Tag Archives: Markets

What Should The Fed Do?

Posted By Jim Bianco

Jim was on Bloomberg TV this morning talking about the Fed and what they should do at the December FOMC meeting.... Read More

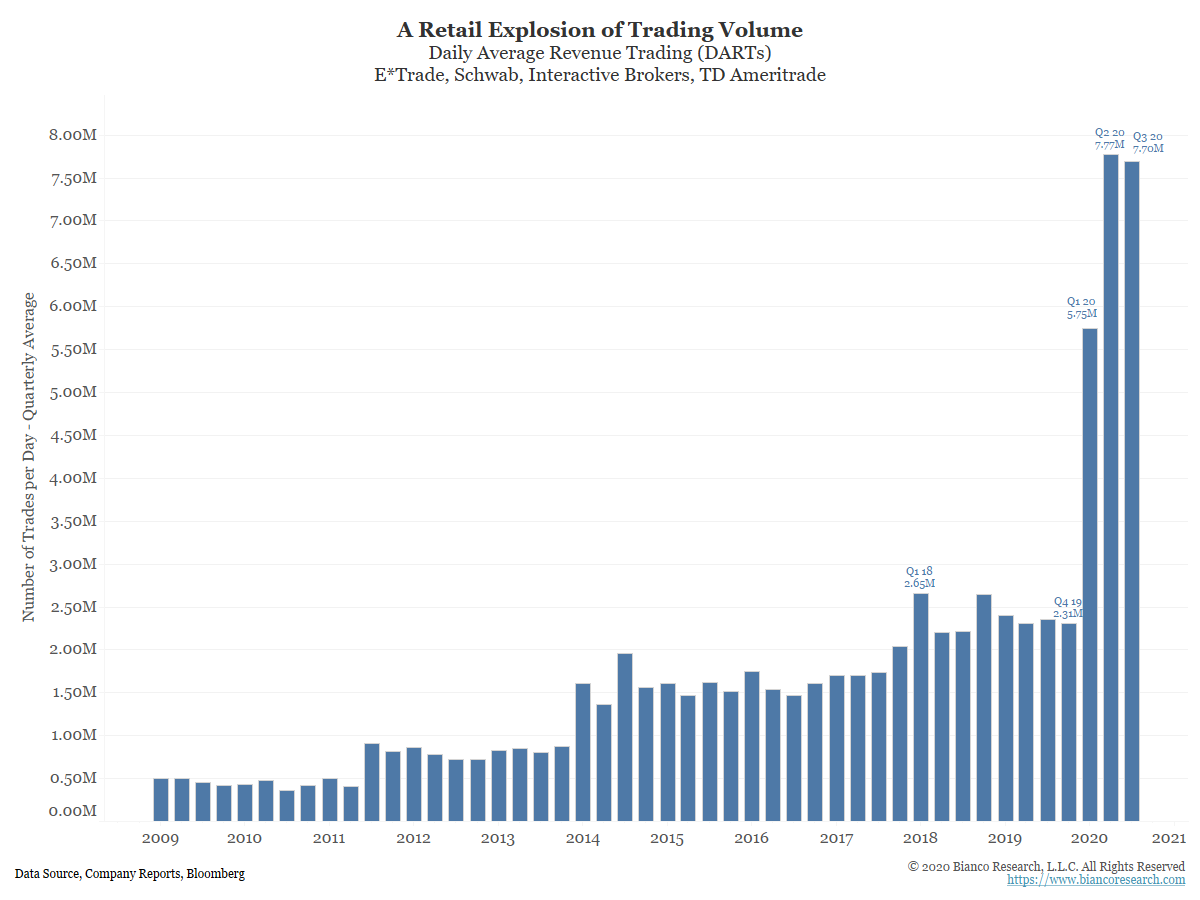

The Public’s Changing Investment Preferences

Posted By Jim Bianco

The outflows from funds should not be seen as the result of investors de-risking. Rather, investing styles and preferences are changing.... Read More

