Summary

Comment

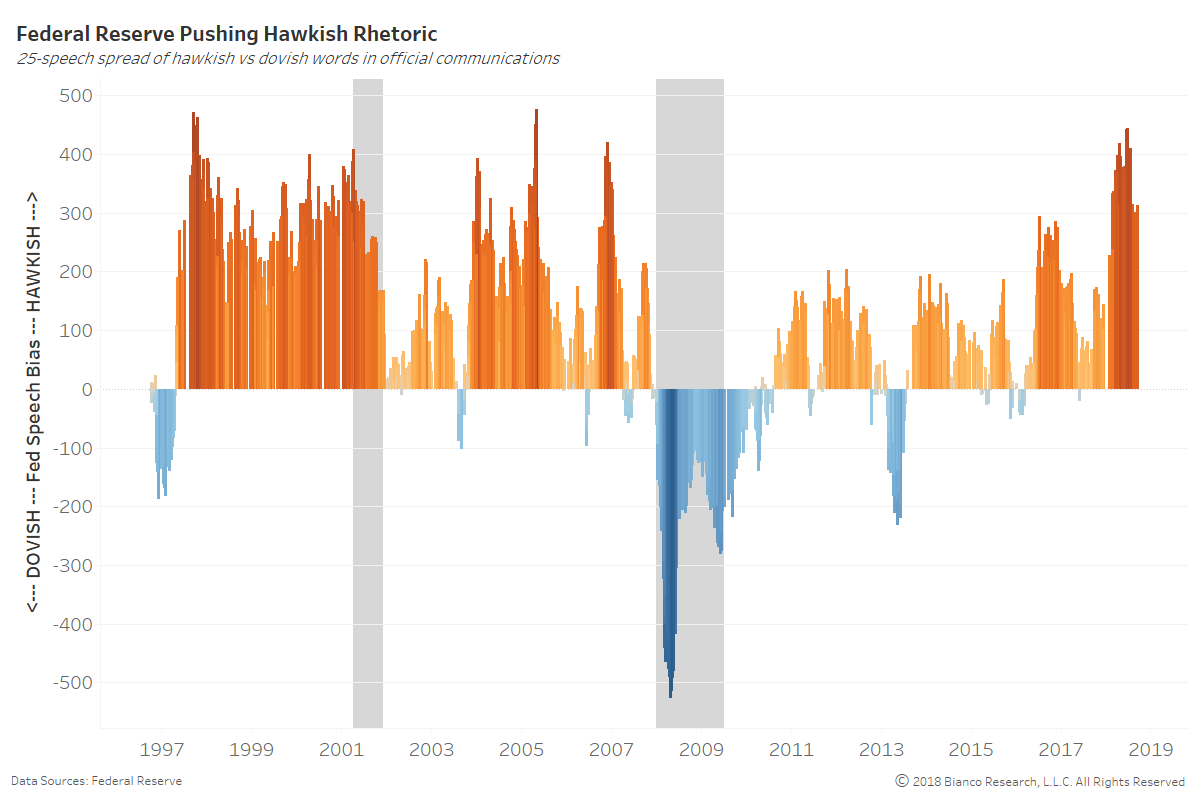

Markets should not be surprised by the Fed’s recent hawkish rhetoric. Official communications have seasonally become the most hawkish into late September through October since 1997.

