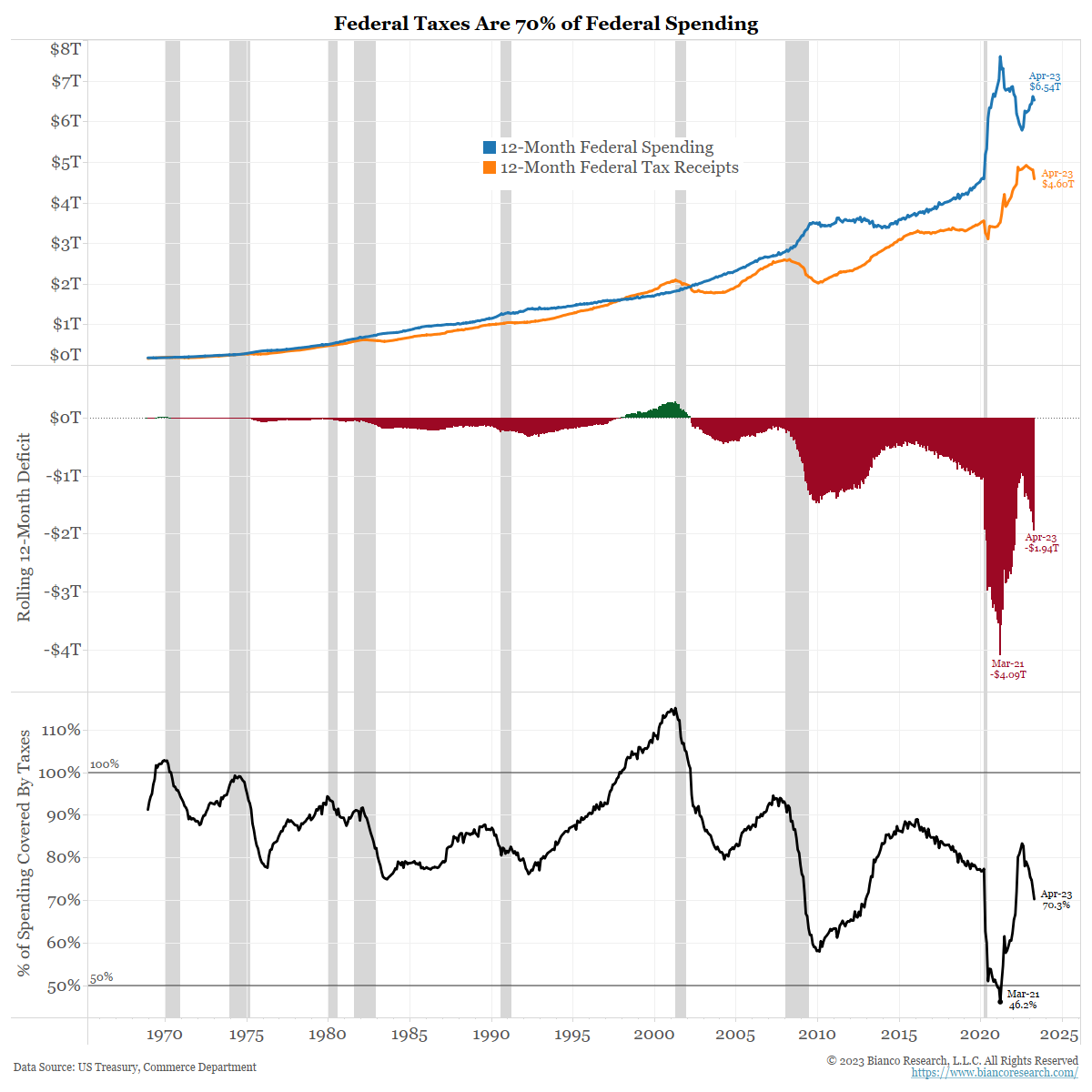

Tax Receipts Cover 70% of Federal Spending

Posted By Greg Blaha

Tax receipts only cover 70% of federal spending as net interest costs are projected to rise.... Read More

