Tag Archives: Markets

Jim Bianco joins Bloomberg Radio to discuss Inflation, Rate Cuts, the 4-5-6 Market, K-Shaped Economy

Jim Bianco joins Bloomberg Radio to discuss Sticky Inflation, Rate Cuts, the 4-5-6 Market, Active Management, Earnings & the K-Shaped Economy, Real Yields, Jobs Data, US Dollar with Tom Keene & Paul Sweeney.... Read More

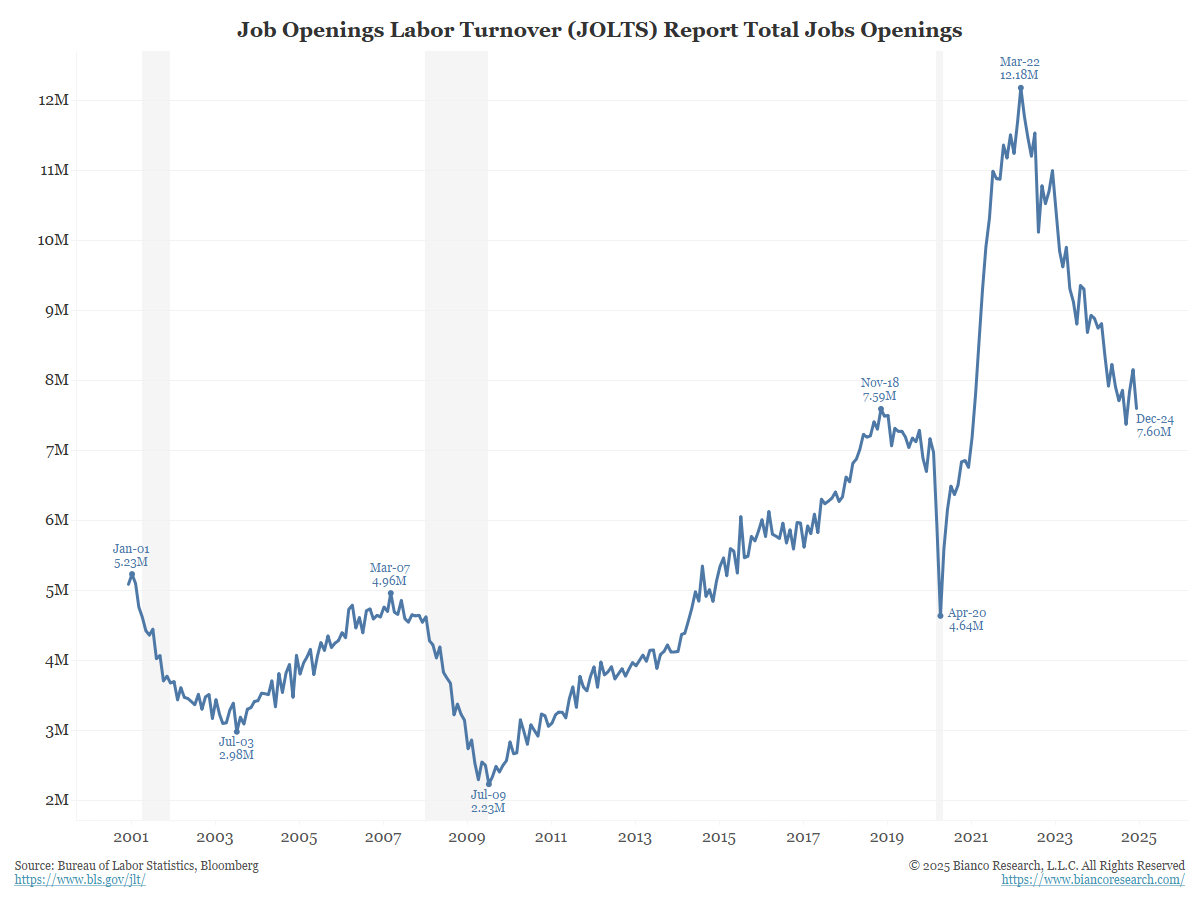

The Post-Covid Job Market

Posted By Jim Bianco

What is the state of the labor market? We must first acknowledge Covid changed things. Remote work is still over one-quarter of the workforce and is not going away.... Read More

