Tag Archives: Markets

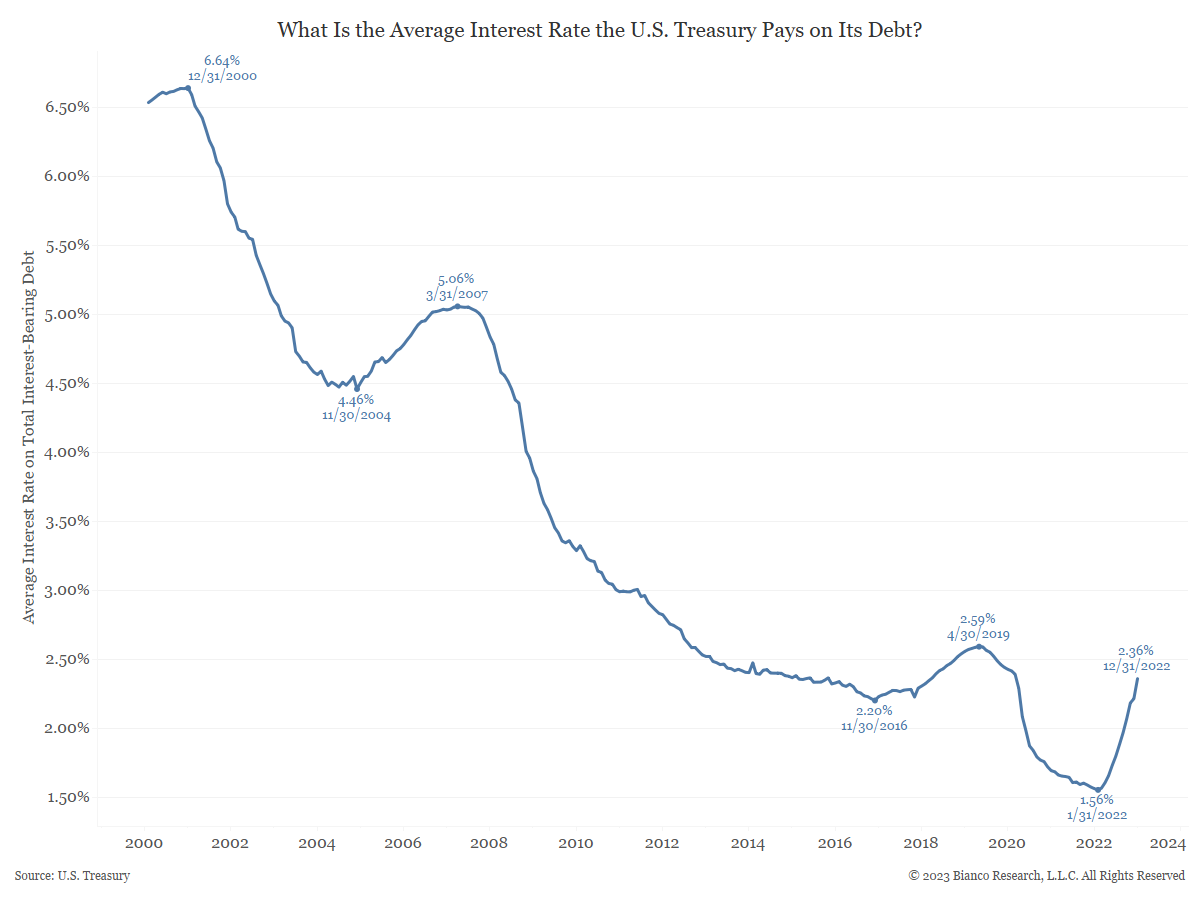

The Government’s Rising Interest Costs

Posted By Greg Blaha

For the last few decades we have been in a low interest rate environment where deficit spending would not cause major issues. However, a 40-year high in inflation prompted the Fed to tighten monetary policy at a fast pace. Higher rates mean the cost of servicing U.S. debt will follow higher. ... Read More