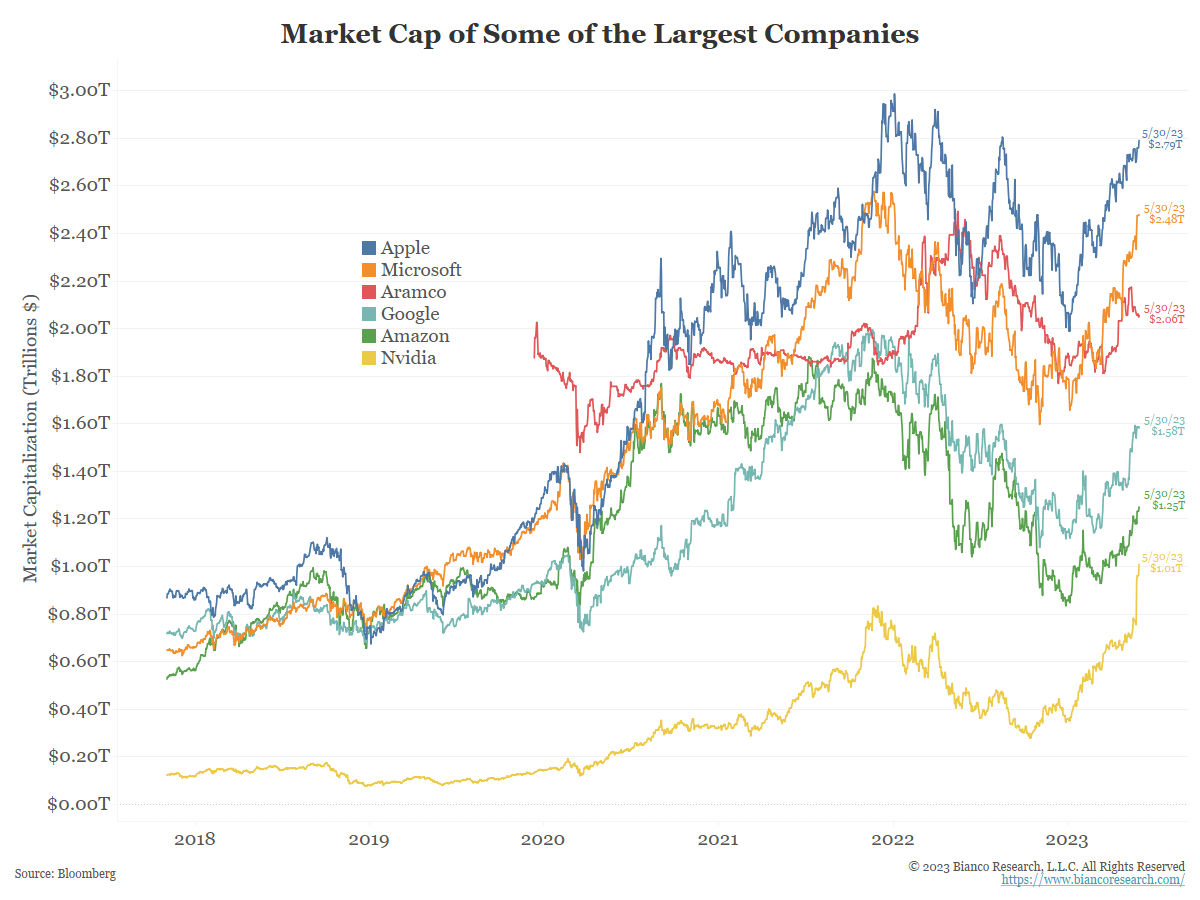

Nvidia Joins the Trillion Dollar Club

Posted By Greg Blaha

Nvidia has capitalized on the AI frenzy, joining a small club of companies worth more than $1 trillion.... Read More

