- CNBC – Market turmoil sparked by coronavirus fears is worse than financial crisis, James Bianco says

“What the Fed did was they restarted QE [quantitative easing], and they essentially announced that in the next two days they’re going to do more QE than they did in the last five years combined,” added Bianco. “The reason they’re doing it is because the financial markets have stopped functioning properly. There’s no liquidity. There’s hardly any trading.” - Bloomberg,com – Conor Sen: Financial Markets Need a Temporary 9/11-Style Shutdown

A close followed by a fresh start could do a lot to contain the panic.

But while we do that, we also should close financial markets. Credit conditions and liquidity have deteriorated rapidly in the past few weeks, and investors are trying to operate with even less near-term clarity than they had during the depths of the 2008 financial crisis. How should stocks and bonds trade if everyone’s going to be hunkered down for a few weeks except for going to the grocery store or hospital? Additionally, with volatility this high, speculation about possible government stimulus and rescue efforts raise the risk of significant amounts of insider trading and market manipulation. Better to bring things to a halt for a brief period so we can focus on the policy response, making sure families and individuals are healthy and safe. That seems like the only realistic way of preventing the panic from spiraling out of control.

Summary

Comment

Financial markets are dysfunctional. They are barely trading, and when they do, everything is being liquidated.

The VIX and yields were just about the only things that went up yesterday.

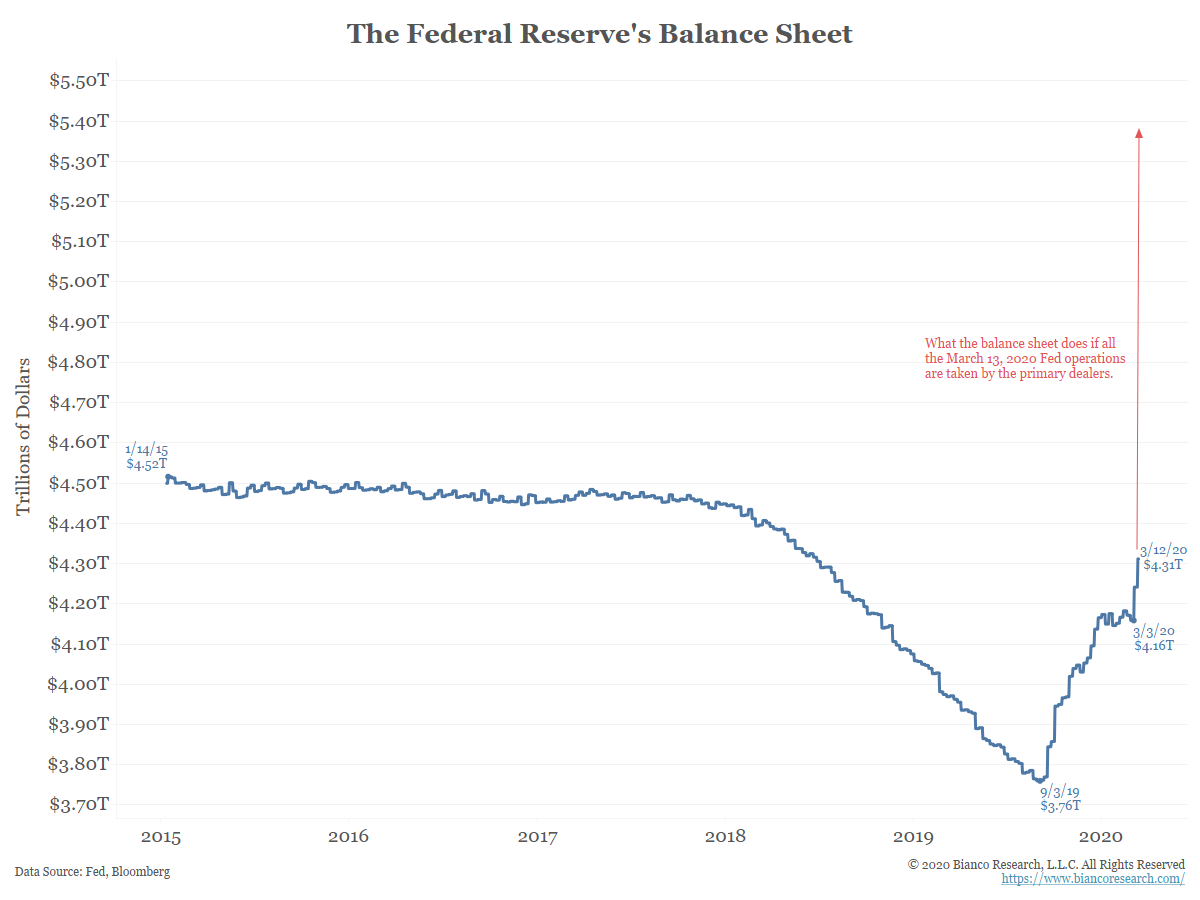

In response to dysfunctional markets, the Fed stepped up yesterday and fired their nuclear weapon. They offered $500B in 3-month repo and announced they would immediately start buying Treasuries across the yield curve. This is true QE on a scale never seen before!

This follows comprehensive moves by both the ECB and the Bank of England in the previous 36 hours. These major central banks are all in to get the dysfunctional markets working again.

However, when the Fed conducted its $500 billion repo operation yesterday, the primary dealers only took $78 billion.

Maybe the dealers did not want it, which would suggest they are not interested in making markets. This would be very bad.

