-

- Reuters – Fed seen raising rates by 25 bps next week and in May

The Federal Reserve is seen raising its benchmark rate a quarter of a percentage point next week and again in May, as a government report showed U.S. inflation remained high in February, and concerns of a long-lasting banking crisis eased. - Bloomberg – Daniel Moss: Breaking the Shackles of Inflation Targets

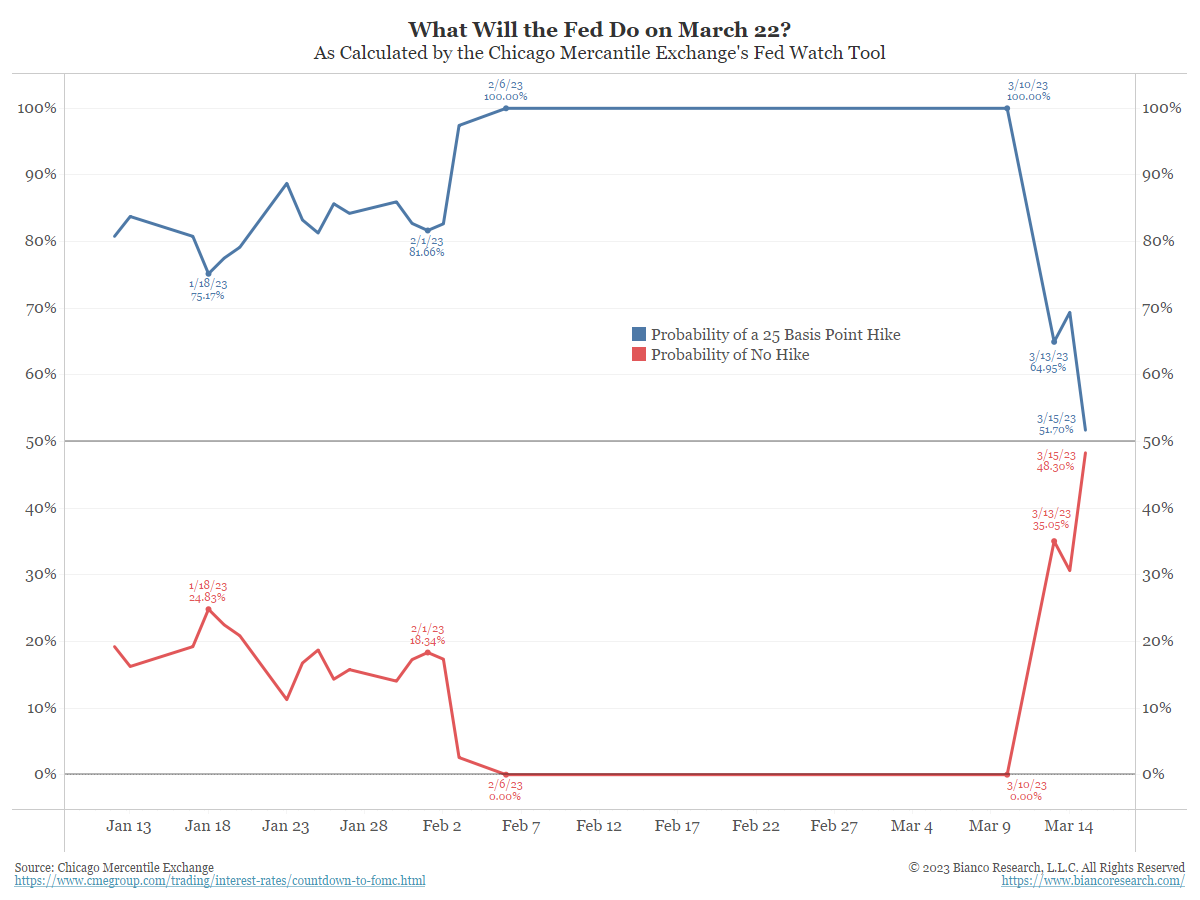

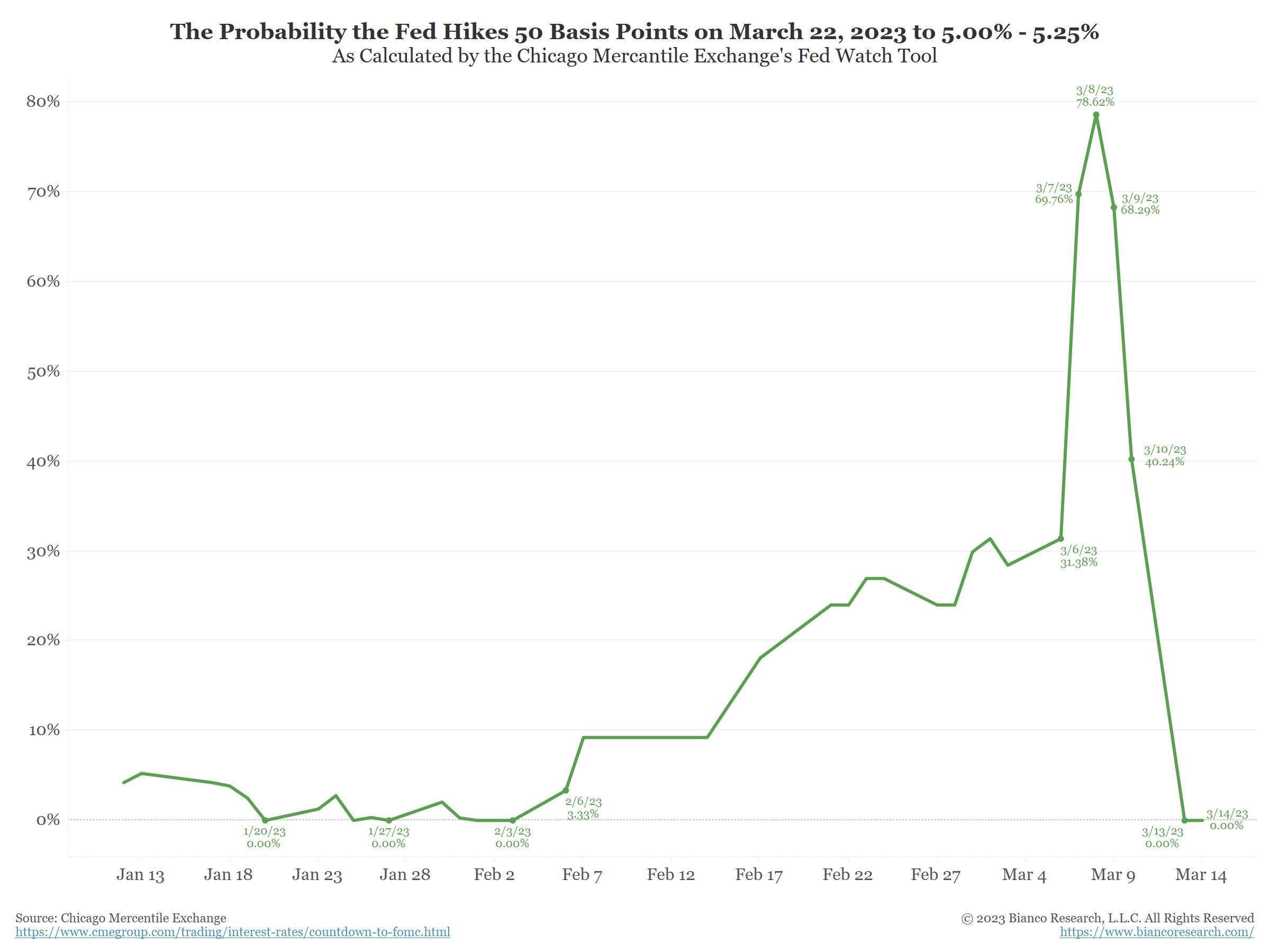

The idea that big central banks could take a pass on further hikes seemed a stretch just a week ago. Federal Reserve Chair Jerome Powell weighed the prospect of picking up the pace while the European Central Bank seemed sure to embark on at least one more increase of 50 basis points in its main rate. In Japan, people speculated that Kazuo Ueda would dismantle the ultra-easy framework fairly soon after he arrives at the central bank next month. Some traders even bet Haruhiko Kuroda would take the plunge last Friday at his final board meeting. The Reserve Bank of Australia said the time was approaching for a pause but was careful to not commit to a particular timetable. The epic retreat in bond yields suggests a range of outcomes is plausible, if not necessarily desired…SVB’s failure and the subsequent market tumult has many economists thinking the Fed will now recoil from the 50-basis-point step that Powell himself laid on the table March 7. Some big names, including Goldman Sachs Group Inc., now see the Fed pausing when policymakers meet next week. Nomura Securities went so far as to predict a rate cut.

- Reuters – Fed seen raising rates by 25 bps next week and in May

