Tag Archives: Markets

Talking Data: Reviewing the Three Big Stories of the Week

In the latest installment of Talking Data, Jim and Ben talk about the three big stories of the week... Read More

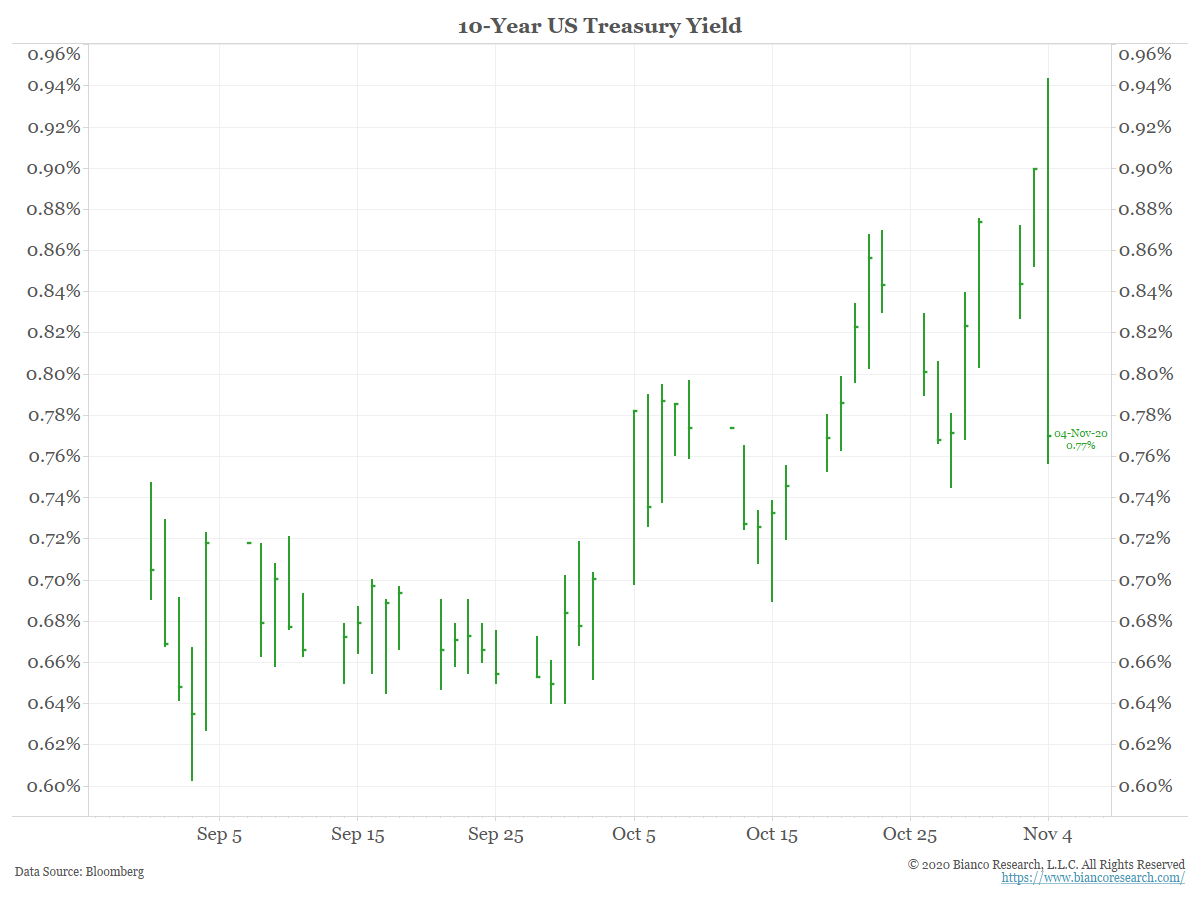

About Last Night … And Beyond

Posted By Jim Bianco

Once the votes made a divided government a high likelihood, the markets reacted by decreasing the odds of further fiscal stimulus. Bond yields fell and the stock market is up.... Read More