Or, maybe given the Fed’s announcement of this massive an operation just 90 minutes before it was offered did not give the players enough time to fully understand it, formulate a strategy with it, and/or get the necessary senior approvals for participating.

Whatever the reason, the street did not take the Fed’s liquidity and dysfunctional markets remained.

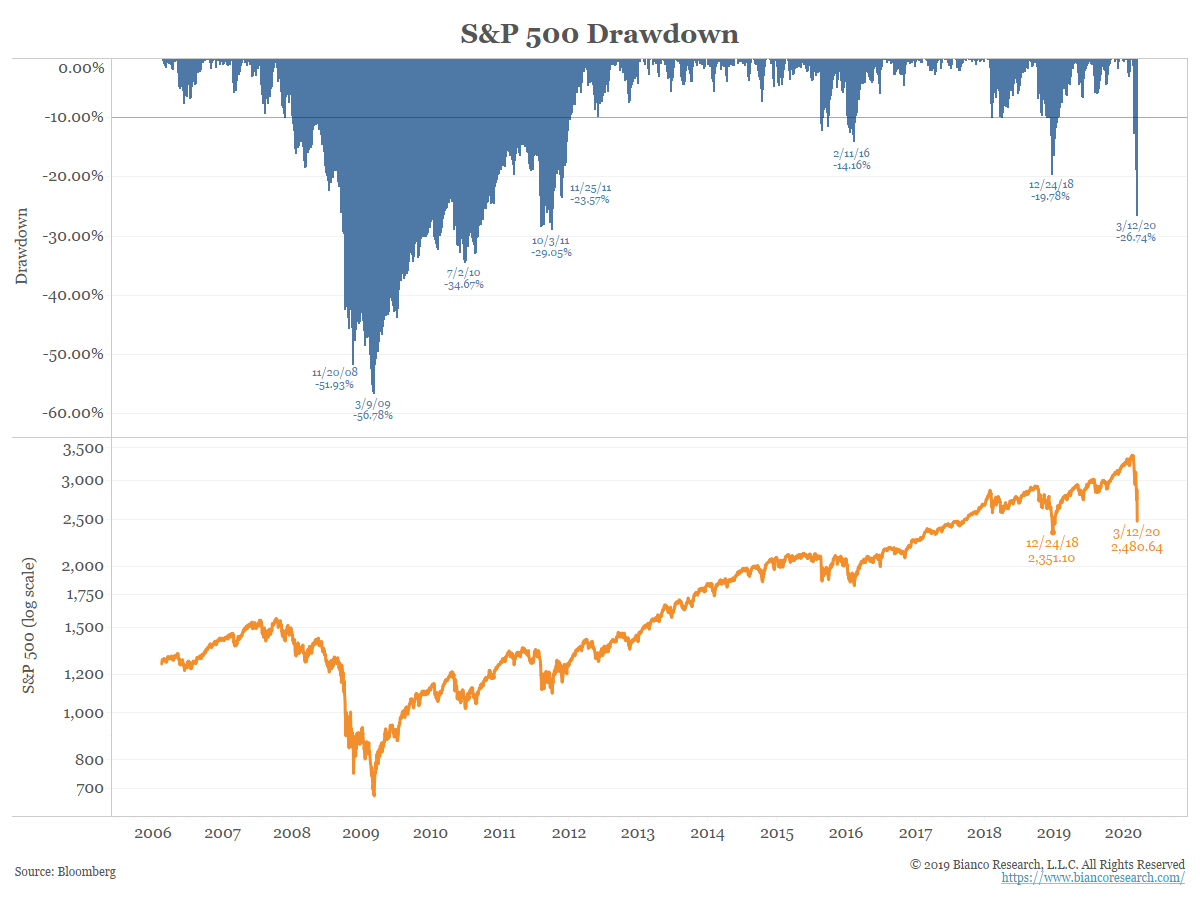

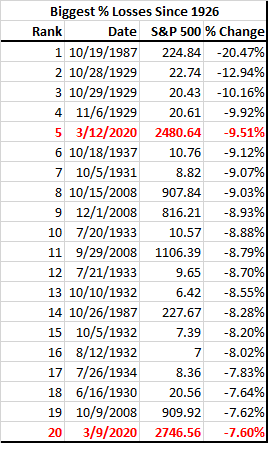

The S&P 500 fell 9.5%, its worst day since 1987 and fifth worst day ever.

Bond yields rose on arguably one of the biggest risk-off days in history, the opposite of what might be expected. Gold fell and currencies crumbled as everyone demanded dollars.

75 Minutes

The markets will face a key decision point this morning between 7:45 and 9:00 AM ET.

As the graphic below shows, the Fed will offer the dealers $1.175 TRILLION in three separate repo operations.

The Fed is prepared to expand their balance more in this 75 minute window than they have in the last five years combined, as highlighted below.

The dealers have had nearly a day to digest the Fed’s offer. Will they take it and get dysfunctional markets to act somewhat normal? Will they pass again? Will the markets rebound? Is the offer alone enough to get risk-taking and market-making to return?

Conclusion

30 minutes after this operation is completed the NYSE opens. Should this fail to work and markets continue to liquidate everything, the exchanges might be forced with the difficult decision to take a hiatus and close for a while until clarity returns.

Lastly, if markets are wobbly even with all this promised liquidity, the Fed has one more card they can play. Cut rates to zero today.

As the following graphic shows, the fed funds futures market has priced in an 87% probability the Fed cuts rates to zero at their March 18 FOMC meeting. Since it is all priced in and expected, they could cut rates tomorrow as a signal of their resolve to get liquidity to return.