Tag Archives: Markets

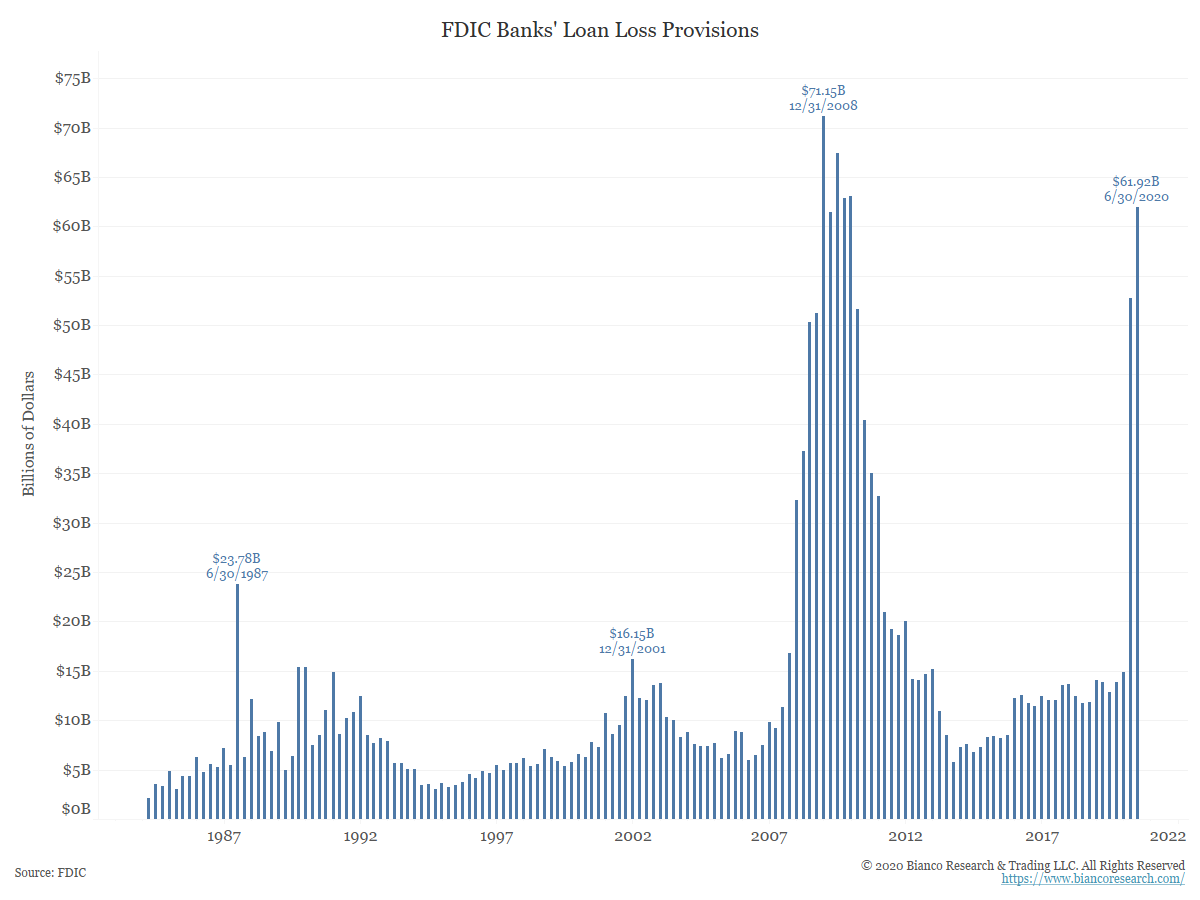

Banks’ Tough Quarter

Posted By Greg Blaha

Q2 was another rough one for banks amidst the lowest net interest margins on record and surging loan loss provisions.... Read More

