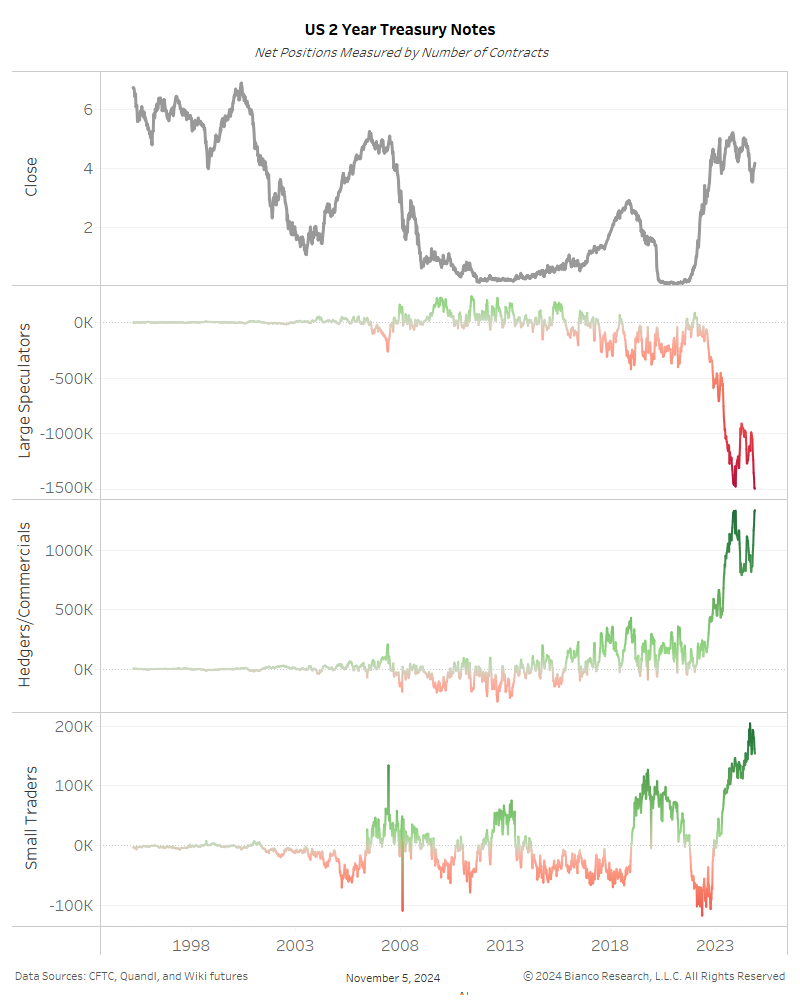

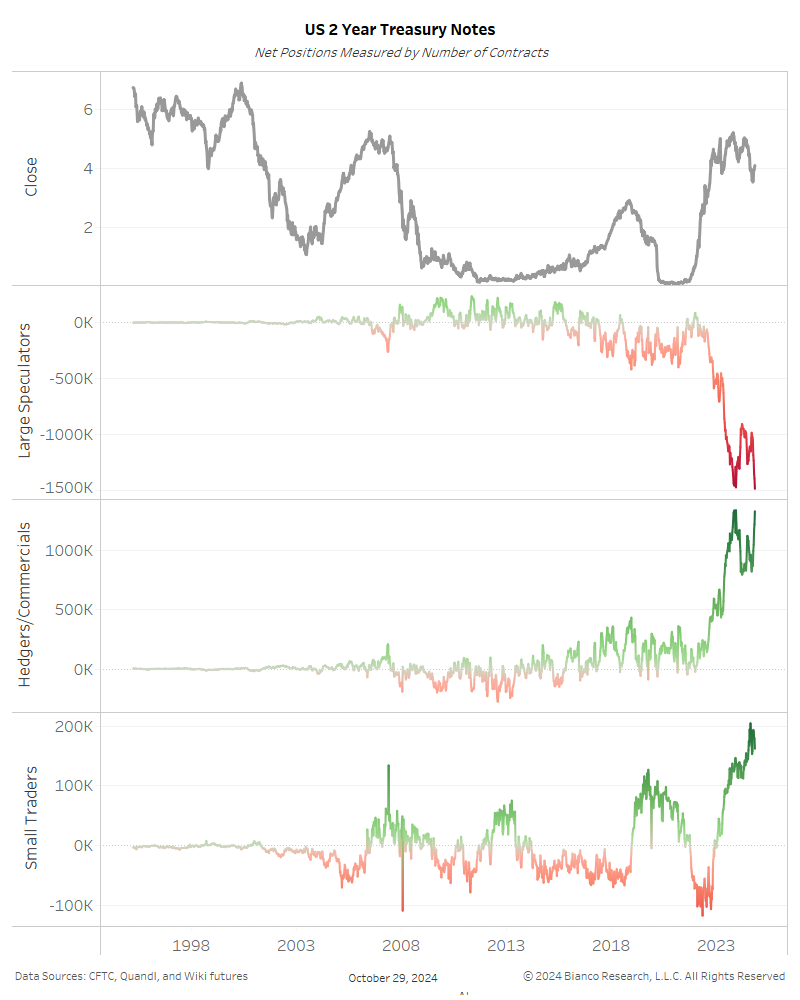

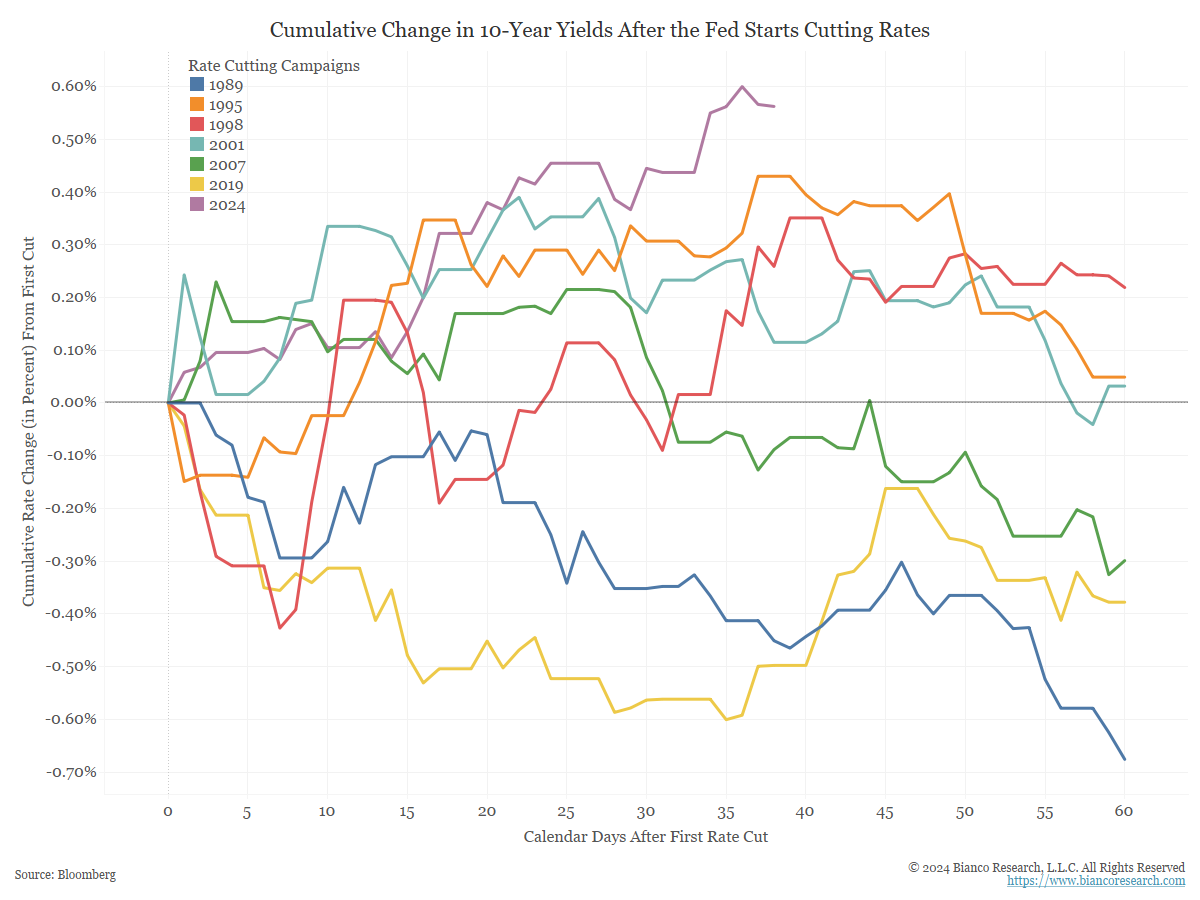

