Tag Archives: Markets

Bespoke Commentary from Bianco Research and Arbor Data Science – May 28th, 2021

Yesterday Jim was the guest on Real Vision?s Daily Briefing with Ed Harrison. They discussed the transitory debate on the inflation front, how the 10-year is the center of the markets, the expectation for more inflation, network effects, meme stocks,... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 27th, 2021

Jim Bianco delivers long-term bull case for cryptocurrencies CNBC: ?Coins like ethereum are going to be a lot higher way down the road,? market forecaster Jim Bianco says Stephanie Landsman – If you can cope with sharp drops in the... Read More

Talking Data Episode #56: A Look at Automated Market Makers

Our presenters today are Jim Bianco and Greg Blaha of Bianco Research. Today Jim and Greg will take a look at Automated Market Makers. · What Is an AMM? · Determining Prices · AMM Risks · How Big Are AMMs?... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 26th, 2021

Jim Bianco: Tracking the reopening.By this measure, everyone is reopening except Canada. The UK is now above pre-covid levels. Financial Times: How to defend against inflation? Ben Funnell – Can you remember the last time the US inflation rate exceeded 5 per... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 25th, 2021

Jim Bianco: Jamie Dimon spoke to the ICI conference on May 6. Just saw this. Forget whether I’m a fan of crypto, I’m not. ?There should be legal regulatory tax-related framework, AML, around crypto. It?s now worth $2 trillion. When... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 21st, 2021

