Tag Archives: Markets

A Study of Inflation, Deflation & the Markets

Posted By Greg Blaha

A study of market performance under various inflation and deflation scenarios since 1801... Read More

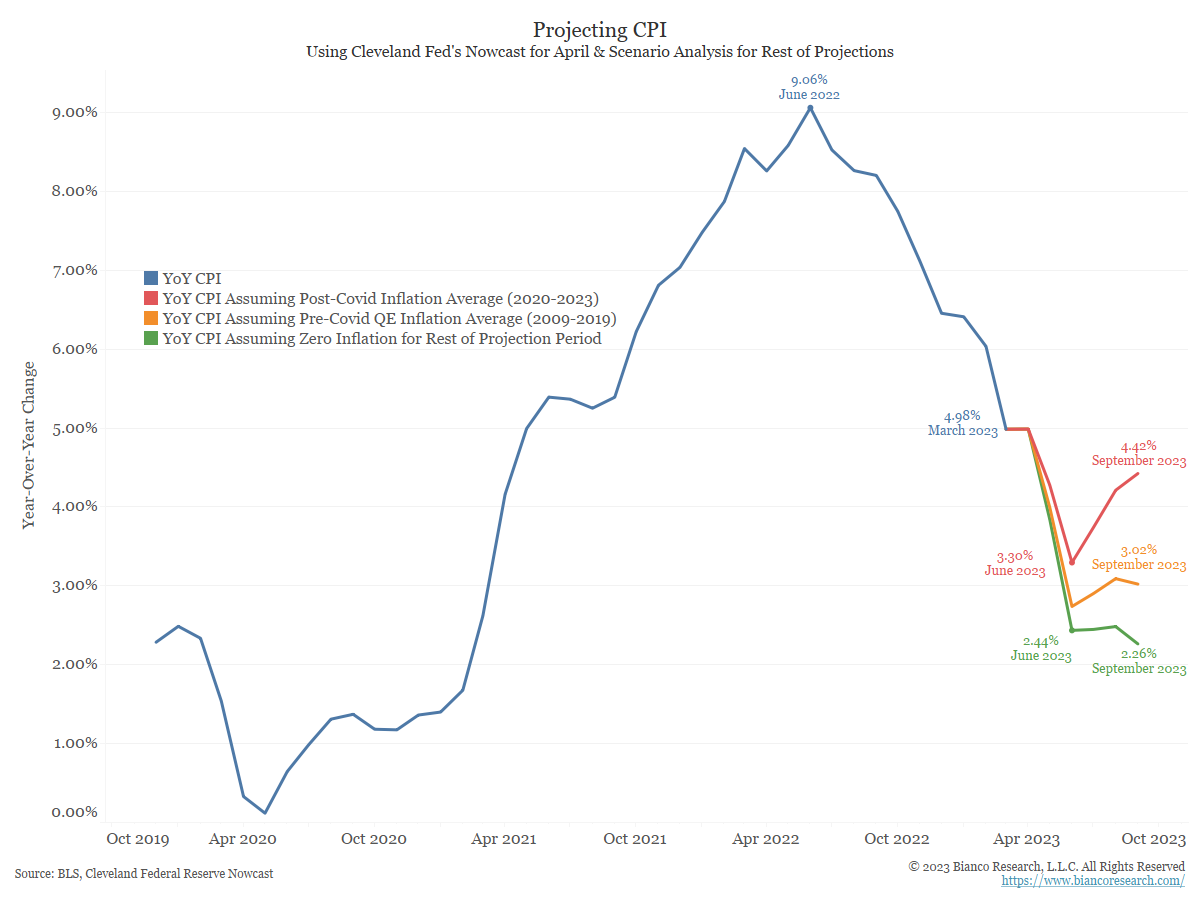

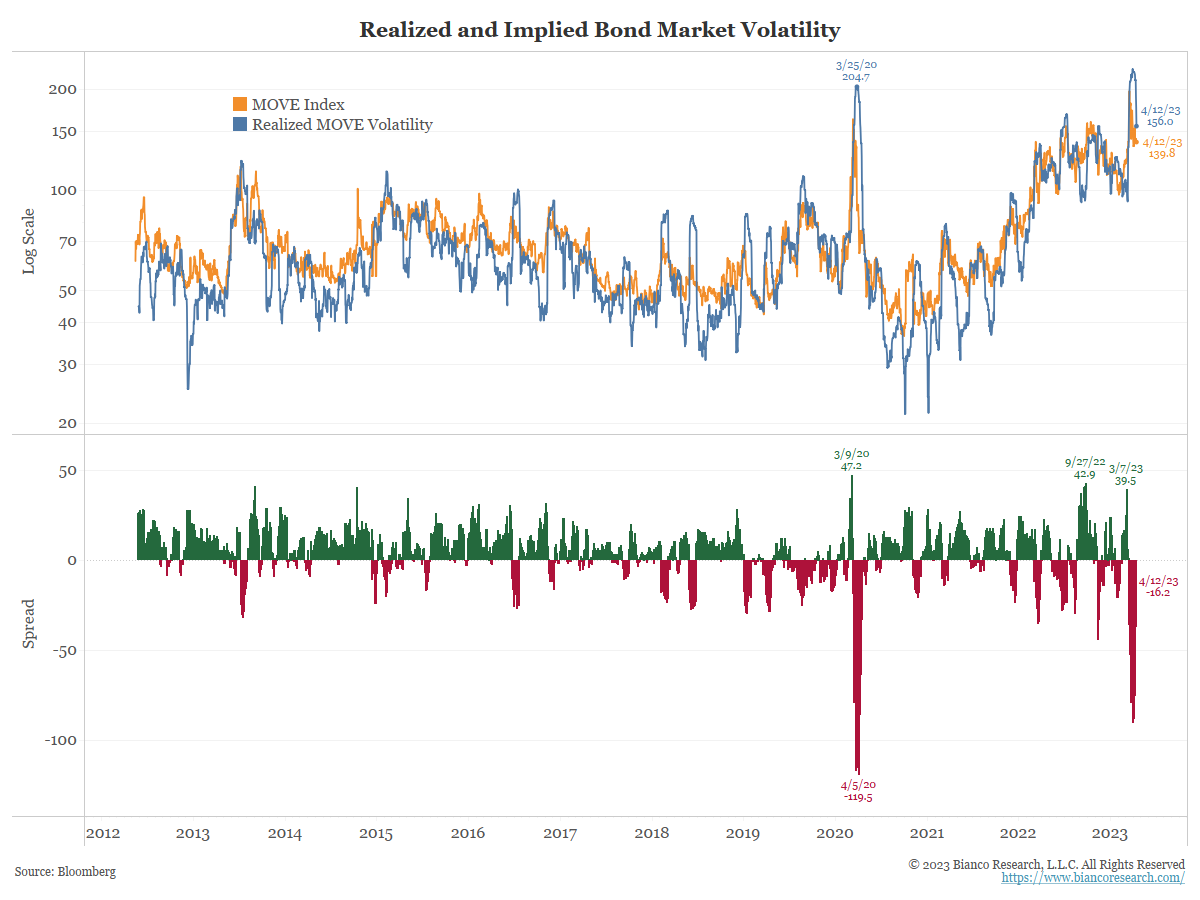

What Are Volatility Measures Telling Us?