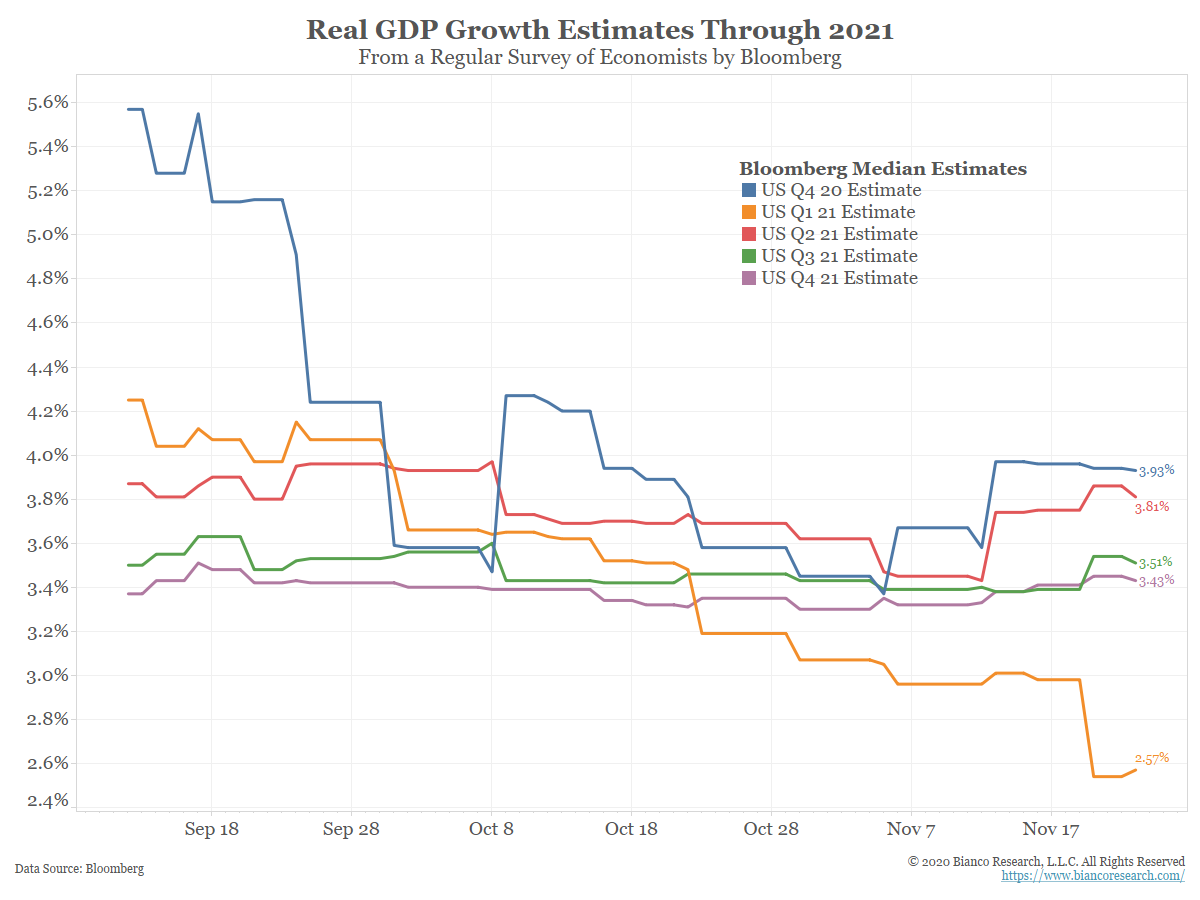

A Poor Outlook and Expensive Markets

Posted By Jim Bianco

Despite the markets "living in the second half of 2021," signs are emerging that the next few quarters will be a struggle. Analysts are not as optimistic about the return to normal.... Read More