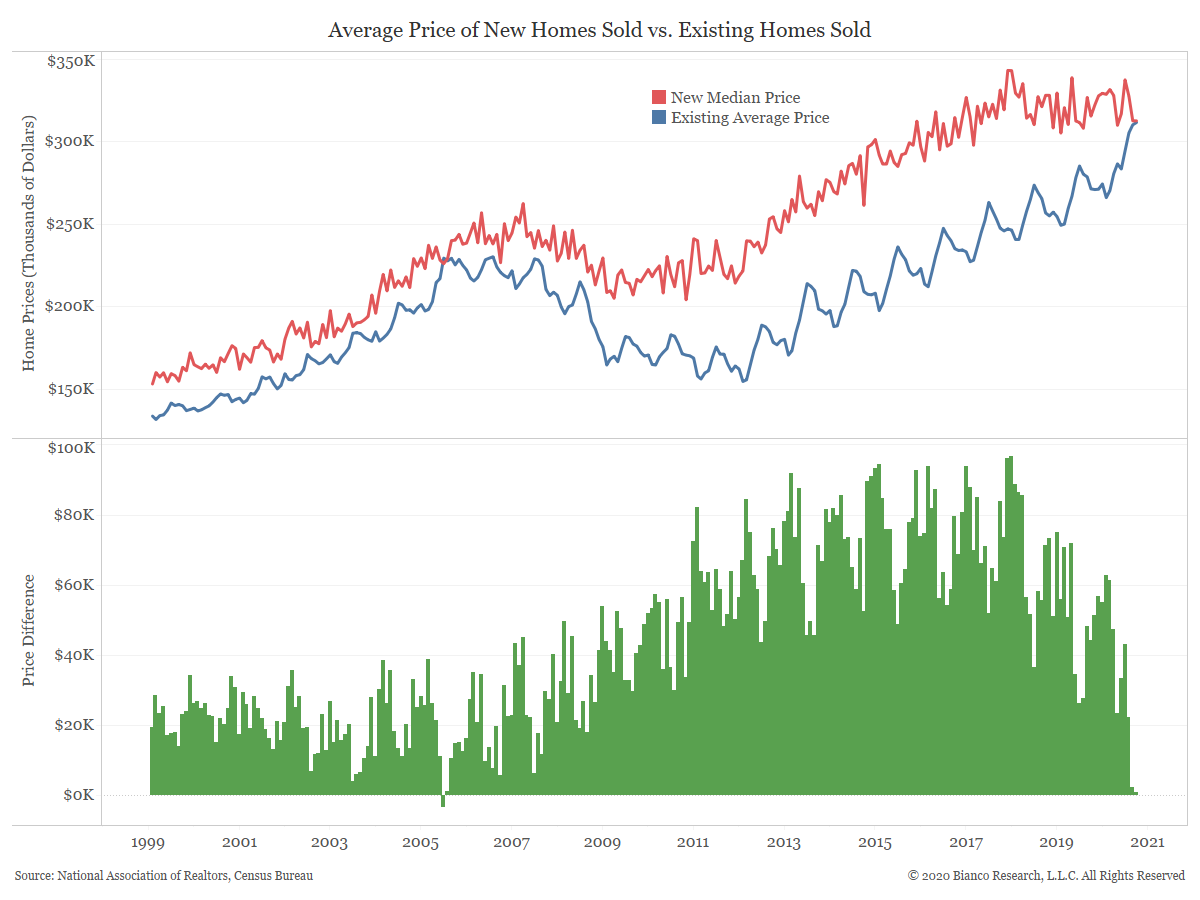

Comparing New Home Prices to Existing Home Prices

Posted By Greg Blaha

As existing home prices continue to trend higher, new home prices have stalled out over the last few years.... Read More

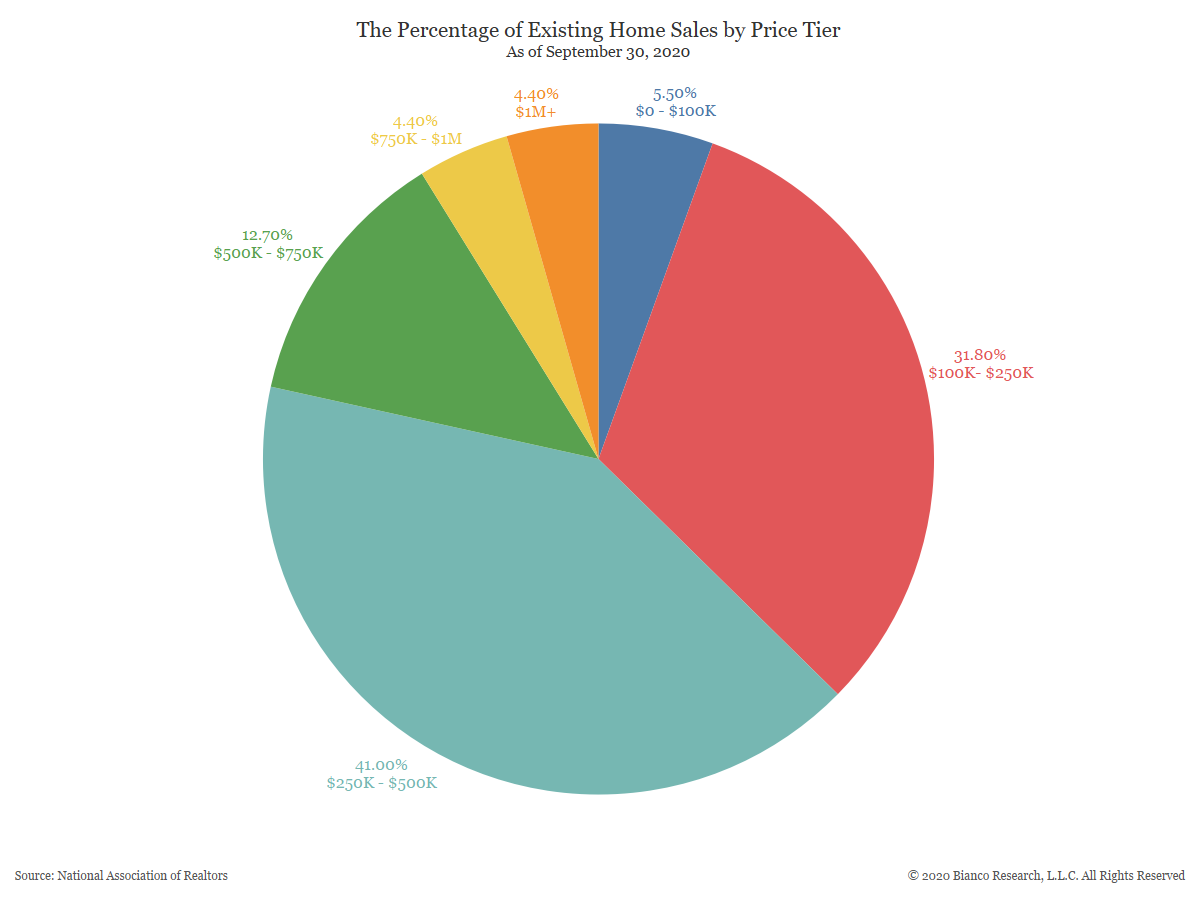

Existing Home Sales by Pricing Tier

Posted By Greg Blaha

Over a third of all existing home sales occurred under the $250,000 price point in September.... Read More

Talking Data: The Election and Markets

Posted By Jim Bianco

In our latest installment of Talking Data, Jim and Ben dive into the election and its potential ramifications for financial markets.... Read More

COVID Spike Now Worrying Markets

Posted By Jim Bianco

COVID cases are spiking worldwide and governments are trying to lockdown, but populations are pushing back. Risk markets have taken note.... Read More

