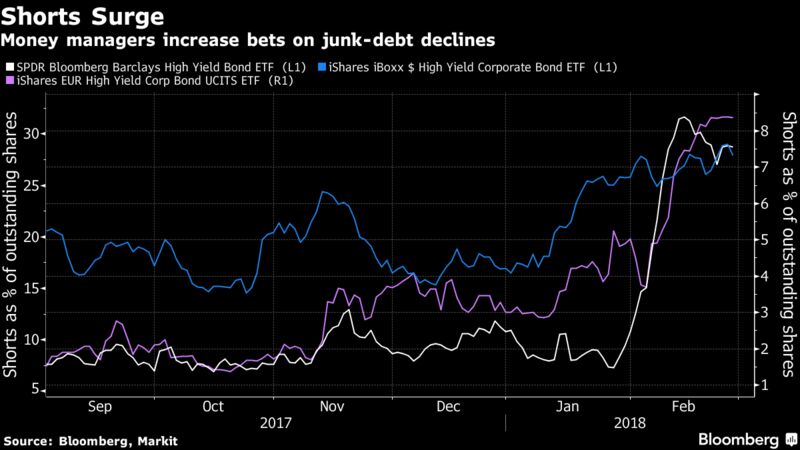

- Bloomberg – Short Interest in High-Yield ETFs Hits Record

Short interest as a percentage of shares outstanding on the $15 billion iShares iBoxx $ High Yield Corporate Bond ETF, ticker HYG, hit an all-time high of 29 percent Monday, Markit data show. Add elevated shorts on the SPDR Bloomberg Barclays High Yield Bond ETF, ticker JNK, in concert with a European counterpart, and bearish sentiment has piled up even as junk-bond spreads recover from the selloff earlier this month. “Investors are hedging against a pop in the U.S. 10-year — a lot of guys are positioning for 3 percent or plus,” said Dave Lutz, head of ETFs at JonesTrading Institutional Services. The potential for a short squeeze looks elevated considering the funds’ indicative gross dividend yields over the next 12 months. At over 5 percent — the amount traders would have to pay lenders annually — shorting JNK is no free lunch.

Summary

Short interest in U.S. high yield ETFs is growing as the cash market continues to recover from February’s losses. We’ve discussed how some of the outflows from high yield positions have traveled to other asset classes. But it’s possible some of these outflows were kept in high yield and simply moved to cash bond positions. Investors holding expensive short positions may be caught offsides.

Comment

The chart below shows the average short interest and average short interest ratio for several of the U.S. fixed income ETF categories. The short interest ratio is simply the total short interest divided by average daily volume, an expression of how long it might take to clear these positions. Although short interest in investment grade ETFs is also elevated, high yield funds stand alone in this measure.

We’ve highlighted investors’ shift away from the pure U.S. corporate bond ETFs several times since January. Net inflows first began to dry up late last year before net outflows accelerated in the wake of the early February volatility spike. The chart below shows monthly net flows for U.S. fixed income ETFs by category. January and February saw the largest monthly net outflows on record. While investment grade ETFs have seen net outflows dissipate this week, high yield funds continue to bleed, though at a much slower pace.

To some extent, these funds have flowed into other types of investments. On Tuesday we shared a network analysis of fund flows since February 9th showing that assets leaving high yield funds have found new homes in safer fixed income funds, value equities, emerging markets and precious metals.

But the net outflows from corporate bond ETFs do not necessarily mean all these funds are fleeing the asset class. In discussions with high yield fund managers, we’ve come to understand that the exchange-traded funds are often used as cash management tools. Opportunistic fund managers who were sitting on excess cash may have withdrawn funds from the ETFs to buy bonds in the cash market. These would show up as outflows but with no bearish implications for high yield broadly.

The last chart shows the Bloomberg Barclays total return indices for U.S. investment-grade and high yield indices since July 2017. Rising Treasury yields have kept investment grade bonds under pressure but high yield has snapped higher since mid-February. As time passes, it looks more and more like the surge in ETF outflows was not as bearish for credit markets as it first appeared.

Conclusion

Some investors appear to smell blood in high yield waters and have ramped up short exposure to high yield ETFs. But different use cases for investment-grade and high yield ETFs by institutional fund managers make the signals from fund flows less clear. It’s likely that some of the surges in net outflows seen in February were opportunistic fund managers moving cash management positions in ETFs to the cash bond market. To the extent that this is true, the large short base may find themselves offsides having misread these outflows as a bearish sign for the asset class.