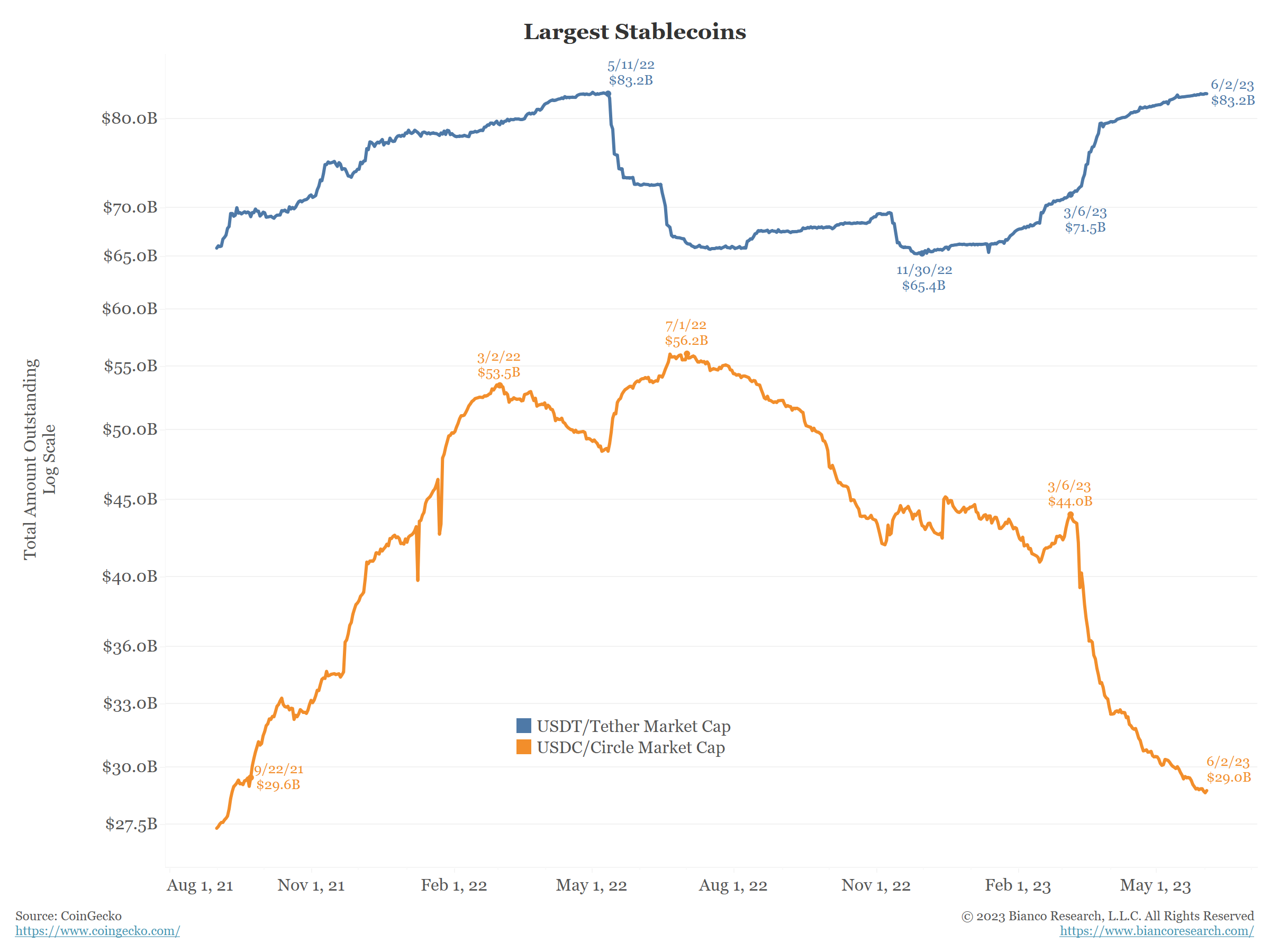

Stablecoins Turn the Tables

Posted By Jim Bianco

Before May 2022, regulators worried that stablecoins posed a systemic risk to traditional financial markets, like Treasury bills. What if everyone lost confidence in stablecoins and moved at once to get out, causing their reserves to dump hundreds of billions of Treasury bills all at once. Now, traditional markets and their regulators, and the specter of defaulting Treasury bills (off the table until early 2025), pose a risk to stablecoins! This is leading to the stablecoin of choice being offshore, opaque, and not involved in Treasury bills ... USDT and not the regulated and transparent options of USDC. How things have changed!... Read More

Is Another Liquidity Drain Coming?