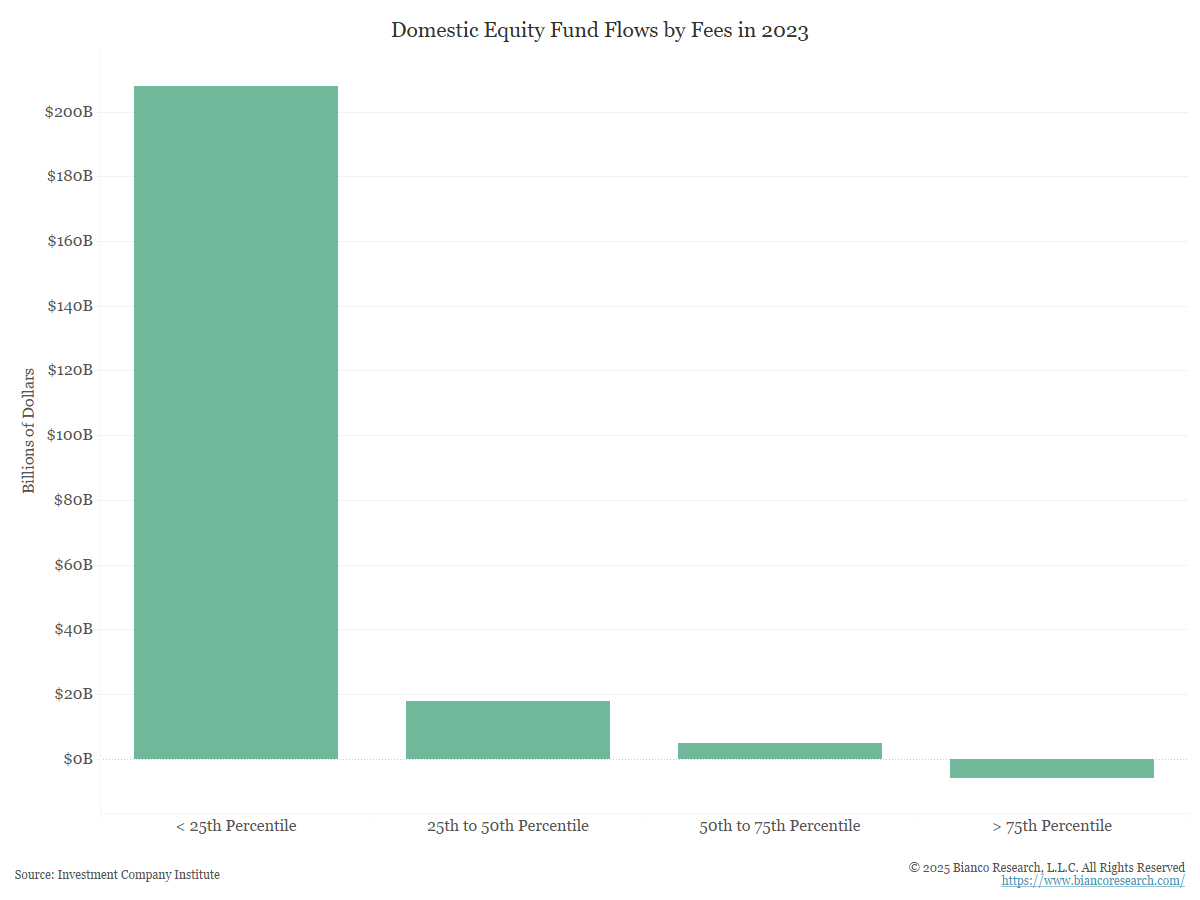

The Fee Wars Continue

Posted By Greg Blaha

Vanguard turned up the heat on the fee war this week, slashing fees on 87 funds.... Read More

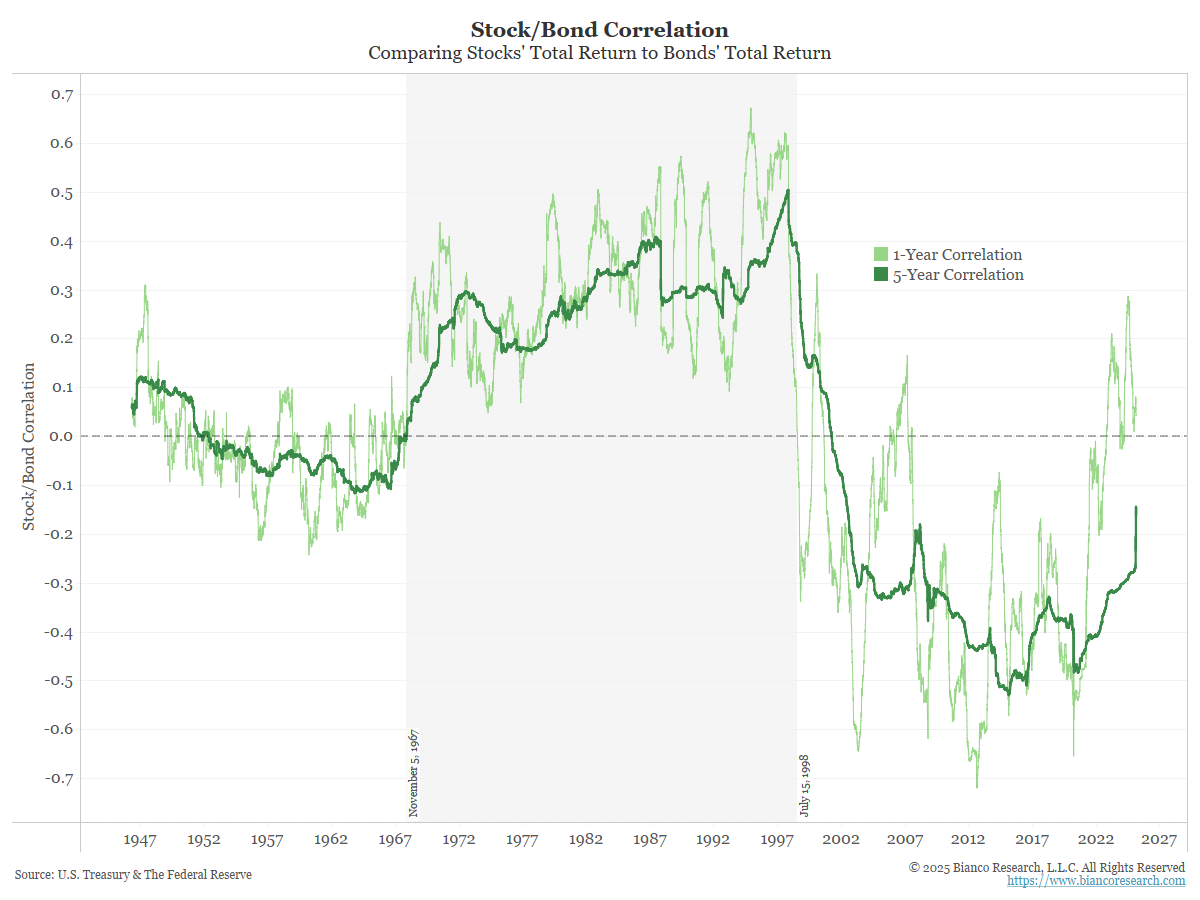

The Stock/Bond Correlation Since the Covid Shock

Posted By Greg Blaha

As pre-Covid data rolls off the five-year window, the long-term correlation between stocks and bonds is turning higher.... Read More