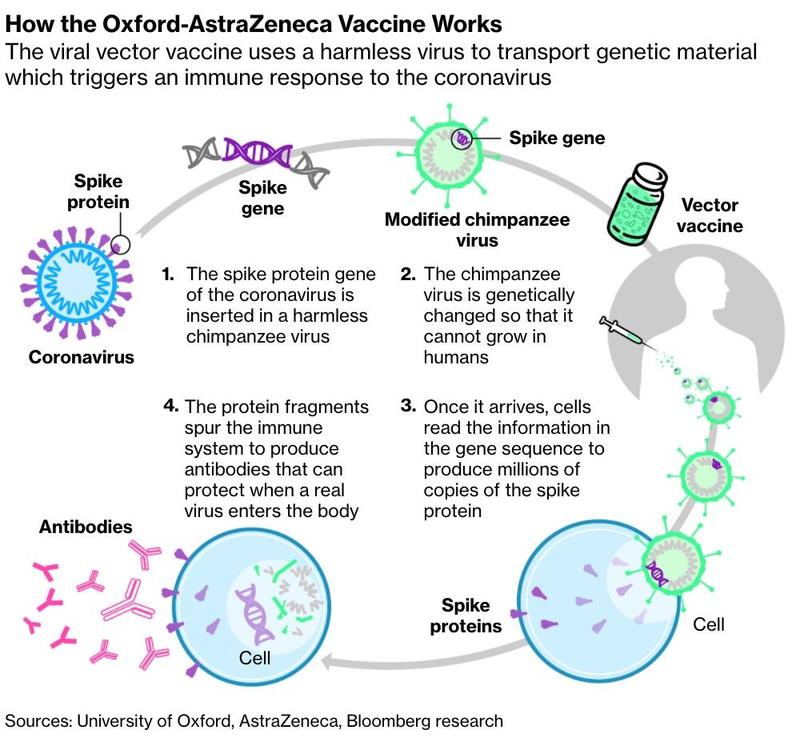

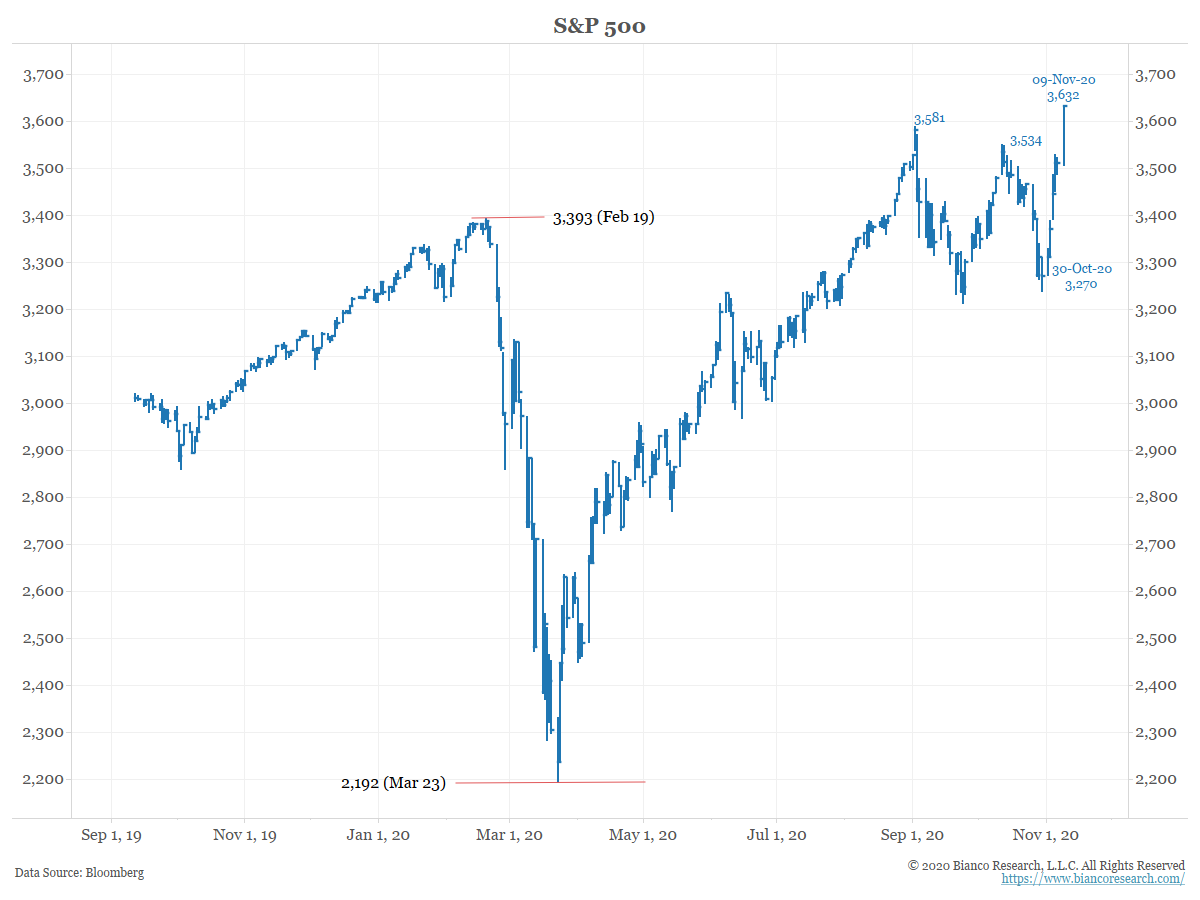

Today’s Vaccine Announcement

Posted By Jim Bianco

AstraZeneca's sold off on news of a new vaccine with 70% efficacy. However, this new vaccine has a couple advantages to those offered by Pfizer and Moderna in recent weeks.... Read More