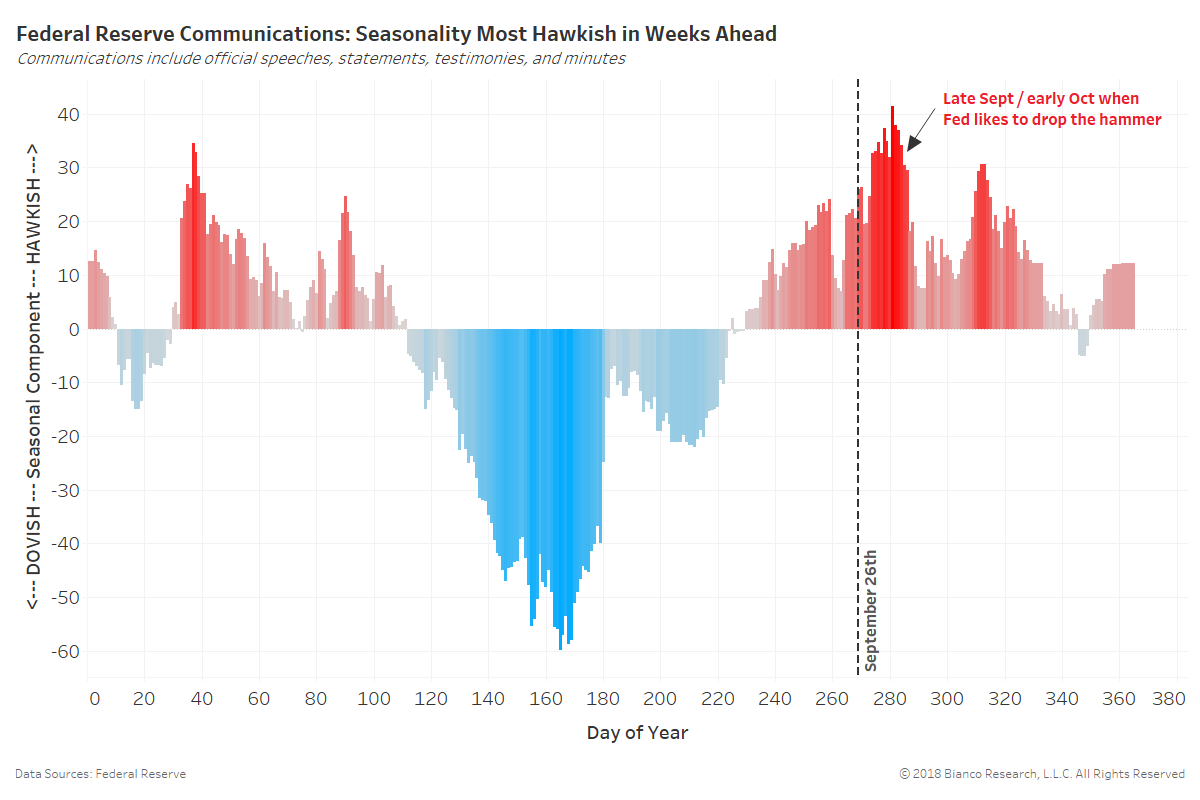

The chart below shows the seasonal component of hawkish versus dovish words found within Fed communications (see chart above). The Federal Reserve habitually ‘drops the hammer’ around this same time each year. We saw this same pattern unfold leading to the December 2015, 2016, and 2017 hikes.