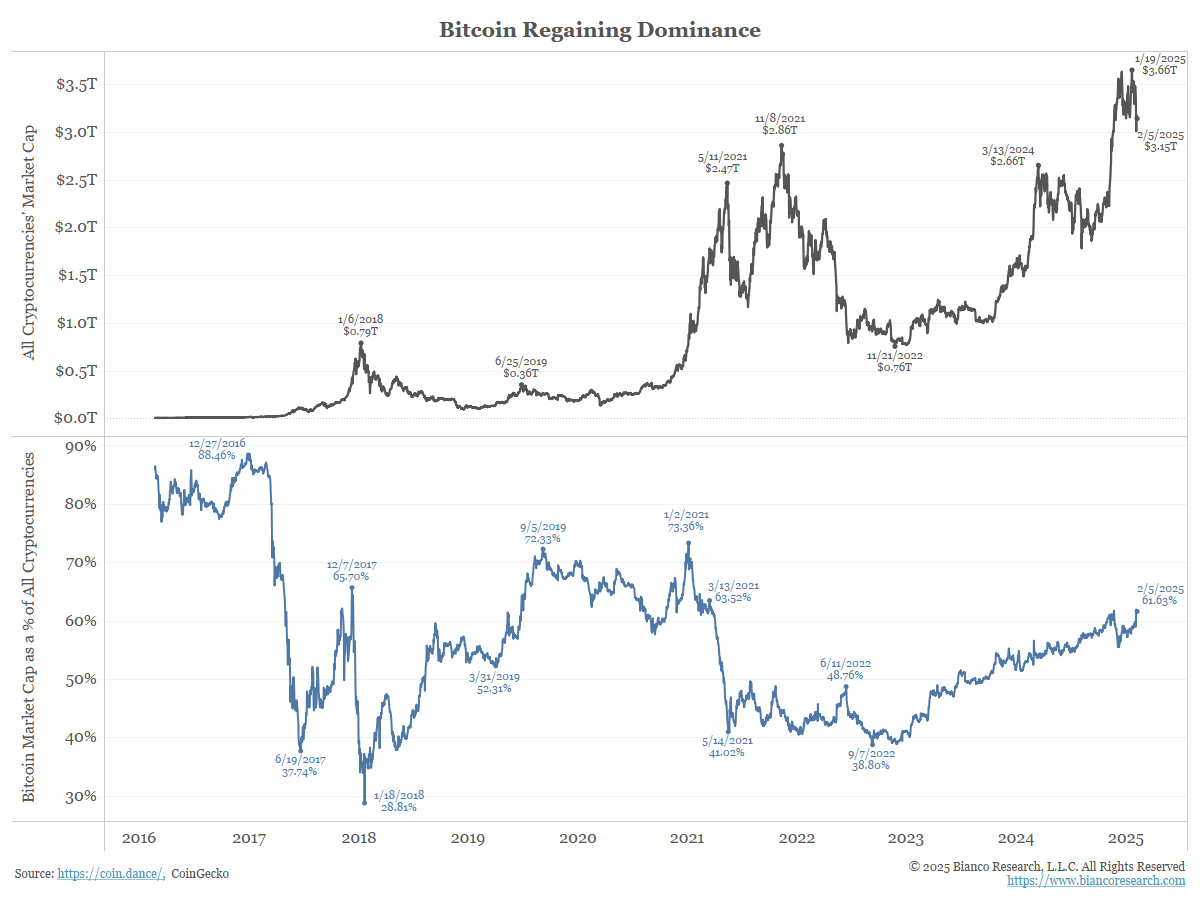

Bitcoin Dominance on the Rise

Posted By Greg Blaha

Bitcoin now accounts for almost two-thirds of the crypto universe.... Read More

Jim Bianco joins Fox Business to discuss the Impacts of Trump Tariffs, Bitcoin & No Landing

Jim Bianco joins Fox Business to discuss the Impacts of Trump Tariffs, Bitcoin & No Landing with Charles Payne.... Read More