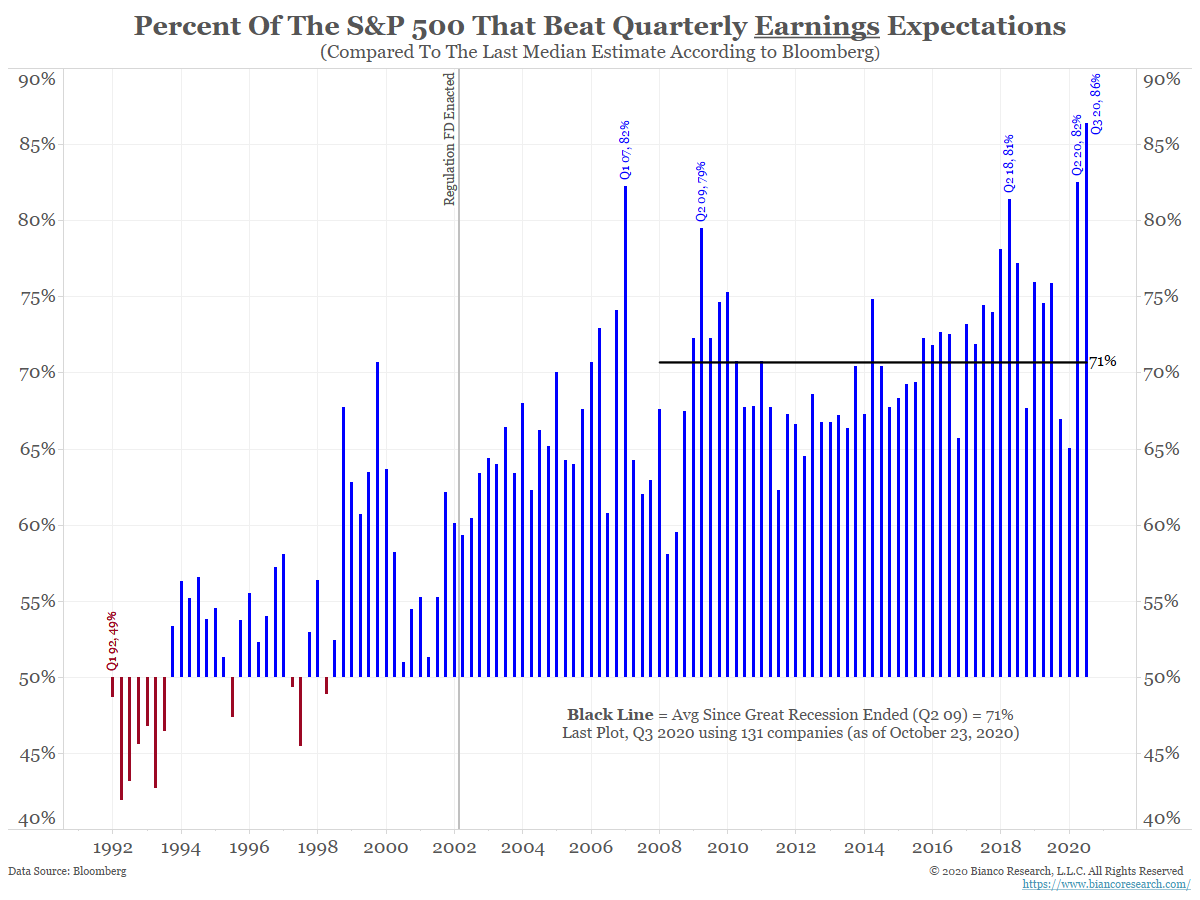

Earnings Update: Companies Beating Estimates at High Rate

Posted By Alex Malitas

To-date, 131 S&P 500 companies (26%) have reported earnings. 86% beat estimates, well above the average quarterly beat rate since 2009 is 71%. The growth rate is -17.24%.... Read More