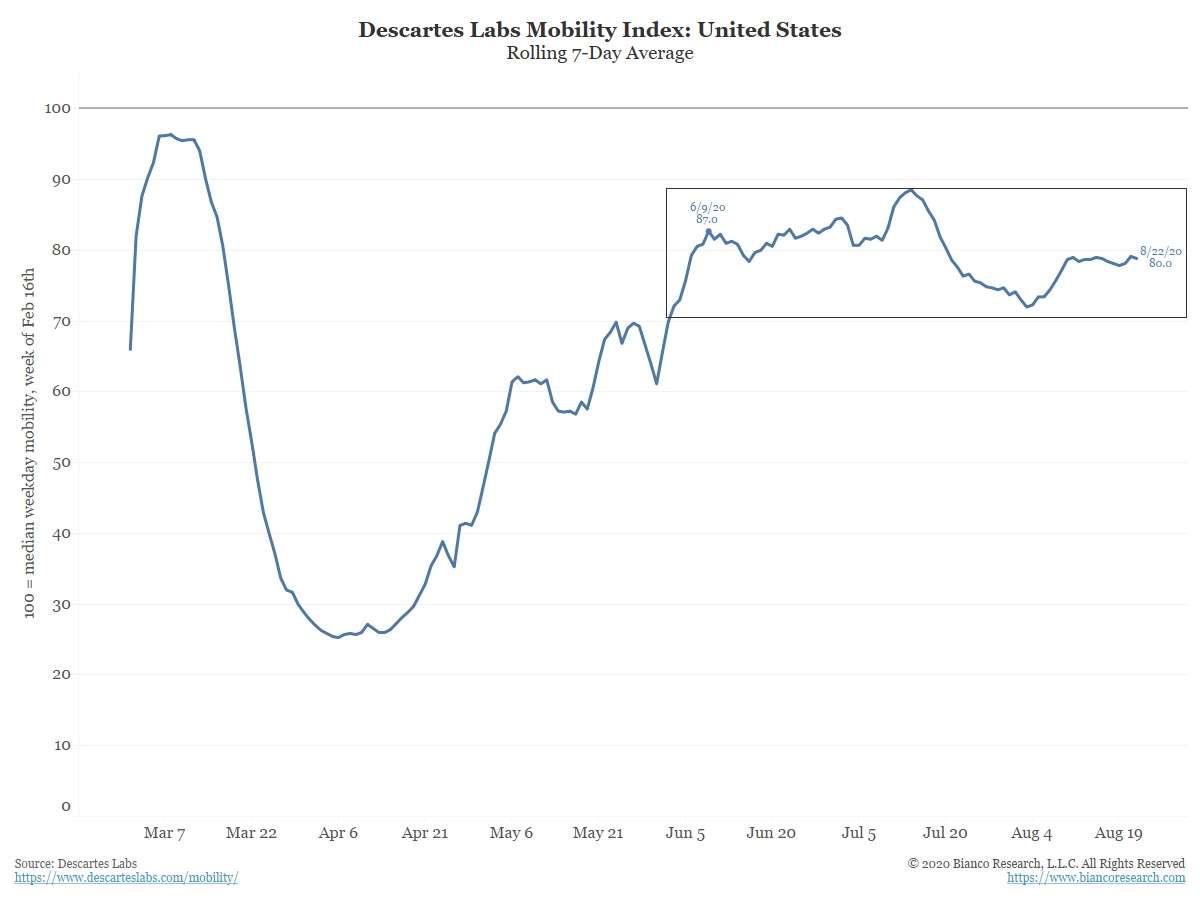

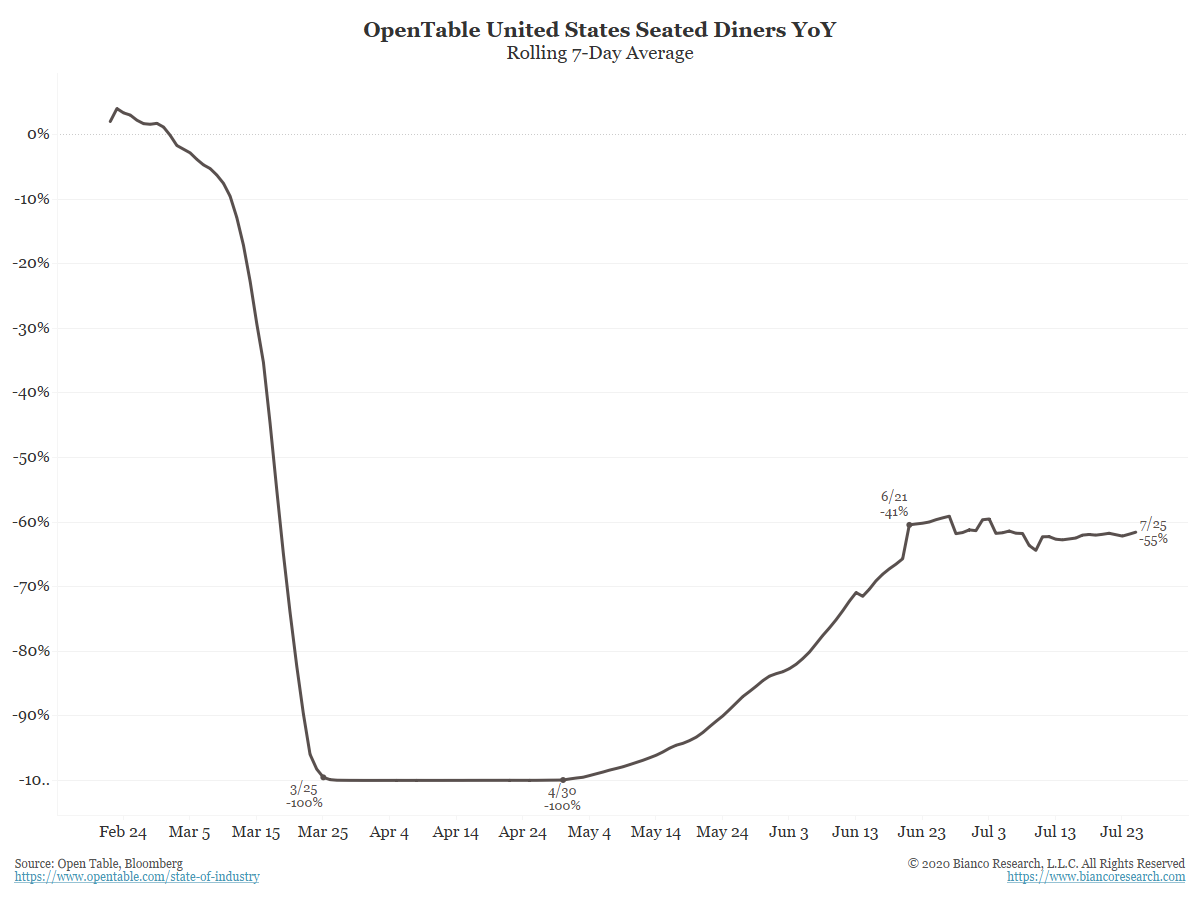

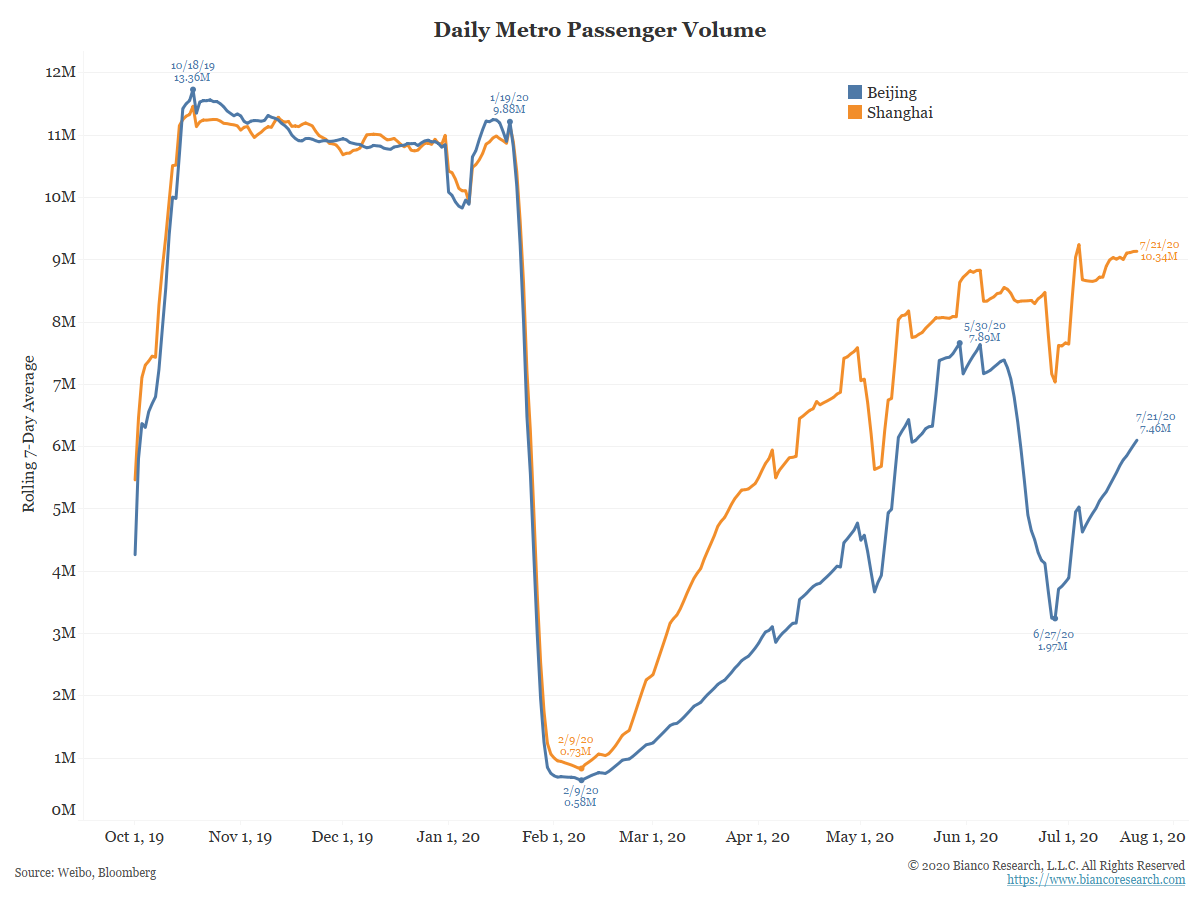

Tracking the Recovery

Posted By Jim Bianco

The recovery continues but is slowing. Many economic measures remain well below pre-pandemic levels. We see little evidence anyone is returning to the office.... Read More

Will a Vaccine Matter?