Posted By Alex Malitas

Market participants are facing a crisis of 'unknown unknowns.' Most would expect volatility measures to reflect this uncertainty. However, looking at the VIX Index, you would suspect a calm market. This is far from what we have seen in the past two years. ... Read More

The Fed Hikes Until Something Breaks, Something Broke

On today's episode of On The Margin Jim Bianco of Bianco Research joins the show to discuss the fallout of SVB's collapse, and the turmoil that ensued in the banking system. Arguing that rates are currently too high for banks, how will the Fed be forced to react whilst managing both financial stability and inflation. ... Read More

“Elon Musk meet Jim Bianco”

Jim Bianco on Bloomberg TV discussing the latest in the Regional Banking Crisis & the Federal Reserve with Tom Keene and Lisa Abramowicz.... Read More

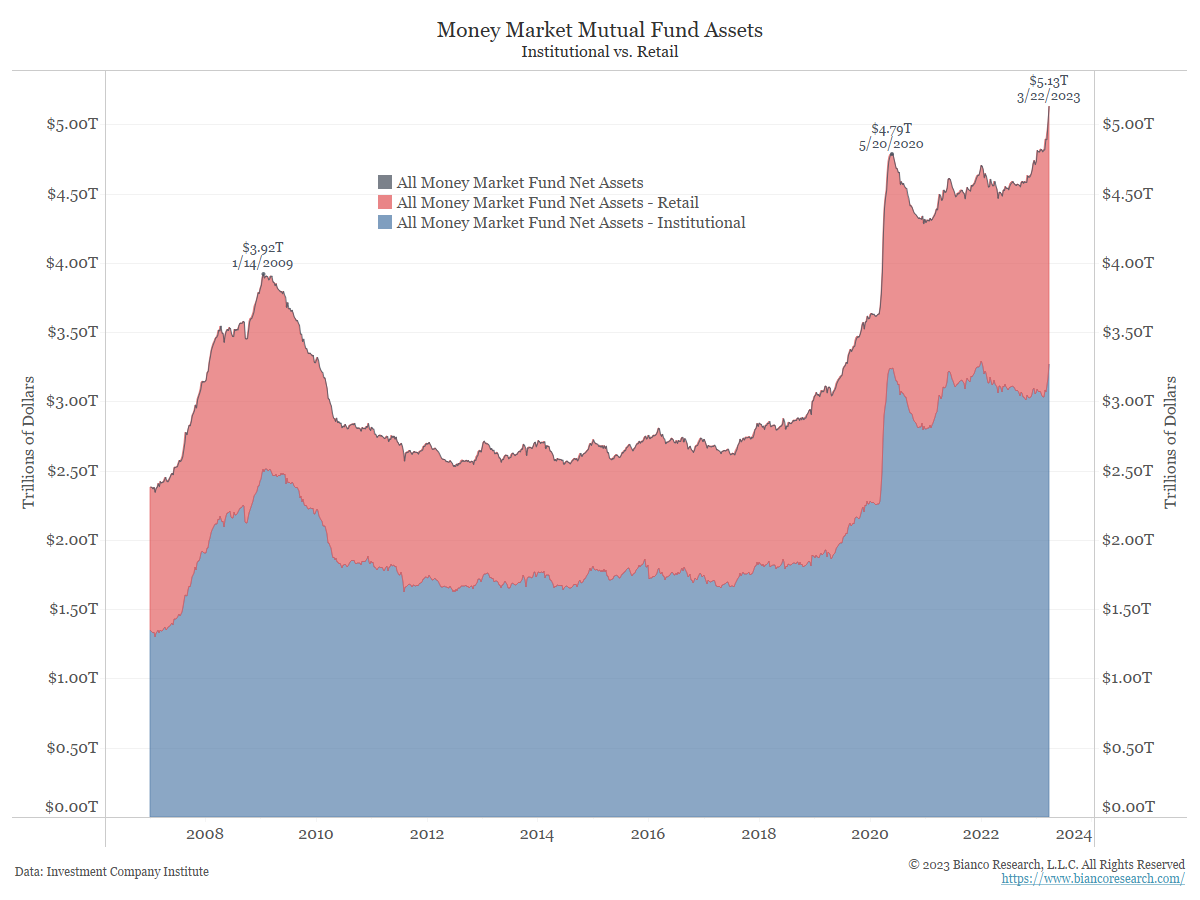

Breaking Down Money Market Funds

Posted By Greg Blaha

Institutional funds accounted for roughly 88% of the inflows into money market funds since March 10.... Read More

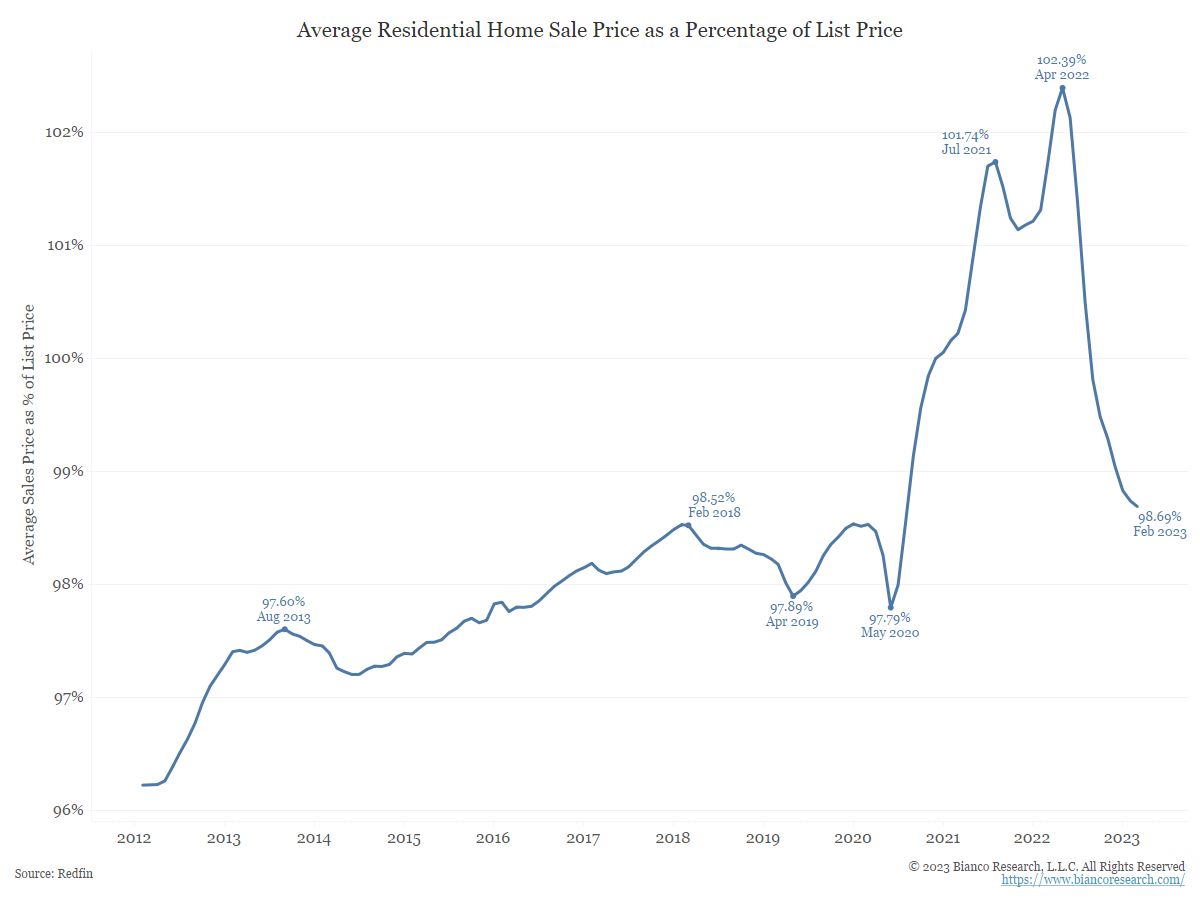

Alternative Housing Data Softened Again in February

Posted By Greg Blaha

Redfin's alternative measures of the housing market continue to show a slowdown in the crazy conditions of the last year.... Read More