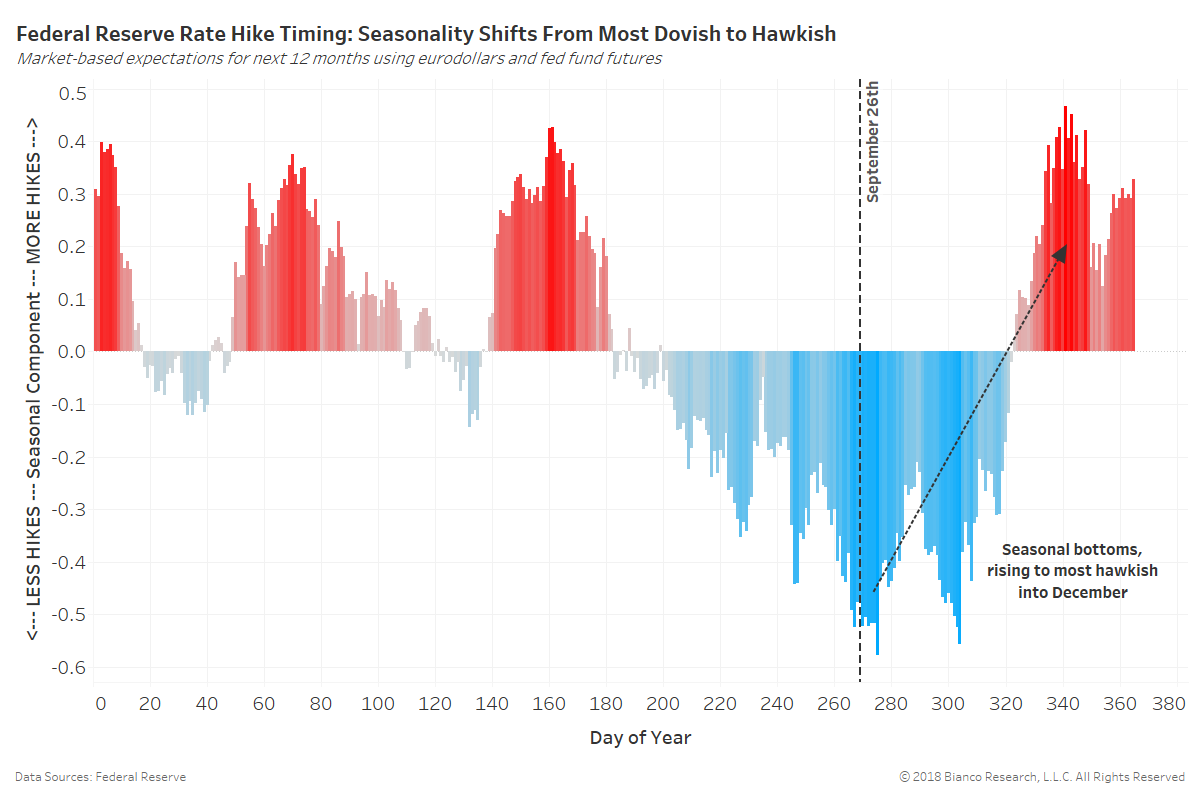

We use the Federal Reserve’s own words from official communications including speeches, minutes, and testimonies to estimate the number of rate hikes expected over the following twelve months. In other words, we determine how these communications have related to realized rate hikes during the period from 1996 through 2007.

The Federal Reserve’s own rhetoric (red line) suggests five hikes are to come over the next twelve months versus markets pricing in half at 2.5 hikes (blue line). Markets continue to significantly under-price the Federal Reserve, predominately due to well-anchored inflation expectations.

Bottom Line:

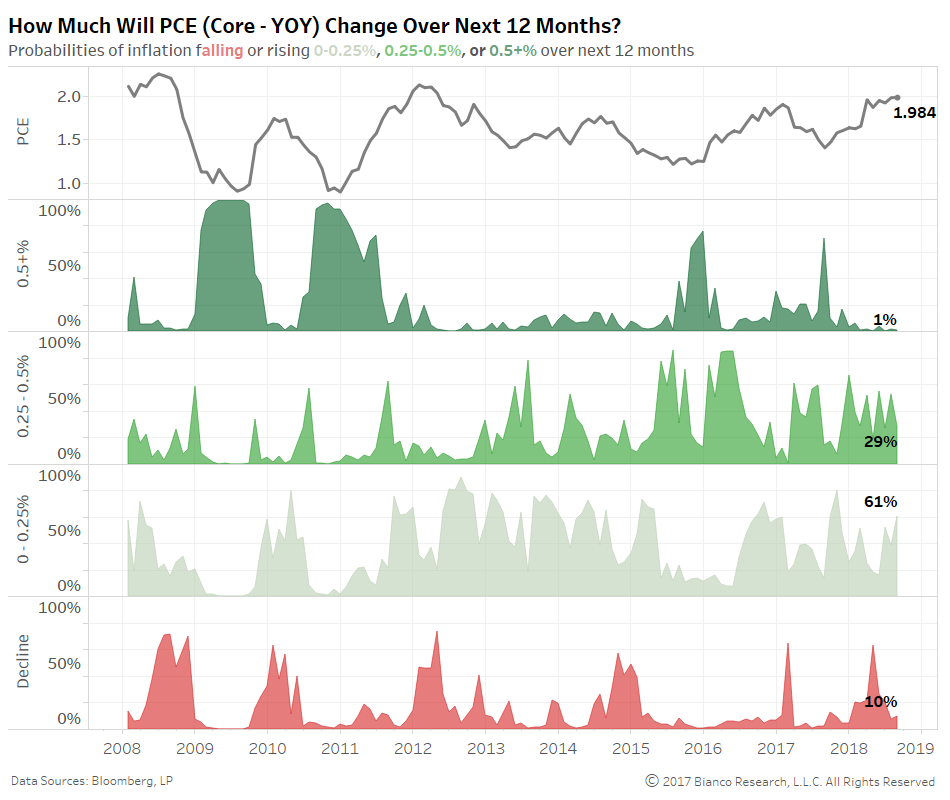

Bond investors have hunkered down with U.S. 10-year term premium stuck in a less than 50 bps range for a record 384 trading days. We believe investors are showing very little concern headline inflation can persist above the 2.5% year-over-year needed to foster core inflation above 2.0% year-over-year.

The odds-on bet is markets will indeed add more hikes with a Federal Reserve chasing higher the so-called short-term neutral rate, while the long-term neutral rate remains stable. The Federal Reserve’s own words today will mean much less than whether or not investors commit to a consistent period of tightening through at least the end of 2019.

We have a very hard time believing core inflation will break high enough from 2.0% to warrant the Federal Reserve taking the target rate above the estimated long-term neutral rate at approximately 3.0%. Markets beginning to believe the target rate can reach 3.0+% is what will lead to yield curve inversion and rising fears of a policy mistake.

The probability core PCE will rise more than 25 bps over the next twelve months is a meager 30%. Our outlook for core PCE by bucket (decline, 0-25 bps, 25-50 bps, and 50+ bps) are shown below.