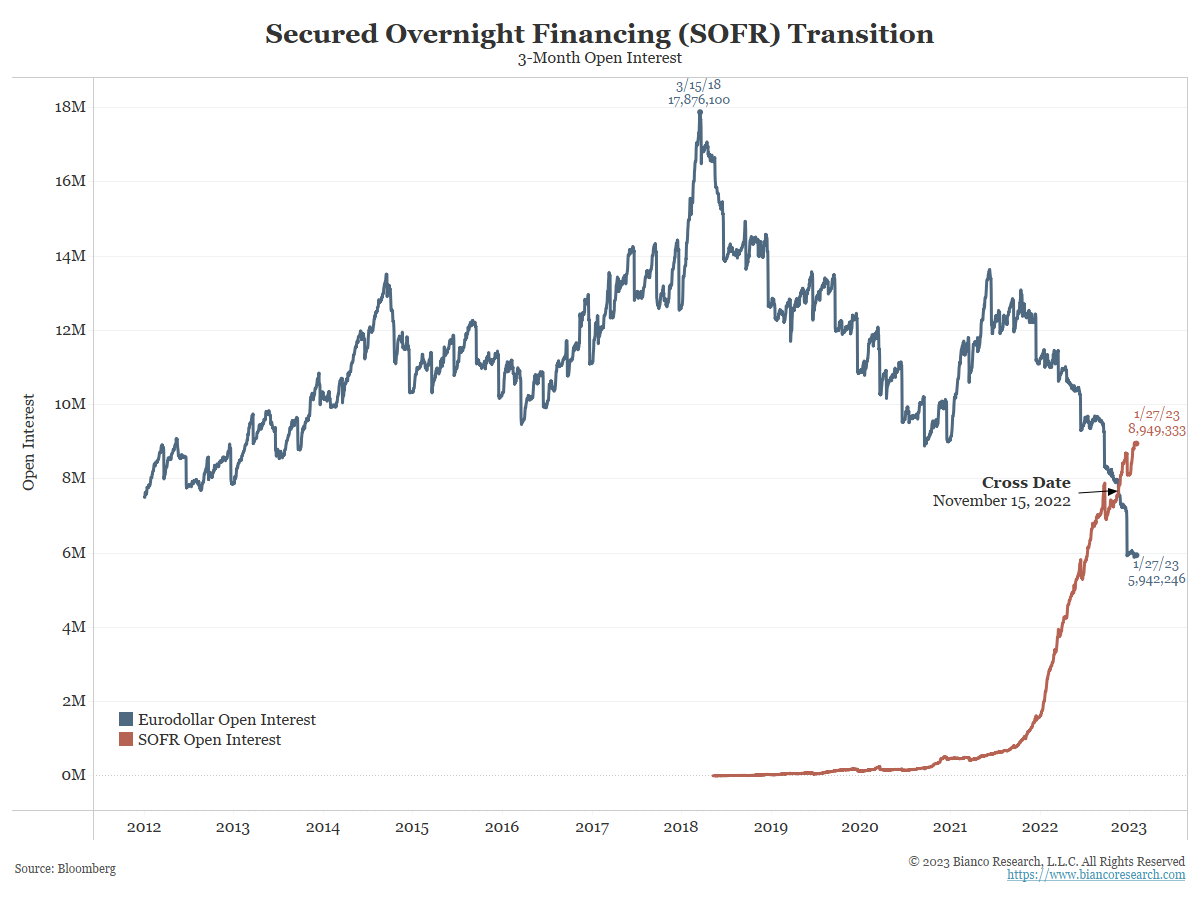

Transitioning From Eurodollars to SOFR

Posted By Jim Bianco

As part of the planned transition away from LIBOR, the CME will convert any remaining Eurodollar positions to SOFR positions on April 14. SOFR futures recently surpassed Eurodollar futures as the world's largest interest rate futures contract.... Read More

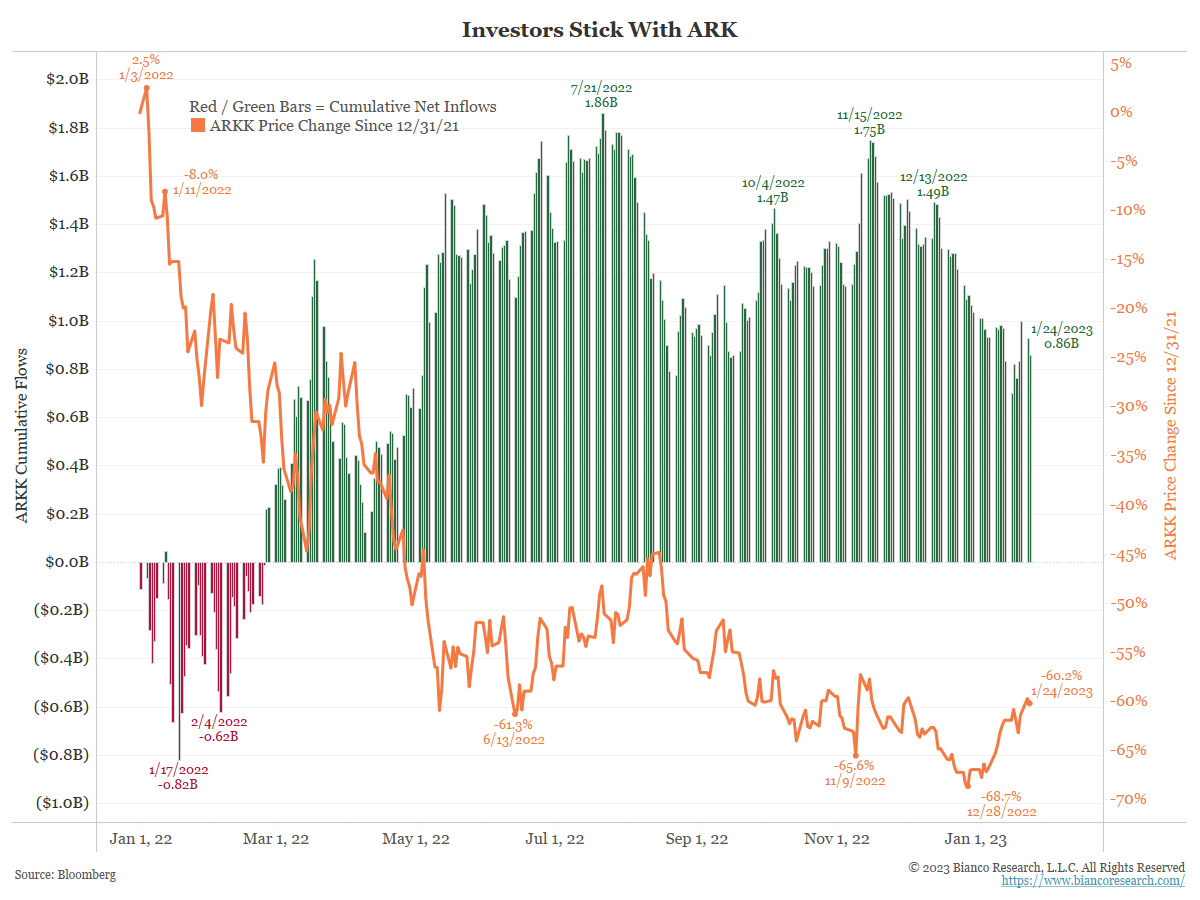

Updating ARK Innovation’s Performance

Posted By Alex Malitas

Flows follow performance, except for when they don't. Cathie Wood's investors seem willing to ride out market losses even as they have lost over 60% of their investment in just over a year. ... Read More