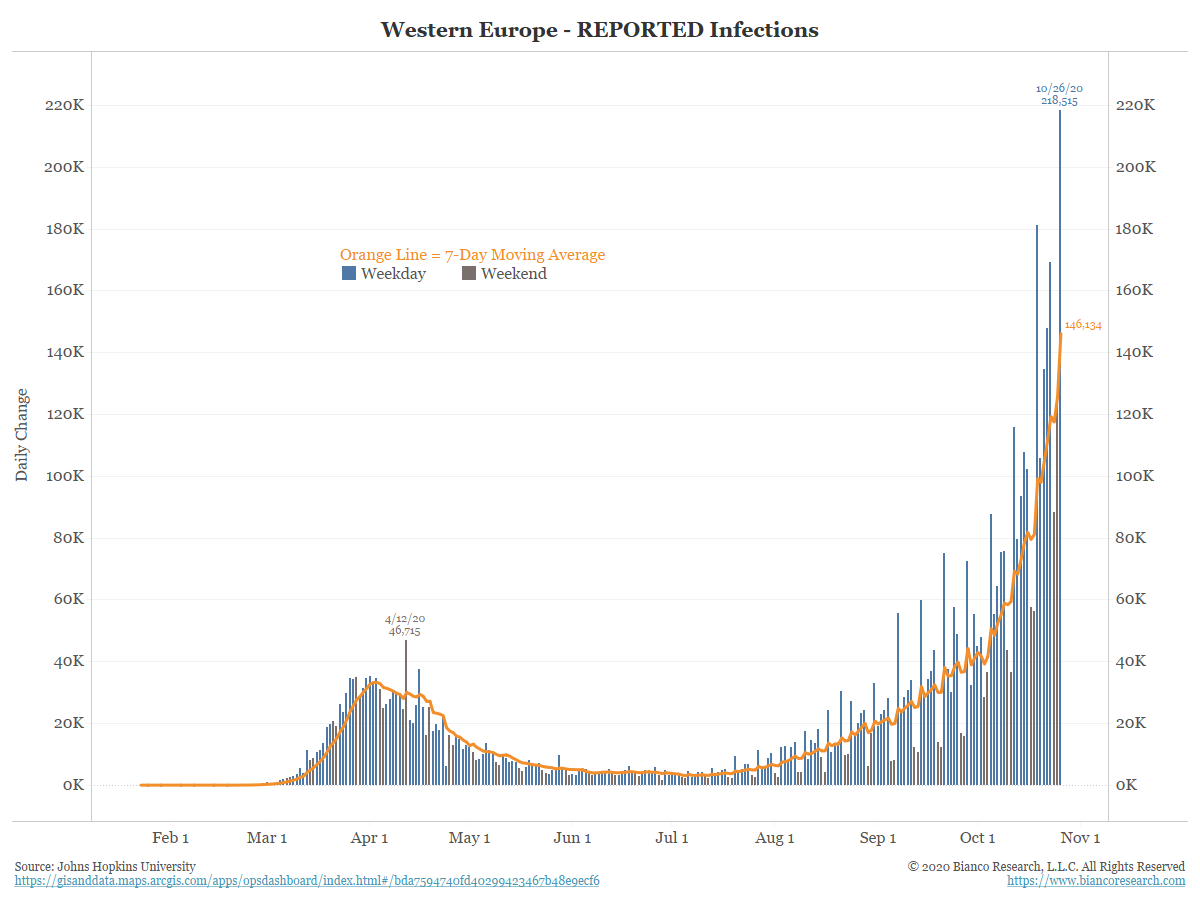

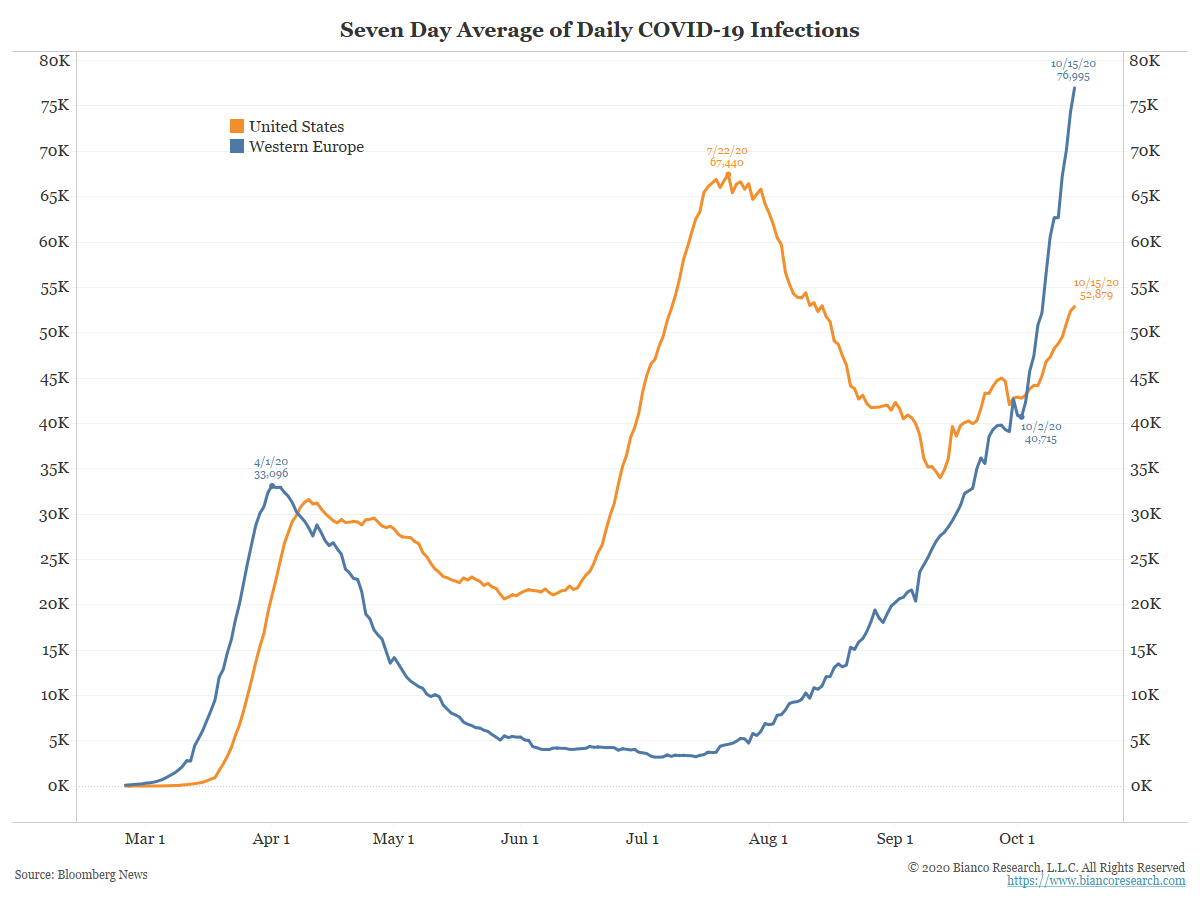

Europe’s COVID Counts Spiking Higher

Posted By Jim Bianco

COVID cases are spiking again in Europe. Deaths are now following. Rising infection counts continue to matter for the global economy.... Read More

Infections Cases Spiking Again

Posted By Jim Bianco

New daily cases in Western Europe are now twice as high as their spring peak and well above the peaks seen over the summer in the United States. When the virus initially spread in March, European cases led U.S. cases by four to six weeks.... Read More