Posted By Jim Bianco

Is our hope for a vaccine to be a "medical bailout" of the economy asking too much?... Read More

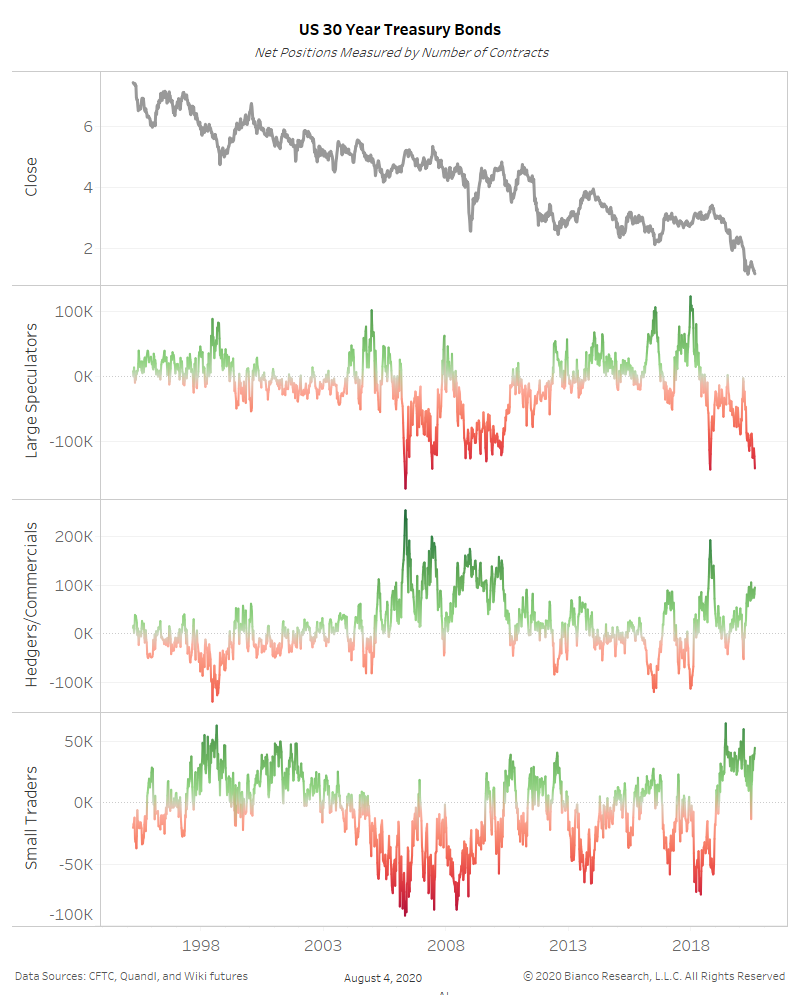

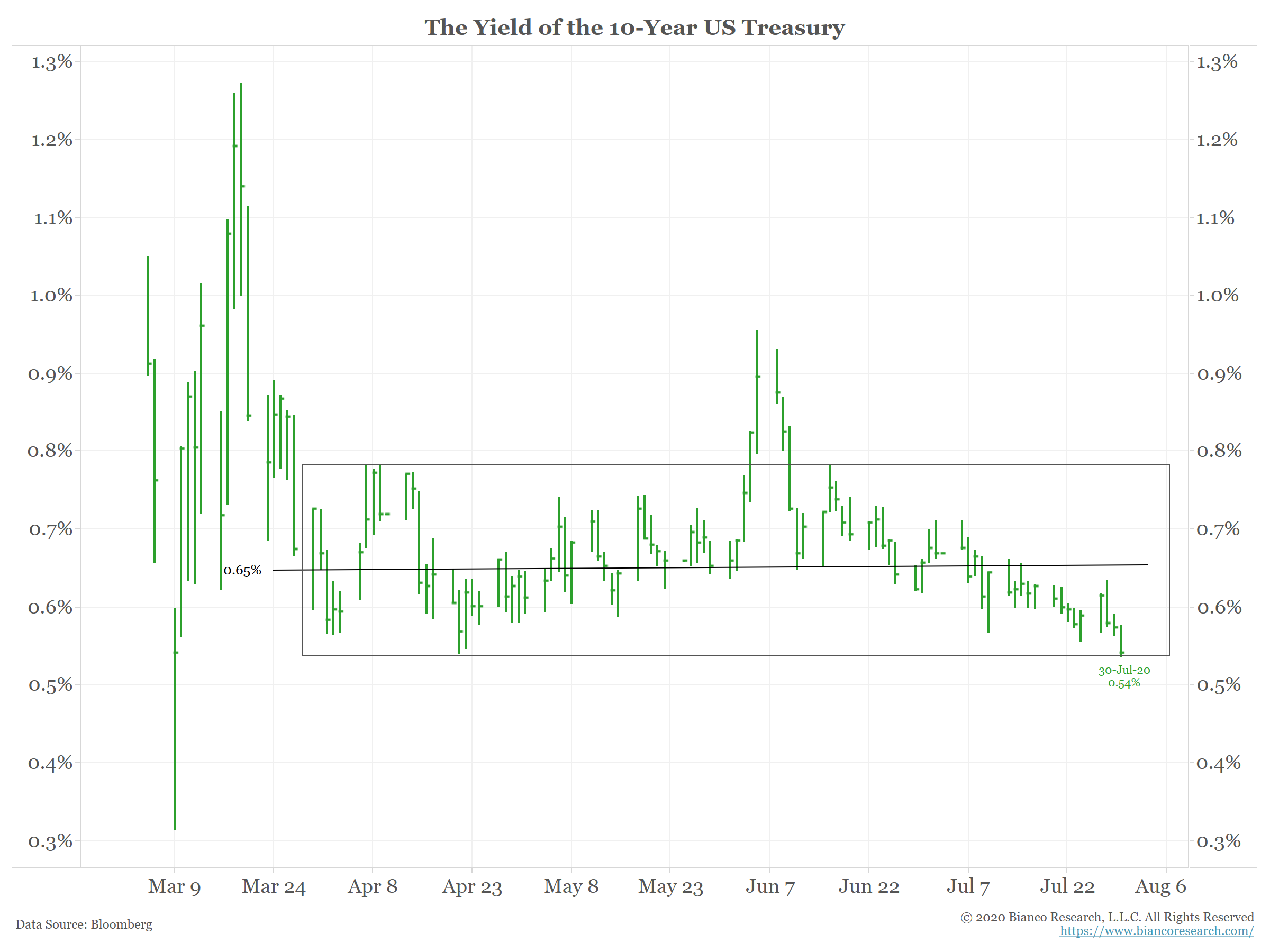

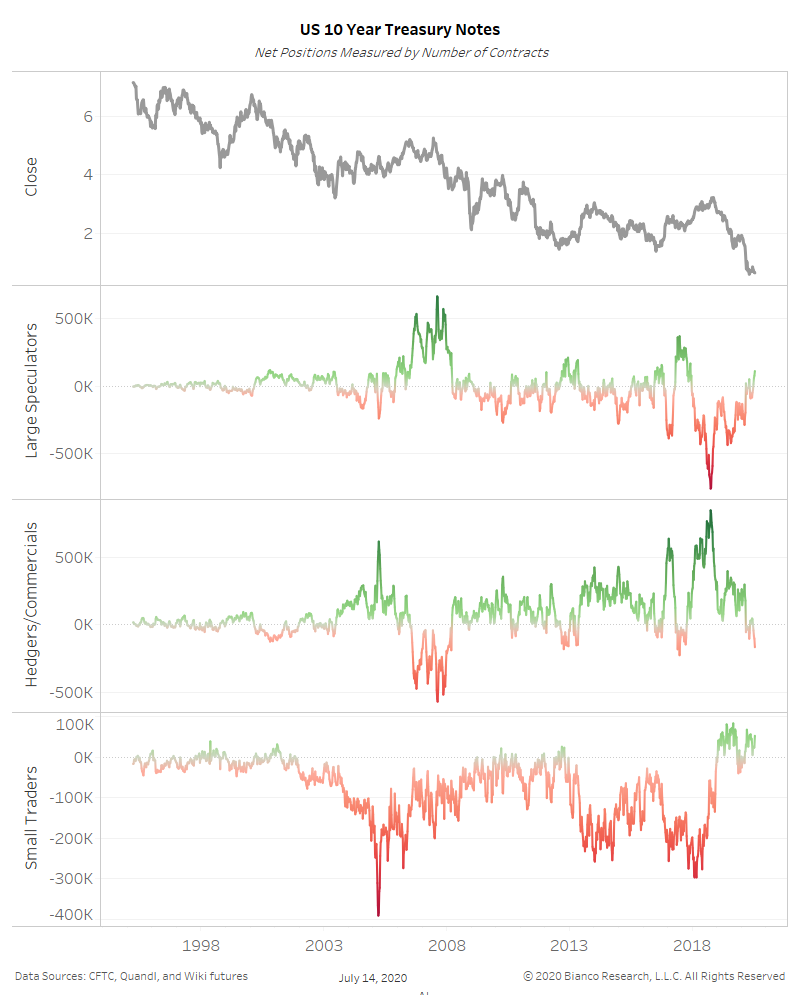

Are Yields Breaking Down?

Posted By Jim Bianco

10-year yields are pushing four-month lows as the Fed has stepped up its POMO purchases to $20 billion/day. These purchases make the economic meaning of this move suspect.... Read More

