All Models Are Wrong, Some Are Useful

Posted By Jim Bianco

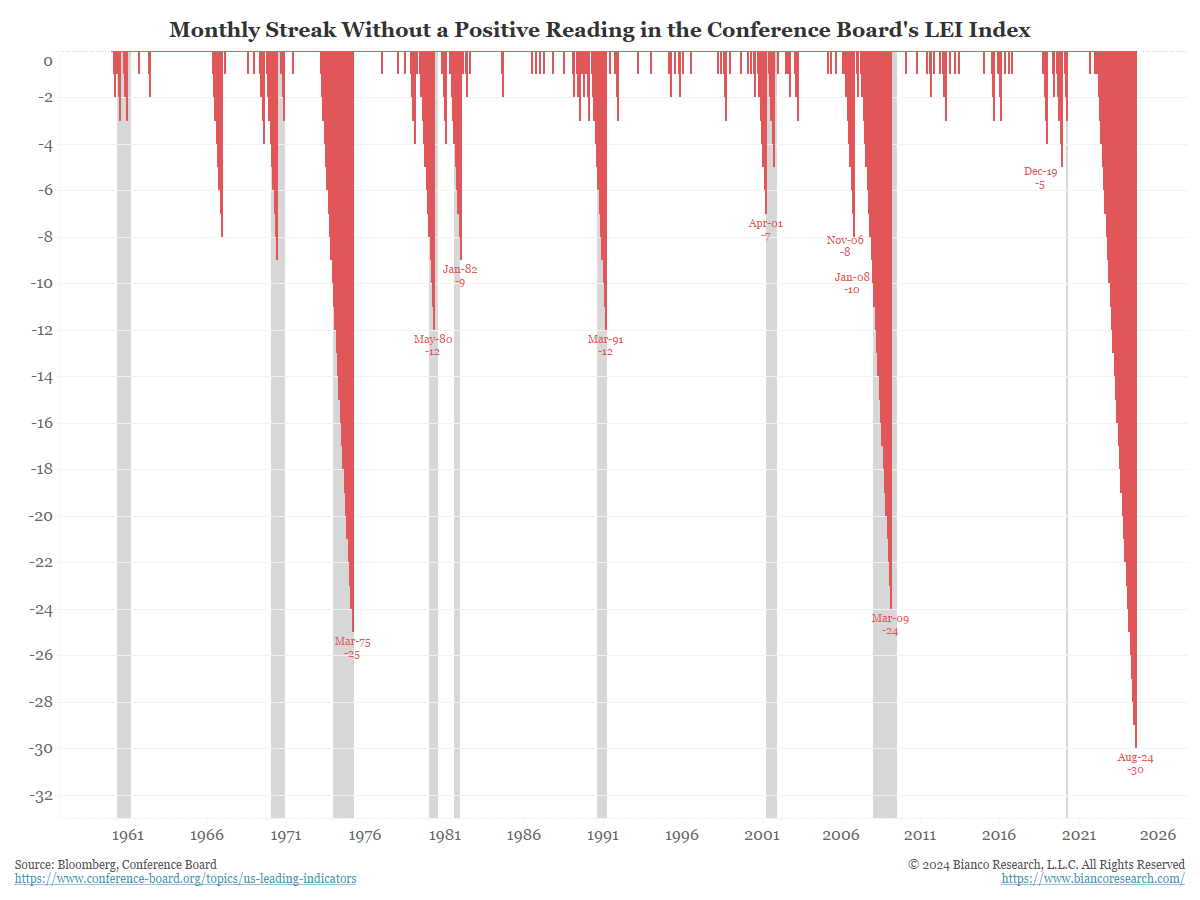

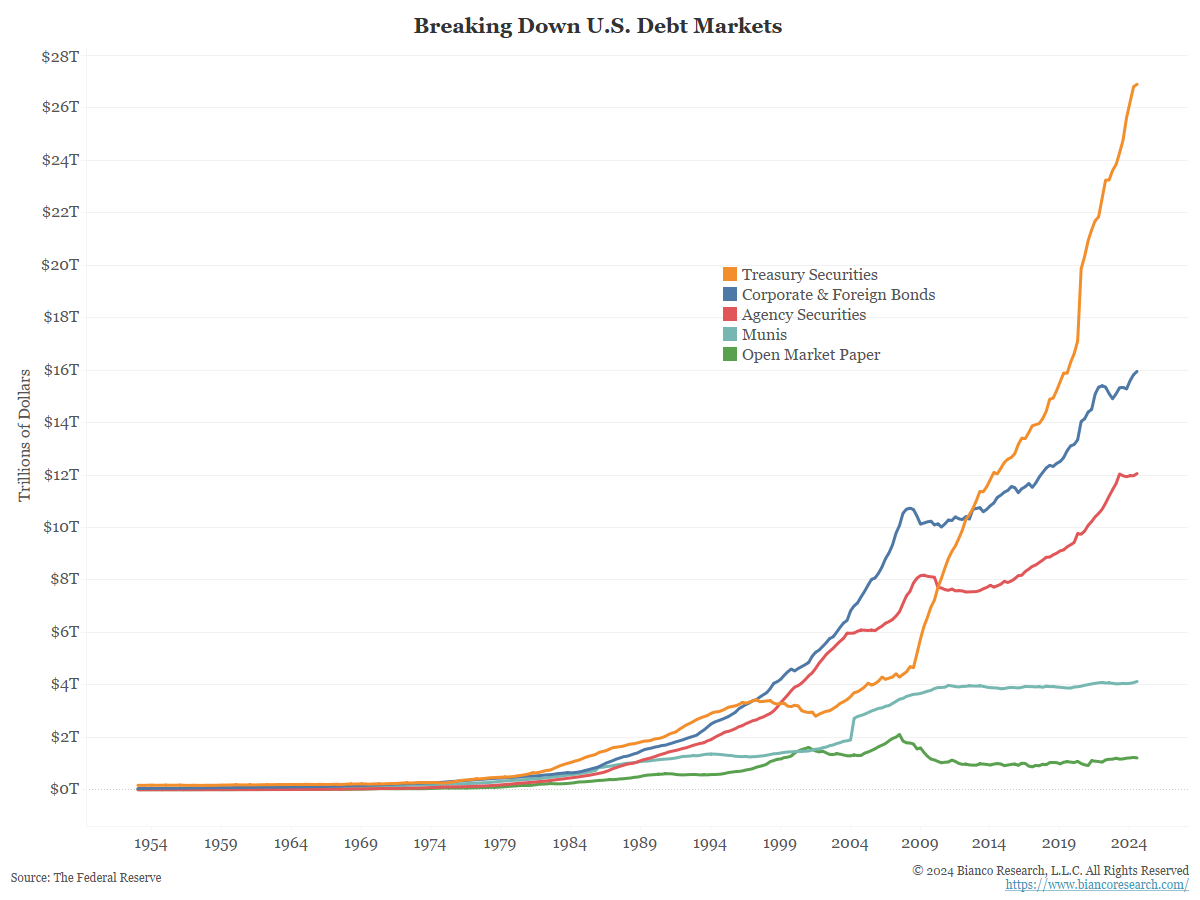

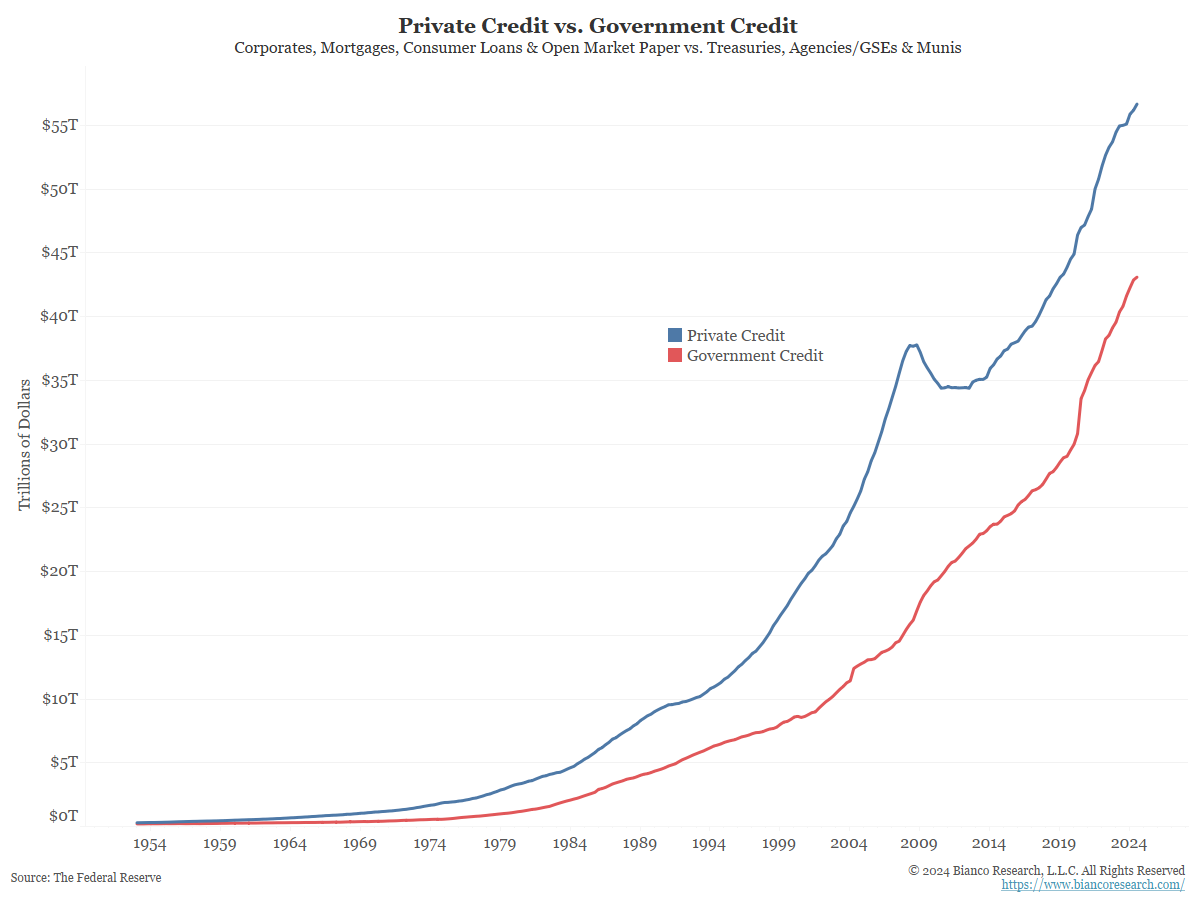

The Index of Leading Economic Indicators' failure to predict the post-Covid economy should be a reminder that this is no longer the pre-Covid economy. Assuming the economy "normalizes" to the pre-Covid economy risks policy mistakes.... Read More