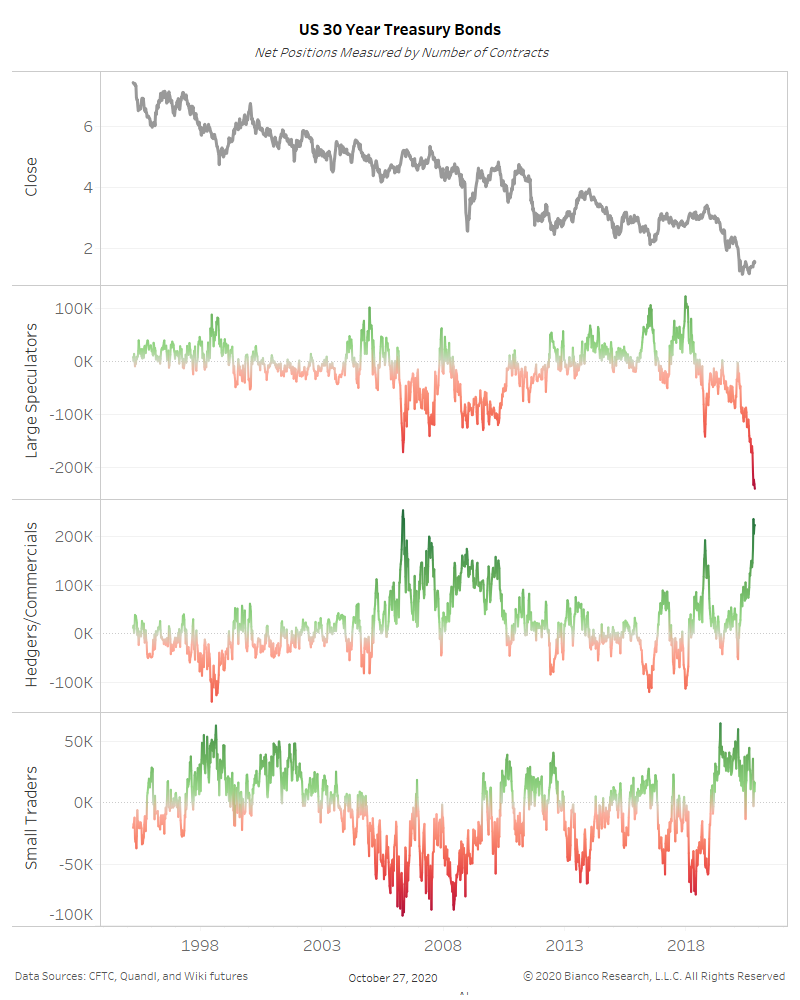

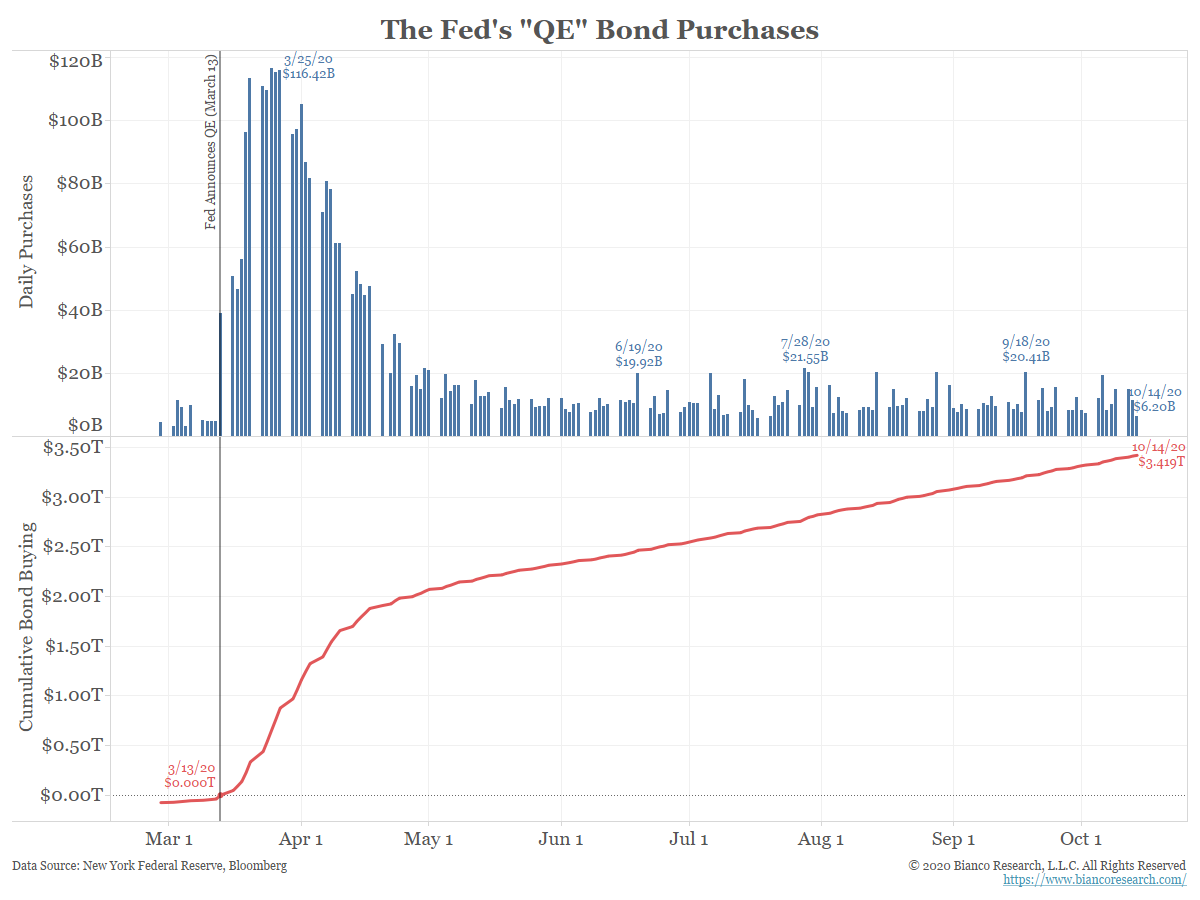

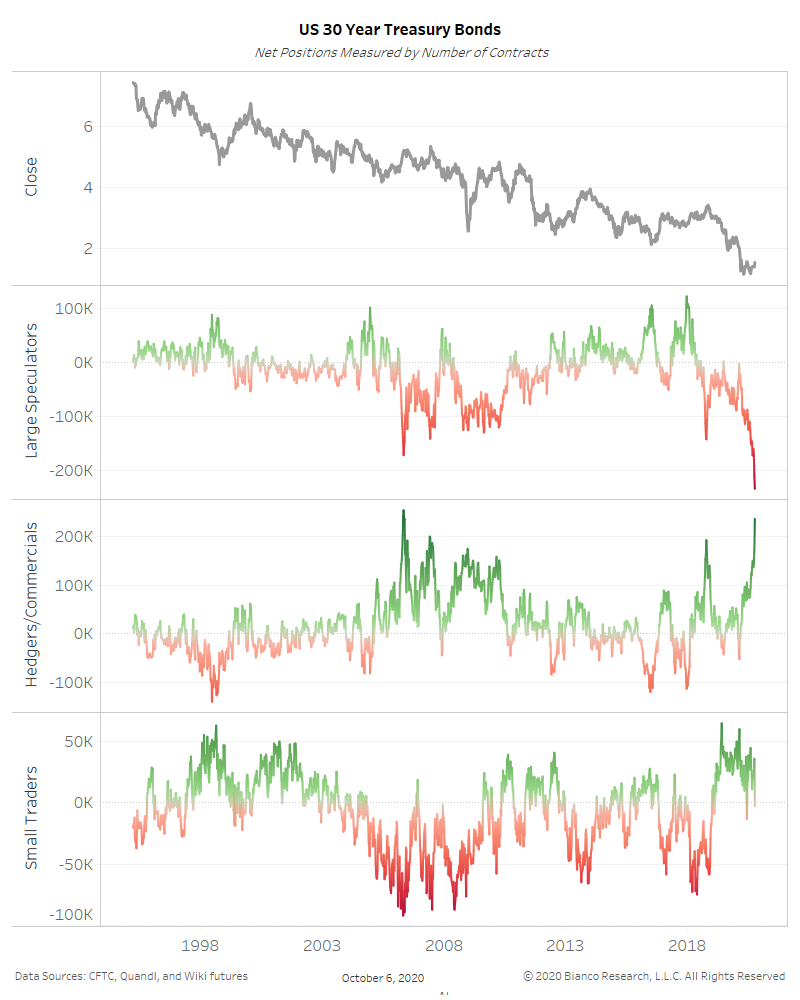

There Are No Bad Bonds, Only Bad Prices

Posted By Jim Bianco

There is an old saying on Wall Street that "there are no bad bonds, only bad prices." It seems Quarles is proudly announcing the Fed will hold Treasuries at "bad prices." What ends this? Inflation.... Read More