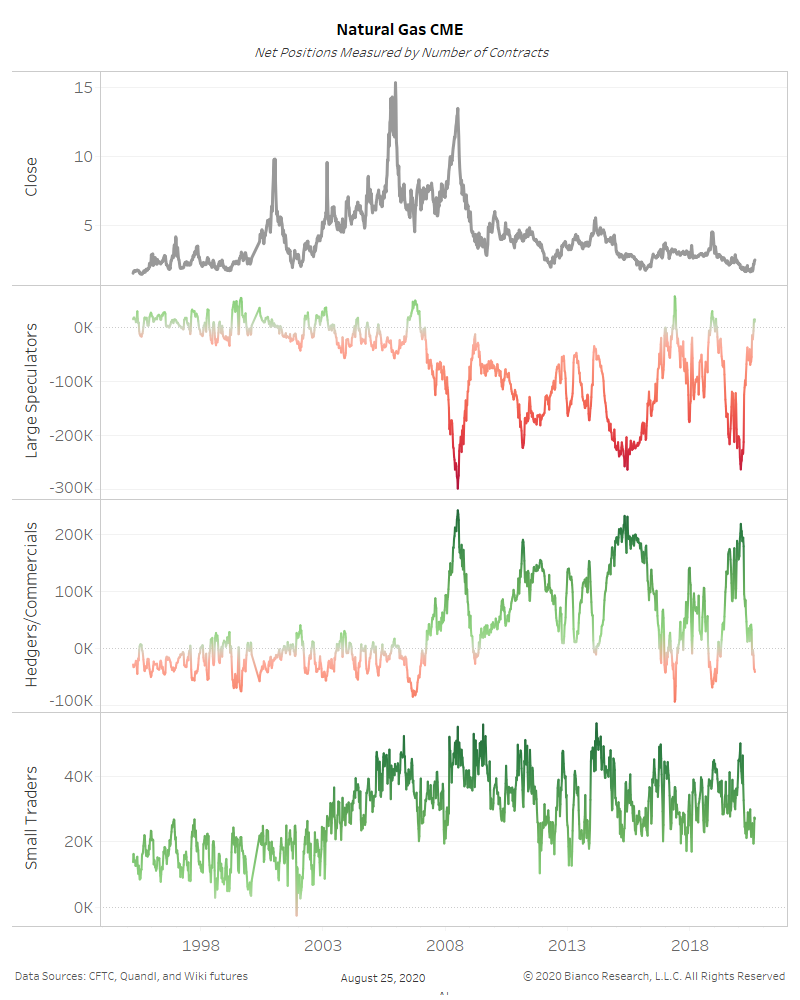

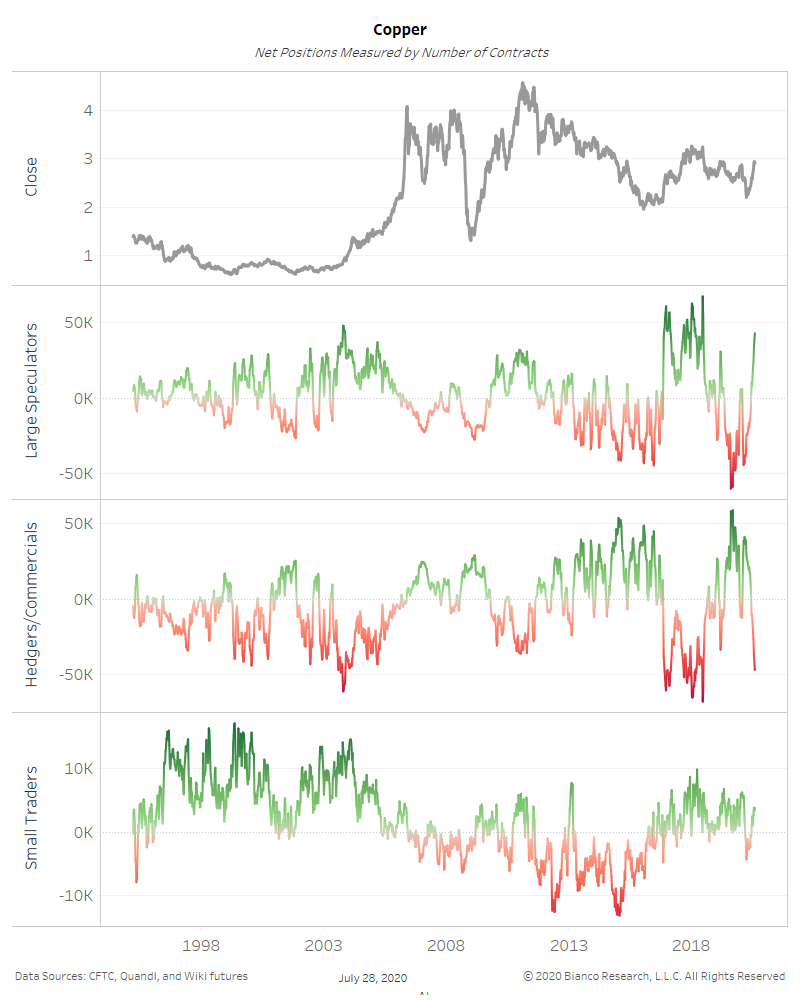

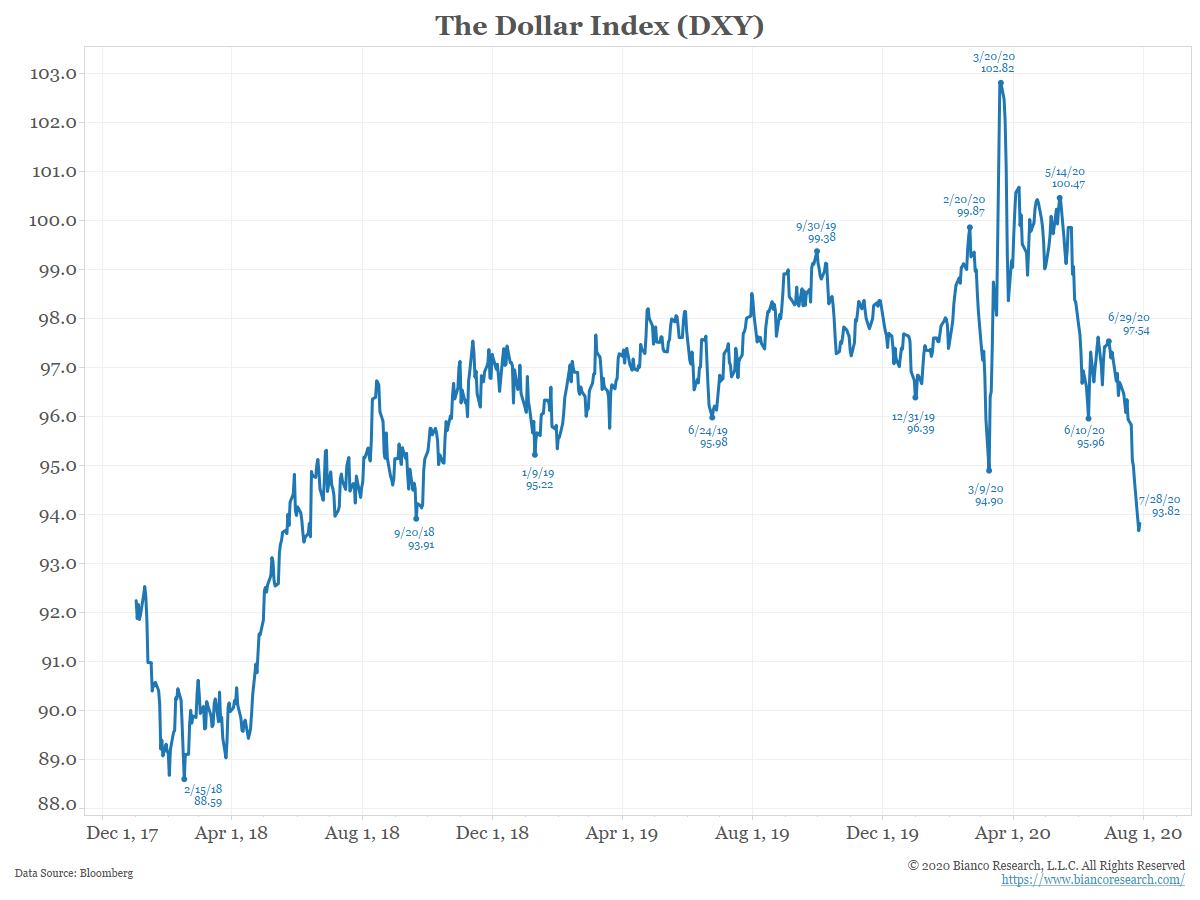

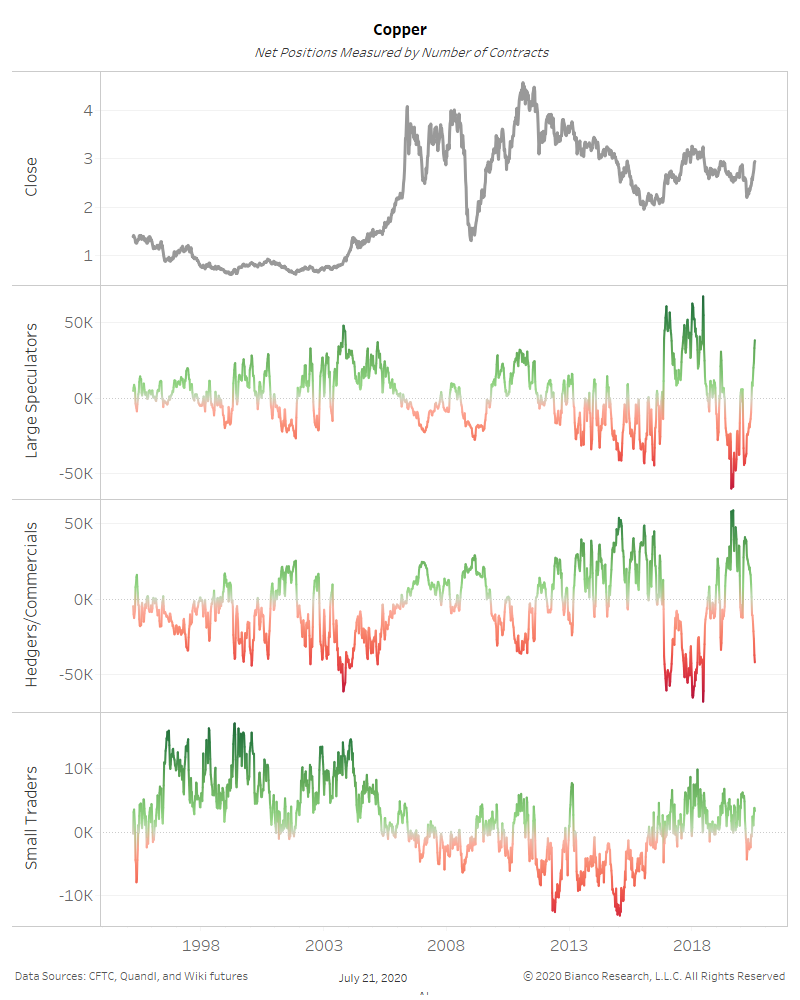

Recent Dollar Weakness Is About Euro Strength

Posted By Jim Bianco

We believe two forces are driving the dollar lower. One is an exhale from the world about owning non-dollar assets again. The second is rampant speculation by the hot money crowd.... Read More

The Re-Opening Is Stalling

Posted By Jim Bianco

Over the last month, high-frequency data shows signs that the economy's recovery is flattening out. This lines up with the increase in virus cases.... Read More