Posted By Jim Bianco

Now that a debt deal is in place, the Treasury is expected to issue up to $1 trillion in new securities over the next few months. If investors purchase these securities, it will create a liquidity drain. History shows such drains cause financial market turbulence. If these Treasuries are purchased using funds in the Fed's reverse repo facility, the liquidity drain will be greatly muted.... Read More

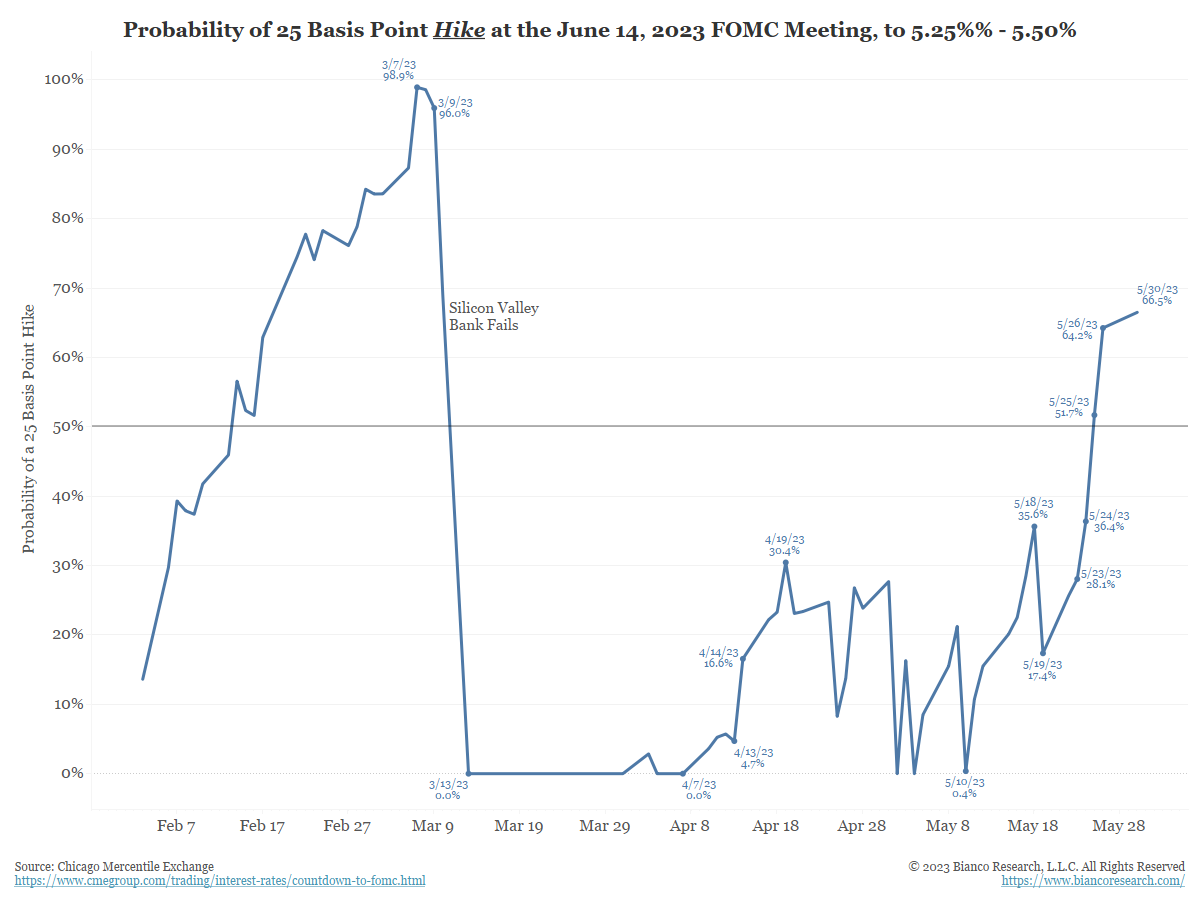

The Return of the Bear Flattener

Posted By Jim Bianco

Inflation data and booming stock prices put a rate hike in play for June. A second hike in July is not out of the picture. Bond yields and the curve are responding accordingly.... Read More