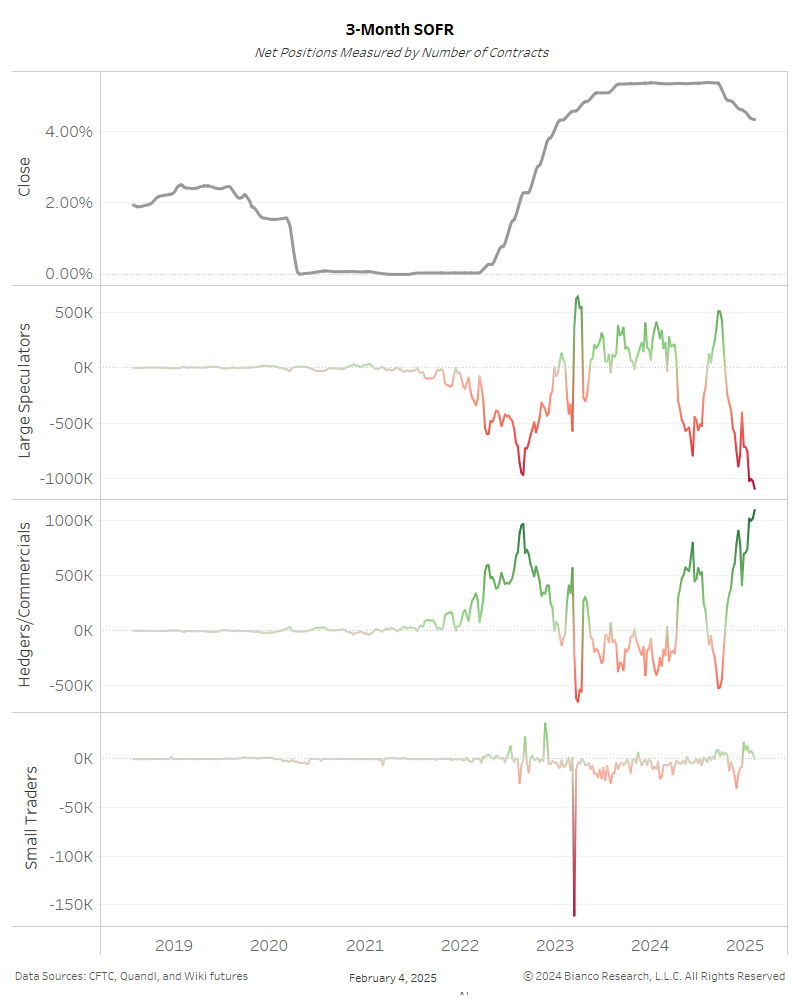

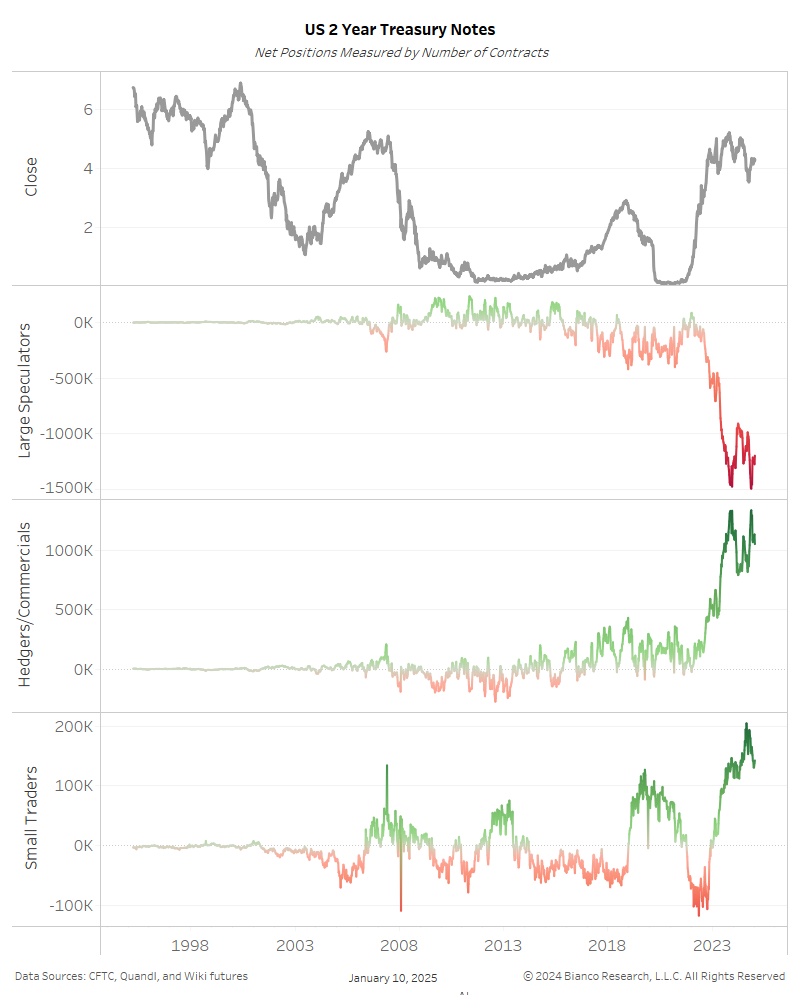

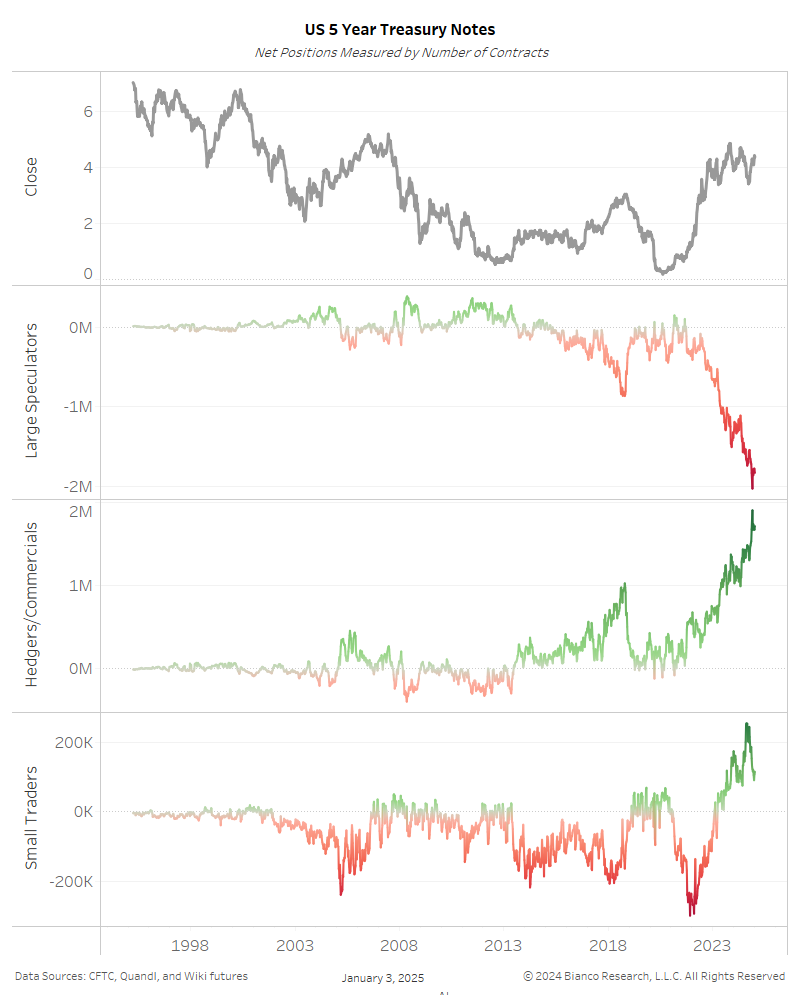

Conference Call Replay & Notes – The 4-5-6 Markets

The era of TINA (?There is No Alternative?) is over. Stocks will compete with bonds and cash over the next several years.... Read More

DoubleLine Round Table Prime 2025: Jim Bianco Highlights