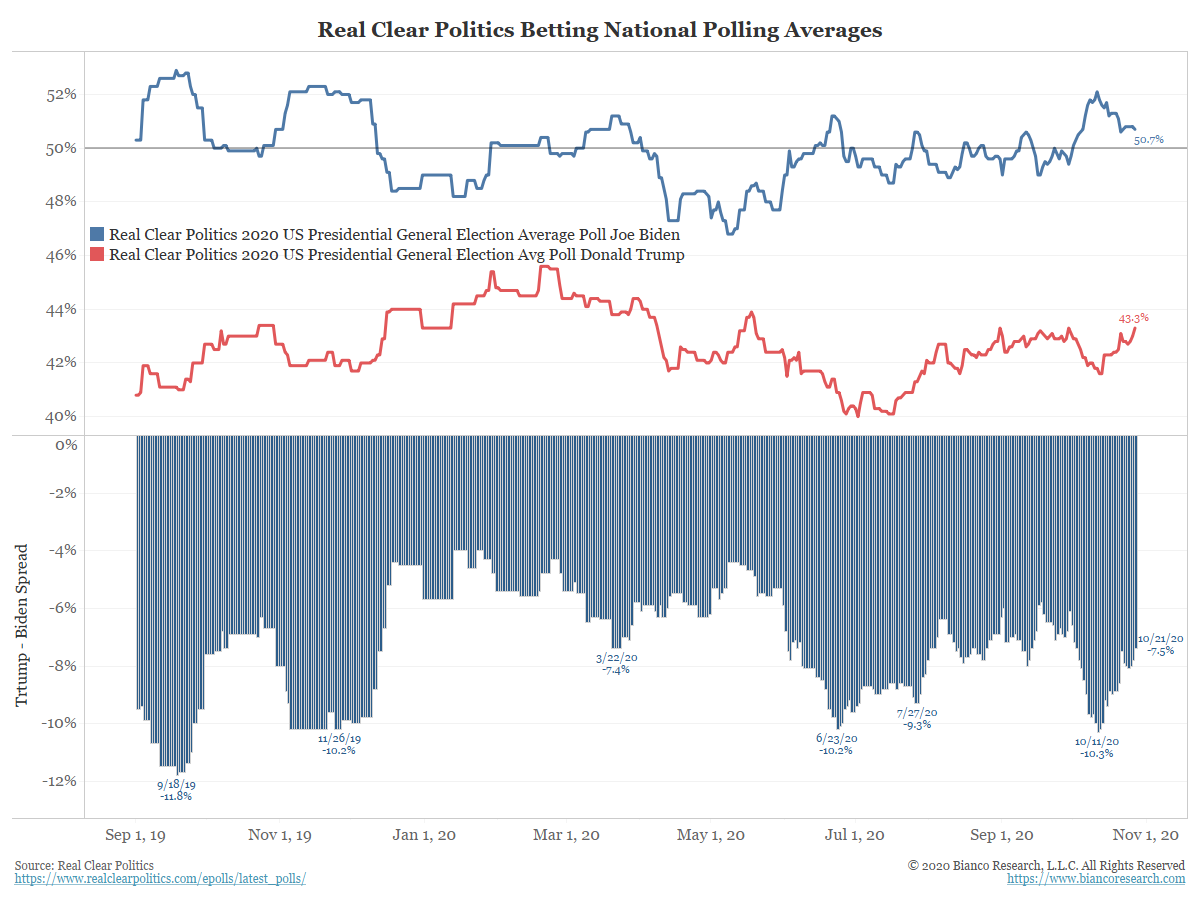

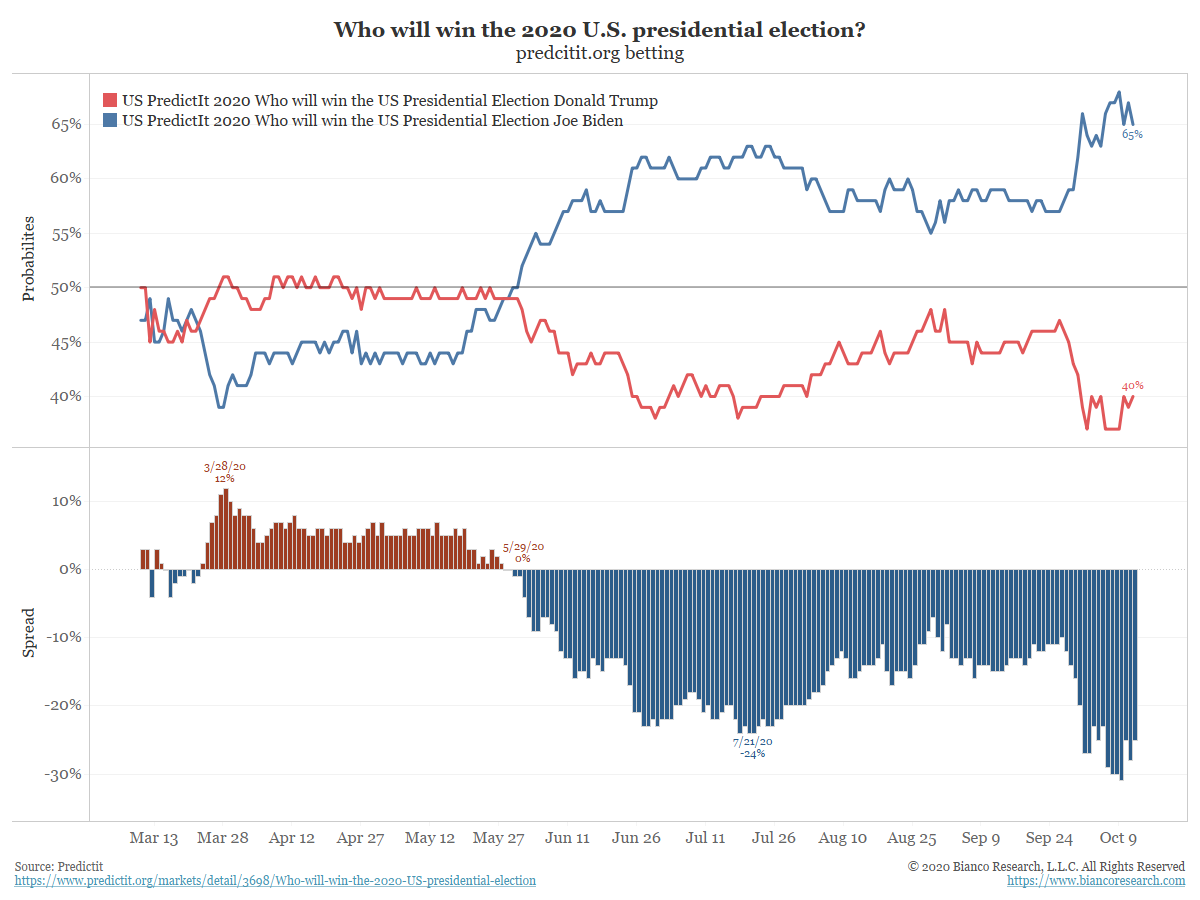

Will We See a “Red Mirage” Election Night?

Posted By Jim Bianco

The "red mirage" is the idea that election night ends with Trump ahead with more than 270 electoral college votes. As mail-in ballots begin being counted, however, several key states may flip until Biden is declared the winner.... Read More

Comparing the Value of Credit in the U.S. to GDP