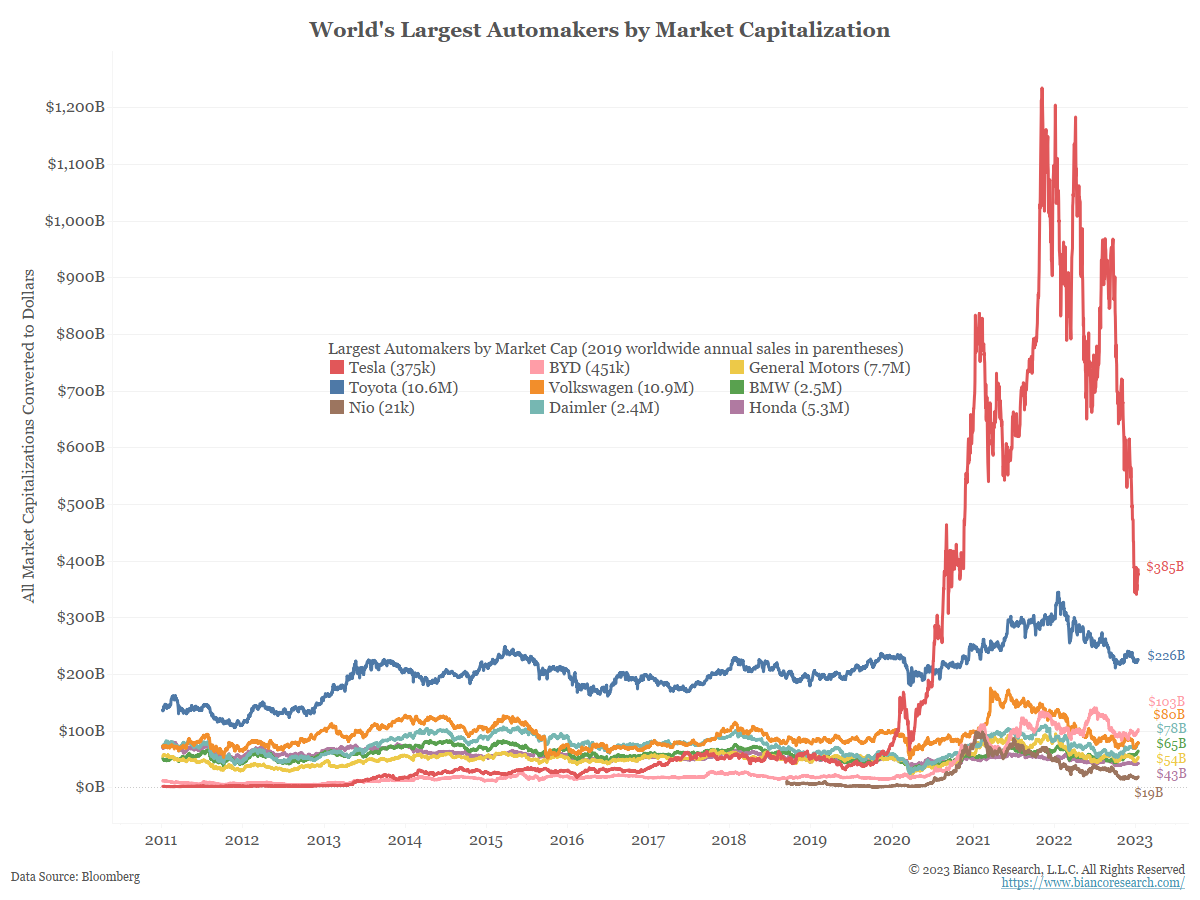

Tesla’s Fall to Earth

Posted By Greg Blaha

At one point in time Tesla was worth more than all other auto companies combined. Their fall over the past fourteen months puts them closer to Toyota's market cap.... Read More

