Tag Archives: Markets

You’re Only as Good as Your Weakest Assumption

Posted By Jim Bianco

At Jackson Hole Chairman Powell said, "The time has come" to start cutting rates. He expressed concern about the labor market. However, the labor market has undergone epic changes post-pandemic, and interpreting its data is very complicated. A credible case can be made that the labor market is still robust, and stimulating the economy could produce more inflation.... Read More

Jim Bianco joins Fox Business to discuss Fed Chairman Powell’s Speech, the Economy & Labor Market

Jim Bianco joins Fox Business to discuss Fed Chairman Powell?s Speech, the Economy & Labor Market with Charles Payne.... Read More

Jim Bianco joins CNBC to discuss Chairman Powell’s Speech and the U.S. Economy

Jim Bianco joins CNBC to recap Chairman Powell?s Speech and the Economy with Sara Eisen and Carl Quintanilla.... Read More

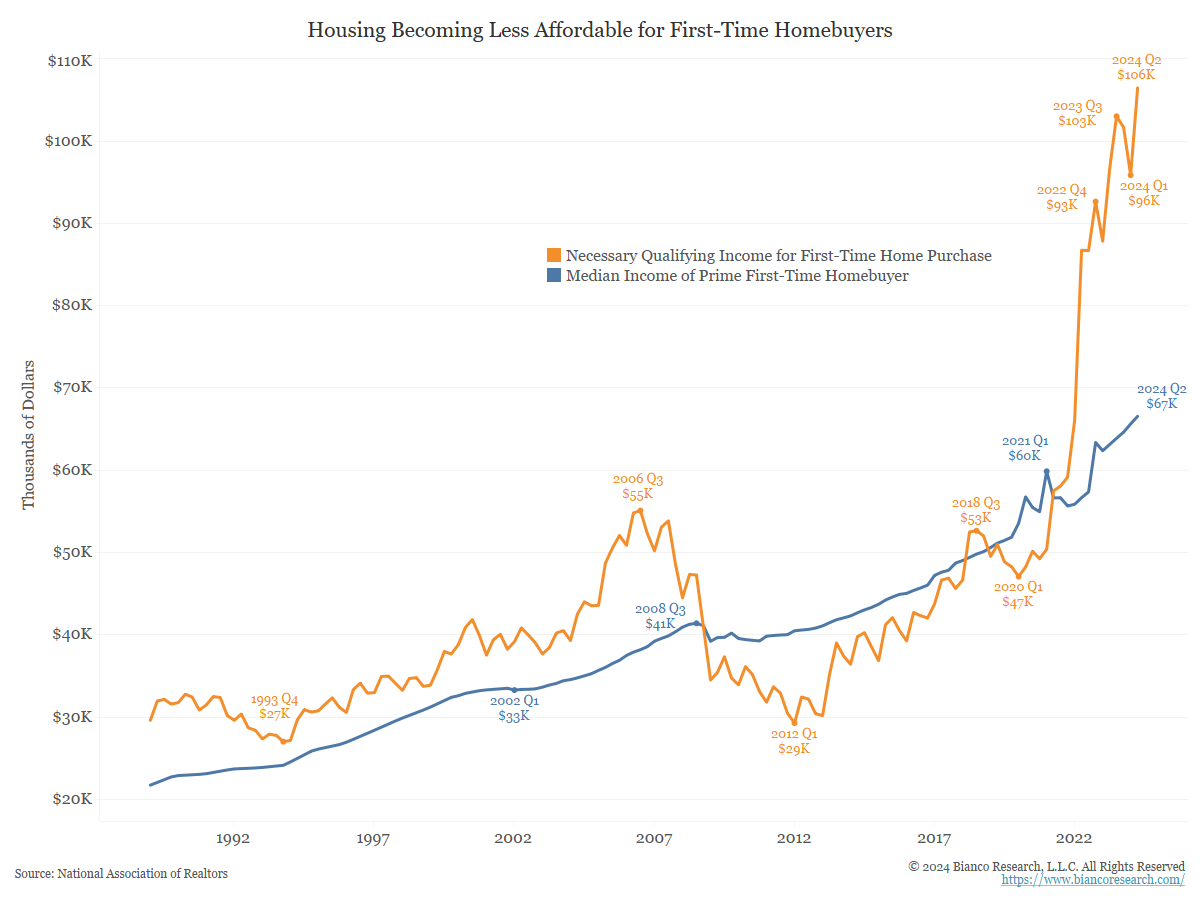

Housing Becomes Less Affordable for First-Time Homebuyers

Posted By Greg Blaha

Homebuyers enjoyed a relatively affordable market in the decade following the housing crash. The recent rise in prices and mortgage rates put homeownership out of reach for many prospective first-time buyers.... Read More