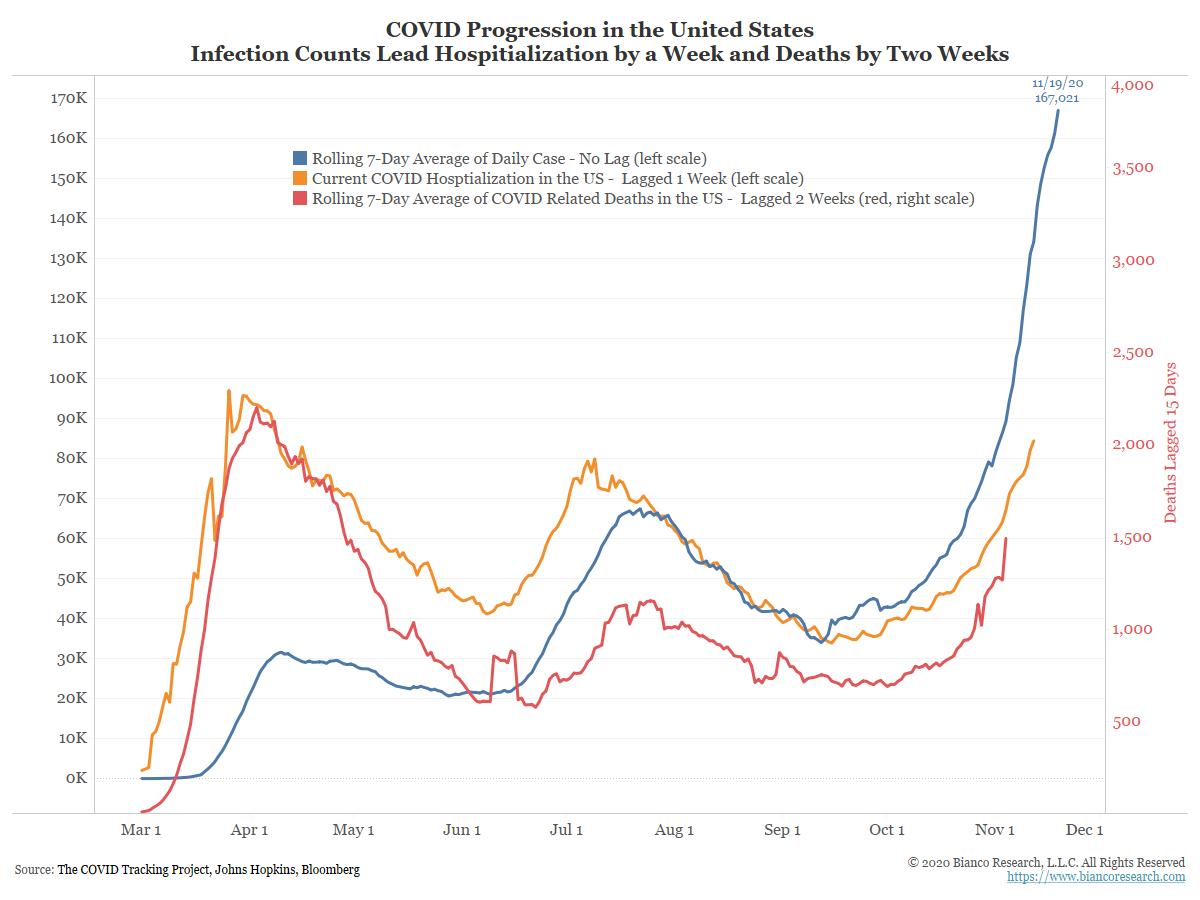

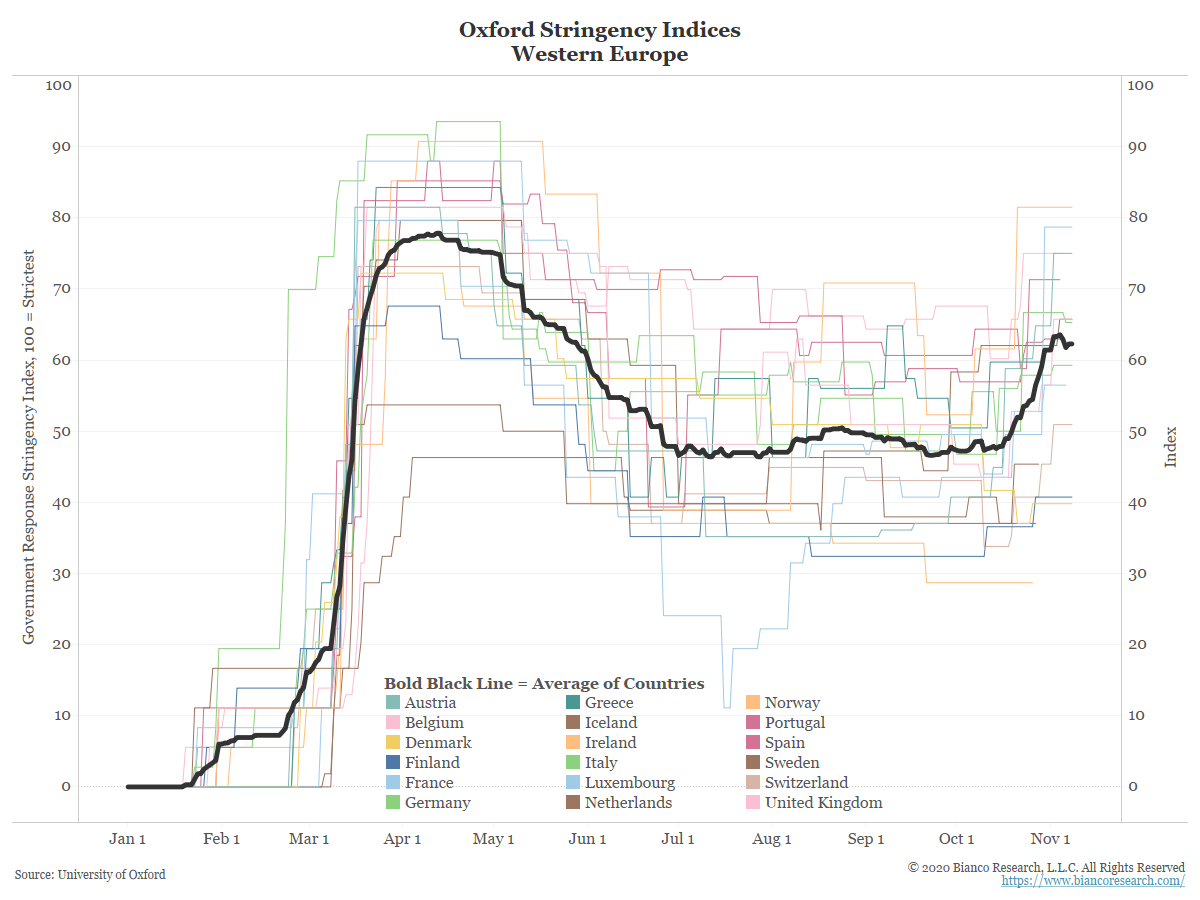

A Dark Winter Coming?

Posted By Jim Bianco

While vaccine news has provided a positive breath recently, infection counts continue to climb across the world. The response between now and the time the vaccine is widely distributed will be critical.... Read More