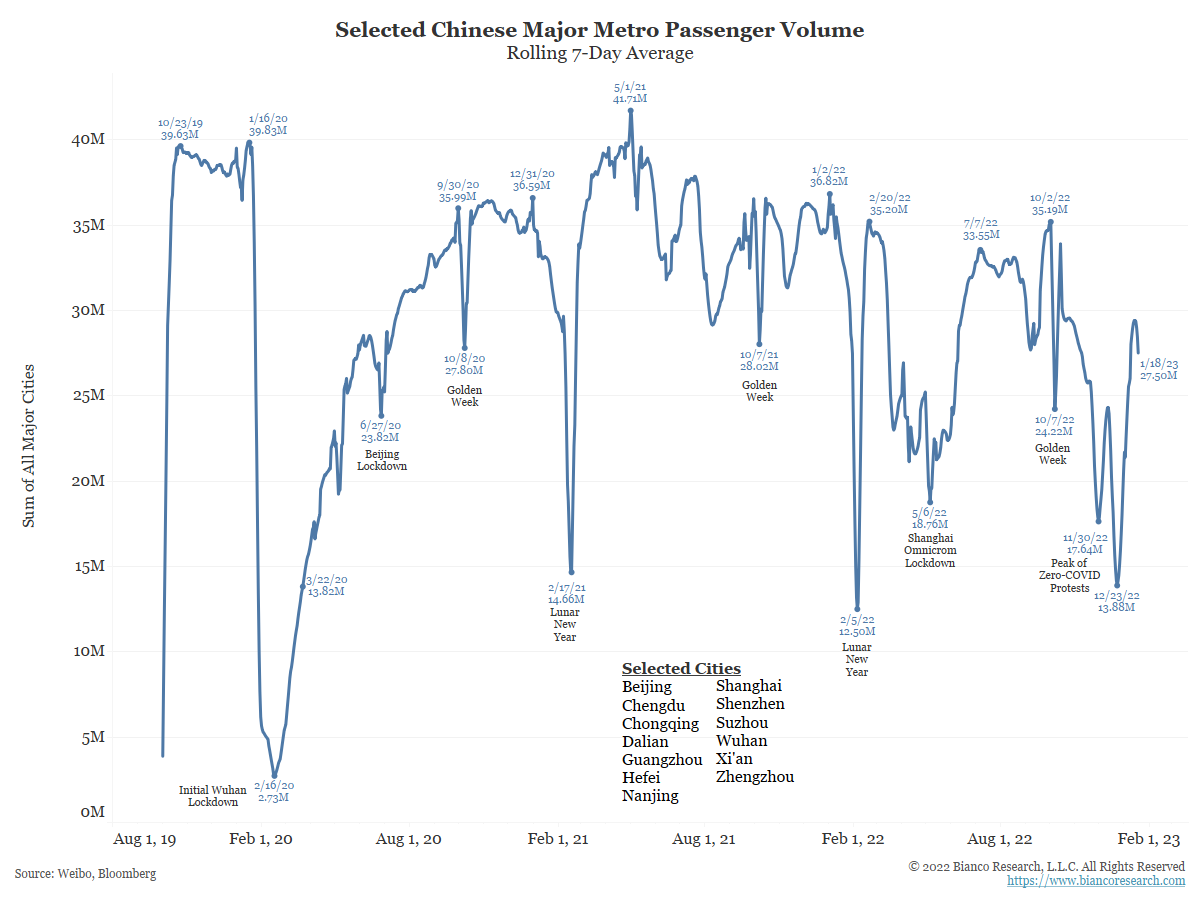

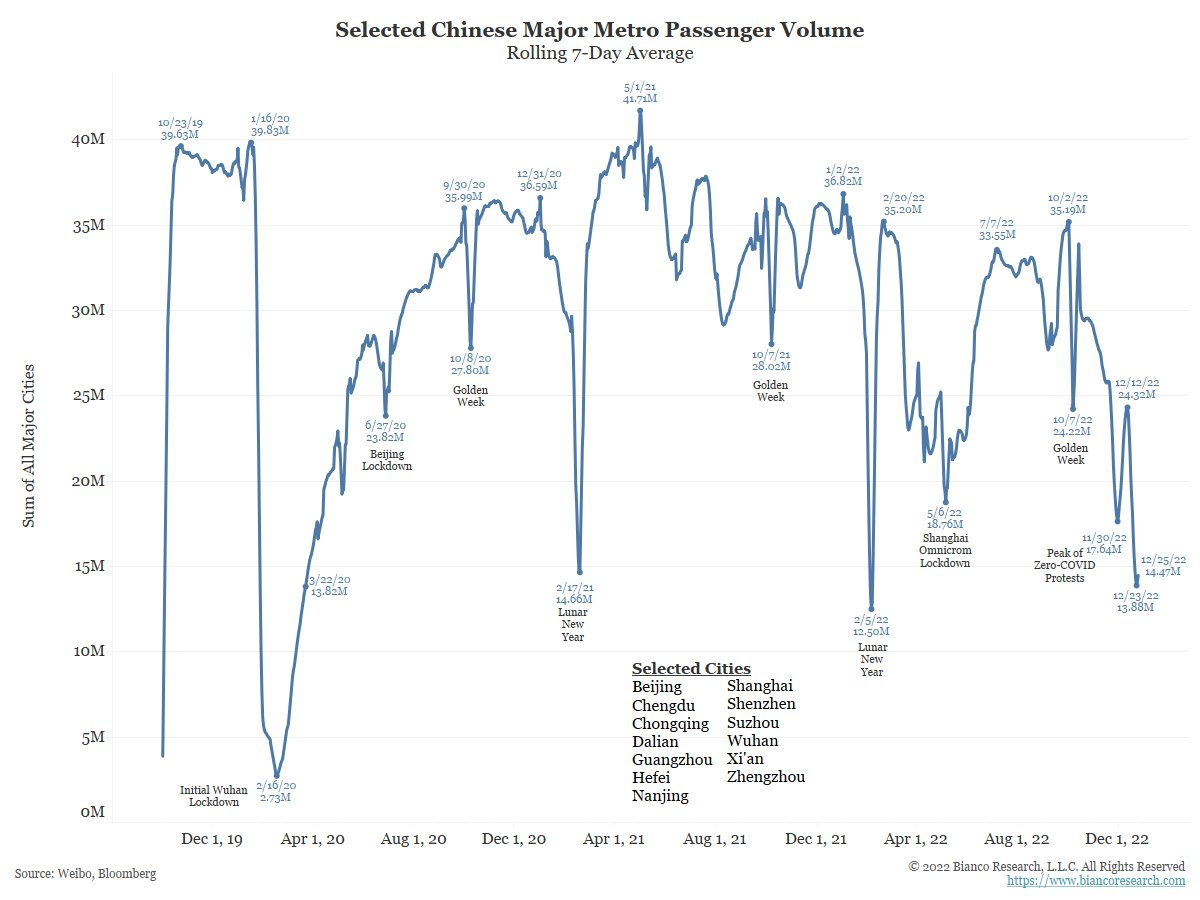

On China’s Reopening

Posted By Jim Bianco

Things have changed in China. We don't yet know exactly how. But to assume the country will immediately return to 2019 norms and its economy will rebound immediately may prove overly optimistic.... Read More

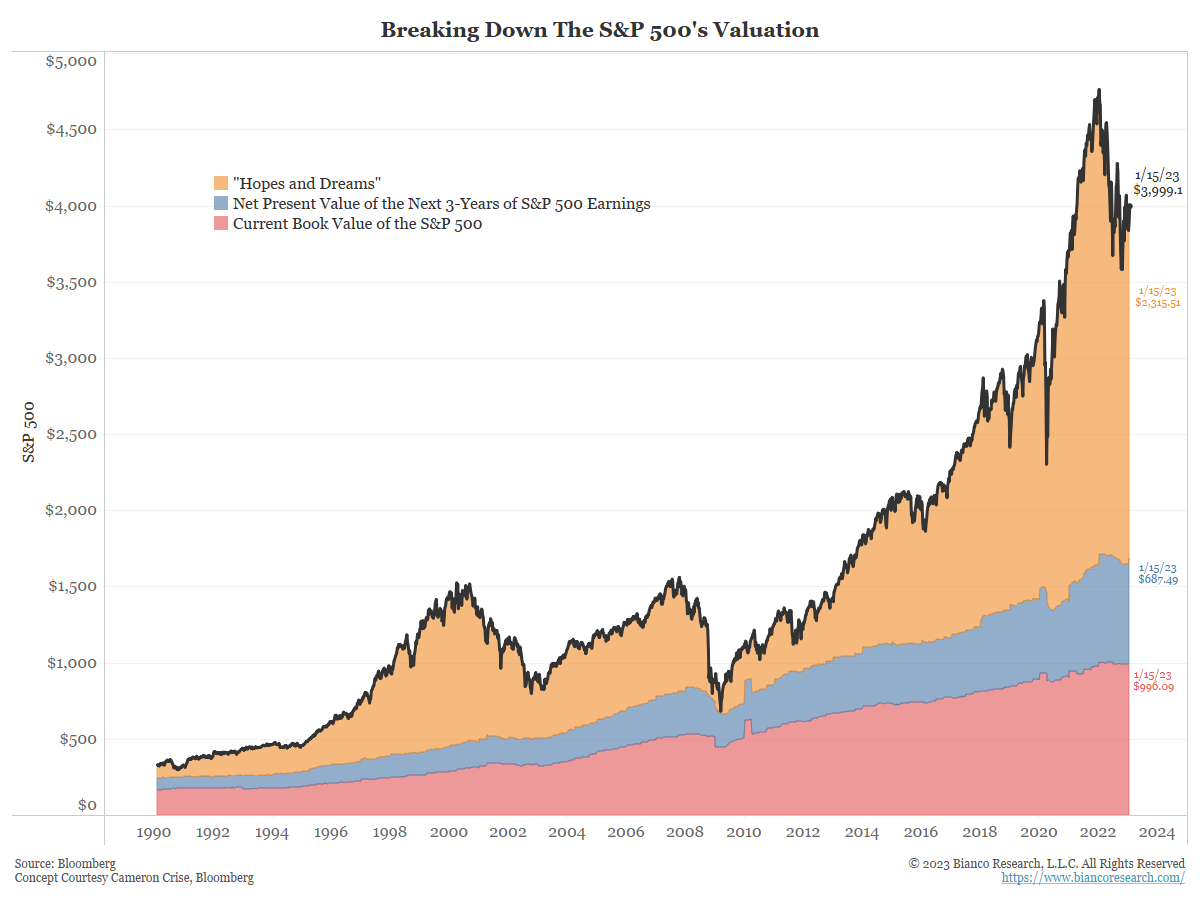

Updating Valuations to Begin 2023

Posted By Alex Malitas

Everyone's consensus call is a mild recession in 2023, and market participants seem eager to accept the consensus call. Given this view, where do valuations stand?... Read More