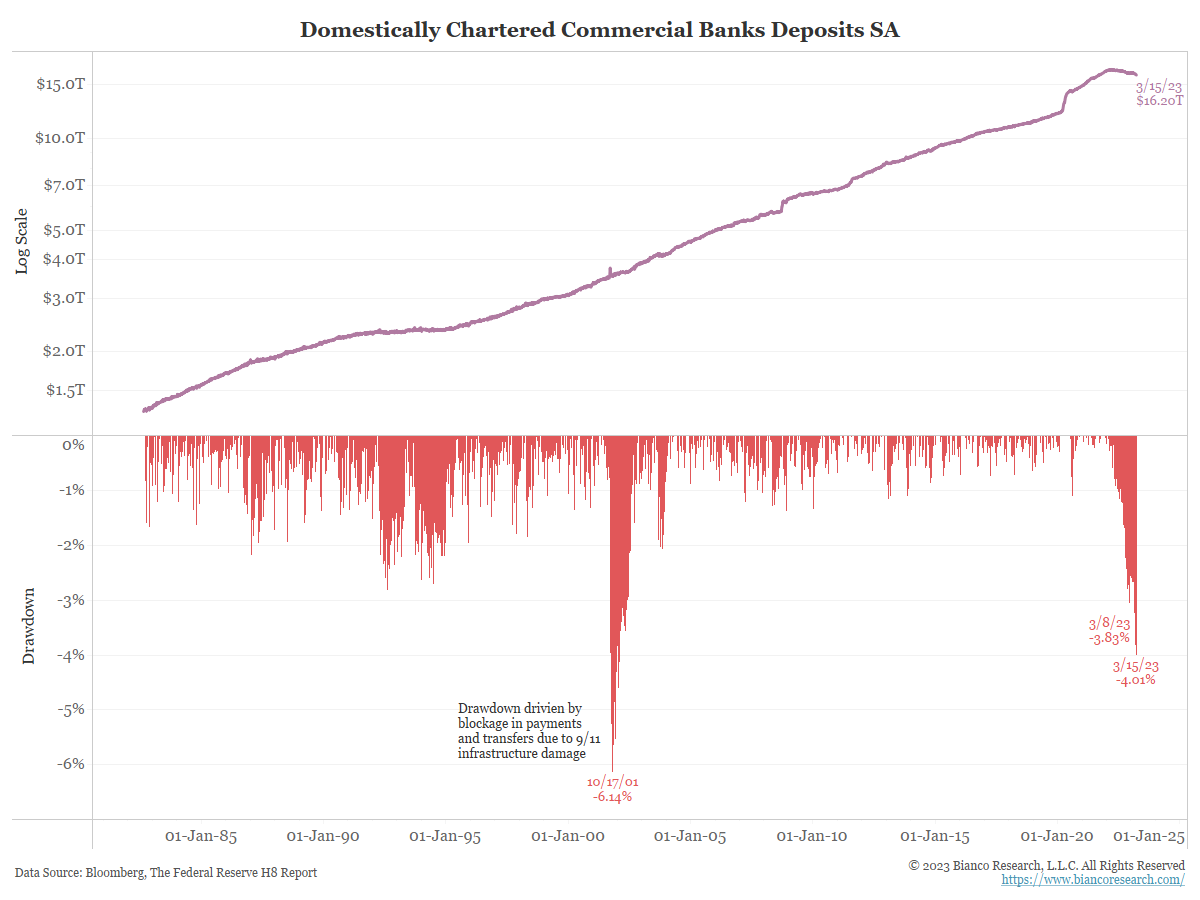

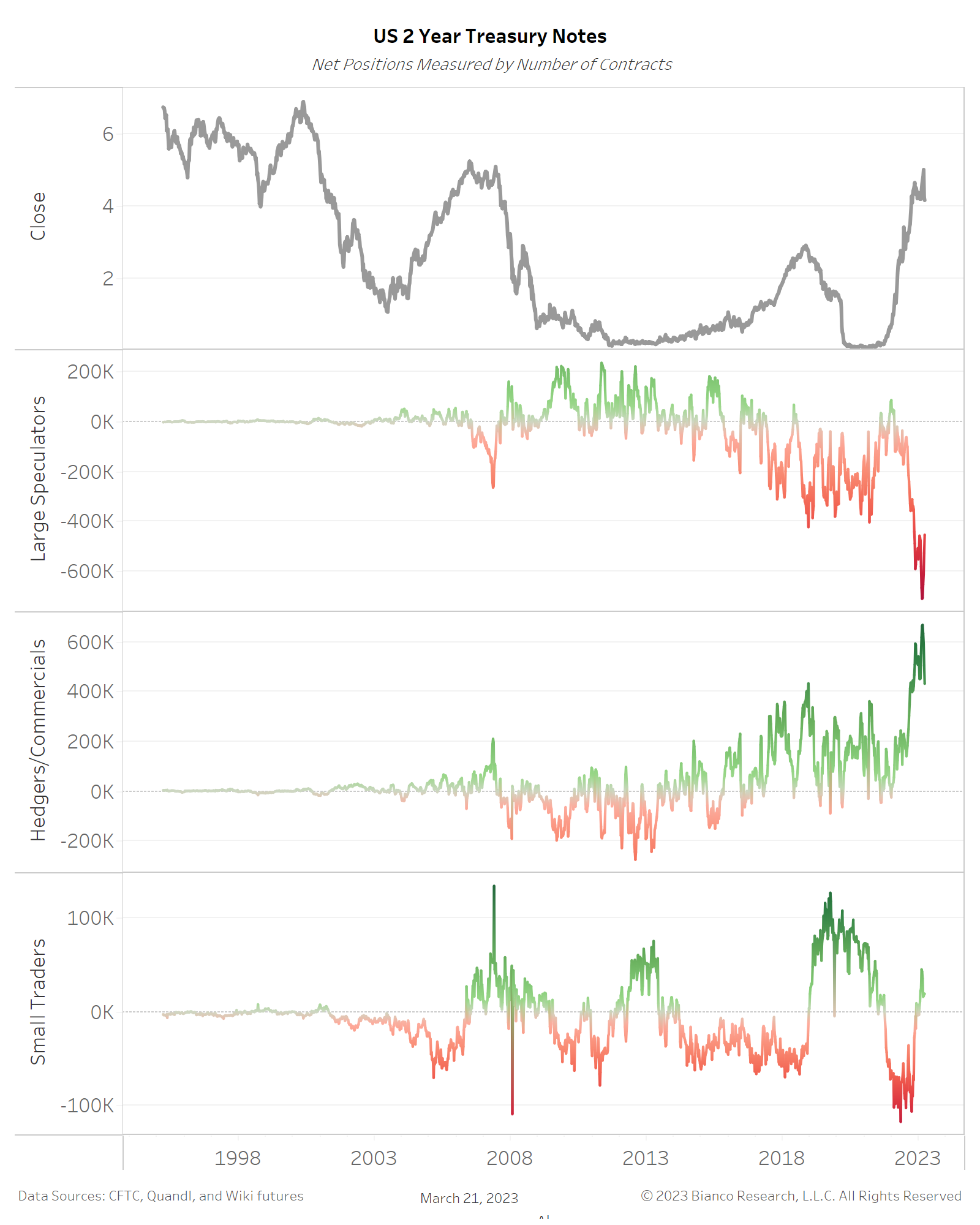

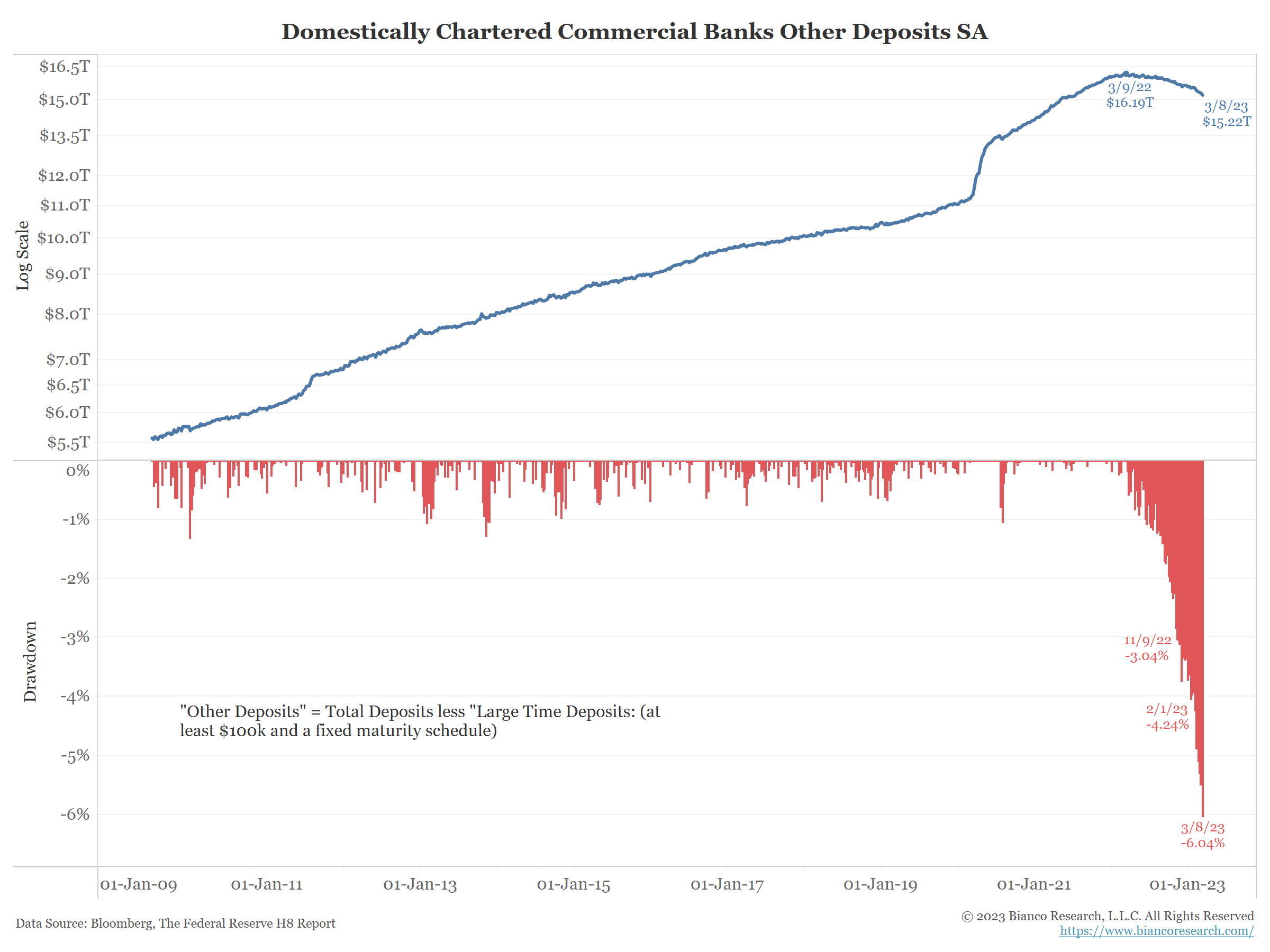

Depositors Are Yield-Seekers

Posted By Jim Bianco

The Federal Reserve's H8 report details the assets and liabilities of commercial banks. The latest data shows deposit flight to higher-yielding options continues.... Read More