DoubleLine Round Table Prime 2025 was held Jan. 9 at DoubleLine?s downtown L.A. office.... Read More

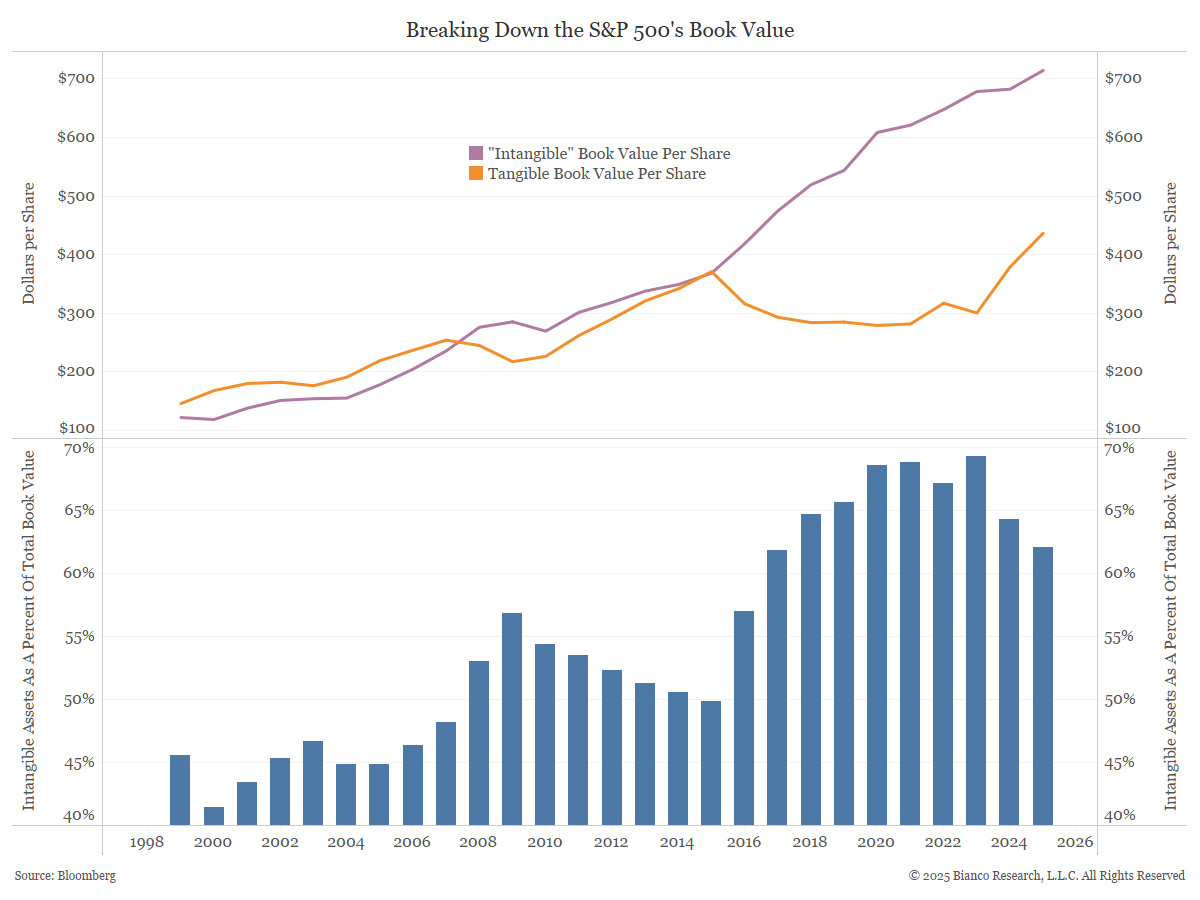

The Rise of Intangible Assets

Posted By Greg Blaha

The majority of S&P 500 companies' market capitalization is made up by intangible assets like branding or patents rather than physical assets like buildings or machinery.... Read More