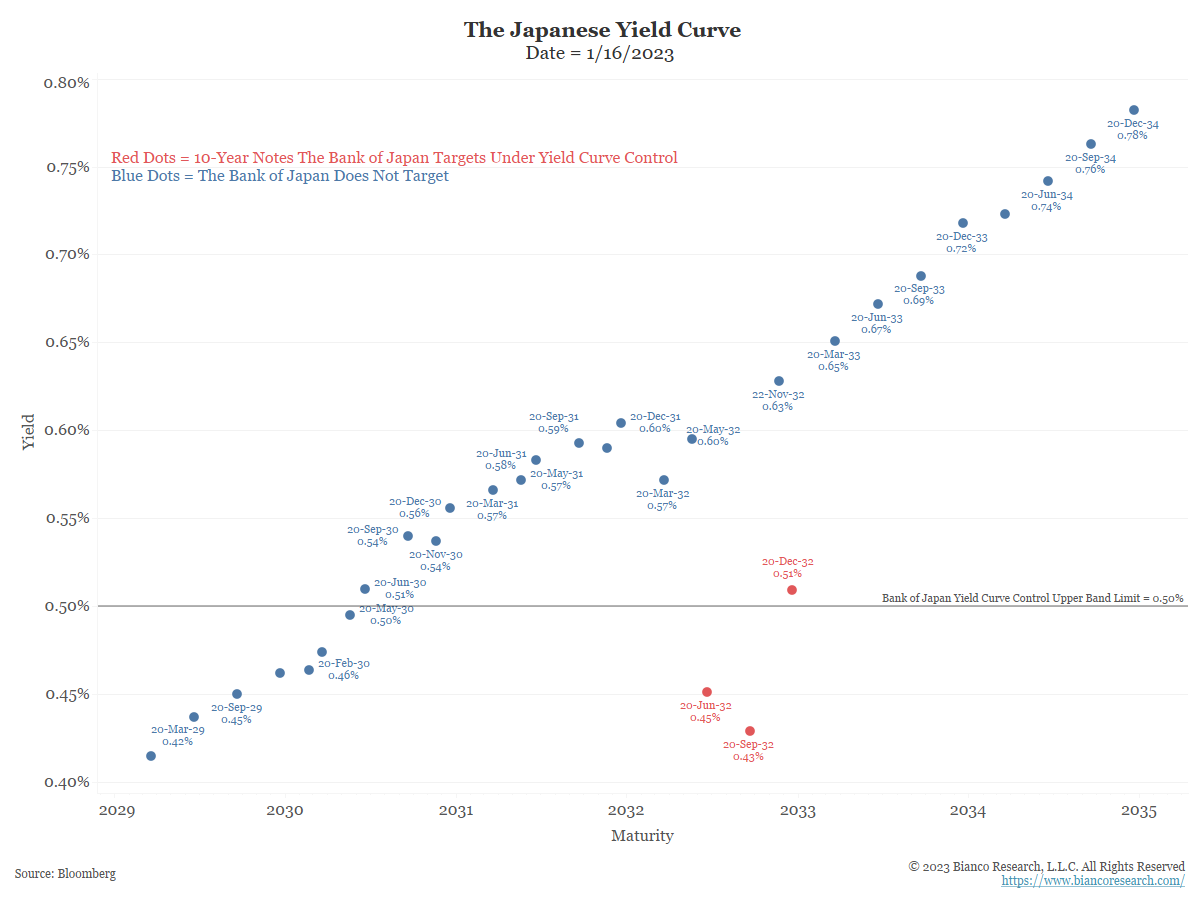

Will Japan’s Inflation Rise Forcibly End Its Yield Curve Control Policy?

Posted By Jim Bianco

Japan's inflation rate is increasing for the first time in a generation, but salaries are not rising. Japanese government bond yields are moving higher, but struggling against the upper band of the Bank of Japan's yield curve control. If rates break through or yield curve control ends, the impact could be felt worldwide.... Read More