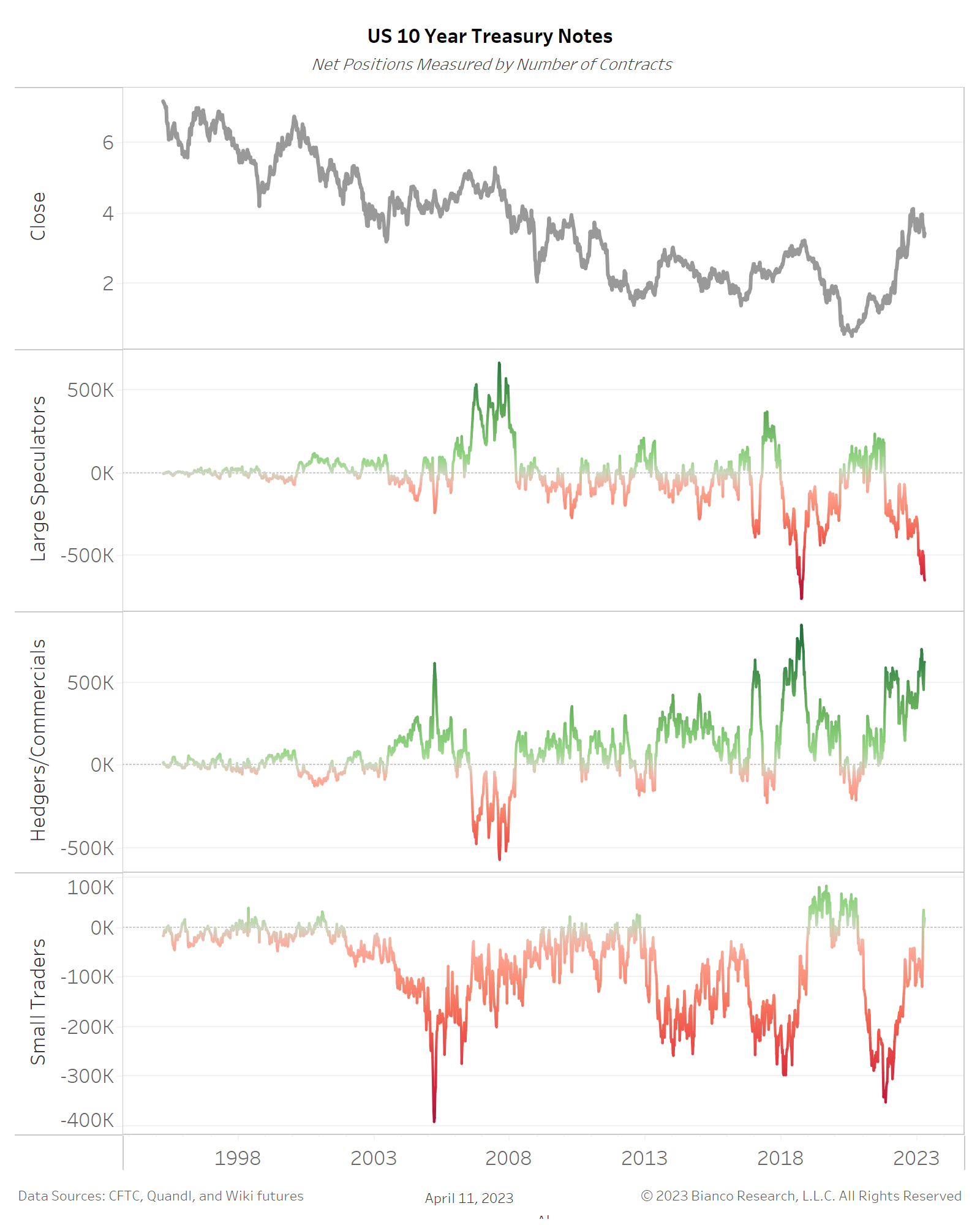

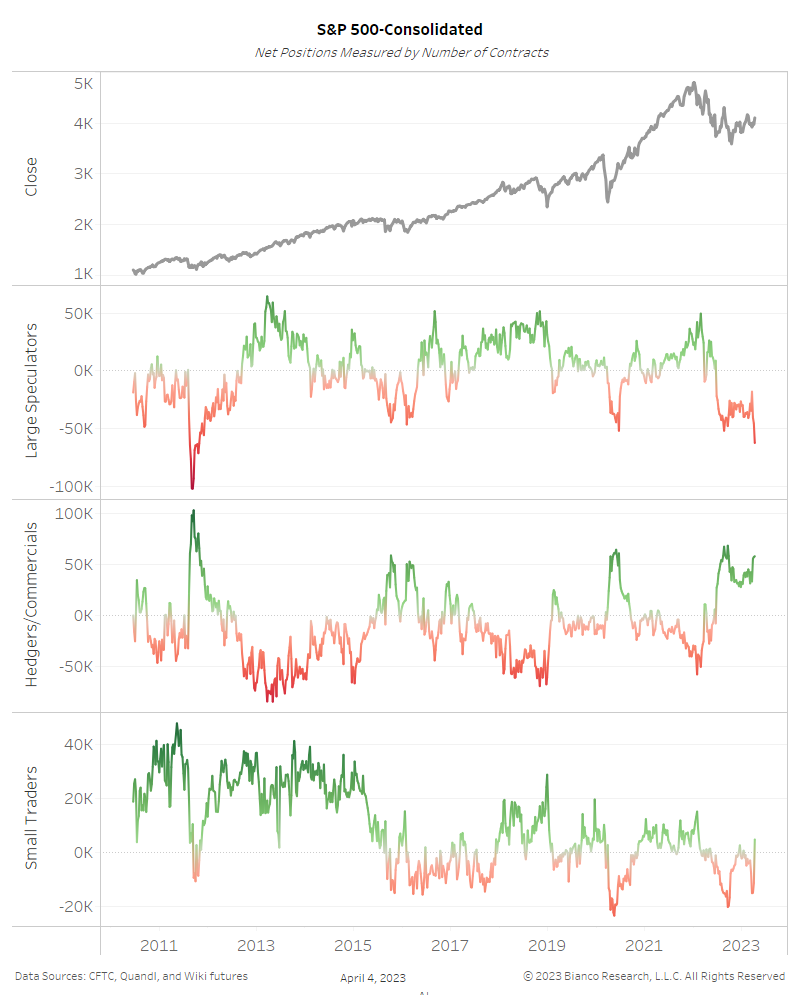

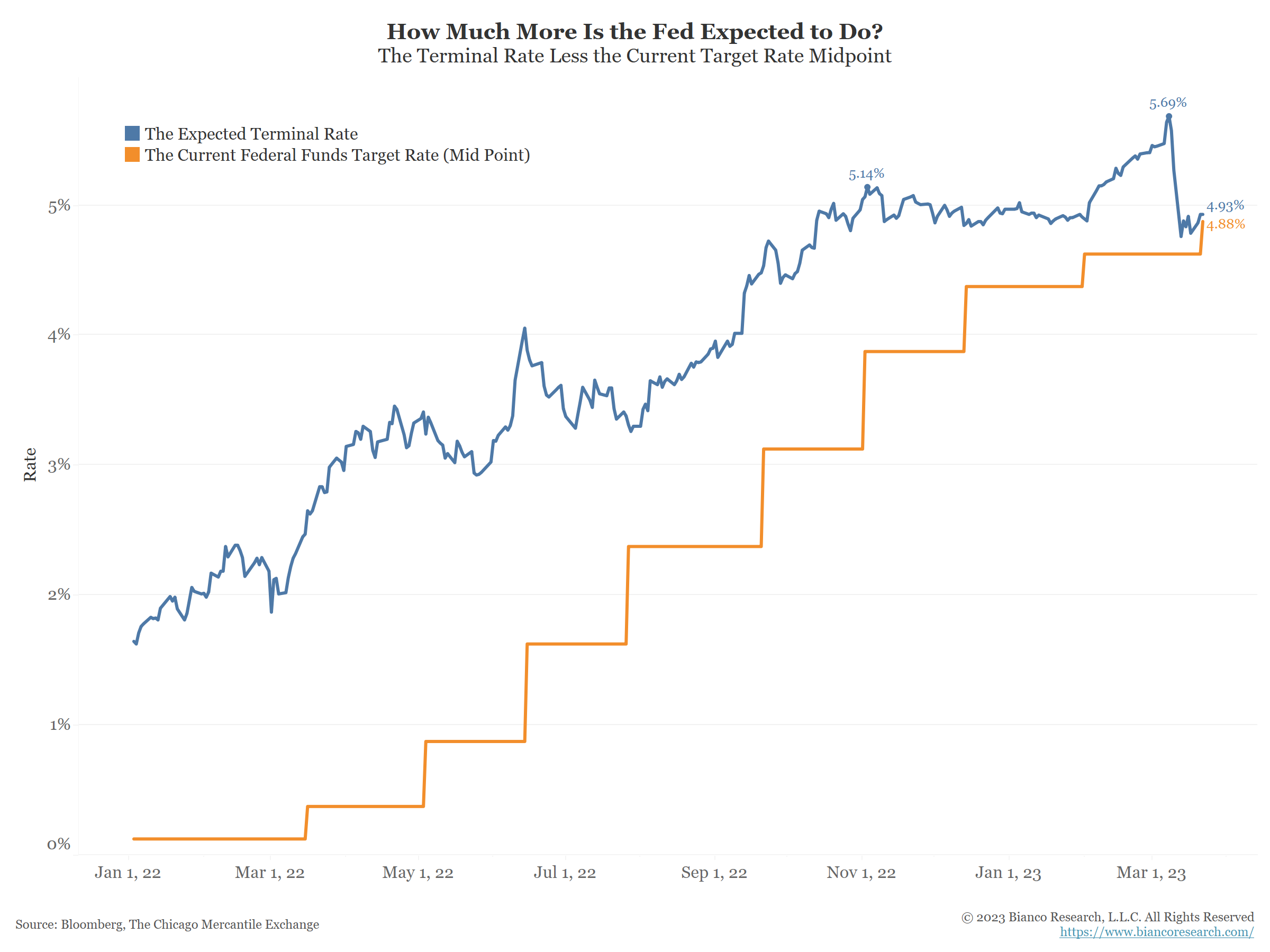

Did We See the Last Rate Hike?

Posted By Jim Bianco

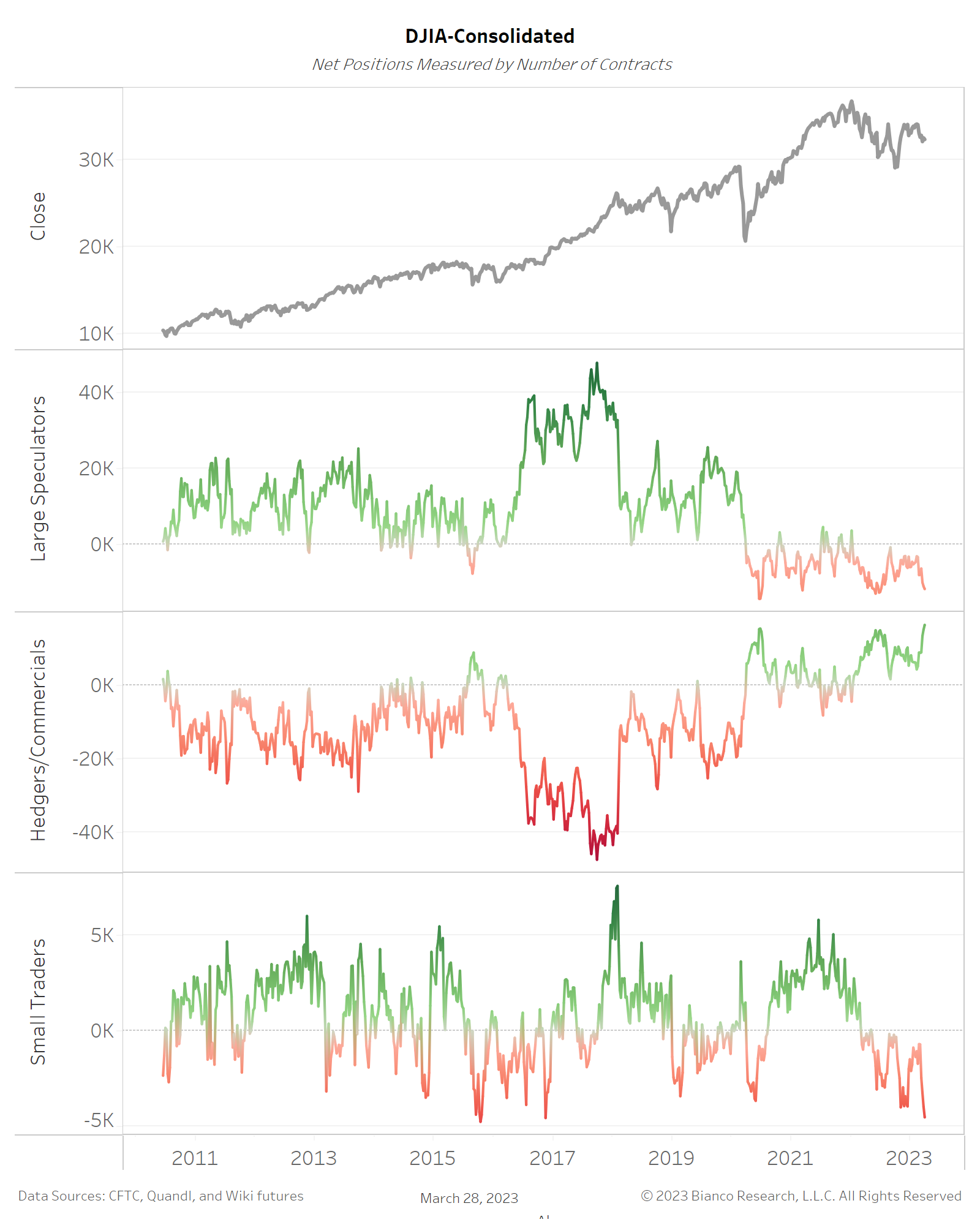

For the first time this hiking cycle, the funds rate has reached the market's expected terminal rate. This suggests the hiking cycle is over. If the Fed is done hiking because they broke something with their aggressive campaign, as they have done in the previous cycles, it is a disastrous time to own stocks.... Read More

The Velocity of Deposits Has Increased

Posted By Jim Bianco

The catalyst for a problem is often unanticipated. In the case of the latest banking crisis, the public's "discovery" of higher rates outside their bank accounts was one such catalyst. As deposits left banks for money market funds, banks were caught off guard. The adoption of mobile banking might have changed banking forever.... Read More