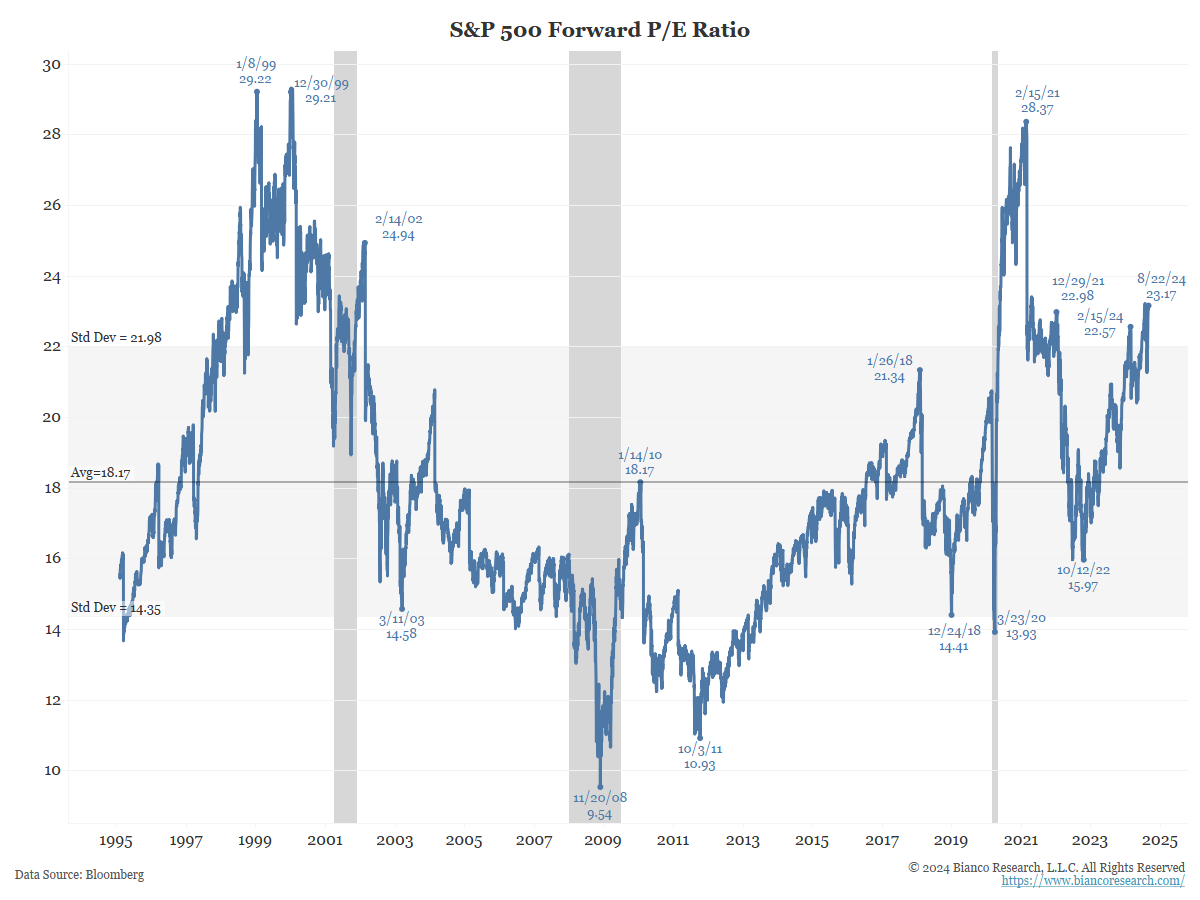

Peering at Today’s Market Through the Asset Bubble Lens

Posted By Alex Malitas

Given the recent selloff in markets, we update market valuations through the lens of common bubble characteristics. ... Read More