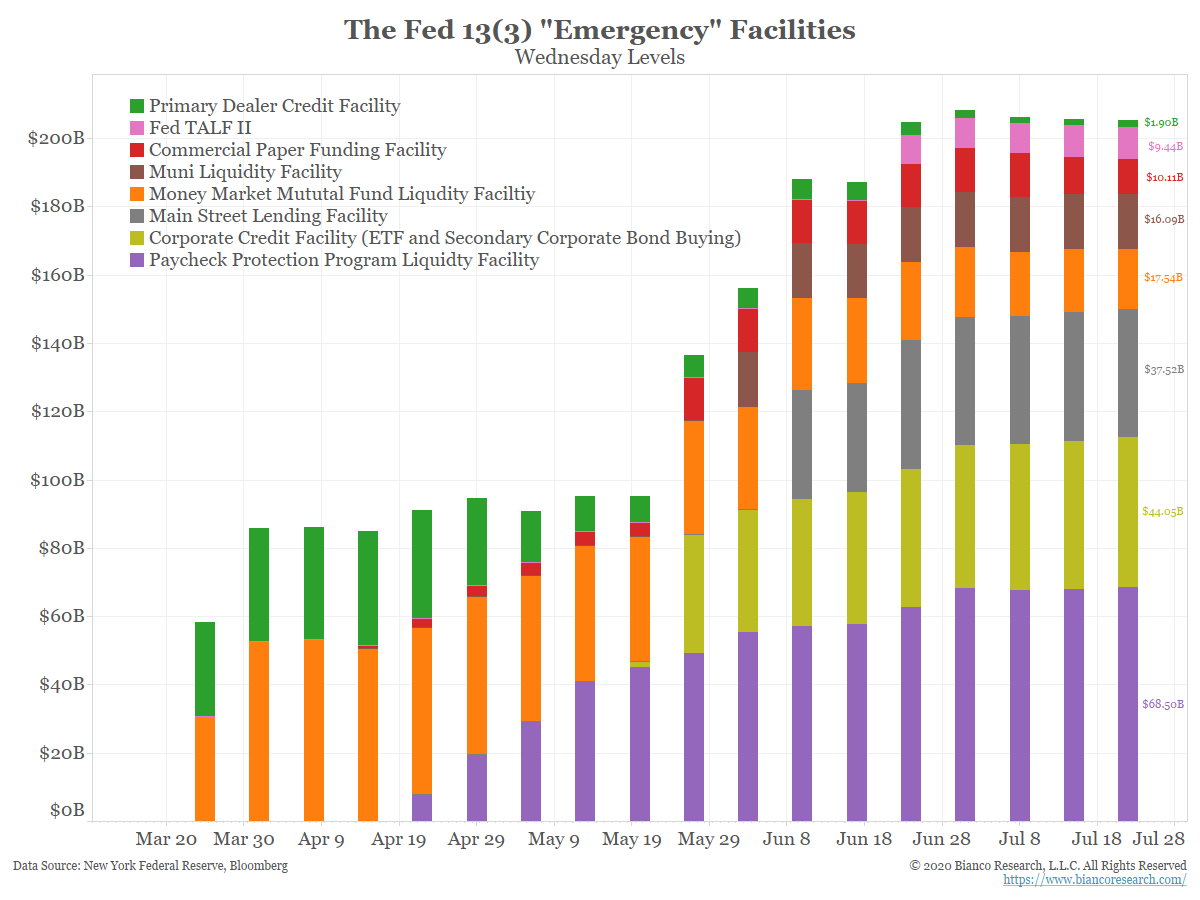

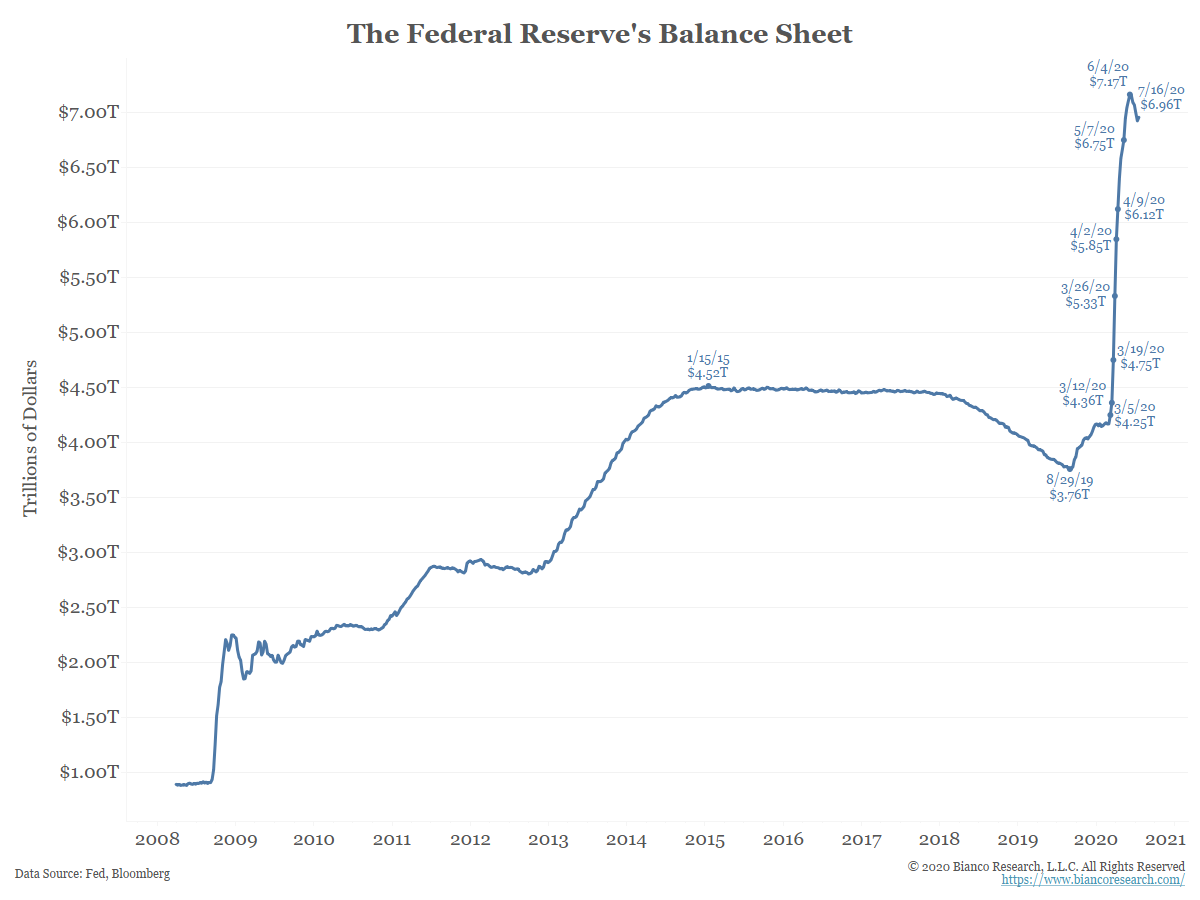

The Fed Explains Pause in Balance Sheet Growth

Posted By Greg Blaha

The small decline in the Fed's balance sheet has come in the form of decreased repo market support and decreased dollar swaps with foreign central banks. Their Treasury purchases continue, albeit at a slower pace.... Read More