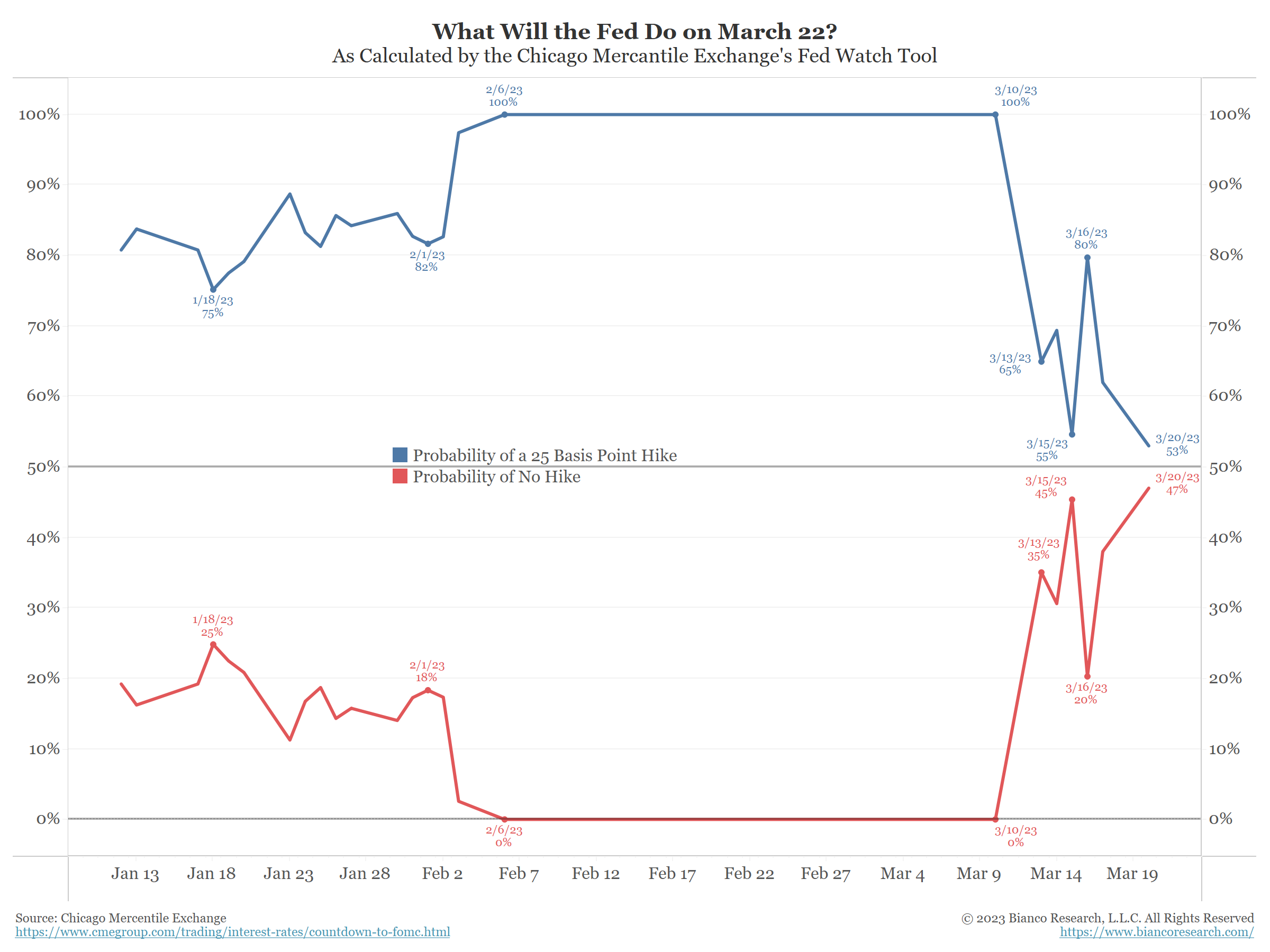

The Most Uncertain Fed Meeting in a Generation

Posted By Jim Bianco

With only two days to go until the next FOMC meeting, traders are still not sure what to expect from the Fed. Since forward guidance began in 1994, there has not been a meeting with this much uncertainty so close to the meeting.... Read More

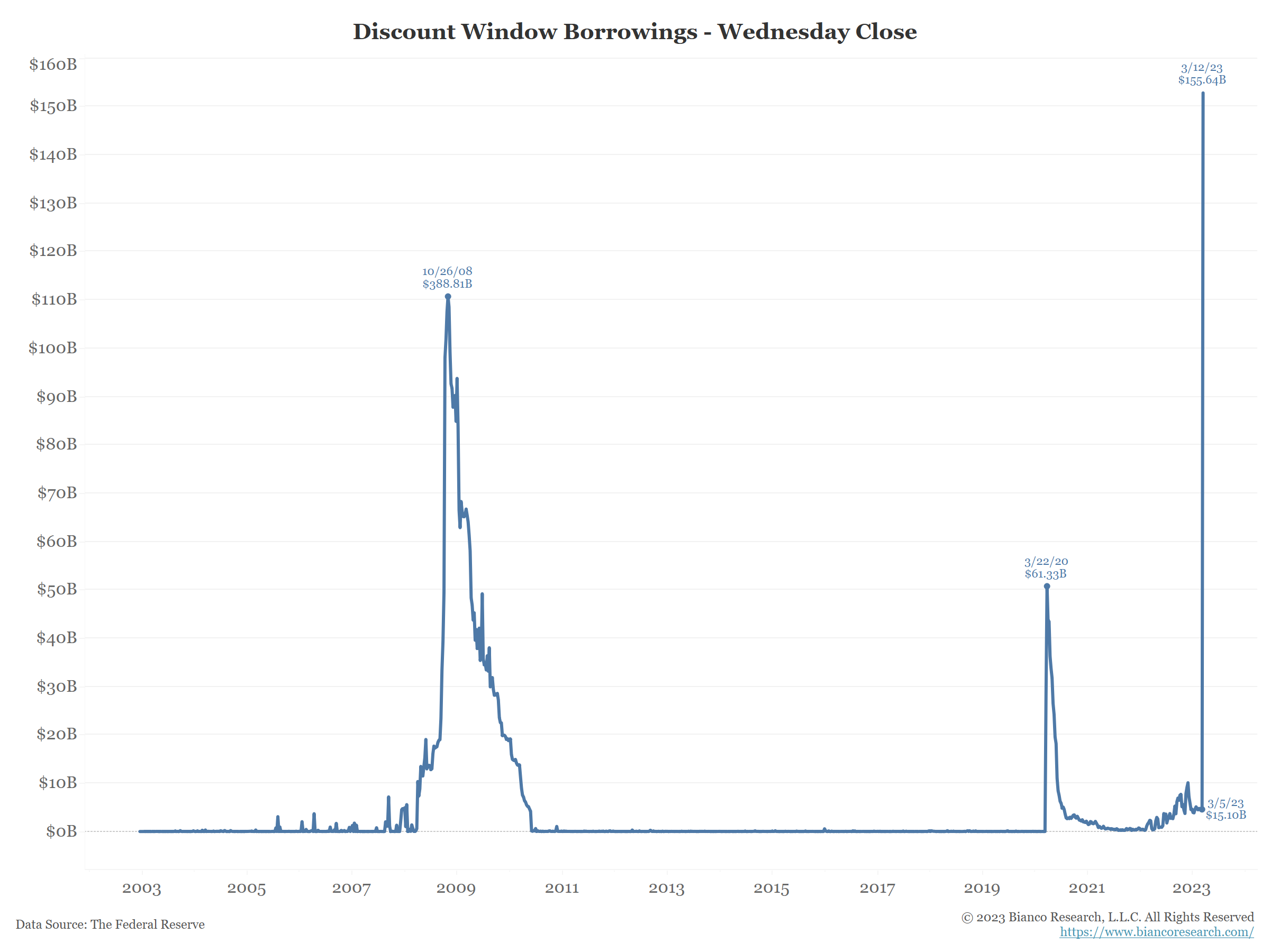

Signs Depositors Are Leaving Regional Banks

Posted By Jim Bianco

The $300 billion surge in loans by the Fed to banks, increasing its balance sheet so much it reversed half of all quantitative tightening in the last year, is a worrisome signal that deposit flight from regional banks is in full bloom. If not reversed in the coming days/weeks, it will lead to a credit crunch that will impair the economy.... Read More