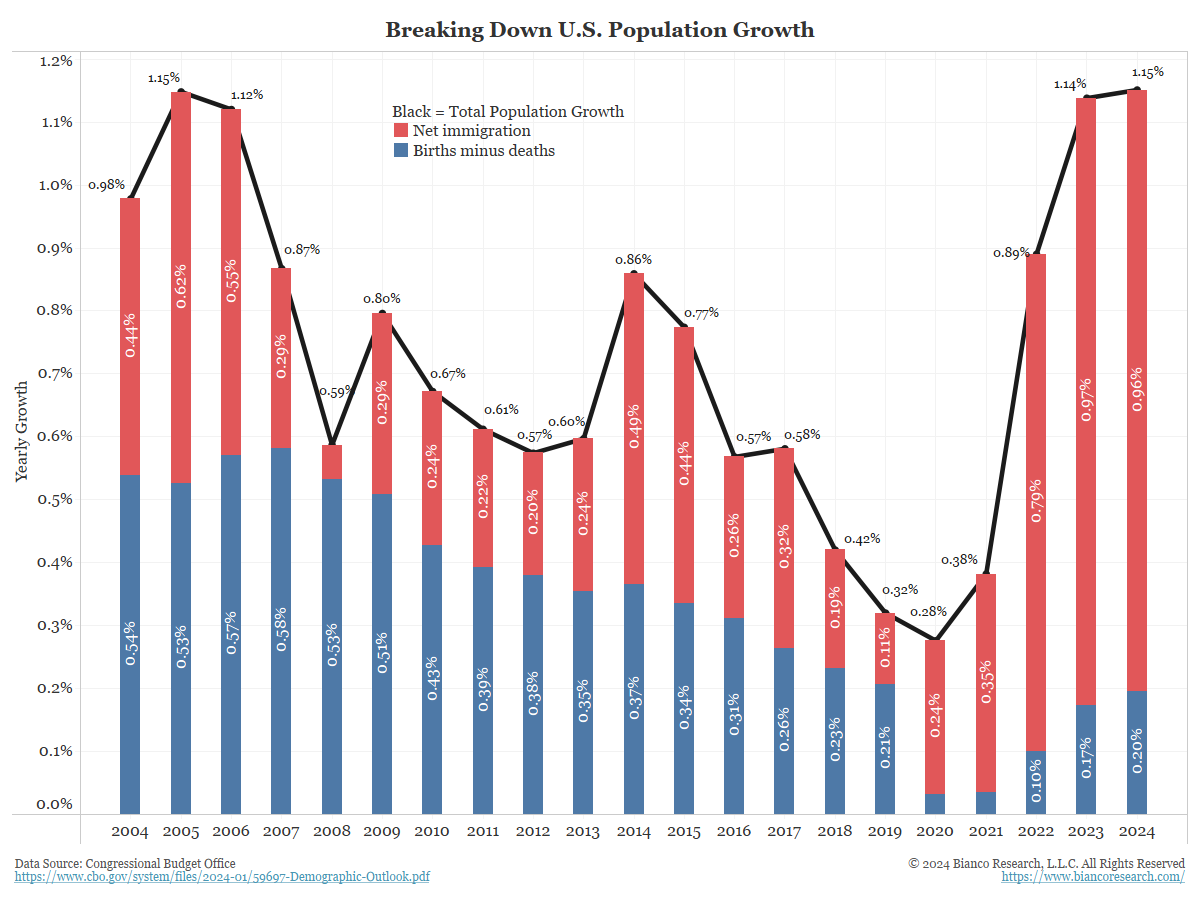

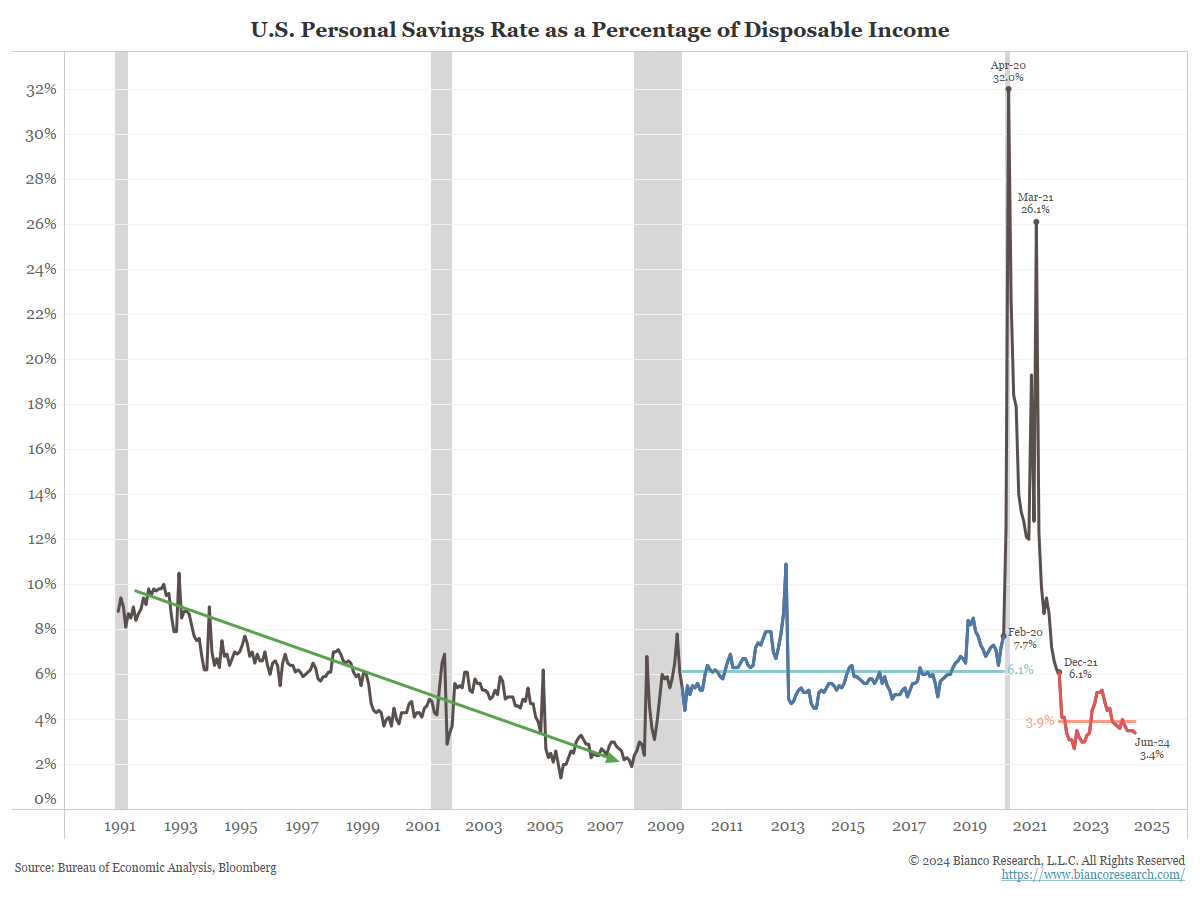

Why Retail Sales and Consumption Is Staying Strong

Posted By Jim Bianco

Recessions and crises change behavior. Government stimulus checks mailed during the pandemic told consumers they don't need to save as much. This is driving strong consumption and retail sales, keeping economic growth above potential. Such an economy does not need rate cuts.... Read More