Posted By Greg Blaha

The amount of outstanding private credit in the U.S. experienced a brief decline during the financial crisis, but government debt grew throughout the entire period. Both are now at new highs.... Read More

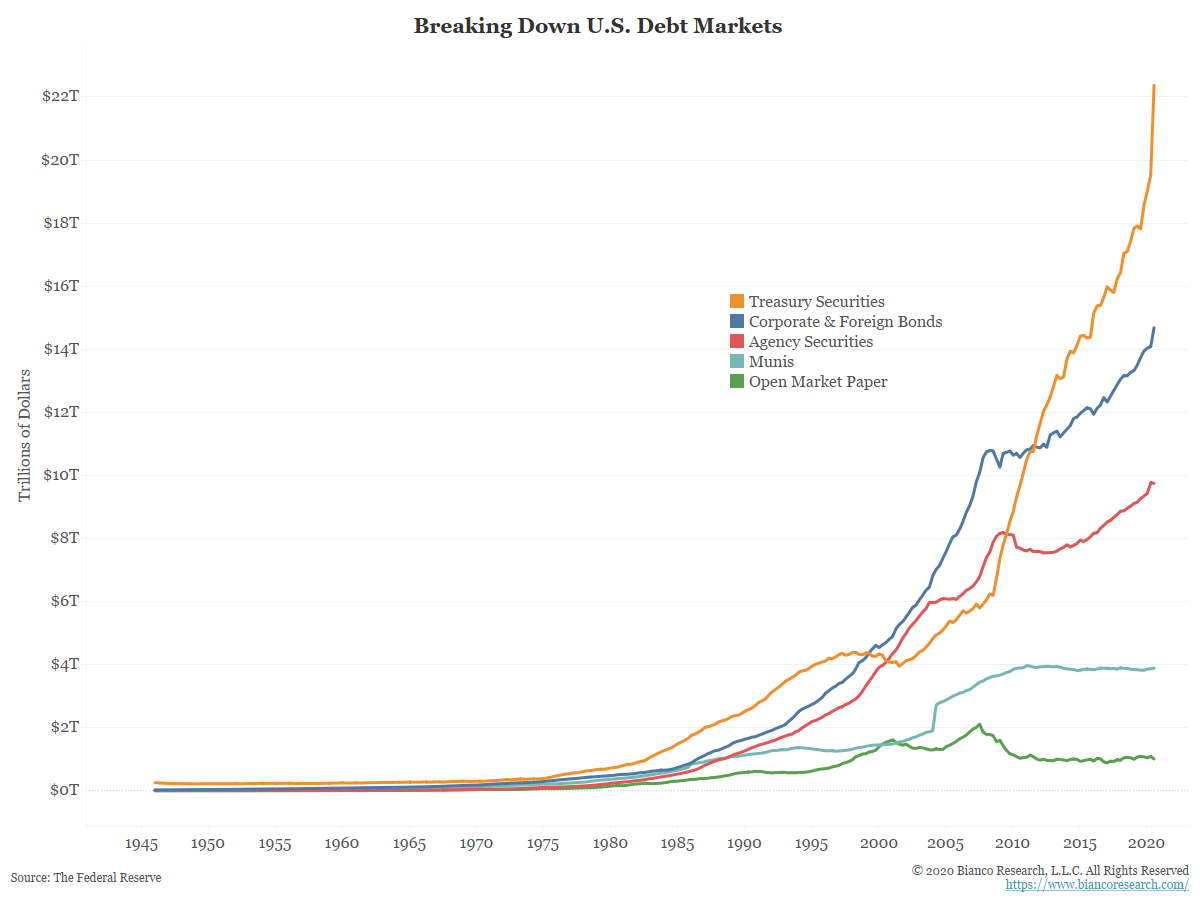

Breaking Down Debt in the U.S.

Posted By Greg Blaha

A look at outstanding amounts of Treasuries, corporates, agencies, munis and open market paper... Read More