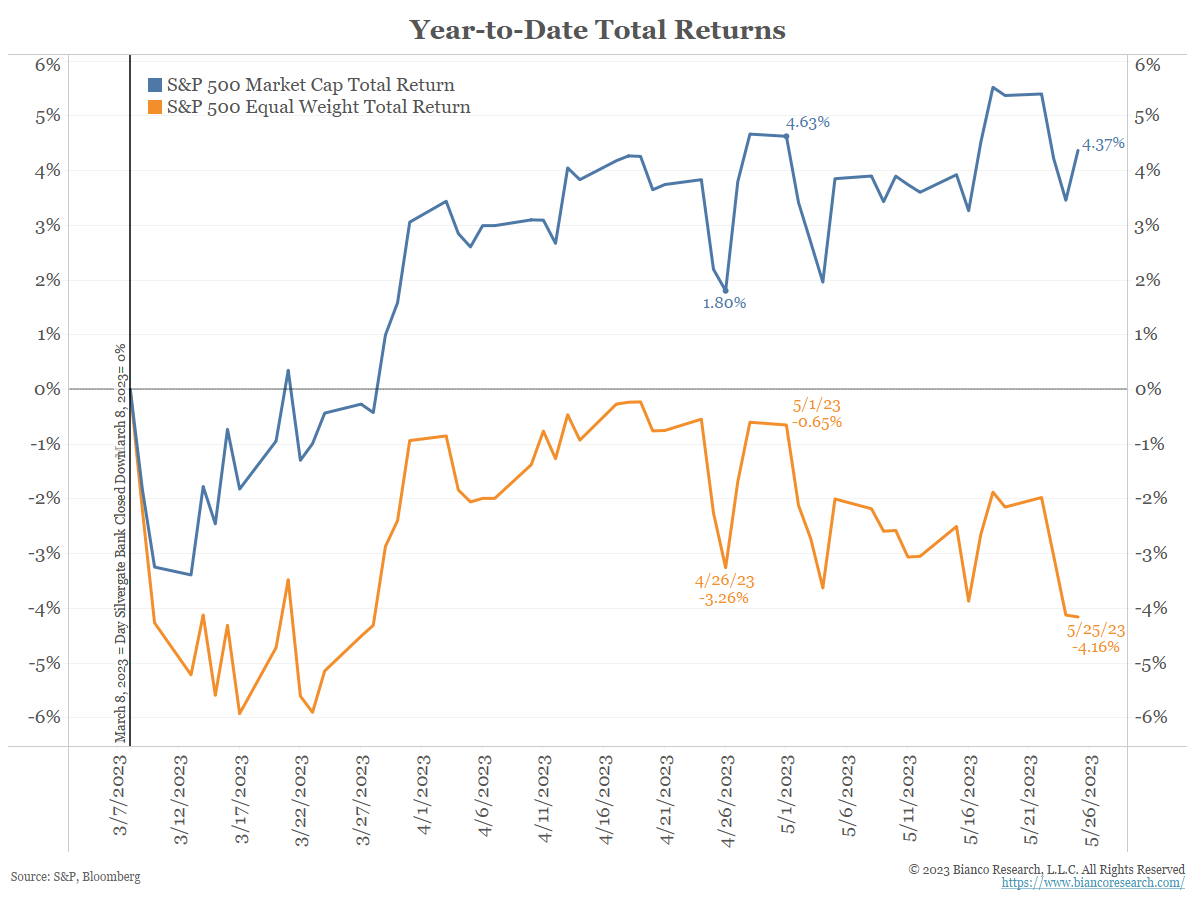

Updating the Narrow Market Rally

Posted By Jim Bianco

Since early March, the AI/ChatGPT stocks have continued to soar on the idea of a paradigm shift. The rest of the market stopped rallying when banks began struggling.... Read More