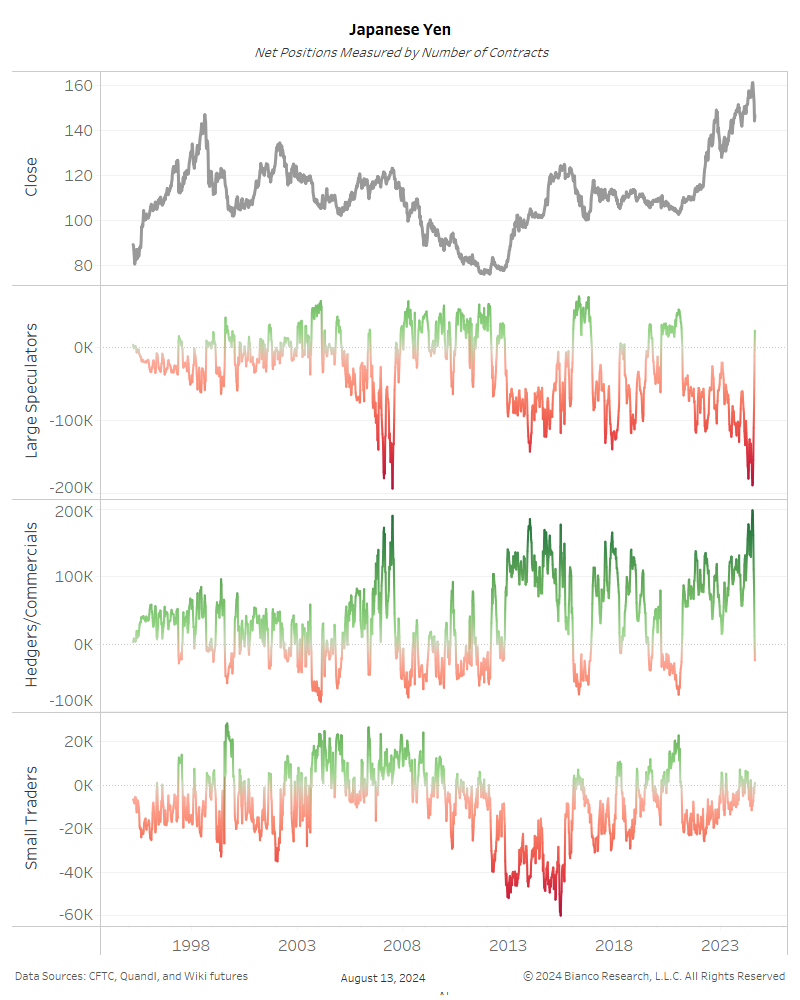

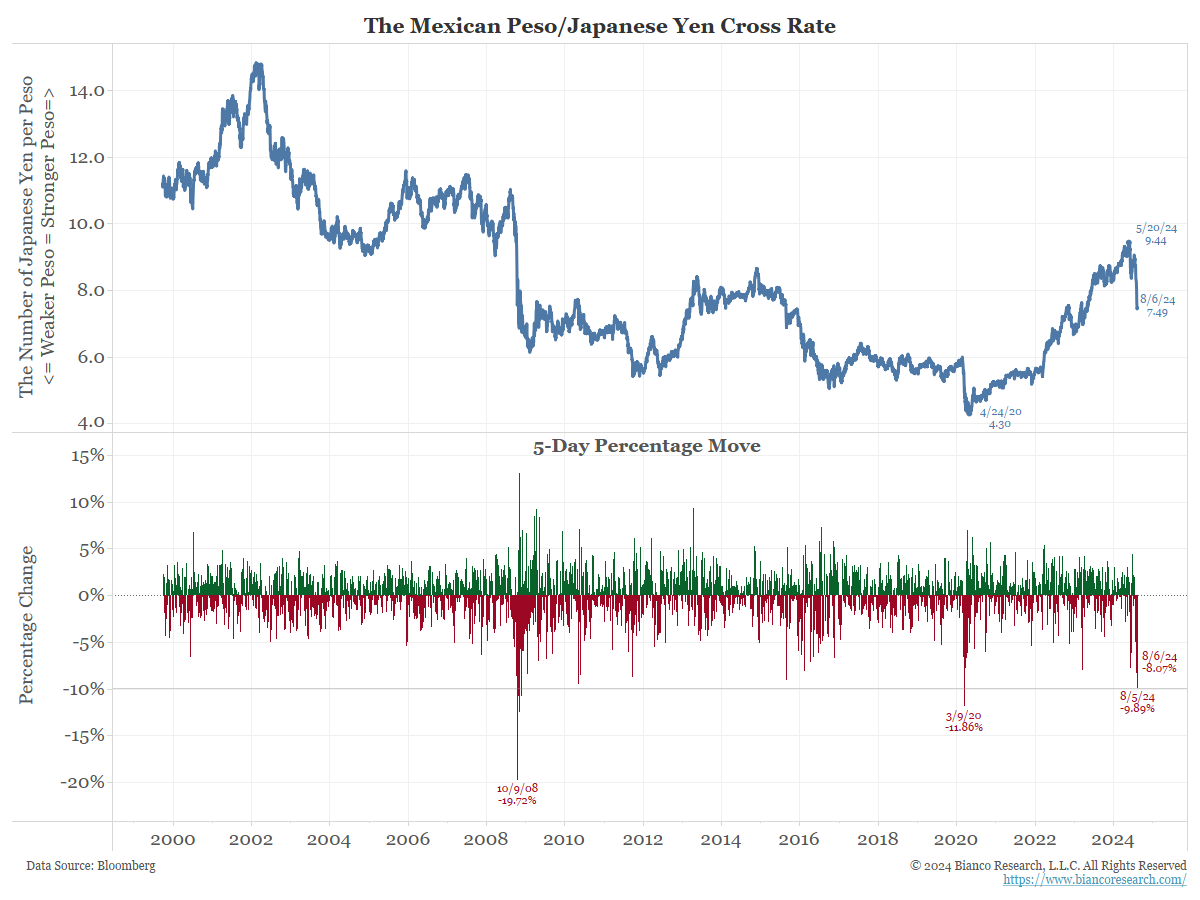

Jim Bianco looks at the sustained impact of the Yen carry trade unwinding with Oliver Renick