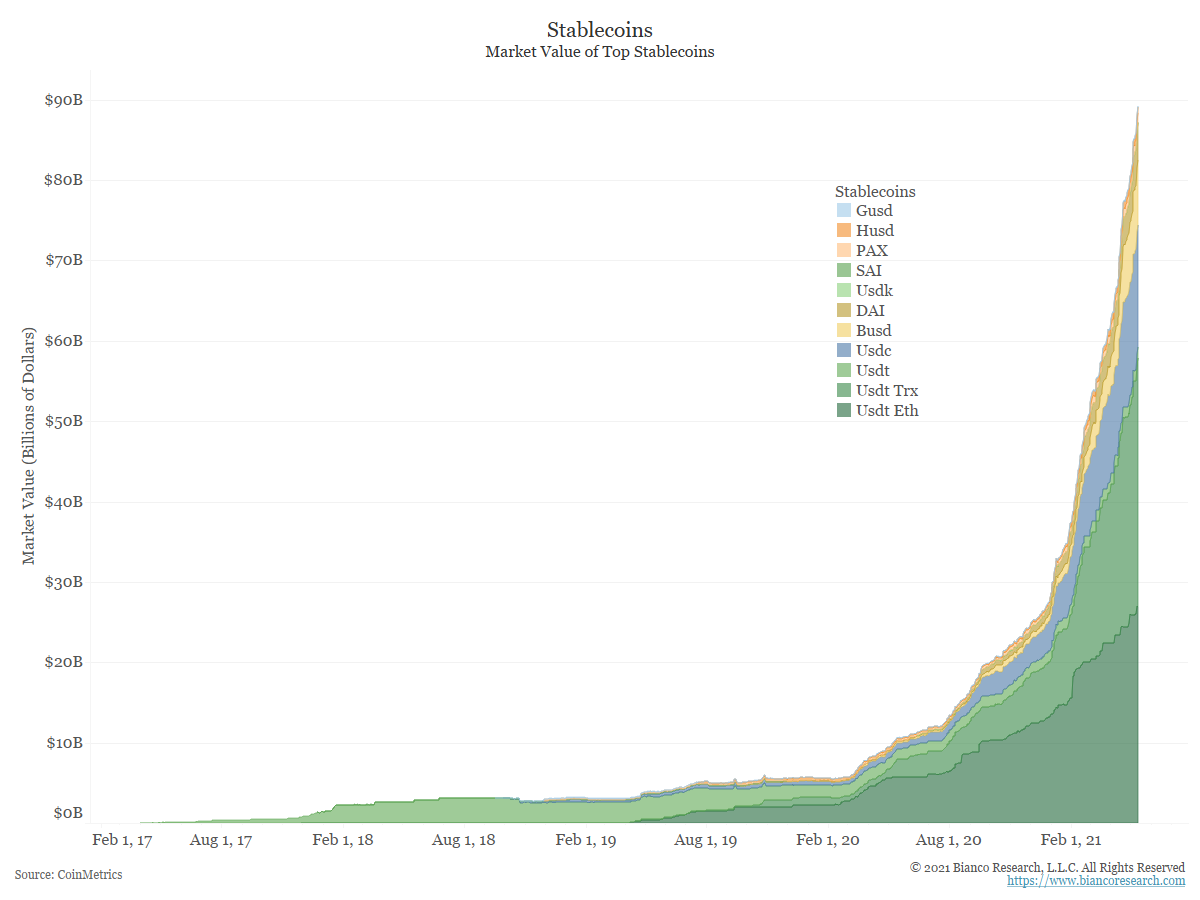

Jim Bianco: Last month the Fed said they had five years to create a digital currency. Today Powell put out this video talking about stablecoins and the Fed will have a report out on it this summer. They are getting... Read More