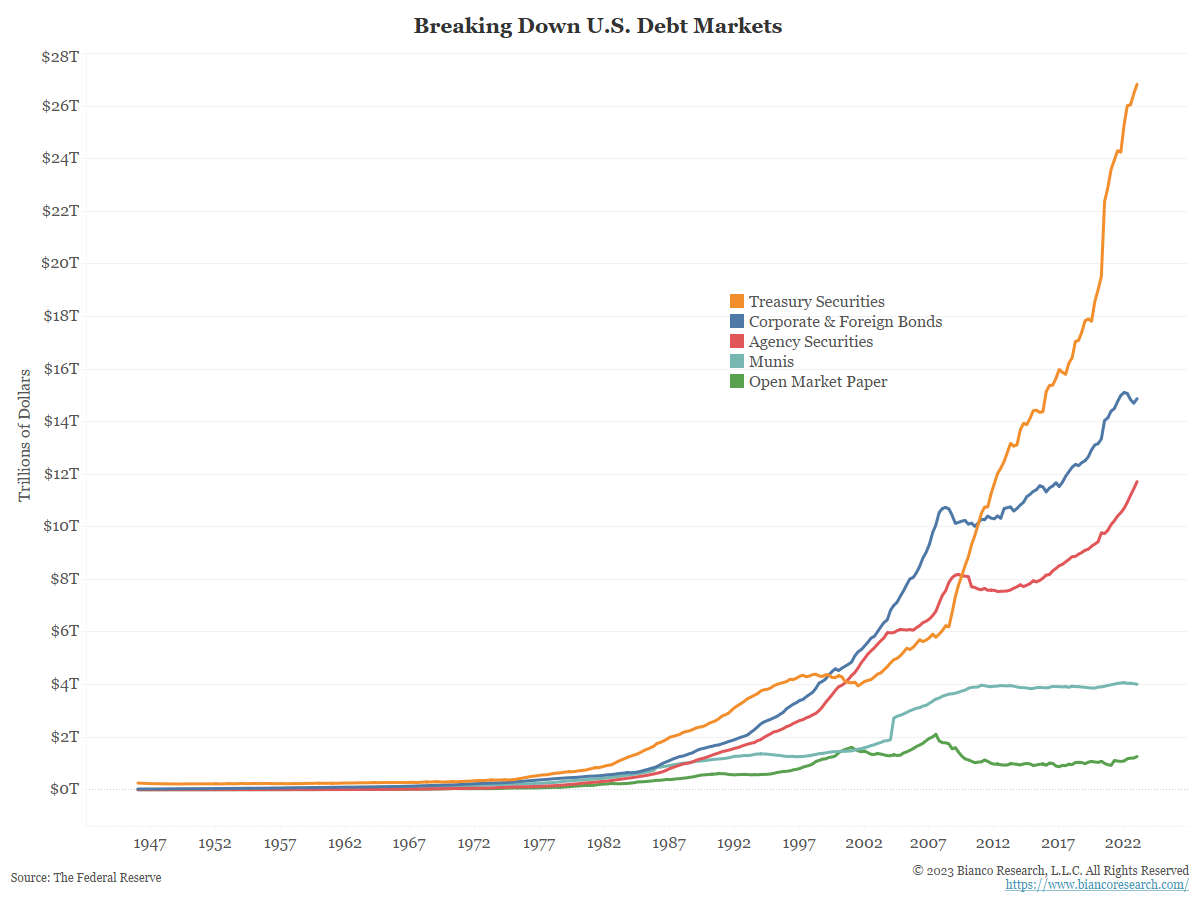

Breaking Down Debt in the U.S.

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper... Read More

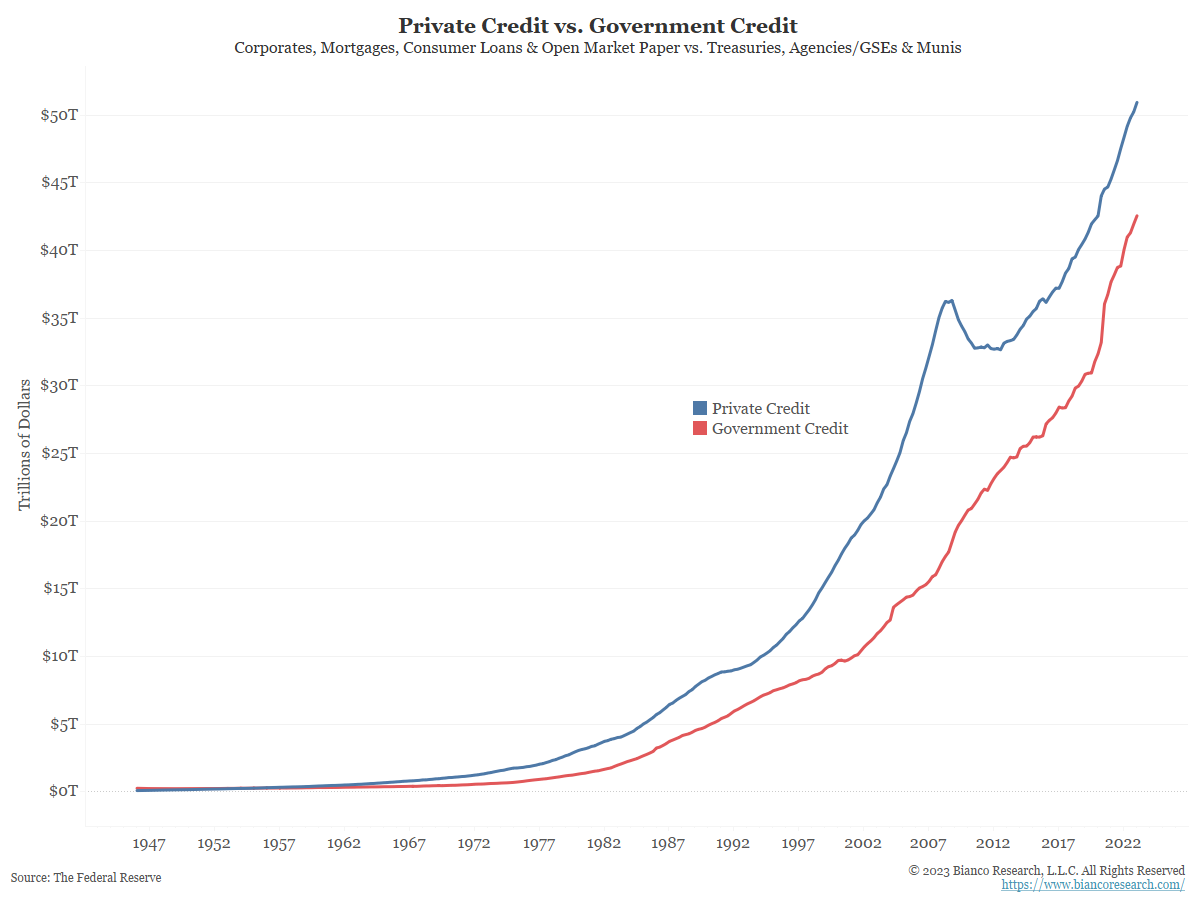

Comparing the Value of Credit in the U.S. to GDP

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period. Both are now at new highs.... Read More