Jim Bianco? is looking for a "sense of stability" in the market ahead of this week's key inflation data. And, following last week's volatile market swings, Bianco weighs in on the state of the yen-carry trade. ... Read More

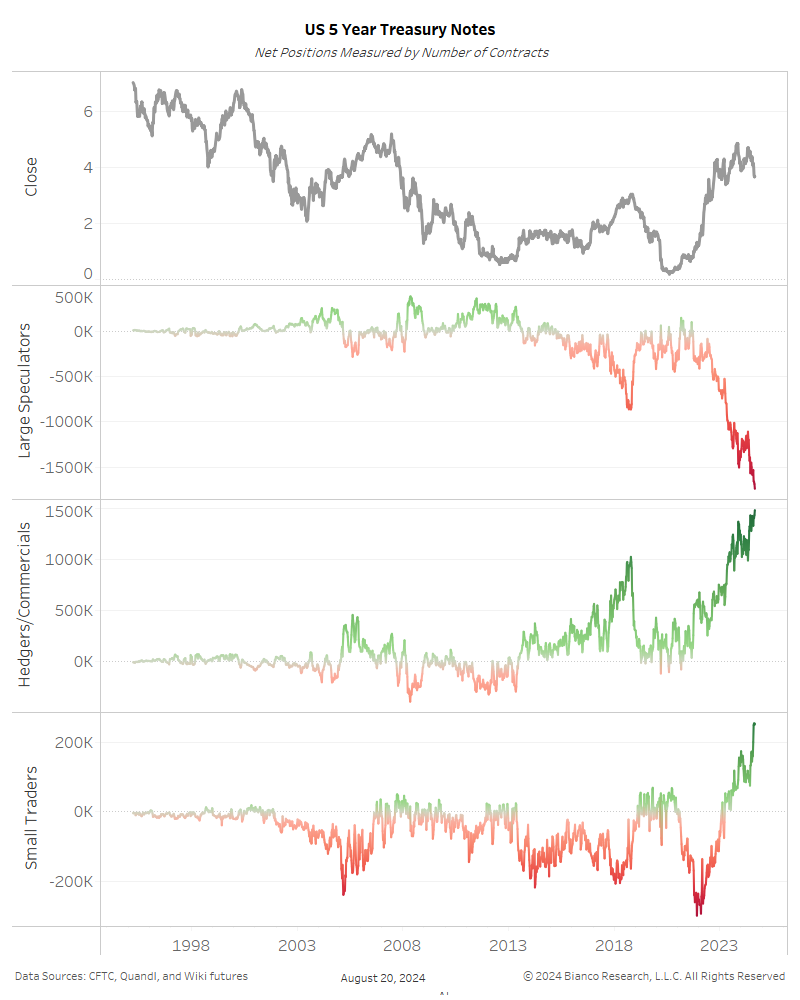

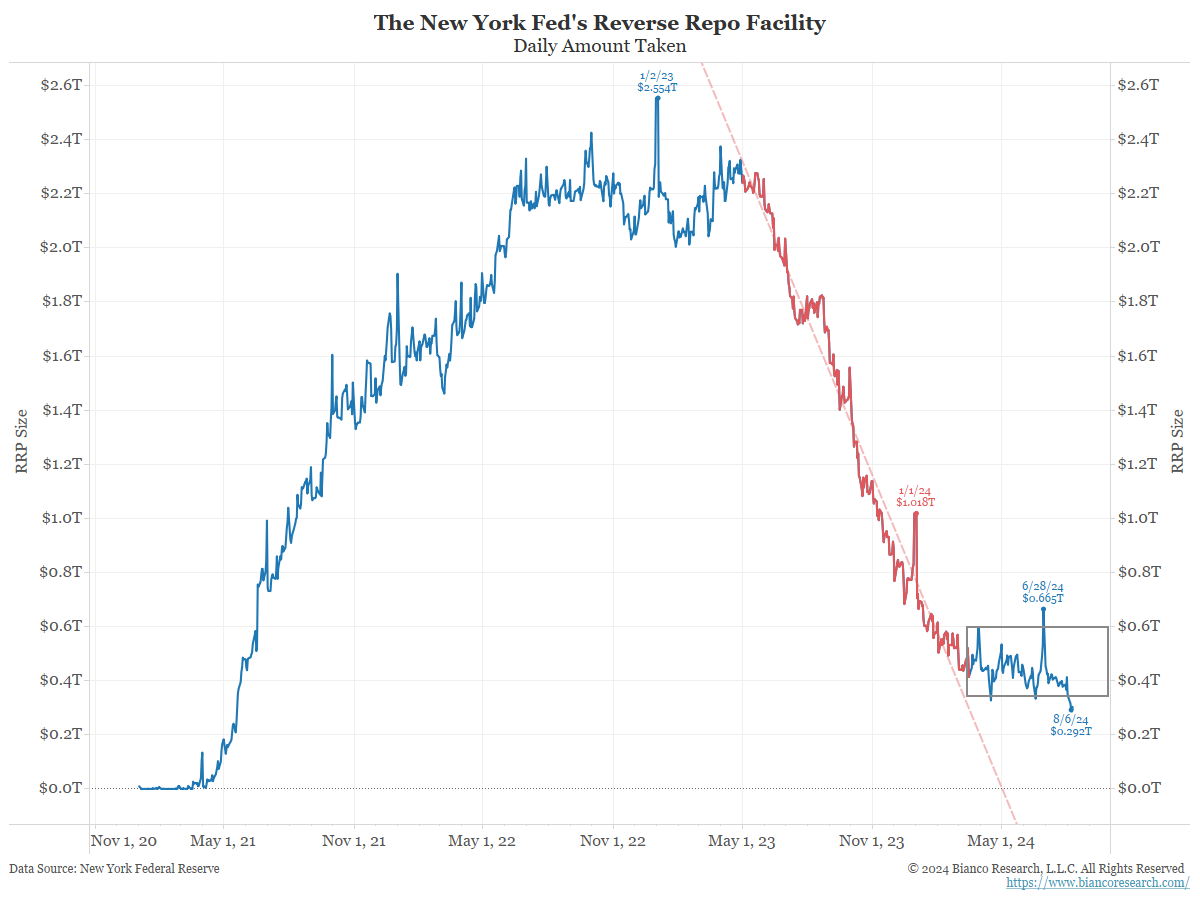

Why Is RRP Falling?

Posted By Jim Bianco

Money parked in the Federal Reserve's reverse repo facility is