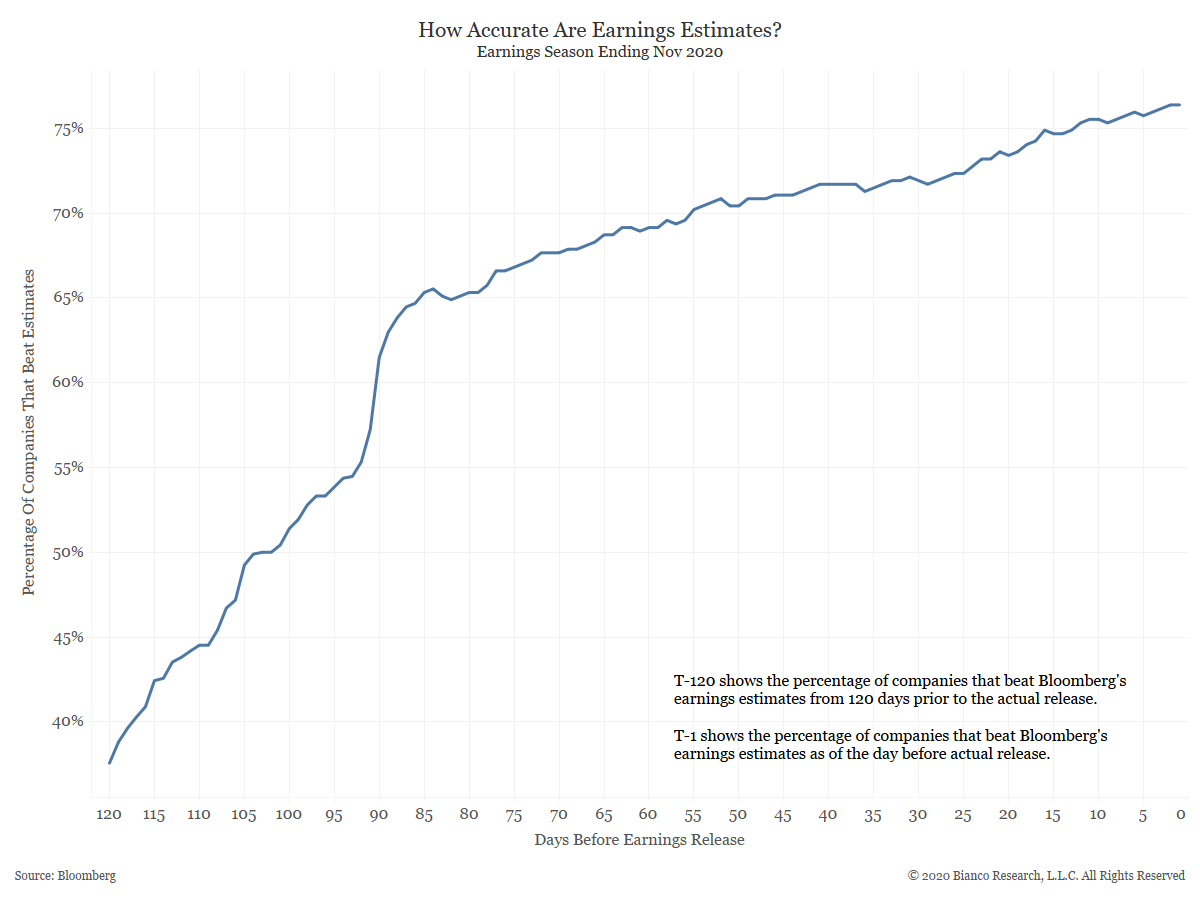

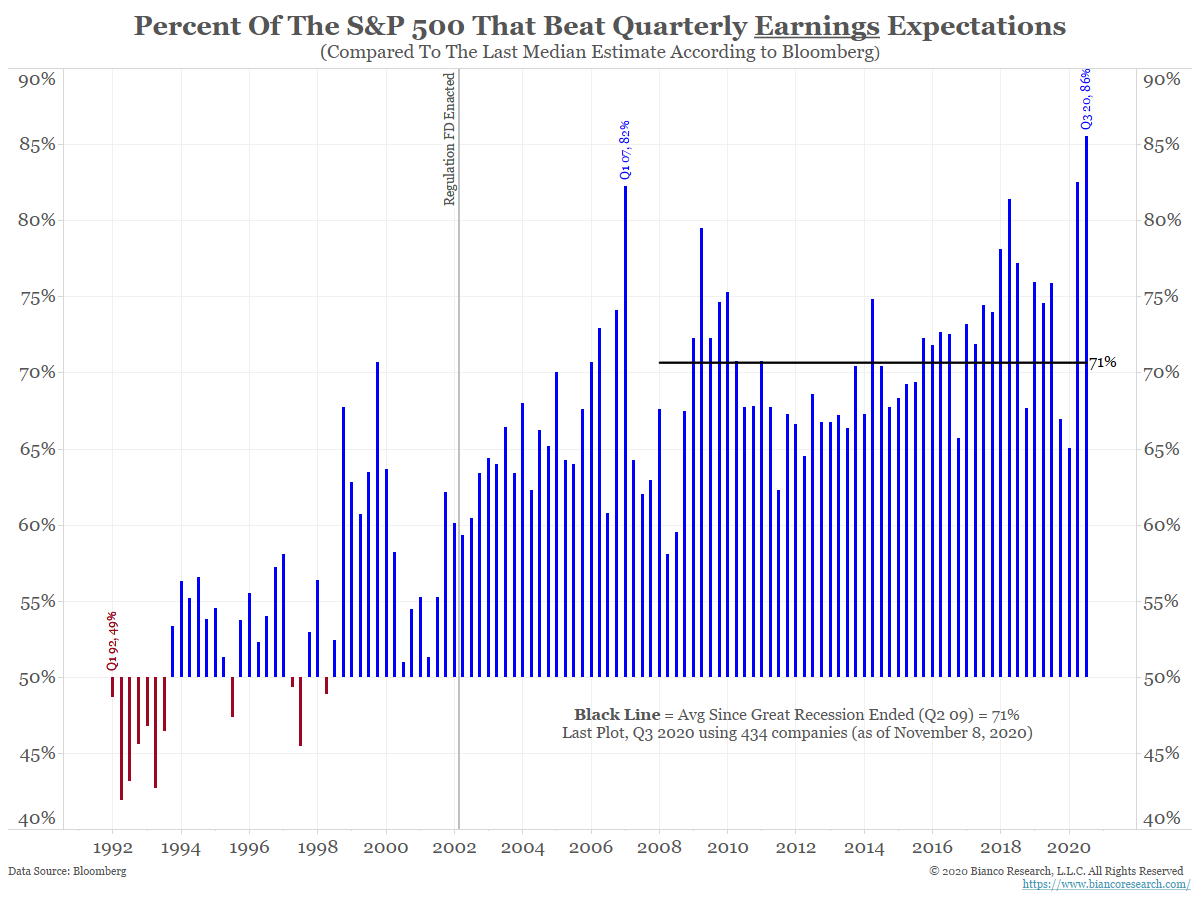

Another Earnings Season Comes to a Close

Posted By Greg Blaha

As another earnings season comes to a close, companies have once again successfully guided analysts' expectations low enough to ensure positive results. This is a game that has been perfected over the past decade.... Read More