The Fed Cannot Answer Why Bond Yields Are Rising

Posted By Jim Bianco

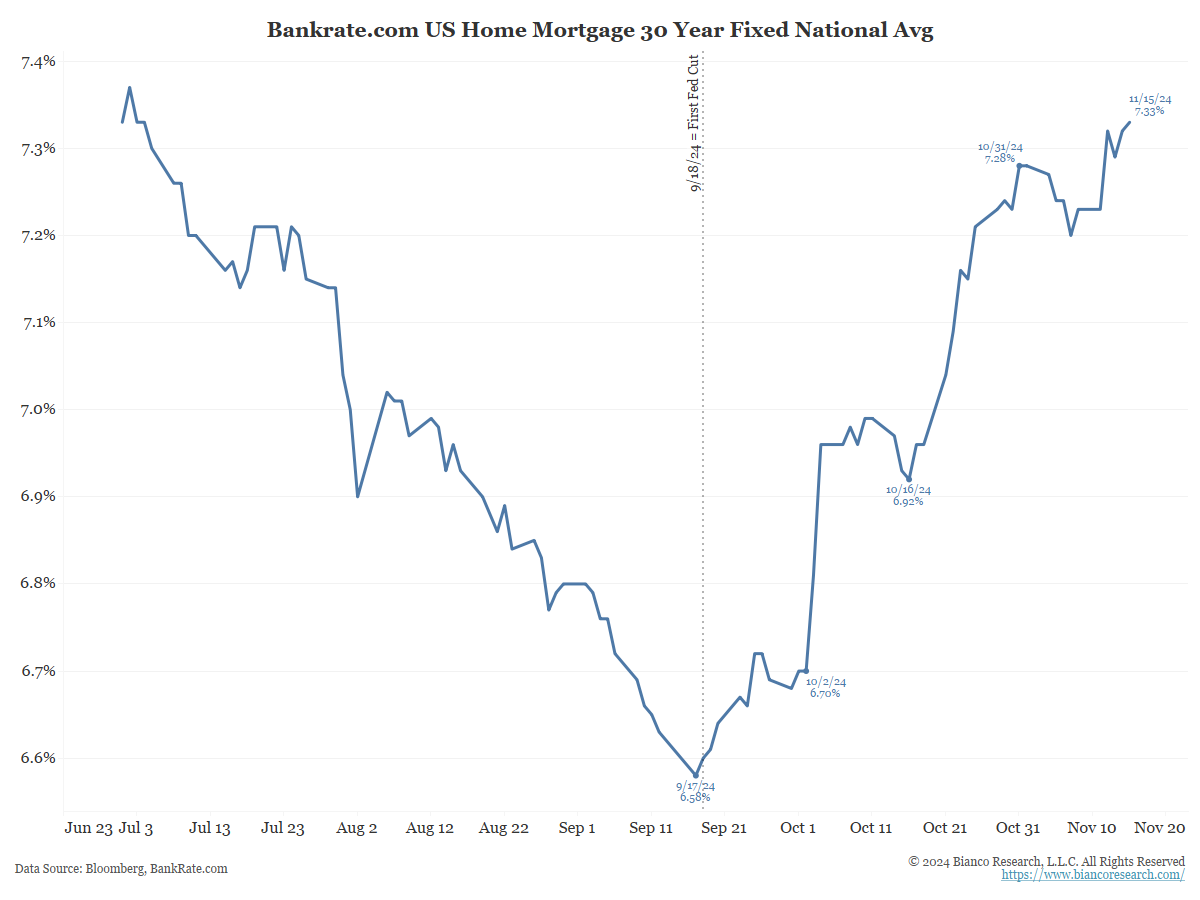