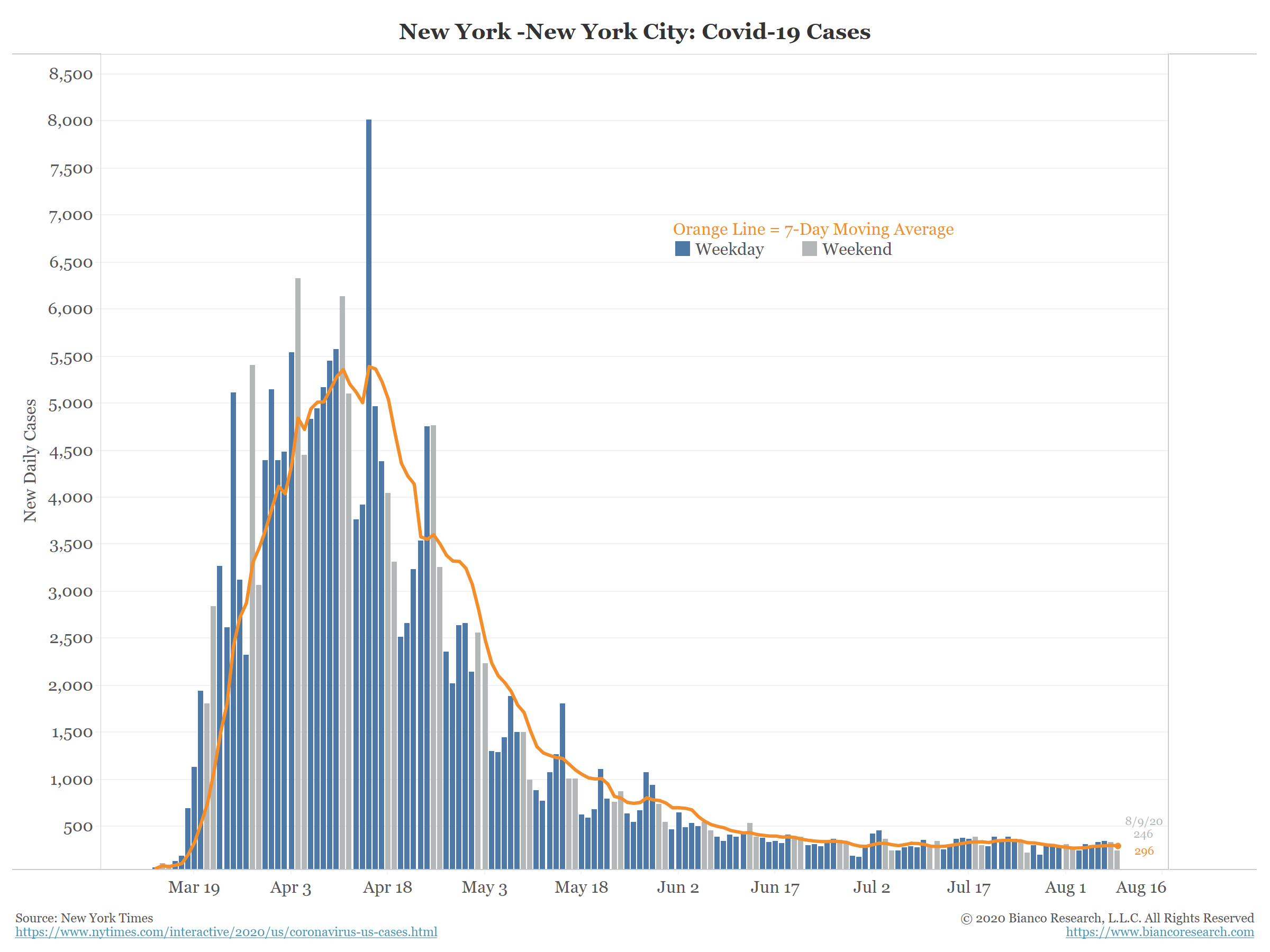

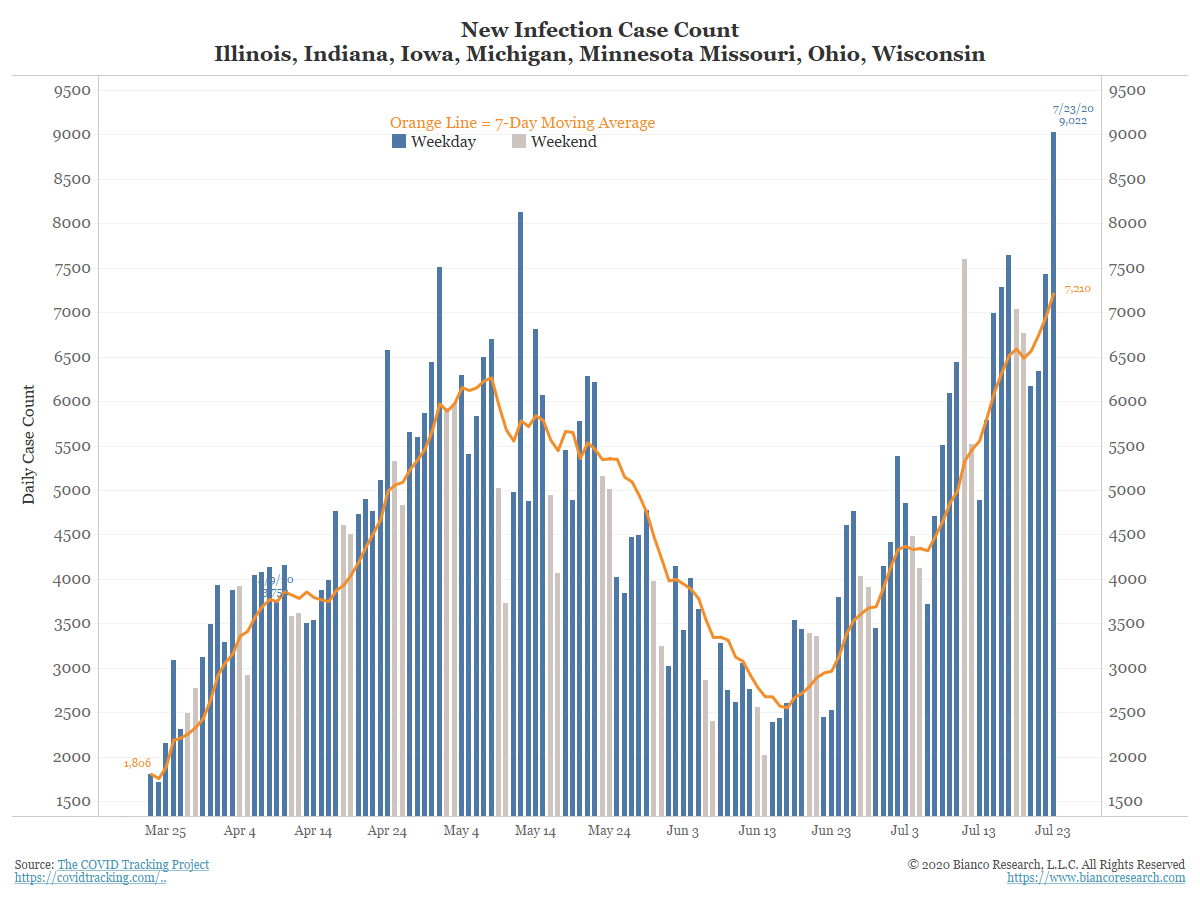

A New COVID Hot Spot – the Upper Midwest?