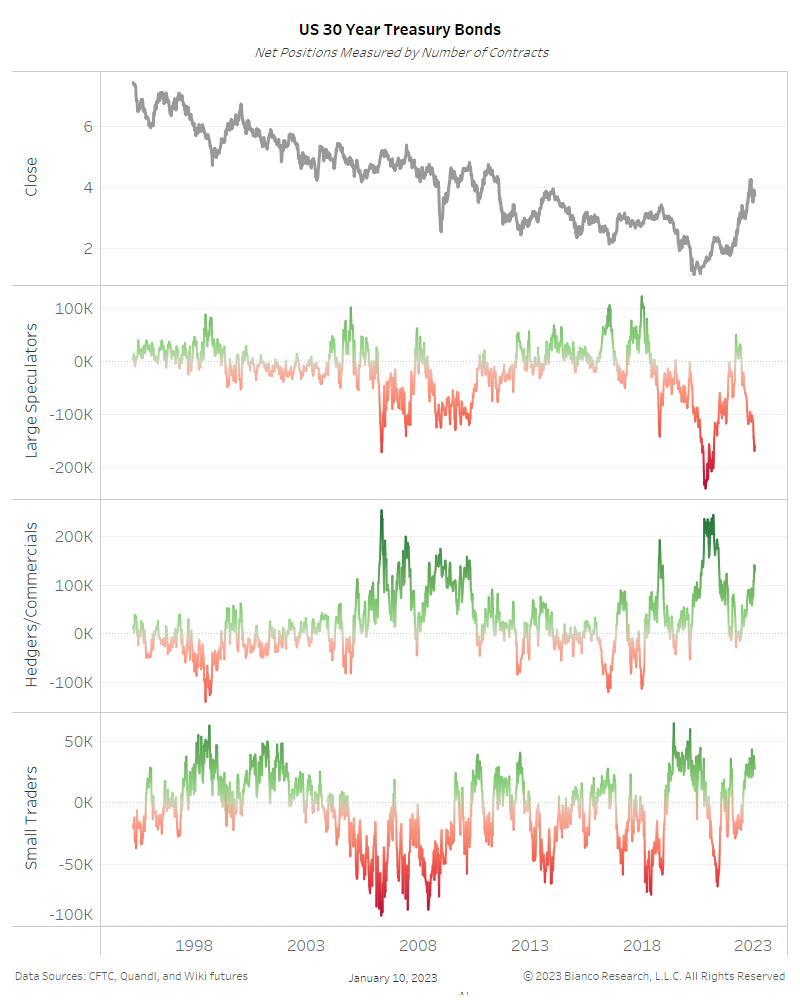

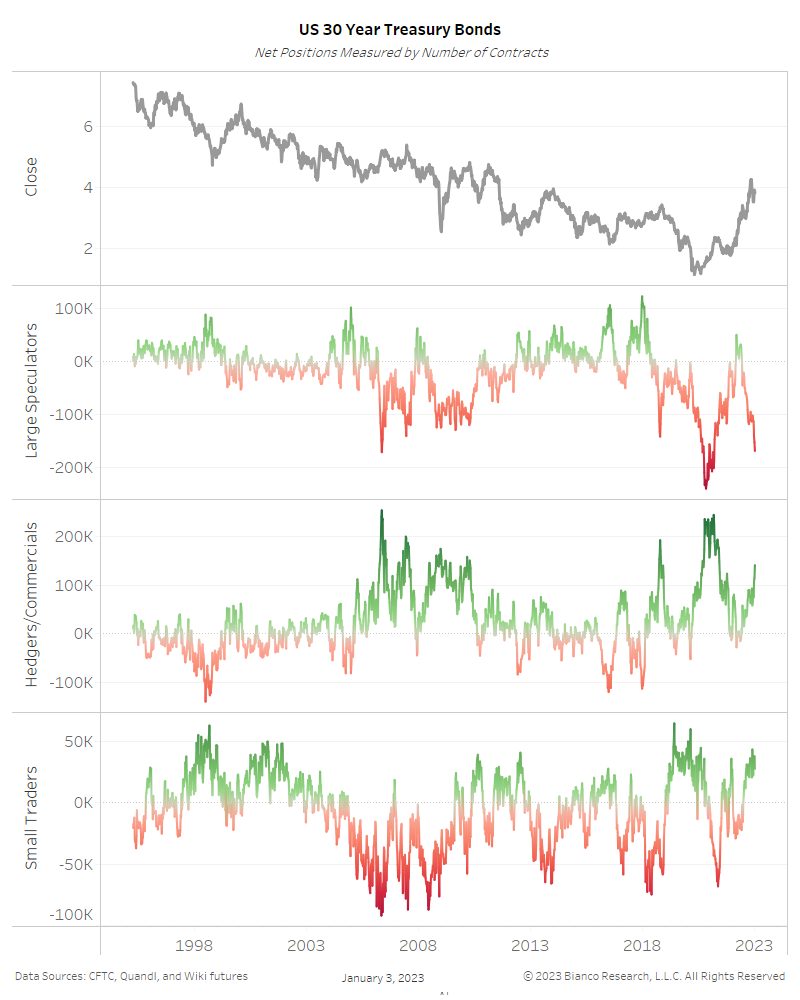

Has the Dynamic Changed?

Posted By Jim Bianco

Chairman Powell still worries a big rally in asset prices would lead to increased spending and higher inflation.... Read More

Reality … inflation has peaked.

Jim Bianco: Watching Bloomberg TV, and they are repeating the same mantra as everyone else. That is stating overwhelming consensus views with a tone in their voice like they are telling you something unique. Reality … inflation has peaked. That... Read More