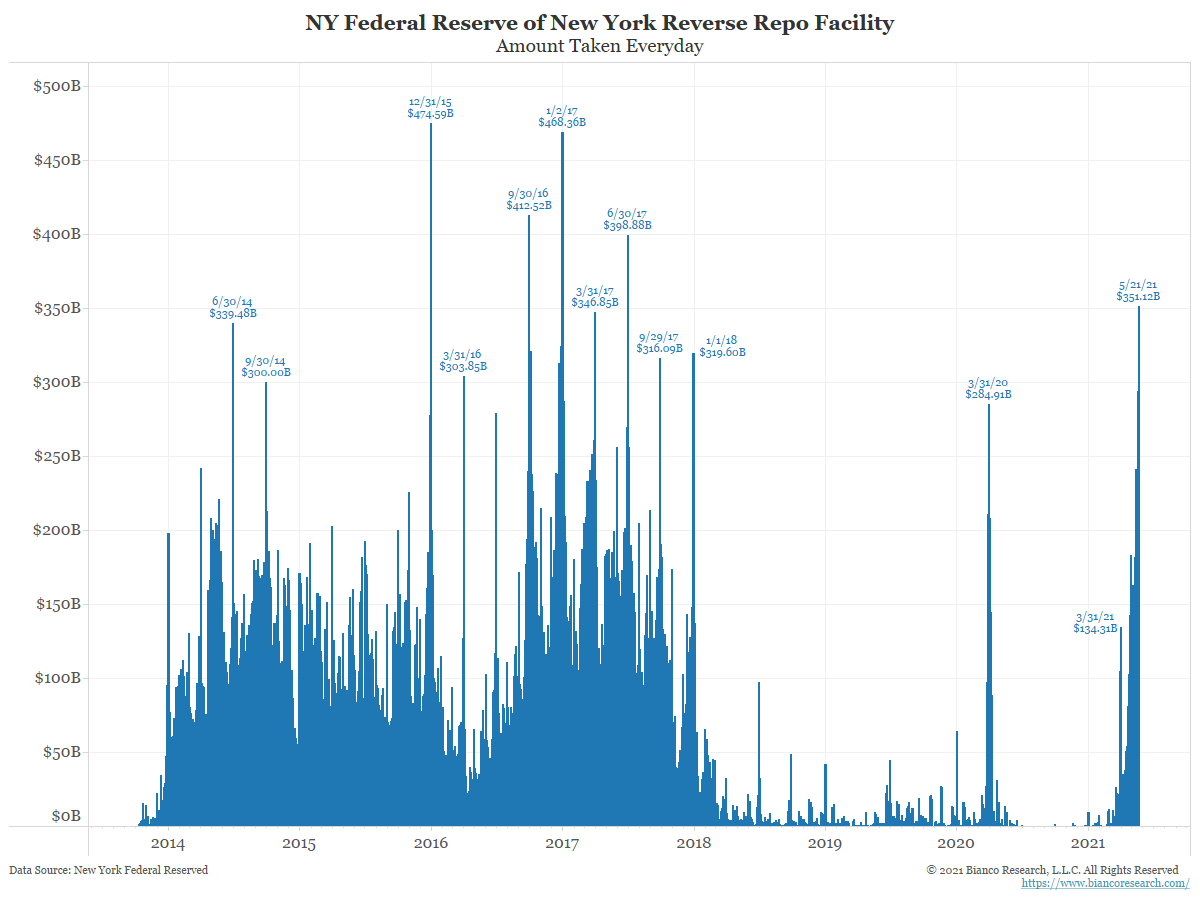

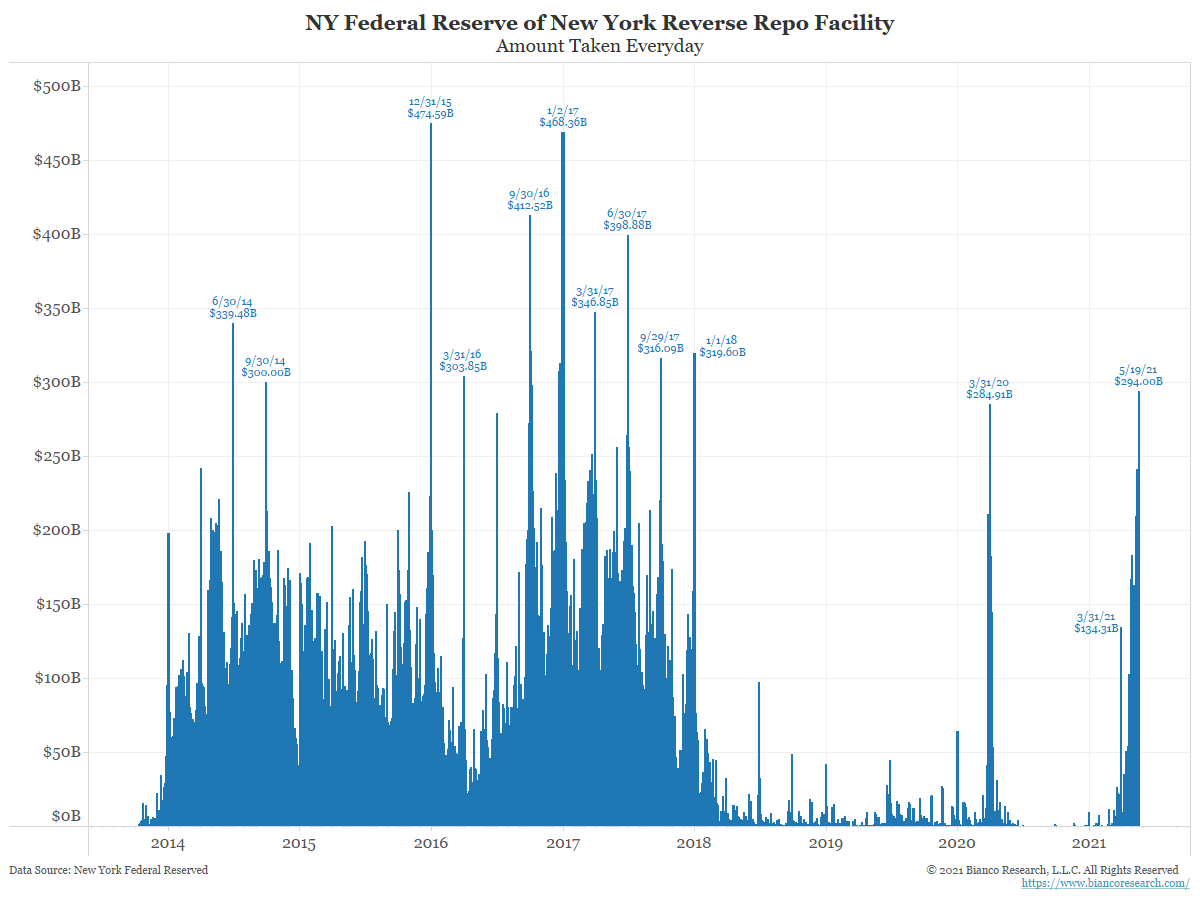

Usage of the Fed’s Reverse Repo Facility Ramps Up Again

Posted By Jim Bianco

Yesterday the Fed took $351 billion in reverse repo from banks and money market funds, the fourth-highest total ever. Why is this happening?... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 20th, 2021