Posted By Jim Bianco

As everyone focuses on coronavirus cases in California, Texas, and Florida, a new potential hot spot is brewing in the upper Midwest.... Read More

The Bond Market Is Still Asleep – Updated

Posted By Jim Bianco

The Fed's iron grip on the fixed income market remains as strong as ever. Low volatility and range-bound trading continue.... Read More

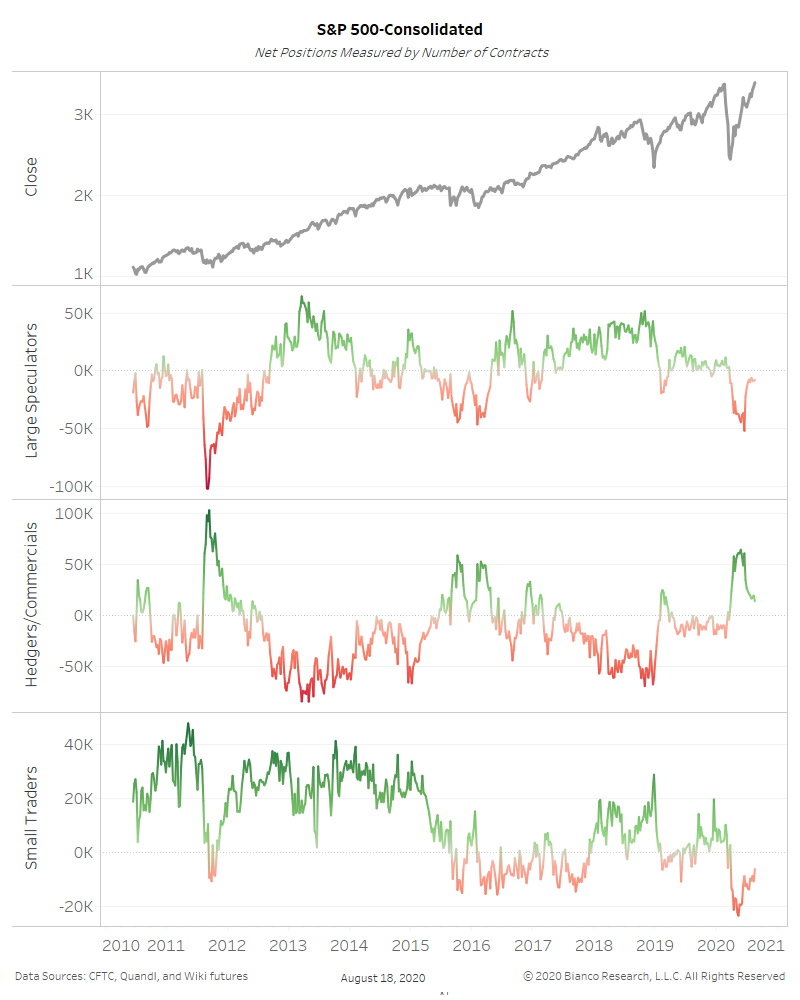

Co-Invest With the Fed!

Posted By Jim Bianco

Despite a massive rally in stocks since the March low, traders flocked to corporate, high yield, and aggregate bond funds in the second quarter.... Read More

Does a Vaccine Matter for Markets Anymore?

Posted By Jim Bianco

Even if a vaccine or cure is immediately found, economies around the world are not likely to return to normal immediately. The economic damage is done, the public's psyche has been shattered, and it will take time to recover. We would argue traders understand this, which is one of many reasons central bank and government stimulus are impacting the markets more than vaccine rumors.... Read More

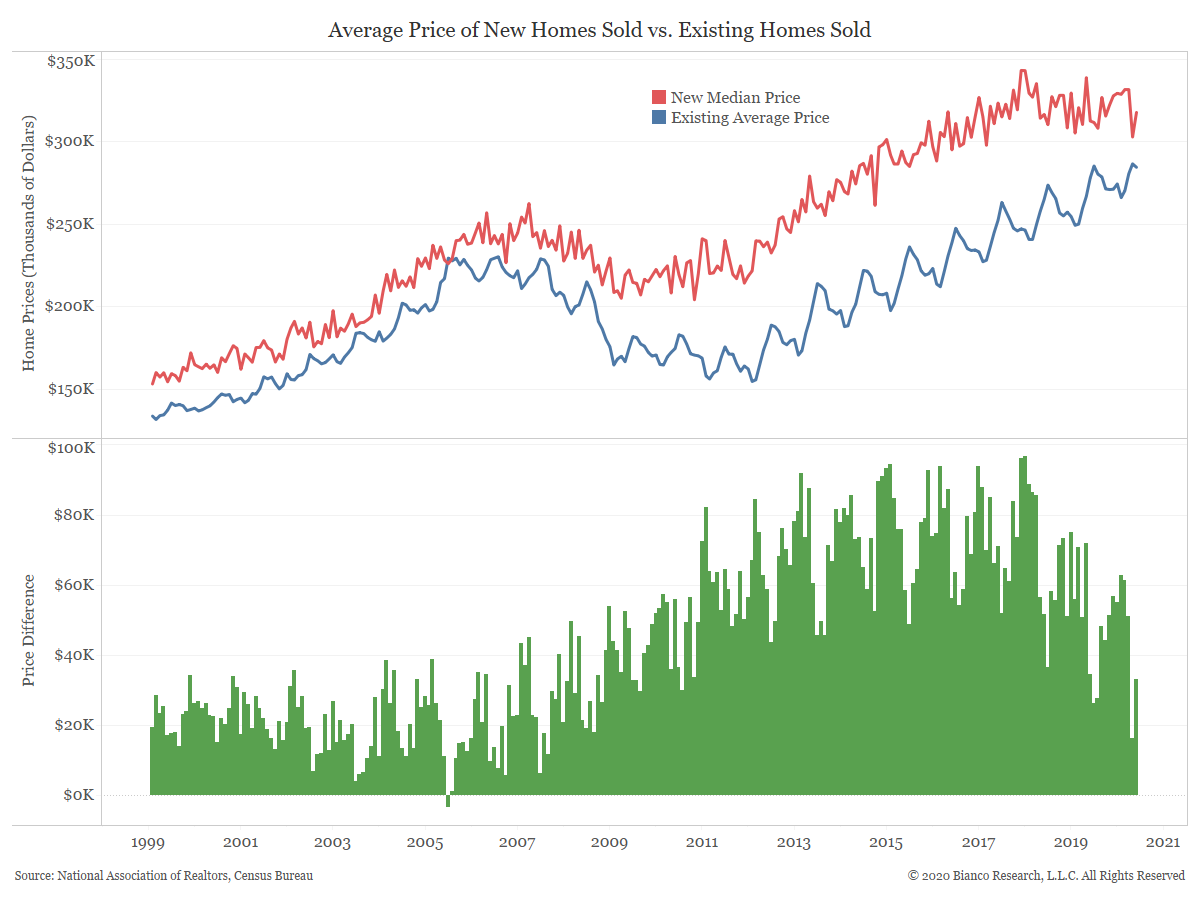

Comparing New Home Prices to Existing Home Prices

Posted By Greg Blaha

As existing home prices continue to trend higher, new home prices have stalled out over the last few years.... Read More