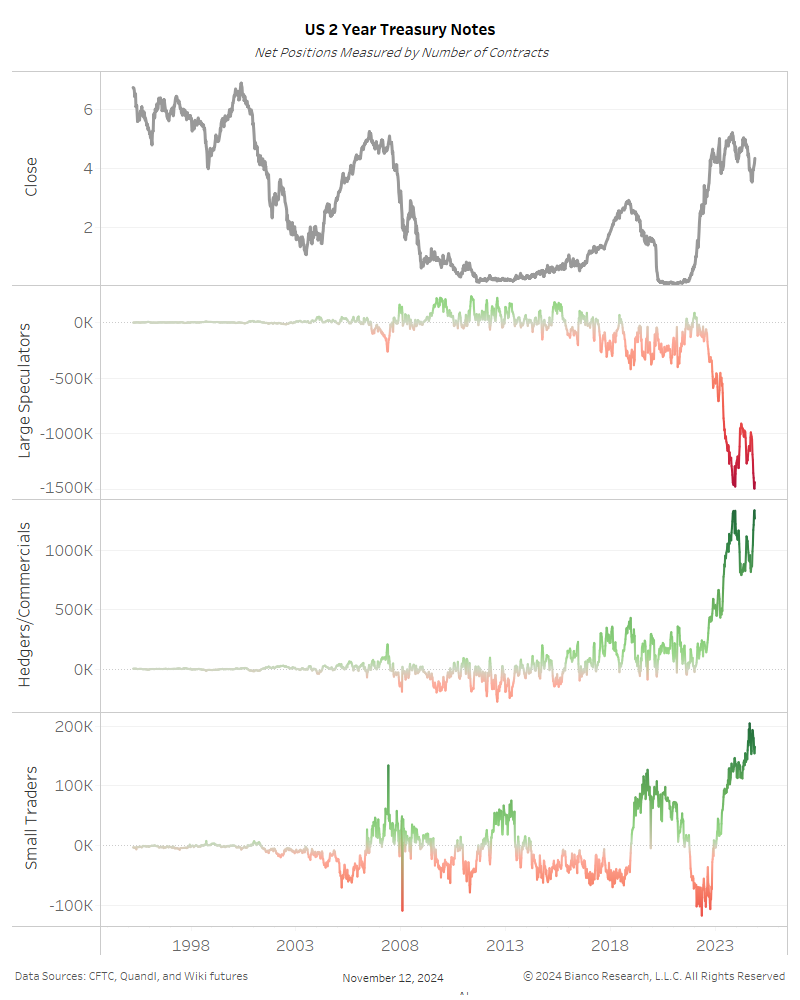

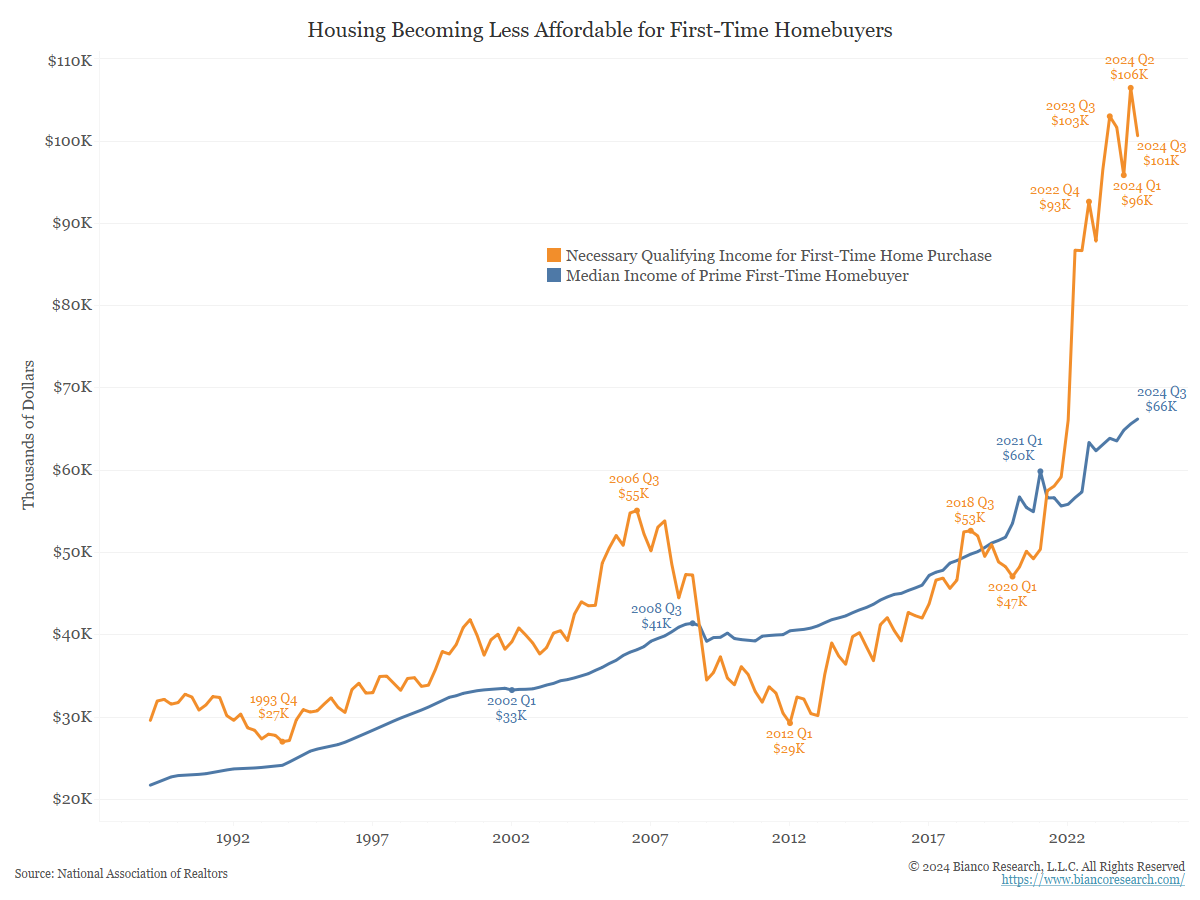