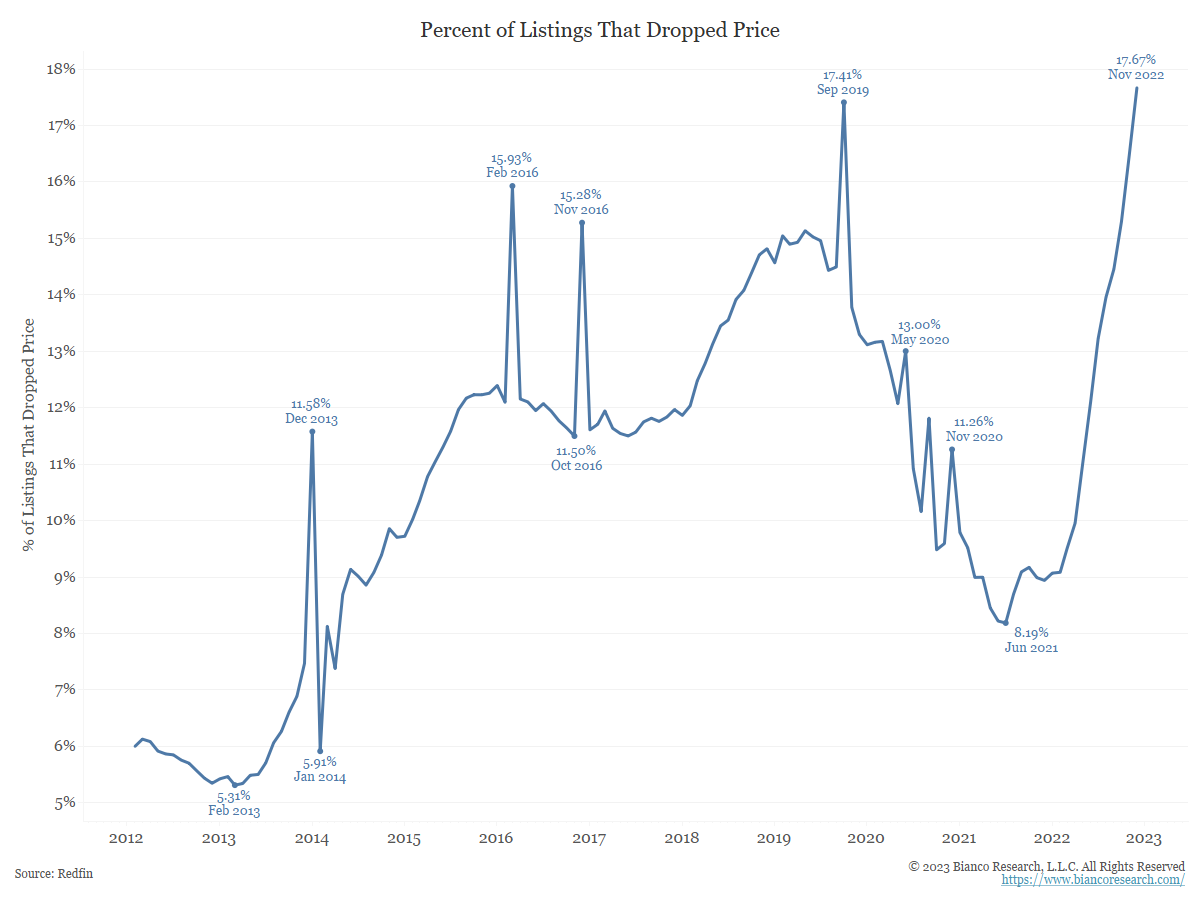

Housing Market’s Slowdown Continues

Posted By Greg Blaha

Redfin's alternative measures of the housing market continue to show a slowdown in the crazy conditions of the last year.... Read More

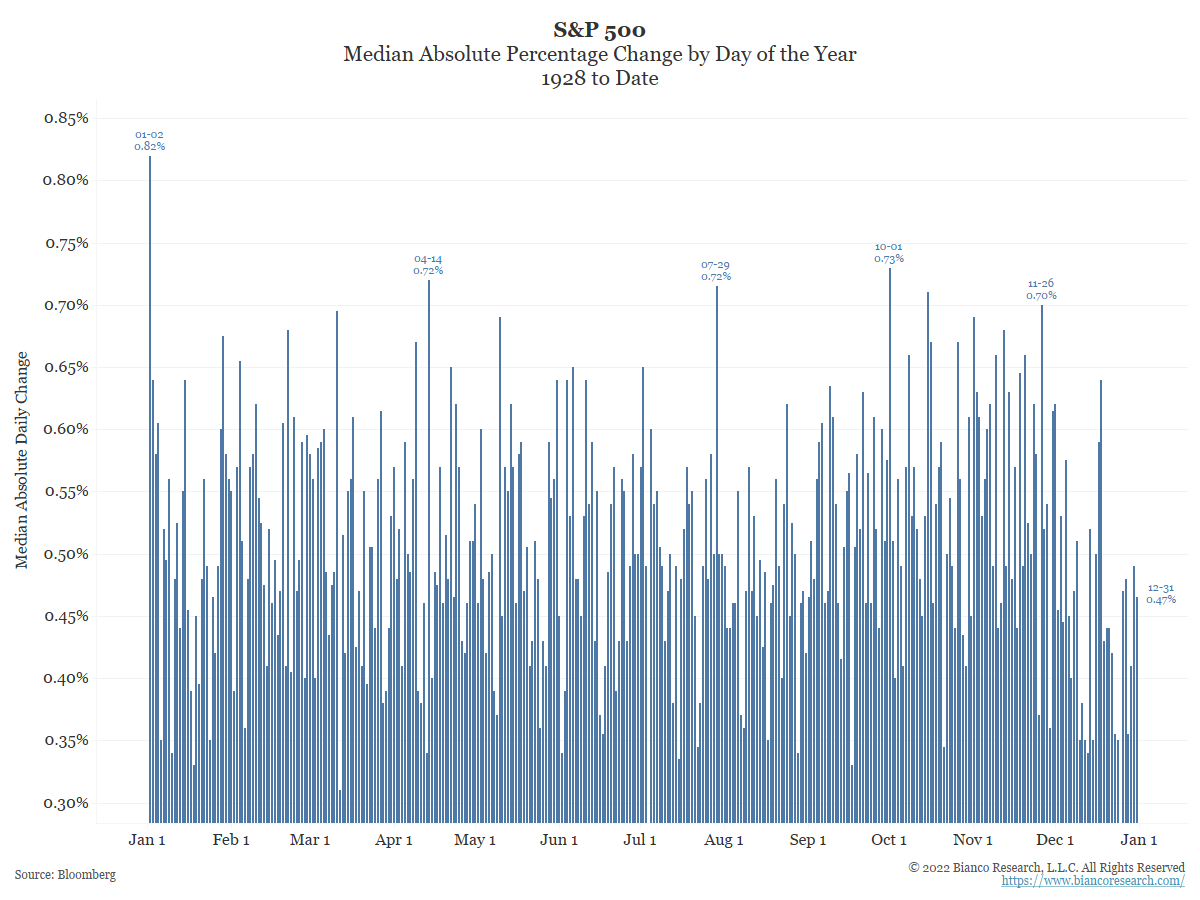

The Most Volatile Day of the Year?

Posted By Jim Bianco

Historically, the first trading day and week of the year are volatile for a range of assets.... Read More