Bloomberg Opinion: Why the Bitcoin Crash Was a Big Win for Cryptocurrencies Jim Bianco – The cryptocurrency market means different things to different people. To many, it represents an object of naked speculation, which consumes almost all the media coverage about the space.... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 19th, 2021

Bianco Research Conference Call: What Is the Market Telling Us About Inflation? Tomorrow, May 20, at 9:00 AM CT (10:00 AM ET, 7:00 AM PT and 15:00 BST) Bianco Research, in conjunction with Arbor Research & Trading, will be hosting... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 18th, 2021

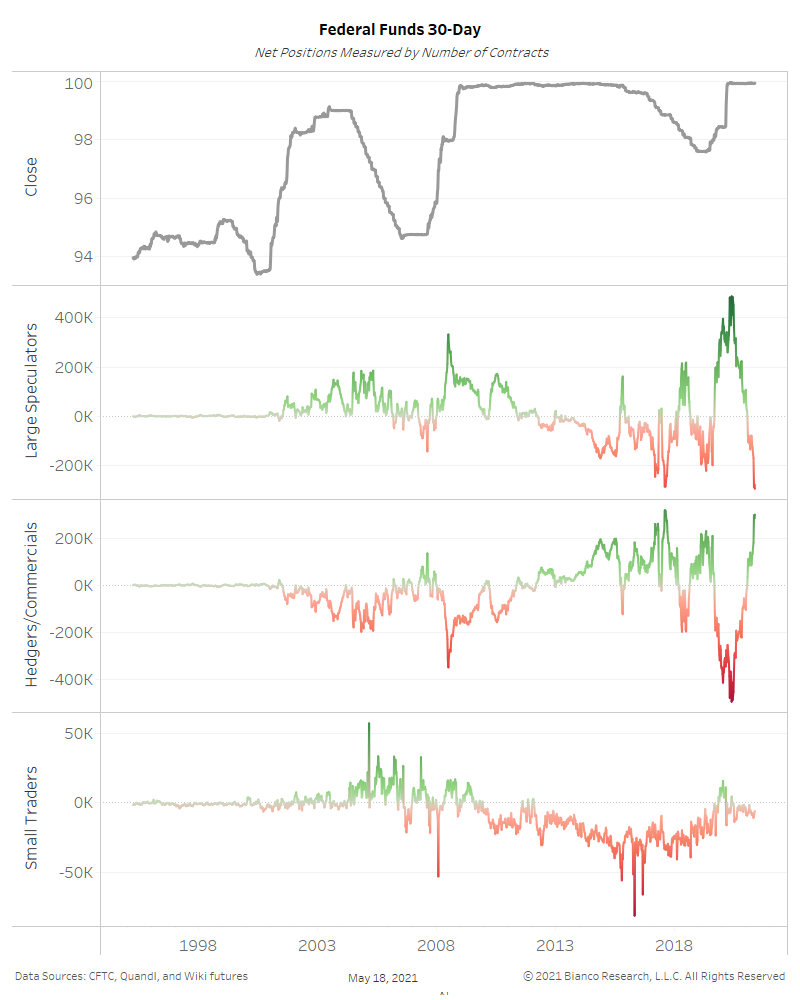

Jim Bianco: ZeroHedge: Michael Burry Reveals Massive Tesla Short, Huge Inflationary Bet PUT on the TLT 20+ Year TSY bond ETF, equivalent to some 1.266MM shares or $171.5 million CALL on the TBT 20+ Year Treasury Ultrashort ETF, equivalent to... Read More

Talking Data Episode #54: About the Crypto Selloff

In today’s installment Jim will give us an update on the Crypto selloff. · Transformative Technologies volatility is different from the S&P 500 · What is Chain Analysis? The full video can be viewed below: An audio-only version can be... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 17th, 2021

Jim Bianco joins Fox Business?s ?Making Money? to discuss Cryptocurrencies with Charles Payne Twitter: Charles V Payne @cvpayne anyone serious about learning and understanding the digital revolution should follow Jim…this was a great discussion…plus next time he will have an... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 14th, 2021