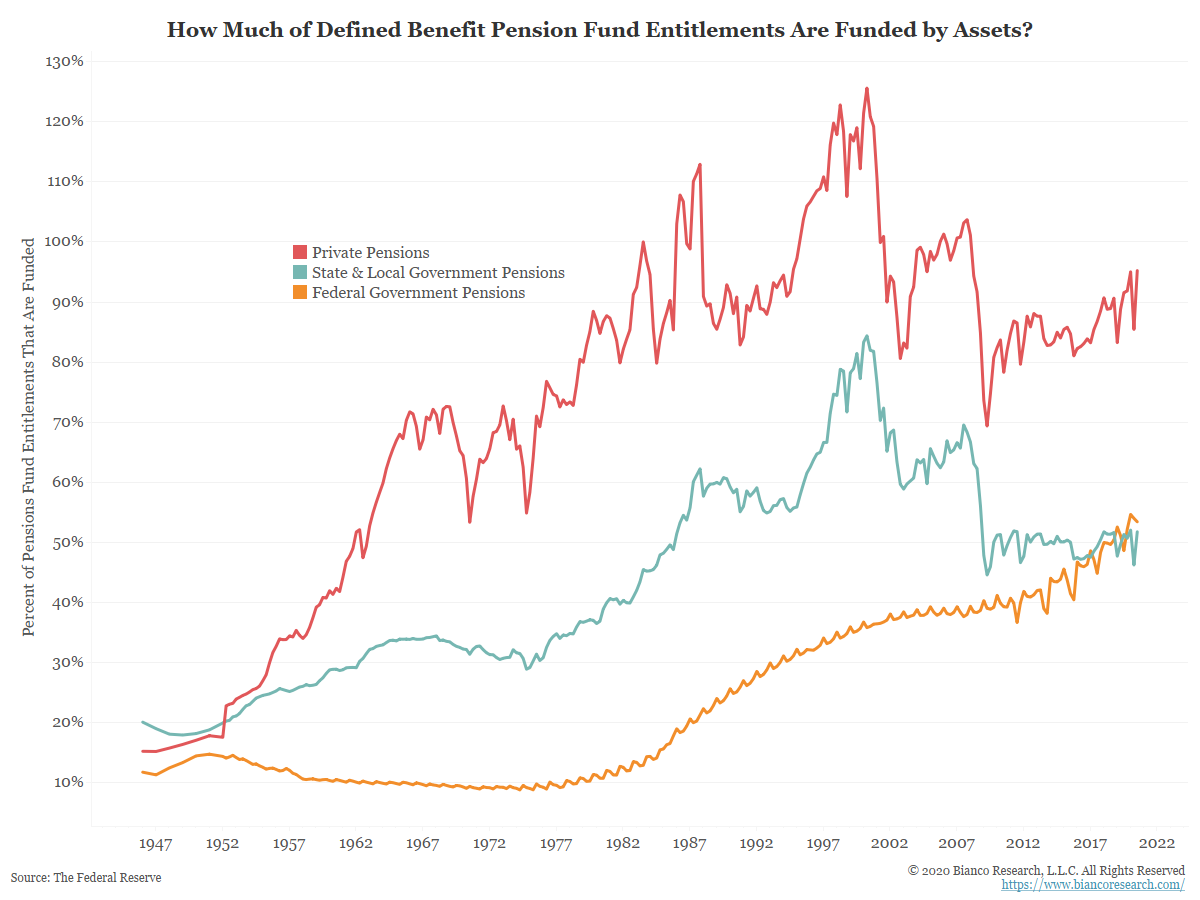

Funding Gaps at Public and Private Pensions

Posted By Greg Blaha

Private pension funds have much smaller funding gaps than their government counterparts.... Read More

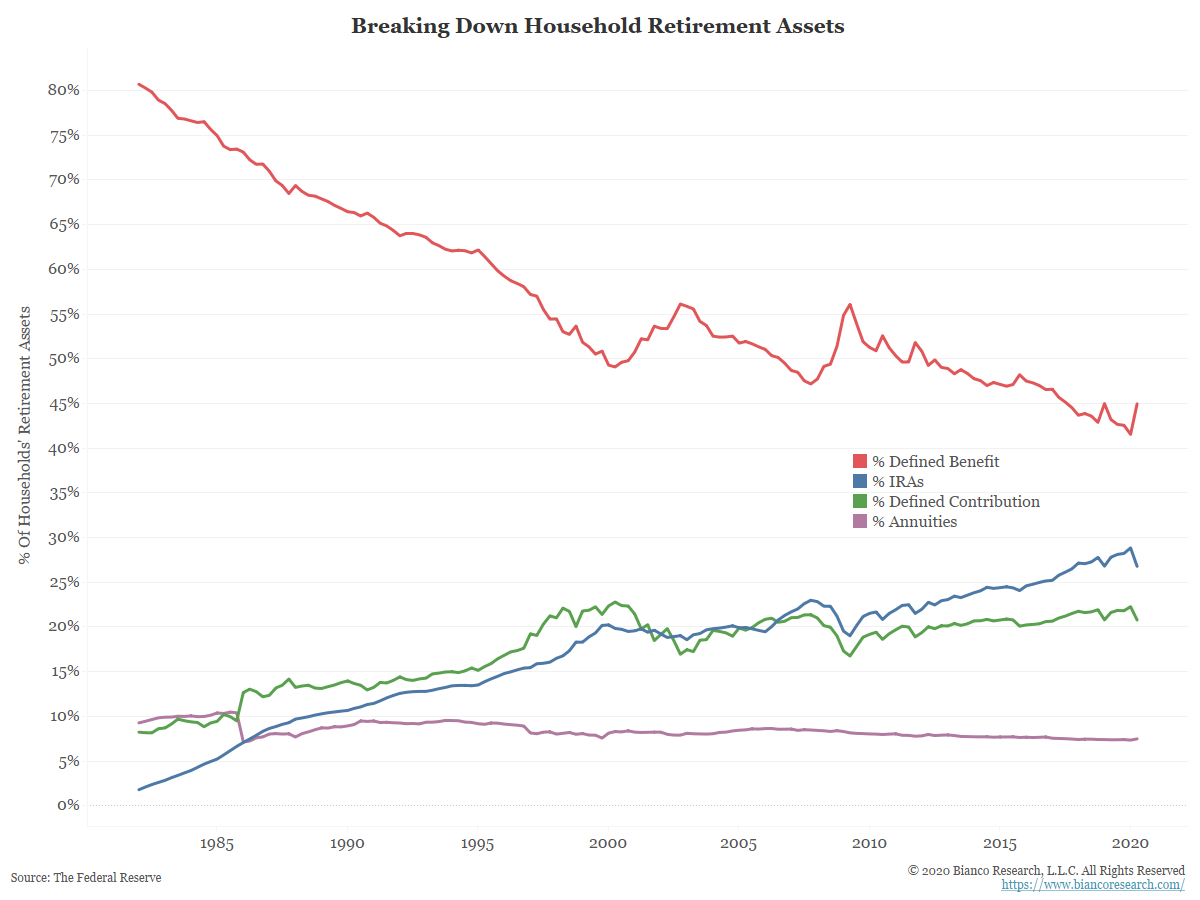

Defined Benefit Plans Continue to Shrink

Posted By Greg Blaha

Defined benefit plans continue to be replaced by IRAs and defined contribution plans.... Read More