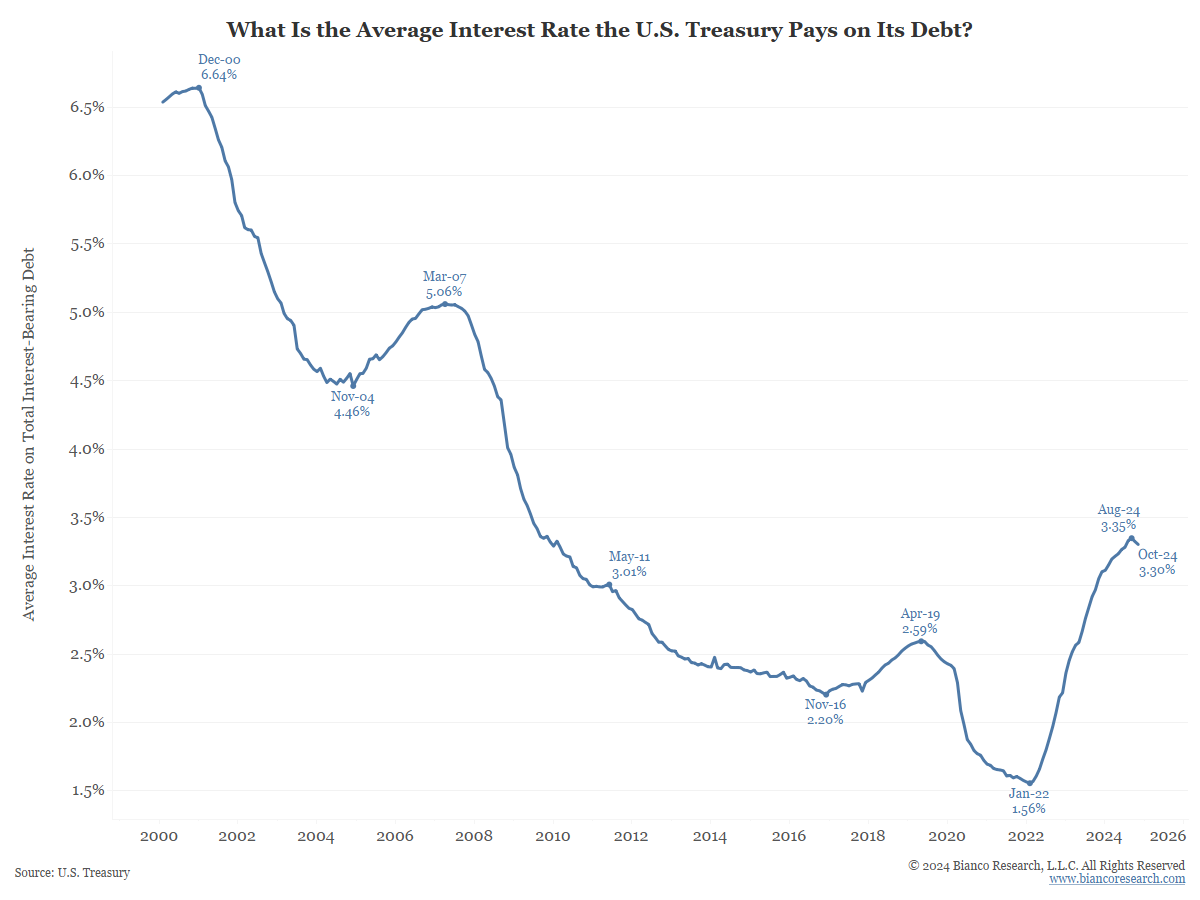

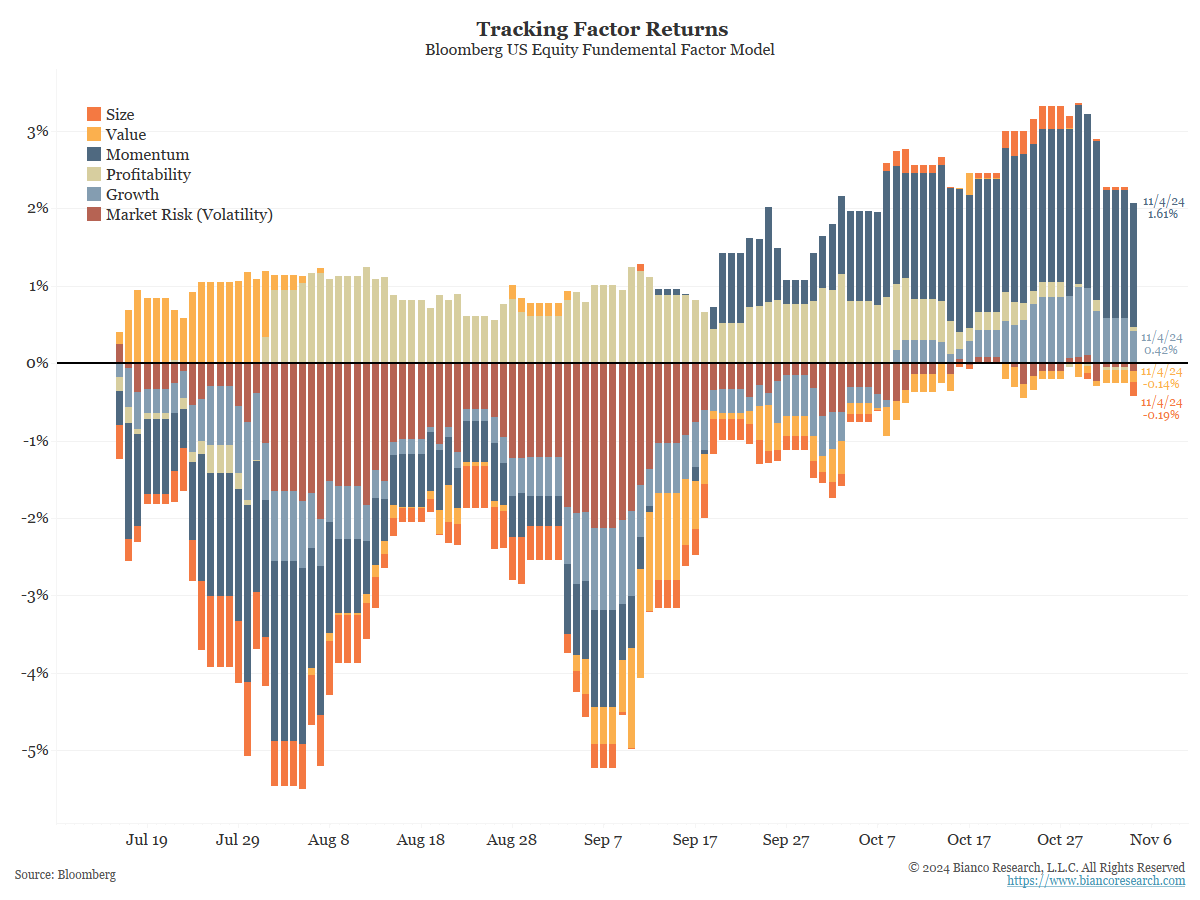

The Fed does not understand why long-term yields are rising. For now, it assumes the reason is unrelated to its policy. If they are wrong, more cuts will drive long-term yields higher and drag down the U.S. economy, potentially making matters worse.... Read More