shrinking again as money fund managers extend maturity to hold onto 5%+ yield as long as possible. This move is being driven by the belief that the Fed is finally going to start cutting rates, not some ominous sign that the financial system's plumbing is at risk.... Read More

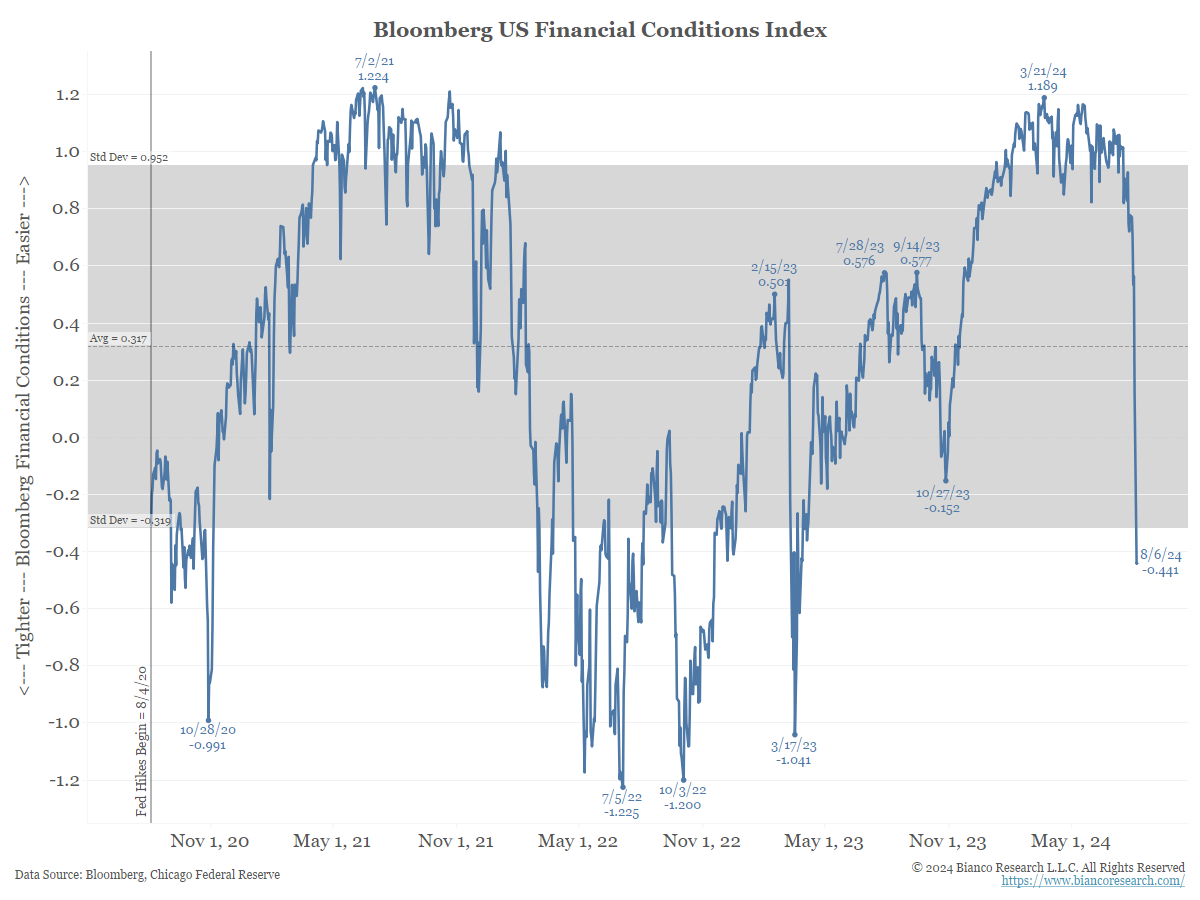

Conference Call Replay & Notes – Is Volatility Being Driven By Financial or Economic Factors?