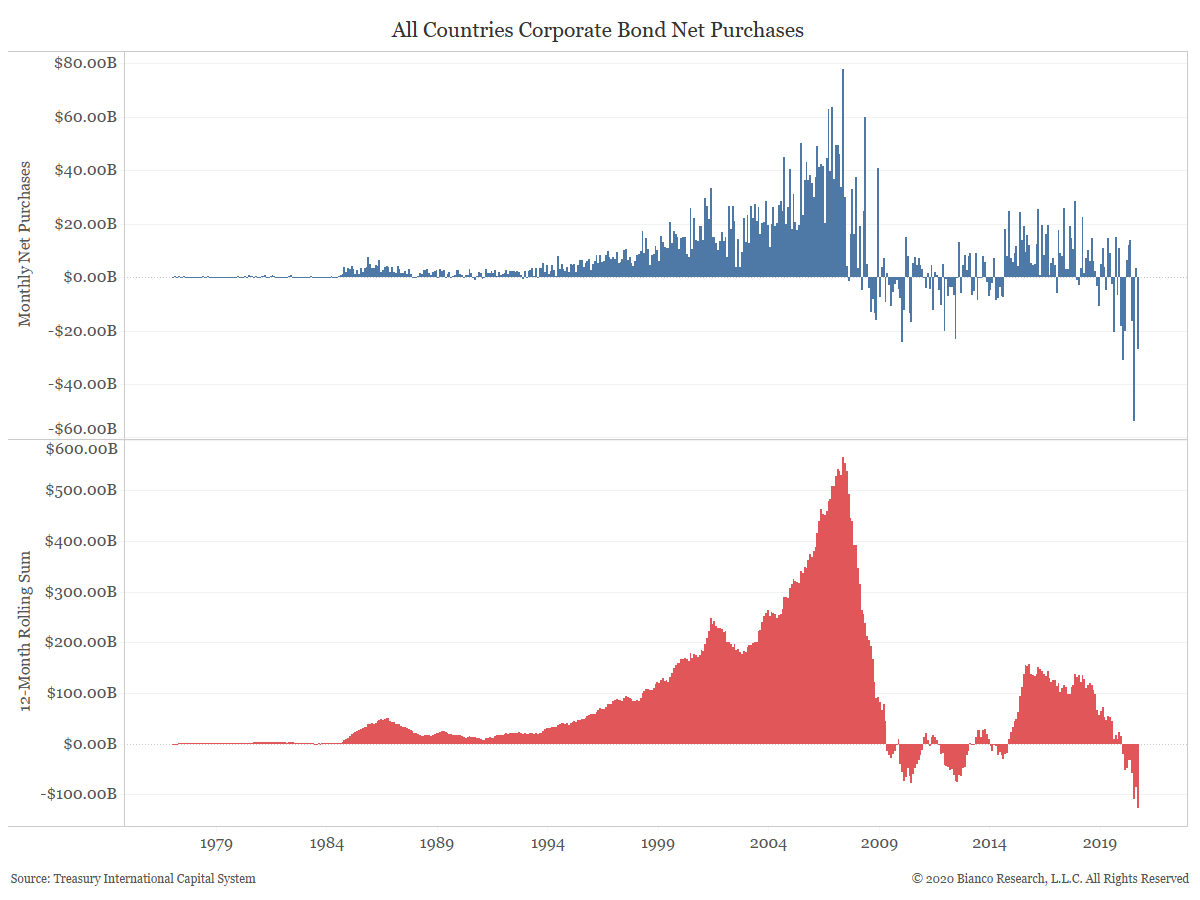

A Review of Foreign Net Purchases of U.S. Securities

Posted By Greg Blaha

Foreigners sold their third largest monthly sum of corporates on record, unloading $26.99 billion in September and a record $127.65 billion over the past year.... Read More