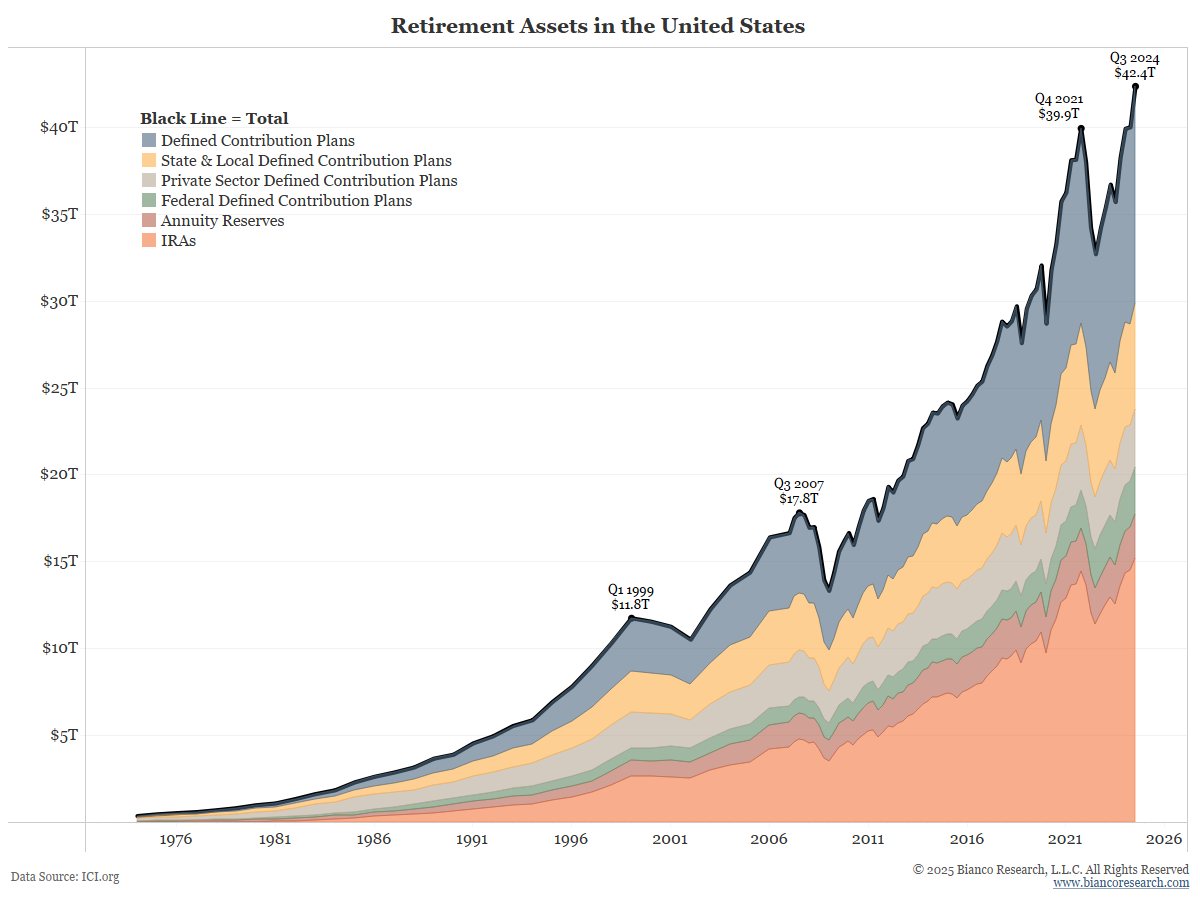

Retirement Assets Added $2.4T in Q3 2024

Posted By Alex Malitas

Retirement assets rose by $2 trillion in Q3 2024. ... Read More

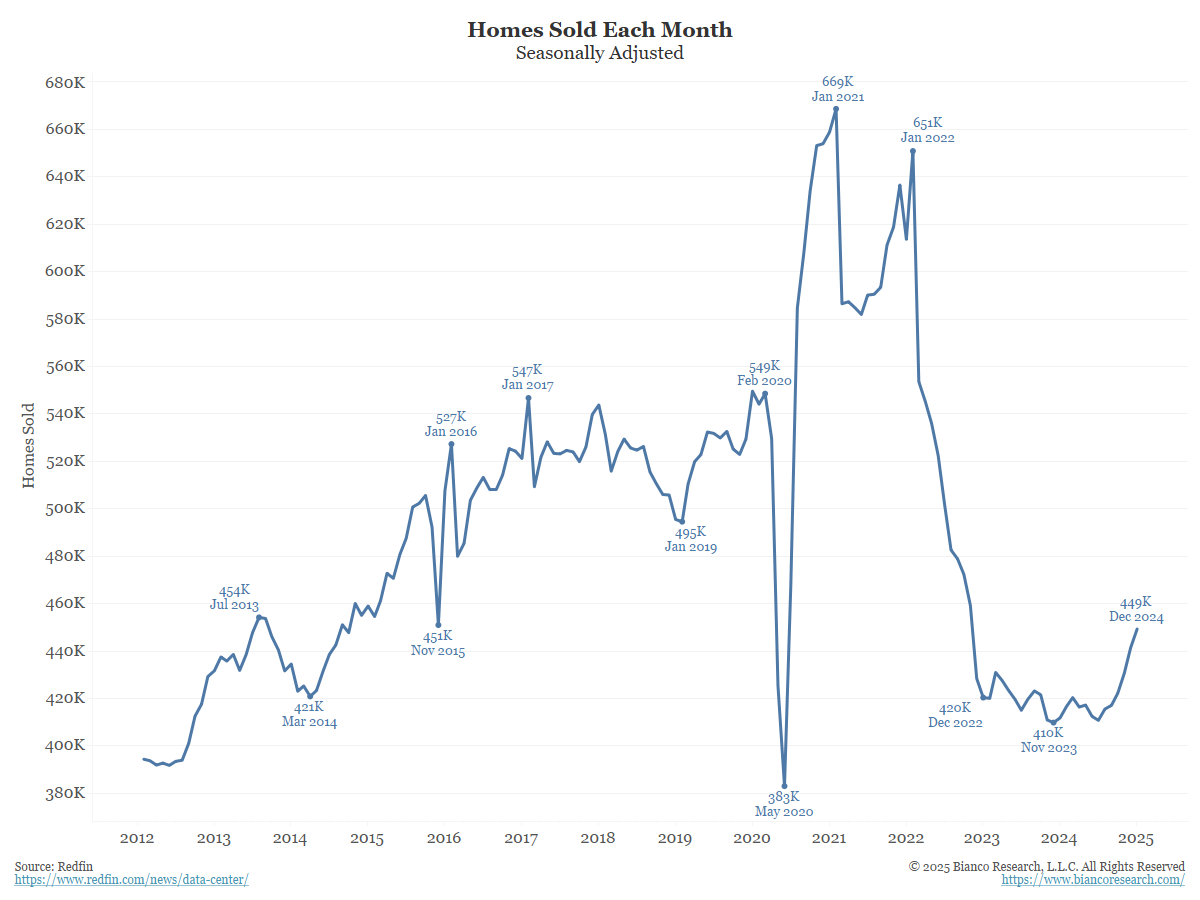

Alternative Measures of the Housing Market

Posted By Greg Blaha

The number of homes sold each month has fallen considerably from the January 2021 high. Over the past few months, however, a bit of an uptrend has formed.... Read More