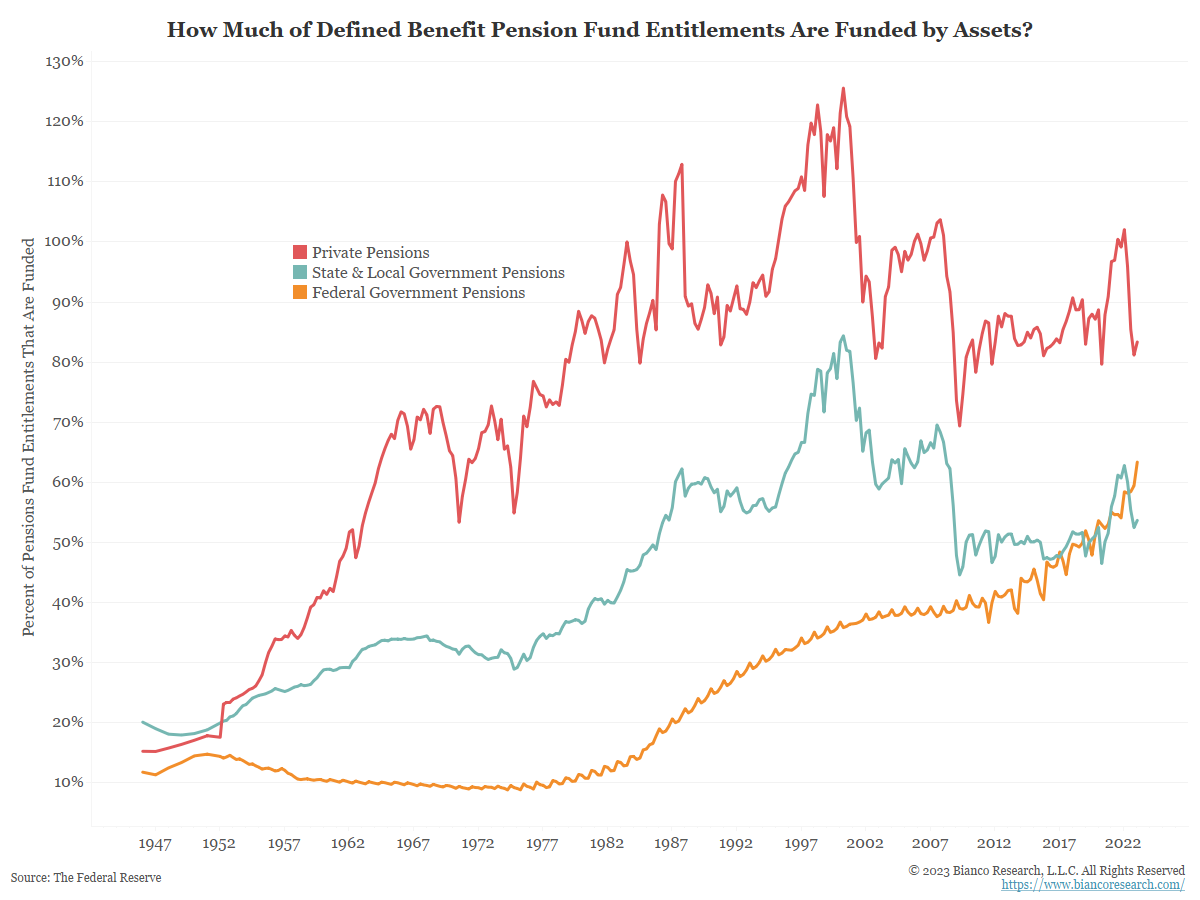

Funding Gaps at Public and Private Pensions

Private pension funds have much smaller funding gaps than their government counterparts.... Read More

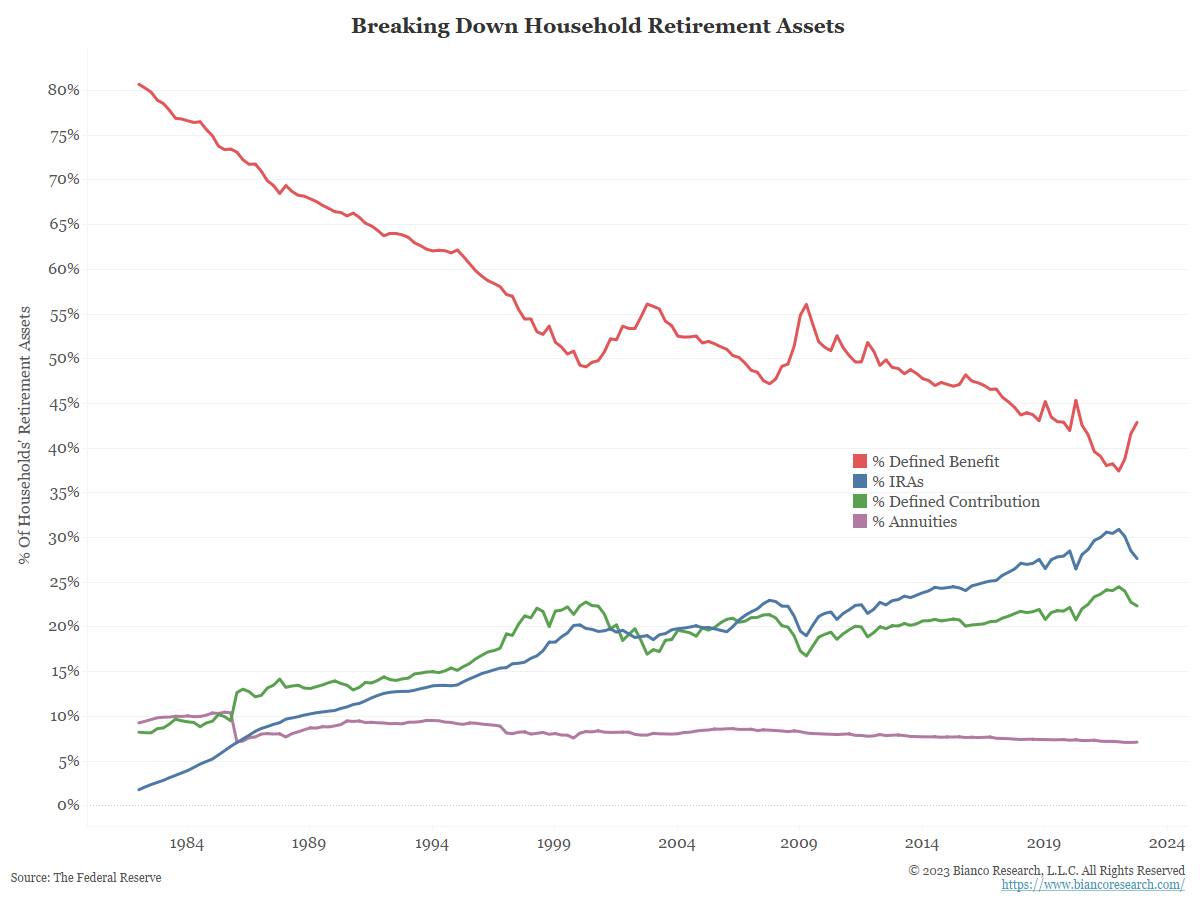

Defined Benefit Plans vs. IRAs

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More

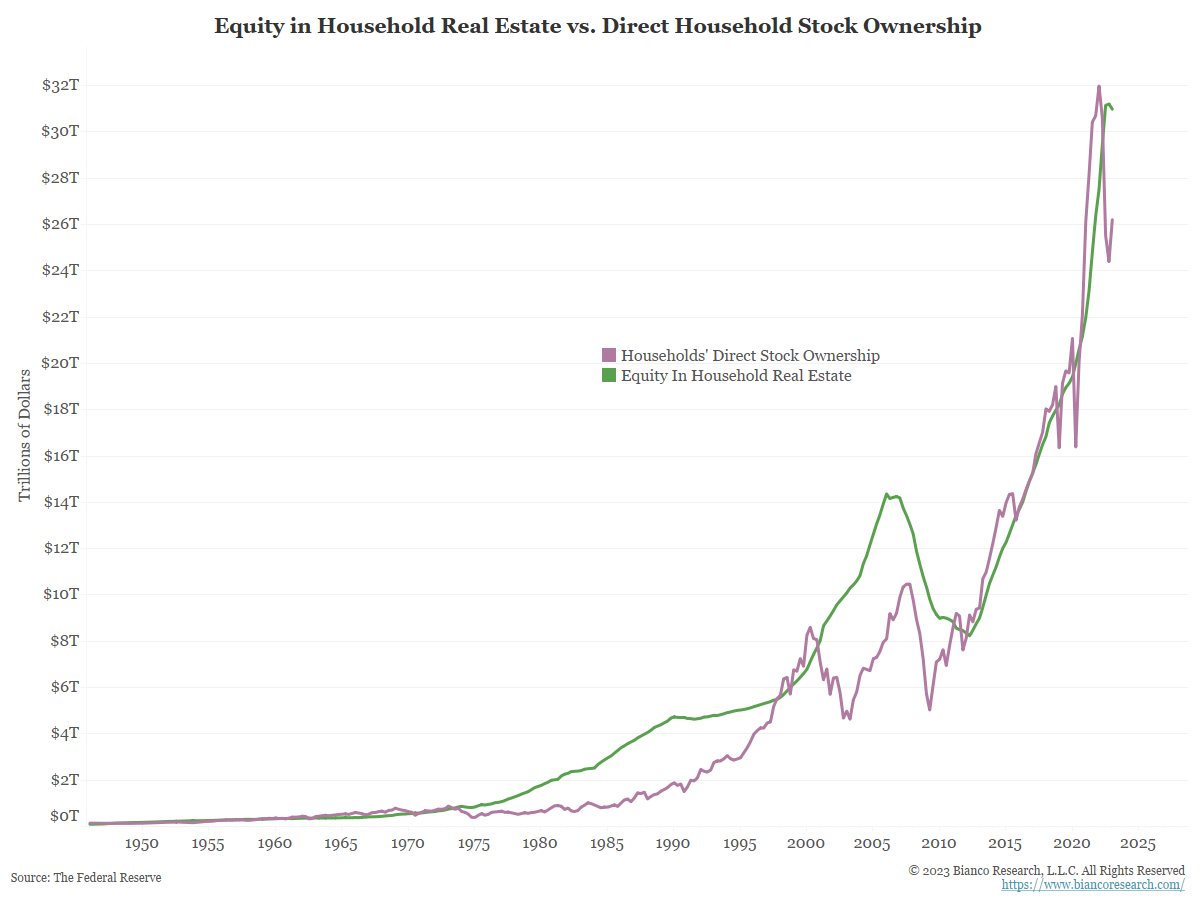

Comparing Real Estate to GDP and Stock Ownership

Over the past couple quarters, households' real estate equity actually surpassed stock ownership.... Read More