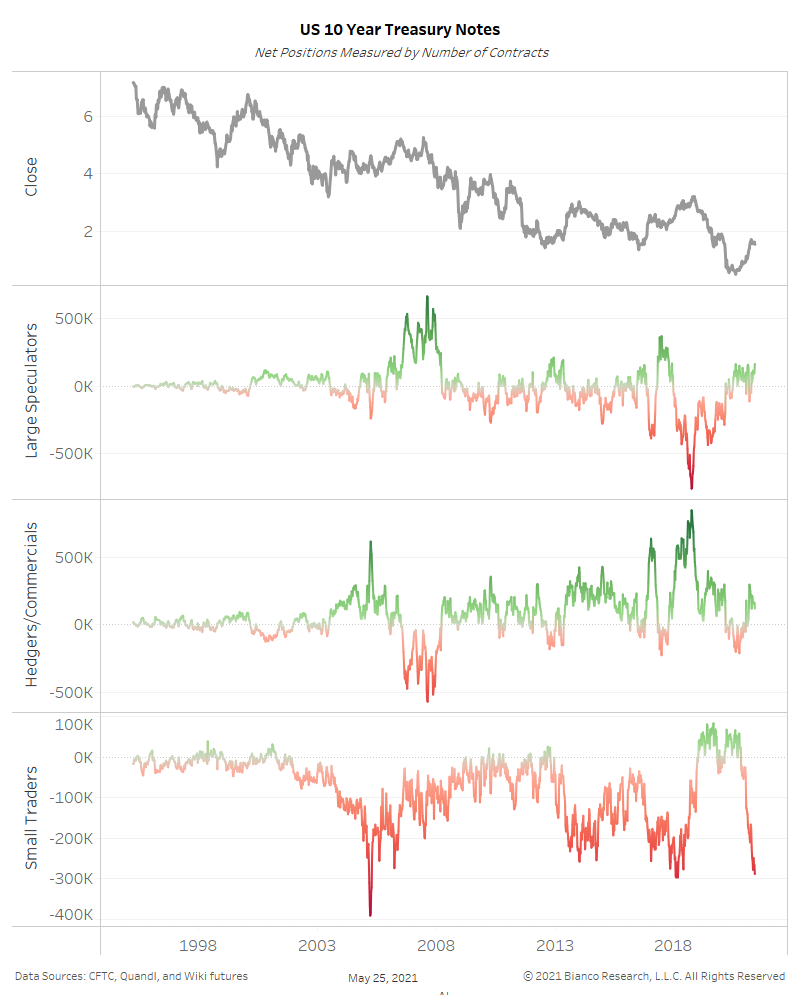

Bloomberg: The Real Reason Why U.S. Bond Yields Are Stuck Richard Cookson – Here?s a conundrum. Why, when growth and inflation are picking up sharply, are U.S. bond yields stuck at modest levels? Yields on 10-year Treasuries are lower now... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 13th, 2021

Ben Breitholtz: Twitter: Matthew C. Klein @M_C_Klein Don?t Be Fooled by April?s Inflation Jump. It?s Being Driven by Reopening Quirks. <– always worth digging into the data on levels and the attribution tables Tweet Ben Breitholtz: US search activity shows workers... Read More

The Rise of a Parallel Financial System

Posted By Jim Bianco

Our latest Bloomberg opinion column about the potential of DeFi and stablecoins... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 12th, 2021

Twitter: GoogleTrends @GoogleTrends #inflation is being searched now more than ever, US Tweet Bloomberg Opinion: A New Global Monetary Order Threatens the Dollar Jim Bianco – The history of modern finance has seen several monetary orders, from the gold standard of... Read More

Bespoke Commentary from Bianco Research and Arbor Data Science – May 11th, 2021

Jim Bianco: Wall Street Journal: Opinion | The Fed Is Playing With Fire Clinging to an emergency policy after the emergency has passed, Chairman Powell courts asset bubbles. Jim Bianco: Seychelles updated their infection rates yesterday. Remember they that have... Read More