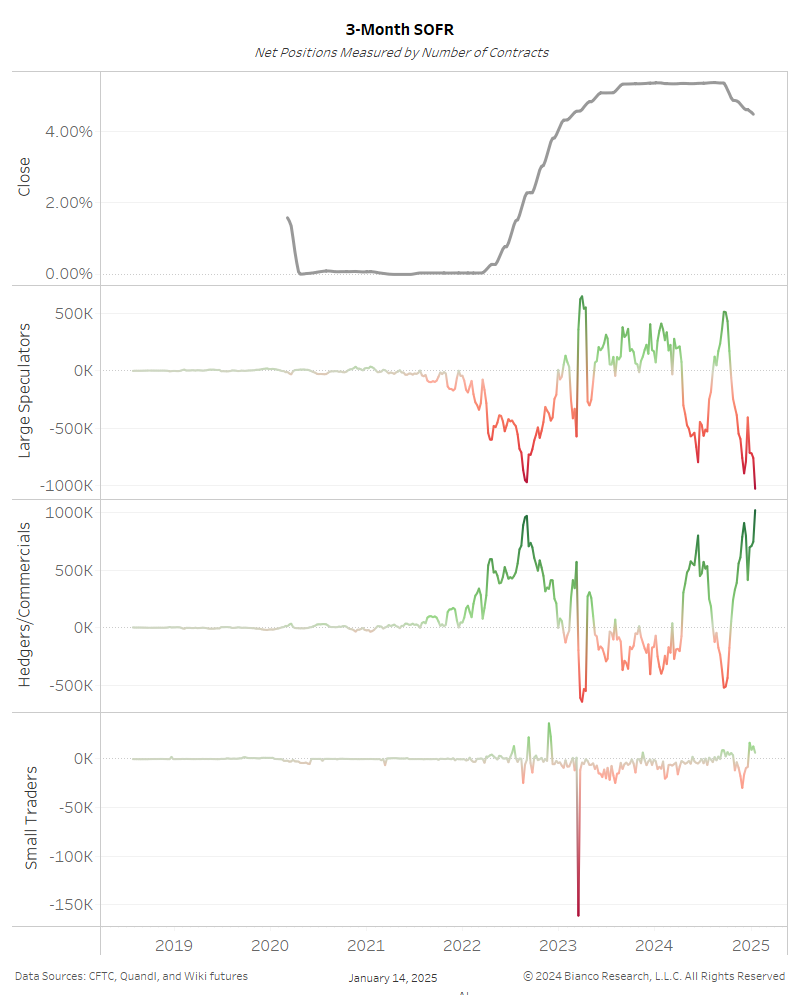

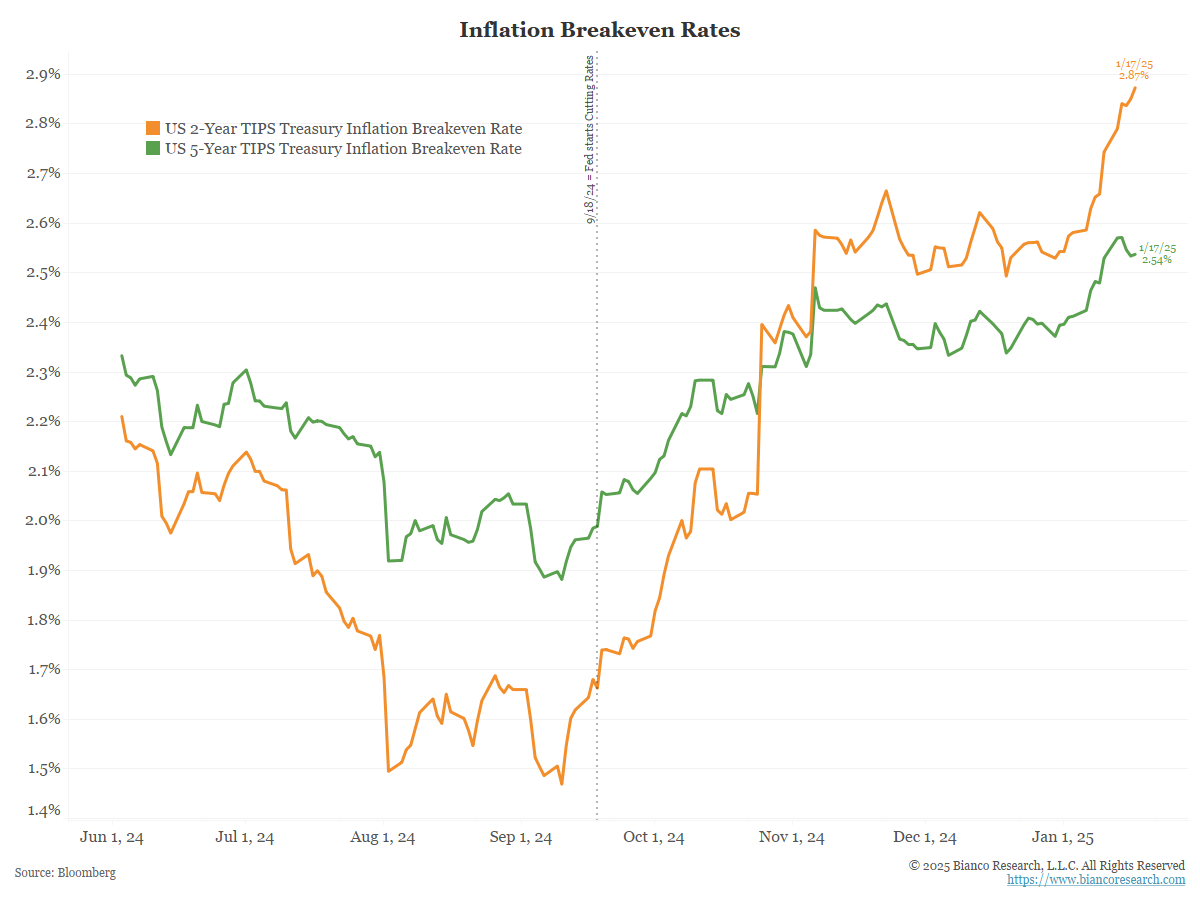

Updating Inflation Expectations

Posted By Jim Bianco

Inflation expectations are rising according to both market measures and public surveys.... Read More

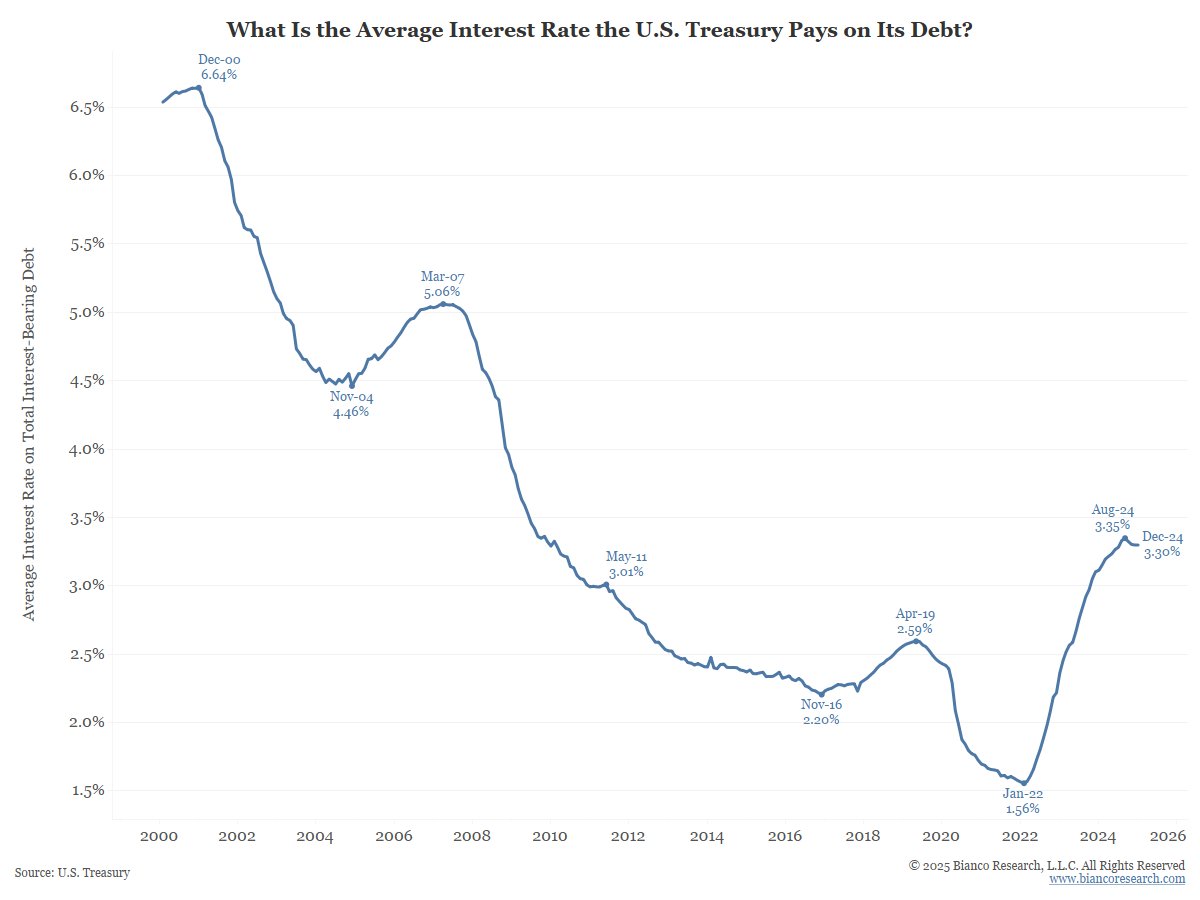

Rising U.S. Government Interest Costs

Posted By Greg Blaha

For the last few decades the U.S. has been in a low interest rate environment where deficit spending would not cause major issues. A 40-year high in inflation and the higher rates that followed are stressing the country's finances.... Read More

Conference Call Replay & Notes – Where Do Bonds Fit in a Diversified Portfolio?

Equity prices are fully valued, suggesting low future returns. The Fed is cutting rates, yet long-term yields are rising along with inflation fears. The economy remains strong. Given all this, where do bonds fit in a portfolio? Is the 60/40 as we know it dead? ... Read More