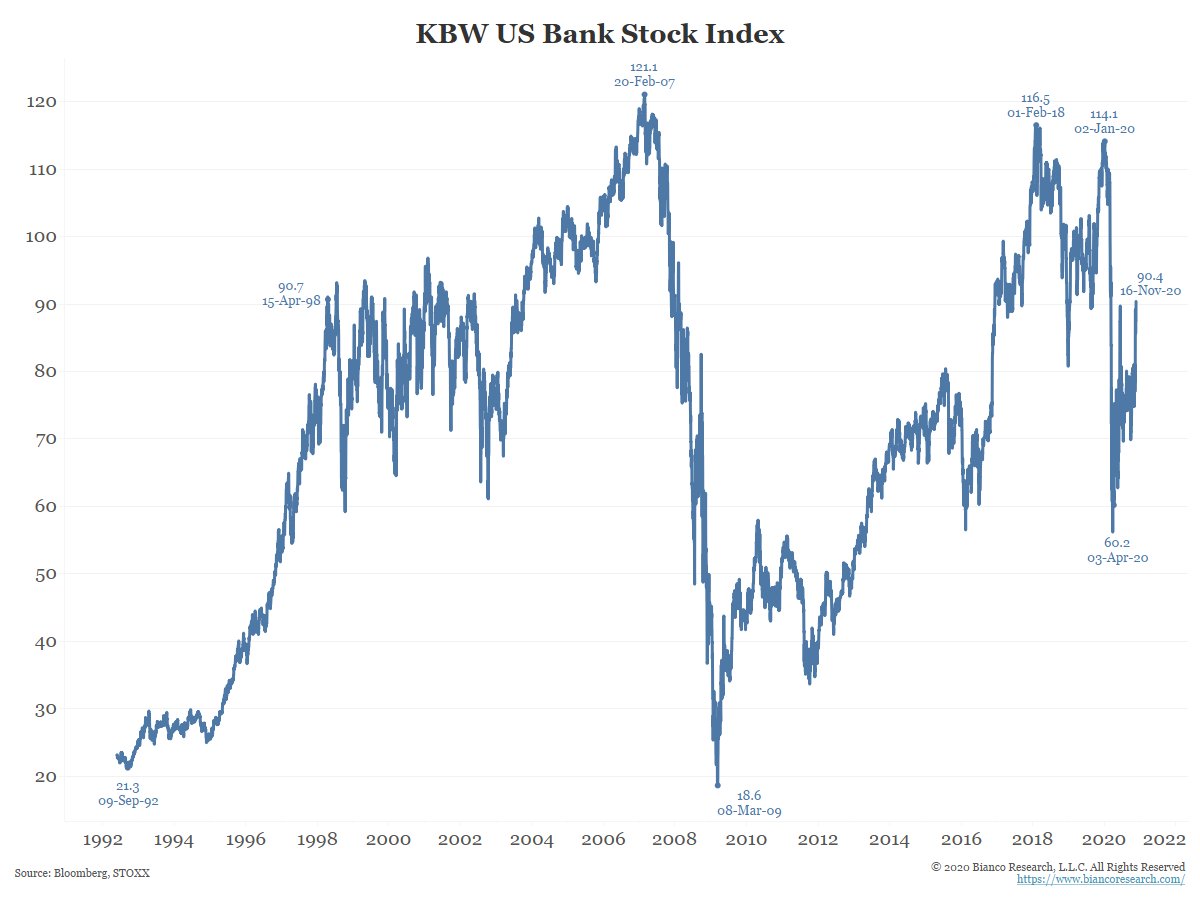

What About Financials?

Posted By Jim Bianco

A big part of bank/financial stock performance is tied to the outlook of interest rates, spreads (net interest margins), and the reason why rates are moving (growth or inflation). We understand why higher rates are considered good for banks for now. But when/if this view flips to a belief that inflation is returning, rising rates will no longer benefit banks.... Read More