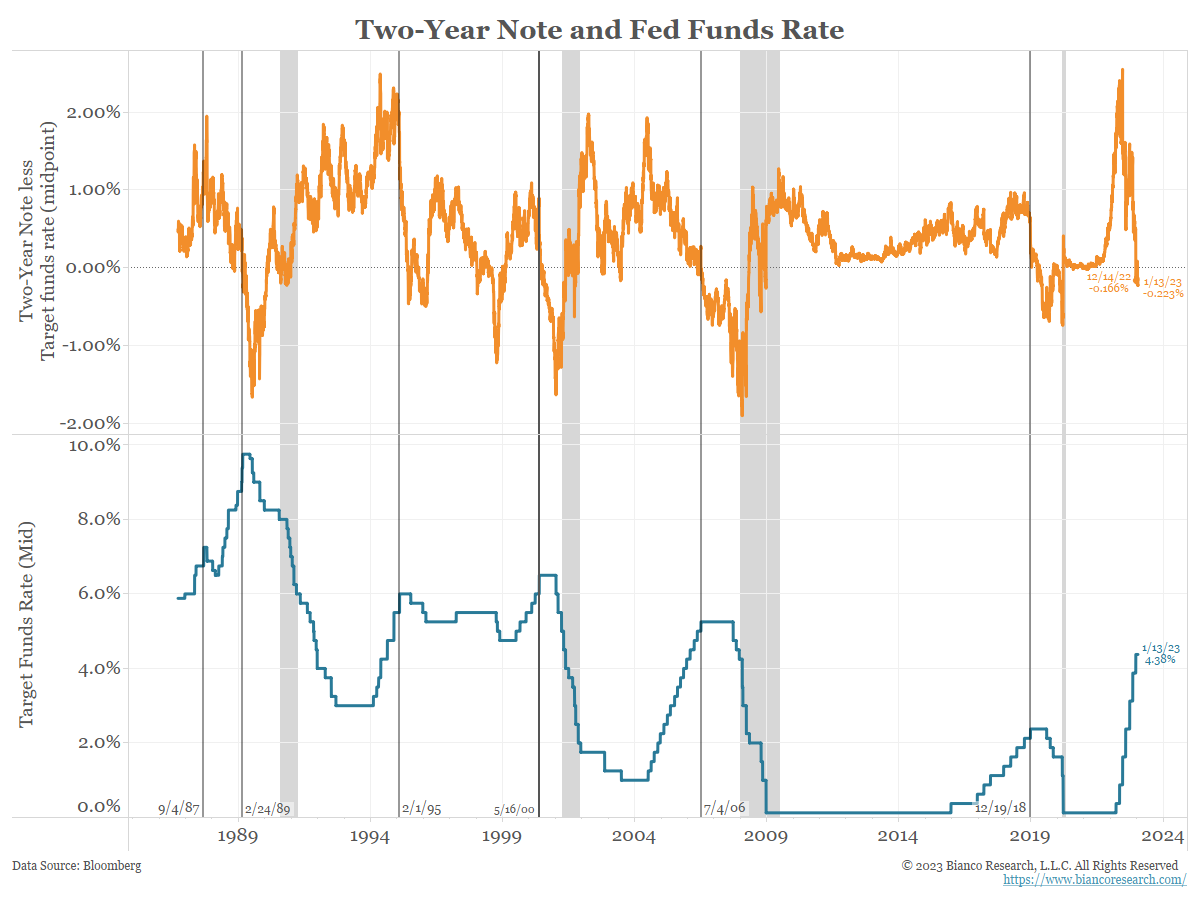

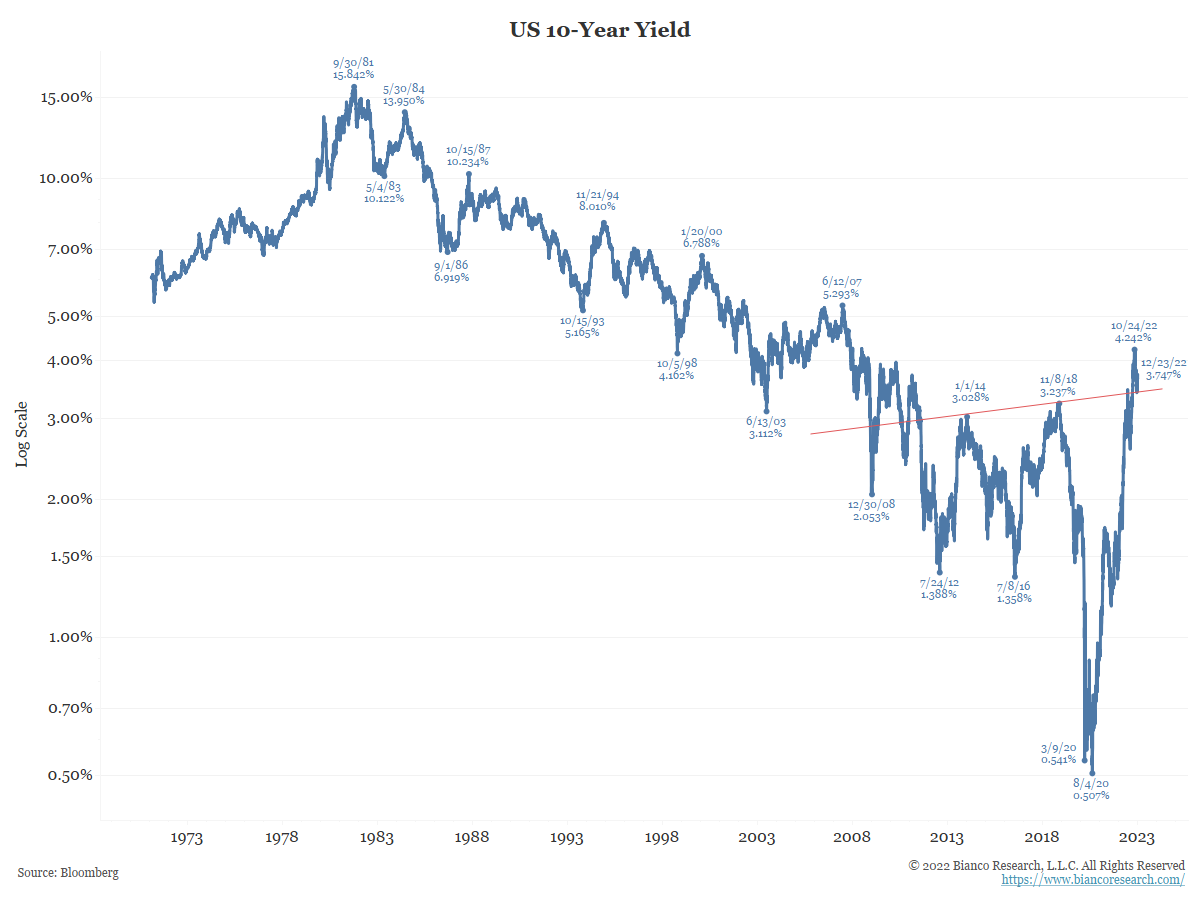

The Trend in 10-Year Yields

Posted By Jim Bianco

The secular trend in 10-year yields is higher and could stay that way for many years.... Read More

China and the 2023 Consensus View

Posted By Jim Bianco

China is not yet showing signs of reopening, despite announcements that zero-Covid restrictions are being lifted. This matters for Wall Street as a Chinese rebound is central to the 2023 consensus views of a rebound in raw commodities, a surge in finished goods that will depress inflation leading to the Fed pivoting, and risk markets soaring in 2H 2023.... Read More