- Hike 25 bps: By Friday, if the S&P 500 closes above Monday’s close, we believe a 25 basis point hike is most likely. The S&P 500 closed at 3,919 yesterday. So, it is 1.7% above this level at the moment, but that is not much given the S&P 500 had three 1.5% swings YESTERDAY!

- No Move: On Friday, if the S&P 500 closes back at Monday’s close or roughly 3% lower, we believe the Fed will not move rates.

- Cut 25 bps: On Friday, if the S&P 500 closes below 3,740, or down more than 3% from Monday’s close, a rate cut is not out of the question.

Summary

Comment

Our view of what the Fed will do is based on one assumption and one historical fact:

Assumption: The Fed is intensely political. They will protect their institution first. They do not want to be blamed for causing a banking crisis.

Fact: When markets get extreme, and only when they are extreme, the Fed typically buckles to the market. They last did this in December 2018/January 2019. In December 2018, Powell announced the first attempt at QT. It was described as being on “automatic pilot.” The market freaked out and tanked hard into the end of the year. Then, on January 4, 2019, speaking at the American Economic Association with Yellen and Bernanke on the stage, he took it all back. This became known as the “Powell pivot” and the stock market roared higher.

We believe the Fed will take its cue from the stock market. Let’s use Monday’s S&P 500 close of 3,855 as a reference point in determining what the Fed will do:

Note that we explained this with specific levels to illustrate our thinking. This is not the product of some precise model. It is a guess, and we thought this was the best way to view the Fed’s options in a highly uncertain environment.