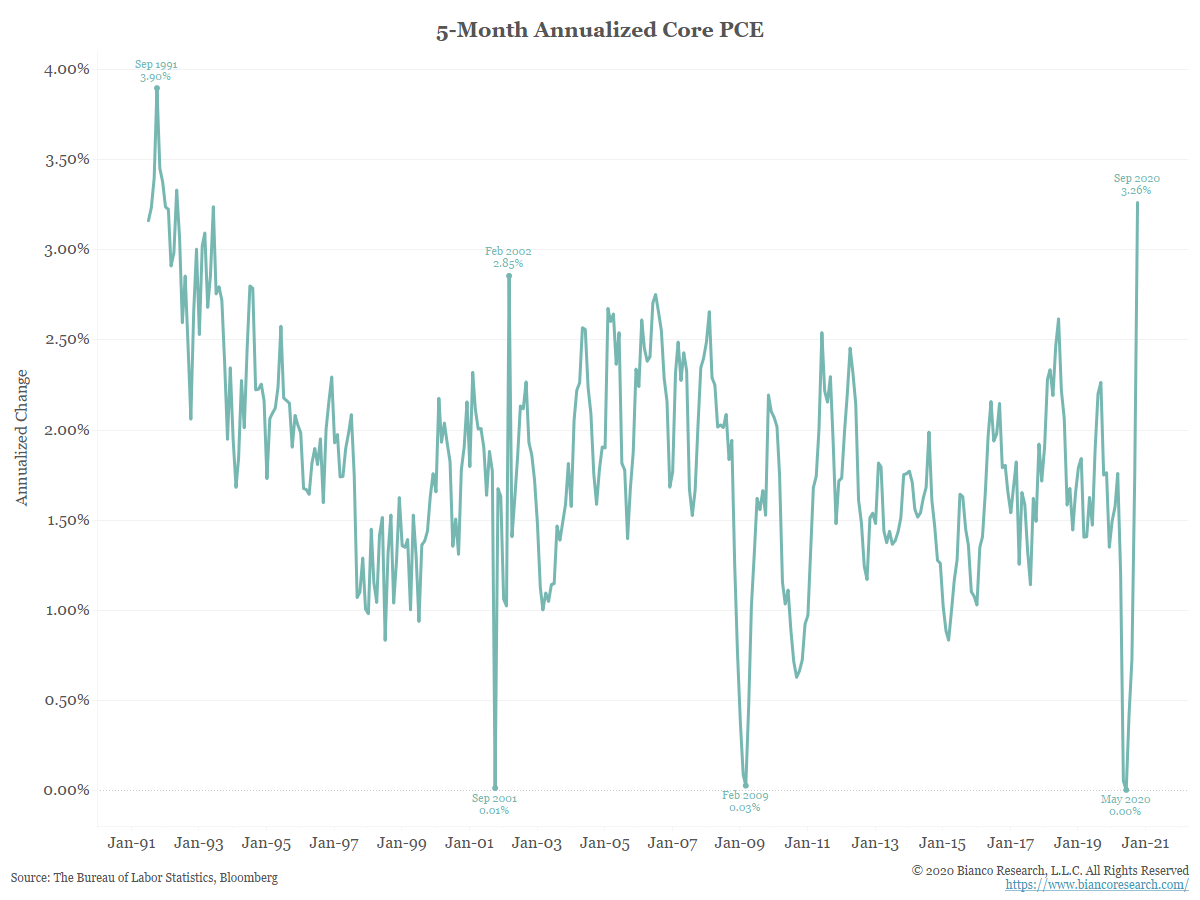

When Will the Fed Hike and Why

Posted By Jim Bianco

The market is starting to see a Fed hike on the distant horizon. This is how a shift in thinking begins. The driving reason for this change seems to be a resurgence of inflation over booming real growth.... Read More

COVID Records and the Economy

Posted By Jim Bianco

As COVID cases continue to spike, lockdowns are being instituted and the economy is struggling. But, for now, all that is being overlooked because a vaccine is coming.... Read More

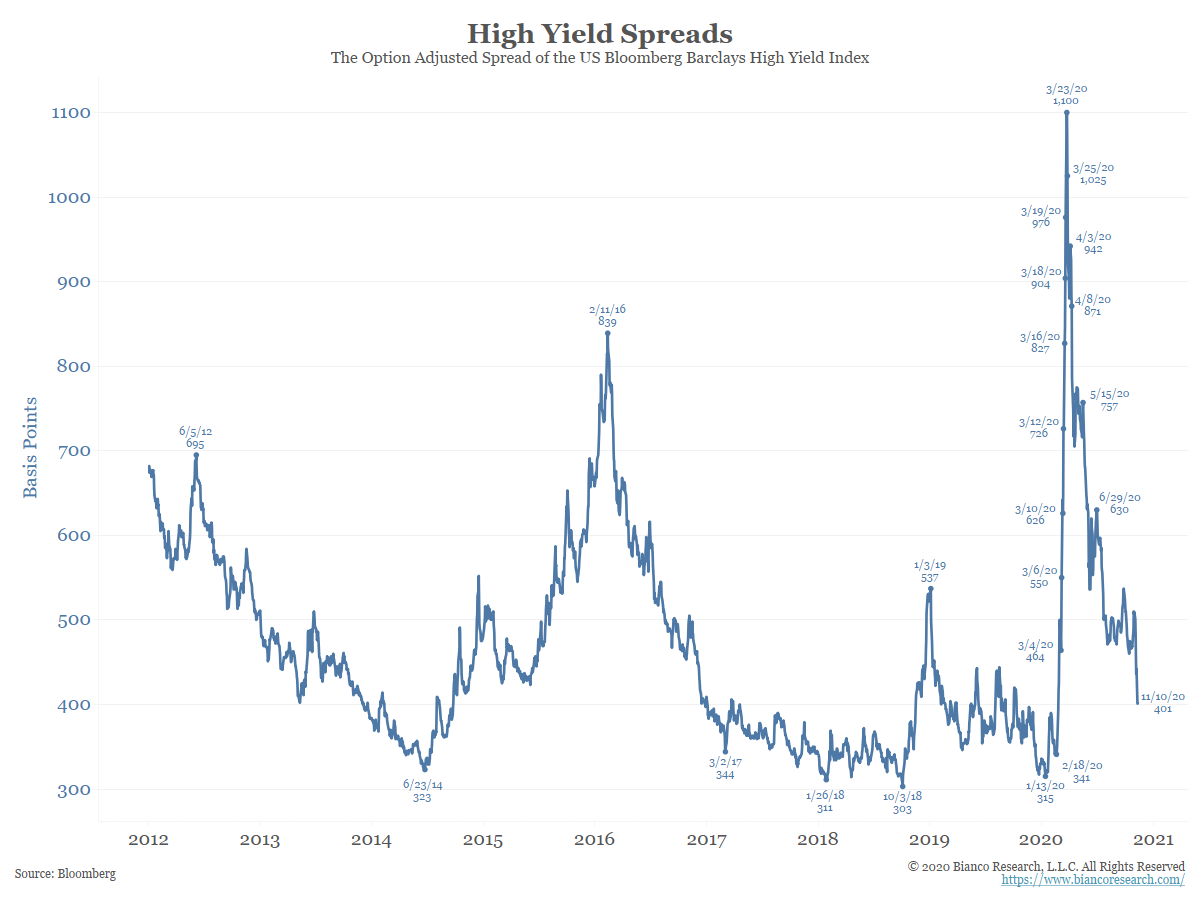

Updating the Macro Nature of Credit Trading

Posted By Jim Bianco

Since the Fed began buying corporate bonds and bond ETFs, this sector trades more like an index and less like a market of bonds.... Read More

A Booming Re-Opening Rally

Posted By Jim Bianco

Good news on the vaccine front has ignited a powerful rally and a violent reversal away from work-from-home stocks. This is all good news. However, inflation and much higher interest rates now become a bigger risk worth monitoring.... Read More

Earnings Update: Record Beat Rates and High Valuations Continue

Posted By Alex Malitas

To-date, 434 S&P 500 companies (87%) have reported earnings. 86% beat estimates, a record pace. Stock valuations remain very high.... Read More