Financial market volatility has spiked in the last few weeks. We argue this has been driven more by financial stress around the Bank of Japan?s surprise rate hike last week than the prospect of the economy sinking into recession.... Read More

Quick Comments/What We’re Reading

Posted By Greg Blaha

Today's topics include has the Yen carry trade been completely unwound?, the odds of another BoJ rate hike, the odds of an emergency Fed rate cut, a soft landing, checking in on sentiment after a rocky week, a lack of liquidity, a historical look at stocks after the VIX spikes, the moral hazard facing central banks, tech valuations, covered call ETFs, searching for neutral, and OPEC's price targets... Read More

Jim Bianco discusses Recent Market Volatility, Mixed Economic Signals & Bond Market Liquidity

Jim Bianco joins Fox Business to discuss Recent Market Volatility, Mixed Economic Signals & Bond Market Liquidity with Charles Payne.... Read More

How Stressed Are Markets?

Posted By Alex Malitas

Monday's selloff in equities and massive bond rally indicated that, after minimal volatility so far in 2024, the interconnectedness of global markets poses upside risks to volatility.... Read More

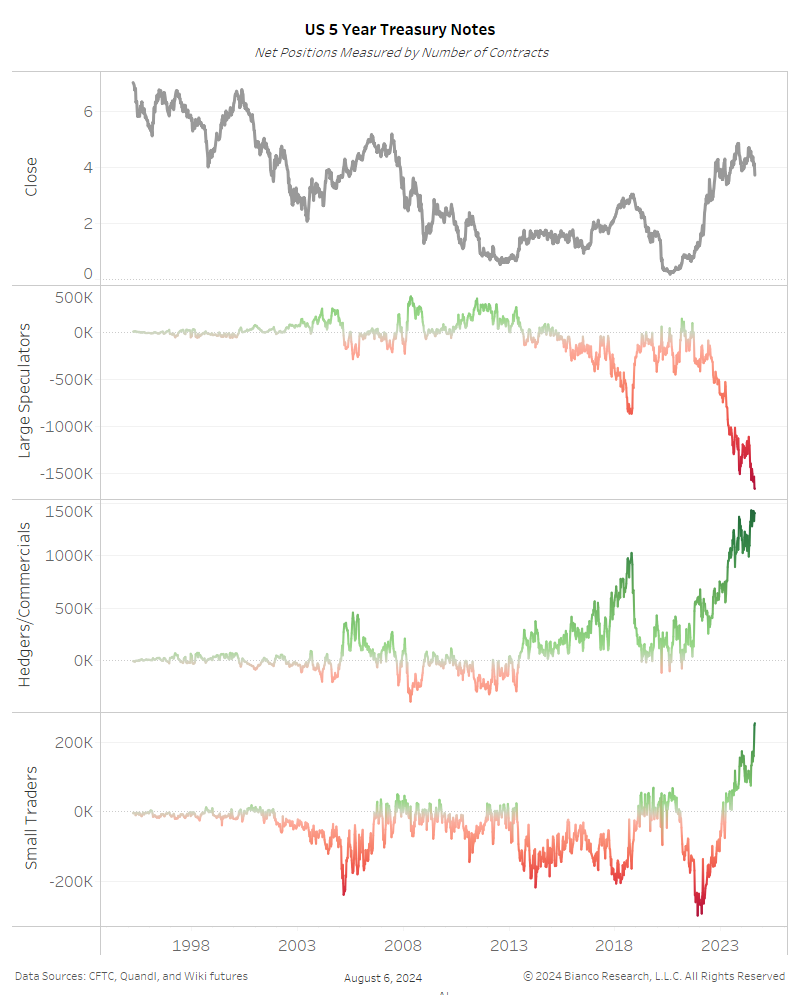

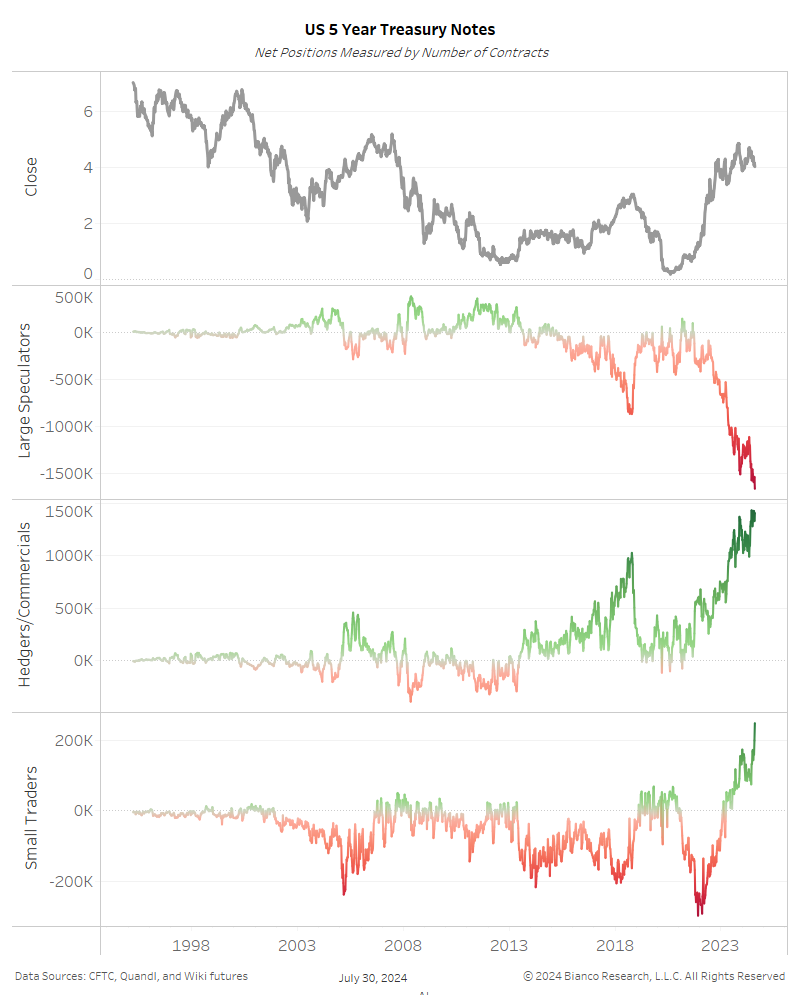

Tracking the Unwind

Posted By Jim Bianco

JP Morgan suggests the speculative carry trade is only half unwound. The exchange rate between the yen and peso is one market to monitor closely.... Read More

Are These Markets Financially or Economically Driven?

Posted By Jim Bianco

Not all sharp moves in financial markets are driven by rapid changes in the economic outlook. Unexpected changes in the financial structure of the markets can also force repricing. The most recent move in the markets has been driven by the Bank of Japan's larger-than-expected hike last week, leading to a subsequent unwind of the yen carry trade.... Read More

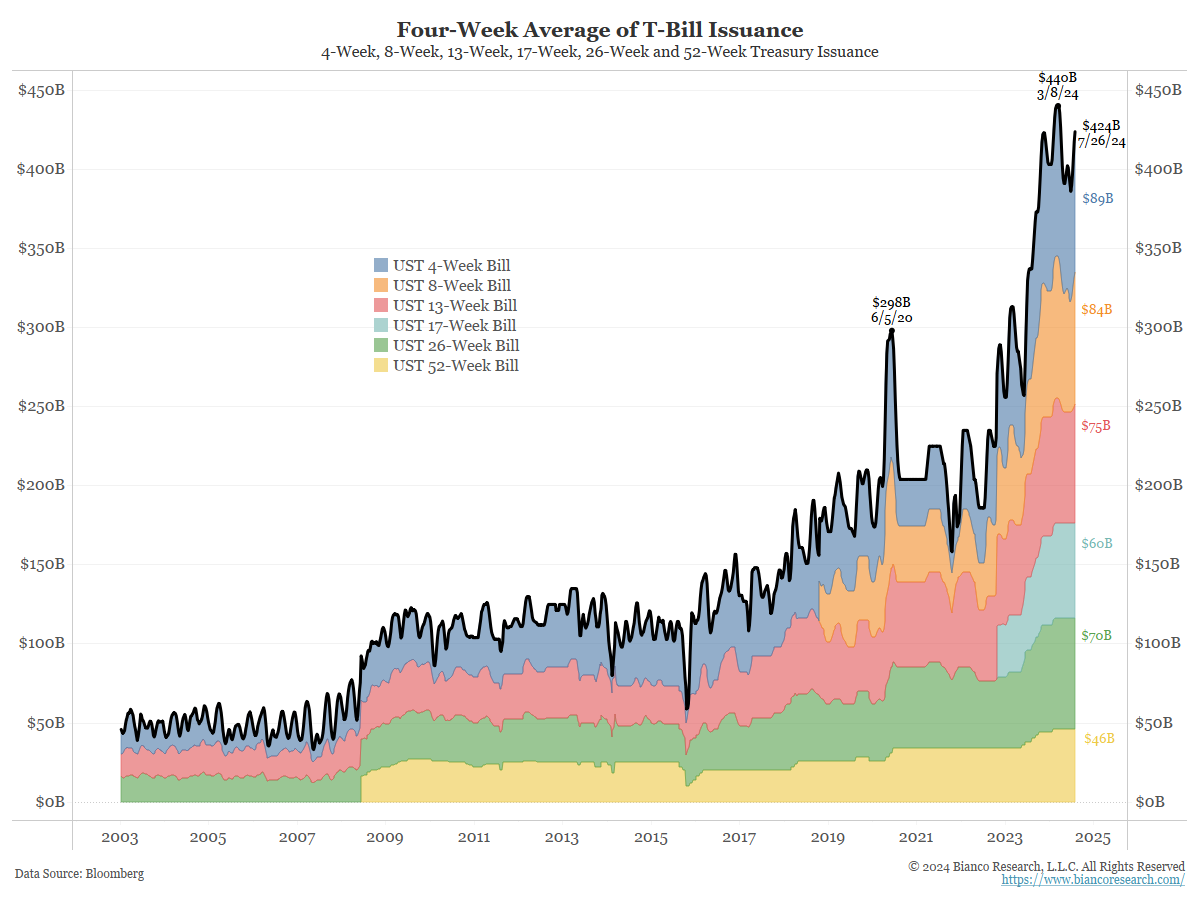

The TBAC Tweaks Its Stance on T-Bill Issuance

Posted By Greg Blaha

As part of this week's Quarterly Refunding Announcement, the TBAC conducted a study on the optimal level of T-bill issuance as a percentage of total Treasury issuance.... Read More